70 8. Exercises (Part 2) Weighted Average

Problems

-

Production Cost Report: Weighted Average Method. Calvin Chemical Company produces a chemical used in the production of silicon wafers. Calvin Chemical uses the weighted average method for its process costing system. The Mixing department at Calvin Chemical began the month of June with 5,000 units (gallons) in work-in-process inventory, all of which were completed and transferred out during June. An additional 15,000 units were started during the month, 11,000 of which were completed and transferred out during June. A total of 4,000 units remained in work-in-process inventory at the end of June and were at varying levels of completion, as shown in the following

|

Direct materials

|

60 percent complete |

|

Direct labor

|

40 percent complete |

| Overhead | 40 percent complete |

The cost information is as follows:

Costs in beginning work-in-process inventory

|

Direct materials

|

$8,000 |

|

Direct labor

|

$3,000 |

| Overhead | $2,800 |

Costs incurred during the month

|

Direct materials

|

$21,000 |

|

Direct labor

|

$ 8,500 |

| Overhead | $ 7,200 |

Required:

- Prepare a production cost report for the Mixing department at Calvin Chemical Company for the month of June.

- Confirm that total costs to be accounted for (from step 2) equals total costs accounted for (from step 4). Note that minor differences may occur due to rounding the cost per equivalent unit in step 3.

- According to the production cost report, what is the total cost per equivalent unit for the work performed in the Mixing department? Which of the three product cost components is the highest, and what percent of the total does this product cost represent?

-

Production Cost Report: Weighted Average Method. Quality Confections Company manufactures chocolate bars in two processing departments, Mixing and Packaging, and uses the weighted average method for its process costing system. The table that follows shows information for the Mixing department for the month of March.

| Unit Information (Measured in Pounds) | Mixing |

| Beginning work-in-process inventory | 8,000 |

| Started or transferred in during the month | 230,000 |

| Ending work-in-process inventory: 80 percent materials, 70 percent labor, and 60 percent overhead | 6,000 |

| Cost Information | |

| Beginning Work-in-Process Inventory | |

|

Direct materials

|

$ 3,000 |

|

Direct labor

|

$ 1,500 |

| Overhead | $ 2,200 |

| Costs Incurred during the Period | |

|

Direct materials

|

$103,000 |

|

Direct labor

|

$ 55,000 |

| Overhead | $ 81,000 |

Required:

- Prepare a production cost report for the Mixing department for the month of March.

- Confirm that total costs to be accounted for (from step 2) equals total costs accounted for (from step 4); minor differences may occur due to rounding the cost per equivalent unit in step 3.

- According to the production cost report, what is the total cost per equivalent unit for the work performed in the Mixing department? Which of the three product cost components is the highest, and what percent of the total does this product cost represent?

-

Production Cost Report and Journal Entries: Weighted Average Method. Wood Products, Inc., manufactures plywood in two processing departments, Milling and Sanding, and uses the weighted average method for its process costing system. The table that follows shows information for the Milling department for the month of April.

| Unit Information (Measured in Feet) | Milling |

| Beginning work-in-process inventory | 24,000 |

| Started or transferred in during the month | 110,000 |

| Ending work-in-process inventory: 80 percent materials, 70 percent labor, and 60 percent overhead | 32,000 |

| Cost Information | |

| Beginning Work-in-Process Inventory | |

|

Direct materials

|

$ 9,000 |

|

Direct labor

|

$ 3,000 |

| Overhead | $ 3,200 |

| Costs Incurred during the Period | |

|

Direct materials

|

$45,000 |

|

Direct labor

|

$14,000 |

| Overhead | $16,000 |

Required:

- Prepare a production cost report for the Milling department for the month of April.

- Confirm that total costs to be accounted for (from step 2) equals total costs accounted for (from step 4); minor differences may occur due to rounding the cost per equivalent unit in step 3.

- For the Milling department at Wood Products, Inc., prepare journal entries to record:

- The cost of direct materials placed into production during the month (from step 2).

-

Direct labor costs incurred during the month but not yet paid (from step 2).

- The application of overhead costs during the month (from step 2).

- The transfer of costs from the Milling department to the Sanding department (from step 4).

One Step Further: Skill-Building Cases

- Internet Project: Production Company Plant Tour. Using the Internet, find a company that provides a virtual tour of its production processes. Document your findings by completing the following requirements.

Required:

- Summarize each step in the production process.

- Which type of costing system (job or process) would you expect the company to use? Why?

- Process Costing at Coca-Cola. Refer to Note 8.4 “Business in Action 8.1”.

Required:

- What type of costing system does Coca-Cola use? Explain.

- What is the purpose of preparing a production cost report? What information results from preparing a production cost report for the mixing and blending department at Coca-Cola?

- Based on the information provided, what is the minimum number of production cost reports that Coca-Cola prepares each reporting period? Explain.

- Process Costing at Wrigley. Refer to Note 8.9 “Business in Action 8.2”.

Required:

- What type of costing system does Wrigley use? Explain.

- What is the purpose of preparing a production cost report? What information results from preparing a production cost report for Wrigley’s Packaging department?

- Based on the information provided, what is the minimum number of production cost reports that Wrigley prepares each reporting period? Explain.

- Group Activity:

Jobor Process Costing? Form groups of two to four students. Each group should determine whether a process costing or job costing system is most likely used to calculate product costs for each item listed in the following and should be prepared to explain its answers.

- Jetliners produced by Boeing

- Gasoline produced by Shell Oil Company

- Audit of Intel by Ernst & Young

- Oreo cookies produced by Nabisco Brands, Inc.

- Frosted Mini-Wheats produced by Kellogg Co.

- Construction of suspension bridge in Puget Sound, Washington, by Bechtel Group, Inc.

- Aluminum foil produced by Alcoa, Inc.

- Potato chips produced by Frito-Lay, Inc.

Comprehensive Cases

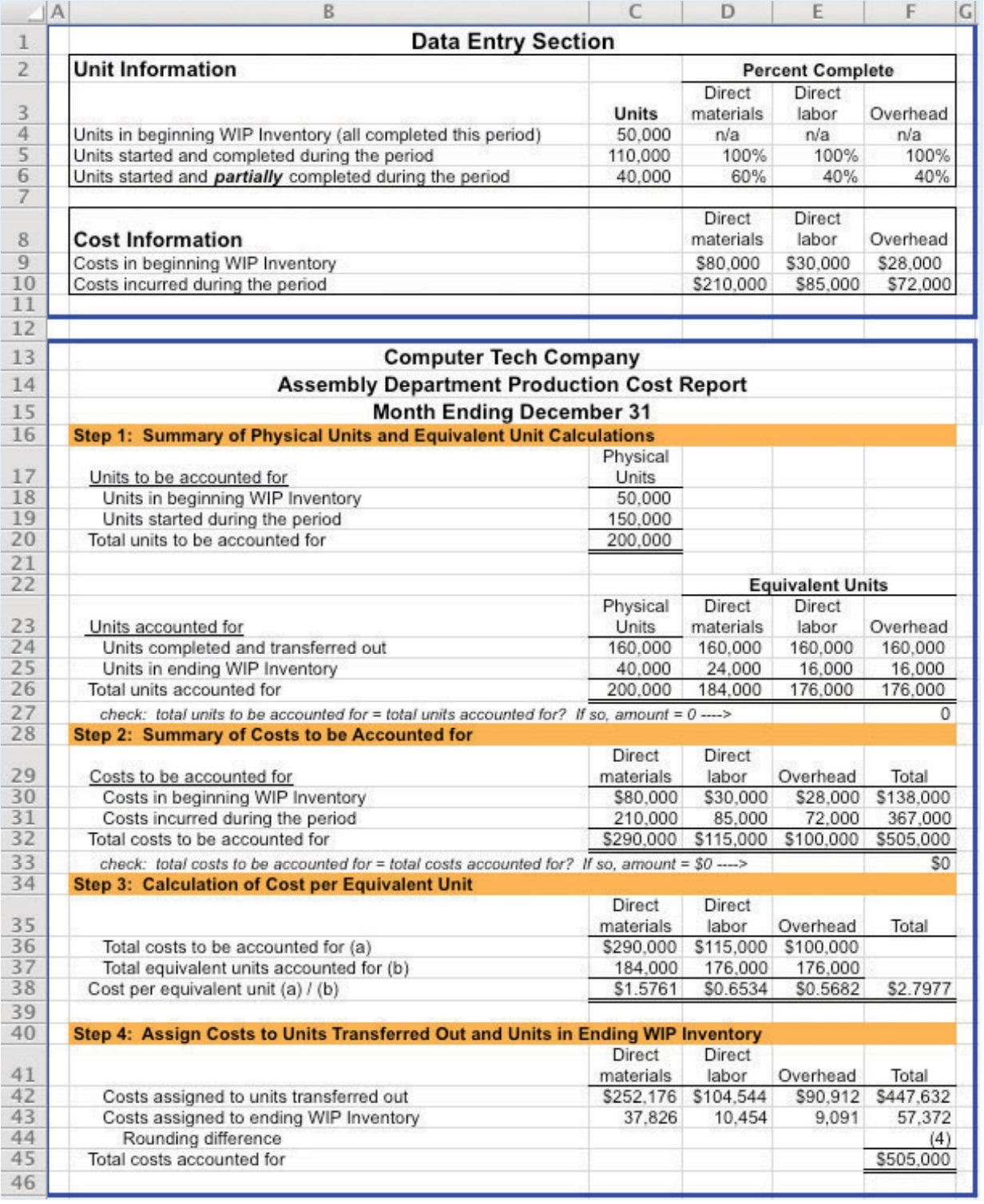

- Ethics: Manipulating Percentage of Completion Estimates. Computer Tech Corporation produces computer keyboards, and its fiscal year ends on December 31. The weighted average method is used for the company’s process costing system. As the controller of Computer Tech, you present December’s production cost report for the Assembly department to the president of the company. The Assembly department is the last processing department before goods are transferred to finished goods inventory. All 160,000 units completed and transferred out during the month were sold by December 31.The board of directors at Computer Tech established a compensation incentive plan that includes a substantial bonus for the president of the company if annual net income before taxes exceeds $2,000,000. Preliminary figures show current year net income before taxes totaling $1,970,000, which is short of the target by $30,000. The president approaches you and asks you to increase the percentage of completion for the 40,000 units in ending WIP inventory to 90 percent for direct materials and to 95 percent for direct labor and overhead. Even though you are confident in the percentages used to prepare the production cost report, which appears as follows, the president insists that his change is minor and will have little impact on how investors and creditors view the company.

Required:

- Why is the president asking you to increase the percentage of completion estimates?

- Prepare another production cost report for Computer Tech Company that includes the president’s revisions. Indicate what impact the president’s request will have on cost of goods sold and on net income (ignore income taxes in your calculations).

- As the controller of the company, how would you handle the president’s request? (If necessary, review the presentation of ethics in Chapter 1 for additional information.)

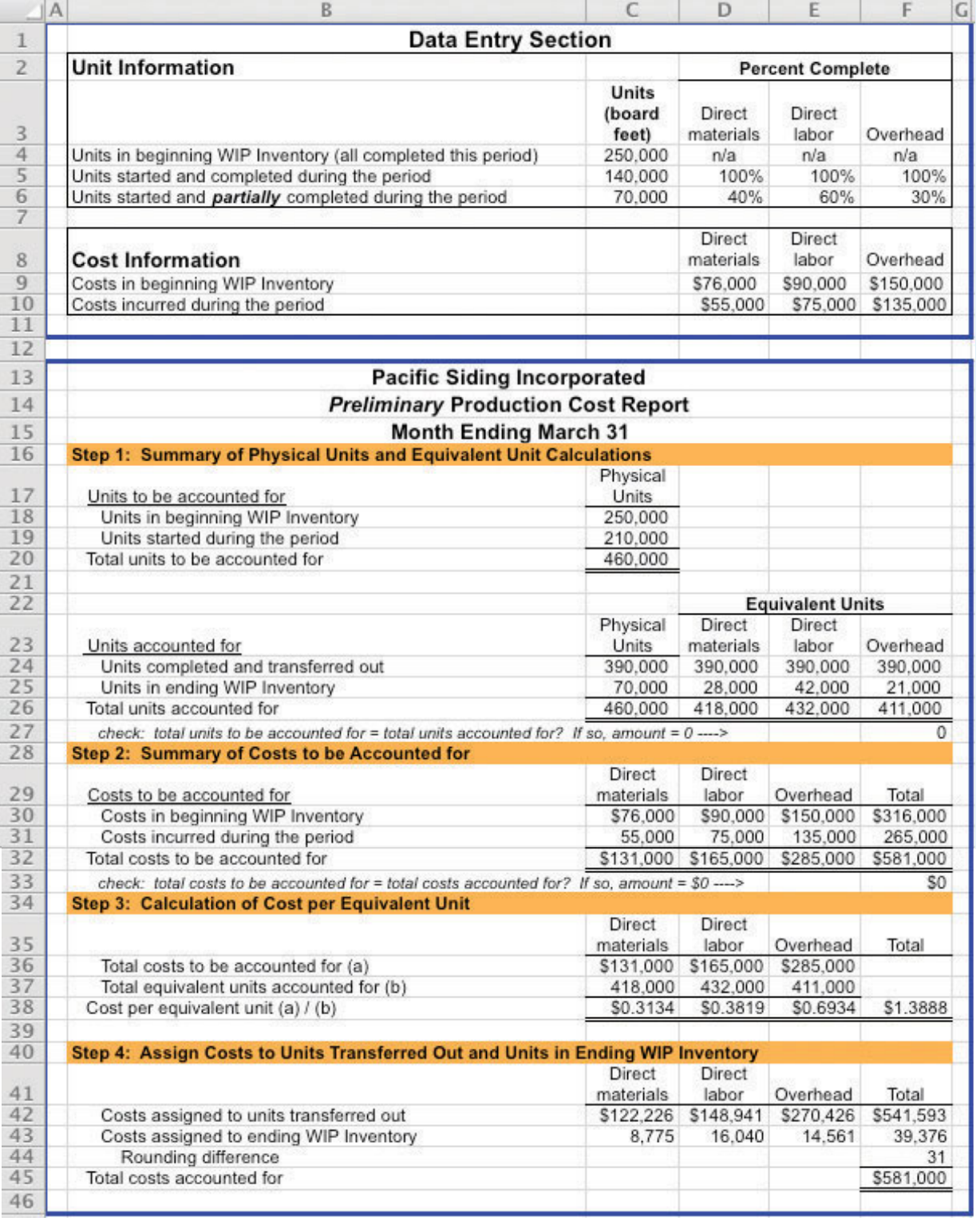

- Ethics: Increasing Production to Boost Profits. Pacific Siding, Inc., produces synthetic wood siding used in the construction of residential and commercial buildings. Pacific Siding’s fiscal year ends on March 31, and the weighted average method is used for the company’s process costing system.Financial results for the first 11 months of the current fiscal year (through February 28) are well below expectations of management, owners, and creditors. Halfway through the month of March, the chief executive officer and chief financial officer asked the controller to estimate the production results for the month of March in the form of a production cost report(the company only has one production department). This report is shown as follows.

Armed with the preliminary production cost report for March, and knowing that the company’s production is well below capacity, the CEO and CFO decide to produce as many units as possible for the last half of March even though sales are not expected to increase any time soon. The production manager is told to push his employees to get as far as possible with production, thereby increasing the percentage of completion for ending WIP inventory. However, since the production process takes three weeks to complete, all the units produced in the last half of March will be in WIP inventory at the end of March.

Required:

- Explain how the CEO and CFO expect to increase profit (net income) for the year by boosting production at the end of March.

- Using the following assumptions, prepare a revised estimate of production results in the form of a production cost report for the month of March.

Assumptions based on the CEO and CFO’s request to boost production- Units started and partially completed during the period will increase to 225,000 (from the initial estimate of 70,000). This is the projected ending WIP inventory at March 31.

- Percentage of completion estimates for units in ending WIP inventory will increase to 80 percent for direct materials, 85 percent for direct labor, and 90 percent for overhead.

- Costs incurred during the period will increase to $95,000 for direct materials, $102,000 for direct labor, and $150,000 for overhead (most overhead costs are fixed).

- All units completed and transferred out during March are sold by March 31.

- Compare your new production cost report with the one prepared by the controller. How much do you expect profit to increase as a result of increasing production during the last half of March? (Ignore income taxes in your calculations.)

- Is the request made by the CEO and CFO ethical? Explain your answer.