Chapter 1

Accounting in Business

Accounting involves a process of collecting, recording, and reporting a business’s economic activities to users. It is often called the language of business because it uses a unique vocabulary to communicate information to decision-makers. To understand accounting, we first look at the basic forms of business organizations. The concepts and principles that provide the foundation for financial accounting are then discussed. With an emphasis on the corporate form of business organization, we will examine how we communicate to users of financial information using financial statements. Finally, we will review how financial transactions are analyzed and then reported on financial statements.

Chapter 1 Learning Objectives

In this chapter, you will learn how to:

- LO1 – Define accounting.

- LO2 – Identify and describe the forms of business organization.

- LO3 – Identify and explain the Generally Accepted Accounting Principles (GAAP).

- LO4 – Identify, explain, and prepare the financial statements.

- LO5 – Analyze transactions by using the accounting equation.

Concept Self-Check

Use the following as a self-check while working through Chapter 1:

- What is accounting?

- What is the difference between internal and external users of accounting information?

- What is the difference between managerial and financial accounting?

- What is the difference between a business organization and a non-business organization?

- What are the three types of business organizations?

- What is a PAE? A PE?

- What does the term limited liability mean?

- Explain how ethics are involved in the practice of accounting.

- Describe what GAAP refers to.

- Identify and explain the six qualitative characteristics of GAAP.

- Identify and explain at least five of the nine principles that support the GAAP qualitative characteristics.

- How is financial information communicated to external users?

- What are the four financial statements?

- Which financial statement measures financial performance? Financial position?

- What information is provided in the statement of cash flows?

- Explain how retained earnings and dividends are related.

- What are the three primary components of the balance sheet?

- Equity consists of what two components?

- How are assets financed?

- Identify and explain the three types of activities a business engages in.

- What are notes to the financial statements?

- What is the accounting equation?

- What are the distinctions among calendar, interim, and fiscal year ends?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

1.1 Accounting Defined

LO1 – Define accounting

Accounting is the process of identifying, measuring, recording, and communicating an organization’s economic activities to users. Users need information for decision making. Internal users of accounting information work for the organization and are responsible for planning, organizing, and operating the entity. The area of accounting known as managerial accounting serves the decision-making needs of internal users. External users do not work for the organization and include investors, creditors, labour unions, and customers. Financial accounting is the area of accounting that focuses on external reporting and meeting the needs of external users. This book addresses financial accounting. Managerial accounting is covered in other books.

1.2 Business Organizations

LO2 – Identify and describe the forms of business organization.

An organization is a group of individuals who come together to pursue a common set of goals and objectives. There are two types of business organizations: business and non-business. A business organization sells products and/or services for profit. A non-business organization, such as a charity or hospital, exists to meet various societal needs and does not have profit as a goal. All businesses, regardless of type, record, report, and, most importantly, use accounting information for making decisions.

This book focuses on business organizations. There are three common forms of business organizations — a proprietorship, a partnership, and a corporation.

Proprietorship

A proprietorship is a business owned by one person. It is not a separate legal entity, which means that the business and the owner are considered to be the same entity. This means, for example, that from an income tax perspective, the profits of a proprietorship are taxed as part of the owner’s personal income tax return. Unlimited liability is another characteristic of a sole proprietorship meaning that if the business could not pay its debts, the owner would be responsible even if the business’s debts were greater than the owner’s personal resources.

Partnership

A partnership is a business owned by two or more individuals. Like the proprietorship, it is not a separate legal entity and its owners are typically subject to unlimited liability.

Corporation

A corporation is a business owned by one or more owners. The owners are known as shareholders. A shareholder owns shares of the corporation. Shares1 are units of ownership in a corporation. For example, if a corporation has 1,000 shares, there may be three shareholders where one has 700 shares, another has 200 shares, and the third has 100 shares. The number of shares held by a shareholder represents how much of the corporation they own. A corporation can have different types of shares; this topic is discussed in a later chapter. When there is only one type of share, it is usually called common shares.

A corporation’s shares can be privately held or available for public sale. A corporation that holds its shares privately and does not sell them publicly is known as a private enterprise (PE). A corporation that sells its shares publicly, typically on a stock exchange, is called a publicly accountable enterprise (PAE).

Unlike the proprietorship and partnership, a corporation is a separate legal entity. This means, for example, that from an income tax perspective, a corporation files its own tax return. The owners or shareholders of a corporation are not responsible for the corporation’s debts so have limited liability meaning that the most they can lose is what they invested in the corporation.

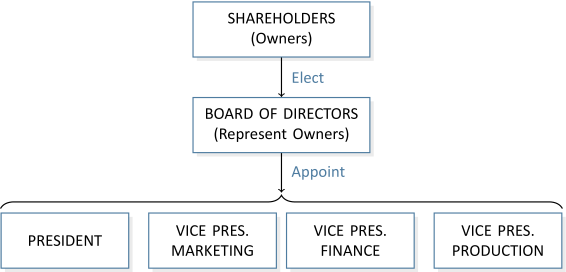

In larger corporations, there can be many shareholders. In these cases, shareholders do not manage a corporation but participate indirectly through the election of a Board of Directors. The Board of Directors does not participate in the day-to-day management of the corporation but delegates this responsibility to the officers of the corporation. An example of this delegation of responsibility is illustrated in Figure 1.1:

Shareholders usually meet annually to elect a Board of Directors. The Board of Directors meets regularly to review the corporation’s operations and to set policies for future operations. Unlike shareholders, directors can be held personally liable if a company fails.

Learning Activity 1.1 – Forms of Organization

This first activity provides you with the opportunity to self-assess how well you know the different types of business organizations.

Instructions: Identify properties of different types of business organizations. In all cases, incorrect entries will be shaded red. Correct entries will be shaded green. Note – this is not a graded activity.

1.3 Generally Accepted Accounting Principles (GAAP)

LO3 – Identify and explain the Generally Accepted Accounting Principles (GAAP)

The goal of accounting is to ensure information provided to decision-makers is useful. To be useful, information must be relevant and faithfully represent a business’s economic activities. This requires ethics, beliefs that help us differentiate right from wrong, in the application of underlying accounting concepts or principles. These underlying accounting concepts or principles are known as Generally Accepted Accounting Principles (GAAP).

GAAP in Canada, as well as in many other countries, is based on International Financial Reporting Standards (IFRS) for publicly accountable enterprises (PAE). IFRS are issued by the International Accounting Standards Board (IASB). The IASB’s mandate is to promote the adoption of a single set of global accounting standards through a process of open and transparent discussions among corporations, financial institutions, and accounting firms around the world. Private enterprises (PE) in Canada are permitted to follow either IFRS or Accounting Standards for Private Enterprises (ASPE), a set of less onerous GAAP-based standards developed by the Canadian Accounting Standards Board (AcSB). The AcSB is the body that governs accounting standards in Canada. The focus in this book will be on IFRS for PAEs.

Accounting practices are guided by GAAP which are comprised of qualitative characteristics and principles. As already stated, relevance and faithful representation are the primary qualitative characteristics. Comparability, verifiability, timeliness, and understandability are additional qualitative characteristics.

Information that possesses the quality of:

- relevance has the ability to make a difference in the decision-making process.

- faithful representation is complete, neutral, and free from error.

- comparability tells users of the information that businesses utilize similar accounting practices.

- verifiability means that others are able to confirm that the information faithfully represents the economic activities of the business.

- timeliness is available to decision makers in time to be useful.

- understandability is clear and concise.

Table 1.1 lists the nine principles that support these qualitative characteristics.

| Accounting Principle | Explanation/Example |

| Business reporting entity

|

Requires that each economic entity maintain separate records.

Example: A business owner keeps separate accounting records for business transactions and for personal transactions. |

|

Consistency

|

Requires that a business use the same accounting policies and procedures from period to period.

Example: A business uses a particular inventory costing method. It cannot change to a different inventory costing method in the next accounting period. |

| Cost

|

Requires that each economic transaction be based on the actual original cost (also known as historical cost principle).

Example: The business purchases a delivery truck advertised for $75,000 and pays $70,000. The truck must be recorded at the cost of $70,000, the amount actually paid. |

| Full disclosure

|

Requires that accounting information communicate sufficient information to allow users to make knowledgeable decisions.

Example: A business is applying to the bank for a $1,000,000 loan. The business is being sued for $20,000,000 and it is certain that it will lose. The business must tell the bank about the lawsuit even though the lawsuit has not yet been finalized. |

| Going concern | Assumes that a business will continue for the foreseeable future.

Example: All indications are that Business X will continue so it is reported to be a ‘going concern’. Business Z is being sued for $20,000,000 and it is certain that it will lose. The $20,000,000 loss will force the business to close. Business Z must not only disclose the lawsuit but it must also indicate that there is a ‘going concern’ issue. |

| Matching

|

Requires that financial transactions be reported in the period in which they occurred/were realized.

Example: Supplies were purchased March 15 for $700. They will be recorded as an asset on March 15 and then expensed as they are used. |

| Materiality

|

Requires a business to apply proper accounting only for items that would affect decisions made by users.

Example: The business purchases a stapler for $5 today. Technically, the stapler will last several years so should be recorded as an asset. However, the business will record the $5 as an expense instead because depreciating a $5 item will not impact the decisions of financial information. |

| Monetary unit | Requires that financial information be communicated in stable units of money.

Example: Land was purchased in 1940 for $5,000 Canadian. It is maintained in the accounting records at $5,000 Canadian and is not adjusted. |

| Recognition

|

Requires that revenues be recorded when earned and expenses be recorded when incurred, which is not necessarily when cash is received (in the case of revenues) or paid (in the case of expenses).

Example: A sale occurred on March 5. The customer received the product on March 5 but will pay for it on April 5. The business records the sale on March 5 when the sale occurred even though the cash is not received until April 5. |

Note: Some of the principles discussed above may be challenging to understand because related concepts have not yet been introduced. Therefore, most of these principles will be discussed again in more detail in a later chapter.

Learning Activity 1.2 – Check Your Knowledge

This Learning Activity provides you with the opportunity to self-assess how well you know key-terms from sections 1.1-1.3.

Instructions: Match each term with the correct definition. Note – this is not a graded activity.

1.4 Financial Statements

LO4 – Identify, explain, and prepare the financial statements.

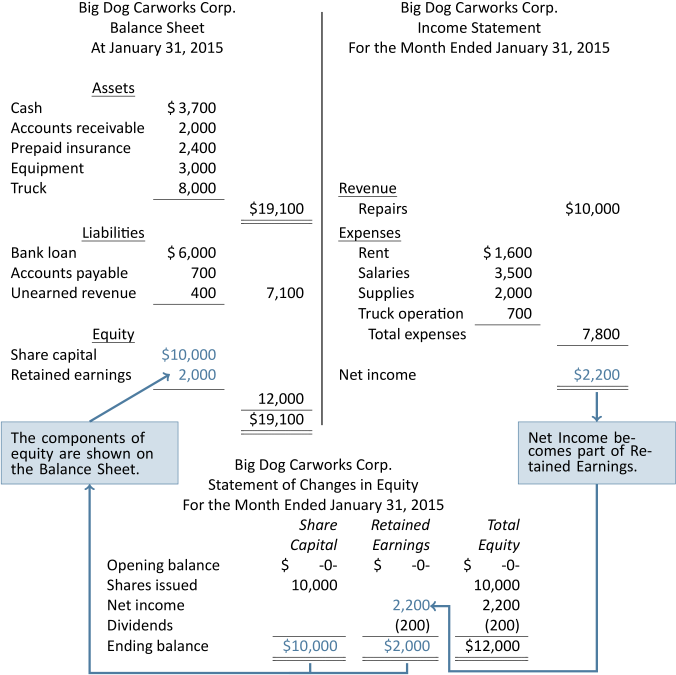

Recall that financial accounting focuses on communicating information to external users. That information is communicated using financial statements. There are four financial statements: the income statement, statement of changes in equity, balance sheet, and statement of cash flows. Each of these is introduced in the following sections using an example based on a fictitious corporate organization called Big Dog Carworks Corp.

The Income Statement

An income statement communicates information about a business’s financial performance by summarizing revenues less expenses over a period of time. Revenues are created when a business provides products or services to a customer in exchange for assets. Assets are resources resulting from past events and from which future economic benefits are expected to result. Examples of assets include cash, equipment, and supplies. Assets will be discussed in more detail later in this chapter. Expenses are the assets that have been used up or the obligations incurred in the course of earning revenues. When revenues are greater than expenses, the difference is called net income or profit. When expenses are greater than revenue, a net loss results.

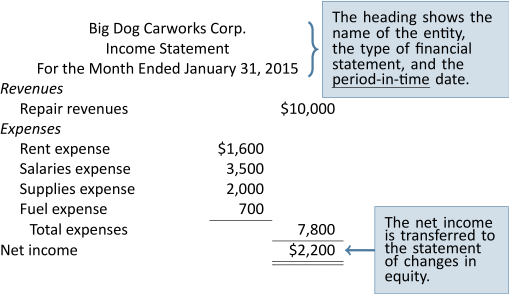

Consider the following income statement of Big Dog Carworks Corp. (BDCC). This business was started on January 1, 2015 by Bob “Big Dog” Baldwin in order to repair automobiles. All the shares of the corporation are owned by Bob.

At January 31, the income statement shows total revenues of $10,000 and various expenses totaling $7,800. Net income, the difference between $10,000 of revenues and $7,800 of expenses, equals $2,200:

The Statement of Changes in Equity

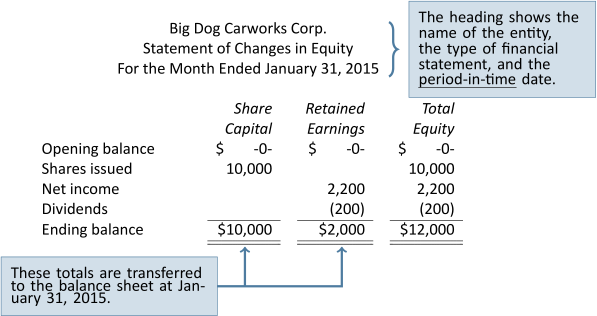

The statement of changes in equity provides information about how the balances in Share capital and Retained earnings changed during the period. Share capital is a heading in the shareholders’ equity section of the balance sheet and represents how much shareholders have invested. When shareholders buy shares, they are investing in the business. The number of shares they purchase will determine how much of the corporation they own. The type of ownership unit purchased by Big Dog’s shareholders is known as common shares. Other types of shares will be discussed in a later chapter. When a corporation sells its shares to shareholders, the corporation is said to be issuing shares to shareholders.

In the statement of changes in equity shown below, Share capital and Retained earnings balances at January 1 are zero because the corporation started the business on that date. During January, Share capital of $10,000 was issued to shareholders so the January 31 balance is $10,000.

Retained earnings is the sum of all net incomes earned by a corporation over its life, less any distributions of these net incomes to shareholders. Distributions of net income to shareholders are called dividends. Shareholders generally have the right to share in dividends according to the percentage of their ownership interest. To demonstrate the concept of retained earnings, recall that Big Dog has been in business for one month in which $2,200 of net income was reported. Additionally, $200 of dividends were distributed, so these are subtracted from retained earnings. Big Dog’s retained earnings were therefore $2,000 at January 31, 2015 as shown in the statement of changes in equity below:

To demonstrate how retained earnings would appear in the next accounting period, let’s assume that Big Dog reported a net income of $5,000 for February, 2015 and dividends of $1,000 were given to the shareholder. Based on this information, retained earnings at the end of February would be $6,000, calculated as the $2,000 January 31 balance plus the $5,000 February net income less the $1,000 February dividend. The balance in retained earnings continues to change over time because of additional net incomes/losses and dividends.

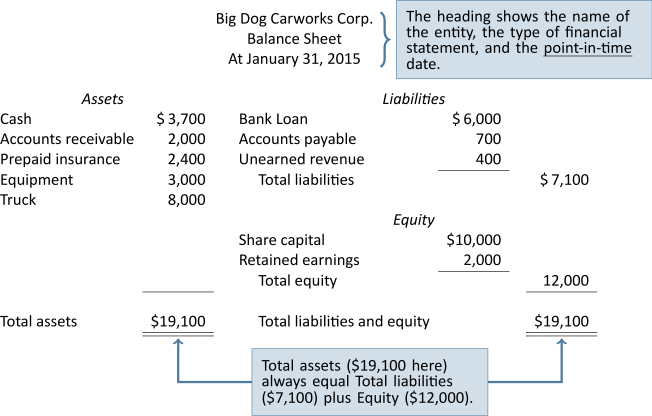

The Balance Sheet

The balance sheet, or statement of financial position, shows a business’s assets, liabilities, and equity at a point in time. The balance sheet of Big Dog Carworks Corp. at January 31, 2015 is shown below:

What Is an Asset?

Assets are economic resources that provide future benefits to the business. Examples include cash, accounts receivable, prepaid expenses, equipment, and trucks. Cash is coins and currency, usually held in a bank account, and is a financial resource with future benefit because of its purchasing power. Accounts receivable represent amounts to be collected in cash in the future for goods sold or services provided to customers on credit. Prepaid expenses are assets that are paid in cash in advance and have benefits that apply over future periods. For example, a one-year insurance policy purchased for cash on January 1, 2015 will provide a benefit until December 31, 2015 so is a prepaid asset. The equipment and truck were purchased on January 1, 2015 and will provide benefits for 2015 and beyond so are assets.

What Is a Liability?

A liability is an obligation to pay an asset in the future. For example, Big Dog’s bank loan represents an obligation to repay cash in the future to the bank. Accounts payable are obligations to pay a creditor for goods purchased or services rendered. A creditor owns the right to receive payment from an individual or business. Unearned revenue represents an advance payment of cash from a customer for Big Dog’s services or products to be provided in the future. For example, Big Dog collected cash from a customer in advance for a repair to be done in the future.

What Is Equity?

Equity represents the net assets owned by the owners (the shareholders). Net assets are assets minus liabilities. For example, in Big Dog’s January 31 balance sheet, net assets are $12,000, calculated as total assets of $19,100 minus total liabilities of $7,100. This means that although there are $19,100 of assets, only $12,000 are owned by the shareholders and the balance, $7,100, are financed by debt. Notice that net assets and total equity are the same value; both are $12,000. Equity consists of share capital and retained earnings. Share capital represents how much the shareholders have invested in the business. Retained earnings is the sum of all net incomes earned by a corporation over its life, less any dividends distributed to shareholders.

In summary, the balance sheet is represented by the equation: Assets = Liabilities + Equity. Assets are the investments held by a business. The liabilities and equity explain how the assets have been financed, or funded. Assets can be financed through liabilities, also known as debt, or equity. Equity represents amounts that are owned by the owners, the shareholders, and consists of share capital and retained earnings. Investments made by shareholders, namely share capital, are used to finance assets and/or pay down liabilities. Additionally, retained earnings, comprised of net income less any dividends, also represent a source of financing.

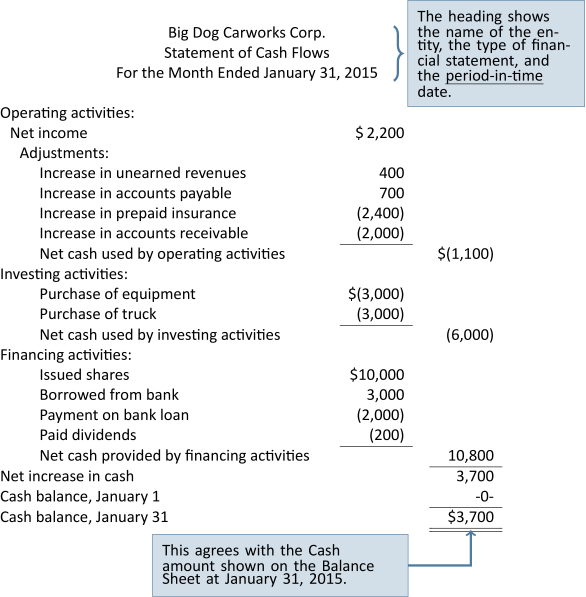

The Statement of Cash Flows (SCF)

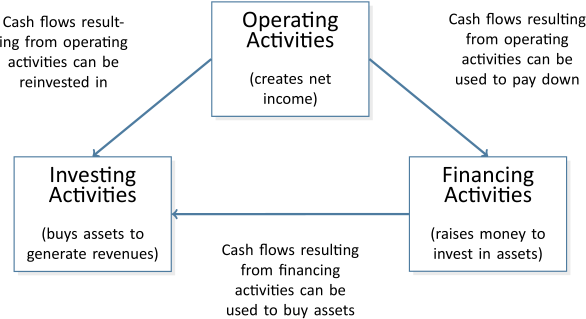

Cash is an asset reported on the balance sheet. Ensuring there is sufficient cash to pay expenses and liabilities as they come due is a critical business activity. The statement of cash flows (SCF) explains how the balance in cash changed over a period of time by detailing the sources (inflows) and uses (outflows) of cash by type of activity: operating, investing, and financing, as these are the three types of activities a business engages in. Operating activities are the day-to-day processes involved in selling products and/or services to generate net income. Examples of operating activities include the purchase and use of supplies, paying employees, fuelling equipment, and renting space for the business. Investing activities are the buying of assets needed to generate revenues. For example, when an airline purchases airplanes, it is investing in assets required to help it generate revenue. Financing activities are the raising of money needed to invest in assets. Financing can involve issuing share capital (getting money from the owners known as shareholders) or borrowing. Figure 1.2 summarizes the interrelationships among the three types of business activities:

The statement of cash flows for Big Dog is shown below:

The statement of cash flows is useful because cash is one of the most important assets of a corporation. Information about expected future cash flows are therefore important for decision makers. For instance, Big Dog’s bank manager needs to determine whether the remaining $6,000 loan can be repaid, and also whether or not to grant a new loan to the corporation if requested. The statement of cash flows helps inform those who make these decisions.

Important: Notes to the Financial Statements

An essential part of financial statements are the notes that accompany them. These notes are generally located at the end of a set of financial statements. The notes provide greater detail about various amounts shown in the financial statements, or provide non-quantitative information that is useful to users. For example, a note may indicate the estimated useful lives of long-lived assets, or loan repayment terms. Examples of note disclosures will be provided later.

Learning Activity 1.3 – Check Your Knowledge

This Learning Activity will focus on your understanding of the content from section 1.4. In this activity, indicate whether each of the following is an Asset, Liability, or an Equity item. Note: This activity is intended to be used as a self-assessment – it is not for grades.

1.5 Transaction Analysis and Double-entry Accounting

LO5 – Analyze transactions by using the accounting equation.

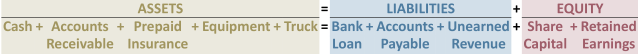

The accounting equation is foundational to accounting. It shows that the total assets of a business must always equal the total claims against those assets by creditors and owners. The equation is expressed as:

When financial transactions are recorded, combined effects on assets, liabilities, and equity are always exactly offsetting. This is the reason that the balance sheet always balances.

Each economic exchange is referred to as a financial transaction — for example, when an organization exchanges cash for land and buildings. Incurring a liability in return for an asset is also a financial transaction. Instead of paying cash for land and buildings, an organization may borrow money from a financial institution. The company must repay this with cash payments in the future. The accounting equation provides a system for processing and summarizing these sorts of transactions.

Accountants view financial transactions as economic events that change components within the accounting equation. These changes are usually triggered by information contained in source documents (such as sales invoices and bills from creditors) that can be verified for accuracy.

The accounting equation can be expanded to include all the items listed on the Balance Sheet of Big Dog at January 31, 2015, as follows:

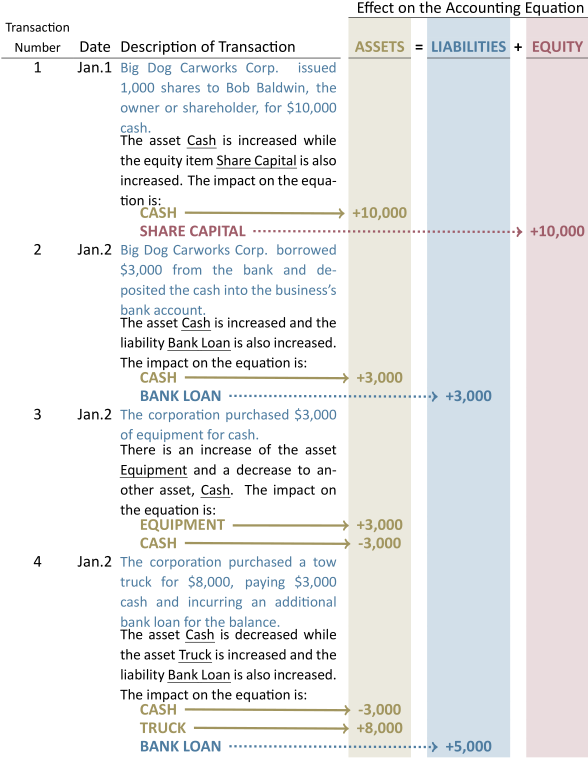

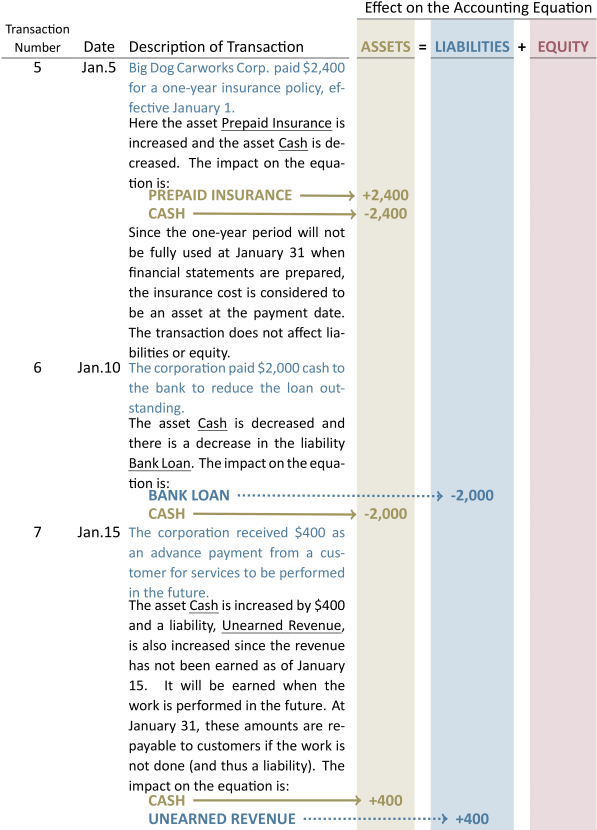

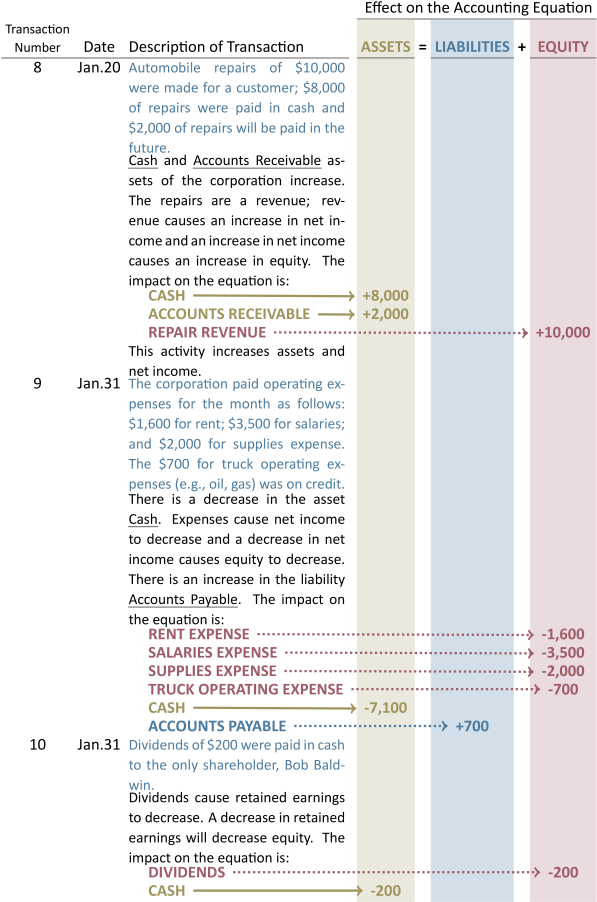

If one item within the accounting equation is changed, then another item must also be changed to balance it. In this way, the equality of the equation is maintained. For example, if there is an increase in an asset account, then there must be a decrease in another asset or a corresponding increase in a liability or equity account. This equality is the essence of double-entry accounting. The equation itself always remains in balance after each transaction. The operation of double-entry accounting is illustrated in the following section, which shows 10 transactions of Big Dog Carworks Corp. for January 2015.

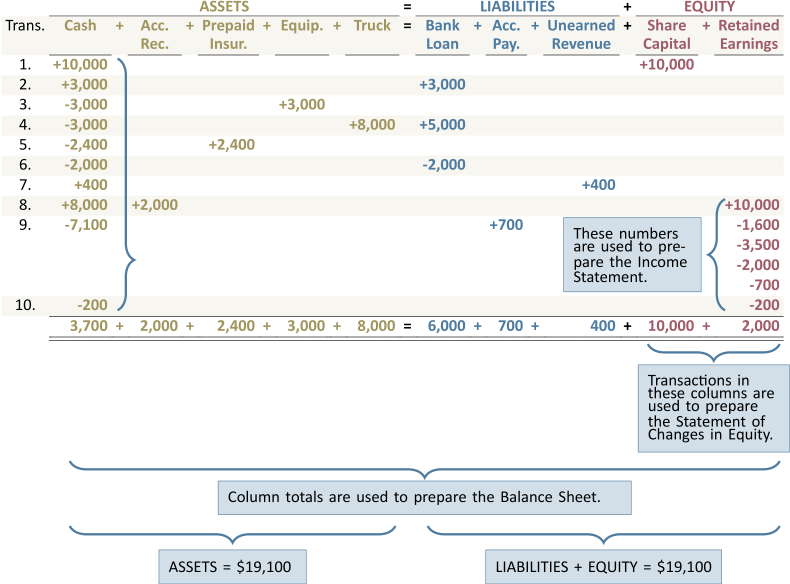

These various transactions can be recorded in the expanded accounting equation as shown below:

Figure 1.3 Transactions Worksheet for January 31, 2015

Transactions summary:

- Issued share capital for $10,000 cash.

- Received a bank loan for $3,000.

- Purchased equipment for $3,000 cash.

- Purchased a truck for $8,000; paid $3,000 cash and incurred a bank loan for the balance.

- Paid $2,400 for a comprehensive one-year insurance policy effective January 1.

- Paid $2,000 cash to reduce the bank loan.

- Received $400 as an advance payment for repair services to be provided over the next two months as follows: $300 for February, $100 for March.

- Performed repairs for $8,000 cash and $2,000 on credit.

- Paid a total of $7,100 for operating expenses incurred during the month; also incurred an expense on account for $700.

- Dividends of $200 were paid in cash to the only shareholder, Bob Baldwin.

The transactions summarized in Figure 1.3 were used to prepare the financial statements described earlier, and reproduced in Figure 1.4 below:

Figure 1.4 Financial Statements of Big Dog Carworks Corp.

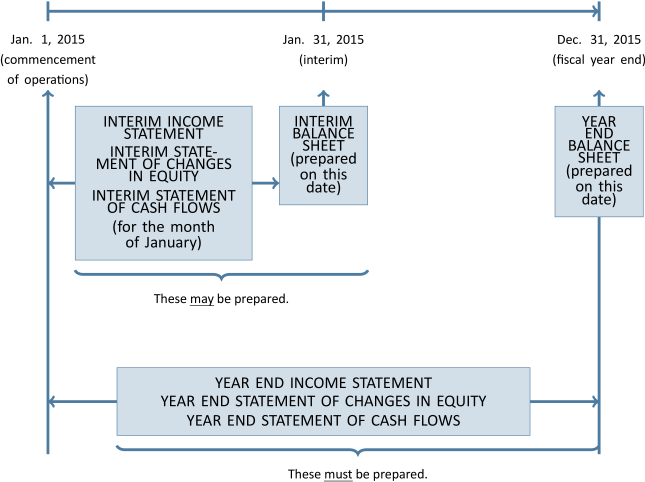

Accounting Time Periods

Financial statements are prepared at regular intervals — usually monthly or quarterly — and at the end of each 12-month period. This 12-month period is called the fiscal year. The timing of the financial statements is determined by the needs of management and other users of the financial statements. For instance, financial statements may also be required by outside parties, such as bankers and shareholders. However, accounting information must possess the qualitative characteristic of timeliness — it must be available to decision makers in time to be useful — which is typically a minimum of once every 12 months.

Accounting reports, called the annual financial statements, are prepared at the end of each 12-month period, which is known as the year-end of the entity. Some companies’ year-ends do not follow the calendar year (year ending December 31). This may be done so that the fiscal year coincides with their natural year. A natural year ends when business operations are at a low point. For example, a ski resort may have a fiscal year ending in late spring or early summer when business operations have ceased for the season.

Corporations listed on stock exchanges are generally required to prepare interim financial statements, usually every three months, primarily for the use of shareholders or creditors. Because these types of corporations are large and usually have many owners, users require more up-to-date financial information.

The relationship of the interim and year-end financial statements is illustrated in Figure 1.5:

Figure 1.5 Relationship of Interim and Year-end Financial Statements

Summary of Chapter 1 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 1. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Define accounting.

Accounting is the process of identifying, measuring, recording, and communicating an organization’s economic activities to users for decision making. Internal users work for the organization while external users do not. Managerial accounting serves the decision-making needs of internal users. Financial accounting focuses on external reporting to meet the needs of external users.

LO2 – Identify and describe the forms of business organization.

The three forms of business organizations are a proprietorship, partnership, and corporation.

The following chart summarizes the key characteristics of each form of business organization.

| Characteristic | Proprietorship | Partnership | Corporation |

| Separate legal entity | No | No | Yes |

| Business income is taxed as part of the business | No | No | Yes |

| Unlimited liability | Yes | Yes | No |

| One owner permitted | Yes | No | Yes |

| Board of Directors | No | No | Yes |

LO3 – Identify and explain the Generally Accepted Accounting Principles (GAAP).

GAAP followed in Canada by PAEs (Publicly Accountable Enterprises) are based on IFRS (International Financial Reporting Standards). PEs (Private Enterprises) follow GAAP based on ASPE (Accounting Standards for Private Enterprises), a less onerous set of GAAP maintained by the AcSB (Accounting Standards Board). GAAP have qualitative characteristics (relevance, faithful representation, comparability, verifiability, timeliness, and understandability) and principles (business entity, consistency, cost, full disclosure, going concern, matching, materiality, monetary unit, and recognition).

LO4 – Identify, explain, and prepare the financial statements.

The four financial statements are: income statement, statement of changes in equity, balance sheet, and statement of cash flows. The income statement reports financial performance by detailing revenues less expenses to arrive at net income/loss for the period. The statement of changes in equity shows the changes during the period to each of the components of equity: share capital and retained earnings. The balance sheet identifies financial position at a point in time by listing assets, liabilities, and equity. Finally, the statement of cash flows details the sources and uses of cash during the period based on the three business activities: operating, investing, and financing.

LO5 – Analyze transactions by using the accounting equation.

The accounting equation, A = L + E, describes the asset investments (the left side of the equation) and the liabilities and equity that financed the assets (the right side of the equation). The accounting equation provides a system for processing and summarizing financial transactions resulting from a business’s activities. A financial transaction is an economic exchange between two parties that impacts the accounting equation. The equation must always balance.

Review Questions

After reading through Chapter 1, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

Use the questions below to self-assess how well you understand the content from Chapter 1:

- What are generally accepted accounting principles (GAAP)?

- When is revenue recognised?

- How does the matching concept more accurately determine the Net Income of a business?

- What are the qualities that accounting information is expected to have? What are the limitations on the disclosure of useful accounting information?

- What are assets?

- To what do the terms liability and equity refer?

- Explain the term financial transaction. Include an example of a financial transaction as part of your explanation.

- Identify the three forms of business organization.

- What is the business entity concept of accounting? Why is it important?

- What is the general purpose of financial statements? Name the four financial statements?

- Each financial statement has a title that consists of the name of the financial statement, the name of the business, and a date line. How is the date line on each of the four financial statements the same or different?

- What is the purpose of an income statement? a balance sheet? How do they interrelate?

- Define the terms revenue and expense.

- What is net income? What information does it convey?

- What is the purpose of a statement of changes in equity? a statement of cash flows?

- Why are financial statements prepared at regular intervals? Who are the users of these statements?

- What is the accounting equation?

- Explain double-entry accounting.

- What is a year-end? How does the timing of year-end financial statements differ from that of interim financial statements?

- How does a fiscal year differ from a calendar year?

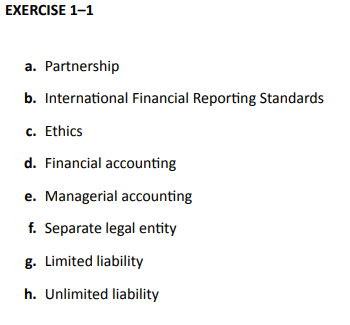

Exercises

| Ethics | Managerial accounting |

| Financial accounting | Partnership |

| International Financial Reporting Standards | Separate legal entity |

| Limited liability | Unlimited liability |

Match each term in the above alphabetized list to the corresponding description below.

| a. | The owners pay tax on the business’s net income. | |

| b. | Accounting standards followed by PAEs in Canada. | |

| c. | Rules that guide us in interpreting right from wrong. | |

| d. | Accounting aimed at communicating information to external users. | |

| e. | Accounting aimed at communicating information to internal users. | |

| f. | The business is distinct from its owners. | |

| g. | The owner(s) are not responsible for the debts of the business. | |

| h. | If the business is unable to pay its debts, the owner(s) are responsible. |

Click Here to View Solution

| Business entity | Full disclosure | Materiality | ||

| Consistency | Going concern | Monetary unit | ||

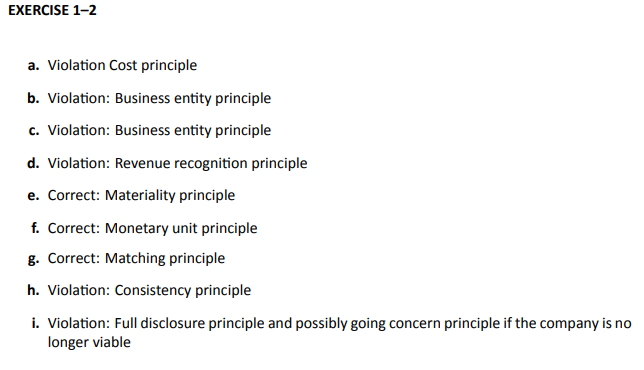

| Cost | Matching | Recognition |

Identify whether each of the following situations represents a violation or a correct application of GAAP, and which principle is relevant in each instance.

- A small storage shed was purchased from a home supply store at a discount sale price of $5,000 cash. The clerk recorded the asset at $6,000, which was the regular price.

- One of the business partners of a small architect firm continually charges the processing of his family vacation photos to the business firm.

- An owner of a small engineering business, operating as a proprietorship from his home office, also paints and sells watercolour paintings in his spare time. He combines all the transactions in one set of books.

- ABS Consulting received cash of $6,000 from a new customer for consulting services that ABS is to provide over the next six months. The transaction was recorded as a credit to revenue.

- Tyler Tires, purchased a shop tool for cash of $20 to replace the one that had broken earlier that day. The tool would be useful for several years, but the transaction was recorded as a debit to shop supplies expense instead of to shop equipment (asset).

- Embassy Lighting, a small company operating in Canada, sold some merchandise to a customer in California and deposited cash of $5,000 US. The bookkeeper recorded it as a credit to revenue of $7,250 CAD, which was the Canadian equivalent currency at that time.

- An owner of a small car repair shop purchased shop supplies for cash of $2,200, which will be used over the next six months. The transaction was recorded as a debit to shop supplies (asset) and will be expensed as they are used.

- At the end of each year, a business owner looks at his estimated net income for the year and decides which depreciation method he will use in an effort to reduce his business income taxes to the lowest amount possible.

- XYZ is in deep financial trouble and recently was able to obtain some badly needed cash from an investor who was interested in becoming an equity partner. However, a few days ago, the investor unexpectedly changed the terms of his cash investment in XYZ company from the proposed equity partnership to a long-term loan. XYZ does not disclose this to their bank, who they recently applied to for an increase in their overdraft line-of-credit.

Click Here to View Solution

| Assets | = | Liabilities | + | Equity | ||||||

| a. | 50,000 | = | 20,000 | + | ? | |||||

| b. | 10,000 | = | ? | + | 1,000 | |||||

| c. | ? | = | 15,000 | + | 80,000 |

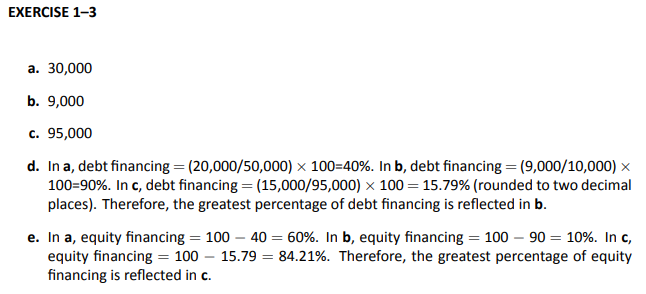

Calculate the missing amounts in a, b, and c above. Additionally, answer each of the questions in d and e below.

d. Assets are financed by debt and equity. The greatest percentage of debt financing is reflected in a, b, or c?

e. The greatest percentage of equity financing is reflected in a, b, or c?

Click Here to View Solution

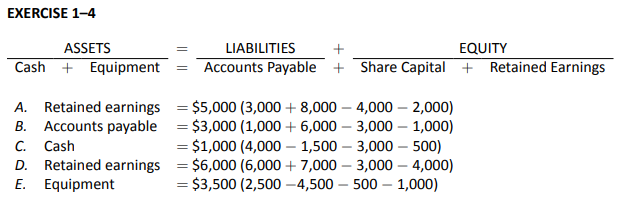

Calculate the missing amounts for companies A to E.

| A | B | C | D | E | |||||

| Cash | $3,000 | $1,000 | $

? |

$6,000 | $2,500 | ||||

| Equipment | 8,000 | 6,000 | 4,000 | 7,000 | ? | ||||

| Accounts Payable | 4,000 | ? | 1,500 | 3,000 | 4,500 | ||||

| Share Capital | 2,000 | 3,000 | 3,000 | 4,000 | 500 | ||||

| Retained Earnings | ? | 1,000 | 500 | ? | 1,000 |

Click Here to View Solution

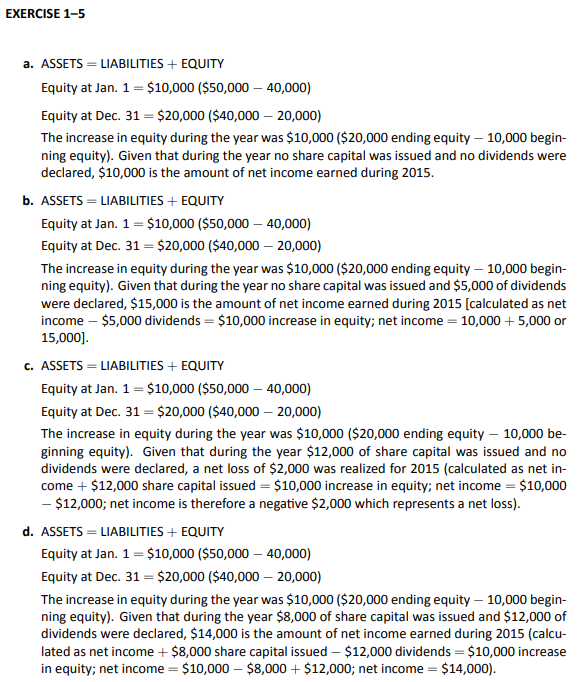

| Assets | = | Liabilities | + | Equity | |

| Balance, Jan. 1, 2015 | $50,000 | $40,000 | ? | ||

| Balance, Dec. 31, 2015 | 40,000 | 20,000 | ? |

Using the information above, calculate net income under each of the following assumptions.

- During 2015, no share capital was issued and no dividends were declared.

- During 2015, no share capital was issued and dividends of $5,000 were declared.

- During 2015, share capital of $12,000 was issued and no dividends were declared.

- During 2015, share capital of $8,000 was issued and $12,000 of dividends were declared.

Click Here to View Solution

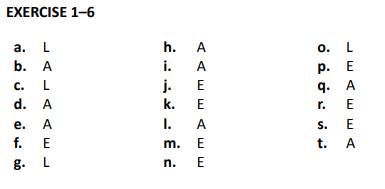

Indicate whether each of the following is an asset (A), liability (L), or an equity (E) item.

| a. | Accounts Payable | k. | Dividends |

| b. | Accounts Receivable | l. | Interest Receivable |

| c. | Bank Loan Payable | m. | Retained Earnings |

| d. | Building | n. | Interest Revenue |

| e. | Cash | o. | Interest Payable |

| f. | Share Capital | p. | Interest Expense |

| g. | Loan Payable | q. | Prepaid Insurance |

| h. | Office Supplies | r. | Insurance Expense |

| i. | Prepaid Insurance | s. | Insurance Revenue |

| j. | Utilities Expense | t. | Machinery |

Click Here to View Solution

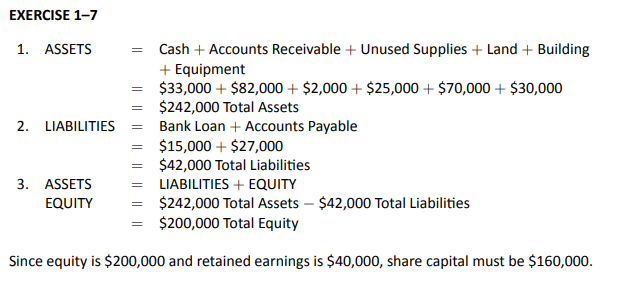

The following information is taken from the records of Jasper Inc. at January 31, 2015, after its first month of operations. Assume no dividends were declared in January.

| Cash | $33,000 | Equipment | $30,000 | |

| Accounts Receivable | 82,000 | Bank Loan | 15,000 | |

| Unused Supplies | 2,000 | Accounts Payable | 27,000 | |

| Land | 25,000 | Share Capital | ? | |

| Building | 70,000 | Net Income | 40,000 |

- Calculate total assets.

- Calculate total liabilities.

- Calculate share capital.

- Calculate retained earnings.

- Calculate total equity.

Click Here to View Solution

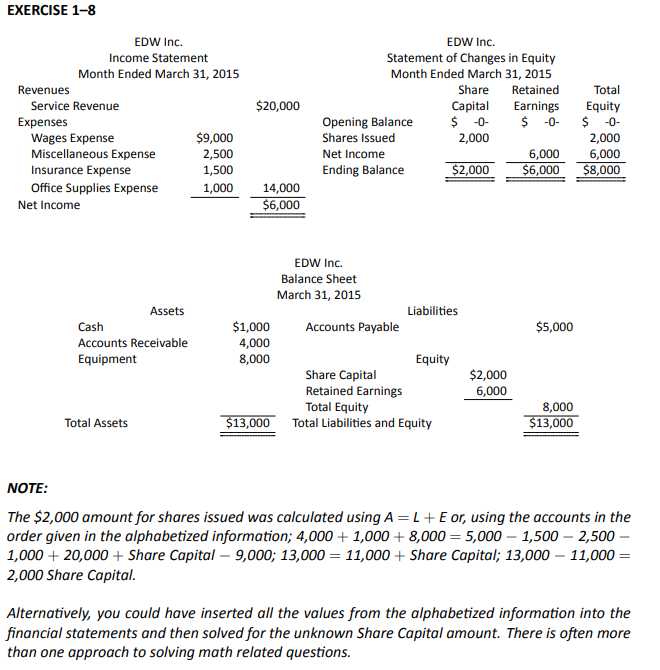

| Accounts Receivable | $4,000 | Miscellaneous Expense | $

2,500 |

|

| Accounts Payable | 5,000 | Office Supplies Expense | 1,000 | |

| Cash | 1,000 | Service Revenue | 20,000 | |

| Equipment | 8,000 | Share Capital | ? | |

| Insurance Expense | 1,500 | Wages Expense | 9,000 |

Using the alphabetized information above for EDW Inc. after its first month of operations, complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

| EDW Inc. | EDW Inc. | |||||||||

| Income Statement | Statement of Changes in Equity | |||||||||

| Month Ended March 31, 2015 | Month Ended March 31, 2015 | |||||||||

| Revenues | Share | Retained | Total | |||||||

|

Service Revenue |

$ | Capital | Earnings | Equity | ||||||

| Expenses | Opening Balance | $ | $ | $ | ||||||

|

Wages Expense |

$ | Shares Issued | ||||||||

|

Miscellaneous Expense |

Net Income | |||||||||

|

Insurance Expense |

Ending Balance | $ | $ | $ | ||||||

|

Office Supplies Expense |

||||||||||

| Net Income | $ | |||||||||

| EDW Inc. | ||||||

| Balance Sheet | ||||||

| March 31, 2015 | ||||||

| Assets | Liabilities | |||||

|

Cash |

$ |

Accounts Payable |

$ | |||

|

Accounts Receivable |

||||||

|

Equipment |

Equity | |||||

|

Share Capital |

$ | |||||

|

Retained Earnings |

||||||

|

Total Equity |

||||||

| Total Assets | $ | Total Liabilities and Equity | $ | |||

Click Here to View Solution

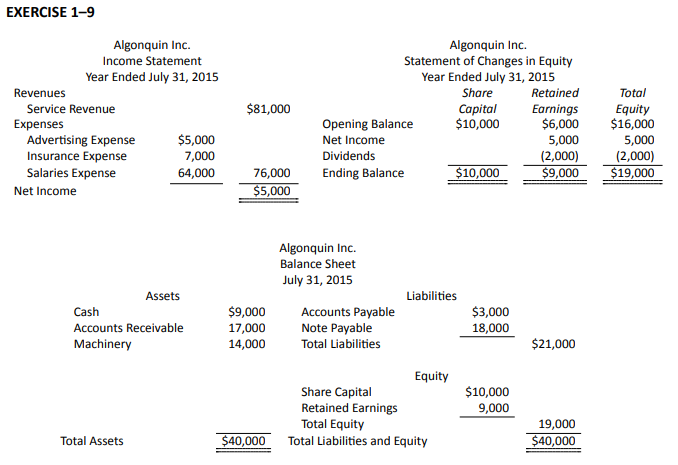

| Accounts Receivable | $17,000 | Machinery | $14,000 | |

| Accounts Payable | 3,000 | Note Payable | 18,000 | |

| Advertising Expense | 5,000 | Retained Earnings | 6,000 | |

| Cash | 9,000 | Salaries Expense | 64,000 | |

| Dividends | 2,000 | Service Revenue | 81,000 | |

| Insurance Expense | 7,000 | Share Capital | 10,000 |

Algonquin Inc. began operations on August 1, 2013. After its second year, Algonquin Inc.’s accounting system showed the information above. During the second year, no additional shares were issued. Complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

| Algonquin Inc. | Algonquin Inc. | |||||||||

| Income Statement | Statement of Changes in Equity | |||||||||

| Year Ended July 31, 2015 | Year Ended July 31, 2015 | |||||||||

| Revenues | Share | Retained | Total | |||||||

|

Service Revenue |

$ | Capital | Earnings | Equity | ||||||

| Expenses | Opening Balance | $

10,000 |

$

6,000 |

$

16,000 |

||||||

|

Advertising Expense |

$ | Net Income | ||||||||

|

Insurance Expense |

Dividends | |||||||||

|

Salaries Expense |

Ending Balance | $ | $ | $ | ||||||

| Net Income | $ | |||||||||

| Algonquin Inc. | ||||||

| Balance Sheet | ||||||

| July 31, 2015 | ||||||

| Assets | Liabilities | |||||

|

Cash |

$ |

Accounts Payable |

$ | |||

|

Accounts Receivable |

Note Payable |

|||||

|

Machinery |

Total Liabilities |

$ | ||||

| Equity | ||||||

|

Share Capital |

$ | |||||

|

Retained Earnings |

||||||

|

Total Equity |

||||||

| Total Assets | $ | Total Liabilities and Equity | $ | |||

Click Here to View Solution

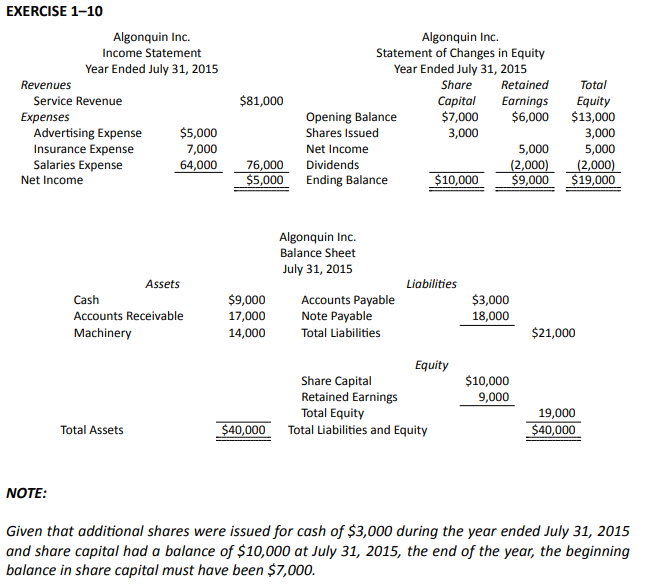

Refer to EXERCISE 1–9. Use the same information EXCEPT assume that during the second year, additional shares were issued for cash of $3,000. Complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

| Algonquin Inc. | Algonquin Inc. | |||||||||

| Income Statement | Statement of Changes in Equity | |||||||||

| Year Ended July 31, 2015 | Year Ended July 31, 2015 | |||||||||

| Revenues | Share | Retained | Total | |||||||

|

Service Revenue |

$ | Capital | Earnings | Equity | ||||||

| Expenses | Opening Balance | $ | $ | $ | ||||||

|

Advertising Expense |

$ | Shares Issued | ||||||||

|

Insurance Expense |

Net Income | |||||||||

|

Salaries Expense |

Dividends | |||||||||

| Net Income | $ | Ending Balance | $ | $ | $ | |||||

| Algonquin Inc. | ||||||

| Balance Sheet | ||||||

| July 31, 2015 | ||||||

| Assets | Liabilities | |||||

|

Cash |

$ |

Accounts Payable |

$ | |||

|

Accounts Receivable |

Note Payable |

|||||

|

Machinery |

Total Liabilities |

$ | ||||

| Equity | ||||||

|

Share Capital |

$ | |||||

|

Retained Earnings |

||||||

|

Total Equity |

||||||

| Total Assets | $ | Total Liabilities and Equity | $ | |||

Click Here to View Solution

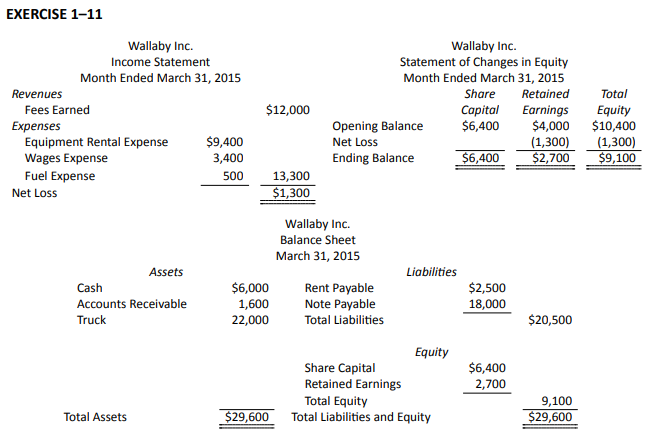

| Accounts Receivable | $1,600 | Rent Payable | $2,500 | |

| Cash | 6,000 | Retained Earnings | 4,000 | |

| Equipment Rental Expense | 9,400 | Share Capital | 6,400 | |

| Fees Earned | 12,000 | Truck | 22,000 | |

| Fuel Expense | 500 | Wages Expense | 3,400 | |

| Note Payable | 18,000 |

Wallaby Inc. began operations on February 1, 2014. After its second month, Wallaby Inc.’s accounting system showed the information above. During the second month, no dividends were declared and no additional shares were issued. Complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

| Wallaby Inc. | Wallaby Inc. | |||||||||

| Income Statement | Statement of Changes in Equity | |||||||||

| Month Ended March 31, 2015 | Month Ended March 31, 2015 | |||||||||

| Revenues | Share | Retained | Total | |||||||

|

Fees Earned |

$ | Capital | Earnings | Equity | ||||||

| Expenses | Opening Balance | $

6,400 |

$

4,000 |

$

10,400 |

||||||

|

Equipment Rental Expense |

$ | Net Loss | ||||||||

|

Wages Expense |

Ending Balance | $ | $ | $ | ||||||

|

Fuel Expense |

||||||||||

| Net Loss | $ | |||||||||

| Wallaby Inc. | ||||||

| Balance Sheet | ||||||

| March 31, 2015 | ||||||

| Assets | Liabilities | |||||

|

Cash |

$ |

Rent Payable |

$ | |||

|

Accounts Receivable |

Note Payable |

|||||

|

Truck |

Total Liabilities |

$ | ||||

| Equity | ||||||

|

Share Capital |

$ | |||||

|

Retained Earnings |

||||||

|

Total Equity |

||||||

| Total Assets | $ | Total Liabilities and Equity | $ | |||

Click Here to View Solution

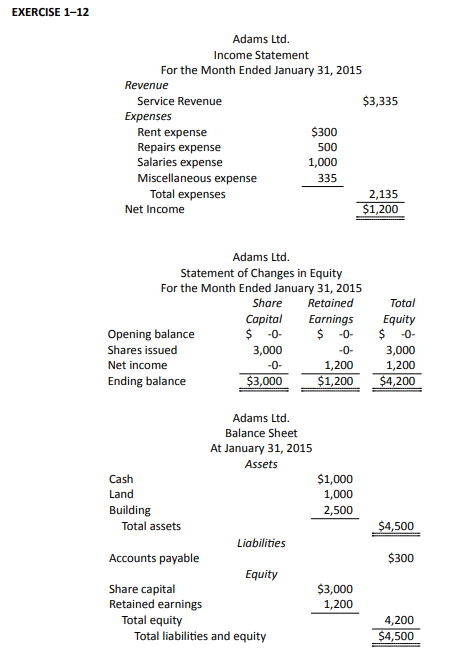

A junior bookkeeper of Adams Ltd. prepared the following incorrect financial statements at the end of its first month of operations.

| Adams Ltd. | |||

| Income Statement | |||

| For the Month Ended January 31, 2015 | |||

| Service Revenue | $3,335 | ||

| Expenses | |||

|

Accounts Payable |

$300 | ||

|

Land |

1,000 | ||

|

Miscellaneous Expenses |

335 | 1,635 | |

| Net Income | $1,700 | ||

| Balance Sheet | ||||

| Assets | Liabilities and Equity | |||

| Cash | $1,000 | Rent Expense | $300 | |

| Repairs Expense | 500 | Share Capital | 3,000 | |

| Salaries Expense | 1,000 | Retained Earnings | 1,700 | |

| Building | 2,500 | |||

| $5,000 | $5,000 | |||

Prepare a corrected income statement, statement of changes in equity, and balance sheet.

Click Here to View Solution

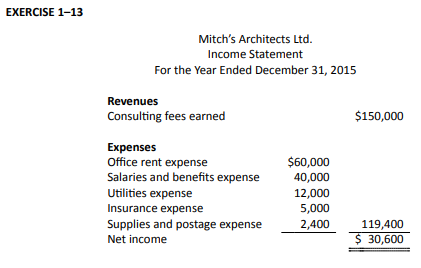

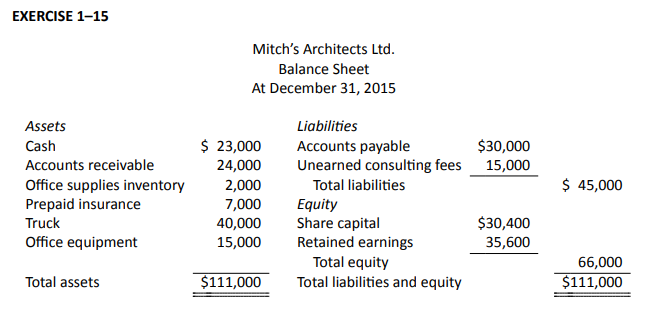

Below are the December 31, 2015, year-end accounts balances for Mitch’s Architects Ltd. This is the business’s second year of operations.

| Cash | $ | 23,000 | Share capital | $ | 30,400 | |

| Accounts receivable | 24,000 | Retained earnings | 5,000 | |||

| Office supplies inventory | 2,000 | Consulting fees earned | 150,000 | |||

| Prepaid insurance | 7,000 | Office rent expense | 60,000 | |||

| Truck | 40,000 | Salaries and benefits expense | 40,000 | |||

| Office equipment | 15,000 | Utilities expense | 12,000 | |||

| Accounts payable | 30,000 | Insurance expense | 5,000 | |||

| Unearned consulting fees | 15,000 | Supplies and postage expense | 2,400 |

Additional information:

- Included in the share capital account balance was an additional $10,000 of shares issued during the current year just ended.

- Included in the retained earnings account balance was dividends paid to the shareholders of $1,000 during the current year just ended.

Use these accounts to prepare an income statement similar to the example illustrated in Section 1.4.

Click Here to View Solution

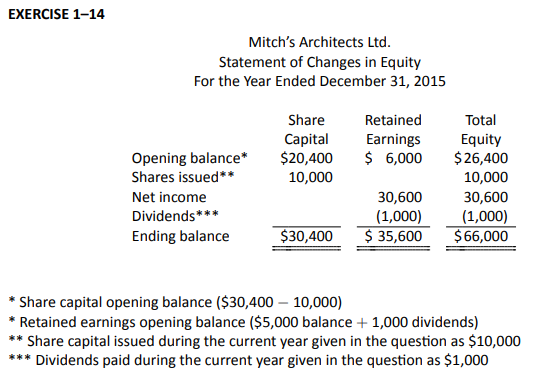

Using the data in EXERCISE 1–13, prepare a statement of changes in equity similar to the example illustrated in Section 1.4.

Click Here to View Solution

Using the data in EXERCISE 1–13, prepare a balance sheet similar to the example illustrated in Section 1.4.

Click Here to View Solution

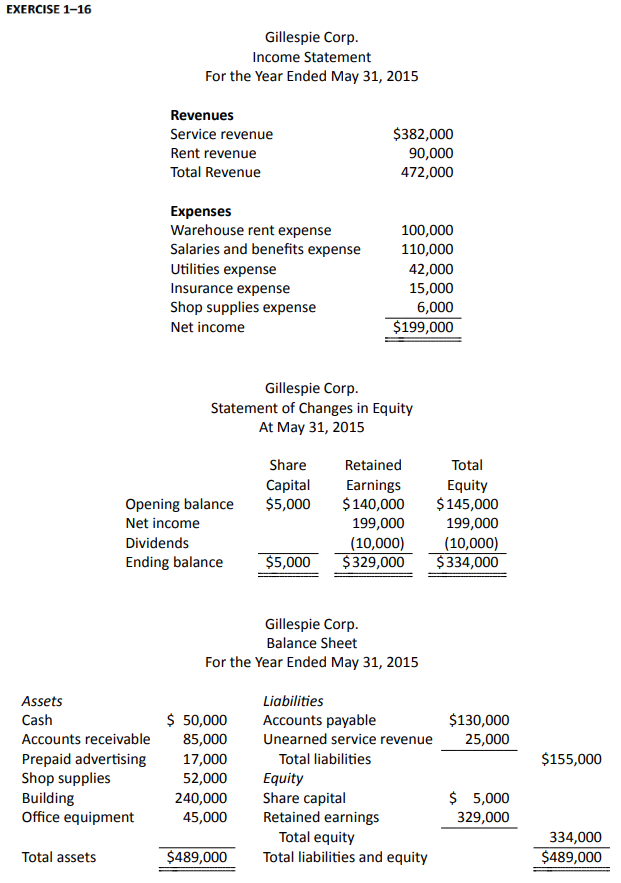

Below are the May 31, 2015, year-end financial statements for Gillespie Corp., prepared by a summer student. There were no share capital transactions in the year just ended.

| Gillespie Corp. | |||

| Income Statement | |||

| For the Year Ended May 31, 2015 | |||

| Revenues | |||

| Service revenue | $ | 382,000 | |

| Unearned service revenue | 25,000 | ||

| Rent revenue | 90,000 | ||

| Expenses | |||

| Warehouse rent expense | 100,000 | ||

| Prepaid advertising | 17,000 | ||

| Salaries and benefits expense | 110,000 | ||

| Dividends | 10,000 | ||

| Utilities expense | 42,000 | ||

| Insurance expense | 15,000 | ||

| Shop supplies expense | 6,000 | ||

| Net income | $ | 197,000 | |

| Gillespie Corp. | |||||||||

| Statement of Changes in Equity | |||||||||

| At May 31, 2015 | |||||||||

| Share | Retained | Total | |||||||

| Capital | Earnings | Equity | |||||||

| Opening balance | $ | 5,000 | $ | 140,000 | $ | 145,000 | |||

| Net income | 197,000 | 197,000 | |||||||

| Ending balance | $ | 5,000 | $ | 337,000 | $ | 342,000 | |||

| Gillespie Corp. | |||||||||

| Balance Sheet | |||||||||

| For the Year Ended May 31, 2015 | |||||||||

| Assets | Liabilities | ||||||||

| Cash | $ | 50,000 | Accounts payable | $ | 130,000 | ||||

| Accounts receivable | 85,000 | ||||||||

| Office equipment | 45,000 |

Total liabilities |

$ | 130,000 | |||||

| Building | 240,000 | Equity | |||||||

| Shop supplies | 52,000 | Share capital | $ | 5,000 | |||||

| Retained earnings | 337,000 | ||||||||

|

Total equity |

342,000 | ||||||||

| Total assets | $ | 472,000 | Total liabilities and equity | $ | 472,000 | ||||

Using the data above, prepare a corrected set of financial statements similar to the examples illustrated in Section 1.4.

Click Here to View Solution

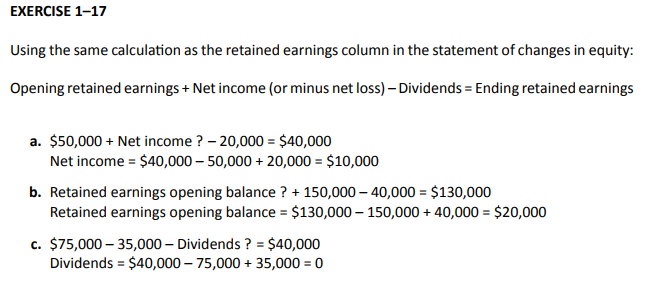

Complete the following calculations for each individual company:

- If ColourMePink Ltd. has a retained earnings opening balance of $50,000 at the beginning of the year, and an ending balance of $40,000 at the end of the year, what would be the net income/loss, if dividends paid were $20,000?

- If ForksAndSpoons Ltd. has net income of $150,000, dividends paid of $40,000 and a retained earnings ending balance of $130,000, what would be the retained earnings opening balance?

- If CupsAndSaucers Ltd. has a retained earnings opening balance of $75,000 at the beginning of the year, and an ending balance of $40,000 at the end of the year, what would be the dividends paid, if the net loss was $35,000?

Click Here to View Solution

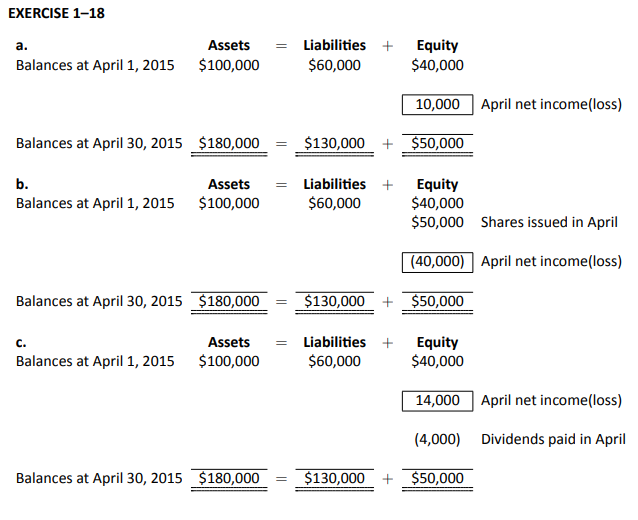

| Assets | = | Liabilities | + | Equity | ||

| Balances at April 1, 2015 | $100,000 | $60,000 | $40,000 | |||

| ? | Shares issued in April | |||||

| ? | April net income(loss) | |||||

| ? | Dividends paid in April | |||||

| Balances at April 30, 2015 | $180,000 | = | $130,000 | + | ? |

Using the information provided above, calculate the net income or net loss realized during April under each of the following independent assumptions.

- No shares were issued in April and no dividends were paid.

- $50,000 of shares were issued in April and no dividends were paid.

- No shares were issued in April and $4,000 of dividends were paid in April.

Click Here to View Solution

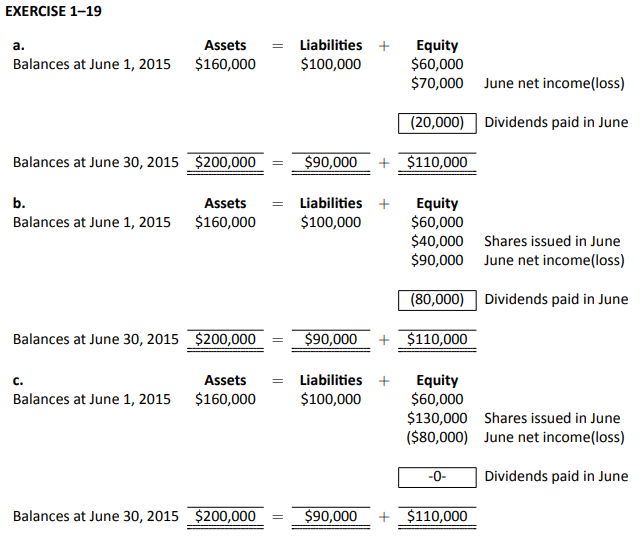

| Assets | = | Liabilities | + | Equity | ||

| Balances at June 1, 2015 | $160,000 | $100,000 | $60,000 | |||

| ? | Shares issued in June | |||||

| ? | June net income(loss) | |||||

| ? | Dividends paid in June | |||||

| Balances at June 30, 2015 | $200,000 | = | $90,000 | + | ? |

Using the information provided above, calculate the dividends paid in June under each of the following independent assumptions.

- In June no shares were issued and a $70,000 net income was earned.

- $40,000 of shares were issued in June and a $90,000 net income was earned.

- In June $130,000 of shares were issued and an $80,000 net loss was realized.

Click Here to View Solution

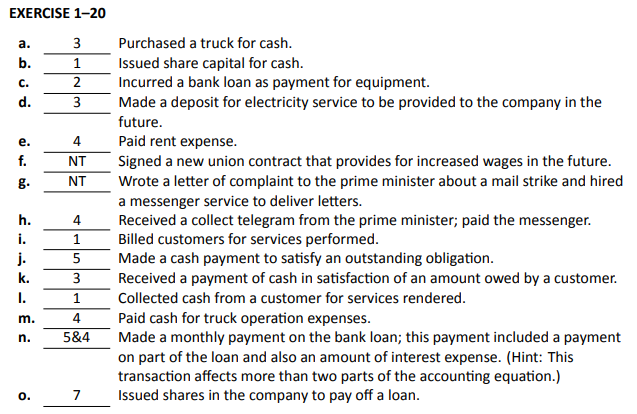

The following list shows the various ways in which the accounting equation might be affected by financial transactions.

| Assets | = | Liabilities | + | Equity | |

| 1. | (+) | (+) | |||

| 2. | (+) | (+) | |||

| 3. | (+)(-) | ||||

| 4. | (-) | (-) | |||

| 5. | (-) | (-) | |||

| 6. | (+) | (-) | |||

| 7. | (-) | (+) | |||

| 8. | (+)(-) | ||||

| 9. | (+)(-) |

Match one of the above to each of the following financial transactions. If the description below does not represent a financial transaction, indicate ‘NT’ for ‘No Transaction’. The first one is done as an example.

| a. | 3 | Purchased a truck for cash. |

| b. | Issued share capital for cash. | |

| c. | Incurred a bank loan as payment for equipment. | |

| d. | Made a deposit for electricity service to be provided to the company in the | |

| future. | ||

| e. | Paid rent expense. | |

| f. | Signed a new union contract that provides for increased wages in the future. | |

| g. | Wrote a letter of complaint to the prime minister about a mail strike and hired | |

| a messenger service to deliver letters | ||

| h. | Received a collect telegram from the prime minister; paid the messenger. | |

| i. | Billed customers for services performed. | |

| j. | Made a cash payment to satisfy an outstanding obligation. | |

| k. | Received a payment of cash in satisfaction of an amount owed by a customer. | |

| l. | Collected cash from a customer for services rendered. | |

| m. | Paid cash for truck operation expenses. | |

| n. | Made a monthly payment on the bank loan; this payment included a payment | |

| on part of the loan and also an amount of interest expense. (Hint: This | ||

| transaction affects more than two parts of the accounting equation.) | ||

| o. | Issued shares in the company to pay off a loan. |

Click Here to View Solution

Practice Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 1. It is recommended that students review any relevant sections that they struggled with in answering these problems.

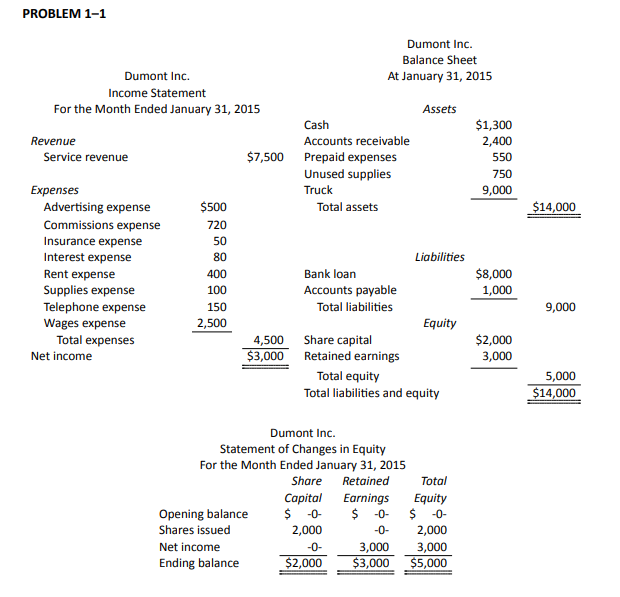

Following are the asset, liability, and equity items of Dumont Inc. at January 31, 2015, after its first month of operations.

| ASSETS | = | LIABILITIES | + | EQUITY | |||

| Cash | $1,300 | Bank Loan | $8,000 | Share Capital | $2,000 | ||

| Accounts Receivable | 2,400 | Accounts Payable | 1,000 | Service Revenue | 7,500 | ||

| Prepaid Expenses | 550 | Advertising Expense | 500 | ||||

| Unused Supplies | 750 | Commissions Expense | 720 | ||||

| Truck | 9,000 | Insurance Expense | 50 | ||||

| Interest Expense | 80 | ||||||

| Rent Expense | 400 | ||||||

| Supplies Expense | 100 | ||||||

| Telephone Expense | 150 | ||||||

| Wages Expense | 2,500 | ||||||

- Prepare an income statement and statement of changes in equity for Dumont’s first month ended January 31, 2015.

- Prepare a balance sheet at January 31, 2015.

Click Here to View Solution

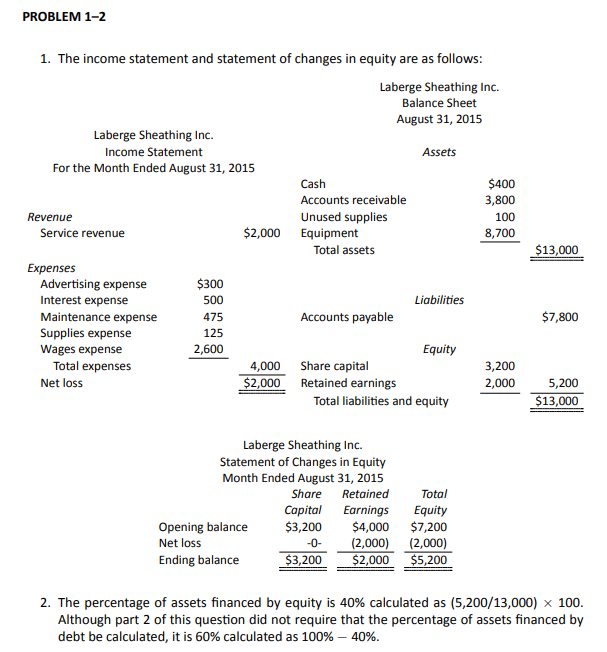

Laberge Sheathing Inc. began operations on January 1, 2015. The office manager, inexperienced in accounting, prepared the following statement for the business’s most recent month ended August 31, 2015.

| Laberge Sheathing Inc. | ||||

| Financial Statement | ||||

| Month Ended August 31, 2015 | ||||

| Cash | $400 | Accounts Payable | $7,800 | |

| Accounts Receivable | 3,800 | Share Capital | 3,200 | |

| Unused Supplies | 100 | Service Revenue | 2,000 | |

| Equipment | 8,700 | Retained Earnings | 4,000 | |

| Advertising Expense | 300 | |||

| Interest Expense | 500 | |||

| Maintenance Expense | 475 | |||

| Supplies Used | 125 | |||

| Wages Expense | 2,600 | |||

| $17,000 | $17,000 | |||

- Prepare an income statement and statement of changes in equity for the month ended August 31, 2015, and a balance sheet at August 31, 2015. No shares were issued in August.

- Using the information from the balance sheet completed in Part 1, calculate the percentage of assets financed by equity.

Click Here to View Solution

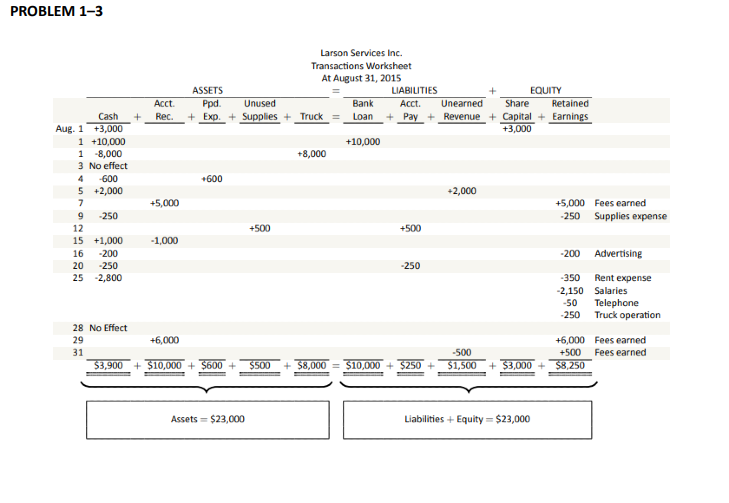

The following transactions of Larson Services Inc. occurred during August 2015, its first month of operations.

| Aug. | 1 | Issued share capital for $3,000 cash |

| 1 | Borrowed $10,000 cash from the bank | |

| 1 | Paid $8,000 cash for a used truck | |

| 3 | Signed a contract with a customer to do a $15,000 job beginning in November | |

| 4 | Paid $600 for a one-year truck insurance policy effective August 1 | |

| 5 | Collected fees of $2,000 for work to be performed in September | |

| 7 | Billed a client $5,000 for services performed today | |

| 9 | Paid $250 for supplies purchased and used today | |

| 12 | Purchased $500 of supplies on credit | |

| 15 | Collected $1,000 of the amount billed August 7 | |

| 16 | Paid $200 for advertising in The News that ran the first two weeks of August | |

| 20 | Paid $250 of the amount owing regarding the credit purchase of August 12 | |

| 25 | Paid the following expenses: rent for August, $350; salaries, $2,150; telephone, $50; | |

| truck operation, $250 | ||

| 28 | Called clients for payment of the balances owing from August 7 | |

| 31 | Billed a client $6,000 for services performed today | |

| 31 | $500 of the amount collected on August 5 has been earned as of today |

- Create a table like the one below by copying the headings shown.

ASSETS = LIABILITIES + EQUITY Acct. Ppd. Unused Bank Acct. Unearned Share Retained Cash + Rec. + Exp. + Supplies + Truck = Loan + Pay. + Revenue + Capital + Earnings - Use additions and subtractions in the table created in Part 1 to show the effects of the August transactions. For non-transactions that do not impact the accounting equation items (such as August 3), indicate ‘NE’ for ‘No Effect’.

- Total each column and prove the accounting equation balances.

Click Here to View Solution

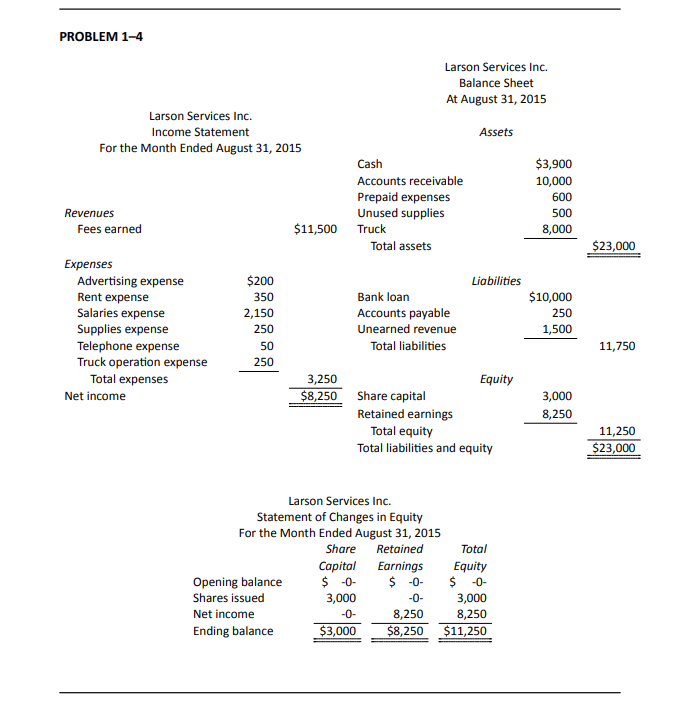

Refer to your answer for Problem 1–3. Prepare an income statement and a statement of changes in equity for the month ended August 31, 2015. Label the revenue earned as Fees Earned. Prepare a balance sheet at August 31, 2015.

Click Here to View Solution

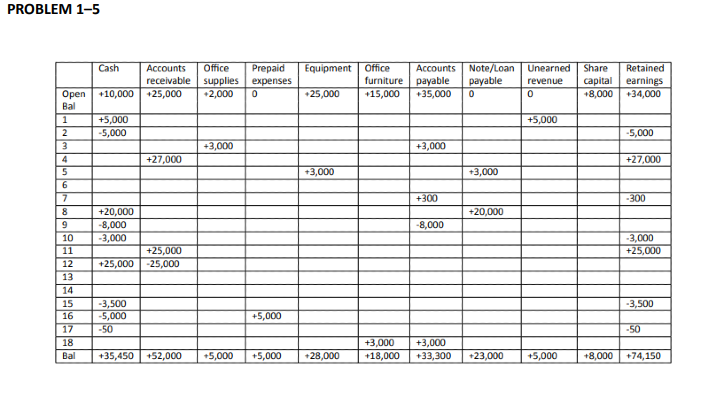

The following transactions occurred for Olivier Bondar Ltd., an restaurant management consulting service, during May, 2016:

| May 1 | Received a cheque in the amount of $5,000 from TUV Restaurant Ltd., for a restaurant food cleanliness assessment to be conducted in June. |

| May 1 | Paid $5,000 for office rent for the month of May. |

| May 2 | Purchased office supplies for $3,000 on account. |

| May 3 | Completed a consultation project for McDanny’s Restaurant and billed them $27,000 for the work. |

| May 4 | Purchased a laptop computer for $3,000 in exchange for a note payable due in 45 days. |

| May 5 | Olivier Bondar was a little short on cash, so the manager made an application for a bank loan in the amount of $20,000. It is expected that the bank will make their decision regarding the loan next week. |

| May 6 | Received an invoice from the utilities company for electricity in the amount of $300. |

| May 10 | Bank approved the loan and deposited $20,000 into Olivier Bondar’s bank account. First loan payment is due on June 10. |

| May 11 | Paid for several invoices outstanding from April for goods and services received for a total of $8,000. The breakdown of the invoice costs are: telephone expense $500; advertising expense $3,000; office furniture $2,000; office supplies $2,500. |

| May 13 | Paid employee salaries owing from May 1 to May 13 in the amount of $3,000. |

| May 14 | Completed consulting work for a U.S. client and invoiced $18,000 US (US funds). The Canadian equivalent is $25,000 CAD. |

| May 15 | Received $25,000 cash for work done and invoiced in April. |

| May 18 | Hired a new employee who will begin work on May 25. Salary will be $2,500 every two weeks. |

| May 21 | Placed an order request for new shelving for the office. Catalogue price is $2,500. |

| May 27 | Paid employee salaries owing from May 14 to May 27 in the amount of $3,500. |

| May 29 | The bookkeeper was going to be away for two weeks, so the June rent of $5,000 was paid. |

| May 31 | Reimbursed $50 in cash to an employee for use of his personal vehicle for company business on May 20. |

| May 31 | Shelving unit ordered on May 21 was delivered and installed. Total cost was $3,000, including labour. |

Create a table with the following column headings and opening balances. Below the opening balance, number each row from 1 to 18:

| Cash | Accounts | Office | Prepaid | Equipment | Office | Accounts | Note/Loan | Unearned | Share | Retained | |

| receivable | supplies | expenses | furniture | payable | payable | revenue | capital | earnings | |||

| Open | +10,000 | +25,000 | +2,000 | 0 | +25,000 | +15,000 | +35,000 | 0 | 0 | +8,000 | +34,000 |

| Bal | |||||||||||

| 1 | |||||||||||

| 2 | |||||||||||

| 3 | |||||||||||

| 4 | |||||||||||

| 5 | |||||||||||

| 6 | |||||||||||

| 7 | |||||||||||

| 8 | |||||||||||

| 9 | |||||||||||

| 10 | |||||||||||

| 11 | |||||||||||

| 12 | |||||||||||

| 13 | |||||||||||

| 14 | |||||||||||

| 15 | |||||||||||

| 16 | |||||||||||

| 17 | |||||||||||

| 18 | |||||||||||

| Bal |

Using the table as shown in Figure 1.3 of the text, complete the table for the 18 items listed in May and total each column. If any of the items are not to be recorded, leave the row blank.

Click Here to View Solution

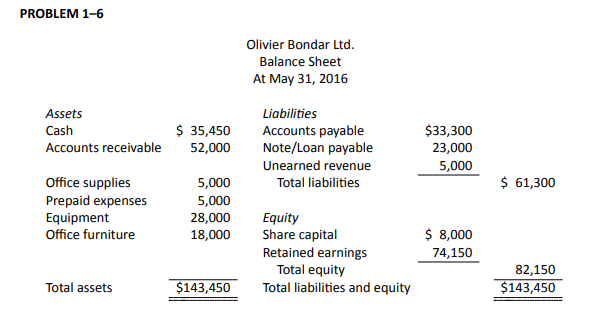

Using the data from the table in PROBLEM 1–5, prepare the balance sheet as at May 31, 2016.

1. Shares are also called stock.

2. It should be noted, however, that at the introductory level, there are no significant differences in how IFRS and ASPE are applied.

3. Business income is added to the owner’s personal income and the owner pays tax on the sum of the two.

4. Business income is added to the owner’s personal income and the owner pays tax on the sum of the two.

5. A corporation can have one or more owners.

Click Here to View Solution