87 12.E: Exercises (part 1)

-

Last updated

- Dec 28, 2020

- Explain how a flexible budget differs from a master budget.

- Assume you are the production manager for a manufacturing company that anticipated selling 40,000 units of product for the master budget and actually sold 50,000 units. Why would you prefer to be evaluated using a flexible budget for direct labor rather than the master budget?

- What is a standard cost, and how does it differ from a budgeted cost?

- How are standards established for direct materials, direct labor, and variable manufacturing overhead?

- Explain what management is trying to evaluate in reviewing the materials price variance and materials quantity variance. Be sure to include the formula for each variance in your explanation.

- Explain what management is trying to evaluate in reviewing the labor rate variance and labor efficiency variance. Be sure to include the formula for each variance in your explanation.

- Explain how an unfavorable labor rate variance might cause a favorable labor efficiency variance and favorable materials quantity variance.

- The production manager just received a report indicating an unfavorable labor rate variance. Further investigation reveals that the sales department accepted a large rush order. Who should be held responsible for the unfavorable variance? Explain.

- Refer to Note 12.38 “Business in Action 12.3” Why is direct labor variance analysis particularly important for United Airlines?

- Are favorable variances always a result of good management decisions? Explain.

- Do most companies investigate all variances? Explain.

- How is variable overhead variance analysis similar for companies using activity-based costing and companies using traditional costing?

- What causes the fixed overhead production volume variance?

- (Appendix). Why are direct materials and direct labor variance accounts needed in a standard costing system? What happens to these accounts at the end of the period?

Brief Exercise

- Analyzing Costs at Jerry’s Ice Cream. Refer to the dialogue at Jerry’s Ice Cream presented at the beginning of the chapter. What happened with direct labor and direct materials costs at Jerry’s Ice Cream? What did Jerry, the owner, ask Michelle to do?

- Direct Materials Standard Cost and Flexible Budget. Manhattan Company produces high-quality chairs. Each chair requires a standard quantity of 10 board feet of wood at $5 per board foot. Production for July totaled 3,000 units. Calculate (a) standard cost per unit for direct materials and (b) flexible budget amount for direct materials for the month of July.

- Direct Labor Standard Cost and Flexible Budget. Manhattan Company produces high-quality chairs. Each chair requires a standard quantity of 8 direct labor hours at $15 per hour. Production for July totaled 3,000 units. Calculate (a) standard cost per unit for direct labor and (b) flexible budget amount for direct labor for the month of July.

- Variable Overhead Standard Cost and Flexible Budget. Manhattan Company produces high-quality chairs. Variable manufacturing overhead is applied at a standard rate of $10 per machine hour. Each chair requires a standard quantity of three machine hours. Production for July totaled 3,000 units. Calculate (a) standard cost per unit for variable overhead and (b) flexible budget amount for variable overhead for the month of July.

- Materials Price Variance. Sweets Company produces boxes of chocolate. The company expects to pay $5 a pound for chocolate. Sweets purchased 4,000 pounds of chocolate during the month of April for $4.80 per pound. Calculate the materials price variance for the month of April.

- Materials Quantity Variance. Sweets Company produces boxes of chocolate. A standard of 2 pounds of material is expected to be used for each box produced, at a cost of $5 per pound. Sweets produced 1,000 boxes of chocolate during the month of April and used 2,200 pounds of chocolate. Calculate the materials quantity variance for the month of April.

- Labor Rate Variance. Tech Company produces computer servers. The company’s standards show an expected direct labor rate of $20 per hour. Tech’s direct labor workforce worked 3,200 hours to produce 300 units during the month of August and was paid $22 per direct labor hour. Calculate the labor rate variance for the month of August.

- Labor Efficiency Variance. Tech Company produces computer servers. The company’s standards show that each server will require 10 hours of direct labor at $20 per hour. Tech produced 300 units during the month of August and direct labor hours totaled 3,200 for the month. Calculate the labor efficiency variance for the month of August.

- Variable Overhead Spending Variance. Tech Company produces computer servers. Variable overhead is allocated to each server based on a standard of $100 per machine hour. A total of 850 machine hours were used during the month of August and variable overhead costs totaled $96,000. Calculate the variable overhead spending variance for the month of August.

- Variable Overhead Efficiency Variance. Tech Company produces computer servers. Variable overhead is allocated to each server based on a standard of $100 per machine hour and 3 machine hours per server. A total of 850 machine hours were used during the month of August to produce 300 servers. Calculate the variable overhead efficiency variance for the month of August.

- Investigating Variances. Fiber Optic, Inc., investigates all variances above 10 percent of the flexible budget. The flexible budget for direct materials is $50,000. The direct materials price variance is $4,000 unfavorable and the direct materials quantity variance is $(6,000) favorable. Which variances should be investigated according to company policy? Show calculations to support your answer.

- Spending Variance Using Activity-Based Costing. Albany, Inc., uses activity-based costing to allocate variable manufacturing overhead costs to products. One of the activities used to allocate these costs is product testing. The standard rate is $15 per test hour. The cost for this activity during June totaled $2,000, and actual test time during June totaled 120 hours. Calculate the spending variance for this activity for the month of June, and clearly label whether the variance is favorable or unfavorable.

- Fixed Overhead Spending Variance. Sampson Company applies fixed manufacturing overhead costs to products based on direct labor hours. Budgeted direct labor hours for the month of January totaled 30,000 hours, with a standard cost per direct labor hour of $12. Actual fixed overhead costs totaled $350,000 for January. Calculate the fixed overhead spending variance for January, and clearly label whether the variance is favorable or unfavorable.

- (Appendix) Journalizing the Purchase of Raw Materials. Mill Company purchased 40,000 pounds of raw materials on account for $3.40 per pound. The standard price is $3 per pound. Prepare a journal entry to record this transaction assuming the company uses a standard costing system.

Exercises: Set A

-

Standard Cost and Flexible Budget. Hal’s Heating produces furnaces for commercial buildings. The company’s master budget shows the following standards information.

Expected production for January 300 furnaces Direct materials 3 heating elements at $40 per element Direct labor 35 hours per furnace at $18 per hour Variable manufacturing overhead 35 direct labor hours per furnace at $15 per hour Required:

- Calculate the standard cost per unit for direct materials, direct labor, and variable manufacturing overhead using the format shown in Figure 12.1.

- Assume Hal’s Heating produced 320 furnaces during January. Prepare a flexible budget for direct materials, direct labor, and variable manufacturing overhead using the format shown in Figure 12.2 “Flexible Budget for Variable Production Costs at Jerry’s Ice Cream”.

-

Materials and Labor Variances. Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercise. This exercise can be assigned independently.)

For direct materials, the standard price for a heating element part is $40. A standard quantity of 3 heating elements is expected to be used in each furnace produced. During January, Hal’s Heating purchased 1,000 heating elements for $38,000 and used 980 heating elements to produce 320 furnaces.

For direct labor, Hal’s Heating established a standard number of direct labor hours at 35 hours per furnace. The standard rate is $18 per hour. A total of 10,000 direct labor hours were worked during January, at a cost of $190,000, to produce 320 furnaces.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 12.4 “Direct Materials Variance Analysis for Jerry’s Ice Cream”. Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 12.6 “Direct Labor Variance Analysis for Jerry’s Ice Cream”. Clearly label each variance as favorable or unfavorable.

-

Variable Overhead Variances. Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercises. This exercise can be assigned independently.) The company applies variable manufacturing overhead at a standard rate of $15 per direct labor hour. The standard quantity of direct labor is 35 hours per unit. Variable overhead costs totaled $190,000 for the month of January. A total of 10,000 direct labor hours were worked during January to produce 320 furnaces.

Required:

Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 12.8 “Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream”. Clearly label each variance as favorable or unfavorable.

-

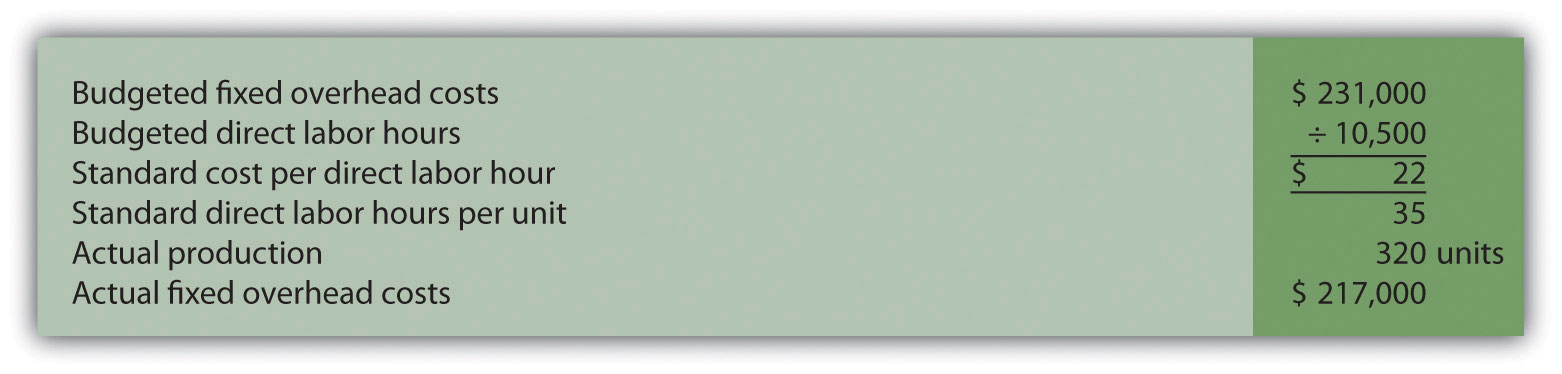

Fixed Overhead Variance Analysis. Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercises. This exercise can be assigned independently.) The company applies fixed manufacturing overhead costs to products based on direct labor hours. Information for the month of January appears as follows. Hal’s expected to produce and sell 300 units for the month.

Required:

Calculate the fixed overhead spending variance and production volume variance using the format shown in Figure 12.13 “Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream”. Clearly label each variance as favorable or unfavorable.

-

Journalizing Direct Materials and Direct Labor Transactions (Appendix). Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercises. This exercise can be assigned independently.)

Direct materials and direct labor variances for the month of January are shown as follows.

Materials price variance $(2,000) favorable Materials quantity variance $ 800 unfavorable Labor rate variance $ 10,000 unfavorable Labor efficiency variance $(21,600) favorable Required:

- The company purchased 1,000 elements during the month for $38 each. Assuming a standard price of $40 per element, prepare a journal entry to record the purchase of raw materials for the month.

- The company used 980 elements in production for the month, and the flexible budget shows the company expected to use 960 elements. Assuming a standard price of $40 per element, prepare a journal entry to record the usage of raw materials in production for the month.

- The company used 10,000 direct labor hours during the month with an actual rate of $19 per hour. The flexible budget shows the company expected to use 11,200 direct labor hours at a standard rate of $18 per hour. Prepare a journal entry to record direct labor costs for the month.

-

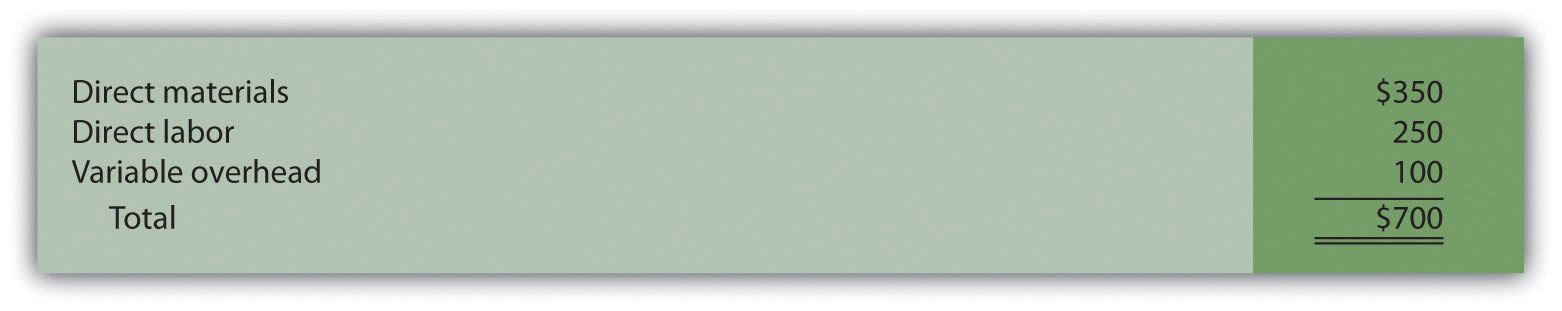

Investigating Variances. Quality Tables, Inc., produces high-end coffee tables. Standard cost information for each table is presented as follows.

Quality Tables produced and sold 2,000 tables for the year and encountered the following production variances:

Required:

Company policy is to investigate all unfavorable variances above 10 percent of the flexible budget amount for direct materials, direct labor, and variable overhead.

- Identify the variances that should be investigated according to company policy. Show calculations to support your answer.

- What potential weakness exists in the company’s current policy?

-

Variance Analysis with Activity-Based Costing. Assume Mammoth Company uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter.

Activity Standard Rate Standard Quantity per Unit Produced Actual Costs Actual Quantity Indirect materials $2.40 per yard 7 yards per unit $691,650 265,000 yards Product testing $1.50 per test minute 5 minutes per unit $301,000 215,000 test minutes Indirect labor $4.50 per direct labor hour 4 hours per unit $930,000 180,000 direct labor hours Required:

Assume Mammoth Company produced 40,000 units last quarter. Prepare a variance analysis using the format shown in Figure 12.11 “Variable Overhead Variance Analysis for Jerry’s Ice Cream Using Activity-Based Costing”. Clearly label each variance as favorable or unfavorable.

-

Closing Variance and Overhead Accounts (Appendix). Gonzaga Products had the following balances at the end of its fiscal year.

Debit Credit Materials price variance $10,000 Materials quantity variance $8,000 Labor rate variance 6,000 Labor efficiency variance 5,000 Manufacturing overhead 14,000 Required:

- Prepare a journal entry to close the variance and manufacturing overhead accounts. Assume the balances are not significant and thus are closed to cost of goods sold.

- Assume all products were sold and the company has no ending inventories. After making the entry in requirement a, does the balance of cost of goods sold on the income statement reflect standard costs or actual costs? Explain.