96 11.E: Exercises (Part 1)

-

Last updated

- Dec 28, 2020

Questions

- Describe the planning phase of budgeting.

- Describe the control phase of budgeting.

- Refer to Note 11.4 “Business in Action 11.1” Describe two characteristics that make budgeting difficult for multinational companies.

- Why do successful companies tend to use the bottom-up approach to budgeting?

- Briefly describe the components of a master budget for a manufacturing organization.

- Why is the sales budget the most important component of the master budget?

- Describe the information used by companies to estimate sales.

- Describe how units to be produced is calculated in the production budget.

- How does a production budget help the production manager plan for the future?

- Why is depreciation deducted at the bottom of the manufacturing overhead budget?

- Why do companies that prepare a budgeted income statement also prepare a cash budget?

- Refer to Business in Action 11.2 titled “Moving from Spreadsheets to Intranet Budgeting.” What are the advantages of using intranet budgeting? What are some possible disadvantages?

- How does the master budget for a merchandising organization differ from the master budget for a manufacturing organization?

- Describe the difference between service organization budgets and manufacturing organization budgets.

- Refer to Note 11.35 “Business in Action 11.3” Describe the two procedures that the symphony uses in the control phase of budgeting.

- Describe the ethical conflict that can occur between the planning and control phases of the budgeting process.

- Why might a sales budget that intentionally underestimates sales have a negative impact on the organization?

Brief Exercises

- Budgeting at Jerry’s Ice Cream. Refer to the dialogue for Jerry’s Ice Cream presented at the beginning of the chapter and the follow-up dialogue after Note 11.31 “Review Problem 11.7”.

Required:

- In the opening dialogue, why is Jerry Feltz concerned about the sales growth expected for the coming year?

- In the follow-up dialogue, why is the company’s treasurer and controller concerned about the third quarter?

-

Budget Sequence. Indicate the order in which the following budget schedules are prepared.

-

Direct materials purchases

-

Manufacturing overhead

- Income statement

-

Direct labor

- Selling and administrative

- Cash

- Production

- Balance sheet

- Sales

- Capital expenditures

-

-

Sales Budget. Schwartz and Company expects to sell 100 units in the first quarter, 90 units in the second quarter, 150 units in the third quarter, and 160 units in the fourth quarter. The average sales price per unit is expected to be $3,000. Prepare a sales budget for each quarter and include a column for the year ending December 31.

-

Production Budget. Schwartz and Company expects to sell 100 units in the first quarter and 90 units in the second quarter. Assuming the company prefers to maintain finished goods inventory equal to 10 percent of the next quarter’s sales, prepare a production budget for the first quarter using Figure 11.4 as a guide. (Hint: you are preparing a production budget for the first quarter only.)

-

Direct Materials Purchases Budget. The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter and 600 units in the second quarter. Each unit requires 10 pounds of direct materials at a cost of $2 per pound. The company prefers to maintain raw materials inventory equal to 20 percent of next quarter’s materials needed in production. Prepare a direct materials purchases budget using Figure 11.5 as a guide. (Hint: you are preparing a direct materials purchases budget for the first quarter only.)

-

Direct Labor Budget. The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter. Assuming each unit of product requires 3 direct labor hours at a cost of $13 per hour, prepare a direct labor budget for the first quarter using Figure 11.6 as a guide. (Hint: you are preparing a direct labor budget for the first quarter only.)

-

Manufacturing Overhead Budget. The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter. Assume variable overhead cost per unit is $5 for indirect materials, $8 for indirect labor, and $3 for other items. Fixed overhead cost per quarter is $30,000 for salaries, $20,000 for rent, and $8,000 for depreciation. Prepare a manufacturing overhead budget for the first quarter using Figure 11.7 as a guide (Hint: you are preparing a manufacturing overhead budget for the first quarter only.)

- Sales Cash Collections Budget. All sales for Malik and Associates are on credit. Accounts receivable at the end of last quarter totaled $100,000. Credit sales for the first quarter of the upcoming period are expected to be $300,000. The company expects to collect 70 percent of sales in the quarter of the sale, and 30 percent the quarter following the sale. Prepare a sales cash collections budget for the first quarter of the upcoming period using the top of Figure 11.11 as a guide. (Hint: you are preparing a sales cash collections budget for the first quarter only.)

- Purchases Cash Payments Budget. All direct material purchases made by Keen and Company are on credit. Accounts payable at the end of last quarter totaled $50,000. Purchases for the first quarter of the upcoming period are expected to be $200,000. The company expects to pay 40 percent of purchases in the quarter of purchase and 60 percent the quarter following the purchase. Prepare a purchases cash payments budget for the first quarter of the upcoming period using the middle of Figure 11.11 as a guide. (Hint: you are preparing a purchases cash payments budget for the first quarter only.)

-

Sales Budget for Service Organization; Ethical Issues. Rami and Associates is an accounting firm that estimates revenues based on billable hours. The company expects to charge 8,000 hours to clients in the first quarter, 9,000 hours in the second quarter, 7,000 hours in the third quarter and 8,500 hours in the fourth quarter. The average hourly billing rate is expected to be $100.

Required:

- Prepare a services revenue budget for each quarter and include a column for the year ending December 31. (Hint: this is similar to a sales budget except sales are measured in labor hours rather than in units, and revenue is measured as an average hourly billing rate rather than a sales price per unit.)

- Since the manager of the company is given a bonus if actual billable hours exceed budgeted billable hours, the manager intentionally underestimated the number of expected billable hours for each quarter. How might this underestimate affect the company?

Exercises: Set A

- Sales and Production Budgets. Templeton Corporation produces windows used in residential construction. Unit sales last year, ending December 31, are as follow:

First quarter 40,000 Second quarter 50,000 Third quarter 52,000 Fourth quarter 48,000 Unit sales are expected to increase 10 percent this coming year over the same quarter last year. Average sales price per window will remain at $200.

Assume finished goods inventory is maintained at a level equal to 5 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 2,300 units.

Required:

- Prepare a sales budget for Templeton Corporation using a format similar to Figure 11.3. (Hint: be sure to increase last year’s unit sales by 10 percent.)

- Prepare a production budget for Templeton Corporation using a format similar to Figure 11.4.

-

Direct Materials Purchases and Direct Labor Budgets. Templeton Corporation produces windows used in residential construction. The company expects to produce 44,550 units in the first quarter, 55,110 units in the second quarter, 56,980 units in the third quarter, and 52,460 units in the fourth quarter. (This information is derived from the previous exercise for Templeton Corporation.)

With regards to direct materials, each unit of product requires 12 square feet of glass at a cost of $1.50 per square foot. Management prefers to maintain ending raw materials inventory equal to 10 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 65,000 square feet.

With regards to direct labor, each unit of product requires 2 labor hours at a cost of $15 per hour.

Required:

- Prepare a direct materials purchases budget for Templeton Corporation using a format similar to Figure 11.5.

- Prepare a direct labor budget for Templeton Corporation using a format similar to Figure 11.6.

-

Manufacturing Overhead Budget. Templeton Corporation produces windows used in residential construction. The company expects to produce 44,550 units in the first quarter, 55,110 units in the second quarter, 56,980 units in the third quarter, and 52,460 units in the fourth quarter. (This information is the same as in the previous exercise for Templeton Corporation.) The following information relates to the manufacturing overhead budget.

| Variable Overhead Costs | |

|---|---|

| Indirect materials | $2.50 per unit |

| Indirect labor | $3.20 per unit |

| Other | $1.70 per unit |

| Fixed Overhead Costs per Quarter | |

|---|---|

| Salaries | $50,000 |

| Rent | $60,000 |

| Depreciation | $36,370 |

Required: Prepare a manufacturing overhead budget for Templeton Corporation using a format similar to Figure 11.7.

- Budgets for Cash Collections from Sales and Cash Payments for Purchases. Templeton Corporation produces windows used in residential construction. The dollar amount of the company’s quarterly sales and direct materials purchases are projected to be as follows (this information is derived from the previous exercises for Templeton Corporation):

1st 2nd 3rd 4th Sales $8,800,000 $11,000,000 $11,440,000 $10,560,000 Direct materialspurchases

$ 820,908 $ 995,346 $ 1,017,504 $ 947,352 Assume all sales are made on credit. The company expects to collect 60 percent of sales in the quarter of sale and 40 percent the quarter following the sale. Accounts receivable at the end of last year totaled $3,000,000, all of which will be collected in the first quarter of the coming year.

Assume all direct materials purchases are on credit. The company expects to pay 70 percent of purchases in the quarter of purchase and 30 percent the following quarter. Accounts payable at the end of last year totaled $325,000, all of which will be paid in the first quarter of this coming year.

Required:

- Prepare a budget for cash collections from sales. Use a format similar to the top section of Figure 11.11.

- Prepare a budget for cash payments for purchases of materials. Use a format similar to the middle section of Figure 11.11. Round to the nearest dollar.

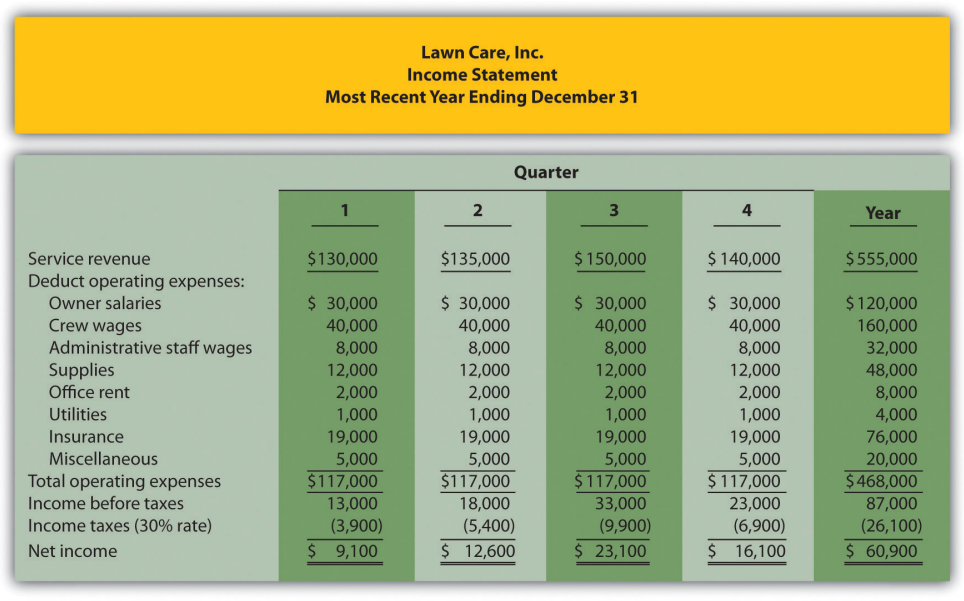

- Service Company Budgeted Income Statement and Ethical Issues. Lawn Care, Inc., has two owners who maintain lawns for residential customers. The company had the following net income for the most current year.

The following information was gathered from the owners to help prepare this coming year’s budgeted income statement:- Service revenue will increase 15 percent (e.g., first quarter service revenue for this coming year will be 15 percent higher than the first quarter shown previously).

- Owner salaries will increase 8 percent.

- Crew wages will increase 12 percent.

- Administrative staff wages will increase 5 percent, and a new staff member will be hired at the beginning of the third quarter at a quarterly rate of $7,000.

- Supplies will increase 9 percent.

- Office rent, utilities, and miscellaneous expenses will remain the same.

- Insurance will increase 18 percent.

- The tax rate will remain at 30 percent.

Required:

- Prepare a quarterly budgeted income statement for Lawn Care, Inc., and include a column summarizing the year.

- The owners of Lawn Care, Inc., have decided to expand and are in need of additional cash to expand operations. Unknown to the owners, the company’s accountant intentionally inflated the revenue projections for this coming year to make the company look better when applying for a loan. Is this behavior ethical? Explain. (It may be helpful to review the presentation of ethics in Chapter 1.)