48 6. Exercises (Part 2)

-

Last updated

- Dec 28, 2020

Problems

-

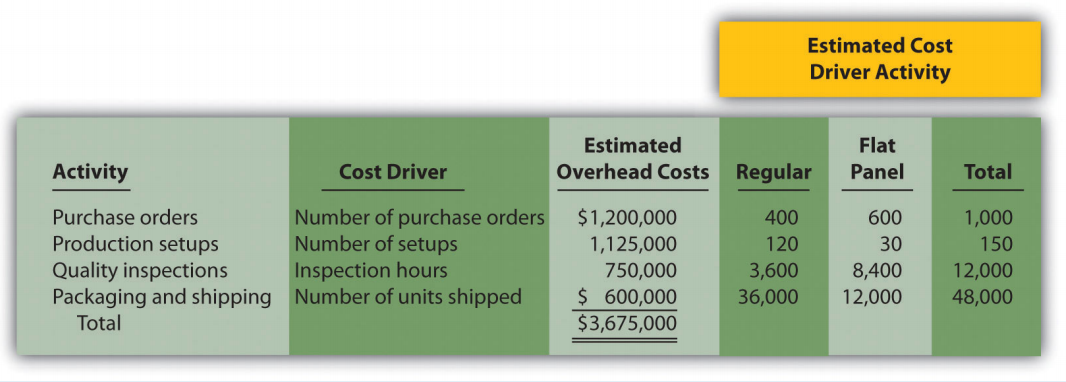

Activity-Based Costing Versus Traditional Approach. Techno Company produces a regular computer monitor that sells for $175 and a flat panel computer monitor that sells for $300. Last year, total overhead costs of $3,675,000 were allocated based on direct labor hours. A total of 63,000 direct labor hours were required last year to build 36,000 regular monitors (1.75 hours per unit), and 42,000 direct labor hours were required to build 12,000 flat panel monitors (3.50 hours per unit). Total direct labor and direct materials costs for last year were as follows: Regular Monitor Flat Panel Monitor Direct materials $1,908,000 $ 900,000 Direct labor $1,728,000 $1,200,000 The management of Techno Company would like to use activity based costing to allocate overhead rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

| Regular Monitor | Flat Panel Monitor | |

|---|---|---|

|

Direct materials

|

$1,908,000 | $ 900,000 |

|

Direct labor

|

$1,728,000 | $1,200,000 |

The management of Techno Company would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

- Calculate the direct materials cost per unit and direct labor cost per unit for each product.

-

- Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the regular and flat panel products.

- Using the plantwide allocation method, calculate the product cost per unit for the regular and flat panel products. Round results to the nearest cent.

-

- Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity -based costing process have already been done for you; this is step 4.)

- Using the activity-based costing allocation method, allocate overhead to each product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest cent.

- What is the product cost per unit for the regular and flat panel products?

- Calculate the per unit profit for each product using the plantwide approach and the activity-based costing approach.

- How much did the profit per unit change for each product when moving from the plantwide approach to the activitybased costing approach? What caused this change?

-

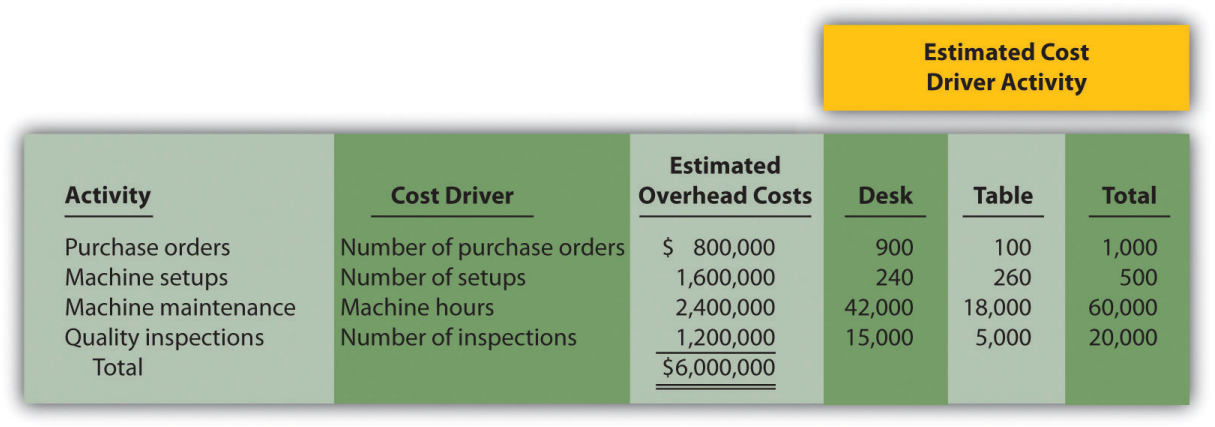

Activity-Based Costing Versus Traditional Approach, Activity-Based Management. Quality Furniture, Inc., produces a wood desk that sells for $500 and a wood table that sells for $900. Last year, total overhead costs of $6,000,000 were allocated based on direct labor costs. Direct labor costs totaled $2,000,000 last year, and Quality Furniture produced 15,000 desks and 5,000 tables. Total direct labor and direct materials costs by product for last year were as follows:

| Desk | Table | |

|---|---|---|

|

Direct materials

|

$1,575,000 | $950,000 |

|

Direct labor

|

$1,200,000 | $800,000 |

The management of Quality Furniture would like to use activity based costing to allocate overhead rather than one plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

- Calculate the direct materials cost per unit and direct labor cost per unit for each product.

-

- Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the desk and table products.

- Using the plantwide allocation method, calculate the product cost per unit for the desk and table products. Round results to the nearest cent.

-

- Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.)

- Using the activity-based costing allocation method, allocate overhead to each product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest cent.

- What is the product cost per unit for the desk and table products?

- Calculate the per unit profit for each product using the plantwide approach and the activity-based costing approach. How much did the per unit profit change when moving from one approach to the other?

- Refer to the estimated cost driver activity provided. Calculate the percent of each activity consumed by each product (e.g., the desk product issued 900 of the 1,000 purchase orders issued in total and therefore consumes 90 percent of this activity). These percentages represent the amount of overhead costs allocated to each product using activity-based costing. Using the plantwide approach, 60 percent of all overhead costs are allocated to the desk and 40 percent to the table. Compare the activity-based costing percentages to the percentage of overhead allocated to each product using the plantwide approach. Use this information to explain what caused the shift in overhead costs to the desk product using activity-based costing.

- Calculating and Recording Overhead Applied. Assume Quality Furniture, Inc., discussed in Problem 41, uses activity-based costing.

Required:

- Using the data presented at the beginning of Problem 41, calculate the predetermined overhead rate for each activity.

- The following activity associated with the desk product was reported for the month of March. Using the predetermined overhead rates calculated in requirement a, determine the amount of overhead applied to the desk product for the month of March.

Number of purchase orders processed 40 Number of machine setups 22 Number of machine hours 2,425 Number of quality inspections 890 - Make the journal entry to record overhead applied to the desk product for the month of March.

- Assume you are the manager of the desk product line and would like to reduce the amount of overhead costs being applied to your products. Which activity would you focus on first? Why?

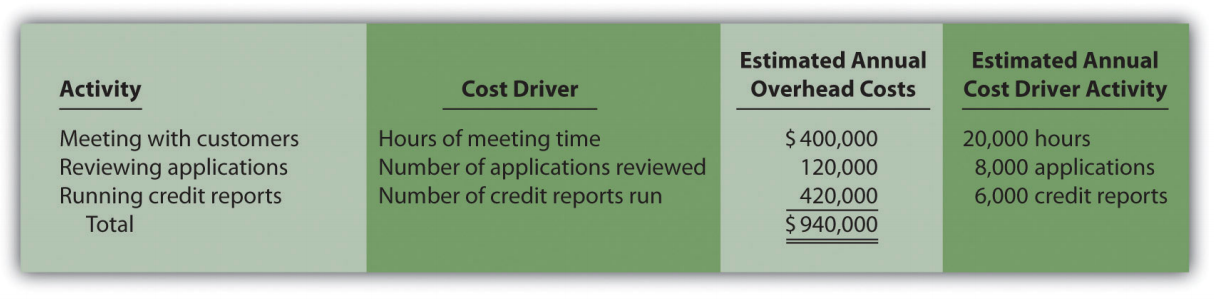

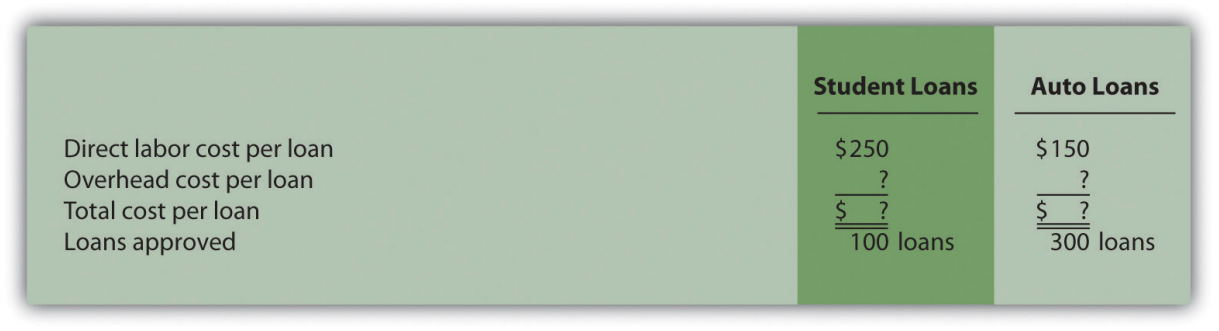

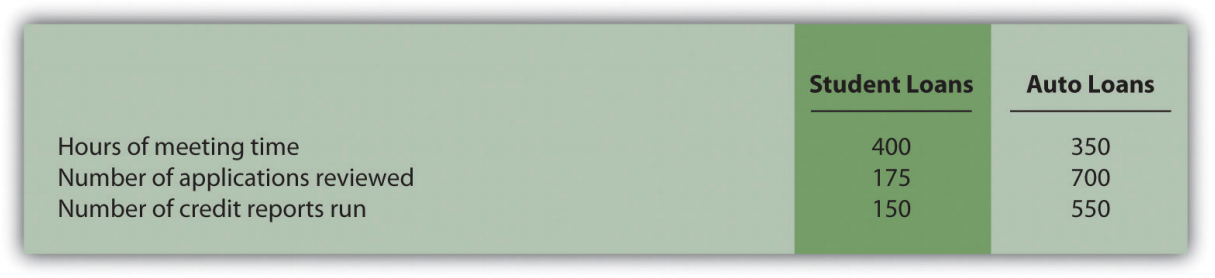

- Computing Product Costs Using Activity-Based Costing, Service Company. Roseville Community Bank uses activity-based costing to assign overhead costs to two different loan products—student loans and auto loans. The bank identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

The following information for the two loan products offered by Roseville Community Bank is for the month of July:

Actual cost driver activity levels for the month of July are as follows:

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for July, allocate overhead to the two products for the month of July.

- For each loan product, calculate the overhead cost per loan approved for the month of July. Round results to the nearest cent.

- For each loan product, calculate the total cost per loan approved for the month of July. Round results to the nearest cent.

- Assume you are the manager of the auto loans product line and would like to reduce the amount of overhead costs being applied to your products. Which activity would you focus on first? Why?

-

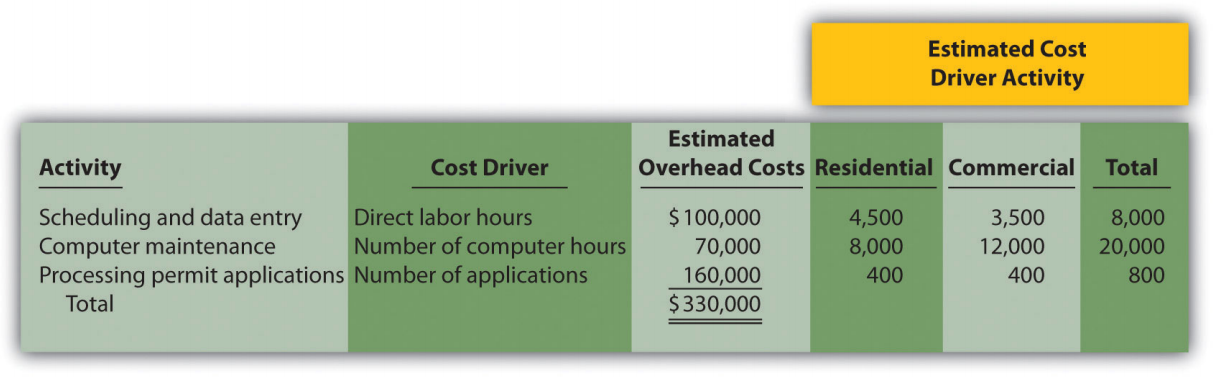

Activity-Based Costing Versus Traditional Approach: Service Company, Activity-Based Management. Hodges and Associates is a small firm that provides structural engineering services for its clients. The company performs structural engineering services for both residential and commercial buildings. Last year, total overhead costs of $330,000 were allocated based on direct labor costs. A total of $300,000 in direct labor costs were incurred in the following areas: $120,000 in the residential segment and $180,000 in the commercial segment. Direct materials used were negligible and are included in overhead costs. Sales revenue totaled $450,000 for residential services and $330,000 for commercial services.

The management of Hodges and Associates would like to use activity-based costing to allocate overhead rather than a plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

-

- Using the plantwide allocation method, calculate the total cost for each product. (Hint: Product costs for this company include overhead and direct labor.)

- Using the plantwide approach, calculate the profit for each product. Also calculate profit as a percent of sales revenue for each product (round to the nearest tenth of a percent).

-

- Using activity-based costing, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.) Round results to the nearest cent.

- Using activity-based costing, calculate the amount of overhead assigned to each product. (Hint: This is step 5 in the activity-based costing process.)

- Using activity-based costing, calculate the profit for each product. Also calculate profit as a percent of sales revenue for each product (round to the nearest tenth of a percent).

- What caused the shift of overhead costs to the residential product using activity-based costing? How might management use this information to make improvements within the company?

- Calculating and Recording Overhead Applied: Service Company. Assume Hodges and Associates, discussed in Problem 44, uses activity-based costing.

Required:

- Using the data presented at the beginning of Problem 44, calculate the predetermined overhead rate for each activity. Round results to the nearest cent.

- The following activity associated with the commercial product was reported for the month of September. Using the predetermined overhead rates calculated in requirement a, determine the amount of overhead applied to the commercial product for the month of September.

Number of direct labor hours350 Number of computer hours 960 Number of applications 50 - Make the journal entry to record overhead applied to the commercial product for the month of September.

- Assume you are manager of the commercial product line and would like to reduce the amount of overhead costs being applied to your products. Which activity would you focus on first? Why?

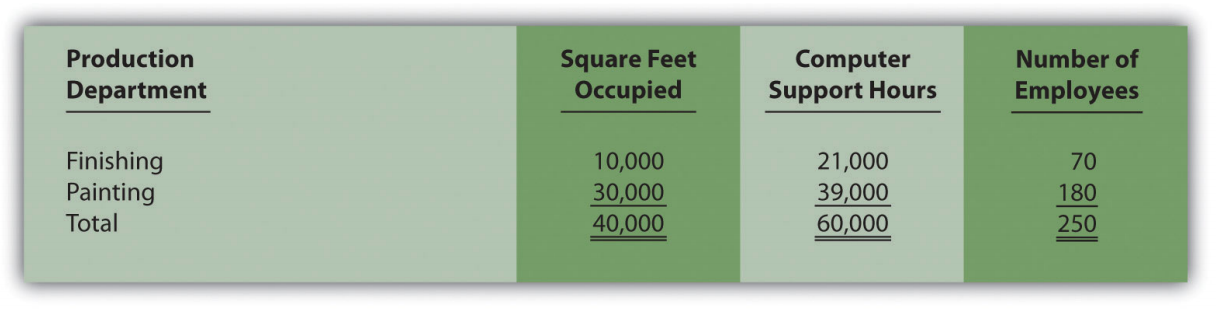

- Allocating Service Department Costs. Szabo Industries has two production departments (Finishing and Painting) and three service departments (Maintenance, Computer Support, and Personnel). Service department costs are allocated to production departments using the direct method. Maintenance allocates costs totaling $3,000,000 based on the square footage of space occupied by each production department. Computer Support allocates costs totaling $4,000,000 based on hours of computer support used by each production department. Personnel allocates costs totaling $2,500,000 based on number of employees in each production department. Information for each production department follows.

Required:

- Calculate the service department costs allocated to each production department.

- Why do companies allocate service department costs to production departments?

- Selecting an Allocation Base for Service Costs. Winstead, Inc., is looking for an appropriate allocation base to allocate personnel costs totaling $5,000,000. Service department costs are allocated to three production departments: Assembly, Sanding, and Finishing. Management is considering two allocation bases.

| Possible Allocation Base | Assembly | Sanding | Finishing |

|---|---|---|---|

| Number of employees | 30 | 20 | 50 |

| Square feet of space occupied | 25,000 | 15,000 | 10,000 |

Required:

- Calculate the amount of personnel department costs allocated to production departments using each allocation base.

- Which allocation base do you think is most reasonable? Why?

One Step Further: Skill-Building Cases

48. Overhead Allocation. Do you agree with the following statement? Explain your answer. Total estimated overhead costs will vary depending on whether we use the plantwide method, department method, or activity-based costing to allocate overhead.

- Cost Allocation Issues. Assume you rent a house with two friends. The total monthly rent is $1,500. Your bedroom is the smallest of the three bedrooms, and each of the others has a bathroom attached. You and your friends are trying to decide how to divide up the rent. Two possibilities are being discussed.

- Share the cost equally among the three of you.

- Determine rent based on square feet occupied (the attached bathrooms would be part of the square footage measurement).

Required:

- Which approach do you think is most fair for all involved? Why?

- Which approach is easiest? Why?

- Suggest another approach to dividing up the cost of rent.

-

Activity-Based Costing and Activity-Based Management. A colleague states, “We produce one product, and our operations are relatively simple. Activity-based costing and activity-based management would be a waste of time for our company!” Do you agree with this statement? Explain.

-

Product Costs. The company president makes the following statement: “Product costs are straightforward. Whatever costs are incurred to produce a product are assigned to that product.” Do you agree with this statement? Explain.

- Changing Plantwide Allocation Rate at SailRite. Recall from the chapter discussion that SailRite uses one plantwide rate based on direct labor hours to allocate manufacturing overhead costs to the company’s two sailboat products—Basic and Deluxe. Management was concerned about the inaccuracy of overhead costs being assigned to each product and decided to calculate product costs using activity-based costing. Product cost and profit results are summarized in the following for the plantwide allocation approach (based on direct labor hours) and activity-based costing approach. This information was presented in the chapter in Figure 6.7 ” Activity-Based Costing Versus Plantwide Costing at SailRite Company”.

*Overhead taken from Figure 6.2 “SailRite Company Product Costs Using One Plantwide Rate Based on Direct Labor Hours”.

**Overhead taken from Figure 6.5 “Allocation of Overhead Costs to Products at SailRite Company”.

Although management of SailRite prefers the accuracy of activity-based costing, the cost of maintaining such an accounting system for the long term is prohibitive. John, the accountant, has proposed going back to using one plantwide rate, but he would like to allocate overhead costs using machine hours rather than direct labor hours.

Recall that overhead costs totaled $8,000,000. A total of 90,000 machine hours were used for the period: 50,000 for Basic sailboats and 40,000 for Deluxe sailboats. The company produced 5,000 units of the Basic model and 1,000 units of the Deluxe model. Thus the Basic model uses 10 machine hours per unit (= 50,000 machine hours ÷ 5,000 units) and the Deluxe model uses 40 machine hours per unit (= 40,000 machine hours ÷ 1,000 units).

Required:

- Calculate the predetermined overhead rate using machine hours as the allocation base, and determine the overhead cost per unit allocated to the Basic and Deluxe sailboats. Round results to the nearest cent.

- For each product, calculate the unit product cost and profit using the same format presented previously. Round results to the nearest cent.

- Compare your results in requirement b to the results using direct labor hours as the allocation base and activity-based costing.

- Provide at least two reasons why management might prefer machine hours as the overhead allocation base rather than direct labor hours or activity-based costing.

- Service Department Cost Allocation. Biotech, Inc., recently began providing cafeteria services to its employees. Because revenue from the sale of food at the cafeteria does not fully cover cafeteria expenses, Biotech must pay for the shortfall. These costs are allocated to production departments based on employee usage. That is, the company tracks which employees use the cafeteria and allocates costs to production departments accordingly. Sarah Kolster, manager of the quality testing department, is not happy with receiving cafeteria cost allocations. She is evaluated based on meeting a cost budget established at the beginning of the fiscal year, which does not include the cafeteria allocation, and she clearly has an incentive to minimize costs. When Sarah met with the company’s accountant, Dan, regarding this issue, she said, “Dan, I like the idea of providing cafeteria service to our employees, but the costs allocated to my department are killing my budget. Last month alone, I was allocated $3,000 in costs related to the new cafeteria. I have no choice but to require my employees to go elsewhere for food.”Dan responded, “I understand your concern, Sarah. Management’s intent was to provide a service to our employees that would improve productivity and reward employees for their hard work. If you tell your employees to stop using the cafeteria, more costs will be allocated to other departments, and the other departments might also stop using the cafeteria. My belief is that the cafeteria will be self-sufficient within a year if more employees are encouraged to use it. This translates into no more cost allocations to departments within a year. I’ll discuss your concerns with top management later this week.”

Required:

- Why does Biotech, Inc., allocate cafeteria costs to departments?

- What recommendations would you make to top management regarding the way cafeteria costs are allocated to departments?

Comprehensive Case

-

Activity-Based Costing, Journal Entries, T-Accounts, and Preparing an Income Statement. This problem is an adaptation of the example presented at the end of Chapter 2 “How Is Job Costing Used to Track Production Costs?” for Custom Furniture Company. The only difference is that this problem uses activity-based costing to allocate overhead costs rather than one plantwide rate. Recall that inventory beginning balances were $25,000 for raw materials inventory, $35,000 for work-in-process inventory, and $90,000 for finished goods inventory.

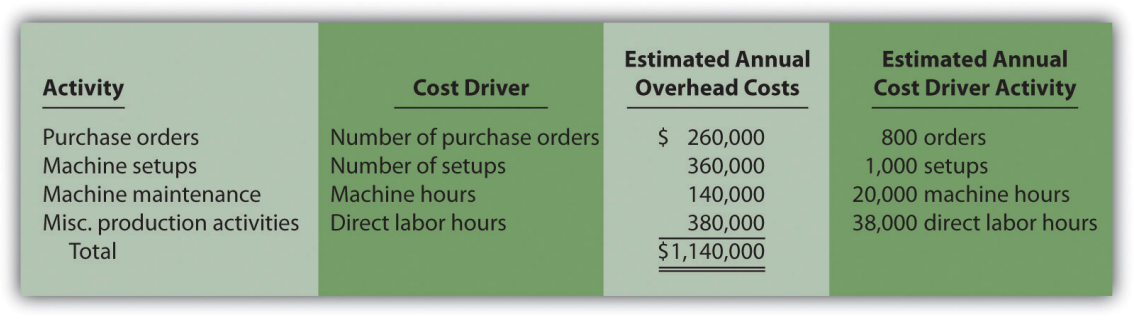

Management of Custom Furniture Company would like to use activity-based costing to allocate overhead costs totaling $1,140,000 rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Transactions for the month of May are shown as follows:

- Raw materials were purchased during the month for $15,000 on account.

- Raw materials totaling $21,000 were placed in production: $3,000 for indirect materials (glue, screws, nails, and the like) and $18,000 for direct materials (wood planks, hardware, etc.).

- Timesheets from the direct labor workforce show total costs of $40,000, to be paid the next month.

- Production supervisors and other indirect labor working in the factory are owed wages totaling $27,000.

- The following costs were incurred related to the factory: building depreciation of $29,000, insurance of $11,000 (originally recorded as prepaid insurance), utilities of $4,000 (to be paid the next month), and maintenance costs of $22,000 (paid immediately).

-

Manufacturing overhead is applied to products based on the following cost driver activity for the month:

Number of purchase orders 75 Number of machine setups 120 Machine hours 1,850 Direct labor hours3,240 - The following selling costs were incurred: wages of $5,000 (to be paid the next month), building rent of $3,000 (originally recorded as prepaid rent), and advertising totaling $10,000 (to be paid the next month).

- The following general and administrative (G&A) costs were incurred: wages of $13,000 (to be paid the next month), equipment depreciation of $6,000, and building rent of $7,000 (originally recorded as prepaid rent).

- Completed goods costing $155,000 were transferred out of work-in-process inventory.

- Sold goods for $100,000 on account and $90,000 cash.

- The goods sold in the previous transaction had a cost of $129,000.

- Closed the manufacturing overhead account to cost of goods sold.

Required:

- Calculate the predetermined overhead rate for each activity.

- Prepare T-accounts for the following accounts: cash, accounts receivable, prepaid insurance, prepaid rent, raw materials inventory, work-in-process inventory, finished goods inventory, accumulated depreciation (building and equipment), accounts payable, wages payable, manufacturing overhead, sales, cost of goods sold, advertising expense (selling), rent expense (selling), wages expense (selling), depreciation expense (G&A), rent expense (G&A), and wages expense (G&A). Enter beginning balances in T-accounts for the inventory accounts (raw materials, work in process, and finished goods).

- Prepare a journal entry for each of the transactions 1 through 11, and post each entry to the T-accounts set up in requirement b. Label each entry in the T-accounts by transaction number, and total each T-account.

- Is overhead underapplied or overapplied for the month of May? Based on the balance in the manufacturing overhead T-account prepared in requirement c, prepare a journal entry for transaction 12.

- Prepare an income statement for the month of May. (Hint: Be sure to include the adjustment made to cost of goods sold in requirement d.)