97 11.E: Exercises (Part 2)

-

Last updated

- Dec 28, 2020

- Sales and Production Budgets. Catalina, Inc., produces tents used for camping. Unit sales last year, ending December 31, follow.

First quarter 6,000 Second quarter 10,000 Third quarter 12,000 Fourth quarter 8,000 Unit sales are expected to increase 30 percent this coming year over the same quarter last year. Average sales price per tent will remain at $300.

Assume finished goods inventory is maintained at a level equal to 10 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 1,900 units.

Required:

- Prepare a sales budget for Catalina, Inc., using a format similar to Figure 11.3. (Hint: be sure to increase last year’s unit sales by 30 percent.)

- Prepare a production budget for Catalina, Inc., using a format similar to Figure 11.4.

-

Direct Materials Purchases and Direct Labor Budgets. Catalina, Inc., produces tents used for camping. The company expects to produce 8,320 units in the first quarter, 13,260 units in the second quarter, 15,080 units in the third quarter, and 11,260 units in the fourth quarter (this information is derived from the previous exercise for Catalina, Inc.).

With regards to direct materials, each unit of product requires 8 yards of material, at a cost of $4 per yard. Management prefers to maintain ending raw materials inventory equal to 15 percent of next quarter’s materials needed in production.

Raw materials inventory at the end of the fourth quarter budget period is estimated to be 14,000 yards.With regards to direct labor, each unit of product requires 3 labor hours at a cost of $16 per hour.

Required:

- Prepare a direct materials purchases budget for Catalina, Inc., using a format similar to Figure 11.5.

- Prepare a direct labor budget for Catalina, Inc., using a format similar to Figure 11.6.

-

Manufacturing Overhead Budget. Catalina, Inc., produces tents used for camping. The company expects to produce 8,320 units in the first quarter, 13,260 units in the second quarter, 15,080 units in the third quarter, and 11,260 units in the fourth quarter. (This information is the same as in the previous exercise for Catalina, Inc.) The following information relates to themanufacturing overhead budget.

| Variable Overhead Costs | |

|---|---|

| Indirect materials | $0.20 per unit |

| Indirect labor | $4.20 per unit |

| Other | $2.70 per unit |

| Fixed Overhead Costs per Quarter | |

|---|---|

| Salaries | $100,000 |

| Rent | $ 30,000 |

| Depreciation | $ 44,908 |

Required:

Prepare a manufacturing overhead budget for Catalina, Inc., using a format similar to Figure 11.7.

- Budgets for Cash Collections from Sales and Cash Payments for Purchases. Catalina, Inc., produces tents used for camping. The dollar amount of the company’s quarterly sales and direct materials purchases are projected to be as follows (this information is derived from the previous exercises for Catalina, Inc.):

1st 2nd 3rd 4th Sales $2,340,000 $3,900,000 $4,680,000 $3,120,000 Direct materialspurchases

$ 289,952 $ 433,056 $ 464,224 $ 362,272 Assume all sales are made on credit. The company expects to collect 80 percent of sales in the quarter of sale and 20 percent the quarter following the sale. Accounts receivable at the end of last year totaled $400,000, all of which will be collected in the first quarter of the coming year.

Assume all direct materials purchases are on credit. The company expects to pay 90 percent of purchases in the quarter of purchase and 10 percent the following quarter. Accounts payable at the end of last year totaled $30,000, all of which will be paid in the first quarter of this coming year.

Required:

- Prepare a budget for cash collections from sales. Use a format similar to the top section of Figure 11.11.

- Prepare a budget for cash payments for purchases of materials. Use a format similar to the middle section of Figure 11.11. Round to the nearest dollar.

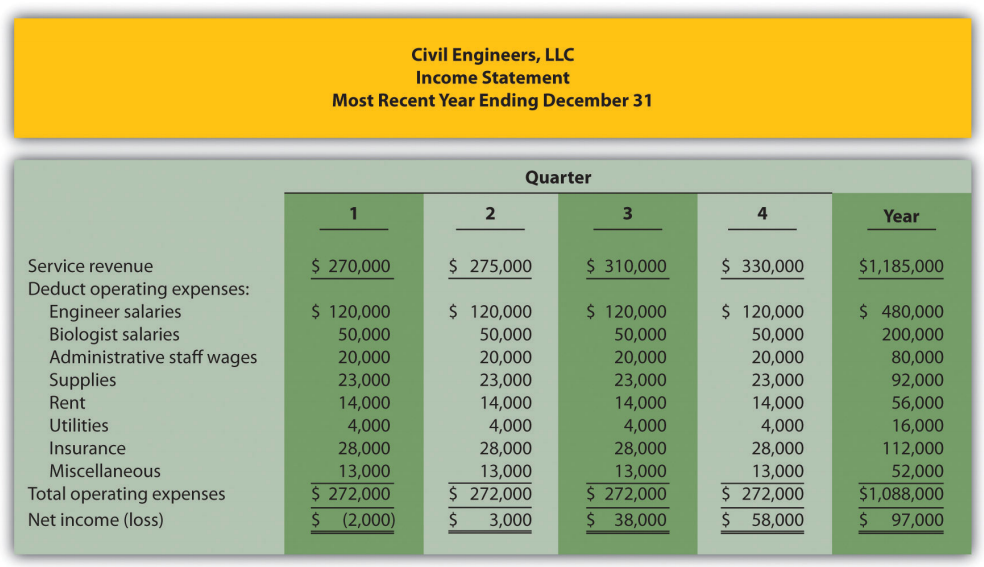

- Service Company Budgeted Income Statement. Civil Engineers, LLC, has five engineers who design and maintain wetlands. The company had the following net income for the most current year.

The following information was gathered from management to help prepare this coming year’s budgeted income statement:- Service revenue will increase 3 percent (e.g., first quarter service revenue for this coming year will be 3 percent higher than the first quarter shown previously).

- Existing engineer and biologist salaries will increase 5 percent, and a new biologist will be hired at the beginning of the second quarter at a quarterly salary of $10,000.

- Administrative staff wages will increase 15 percent.

- Supplies and rent will remain the same.

- Utilities will increase 8 percent.

- Insurance will increase 20 percent.

- Miscellaneous expenses will decrease 5 percent.

Required:

Prepare a quarterly budgeted income statement for Civil Engineers, LLC, and include a column summarizing the year.

Problems

- Budgeting for Sales, Production, Direct Materials, Direct Labor, and Manufacturing Overhead; Ethical Issues. Sanders Swimwear, Inc., produces swimsuits. The following information is to be used for the operating budget this coming year.

- Average sales price for each swimsuit is estimated to be $50. Unit sales for this coming year ending December 31 are expected to be as follows:

First quarter 3,000 Second quarter 5,000 Third quarter 20,000 Fourth quarter 6,000 -

Finished goods inventory is maintained at a level equal to 10 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 400 units.

- Each unit of product requires 3 yards of direct materials, at a cost of $4 per yard. Management prefers to maintain ending raw materials inventory equal to 20 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 9,500 yards.

- Each unit of product requires 0.5 direct labor hours at a cost of $12 per hour.

- Variable manufacturing overhead costs are

Indirect materials $0.60 per unit Indirect labor $3.50 per unit Other $2.80 per unit - Fixed manufacturing overhead costs per quarter are

Salaries $30,000 Other $ 5,000 Depreciation $ 9,330

- Average sales price for each swimsuit is estimated to be $50. Unit sales for this coming year ending December 31 are expected to be as follows:

Required:

- Prepare a sales budget using the format shown in Figure 11.3.

- Prepare a production budget using the format shown in Figure 11.4.

- Prepare a direct materials purchases budget using the format shown in Figure 11.5.

- Prepare a direct labor budget using the format shown in Figure 11.6.

- Prepare a manufacturing overhead budget using the format shown in Figure 11.7.

- As the production manager, what concerns, if any, do you have about production requirements for each of the four quarters?

- Assume the sales budget was developed based on input provided by the company’s vice president of sales. The vice president is paid a base salary plus a bonus if actual sales exceed budgeted sales. How might this influence the vice president’s estimate of quarterly sales? What effect might this have on the company?

- Budgeting for Sales, Production, Direct Materials, Direct Labor, and Manufacturing Overhead. Hershel’s Chocolate produces chocolate bars and sells them by the case (1 unit = 1 case). Information to be used for the operating budget this coming year follows:

- Average sales price for each case is estimated to be $25. Unit sales for this coming year, ending December 31, are expected to be as follows:

First quarter 80,000 Second quarter 84,000 Third quarter 88,000 Fourth quarter r 97,000 -

Finished goods inventory is maintained at a level equal to 15 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 13,000 units.

- Each unit of product requires 5 pounds of cocoa beans for direct materials, at a cost of $3 per pound. Management prefers to maintain ending raw materials inventory equal to 10 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 43,000 pounds.

- Each unit of product requires 0.10 direct labor hours at a cost of $14 per hour.

- Variable manufacturing overhead costs are

Indirect materials $0.20 per unit Indirect labor $0.15 per unit Other $0.10 per unit - Fixed manufacturing overhead costs per quarter are

Salaries $80,000 Other $70,000 Depreciation $55,625

- Average sales price for each case is estimated to be $25. Unit sales for this coming year, ending December 31, are expected to be as follows:

Required:

- Prepare a sales budget using the format shown in Figure 11.3.

- Prepare a production budget using the format shown in Figure 11.4.

- Prepare a direct materials purchases budget using the format shown in Figure 11.5.

- Prepare a direct labor budget using the format shown in Figure 11.6.

- Prepare a manufacturing overhead budget using the format shown in Figure 11.7. Round to the nearest dollar.

- As the production manager, what concerns, if any, do you have about production requirements for each of the four quarters?

-

Selling and Administrative Budget and Budgeted Income Statement. (The previous problem must be completed before working this problem.) Hershel’s Chocolate produces chocolate bars. Management estimates all selling and administrative costs are fixed. Quarterly selling and administrative cost estimates for the coming year follow.

| Salaries | $170,000 |

| Rent | $ 65,000 |

| Advertising | $120,000 |

| Depreciation | $ 75,000 |

| Other | $ 36,000 |

Required:

- Use the information presented previously to prepare a selling and administrative budget. Refer to the format shown in Figure 11.8.

- Use the information from the previous problem and from requirement a of this problem to prepare a budgeted income statement. Refer to the format shown in Figure 11.9.

- How will management use the information presented in the budgeted income statement?

- Budgeting for Cash Collections and Cash Payments. Hershel’s Chocolate produces chocolate bars. The treasurer at Hershel’s Chocolate is preparing the cash budget and would like to know when cash collections from sales and cash payments for materials will occur. The dollar amount of the company’s quarterly sales and direct materials purchases are projected to be as follows (this information is the result of working the previous problems for Hershel’s Chocolate):

1st 2nd 3rd 4th Sales $2,000,000 $2,100,000 $2,200,000 $2,425,000 Direct materialspurchases

$1,215,000 $1,276,125 $1,349,400 $1,417,575 - All sales are made on credit. The company expects to collect 60 percent of sales in the quarter of sale and 40 percent the quarter following the sale. Accounts receivable at the end of last year totaled $770,000, all of which will be collected during the first quarter of this coming year.

- All direct materials purchases are on credit. The company expects to pay 80 percent of purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $257,000, all of which will be paid during the first quarter of this coming year.

Required:

- Prepare a budget for cash collections from sales. Refer to the format shown at the top of Figure 11.11.

- Prepare a budget for cash payments for purchases of materials. Refer to the format shown in the middle section of Figure 11.11.

- How will the treasurer use this information?

- Services Revenue and Direct Labor Budgets for Service Organization; Ethical Issues. Engineering, Inc., provides structural engineering services for its clients. Billable hours for each month of the first quarter of this coming budget period are expected to be as follows:

January 2,000 February 2,200 March 3,000 The average hourly billing rate is estimated to be $150.

Required:

- Prepare a services revenue budget for Engineering, Inc., for each month of the first quarter and include a total column for the quarter. (Hint: this is similar to a sales budget except sales are measured in labor hours rather than in units, and revenue is measured as an average hourly billing rate rather than a sales price per unit.)

- The average cost for each hour of direct labor is expected to be $50. Assume total direct labor hours are expected to be 20 percent higher than billable direct labor hours presented previously. This is caused by employees working on projects that are not billable to clients (e.g., recruiting and community work). Prepare a direct labor budget for each month of the first quarter and include a total column for the quarter. (Hint: this budget will have three lines: projected direct labor hours, labor rate per hour, and total direct labor cost.)

- Assume the manager of the company is given a monthly bonus if actual billable hours exceed budgeted billable hours. How might this influence the manager’s estimate of monthly billable hours for budgeting purposes? What effect might this have on the company?

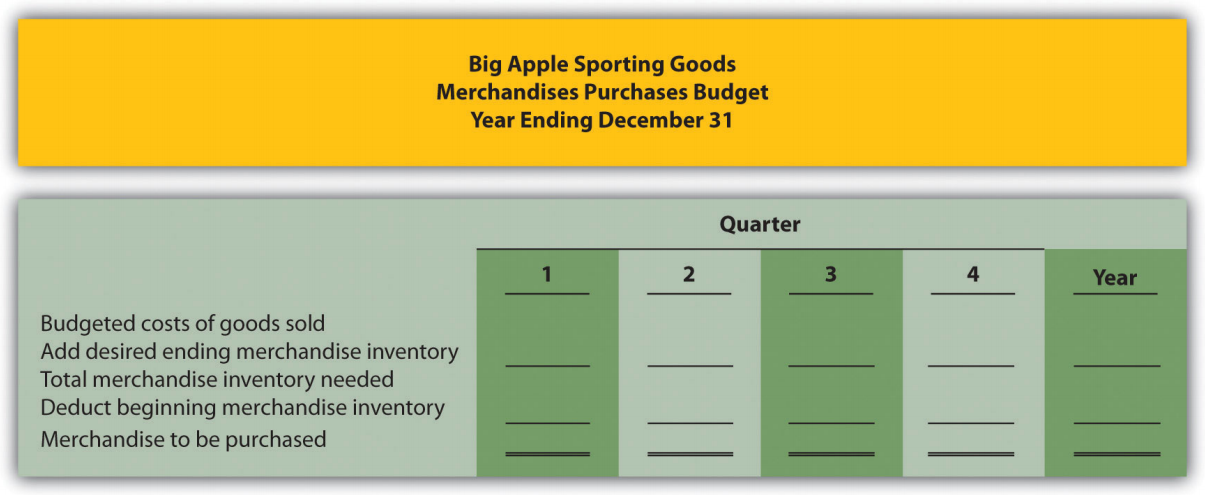

- Merchandising Company Master Budget. Big Apple Sporting Goods is a retail store that sells a variety of sports equipment. The company’s fiscal year ends on December 31. Information to be used for the operating budget this coming year follows.

Sales and Merchandise Purchases Budget Information

- Sales for this coming year ending December 31 are expected to be as follows:

First quarter $600,000 Second quarter $650,000 Third quarter $660,000 Fourth quarter $800,000 -

Cost of goods sold

is 40 percent of sales (this is the first line of the merchandise purchases budget). Merchandise inventory is maintained at a level equal to 20 percent of the next quarter’s cost of goods sold. Merchandise inventory at the end of the fourth quarter

budget period is estimated to be $55,000.

- Management estimates all selling and administrative costs are fixed.

- Quarterly selling and administrative cost estimates for the coming year are

| Salaries | $150,000 |

| Rent | $ 25,000 |

| Advertising | $ 40,000 |

| Depreciation | $ 18,000 |

| Other | $ 12,000 |

Capital Expenditure and Cash Budget Information

- The company plans to pay cash for property, plant, and equipment totaling $35,000 at the end of the fourth quarter. This purchase will not affect depreciation expense for the coming year.

- The company expects to collect 70 percent of sales in the quarter of sale and 30 percent the quarter following the sale. Accounts receivable at the end of last year totaled $200,000, all of which will be collected during the first quarter of this coming year.

- All inventory purchases are on credit. The company expects to pay 80 percent of inventory purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $68,000, all of which will be paid during the first quarter of this coming year.

- The cash balance at the beginning of this coming year is expected to be $90,000.

Information

- Assume 30 percent of fourth quarter budgeted sales will be collected in full the following year (this represents accounts receivable at the end of the fourth quarter).

- Expected account balances at the end of the fourth quarter are

Property, plant, and equipment (net) $120,000 Common stock $175,000 - Actual retained earnings at the end of the last year totaled $252,000, and no cash dividends will be paid during the current

budget period ending December 31.

Required:

- Prepare a quarterly sales budget. (Hint: this budget will not have any units of product, only total sales revenue.)

- Prepare a quarterly merchandise purchases budget using the following format. All amounts are in dollars.

- Prepare a quarterly selling and administrative budget using the format shown in Figure 11.8.

- Prepare a quarterly budgeted income statement using the format shown in Figure 11.9. (Hint: cost of goods sold will be based on a percent of sales rather than a cost per unit.)

- Prepare a quarterly capital expenditure budget using the format shown in Figure 11.10.

- Prepare a quarterly cash budget using the format shown in Figure 11.11. (Hint: Merchandising companies have merchandise purchases rather than direct materials purchases. Merchandising companies do not have direct labor or manufacturing overhead.)

- Prepare a budgeted balance sheet at December 31 using the format shown in Figure 11.12. (Hint: merchandising companies have merchandise inventory rather than raw materials inventory or finished goods inventory.)