47 6. Exercises (Part 1)

-

Last updated

- Dec 28, 2020

Questions

- Why do managers allocate overhead costs to products?

- Describe the three methods of allocating overhead costs.

- What is a cost pool, and how does it relate to allocating overhead to products?

- What is the difference between an activity and a cost driver?

- How do cost flows using activity-based costing differ from cost flows using one plantwide rate?

- Describe the five steps required to implement activity-based costing.

- What are some advantages of using an activity-based costing system?

- What are some disadvantages of using an activity-based costing system?

- Review Note 6.14 “Business in Action 6.1” What were the two common characteristics of the 130 U.S. manufacturing companies that used activity-based costing?

- Explain how to record the application of overhead to products using activity-based costing.

- Describe the three steps required to implement activity-based management.

- How does activity-based management differ from activity-based costing?

- What is the difference between a value-added activity and a non-value-added activity? Provide two examples of non-value-added activities for each of the following:

- Fast-food restaurant

- Clothing store

- College bookstore

- Review Note 6.16 “Business in Action 6.2” How did activity-based costing help BuyGasCo Corporation settle its predatory pricing case?

- Review Note 6.23 “Business in Action 6.3” What did the survey of 296 users of ABC and ABM show were the top two objectives in using these systems?

- Review Note 6.26 “Business in Action 6.4” What was management’s primary concern in deciding to implement an activity-based costing system?

- What selling costs and general and administrative costs might be allocated to products using activity-based costing? Why do some managers prefer allocating these costs to products?

- What are service departments? Why do some managers allocate service department costs to production departments?

- Describe the four categories included in the hierarchy of costs.

- What is the difference between a facility-level cost and a unit-level cost?

- How does the hierarchy of costs help managers allocate overhead costs?

- Describe the four categories related to the costs of quality. How might the allocation of quality costs to these four categories help managers?

Brief Exercises

- Product Costing at SailRite. Refer to the dialogue presented at the beginning of the chapter and the follow-up dialogue before Figure 6.7 ” Activity-Based Costing Versus Plantwide Costing at SailRite Company”.

Required:

- In the opening dialogue, why was the owner concerned about the product costs for each of the company’s boats?

- In the follow-up dialogue before Figure 3.7 “Activity-Based Costing Versus Plantwide Costing at SailRite Company”, what did the company’s accountant discover about the profitability of each boat using activity-based costing? (Refer to Figure 6.7 “Activity-Based Costing Versus Plantwide Costing at SailRite Company” as you prepare your answer.)

- Calculating Plantwide Predetermined Overhead Rate. Manufacturing overhead costs totaling $5,000,000 are expected for this coming year. The company also expects to use 50,000 direct labor hours and 20,000 machine hours.

Required:

- Calculate the plantwide predetermined overhead rate using direct labor hours as the base. Provide a one-sentence description of how the rate will be used to allocate overhead costs to products.

- Calculate the plantwide predetermined overhead rate using machine hours as the base. Provide a one-sentence description of how the rate will be used to allocate overhead costs to products.

- Calculating Department Predetermined Overhead Rates. Manufacturing overhead costs totaling $1,000,000 are expected for this coming year—$400,000 in the Assembly department and $600,000 in the Finishing department. The Assembly department expects to use 4,000 machine hours, and the Finishing department expects to use 30,000 direct labor hours.

Required:

- Identifying Cost Drivers. Ehrman Company identified the activities listed in the following as being most important (step 1 and step 2 of activity-based costing), and it formed cost pools for each activity.

- Purchasing raw materials

- Inspecting raw materials

- Storing raw materials

- Maintaining production equipment

- Setting up machines to produce batches of product

- Testing finished products

Required:

Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.

- Identifying Cost Drivers: Service Company. McHale Architects, Inc., designs, engineers, and supervises the construction of custom homes. The following activities were identified as being most important (step 1 and step 2 of activity-based costing), and cost pools were formed for each activity.

- Meeting with customers

- Coordinating inspections with the building department

- Consulting with contractors

- Maintaining office equipment

- Processing customer billings (invoices)

Required:

Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.

- Value-Added and Non-Value-Added Activities. Novak Corporation manufactures custom-made kayaks and accessories. The company performs the following activities.

- Storing parts and materials

- Queuing orders before beginning production

- Assembling kayaks

- Waiting for materials to arrive to continue production

- Painting kayaks

- Designing kayaks to maximize comfort

- Scrapping defective materials

Required:

Label each activity as value-added or non-value-added.

- Allocation Base for Service Departments. Valencia Company has 15 production departments and produces hundreds of products. Service department costs are allocated to production departments using the direct method. Five service departments provide the following services to the production departments.

- The Computer Technology department provides computer support.

- The Personnel department posts job openings, hires employees, and coordinates employee benefits.

- The Accounting department processes accounting data, provides financial reports, and performs general accounting duties.

- The Maintenance department maintains buildings and equipment.

- The Legal department provides legal services.

Required:

- For each service department, provide a possible allocation base. Explain why the base you chose for each service department is reasonable.

- Does the direct method provide for allocations from one service department to another? Explain.

Exercises: Set A

- Plantwide Versus Department Allocations of Overhead. San Juan Company expects to incur $600,000 in overhead costs this coming year—$100,000 in the Cutting department, $300,000 in the Assembly department, and $200,000 in the Finishing department. Direct labor hours worked in all departments are expected to total 40,000 (used for the plantwide rate). The Cutting department expects to use 20,000 machine hours, the Assembly department expects to use 25,000 direct labor hours, and the Finishing department expects to incur $100,000 in direct labor costs (this information will be used for department rates).

Required:

- Assume San Juan Company uses the plantwide approach for allocating overhead costs and direct labor hours as the allocation base. Calculate the predetermined overhead rate, and explain how this rate will be used to allocate overhead costs.

- Assume San Juan Company uses the department approach for allocating overhead costs. Calculate the predetermined overhead rate for each department, and explain how these rates will be used to allocate overhead costs.

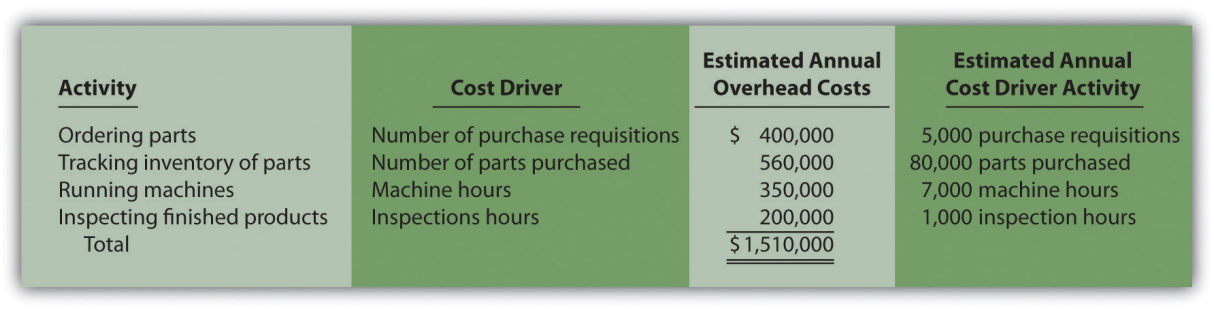

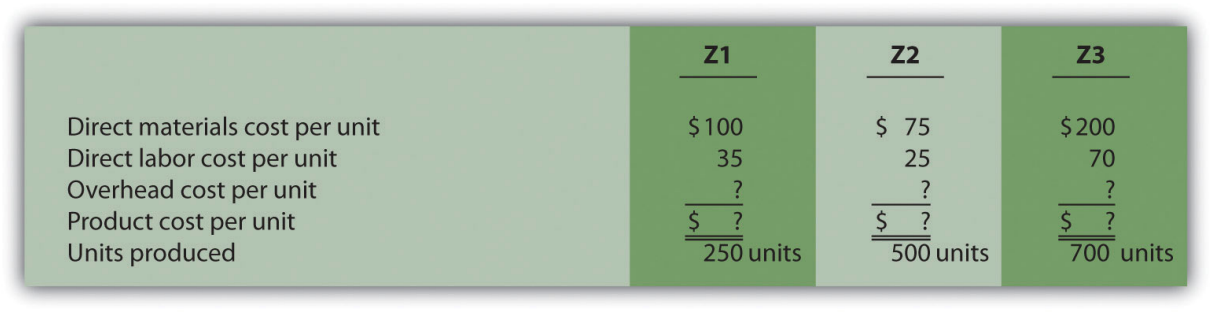

- Computing Product Costs Using Activity-Based Costing. Stillwater Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

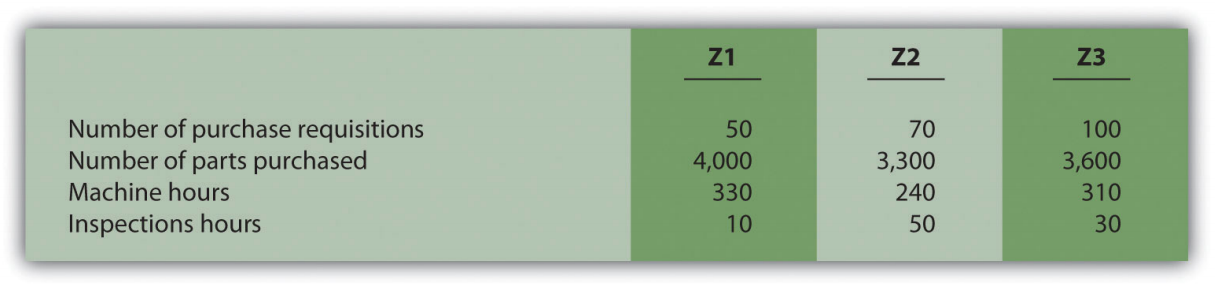

The company produces three products, Z1, Z2, and Z3. Information about these products for the month of January follows:

Actual cost driver activity levels for the month of January are as follows:

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for January, allocate overhead to the three products for the month of January (this is step 5 of the activity-based costing process).

- For each product, calculate the overhead cost per unit for the month of January. Round results to the nearest cent.

- For each product, calculate the product cost per unit for the month of January. Round results to the nearest cent.

- Journal Entry to Apply Overhead. Caspian Company is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided in the following.

- One plantwide rate. The predetermined overhead rate is 150 percent of direct labor cost.

- Department rates. The Machining department uses a rate of $55 per machine hour, and the Assembly department uses a rate of $35 per direct labor hour.

-

Activity-based costing rates. Three activities were identified and rates were calculated for each activity.

| Purchase requisitions | $15 per requisition processed |

| Production setup | $50 per setup |

| Quality

control

|

$70 per inspection |

Required:

-

Direct labor costs for the year totaled $80,000. Using the plantwide method, calculate the amount of overhead applied to products and make the appropriate journal entry.

- During the year, the Machining department used 1,000 machine hours, and the Assembly department used 1,200 direct labor hours. Using the department method, calculate the amount of overhead applied to products and make the appropriate journal entry.

- During the year, 900 purchase requisitions were processed, 1,300 production setups were performed, and 400 products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

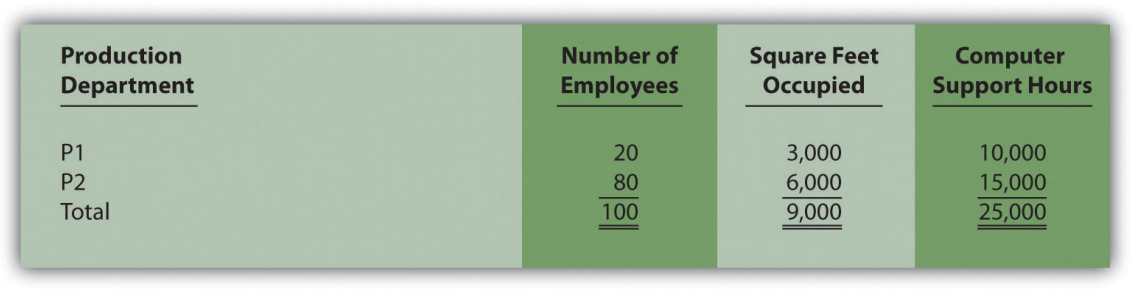

- Allocating Service Department Costs. Crandall Company has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $400,000 costs of department S1 are allocated based on the number of employees in each production department. The $600,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $300,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

-

Cost Hierarchy. The following activities and costs are for Tanaka Company.

-

Direct materials used by workers to assemble products

- Purchase requisitions issued for raw materials

- Machines set up to produce groups of products

- New product research and development

- Maintenance performed on the factory building

-

Direct labor assembling products

- Product designed for a specific customer

- Factory building rent

-

Required:

- Determine whether each item is a facility-level, product- or customer-level, batch-level, or unit-level cost.

- Provide one example of an appropriate allocation base for each item. (For instance, an appropriate allocation base for item 1 is the quantity of direct materials used.)

Exercises: Set B

- Plantwide Versus Department Allocations of Overhead: Service Company. Chan and Associates provides wetlands design and maintenance services for its customers, most of whom are developers. Billing is based on costs plus a 30 percent markup. Thus costs are allocated to customers rather than to products.Total overhead costs this coming year are expected to be $2,000,000 ($600,000 in the Design department and $1,400,000 in the Wetlands Maintenance department). Direct labor costs are expected to total $800,000 (used for the plantwide rate). The Design department expects to incur direct labor costs of $500,000, and the Wetlands Maintenance department expects to work 30,000 direct labor hours (this information is used for the department rates).

Required:

- Assume Chan and Associates uses the plantwide approach to allocating overhead costs and direct labor costs as the allocation base. Calculate the predetermined overhead rate, and explain how this rate will be used to allocate overhead costs. Round results to the nearest cent.

- Assume Chan and Associates uses the department approach for allocating overhead costs. Calculate the predetermined overhead rate for each department, and explain how these rates will be used to allocate overhead costs. Round results to the nearest cent.

- What are two possible interpretations of the term costs in the following statement? “Customers are billed based on costs plus a 30 percent markup.”

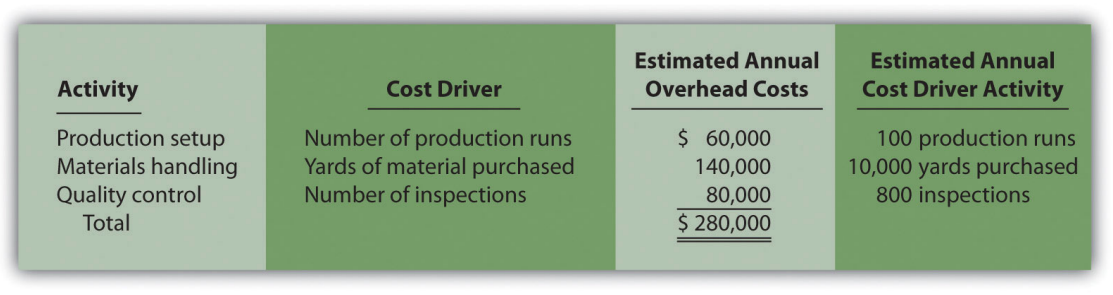

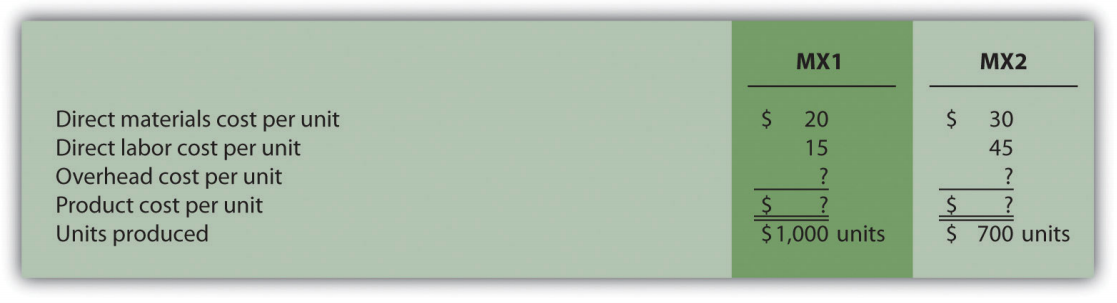

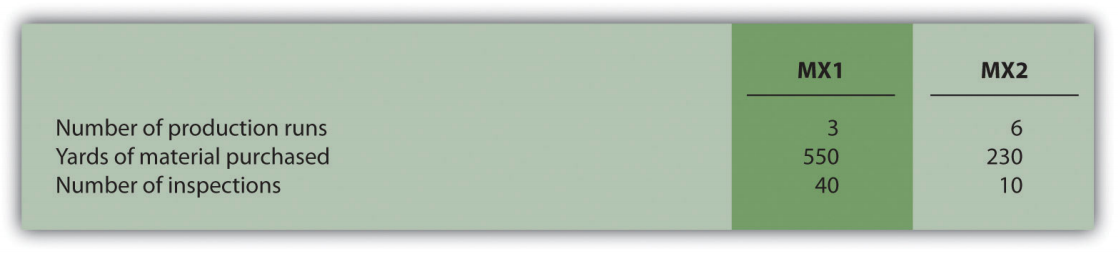

- Computing Product Costs Using Activity-Based Costing. Petrov Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

The company produces two products, MX1 and MX2. Information about these products for the month of March follows:

Actual cost driver activity levels for the month of March are as follows:

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for March, allocate overhead to the three products for the month of March (this is step 5 of the activity-based costing process).

- Calculate the unit costs for each product.

- Journal Entry to Apply Overhead, Closing Overhead Account. Premium Products, Inc., is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided as follows.

- One plantwide rate. The predetermined overhead rate is $130 per direct labor hour.

- Department rates. The Cutting department uses a rate of 200 percent of direct labor cost, and the Finishing department uses a rate of $50 per machine hour.

-

Activity-based costing rates. Three activities were identified, and rates were calculated for each activity.

| Materials handling | $8 per pound of material purchased |

| Production setup | $60 per setup |

| Quality

control

|

$110 per batch inspected |

Required:

-

Direct labor hours totaled 2,000 for the year. Using the plantwide method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

- During the year, the Cutting department incurred $80,000 in direct labor costs, and the Finishing department used 1,800 machine hours. Using the department method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

- During the year, 6,000 pounds of material were purchased, 1,600 production setups were performed, and 1,300 batches of products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

- Premium Products, Inc., closes overapplied or underapplied overhead to the cost of goods sold account at the end of each year. Prepare the journal entry to close the manufacturing overhead account at the end of the year for each of the following independent scenarios assuming the company made the journal entry to apply overhead in requirement c.

- The company recorded $302,500 in actual overhead costs for the year.

- The company recorded $243,000 in actual overhead costs for the year.

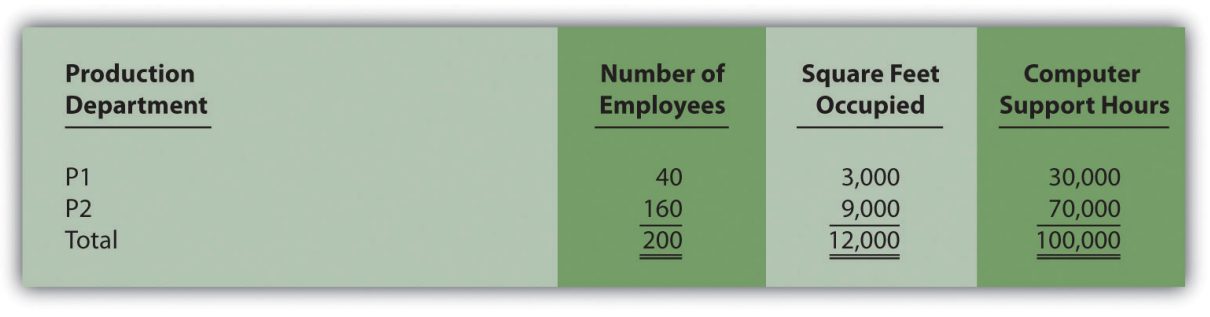

- Allocating Service Department Costs. Southwest, Inc., has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $800,000 costs of department S1 are allocated based on the number of employees in each production department. The $300,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $600,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

- Calculate the service department costs allocated to each production department.

- In general, do U.S. Generally Accepted Accounting Principles allow for the allocation of service department costs to production departments for the purpose of valuing inventory?

-

Cost Hierarchy. The following activities and costs are for Rios Corporation.

- Salary of a supervisor responsible for one product line

- Moving groups of products to the finished goods warehouse upon completion

- New product design

- Factory building depreciation

-

Direct materials used by workers to assemble products

- Machines set up to produce groups of products

- Product designed for a specific customer

- Maintenance performed on the factory building

Required:

- Determine whether each item is a facility-level, product- or customer-level, batch-level, or unit-level cost.

- Provide one example of an appropriate allocation base for each item.