Chapter 9

Liabilities

A corporation often has liabilities. These liabilities must be classified on the balance sheet as current or long-term. Current liabilities can include known liabilities such as payroll liabilities, interest payable, and other accrued liabilities. Short-term notes payable and estimated liabilities, including warranties and income taxes, are also classified as current. Long-term debt is used to finance operations and may include a bond issue or long-term bank loan.

Chapter 9 Learning Objectives

- LO1 – Identify and explain current versus long-term liabilities.

- LO2 – Record and disclose known current liabilities.

- LO3 – Record and disclose estimated current liabilities.

- LO4 – Explain, calculate, and record long-term loans.

Concept Self-Check

Use the following as a self-check while working through Chapter 9.

- What is the difference between a current and long-term liability?

- What are some examples of known current liabilities?

- How are known current liabilities different from estimated current liabilities?

- What are some examples of estimated current liabilities?

- How is an estimated current liability different from a contingent liability?

- How are payments on a loan recorded, and how is a loan payable presented on the balance sheet?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

9.1 Current versus Long-term Liabilities

LO1 – Identify and explain current versus long-term liabilities.

Current or short-term liabilities are a form of debt that is expected to be paid within the longer of one year of the balance sheet date or one operating cycle. Examples include accounts payable, wages or salaries payable, unearned revenues, short-term notes payable, and the current portion of long-term debt.

Long-term liabilities are forms of debt expected to be paid beyond one year of the balance sheet date or the next operating cycle, whichever is longer. Mortgages, long-term bank loans, and bonds payable are examples of long-term liabilities.

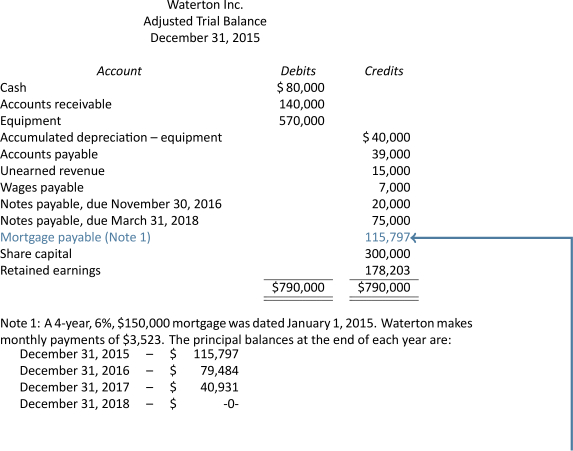

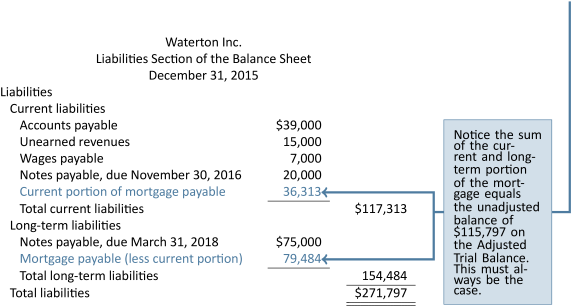

Current and long-term liabilities must be shown separately on the balance sheet. For example, assume the following adjusted trial balance at December 31, 2015 for Waterton Inc.:

Based on this information, the liabilities section of the December 31, 2015 balance sheet would appear as follows:

The $20,000 notes payable, due November 30, 2016 is a current liability because its maturity date is within one year of the balance sheet date, a characteristic of a current liability. The $75,000 notes payable, due March 31, 2018 is a long-term liability since it is to be repaid beyond one year of the balance sheet date.

It is important to classify liabilities correctly otherwise decision-makers may make incorrect conclusions regarding, for example, the organization’s liquidity position.

9.2 Known Current Liabilities

LO2 – Record and disclose known current liabilities.

Known current liabilities are those where the payee, amount, and timing of payment are known. Examples include accounts payable, unearned revenues, and payroll liabilities. These are different from estimated current liabilities where the amount is not known and must be estimated. Estimated current liabilities are discussed later in this chapter.

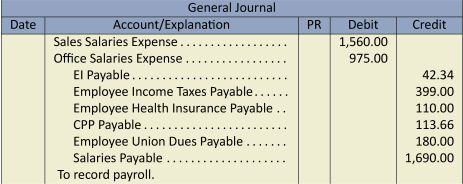

Payroll Liabilities

Accounts payable and unearned revenues were introduced and discussed in previous chapters. Payroll liabilities are amounts owing to employees. Employee income taxes, Canada Pension Plan (CPP, or Quebec Pension Plan in Quebec), Employment Insurance (EI), union dues, health insurance, and other amounts are deducted by the employer from an employee’s salary or wages. These withheld amounts are remitted by the employer to the appropriate agencies. An employee’s gross earnings, less the deductions withheld by the employer, equals the net pay. To demonstrate the journal entries to record a business’s payroll liabilities for its two employees, assume the following payroll record:

| Deductions | Payment | Distribution | ||||||

| Sales | Office | |||||||

| Income | Health | Union | Total | Salaries | Salaries | |||

| EI | Taxes | Ins. | CPP | Dues | Deductions | Net Pay | Expense | Expense |

| 25.84 | 285.00 | 55.00 | 62.16 | 105.00 | 533.00 | 1,027.00 | 1,560.00 | |

| 16.50 | 114.00 | 55.00 | 51.50 | 75.00 | 312.00 | 663.00 | 975.00 | |

| 42.34 | 399.00 | 110.00 | 113.66 | 180.00 | 845.00 | 1,690.00 | 1,560.00 | 975.00 |

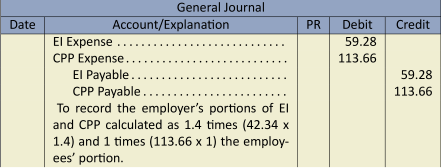

The employer’s journal entries would be:

For EI and CPP, both the employee and employer are responsible for making payments to the government. At the time of writing, the employer’s portion of EI was calculated as 1.4 times the employee’s EI amount. For CPP, the employer is required to pay the same amount as the employee. EI, CPP, and federal/provincial income tax amounts payable are based on rates applied to an employee’s gross earnings. The rates are subject to change each tax year. The actual rates for EI, CPP, and federal/provincial income tax can be viewed online at Canada Revenue Agency’s website: http://www.cra-arc.gc.ca.

Sales Taxes

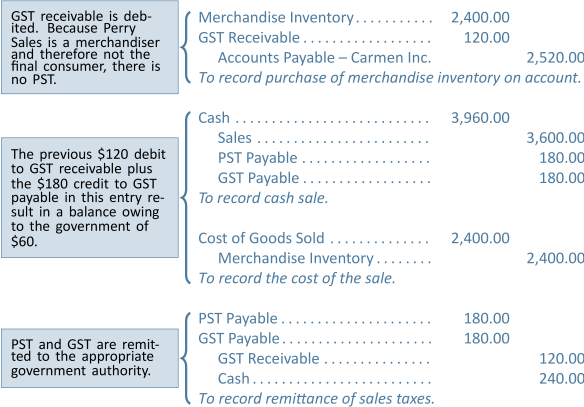

Sales taxes are also classified as known current liabilities. There are two types of sales taxes in Canada: federal Goods and Services Tax (GST) and Provincial Sales Tax (PST). The Goods and Services Tax (GST) is calculated as 5% of the selling price of taxable supplies. For example, if a business is purchasing supplies with a selling price of $1,000, the GST is $50 (calculated as $1,000 x 5%). Taxable supplies are the goods or services on which GST applies. GST is not applied to zero-rated supplies (prescription drugs, groceries, and medical supplies) or exempt supplies (services such as education, health care, and financial). Sellers of taxable supplies are registrants, businesses registered with Canada Revenue Agency that sell taxable supplies and collect GST on behalf of the Receiver General for Canada. The Receiver General for Canada is the federal government body to which all taxes, including federal income tax, are remitted. Registrants also pay GST on the purchase of taxable supplies recording an input tax credit for the GST paid. Total input tax credits, or GST receivable, less GST payable is the amount to be remitted/refunded.

Provincial Sales Tax (PST) is the provincial sales tax paid by the final consumers of products. The PST rate is determined provincially. PST is calculated as a percentage of the selling price. Quebec’s equivalent to PST is called the Quebec Sales Tax (QST).

The Harmonized Sales Tax (HST) is a combination of GST and PST that is used in some Canadian jurisdictions. Figure 9.1 summarizes sales taxes across Canada.

| GST | PST | QST | HST | |

| Alberta | 5% | – | – | – |

| British Columbia | 5% | 7% | – | – |

| Manitoba | 5% | 7% | – | – |

| Northwest Territories | 5% | – | – | – |

| Nunavut | 5% | – | – | – |

| Saskatchewan | 5% | 5% | – | – |

| Yukon | 5% | – | – | – |

| Quebec | 5% | – | 9.975% | – |

| Newfoundland and Labrador | – | – | – | 13% |

| New Brunswick | – | – | – | 13% |

| Nova Scotia | – | – | – | 15% |

| Ontario | – | – | – | 13% |

| Prince Edward Island | – | – | – | 14% |

To demonstrate how sales taxes are recorded, let us review an example. Assume Perry Sales, out of Saskatchewan, purchased $2,400 of merchandise inventory on account from a supplier, Carmen Inc., also in Saskatchewan. Perry Sales then sold this merchandise inventory to a customer for cash of $3,600. Perry Sales’ entries for the purchase, subsequent sale of merchandise, and remittance of sales taxes are:

Short-term Notes Payable

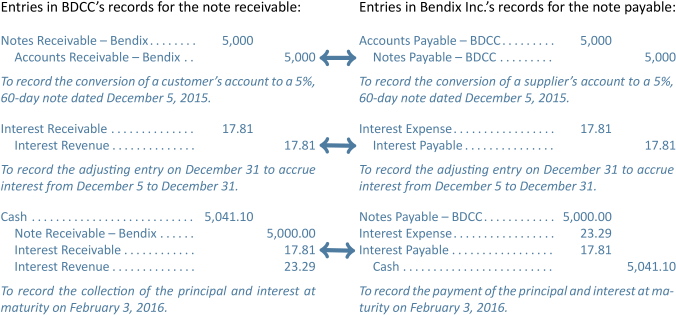

Short-term notes receivable were discussed in Chapter 7. A short-term note payable is identical to a note receivable except that it is a current liability instead of an asset. In Chapter 7, BDCC’s customer Bendix Inc. was unable to pay its $5,000 account within the normal 30-day period. The receivable was converted to a 5%, 60-day note receivable dated December 5, 2015. The following example contrasts the entries recorded by BDCC for the note receivable to the entries recorded by Bendix Inc. for its note payable:

Notice that the dollar amounts in the entries for BDCC are identical to those for Bendix. The difference is that BDCC is recognizing a receivable from Bendix while Bendix is recognizing a payable to BDCC.

9.3 Estimated Current Liabilities

LO3 – Record and disclose estimated current liabilities.

An estimated liability is known to exist where the amount, although uncertain, can be estimated. Two common examples of estimated liabilities are warranties and income taxes.

Warranty Liabilities

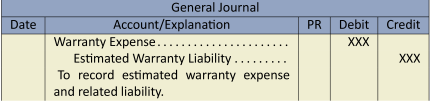

A warranty is an obligation incurred by the seller of a product or service to replace or repair defects. Warranties typically apply for a limited period of time. For example, appliances are often sold with a warranty for a specific time period. The seller does not know which product/service will require warranty work, when it might occur, or the amount. To match the warranty expense to the period in which the revenue was realized, the following entry that estimates the amount of warranty expense and related liability must be recorded:

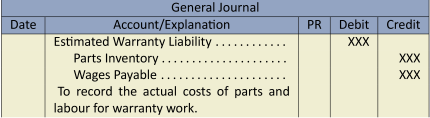

When the warranty work is actually performed, assuming both parts and labour, the following is recorded:

Income Tax Liabilities

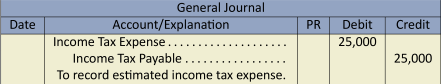

A corporation is taxed on the taxable income it earns. As for any entity, corporations must file a tax return annually. However, the government typically requires the corporation to make advance monthly payments based on an estimated amount. When the total actual amount of income tax is known at the end of the accounting period, the corporation will record an adjustment to reconcile any difference between the total actual tax and the total monthly tax accrued in the accounting records. For example, assume it is estimated that the total income tax for the year ended December 31, 2015 will be $300,000. This translates into $25,000 of income tax to be accrued at the end of each month ($300,000 ![]() 12 months = $25,000/month). Assume further that the government requires payments to be made by the 15th of the following month. The entries at the end of each month from January through to November would be:

12 months = $25,000/month). Assume further that the government requires payments to be made by the 15th of the following month. The entries at the end of each month from January through to November would be:

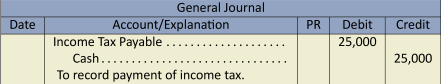

On the 15th of each month beginning February 15th to December 15th, the following entry would be recorded:

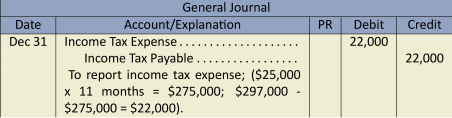

Assume that at the end of December, the corporation’s actual income tax was determined to be $297,000 instead of the originally estimated $300,000. The entry at December 31 would be:

Contingent Liabilities

Recall that an estimated liability is recorded when the liability is probable and the amount can be reliably estimated. A contingent liability exists when one of the following two criteria are satisfied:

- it is not probable or

- it cannot be reliably estimated.

A liability that is determined to be contingent is not recorded, rather it is disclosed in the notes to the financial statements except when there is a remote likelihood of its existence. An example of a contingent liability is a lawsuit where it is probable there will be a loss but the amount cannot be reliably determined. A brief description of the lawsuit must be disclosed in the notes to the financial statements; it would not be recorded until the amount of the loss could be reliably estimated. Great care must be taken with contingencies — if an organization intentionally withholds information, it could cause decision makers, such as investors, to make decisions they would not otherwise have made.

Contingent assets, on the other hand, are not recorded until actually realized. If a contingent asset is probable, it is disclosed in the notes to the financial statements.

9.4 Long-term Liabilities—Loans Payable

LO4 – Explain, calculate, and record long-term loans.

A loan is another form of long-term debt that a corporation can use to finance its operations. Like bonds, loans can be secured, giving the lender the right to specified assets of the corporation if the debt cannot be repaid. For instance a mortgage is a loan secured by specified real estate of the company, usually land with buildings on it.

Unlike a bond, a loan is typically obtained from one lender such as a bank. Also, a loan is repaid in equal blended payments over a period time. These payments contain both interest payments and some repayment of principal. As well, a loan does not give rise to a premium or discount because it is obtained at the market rate of interest in effect at the time.

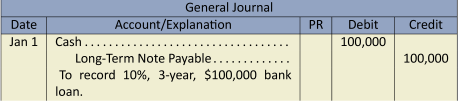

To demonstrate the journal entries related to long-term loans, assume BDCC obtained a three-year, $100,000, 10% loan on January 1, 2015 from First Bank to acquire a piece of equipment. When the loan proceeds are deposited into BDCC’s bank account, the following entry is recorded:

The loan is repayable in three annual blended payments. To calculate the payments, PV analysis is used whereby the following keystrokes are entered into a business calculator:

| PV = 100000 (the cash received from the bank), |

| i = 10 (the interest rate), |

| n = 3 (the term of the loan is three years), and |

| Compute PMT. |

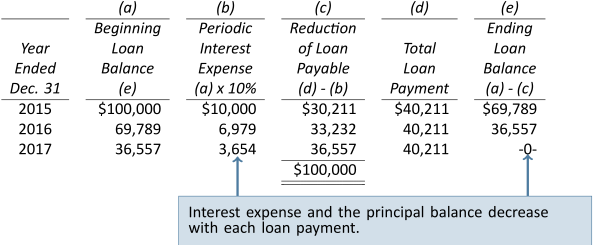

The PMT (or payment) is -40211.48. The result is negative because payments are cash outflows. While the payments remain the same each year, the amount of interest paid decreases and the amount of principal increases. Figure 9.2 illustrates this effect:

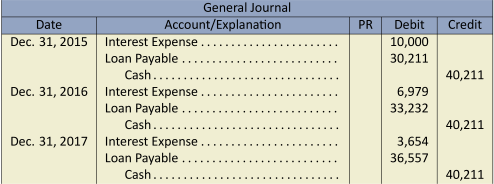

Figure 9.2 can be used to construct the journal entries to record the loan payments at the end of each year:

The amounts in Figure 9.2 can also be used to present the related information on the financial statements of BDCC at each year end. Recall that assets and liabilities need to be classified as current and non-current portions on the balance sheet. Current liabilities are amounts paid within one year of the balance sheet date. That part of the loan payable to First Bank to be paid in the upcoming year needs to be classified as a current liability on the balance sheet. The amount of the total loan outstanding at December 31, 2015, 2016, and 2017 and the current and non-current portions are shown in Figure 9.3:

| A | B | C | D | |||

| Ending loan | ||||||

| Year | balance per | Current portion | (B – C) | |||

| ended Dec. | general ledger | (Fig. 9.2, Col. C) | Long-term | |||

| 31 | (Fig 9.2, Col. E) | portion | ||||

| 2015 | $69,788 | $33,232 | $36,557 | |||

| 2016 | 36,557 | 36,557 | -0- | |||

| 2017 | -0- | -0- | -0- |

Balance sheet presentation would be as follows at the end of 2015, 2016, and 2017:

| 2015 | 2016 | 2017 | |||

| Current liabilities | |||||

|

Current portion of bank loan |

$33,232 | $36,557 | $ | -0- | |

| Long-term liabilities | |||||

|

Bank loan (Note X) |

36,557 | -0- | -0- |

Details of the loan would be disclosed in a note to the financial statements. Only the principal amount of the loan is reported on the balance sheet. The interest expense portion is reported on the income statement as an expense. Because these loan payments are made at BDCC’s year-end, no interest payable is accrued or reported on the balance sheet.

Summary of Chapter 9 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 9. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Identify and explain current versus long-term liabilities.

Current or short-term liabilities are a form of debt that is expected to be paid within the longer of one year of the balance sheet date or one operating cycle. Long-term liabilities are a form of debt that is expected to be paid beyond one year of the balance sheet date or the next operating cycle, whichever is longer. Current and long-term liabilities must be shown separately on the balance sheet.

LO2 – Record and disclose known current liabilities.

Known current liabilities are those where the payee, amount, and timing of payment are known. Payroll liabilities are a type of known current liability. Employers are responsible for withholding from employees amounts including Employment Insurance (EI), Canada Pension Plan (CPP), and income tax, and then remitting the amounts to the appropriate authority. Sales taxes, including the Goods and Services Tax (GST) and Provincial Sales Tax (PST), must be collected by registrants and subsequently remitted to the Receiver General for Canada. Short-term notes payable, also a known current liability, can involve the accrual of interest if the maturity date falls in the next accounting period.

LO3 – Record and disclose estimated current liabilities.

An estimated liability is known to exist where the amount, although uncertain, can be estimated. Warranties and income taxes are examples of estimated liabilities. Contingent liabilities are neither a known liability nor an estimated liability and are not recorded if they are determined to exist. A contingent liability exists when it is not probable or it cannot be realiably estimated. A contingent liability is disclosed in the notes to the financial statements.

LO4 – Explain, calculate, and record long-term loans.

A loan is a form of long-term debt that can be used by a corporation to finance its operations. Loans can be secured and are typically obtained from a bank. Loans are often repaid in equal blended payments containing both interest and principal.

Discussion Questions

After reading through Chapter 9, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

- What is the difference between a current and long-term liability?

- What are some examples of known current liabilities?

- How are known current liabilities different from estimated current liabilities?

- What are some examples of estimated current liabilities?

- How is an estimated current liability different from a contingent liability?

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

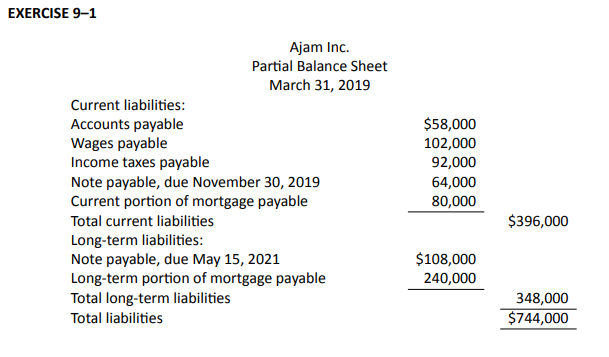

Ajam Inc. shows the following selected adjusted account balances at March 31, 2019:

| Accounts Payable | $

58,000 |

| Wages Payable | 102,000 |

| Accumulated Depreciation – Machinery | 69,000 |

| Income Taxes Payable | 92,000 |

| Note Payable, due May 15, 2021 | 108,000 |

| Note Payable, due November 30, 2019 | 64,000 |

| Mortgage Payable | 320,000 |

| Accounts Receivable | 71,000 |

Note: $240,000 of the mortgage payable balance is due one year beyond the balance sheet date; the remainder will be paid within the next 12 months.

Prepare the liability section of Ajam’s March 31, 2019 balance sheet.

Click Here to View Solution

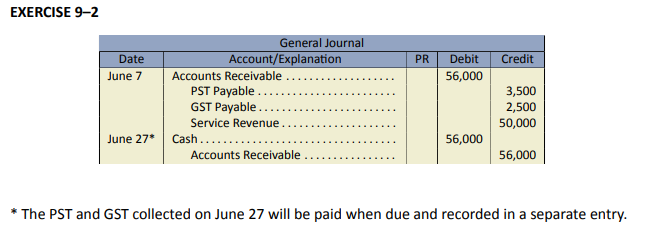

On June 7, 2019, Dilby Mechanical Corp. completed $50,000 of servicing work for a client and billed them for that amount plus GST of $2,500 and PST of $3,500; terms are n20.

- Prepare the journal entry as it would appear in Dilby’s accounting records.

- Assume the receivable established on June 7 was collected on June 27. Record the entry.

Click Here to View Solution

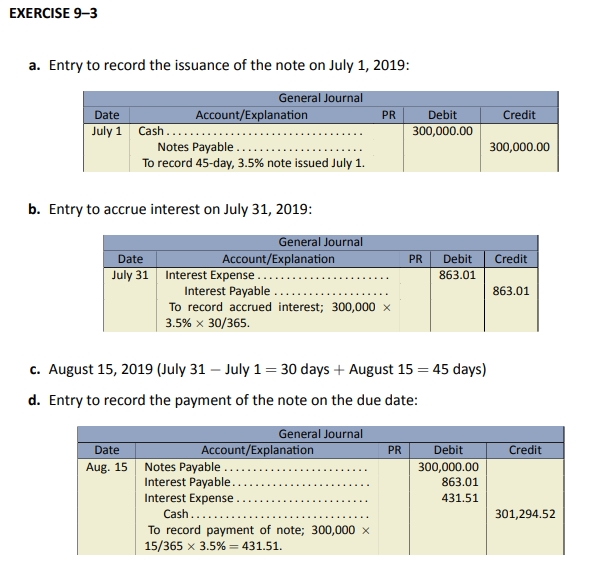

Libra Company borrowed $300,000 by signing a 3.5%, 45-day note payable on July 1, 2019. Libra’s year-end is July 31. Round all calculations to two decimal places.

- Prepare the entry to record the issuance of the note on July 1, 2019.

- Prepare the entry to accrue interest on July 31, 2019.

- On what date will this note mature?

- Prepare the entry to record the payment of the note on the due date.

Click Here to View Solution

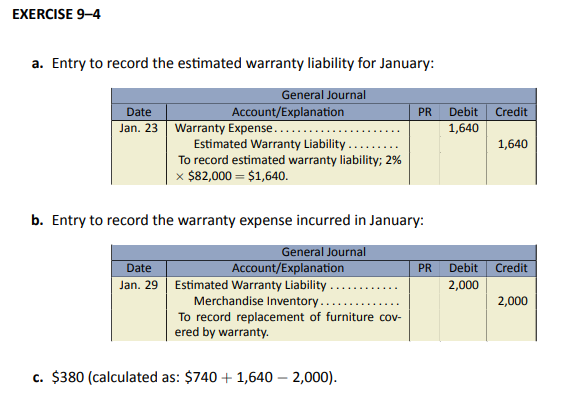

On January 23, 2019, Zenox Company sold $105,000 of furniture on account that had a cost of $82,000. All of Zenox’s sales are covered by an unconditional 24-month replacement warranty. Historical data indicates that warranty costs average 2% of the cost of sales. On January 29, 2019, Zenox replaced furniture with a cost of $2,000 that was covered by warranty.

- Prepare the journal entry to record the estimated warranty liability for January.

- Prepare the entry to record the warranty expense incurred in January.

- Assuming the Estimated Warranty Liability account had a credit balance of $740 on January 1, 2019, calculate the balance at January 31, 2019 after the entries above were posted.

Click Here to View Solution

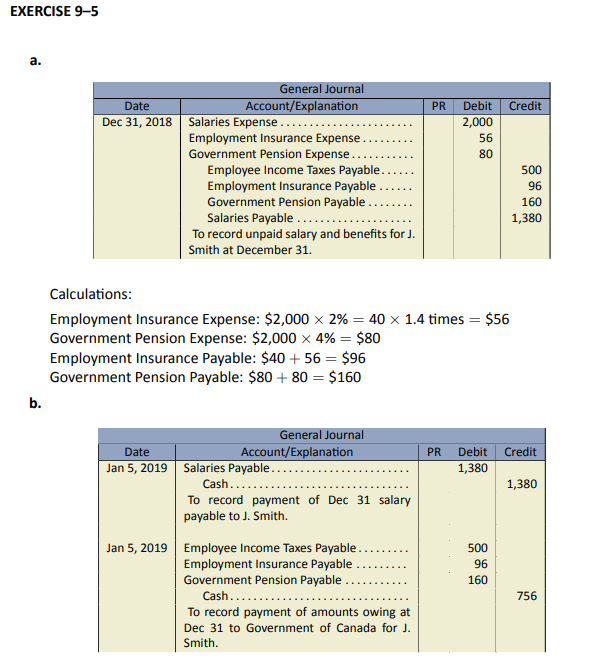

An extract from the trial balance of Paragon Corporation at December 31, 2018 is reproduced below:

| Amount in | Amount in | ||

| unadjusted | adjusted | ||

| trial balance | trial balance | ||

| a. | Salaries expense (J. Smith) | $50,000 | $52,000 |

| b. | Employee income taxes payable | -0- | 500 |

| c. | Employment insurance payable | 1,000 | 96 |

| d. | Government pension payable | -0- | 160 |

Additional Information: Employees pay 2% of their gross salaries to the government employment insurance plan and 4% of gross salaries to the government pension plan. The company matches employees’ government pension contributions 1 to 1, and employment insurance contributions 1.4 to 1.

- Prepare the adjusting entry that was posted, including a plausible description.

- Prepare the journal entries to record the payments on January 5, 2019 to employee J. Smith and the Government of Canada.

Click Here to View Solution

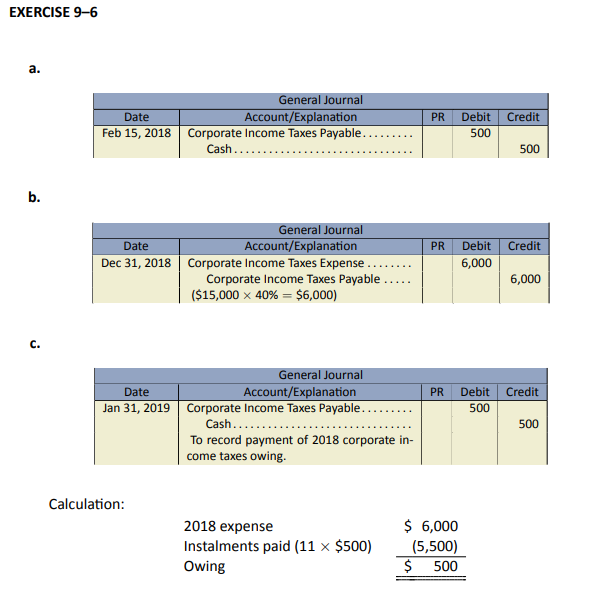

Paul’s Roofing Corporation paid monthly corporate income tax instalments of $500 commencing February 15, 2018. The company’s income before income taxes for the year ended December 31, 2018 was $15,000. The corporate income tax rate is 40%. Paul’s Roofing paid the 2018 corporate income taxes owing on January 31, 2019.

- Record the February 15, 2018 payment.

- Record the 2018 corporate income tax expense.

- Record the January 31, 2019 payment.

Click Here to View Solution

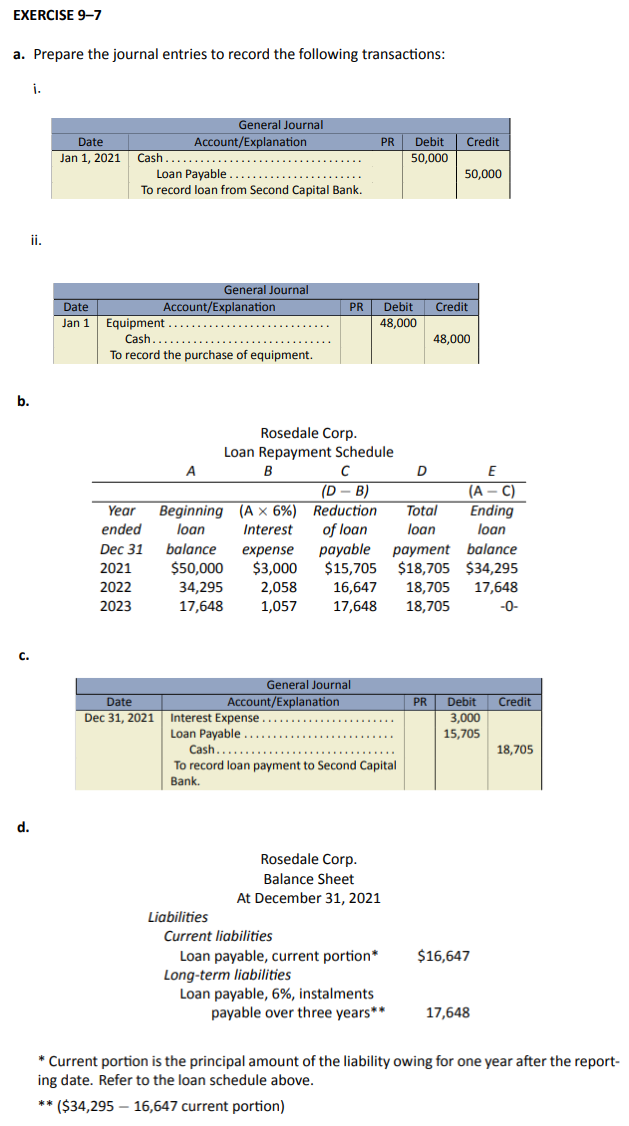

Rosedale Corp. obtained a $50,000 loan from Second Capital Bank on January 1, 2019. It purchased a piece of heavy equipment for $48,000 on the same day. The loan bears interest at 6% per year on the unpaid balance and is repayable in three annual blended payments of $18,705 on December 31 each year.

- Prepare the journal entries to record the following transactions:

- Receipt of loan proceeds from the bank.

- Purchase of the equipment.

- Prepare the loan repayment schedule.

- Prepare the journal entry to record the first loan payment.

- Prepare the liabilities section of the balance sheet.

Click Here to View Solution