2 Assets and Liabilities

Statement of Financial Position Fundamentals

Dr. Jacqueline Gagnon

Assets

Assets are what you own: cash in the bank, your sneaker collection, a building, land, equipment, T-shirts in storage that you’re planning on selling. There are many, many possibilities here because, like you or me, a company can own many things.

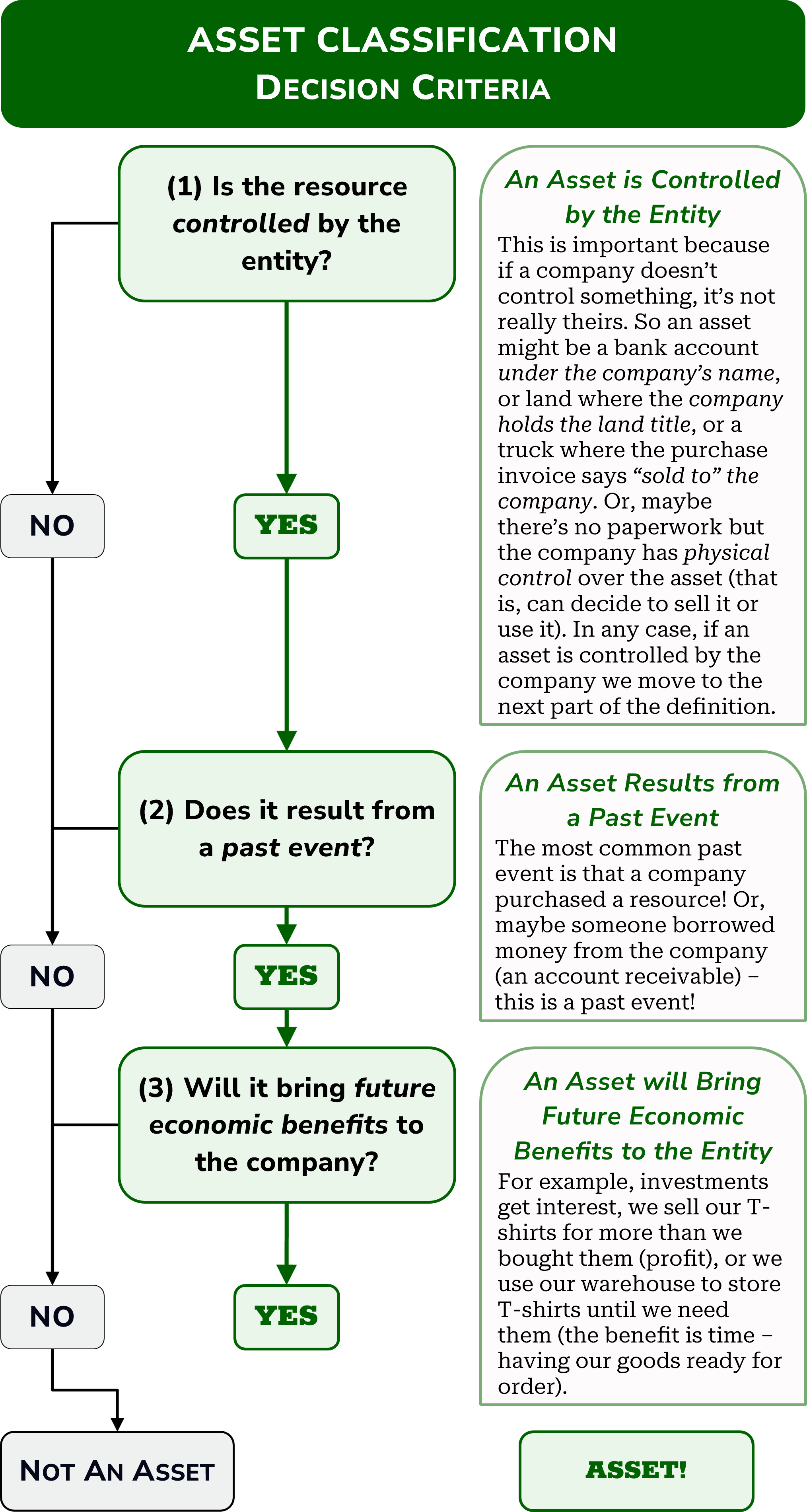

The technical definition of an asset is: (a) a resource controlled by an entity as (b) a result of past events and (c) from which future economic benefits are expected to flow to the entity.

It’s a complicated definition, but we can break it down into small chunks. If we can say yes, that makes sense for this resource to all three parts, then the resource is an asset. Below is a flowchart. Consider a potential asset like cash in a bank account. Is it an asset? Answer the questions below and follow the arrows to find out.

Classifying Assets: A Helpful Flowchart

What did you find? Is cash in a bank account an asset? Let’s take a look:

| Decision Criteria | Discussion | Criterion Met? |

|---|---|---|

| Is the cash in the bank controlled by the entity? | Cash in a bank account is controlled by the entity listed on the account, so if the bank account is in our name, then we control it! | |

| Does cash in the bank result from a past event? | Yes, the cash got into the bank somehow. Probably we deposited it | |

| Will cash in the bank bring future economic benefits to the entity? | Surely the cash in the account will bring economic benefits. For example, the entity could buy inventory to sell, or they could invest the cash to make interest. |

Here’s another example. Graphics Co. creates graphic designs on t-shirts using specialized printing press machinery. Is this machinery an asset?

| Decision Criteria | Discussion | Criterion Met? |

|---|---|---|

| Is the machinery controlled by the entity? | Machinery is controlled by Graphics Co. They can use it however they like. They could use it for t-shirts or sell it. They could, foolishly, destroy it if they like. | |

| Does the machinery result from a past event? | Yes. Graphics Co. came into possession of the machinery somehow. Probably they purchased it from a printing press supplier. | |

| Will the machinery bring future economic benefits to the entity? | Yes, Graphics Co. expects to receive economic benefits through sales of their t-shirts. The graphic designs printed by the machinery increase the value of Graphic Co.’s t-shirt inventory. |