38 5. Exercises (Part 2)

-

Last updated

- Dec 28, 2020

Problems

- Actual and Applied Manufacturing Overhead. Marine Products, Inc., incurred the following actual overhead costs for the month of June.

| Indirect materials | $20,000 |

| Indirect labor | $18,000 |

| Rent | $ 3,000 |

| Equipment depreciation | $ 6,500 |

Overhead is applied based on a predetermined rate of $12 per machine hour, and 5,100 machine hours were used during June.

Required:

- Prepare a journal entry to record actual overhead costs for June. Assume that labor costs will be paid next month and that rent was prepaid.

- Prepare a journal entry to record manufacturing overhead applied to jobs during June.

- Create a T-account for manufacturing overhead, post the appropriate information from parts a and b to this account, and calculate the ending balance.

- Is manufacturing overhead overapplied or underapplied? Using the balance in the manufacturing overhead account calculated in part c, prepare the journal entry to close manufacturing overhead to cost of goods sold.

- Actual and Applied Manufacturing Overhead. Quincy Company incurred the following actual overhead costs for the month of February.

| Indirect materials | $335,000 |

| Indirect labor | $275,000 |

| Factory depreciation | $ 18,000 |

| Factory utilities | $ 9,500 |

Overhead is applied based on a predetermined rate of $2 per direct labor dollar (200 percent of direct labor cost), and direct labor costs were $300,000 for the month.

Required:

- Prepare a journal entry to record actual overhead costs for February. Assume indirect labor costs and utilities will be paid next month.

- Prepare a journal entry to record manufacturing overhead applied to jobs during February.

- Create a T-account for manufacturing overhead, post the appropriate information from parts a and b to this account, and calculate the ending balance.

- Is manufacturing overhead overapplied or underapplied? Using the balance in the manufacturing overhead account calculated in part c, prepare the journal entry to close manufacturing overhead to cost of goods sold.

- Calculating the Cost of Jobs, Making Journal Entries, and Preparing an Income Statement. Racing Bikes, Inc., produces custom bicycles for professional racers. Each bike is built to customer specifications. During July, its first month of operations, Racing Bikes began production of four customer orders—jobs 1 through 4. The following transactions occurred during July.

- Purchased bike parts totaling $14,400

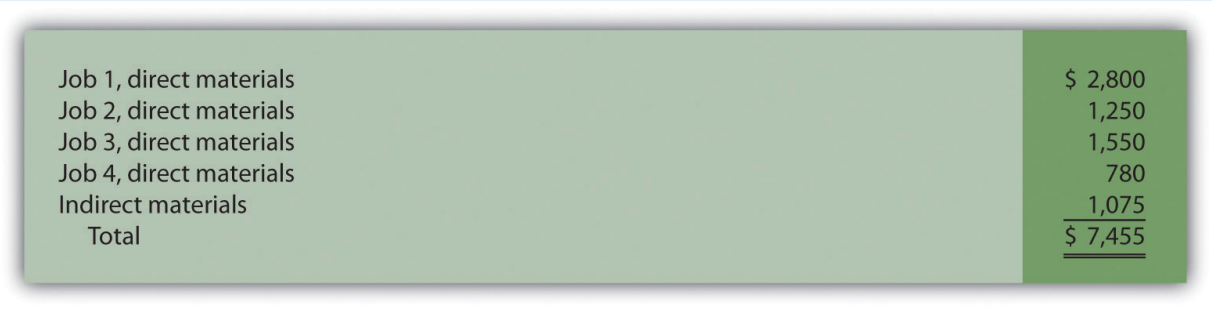

- Processed material requisitions for the following items:

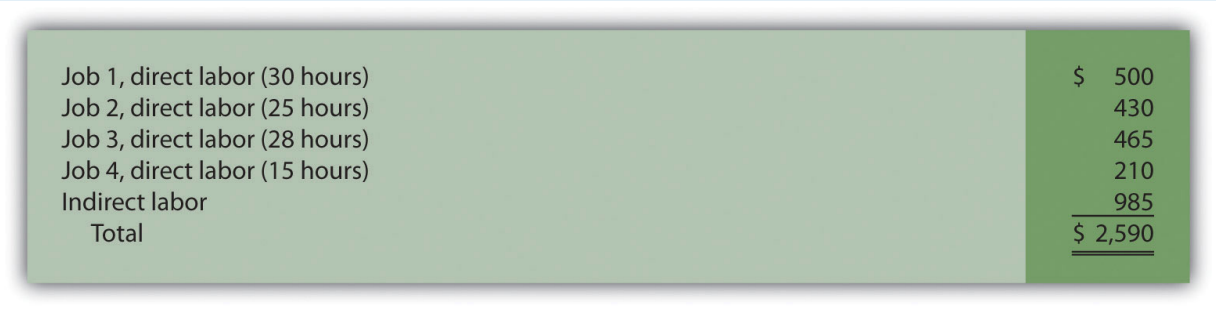

- Processed timesheets showing the following:

- Applied overhead using a predetermined rate of $30 per direct labor hour

- Completed and transferred to finished goods jobs 1, 2, and 3

- Delivered jobs 1 and 2 to customers, billing them $6,000 for job 1 and $3,500 for job 2 (Hint: Two entries are required—one for the cost of the goods and another for the revenue.)

Required:

- Calculate the production costs incurred in July for each of the four jobs.

- Make the appropriate journal entry for each transaction described previously (1 through 6). Assume all payments will be made next month. (Hint: Use Figure 2.7 as a guide.)

- How much gross profit did Racing Bikes, Inc., earn from the sale of job 2?

- Assume selling costs totaled $1,000 and that general and administrative costs totaled $2,200. Prepare an income statement for Racing Bikes for the month of July. (Assume there is no adjustment to cost of goods sold for underapplied or overapplied overhead.)

- Calculating the Cost of Jobs, Making Journal Entries, and Preparing an Income Statement. Classic Boats, Inc., produces custom wood boats. Each boat is built to customer specifications. During April, its first month of operations, Classic Boats began production of three customer orders—jobs 1 through 3. The following transactions occurred during April.

- Purchased production materials totaling $225,000

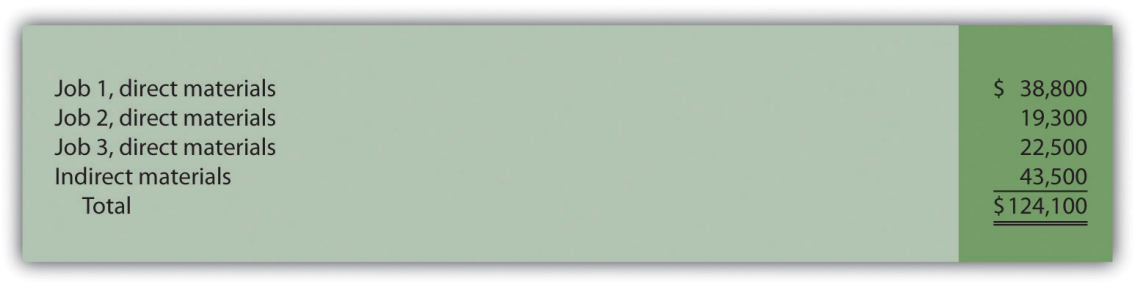

- Processed material requisitions for the following items:

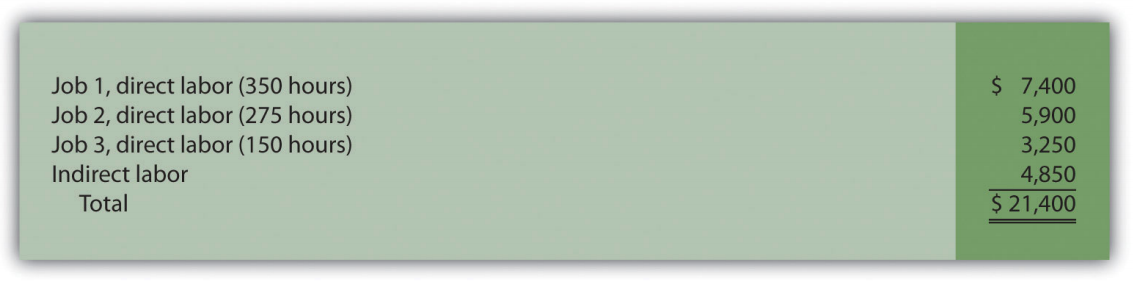

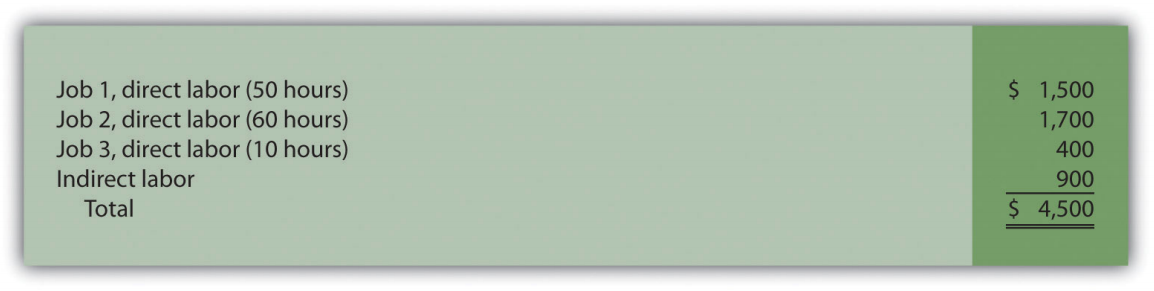

- Processed timesheets showing the following:

- Applied overhead using a predetermined rate of 160 percent of direct labor cost

- Completed job 1 and transferred it to finished goods

- Delivered job 1 to the customer and billed her $70,000. (Hint: Two entries are required—one for the cost of the goods and another for the revenue.)

Required:

- Calculate the production costs incurred in April for each of the three jobs.

- Make the appropriate journal entry for each of the six transactions described previously. Assume all payments will be made next month. (Hint: Use Figure 2.7 as a guide.)

- How much gross profit did Classic Boats earn from the sale of job 1?

- Assume selling costs totaled $2,000 and general and administrative costs totaled $5,500. Prepare an income statement for Classic Boats for the month of April. (Assume there is no adjustment to cost of goods sold for underapplied or overapplied overhead.)

- Calculating the Cost of Jobs and Making Journal Entries for a Service Company. Sampson & Associates provides accounting services. It began jobs 1 through 3 in the first week of January. The following transactions occurred that week.

- Purchased supplies on account totaling $1,500

- Used supplies totaling $800 for various jobs

- Processed timesheets showing the following:

- Applied overhead using a predetermined rate of $10 per direct labor hour.

- Completed job 1 and billed the customer $3,000. (Hint: Two entries are required—one for the cost of services and another for revenue.)

Required:

- Calculate the costs incurred in January for each of the three jobs.

- Make the appropriate journal entry for each item described previously. Assume all payments will be made next month. (Hint: Use Figure 2.7 as a guide.)

- How much gross profit did Sampson & Associates earn from job 1?

- Calculating the Cost of Jobs and Making Journal Entries for a Service Company. Management Consulting, Inc., provides consulting services and began operations on September 1. It began jobs 1 through 4 during the first half of September. The following transactions occurred during that time.

- Purchased supplies on account totaling $6,000

- Used supplies totaling $3,200 for various jobs

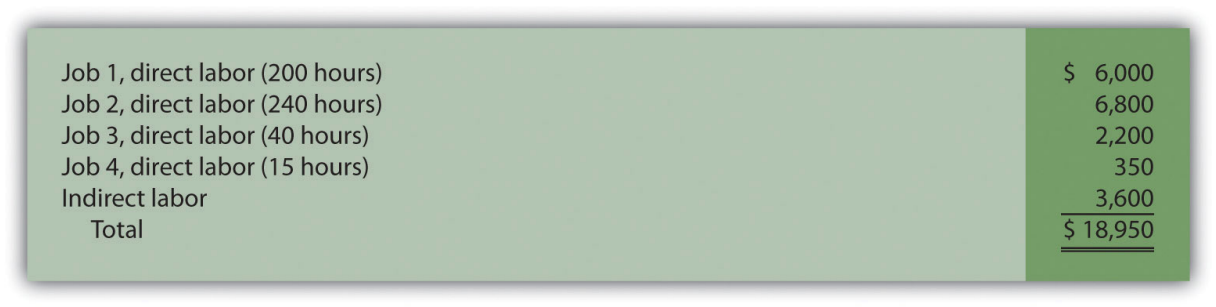

- Processed timesheets showing the following:

- Applied overhead using a predetermined rate of 120 percent of direct labor cost

- Completed jobs 1 and 2 and billed the customers $20,000 and $21,000, respectively. (Hint: Two entries are required—one for the cost of services and another for revenue.)

Required:

- Calculate the costs incurred in September for each of the four jobs.

- Make the appropriate journal entry for each item described previously. Assume all payments will be made next month. (Hint: Use Figure 5.7 as a guide.)

- How much gross profit did Management Consulting, Inc., earn from job 1 and job 2?

- What is the amount in work in process at the end of the first half of September?

- Closing Manufacturing Overhead : Two Approaches. Olympia Company incurred actual manufacturing overhead costs of $630,000 during the year ended December 31, 2012. A total of $570,000 in overhead was applied to jobs. At December 31, 2012, work-in-process inventory totals $200,000, and finished goods inventory totals $400,000. Cost of goods sold before adjustments totals $1,400,000 for the year.

Required:

- Is overhead underapplied or overapplied?

- Close the manufacturing overhead account, assuming the balance is immaterial.

- Close the manufacturing overhead account, assuming the amount is material.

- Closing Manufacturing Overhead : Two Approaches. Placer Company incurred actual manufacturing overhead costs of $260,000 during the year ended December 31, 2012. A total of $350,000 in overhead was applied to jobs. At December 31, 2012, work-in process inventory totals $100,000, and finished goods inventory totals $300,000. Cost of goods sold before adjustments totals $600,000 for the year.

Required:

- Is overhead underapplied or overapplied?

- Close the manufacturing overhead account, assuming the balance is immaterial.

- Close the manufacturing overhead account, assuming the amount is material.

One Step Further: Skill-Building Cases

- Ethics: Shifting Hours Using Job Costing. Shawney Accountancy Corporation provides accounting services. It uses a job costing system to track each client’s revenues and costs. The firm is currently working on two jobs. The first job, preparing tax returns for Bantem Corporation, was bid at $25,000 and had budgeted costs of $18,000. The second job , performing a review of internal controls for Maxum Company, was bid at 50 percent above actual costs. The following conversation took place between Kelly (a manager) and Ron (senior staff working for Kelly).

| Kelly: | Ron, I just reviewed timesheets for the two jobs we’re working on, and it appears we are quickly approaching the budget of $18,000 for the Bantem job. |

| Ron: | Yes, we’re having trouble completing the Bantem job in the hours budgeted. |

| Kelly: | This is the first year on the Bantem job, and budgeting for first-year clients is always difficult. |

| Ron: | I’m sure we can retain this job next year with a little bump in the bid—perhaps to $29,000. |

| Kelly: | That’s fine for next year, but I have to answer to my boss for this year’s results. Why don’t we take some of the pressure off by charging some time from the Bantem job to the internal control project we have with Maxum Company? We’re under budget with the Maxum job, and they are paying us based on actual costs plus a 50 percent markup. |

| Ron: | Can we do that? |

| Kelly: | We don’t do it often, but in cases like this, we have to get creative. |

Required:

- Why is there an incentive to inflate the hours charged to the Maxum job?

- What should Ron do? (You may want to refer to the IMA’s ethical standards discussed in Chapter 1.)

- Internet Project: Automation and Overhead Allocation. Over the past several decades, manufacturing companies have tended to move away from direct labor and more toward automation (i.e., using machinery rather than people to produce products).

Required:

- Use the Internet to find several examples of companies that have made the shift toward an automated production environment. Write a one-page summary of your findings, and include specific information indicating what type of automation is being used.

- How might this shift to automation affect the allocation base used to allocate overhead to products?

- Group Project: Labor Costs at General Motors and Toyota. Both General Motors (GM) and Toyota have production facilities in Texas. GM’s plant was built in 1956 on a 249-acre site and has since undergone billions of dollars in renovations. Toyota’s plant was built in 2006 on 2,000 acres. Each plant has a production capacity of 200,000 vehicles per year. GM averages close to 22 assembly labor hours per vehicle (no data on labor hours per vehicle are available for Toyota). The labor cost per vehicle is $1,800 for GM, which uses a unionized labor force, and $800 for Toyota, which uses nonunion labor. (Based on Lee Hawkins Jr. and Norihiko Shirouzu, “A Tale of Two Auto Plants,” Wall Street Journal, May 24, 2006.)

Required:

Form groups of two to four students and respond to the following items:

- Provide at least two reasons for the significant difference in assembly labor cost per vehicle for GM and Toyota.

- What other production costs should be considered in evaluating the efficiency of each plant?

Comprehensive Cases

- Journal Entries, Closing Manufacturing Overhead, and Preparing an Income Statement. Benning, Inc., is a defense contractor that uses job costing. Because the firm uses a perpetual inventory system, the three supporting schedules to the income statement (the schedule of raw materials placed in production, the schedule of cost of goods manufactured , and the schedule of cost of goods sold) are not necessary. Inventory account beginning balances at January 1, 2012, are listed as follows

|

Raw materials inventory

|

$ 500,000 |

| Work-in-process inventory | $ 700,000 |

|

Finished goods inventory

|

$1,800,000 |

You will be recording the following transactions, which summarize the activities that occurred during the year ended December 31, 2012:

- Raw materials were purchased for $300,000 on account.

- Raw materials totaling $420,000 were placed in production, $60,000 for indirect materials and $360,000 for direct materials.

- The raw materials purchased in transaction 1 were paid for.

- A total cost of $800,000 for direct labor, shown on the timesheets, was recorded as wages payable.

- Production supervisors and other indirect labor working in the factory were owed $540,000, recorded as wages payable.

- Wages owed, totaling $1,200,000, were paid. (These wages were previously recorded correctly as wages payable.)

- The costs listed in the following related to the factory were incurred during the period. (Hint: Record these items in one entry with one debit to manufacturing overhead and four separate credits):

| Building depreciation | $580,000 |

| Insurance (prepaid during 2012, now expired) | $220,000 |

| Utilities (on account) | $ 80,000 |

| Maintenance (paid cash) | $440,000 |

-

Manufacturing overhead was applied at a rate of $20 per machine hour, and 90,000 machine hours were utilized during the year. (Hint: No need to calculate the predetermined overhead rate since it is already given to you here.)

- Miscellaneous selling costs totaling $430,000 were paid. These costs were recorded in an account called selling expenses.

- Miscellaneous general and administrative costs totaling $265,000 were paid. These costs were recorded in an account called G&A expenses.

- Goods costing $2,030,000 (per the job cost sheets) were completed and transferred out of work-in-process inventory.

- Goods were sold on account for $3,800,000.

- The goods sold in transaction 12 had a cost of $2,570,000 (per the job cost sheets).

- Payments totaling $3,300,000 from credit customers related to transaction 12 were received

Required:

- Prepare T-accounts for raw materials inventory, work-in-process inventory, finished goods inventory, manufacturing overhead , and cost of goods sold. Enter the beginning balances for the inventory accounts. (Manufacturing overhead and cost of goods sold are temporary accounts and thus do not have a beginning balance.)

- Prepare a journal entry for each transaction from 1 through 14 in a format like the one in Figure 2.7, and where appropriate, post each entry to the T-accounts set up in requirement a. Note that these entries reflect the flow of costs through the inventory and

cost of goods sold accounts for the year. Label each entry in the T-accounts by transaction number, include a short description (e.g., direct materials and manufacturing overhead applied), and total each T-account.

- Based on the balance in the manufacturing overhead account prepared in requirement b, prepare a journal entry to close the

manufacturing overhead account to cost of goods sold.

- Prepare an income statement for the year ended December 31, 2012. Remember to adjust cost of goods sold for any underapplied or overapplied overhead.

- Why is cost of goods sold adjusted upward on the income statement?

- Journal Entries, Closing Manufacturing Overhead, and Preparing an Income Statement. Sierra Nursery Company grows a variety of plants and sells them to local nurseries. Raw materials consist of such items as seeds and the fertilizer required to grow plants from the seedling stage to a viable, saleable plant. Sierra Nursery uses a job costing system to track revenues and costs associated with customer orders. Because the firm uses a perpetual inventory system, the three supporting schedules to the income statement (the schedule of raw materials placed in production, the schedule of cost of goods manufactured, and the schedule of cost of goods sold) are not necessary. Inventory account beginning balances at January 1, 2012, are as follows:

|

Raw materials inventory

|

$50,000 |

| Work-in-process inventory | $60,000 |

|

Finished goods inventory

|

$90,000 |

You will be recording the following transactions, which summarize the activities that occurred during the year ended December 31, 2012:

- Raw materials were purchased for $30,000 on account.

- Raw materials totaling $41,000 were placed in production, $5,000 for indirect materials and $36,000 for direct materials.

- The raw materials purchased in transaction 1 were paid for.

- A total cost of $140,000 for 9,000 hours of direct labor, shown on the timesheets, was recorded as wages payable.

- Production supervisors and other indirect labor working in the nursery were owed $134,000, recorded as wages payable.

- Wages owed totaling $180,000 were paid. (These wages were previously recorded correctly as wages payable.)

- The costs listed in the following related to the nursery were incurred during the period. (Hint: Record these items in one entry with one debit to manufacturing overhead and four separate credits):

| Equipment depreciation | $22,000 |

| Rent (prepaid during 2012) | $36,000 |

| Utilities (on account) | $33,000 |

| Maintenance (paid cash) | $19,000 |

-

Manufacturing overhead was applied at a rate of $30 per direct labor hour. (Hint: No need to calculate the predetermined overhead rate since it is already given to you here.)

- Miscellaneous selling costs totaling $63,000 were paid. These costs were recorded in an account called selling expenses.

- Miscellaneous general and administrative costs totaling $18,000 were paid. These costs were recorded in an account called G&A expenses.

- Goods costing $478,000 (per the job cost sheets) were completed and transferred out of work-in-process inventory.

- Goods were sold on account for $780,000.

- The goods sold in transaction 12 had a cost of $415,000 (per the job cost sheets).

- Payments totaling $380,000 from credit customers related to transaction 12 were received.

Required:

- Prepare T-accounts for raw materials inventory, work-in-process inventory, finished goods inventory, manufacturing overhead, and cost of goods sold. Enter the beginning balances for the inventory accounts. (Manufacturing overhead and cost of goods sold are temporary accounts and thus do not have a beginning balance.)

- Prepare a journal entry for each transaction from 1 through 14 in a format like the one in Figure 2.7, and where appropriate, post each entry to the T-accounts set up in requirement a. Note that these entries reflect the flow of costs through the inventory and cost of goods sold accounts for the year. Label each entry in the T-accounts by transaction number, include a short description (e.g., direct materials and manufacturing overhead applied), and total each T-account.

- Based on the balance in the manufacturing overhead account prepared in requirement b, prepare a journal entry to close the manufacturing overhead account to cost of goods sold.

- Prepare an income statement for the year ended December 31, 2012. Remember to adjust cost of goods sold for any underapplied or overapplied overhead.

- Why is cost of goods sold adjusted downward on the income statement?