Chapter 8

Property, Plant, and Equipment

Long-lived assets or property, plant, and equipment (PPE) assets are used in the normal operating activities of the business and are expected to provide benefits for a period in excess of one year. Long-lived assets covered in this chapter consist of three types: property, plant, and equipment (PPE), intangible assets, and goodwill. Also discussed are depreciation and amortization, techniques to allocate the cost of most long-lived assets over their estimated useful lives.

Chapter 8 Learning Objectives

- LO1 – Describe how the cost of property, plant, and equipment (PPE) is determined, and calculate PPE.

- LO2 – Explain, calculate, and record depreciation using the units-of-production, straight-line, and double-declining balance methods.

- LO3 – Explain, calculate, and record depreciation for partial years.

- LO4 – Explain, calculate, and record revised depreciation for subsequent capital expenditures.

- LO5 – Explain, calculate, and record the impairment of long-lived assets.

- LO6 – Account for the derecognition of PPE assets.

- LO7 – Explain and record the acquisition and amortization of intangible assets.

- LO8 – Explain goodwill and identify where on the balance sheet it is reported.

- LO9 – Describe the disclosure requirements for long-lived assets in the notes to the financial statements.

Concept Self-Check

Use the following as a self-check while working through Chapter 8.

- What is the distinction between capital expenditures and revenue expenditures?

- How do generally accepted accounting principles prescribe what amount should be capitalized?

- How is partial period depreciation recorded?

- What is the formula for calculating revised depreciation?

- What is the difference between a tangible and intangible long-lived asset?

- What different methods can be used to calculate depreciation for property, plant, and equipment?

- How are disposals of property, plant, and equipment recorded in the accounting records?

- How is the impairment of a long-lived asset accounted for?

- How are intangible assets amortized?

- What is goodwill and what is its accounting treatment?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

8.1 Establishing the Cost of Property, Plant, and Equipment (PPE)

LO1 – Describe how the cost of property, plant, and equipment (PPE) is determined, and calculate PPE.

Property, plant, and equipment (PPE) are tangible long-lived assets that are acquired for the purpose of generating revenue either directly or indirectly. They are held for use in the production or supply of goods and services, have been acquired for use on a continuing basis, and are not intended for sale in the ordinary course of business. Because PPE assets are long-lived or have a life greater than one year, they are non-current in nature, also known as long-term assets. Examples of PPE assets include land, office and manufacturing buildings, production machinery, trucks, ships or aircraft used to deliver goods or transport passengers, salespersons’ automobiles owned by a company, or a farmer’s production machinery like tractors and field equipment. PPE assets are tangible assets because they can be physically touched. There are other types of non-current assets that are intangible – existing only as legal concepts – like copyrights and patents. These will be discussed later in this chapter.

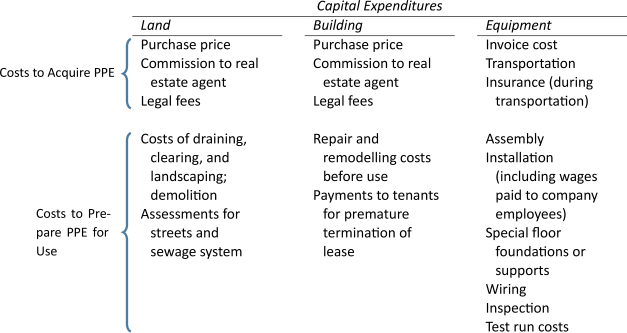

Capital Expenditures

Any cash disbursement is referred to as an expenditure. A capital expenditure results in the acquisition of a non-current asset, including any additional costs involved in preparing the asset for its intended use. Examples of various costs that may be incurred to prepare PPE for use are listed below:

To demonstrate, assume that equipment is purchased for $20,000. Additional costs include transportation costs $500, installation costs $1,000, construction costs for a cement foundation $2,500, and test run(s) costs to debug the equipment $2,000. The total capitalized cost of the asset to put it into use is $26,000.

Determining whether an outlay is a capital expenditure or a revenue expenditure is a matter of judgment. A revenue expenditure does not have a future benefit beyond one year. The concept of materiality enters into the distinction between capital and revenue expenditures. As a matter of expediency, an expenditure of $20 that has all the characteristics of a capital expenditure would probably be expensed rather than capitalized, because the time and effort required by accounting staff to capitalize and then depreciate the item over its estimated useful life is so much greater than the benefits derived from doing so. Capitalization policies are established by many companies to resolve the problem of distinguishing between capital and revenue expenditures. For example, one company’s capitalization policy may state that all capital expenditures equal to or greater than $1,000 will capitalized, while all capital expenditures under $1,000 will be expensed when incurred. Another company may have a capitalization policy limit of $500. Additionally, a company may have a different capitalization policy for different types of plant and equipment assets – hand tools may have a capitalization policy limit of $200 while the limit might be $1,000 for furniture.

Not all asset-related expenditures incurred after the purchase of an asset are capitalized. An expenditure made to maintain PPE in satisfactory working order is a revenue expenditure and recorded as a debit to an expense account. Examples of these expenditures include: (a) the cost of replacing small parts of an asset that normally wear out (in the case of a truck, for example: new tires, new muffler, new battery); (b) continuing expenditures for maintaining the asset in good working order (for example, oil changes, antifreeze, transmission fluid changes); and (c) costs of renewing structural parts of an asset (for example, repairs of collision damage, repair or replacement of rusted parts).

Although some expenditures for repair and maintenance may benefit more than one accounting period, they may not be material in amount or they may have uncertain future benefits. They are therefore treated as expenses. These three criteria must all be met for an expenditure to be considered capital in nature.

- Will it benefit more than one accounting period?

- Will it enhance the service potential of the asset, or make it more valuable or more adaptable?

- Is the dollar amount material?

Regardless of when an expenditure is incurred, if it meets the three criteria above it will always be a capital expenditure and debited to the appropriate asset account. If the expenditure does not meet all three criteria, then it is a revenue expenditure and is expensed.

Land

The purchase of land is a capital expenditure when land is used in the operation of a business. In addition to the costs listed in the schedule above, the cost of land should be increased by the cost of removing any unwanted structures on it. This cost is reduced by the proceeds, if any, obtained from the sale of the scrap. For example, assume that the purchase price of land is $100,000 before an additional $15,000 cost to raze an old building: $1,000 is expected to be received for salvaged materials. The cost of the land is $114,000 ($100,000 + $15,000 – $1,000).

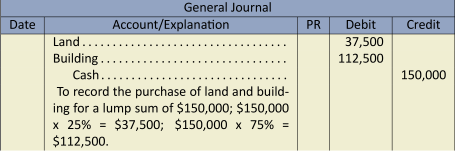

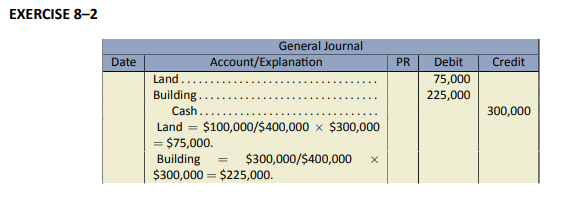

Frequently, land and useful buildings are purchased for a lump sum. That is, one price is negotiated for their entire purchase. A lump sum purchase price must be apportioned between the PPE assets acquired on the basis of their respective market values, perhaps established by a municipal assessment or a professional land appraiser. Assume that a lump sum of $150,000 cash is paid for land and a building, and that the land is appraised at 25% of the total purchase price. The Land account would be debited for $37,500 ($150,000 x 25%) and the Building account would be debited for the remaining 75% or $112,500 ($150,000 x 75% = $112,500 or $150,000 – $37,500 = $112,500) as shown in the following journal entry:

Building and Equipment

When a capital asset is purchased, its cost includes the purchase price plus all costs to prepare the asset for its intended use. However, a company may construct its own building or equipment. In the case of a building, for example, costs include those incurred for excavation, building permits, insurance and property taxes during construction, engineering fees, the cost of labour incurred by having company employees supervise and work on the construction of the building, and the cost of any interest incurred to finance the construction during the construction period.

Property, Plant, and Equipment (PPE) Subsidiary Ledger

The accounts receivable and accounts payable subsidiary ledgers (more commonly referred to as subledgers) were introduced in Chapter 5 and the merchandise inventory subledger was introduced in Chapter 6. To review, a subledger lists individual accounts that fall under a common account, also known as the controlling account. For example, the accounts receivable controlling account for ABC Inc. shows a balance of $4,000 on the December 31, 2015 balance sheet. The accounts receivable subledger shows that the $4,000 is made up of three receivables: $800 for Ducker Inc.; $2,200 for Zest Inc.; and $1,000 for Frank Corporation. Since the controlling account is a summary of the subledger, their balances must be identical. Subledgers allow details to be maintained in a separate record.

In a PPE subledger, an account would exist for each piece of land, each piece of machinery, each vehicle, and so on. The subledger account would include information regarding the date of purchase, cost, residual value, estimated useful life, depreciation, and other relevant information.

Learning Activity 8.1 – Establishing the Cost of PPE

This Learning Activity gives you an opportunity to practice identifying the accounts being adjusted for PPE costs.

Instructions: For each transaction below, indicate the account being adjusted. Assume all expenditures are material in amount.

8.2 Depreciation

LO2 – Explain, calculate, and record depreciation using the units-of-production, straight-line, and double-declining balance methods.

The role of depreciation is to allocate the cost of a PPE asset (except land) over the accounting periods expected to receive benefits from its use. Depreciation begins when the asset is in the location and condition necessary for it to be put to use. Depreciation continues even if the asset becomes idle or is retired from use, unless it is fully depreciated. Land is not depreciated, as it is assumed to have an unlimited life.

Depreciation is an application of the matching principle.

According to generally accepted accounting principles, a company should select a method of depreciation that represents the way in which the asset’s future economic benefits are estimated to be used up.

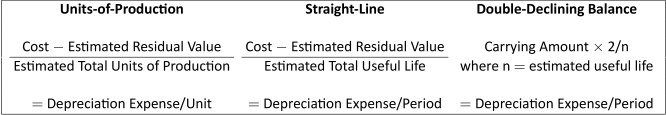

There are many different ways to calculate depreciation. The most frequently used methods are usage-based and time-based. Regardless of depreciation method, there are three factors necessary to calculate depreciation:

- cost of the asset

- residual value

- estimated useful life or productive output.

Residual value is the estimated worth of the asset at the end of its estimated useful life.

Useful life is the length of time that a long-lived asset is estimated to be of benefit to the current owner. This is not necessarily the same as the asset’s economic life. If a company has a policy of replacing its delivery truck every two years, its useful life is two years even though it may be used by the next owner for several more years.

Productive output is the amount of goods or services expected to be provided. For example, it may be measured in units of output, hours used, or kilometres driven.

Usage-Based Depreciation Method – Units-of-Production

Usage-based depreciation methods, such as the Units-of-Production Method, are used when the output of an asset varies from period to period.

Usage methods assume that the asset will contribute to the earning of revenues in relation to the amount of output during the accounting period. Therefore, the depreciation expense will vary from year to year.

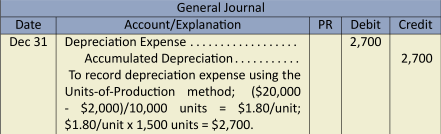

To demonstrate, assume that Big Dog Carworks Corp. purchased a $20,000 piece of equipment on January 1, 2015 with a $2,000 residual value and estimated productive life of 10,000 units. If 1,500 units were produced during 2015, the depreciation expense for the year ended December 31, 2015 would be calculated using the following formula:

The following adjusting entry would be made on December 31, 2015:

The carrying amount or net book value of the asset (cost less accumulated depreciation) on the December 31, 2015 balance sheet would be $17,300 ($20,000 – 2,700).

Note that the residual value is only used to calculate depreciation expense. It is not recorded in the accounts of the company or included as part of the carrying amount (net book value) on the balance sheet.

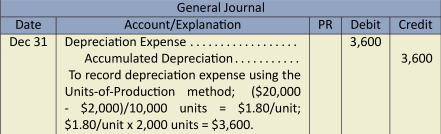

If 2,000 units were produced during 2016, depreciation expense for that year would be $3,600 ($1.80 per unit ![]() 2,000 units). At December 31, 2016, the following adjusting entry would be recorded:

2,000 units). At December 31, 2016, the following adjusting entry would be recorded:

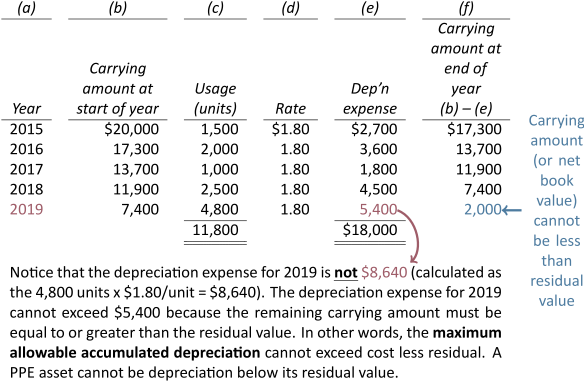

The carrying amount (or net book value) at December 31, 2016 would be $13,700 ($20,000 – 2,700 – 3,600). If the equipment produces 1,000 units in 2017, 2,500 units in 2018, and 3,000 units in 2019, depreciation expense and carrying amounts would be as follows each year:

| (a) | (b) | (c) | (d) | (e) | (f) | |||||

| Carrying | ||||||||||

| amount at | ||||||||||

| Carrying | end of | |||||||||

| amount at | Usage | Dep’n | year | |||||||

| Year | start of year | (units) | Rate | expense | (b) – (e) | |||||

| 2015 | $20,000 | 1,500 | $1.80 | $2,700 | $17,300 | |||||

| 2016 | 17,300 | 2,000 | 1.80 | 3,600 | 13,700 | |||||

| 2017 | 13,700 | 1,000 | 1.80 | 1,800 | 11,900 | |||||

| 2018 | 11,900 | 2,500 | 1.80 | 4,500 | 7,400 | |||||

| 2019 | 7,400 | 3,000 | 1.80 | 5,400 | 2,000 | |||||

| 10,000 | $18,000 |

If the equipment produces exactly 10,000 units over its useful life and is then retired, depreciation expense over all years will total $18,000 (10,000 ![]() $1.80) and the carrying amount will equal residual value of $2,000.

$1.80) and the carrying amount will equal residual value of $2,000.

It is unlikely that the equipment will produce exactly 10,000 units over its useful life. Assume instead that 4,800 units were produced in 2019. Depreciation expense and carrying amounts would be as follows each year:

Time-Based Depreciation Method – Straight-Line

The straight-line method of depreciation – introduced in Chapter 3 – assumes that the asset will contribute to the earning of revenues equally each time period. Therefore, equal amounts of depreciation are recorded during each year of the asset’s useful life. Straight-line depreciation is based on time – the asset’s estimated useful life.

Straight-line depreciation is calculated as:

To demonstrate, assume the same $20,000 piece of equipment used earlier, with an estimated useful life of five years and an estimated residual value of $2,000. Straight-line depreciation would be $3,600 per year calculated as:

Over the five-year useful life of the equipment, depreciation expense and carrying amounts will be as follows:

| (a) | (b) | (c) | (d) | |||

| Carrying | ||||||

| amount at | ||||||

| Carrying | end of | |||||

| amount at | Dep’n | year | ||||

| Year | start of year | expense | (b) – (c) | |||

| 2015 | $20,000 | $3,600 | $16,400 | |||

| 2016 | 16,400 | 3,600 | 12,800 | |||

| 2017 | 12,800 | 3,600 | 9,200 | |||

| 2018 | 9,200 | 3,600 | 5,600 | |||

| 2019 | 5,600 | 3,600 | 2,000 | |||

| $18,000 |

The carrying amount at December 31, 2019 will be the residual value of $2,000 ($20,000 – 18,000).

Under the straight-line method, depreciation expense for each accounting period remains the same dollar amount over the useful life of the asset.

Accelerated Time-Based Depreciation Method – Double-Declining Balance (DDB)

An accelerated depreciation method assumes that a plant and equipment asset will contribute more to the earning of revenues in the earlier stages of its useful life than in the later stages. This means that more depreciation is recorded in earlier years with the depreciation expense decreasing each year. This approach is most appropriate where assets experience a high degree of obsolescence (such as computers) or where the value of the asset is highest in the first year when it is new and efficient and declines significantly each year as it is used and becomes worn (such as equipment).

Under an accelerated depreciation method, depreciation expense decreases each year over the useful life of the asset.

One type of accelerated depreciation is the double-declining balance (DDB) method. It is calculated as:

where n = estimated useful life. 2/n is the rate of depreciation and it remains constant over the asset’s estimated useful life (unless there is a change in the useful life which is discussed in a later section of this chapter). The DDB rate of depreciation can also be described as twice the straight-line rate. For example, if the straight-line rate of depreciation is 15%, the DDB rate will be 30% (calculated as 2 ![]() 15%).

15%).

To demonstrate DDB depreciation calculations, assume the same $20,000 equipment with an estimated useful life of five years. The DDB rate of depreciation is calculated as ![]() =

= ![]() = 0.40 or 40%. Alternatively, given that we know the straight-line rate is 20%, doubling it is 40%.

= 0.40 or 40%. Alternatively, given that we know the straight-line rate is 20%, doubling it is 40%.

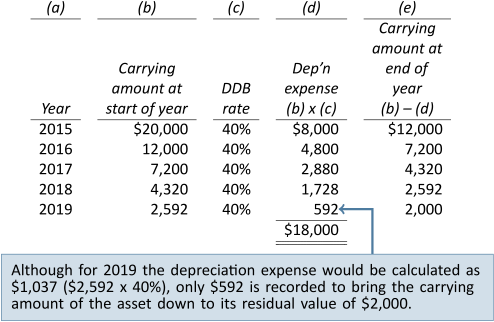

The declining balance rate is applied to the carrying amount of the asset without regard to residual value. Regardless of which depreciation method is used, remember that the asset cannot be depreciated below its carrying amount (or net book value) which in this case is $2,000. The DDB depreciation for the five years of the asset’s useful life follows:

At the end of five years, the carrying amount is once again equal to the residual value of $2,000.

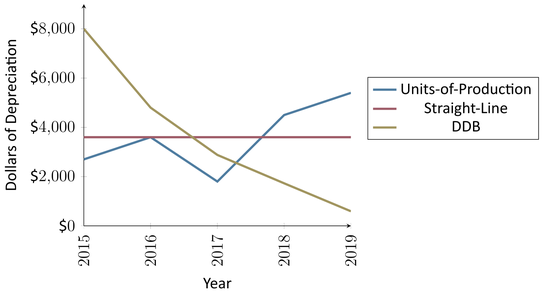

A comparison of the three depreciation methods is shown in Figure 8.1:

Learning Activity 8.2 – Depreciation

This Learning Activity gives you an opportunity to practice applying what you have learned about depreciation.

Instructions: Read the information provided and choose the correct answer.

8.3 Partial Year Depreciation

LO3 – Explain, calculate, and record depreciation for partial years.

Assets may be purchased or sold at any time during a fiscal year. Should depreciation be calculated for a whole year in such a case? The answer depends on corporate accounting policy. There are many alternatives. One is to calculate depreciation to the nearest whole month. Another, often called the half-year rule, records half a year’s depreciation regardless of when an asset purchase or disposal occurs during the year.

To demonstrate the half-year approach to calculating depreciation for partial periods, assume again that Big Dog Carworks Corp. purchases equipment for $20,000 with an estimated useful life of five years and a residual value of $2,000. Recall that depreciation expense for 2015 was $3,600 using the straight-line method. Because of the half-year rule, depreciation expense for 2015 would be $1,800 ($3,600 x .5) even though the asset was purchased on the first day of the fiscal year. Using the double-declining balance method, depreciation expense for 2015 under the half-year rule would be $4,000 ($8,000 ![]() .5). Applying the half-year rule to the units-of-production depreciation for 2015, would result in no change because the method is usage-based and not time-based (presumably usage would be less if the asset is purchased partway through the year, so this depreciation method already takes this into account).

.5). Applying the half-year rule to the units-of-production depreciation for 2015, would result in no change because the method is usage-based and not time-based (presumably usage would be less if the asset is purchased partway through the year, so this depreciation method already takes this into account).

8.4 Revising Depreciation

LO4 – Explain, calculate, and record revised depreciation for subsequent capital expenditures.

Both the useful life and residual value of a depreciable asset are estimated at the time it is purchased. As time goes by, these estimates may change for a variety of reasons. In these cases, the depreciation expense is recalculated from the date of the change in the accounting estimate and applied going forward. No change is made to depreciation expense already recorded.

Consider the example of the equipment purchased for $20,000 on January 1, 2015, with an estimated useful life of five years and residual value of $2,000. If the straight-line depreciation method is used, the yearly depreciation expense is $3,600. After two years, the carrying amount at the end of 2016 is $12,800 ($20,000 – 3,600 – 3,600). Assume that on January 1, 2017, management estimates the remaining useful life of the equipment to be six years, and the residual value to be $5,000.

Depreciation expense for the remaining six years would be calculated as:

Subsequent Capital Expenditures

As noted earlier, normal, recurring expenditures that relate to day-to-day servicing of depreciable assets are not capitalized, but rather are expensed when incurred. Oil changes and new tires for vehicles are examples of recurring expenditures that are expensed. Expenditures that are material, can be reliably measured, and enhance the future economic benefit provided by the asset, are added to the cost of the asset rather than being expensed when incurred. A subsequent capital expenditure can take one of two forms:

- Addition (e.g., adding a garage to the back of an existing building or adding a skywalk in a factory)

- Replacement (e.g., replacing the refrigeration unit in a long-haul truck or replacing the windows in a building).

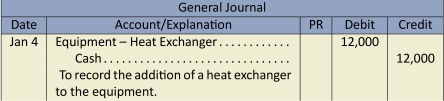

To demonstrate the accounting for an addition, recall our original example where equipment was purchased on January 1, 2015 for $20,000; the estimated useful life and residual value were five years and $2,000, respectively. Assume that on January 4, 2016, a heat exchanger was added to the equipment that allowed it to produce a new product in addition to the existing product line. This $12,000 addition, paid in cash, had an estimated life of ten years with no residual value. The useful life and residual value of the original equipment did not change as a result of the addition. The entry to record the addition on January 4 is:

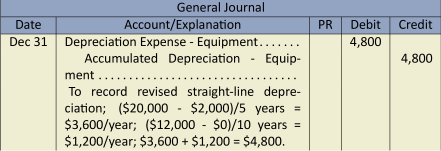

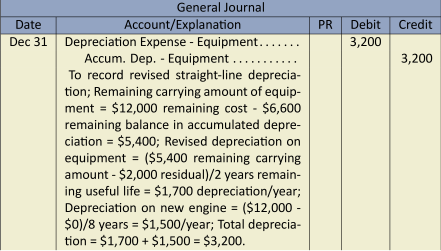

The entry to record revised depreciation on December 31, 2016 is:

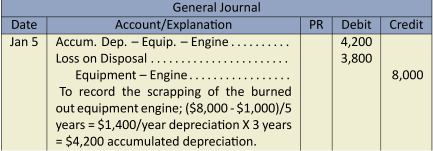

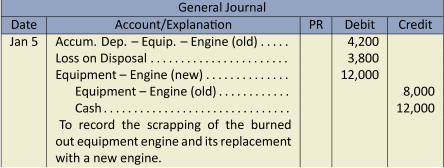

The accounting for a replacement is more involved. The cost of the replaced item and its related accumulated depreciation must be removed from the accounting records when the replacement is capitalized recording any resulting gain or loss as well as calculating revised depreciation. Let’s demonstrate, again using the $20,000 equipment purchased on January 1, 2015 with a five-year life and $2,000 residual value. Assume that on January 5, 2018 the engine in the equipment burned out and needed to be replaced. The PPE subledger showed that the engine had an original cost of $8,000, useful life of five years, and residual value of $1,000 resulting in a carrying amount as at January 5, 2018 of $3,800 ($8,000 cost – $4,200 accumulated depreciation). The entry to dispose of the old engine and remove it from the accounting records is (the old engine was scrapped and not sold because it was burned out):

Notice in the entry above that the cost of the old engine and the accumulated depreciation must be individually removed from the accounting records. Since the asset is not completely depreciated and was scrapped, the $3,800 carrying amount represents a loss. If the engine had been sold, the gain or loss would have been calculated as the difference between its carrying value and the cash proceeds. Losses (as well as gains) are reported on the income statement under Other Revenues and Expenses. A common error made by students is to debit loss on disposal and credit equipment–engine for the carrying amount; this is incorrect. After posting the entry to dispose of the old engine, the account balances in the Equipment account and its related Accumulated Depreciation account would be as follows.

| Equipment | Accumulated Depreciation – Equipment | |||||||

| Jan. 1, 2015 | 20,000 | 8,000 | Jan. 5, 2018 | 3,600 | Dec. 31, 2015 | |||

| 3,600 | Dec. 31, 2016 | |||||||

| 3,600 | Dec. 31, 2017 | |||||||

| Jan. 5, 2018 | 4,200 | |||||||

| Balance | 12,000 | 6,600 | Balance | |||||

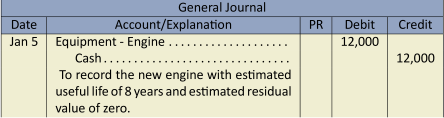

The entry to record the new engine purchased for $12,000 cash (estimated life 8 years; estimated zero residual value) is:

Alternatively, the entries to dispose of the old engine and record the addition of the new engine can be combined into one compound entry as follows:

Assuming the useful life and residual value of the equipment did not change and the new engine had an estimated useful life of eight years and an estimated residual value of zero, the entry to record revised depreciation on December 31, 2018 is:

The previous example emphasizes the importance of maintaining a PPE subledger in order to apply the concept of componentization. Componentization requires each major component that has a different estimated useful life than the rest of an asset to be recorded and depreciated separately. For instance, assume a commercial airliner is purchased for $100 million ($100M) on January 1, 2015 with the following components: airframe, engines, landing gear, interior, and other parts. Original cost, estimated residual value, estimated useful lives, depreciation method to be used, serial numbers where applicable, and other relevant information are recorded in the PPE subledger.

8.5 Impairment of Long-lived Assets

LO5 – Explain, calculate, and record the impairment of long-lived assets.

Under generally accepted accounting principles, management must compare the recoverable amount of a long-lived asset with its carrying amount (cost less accumulated depreciation) at the end of each reporting period. The recoverable amount is the fair value of the asset at the time less any estimated costs to sell it. If the recoverable amount is lower than the carrying amount, an impairment loss must be recorded.

An impairment loss may occur because of a variety of reasons such as technological obsolescence, an economic downturn, or a physical disaster. When an impairment is recorded, subsequent years’ depreciation expense must also be revised.

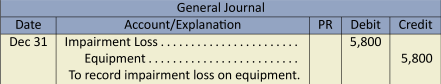

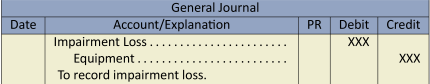

Recall again our $20,000 equipment purchased January 1, 2015 with an estimated useful life of five years and a residual value of $2,000. Assume straight-line depreciation has been recorded for 2015 and 2016 at $3,600 per year. At December 31, 2016, the carrying amount of the equipment is $12,800 ($20,000 – 3,600 – 3,600). At that point management determines that new equipment with equivalent capabilities can be purchased for much less than the old equipment due to technological changes. As a result, the recoverable value of the original equipment at December 31, 2016 is estimated to be $7,000. Because the recoverable amount is less than its carrying amount of $12,800, an impairment loss of $5,800 ($12,800 – 7,000) is recorded in the accounting records of BDCC as follows:

This reduces the carrying amount of the equipment to $7,000 so that revised depreciation expense of $1,667 per year would be recorded at the end of 2017, 2018, and 2019, calculated as follows (assume no change to original useful life and residual value):

Impairment losses can be reversed in subsequent years if the recoverable amount of the asset exceeds the carrying amount. Also, if the fair value of a PPE asset can be reliably measured, it can be revalued to more than its original cost. However, the revaluation process needs to be conducted thereafter on a regular basis. These topics are not dealt with here, as they are beyond the scope of introductory financial accounting.

8.6 Derecognition of Property, Plant, and Equipment

LO6 – Account for the derecognition of PPE assets.

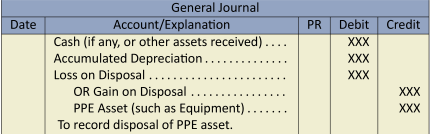

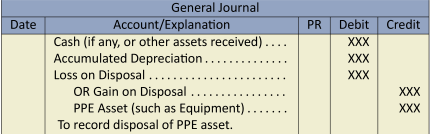

Property, Plant, and Equipment is derecognized (that is, the cost and any related accumulated depreciation are removed from the accounting records) when it is sold or when no future economic benefit is expected. To account for the disposal of a PPE asset, the following must occur:

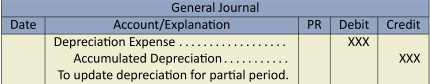

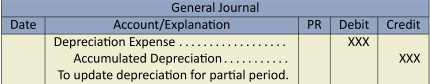

- If the disposal occurs part way through the accounting period, depreciation must be updated to the date of disposal by:

- Record the disposal including any resulting gain or loss by

A loss results when the carrying amount of the asset is greater than the proceeds received, if any. A gain results when the carrying amount is less than any proceeds received.

Sale or Retirement of PPE

When a PPE asset has reached the end of its useful life it can be either sold or retired. In either case, the asset’s cost and accumulated depreciation must be removed from the records, after depreciation expense has been recorded up to the date of disposal or retirement.

Recall the calculation of straight-line depreciation for the equipment purchased for $20,000 with an estimated useful life of five years and a residual value of $2,000. Assume that the general ledger T-accounts of equipment and accumulated depreciation contain the following entries for the last five years:

| Accumulated Depreciation | ||||||||

| Equipment | Equipment | |||||||

| 2015 | 20,000 | 2015 | 3,600 | |||||

| 2016 | 3,600 | |||||||

| 2017 | 3,600 | |||||||

| 2018 | 3,600 | |||||||

| 2019 | 3,600 | |||||||

| 18,000 | ||||||||

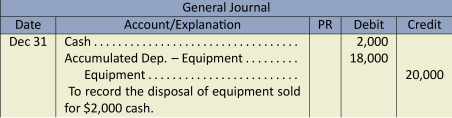

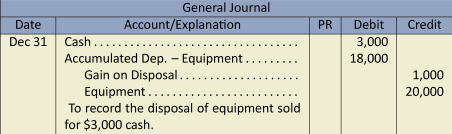

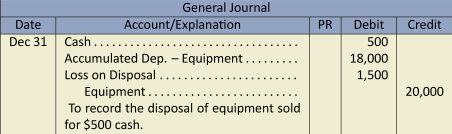

Assume that the equipment is sold at the end of 2019, when accumulated depreciation totals $18,000. The carrying amount at this date is $2,000 ($20,000 cost – $18,000 accumulated depreciation). Three different situations are possible.

- Sale at carrying amountAssume the equipment is sold for its residual value of $2,000. No gain or loss on disposal would occur.

Cost $ 20,000 Accumulated depreciation (18,000) Carrying amount 2,000 Proceeds of disposition (2,000) Gain on disposal $ -0-

- Sale above carrying amountAssume the equipment is sold for $3,000. A gain of $1,000 would occur.

Cost $ 20,000 Accumulated depreciation (18,000) Carrying amount 2,000 Proceeds of disposition (3,000) Gain on disposal $ (1,000)

- Sale below carrying amountAssume the equipment is sold for $500. A loss on disposal of $1,500 would occur.

Cost $ 20,000 Accumulated depreciation (18,000) Carrying amount 2,000 Proceeds of disposition (500) Loss on disposal $ 1,500

In each of these cases, the cash proceeds must be recorded (by a debit) and the cost and accumulated depreciation must be removed from the accounts. A credit difference represents a gain on disposal while a debit difference represents a loss.

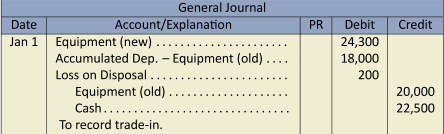

Disposal Involving Trade-In

It is a common practice to exchange a used PPE asset for a new one. This is known as a trade-in. The value of the trade-in agreed by the purchaser and seller is called the trade-in allowance. This amount is applied to the purchase price of the new asset, and the purchaser pays the difference. For instance, if the cost of a new asset is $10,000 and a trade-in allowance of $6,000 is given for the old asset, the purchaser will pay $4,000 ($10,000 – 6,000).

Sometimes as an inducement to the purchaser, the trade-in allowance is higher than the fair value of the used asset on the open market. Regardless, the cost of the new asset must be recorded at its fair value, calculated as follows:

If there is a difference between the fair value of the old asset and its carrying value, a gain or loss results. For example, assume again that equipment was purchased by BDCC for $20,000 and has accumulated depreciation of $18,000 at the end of 2019. It is traded on January 1, 2020 for new equipment with a list price of $25,000. A trade-in allowance of $2,500 is given on the old equipment, which has a fair value of only $1,800. In this case, the cost of the new asset is calculated as follows:

| Cash paid | + | Fair value of asset traded | = | Cost of new asset |

| $22,500 | + | 1,800 | = | $24,300 |

Cash paid will equal the difference between the selling price of the new equipment less the trade-in allowance, or $22,500 ($25,000 – 2,500). The fair value of the asset traded-in is $1,800. The cost of the new asset is therefore $24,300 ($22,500 + 1,800). There will be a loss on disposal of $200 on the old equipment, calculated as follows:

| Cost | $ | 20,000 |

| Accumulated depreciation | (18,000) | |

|

Carrying amount |

2,000 | |

| Fair value | (1,800) | |

| Loss on disposal | $ | 200 |

The journal entry on January 1, 2020 to record the purchase of the new equipment and trade-in of the old equipment is:

By this entry, the cost of the new equipment ($24,300) is entered into the accounts, the accumulated depreciation and cost of the old equipment is removed from the accounts, and the amount of cash paid is recorded. The debit difference of $200 represents the loss on disposal of the old equipment.

8.7 Intangible Assets

LO7 – Explain and record the acquisition and amortization of intangible assets.

Another major category of long-lived assets that arises from legal rights and does not have physical substance is that of intangible assets. The characteristics of various types of intangible assets are discussed below.

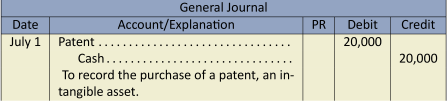

Patents

A patent is an intangible asset that is granted when a company has an exclusive legal privilege to produce and sell a product or use a process for a specified period. This period varies depending on the nature of the product or process patented, and on the legislation in effect. Modifications to the original product or process can result in a new patent being granted, in effect extending the life of the original patent.

Patents are recorded at cost. If purchased from an inventor, the patent’s cost is easily identified; if developed internally, the patent’s cost includes all expenditures incurred in the development of the product or process, including salaries and benefits of staff involved.

Copyrights

A copyright is another intangible asset that confers on the holder an exclusive legal privilege to publish a literary or artistic work. In this case, the state grants control over a published or artistic work for the life of the copyright holder (often the original artist) and for a specified period afterward. This control extends to the reproduction, sale, or other use of the copyrighted material.

Trademarks

A trademark is a symbol or a word used by a company to identify itself or one of its products in the marketplace. Symbols are often logos printed on company stationery or displayed at company offices, on vehicles, or in advertising. A well-known example is Coke®. The right to use a trademark can be protected by registering it with the appropriate agency. The symbol ‘®‘ denotes that a trademark is registered.

Franchises

A franchise is a legal right granted by one company (the franchisor) to another company (the franchisee) to sell particular products or to provide certain services in a given region using a specific trademark or trade name. In return, the franchisee pays a fee to the franchisor. McDonald’s® is an example of a franchised fast-food chain.

Another example of a franchise is one granted by government for the provision of certain services within a given geographical location: for example, television stations and telephone services authorized by the telecommunications branch of the state, or garbage collection authorized within a given community.

In addition to the payment of an initial franchise fee, which is capitalized, a franchise agreement usually requires annual payments. These payments are considered operating expenses.

Computer Software

Computer software programs may be developed by a company, patented, and then sold to customers for use on their computers. Productivity software like Microsoft Office® is an example. The cost of acquiring and developing computer software programs is recorded as an intangible asset, even if it is stored on a physical device like a computer. However, computer software that is integral to machinery – for instance, software that is necessary to control a piece of production equipment – is included as the cost of the equipment and classified as PPE.

Capitalization of Intangible Assets

Normally, intangible assets are measured at cost at the time of acquisition and are reported in the asset section of a company’s balance sheet under the heading “Intangible Assets.” The cost of an acquired intangible asset includes its purchase price and any expenditures needed to directly prepare it for its intended use.

There are special rules regarding intangible assets with a finite life and an indefinite life. Detailed discussion of these topics is beyond the scope of this textbook. It will be assumed that all intangibles being discussed in this textbook have a finite life.

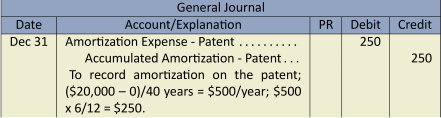

Amortization of Intangible Assets

Plant and equipment assets are depreciated. Intangible assets are also depreciated but the term used is amortization instead of depreciation. Amortization (of intangible assets) is the systematic process of allocating the cost of intangible assets over their estimated useful lives using the straight-line, double-declining-balance, units-of-production

or other method deemed appropriate.

Like PPE considerations, useful life and residual value of intangible assets are estimated by management and must be reviewed annually for reasonableness. Any effects on amortization expense because of changes in estimates are accounted for prospectively. That is, prior accounting periods’ expenses are not changed.

To demonstrate the accounting for intangibles, assume a patent is purchased for $20,000 on July 1, 2015. The entry to record the purchase is:

Assuming the patent will last 40 years with no residual value, and amortization is calculated to the nearest whole month, amortization expense will be recorded at the December 31, 2015 year end as:

Notice that an accumulated amortization account1 is credited and not accumulated depreciation.

Impairment losses, and gains and losses on disposal of intangible assets, are calculated and recorded in the same manner as for property, plant, and equipment.

8.8 Goodwill

LO8 – Explain goodwill and identify where on the balance sheet it is reported.

Assume that Big Dog Carworks Corp. purchases another company for $10 million ($10M). BDCC takes over all operations, including management and staff. There are no liabilities. The fair values of the purchased assets consist of the following:

| Patents | $2M |

| Machinery | $7M |

| Total | $9M |

Why would BDCC pay $10M for assets with a fair value of only $9M? The extra $1M represents goodwill. Goodwill is the excess paid over the fair value of the net assets when one company buys another, and represents the value of the purchasee’s ability to generate superior earnings compared to other companies in the same industry.

Goodwill is the combination of a company’s assets which cannot be separately identified – such as a well-trained workforce, better retail locations, superior products, or excellent senior managers – the value of which is recognized only when a significant portion of the business is purchased by another company.

Recall that among other characteristics, intangible assets must be separately identifiable. Because components of goodwill are not separately identifiable, goodwill is not considered an intangible asset. However, it does have future value and therefore is recorded as a long-lived asset under its own heading of “Goodwill” on the balance sheet.

The detailed discussion of goodwill is an advanced accounting topic and beyond the scope of this textbook.

8.9 Disclosure

LO9 – Describe the disclosure requirements for long-lived assets in the notes to the financial statements.

When long-lived assets are presented on the balance sheet, the notes to the financial statements need to disclose the following:

- details of each class of assets (e.g., land; equipment including separate parts; patents; goodwill)

- measurement basis (usually historical cost)

- type of depreciation and amortization methods used, including estimated useful lives

- cost and accumulated depreciation at the beginning and end of the period, including additions, disposals, and impairment losses

- whether the assets are constructed by the company for its own use (if PPE) or internally developed (if intangible assets).

Examples of appropriate disclosure of long-lived assets were shown in notes 3(d) and 4 of BDCC’s financial statements in Chapter 4.

Summary of Chapter 8 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 8. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Describe how the cost of property, plant, and equipment (PPE) is determined, and calculate PPE.

Property, plant and equipment (PPE) are tangible, long-lived assets that are acquired for the purpose of generating revenue either directly or indirectly. A capital expditure is debited to a PPE asset account because it results in the acquisition of a non-current asset and includes any additional costs involved in preparing the asset for its intended use at or after initial acquisition. A revenue expenditure does not have a future benefit beyond one year so is expensed. The details regarding a PPE asset are maintained in a PPE subsidiary ledger.

LO2 – Explain, calculate, and record depreciation using the units-of-production, straight-line, and double-declining balance methods.

Depreciation, an application of matching, allocates the cost of a PPE asset (except land) over the accounting periods expected to receive benefits from its use. A PPE asset’s cost, residual value, and useful life or productive output are used to calculate depreciation. There are different depreciation methods. Units-of-production is a usage-based method. Straight-line and double-declining balance are time-based methods. The formulas for calculating depreciation using these methods are:

Maximum accumulated depreciation is equal to cost less residual. The carrying amount of a PPE asset, also known as the net book value, equals the cost less accumulated depreciation.

LO3 – Explain, calculate, and record depreciation for partial years.

When assets are acquired or derecognized partway through the accounting period, partial period depreciation is recorded. There are several ways to account for partial period depreciation. Two common approaches are to calculate depreciation to the nearest whole month or to apply the half-year rule. The half-year rule assumes six months of depreciation in the year of acquisition and year of derecognition regardless of the actual date these occurred.

LO4 – Explain, calculate, and record revised depreciation for subsequent capital expenditures.

When there is a change that impacts depreciation (such as a change in the estimated useful life or estimated residual value, or a subsequent capital expenditure) revised depreciation is calculated prospectively. It is calculated as:

![]() where the residual value and/or useful life may have changed

where the residual value and/or useful life may have changed

LO5 – Explain, calculate, and record the impairment of long-lived assets.

The recoverable amount of a long-lived asset must be compared with its carrying amount (cost less accumulated depreciation) at the end of each reporting period. The recoverable amount is the fair value of the asset at the time less any estimated costs to sell it. If the recoverable amount is lower than the carrying amount, an impairment loss must be recorded as:

Impairment losses can be reversed in subsequent years if the recoverable amount of the asset exceeds the carrying amount. Also, if the fair value of a PPE asset can be reliably measured, it can be revalued to more than its original cost.

LO6 – Account for the derecognition of PPE assets.

Property, plant, and equipment is derecognized (that is, the cost and any related accumulated depreciation are removed from the accounting records) when it is sold or when no future economic benefit is expected. To account for the disposal of a PPE asset, the following must occur:

- If the disposal occurs part way through the accounting period, depreciation must be updated to the date of disposal by

- Record the disposal including any resulting gain or loss by

A loss results when the carrying amount of the asset is greater than the proceeds received, if any. A gain results when the carrying amount is less than any proceeds received.

It is a common practice to exchange a used PPE asset for a new one, known as a trade-in. The value of the trade-in is called the trade-in allowance and is applied to the purchase price of the new asset so that the purchaser pays the difference. Sometimes the trade-in allowance is higher than the fair value of the used asset. The cost of the new asset must be recorded at its fair value, calculated as:

If there is a difference between the fair value of the old asset and its carrying value, a gain or loss results.

LO7 – Explain and record the acquisition and amortization of intangible assets.

Intangible assets are long-lived assets that arise from legal rights and do not have physical substance. Examples include patents, copyrights, trademarks, and franchises. Intangibles are amortized using various methods. The entry to record amortization is a debit to amortization expense and a credit to either the intangible asset or to an accumulated amortization account.

LO8 – Explain goodwill and identify where on the balance sheet it is reported.

Goodwill is a long-lived asset that does not have physical substance but it is NOT an intangible. When one company buys another company, goodwill is the excess paid over the fair value of the net assets purchased and represents the value of the purchasee’s ability to generate superior earnings compared to other companies in the same industry. Goodwill appears in the asset section of the balance sheet under its own heading of “Goodwill”.

LO9 – Describe the disclosure requirements for long-lived assets in the notes to the financial statements.

When long-lived assets are presented on the balance sheet, the notes to the financial statements need to disclose the following:

- details of each class of assets (e.g., land; equipment including separate parts; patents; goodwill)

- measurement basis (usually historical cost)

- type of depreciation and amortization methods used, including estimated useful lives

- cost and accumulated depreciation at the beginning and end of the period, including additions, disposals, and impairment losses

whether the assets are constructed by the company for its own use (if PPE) or internally developed (if intangible assets).

Discussion Questions

After reading through Chapter 8, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

- The cost of a long-lived asset is said to be capitalized. What does this mean?

- How does a capital expenditure differ from a revenue expenditure?

- Assume that you have purchased a computer for business use. Illustrate, using examples, capital and revenue expenditures associated with its purchase.

- A company purchases land and buildings for a lump sum. What does this mean? What is the acceptable manner of accounting for a lump sum purchase?

- How does the concept of materiality affect the recording of an expenditure as a capital or revenue item?

- List the three criteria used to determine whether a replacement part for equipment is considered a capital or revenue expenditure.

- When one long-lived asset is exchanged for another, how is the cost of the newly-acquired asset determined?

- What is depreciation?

- Long-lived assets can be considered future benefits to be used over a period of years. The value of these benefits in the first years may not be the same as in later years. Using a car as an example, indicate whether you agree or disagree.

- Assume that you have recently purchased a new sports car. Is a usage or a time-based method preferable for recording depreciation? Why?

- Why is residual value ignored when depreciation is calculated using the declining balance method but not the straight-line method? Is this inconsistent? Why or why not?

- What is the formula for calculating the declining balance method of depreciation? …the straight-line method?

- What is the double-declining balance rate of depreciation for an asset that is expected to have a ten-year useful life?

- Explain two types of partial-year depreciation methods.

- What changes in estimates affect calculation of depreciation expense using the straight-line method? Explain the appropriate accounting treatment when there is a revision of an estimate that affects the calculation of depreciation expense.

- Explain the effect on the calculation of depreciation expense for capital expenditures made subsequent to the initial purchase of plant or equipment.

- Explain the process for determining whether the value of a long-lived asset has been impaired, and the required adjustments to the accounting records.

- Your friend is concerned that the calculation of depreciation and amortization relies too much on the use of estimates. Your friend believes that accounting should be precise. Do you agree that the use of estimates makes accounting imprecise? Why or why not?

- Why are the significant parts of property, plant, and equipment recorded separately?

- When does the disposal of PPE not result in a gain or loss?

- What is a trade-in? Explain whether a trade-in is the same as the sale of an asset.

- Why might a trade-in allowance, particularly in the case of a car, be unrealistic? Why would a dealer give more trade-in allowance on a used car than it is worth?

- How is the cost of a new capital asset calculated when a trade-in is involved?

- How are intangible assets different from property, plant, and equipment? the same?

- What is a patent? Assume a patent’s legal life is twenty years. Does a patent’s useful life correspond to its legal life? Why or why not? Support your answer with an example.

- How does a copyright differ from a trademark? Give an example of each.

- What is goodwill? Why is a company’s internally-generated goodwill usually not recorded in its accounting records?

- How are intangible assets valued, and what are their financial statement disclosure requirements?

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

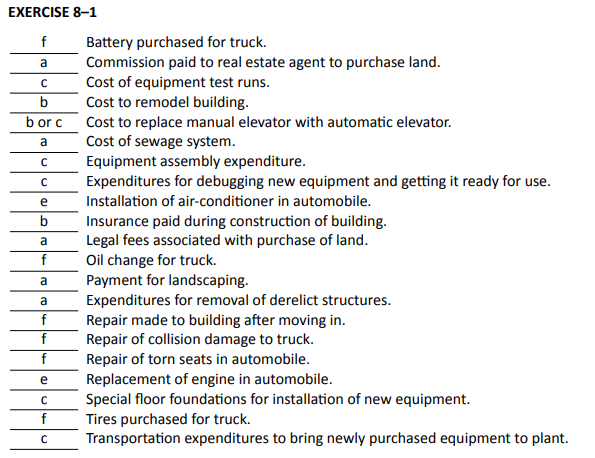

For all expenditures, accountants identify them as either capital or revenue expenditures. The entries for such transactions can be made to any one of the following accounts:

Capital expenditures are recorded in an asset account on the balance sheet such as:

- Land

- Buildings

- Equipment

- Trucks

- Automobiles

Revenue expenditures are recorded in an income statement account:

- An expense account

For each transaction below, indicate the account to be adjusted. Assume all expenditures are material in amount. Explain your answers.

| Example: | |

| b | Architect fees to design building. |

| Battery purchased for truck. | |

| Commission paid to real estate agent to purchase land. | |

| Cost of equipment test runs. | |

| Cost to remodel building. | |

| Cost to replace manual elevator with automatic elevator. | |

| Cost of sewage system. | |

| Equipment assembly expenditure. | |

| Expenditures for debugging new equipment and getting it ready for use. | |

| Installation of air-conditioner in automobile. | |

| Insurance paid during construction of building. | |

| Legal fees associated with purchase of land. | |

| Oil change for truck. | |

| Payment for landscaping. | |

| Expenditures for removal of derelict structures. | |

| Repair made to building after moving in. | |

| Repair of collision damage to truck. | |

| Repair of torn seats in automobile. | |

| Replacement of engine in automobile. | |

| Special floor foundations for installation of new equipment. | |

| Tires purchased for truck. | |

| Transportation expenditures to bring newly purchased equipment to plant. | |

Click Here to View Solution

Glasgo Holdings Inc. purchased a property including land and a building for $300,000. The market values of the land and building were $100,000 and $300,000, respectively.

Using these market values, prepare a journal entry to record the lump sum purchase.

Click Here to View Solution

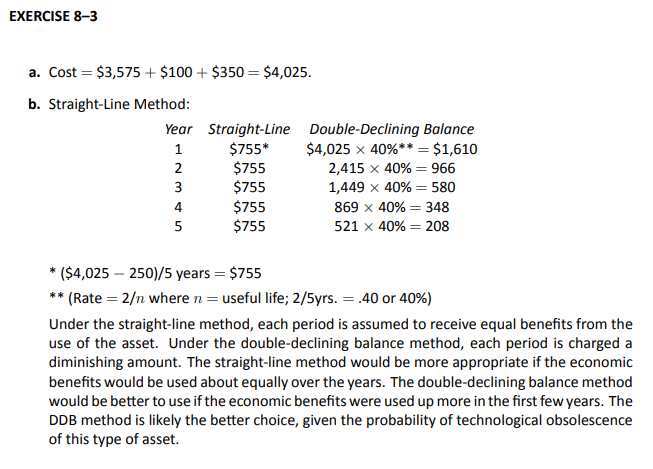

Ekman Corporation purchased a new laser printer to be used in its business. The printer had a list price of $4,000, but Ekman was able to purchase it for $3,575. The company expects it to have a useful life of five years, with an estimated residual value of $250. Ekman is paying the delivery costs of $100 along with the set-up and debugging costs of $350.

- Calculate the total cost of the laser printer.

- Ekman management asks you whether the straight-line or double-declining balance method of depreciation would be most appropriate for the printer. Provide calculations to support your answer.

Click Here to View Solution

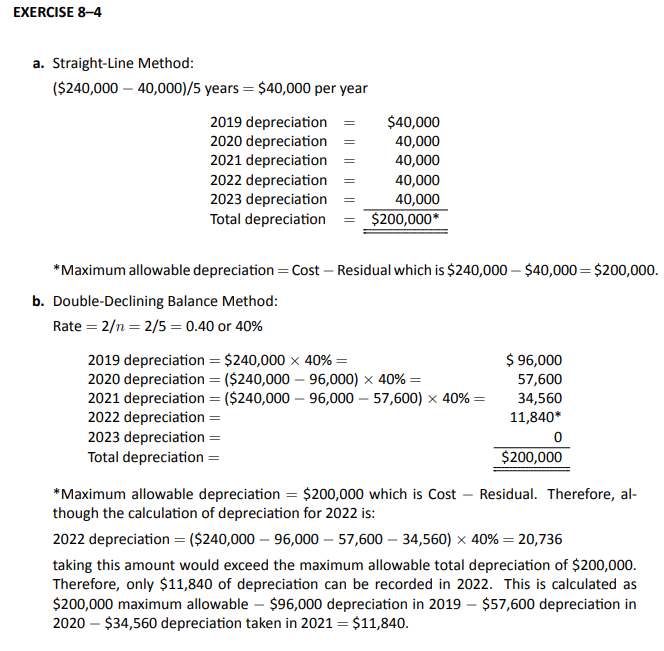

Willow Inc. began a business on January 1, 2019. It purchased equipment for its factory on this date for $240,000. The equipment is expected to have an estimated useful life of five years with a residual value of $40,000. Willow’s year-end is December 31.

Compute the depreciation for 2019, 2020, 2021, 2022 and 2023 using

- The straight-line method

- The double-declining balance method.

Click Here to View Solution

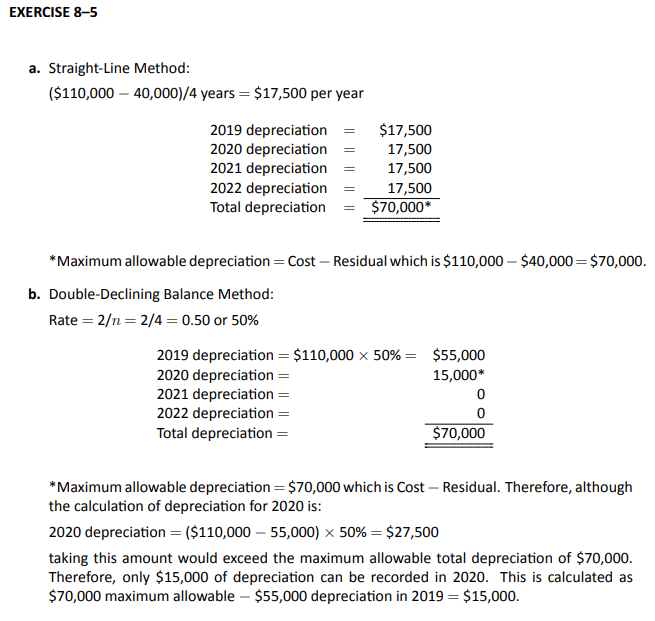

Mayr Inc. began a business on January 1, 2019. It purchased a machine for its factory on this date for $110,000. The machine is expected to have an estimated useful life of four years with a residual value of $40,000.

Compute the depreciation for 2019, 2020, 2021, and 2022 using

- The straight-line method

- The double-declining balance method.

Click Here to View Solution

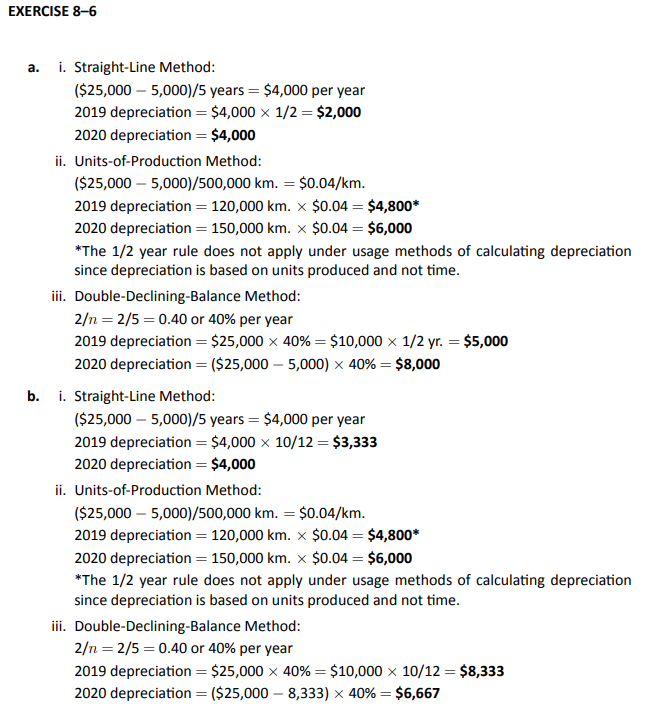

Penny Corp. purchased a new car on March 1, 2019 for $25,000. The estimated useful life of the car was five years or 500,000 kms. Estimated residual value was $5,000. The car was driven 120,000 kms. in 2019 and 150,000 kms. in 2020. Penny Corp.’s year end is December 31.

- Applying the half-year rule, calculate depreciation for 2019 and 2020 using

- The straight-line method

- Units-of-production method

- Double-declining-balance method

- Assuming Penny Corp. calculates depreciation to the nearest whole month, determine depreciation for 2019 and 2020 using

- The straight-line method

- Units-of-production method

- Double-declining-balance method

Click Here to View Solution

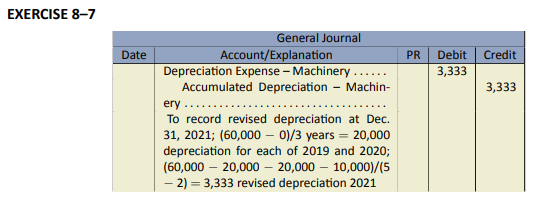

Global Flow Inc. purchased machinery on January 1, 2019 for $60,000 cash. It had an estimated useful life of three years, with no residual value, and depreciation is calculated using the straight-line method. During 2021, Global Flow determined that the estimated useful life should be revised to a total of five years and the residual value changed to $10,000.

Prepare the entry to record revised depreciation for the year ended December 31, 2021.

Click Here to View Solution

Denton Inc. purchased machinery on January 1, 2019 for $140,000 cash. It had an estimated useful life of five years and no residual value. On January 1, 2020, Denton purchased a specialized component for $50,000 that was attached to the machinery to significantly increase its productivity. The estimated useful life of the component was four years with no residual value. The life and residual value of the original machinery was not affected by the new component.

- Prepare the entry to record depreciation for the year ended December 31, 2019.

- Prepare the entry to record revised depreciation for the year ended December 31, 2020.

Click Here to View Solution

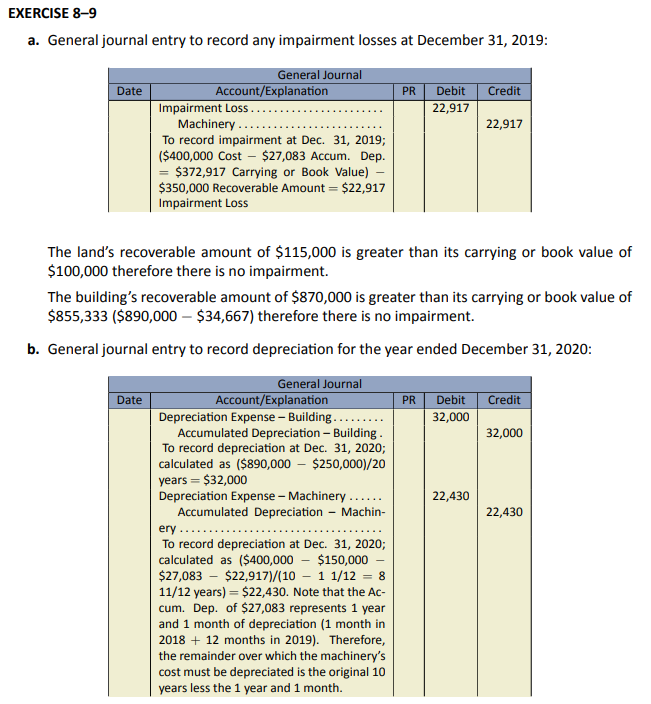

As part of its December 31, 2019 year end procedures, Beltore Inc. is evaluating its assets for impairment. It has recorded no impairment losses for previous years. Following is the Property, Plant and Equipment schedule showing adjusted balances as at December 31, 2019:

| Date of | Depreciation | Estimated | Estimated | Accumulated | Recoverable | |||||||||

| Asset | Purchase | Method | Cost | Residual | Useful life | Depreciation | Amount | |||||||

| Land | Sept. 1/2018 | N/A | $100,000 | N/A | N/A | N/A | $115,000 | |||||||

| Building | Dec. 1/2018 | SL | 890,000 | $250,000 | 20 | $34,667 | 870,000 | |||||||

| Machinery | Dec. 1/2018 | SL | 400,000 | 150,000 | 10 | 27,083 | 350,000 |

DDB = Double-declining-balance; SL = Straight-line; U = Units-of-production; N/A = Not applicable

- Record any impairment losses at December 31, 2019.

- Record depreciation expense for the year ended December 31, 2020 assuming no changes in the estimated residual values or estimated useful lives of the assets.

Click Here to View Solution

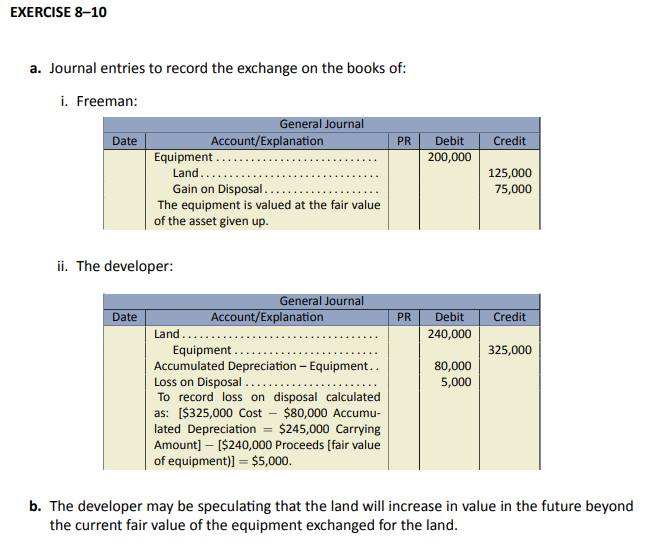

Freeman Inc. purchased a piece of agricultural land several years ago for $125,000. The land has a fair value of $200,000 now. The company plans to exchange this land for equipment owned by a land developer that has a fair value of $240,000. The equipment was originally purchased for $325,000, and $80,000 of depreciation has been recorded to the date of the exchange.

- Prepare the journal entry on the books of

- Freeman

- the developer.

- Why would the developer give up an asset with a fair value of $240,000 in exchange for an asset with a fair value of only $200,000?

Click Here to View Solution

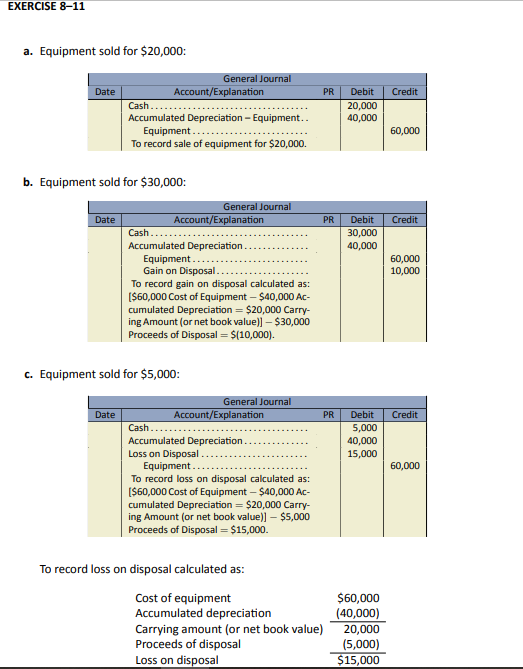

Mayr Inc. showed the following selected adjusted trial balance information at June 30, 2019:

| Debits | Credits | ||

| Equipment | $60,000 | ||

| Accumulated Depreciation – Equipment | $40,000 |

Mayr Inc. is planning on selling the equipment. Using the information provided above, prepare the journal entry to record the sale assuming

- The equipment was sold for $20,000.

- The equipment was sold for $30,000.

- The equipment was sold for $5,000.

Click Here to View Solution

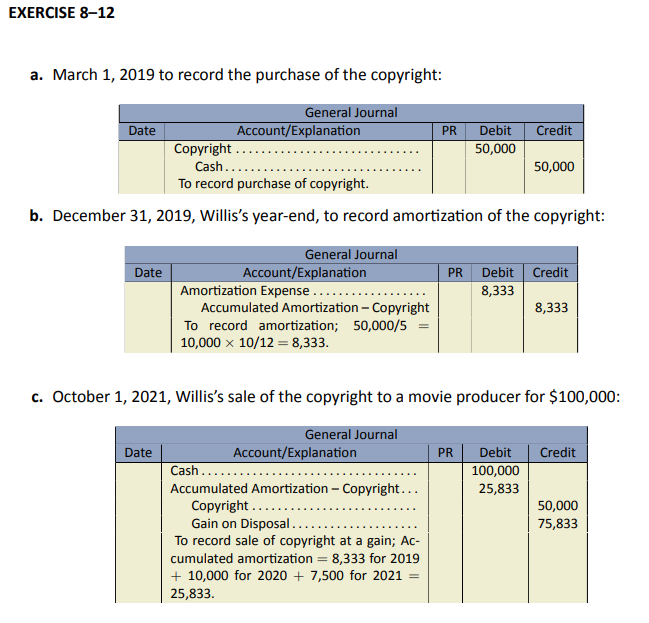

On March 1, 2019, Willis Publishing purchased the copyright from the author of a new book for cash of $50,000. It is expected that the book will have a shelf life of about 5 years with no expected residual value. On October 1, 2021, Willis sold the copyright to a movie producer for $100,000. Willis Publishing uses the straight-line method to amortize copyrights.

Prepare Willis Publishing’s journal entries at

- March 1, 2019 to record the purchase of the copyright.

- December 31, 2019, Willis’s year-end, to record amortization of the copyright.

- October 1, 2021.

Click Here to View Solution

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 8. It is recommended that students review any relevant sections that they struggled with in answering these problems.

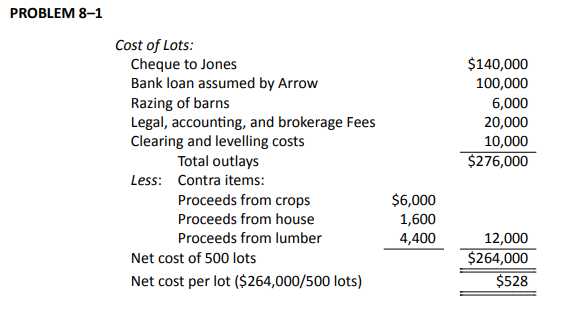

Arrow Construction Company Ltd. purchased a farm from K. Jones. Arrow and Jones completed the transaction under the following terms: a cheque from Arrow to Jones for $140,000; bank loan assumed by Arrow, $100,000. Legal, accounting, and brokerage fees amounted to $20,000.

It was Arrow’s intention to build homes on the property after sub-dividing. Crops on the farm were sold for $6,000; a house, to be moved by the buyer, was sold for $1,600; barns were razed at a cost of $6,000, while salvaged lumber was sold for $4,400. The property was cleared and levelled at a cost of $10,000.

The necessary property was turned over to the township for roads, schools, churches, and playgrounds. Riverside still expected to secure a total of 500 identical lots from the remaining land.

Prepare a schedule showing the cost to Arrow of the 500 lots.

Click Here to View Solution

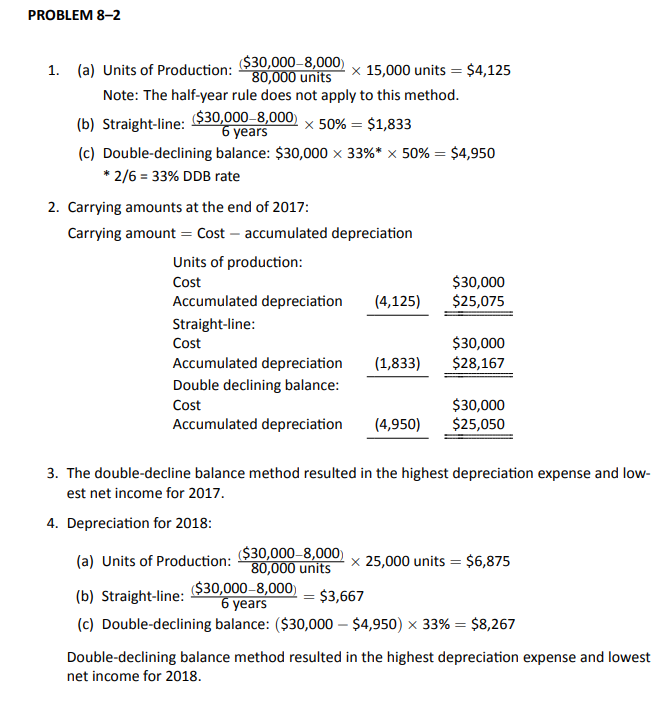

On January 1, 2017, Beyond Adventures Ltd. purchased a safari jeep for use in their wilderness weekends. The following information is available.

| Cost | $30,000 |

| Estimated useful life | 6 years or 80,000 kms |

| Residual value | $8,000 |

| Mileage in 2017 | 15,000 kms |

- Assuming that the company depreciates on the basis of 50% each in the years of acquisition and disposal, calculate the depreciation for 2018 under each of the methods below. Round your final answer to nearest whole dollar.

- Usage based (Units of Production)

- Straight-line

- Double-declining balance – use no decimal places for the double-declining

balance rate

- Compare the carrying amount for 2017 under each of these methods.

- Which of the three methods results in the lowest net income for 2017?

- Which of the three methods results in the lowest net income for 2018 if 25,000 kms were driven?

Click Here to View Solution

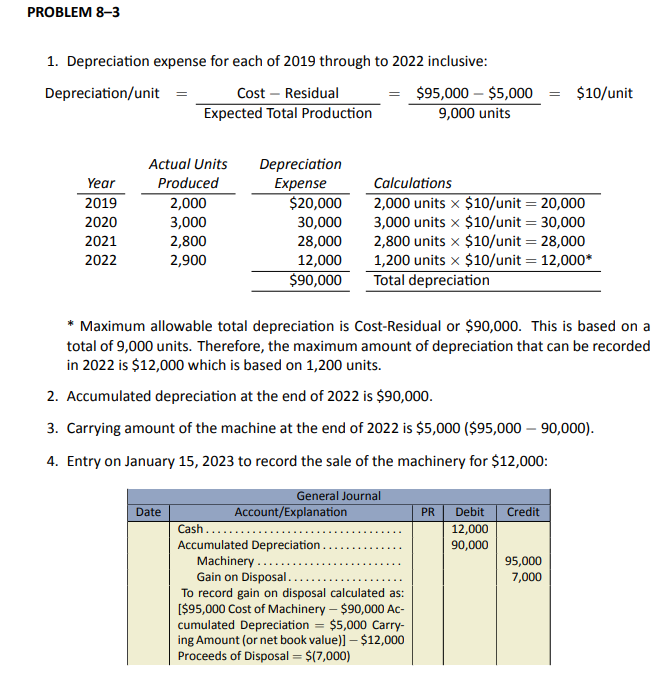

Janz Corporation purchased a piece of machinery on January 1, 2019. The company’s year-end is December 31. The following information is available regarding the machinery:

| Estimated | Estimated | Depreciation | ||||

| Cost | Useful Life | Residual Value | Method | |||

| $95,000 | 9,000 units | $5,000 | Units-of-Production |

Assume actual output was:

| Actual Units | ||

| Year | Produced | |

| 2019 | 2,000 | |

| 2020 | 3,000 | |

| 2021 | 2,800 | |

| 2022 | 2,900 |

The machinery was sold on January 15, 2023 for $12,000.

- Calculate the depreciation expense for each of 2019 through to 2022 inclusive.

- What is the balance of accumulated depreciation at the end of 2022?

- What is the carrying amount of the machinery shown on the balance sheet at the end of 2022?

- Prepare the entry on January 15, 2023 to record the sale of the machinery.

Click Here to View Solution

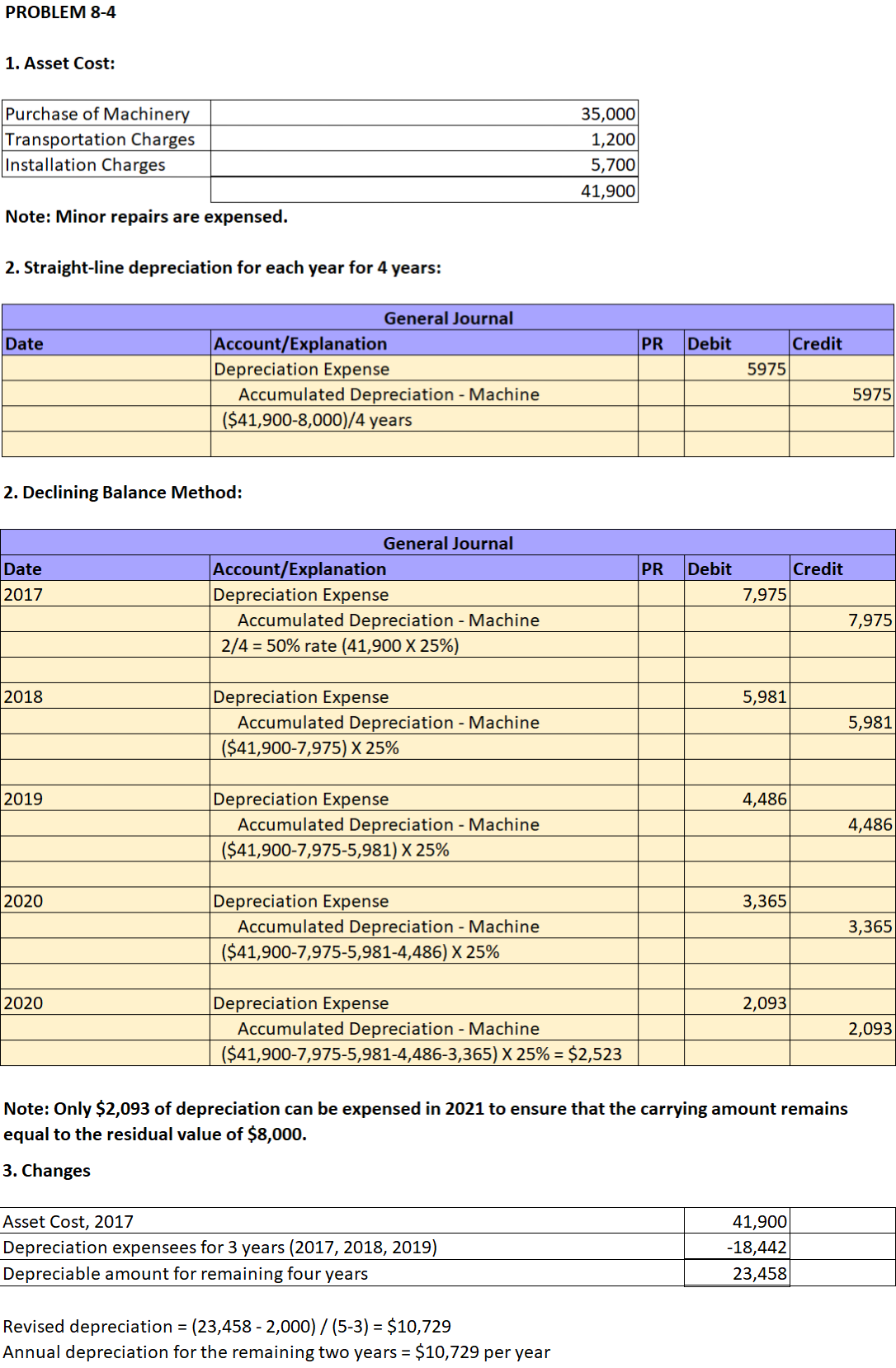

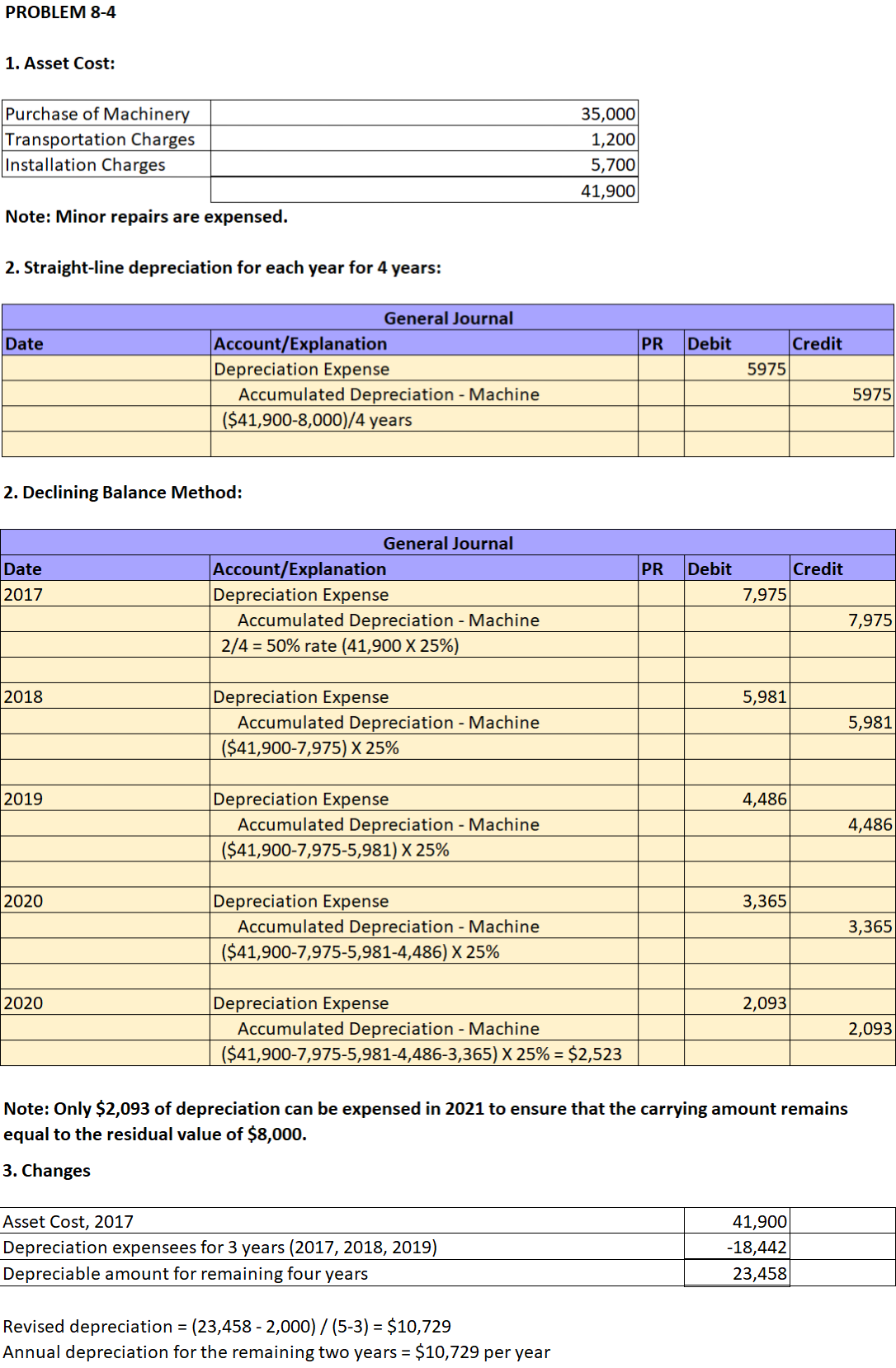

The following are details about an equipment purchase on January 1, 2017:

| Purchase price | $35,000 |

| Transportation charges | 1.200 |

| Installation costs | 5,700 |

| Minor repair cost | 100 |

| Useful life | four years |

| Residual value | $8,000 |

- Calculate the total cost of the equipment asset.

- Record the depreciation for each year of the expected useful life of the machine under straight-line method and double-declining balance method. Year-end is Dec 31.

- Assume now that on January 1, 2020, management changed the estimated useful life on the machine to a total of five years from the date of purchase. Residual value was also changed to $2,000. Calculate the depreciation that should be recorded in 2020 and each year thereafter assuming the company used the straight-line method.

Round all final answers to the nearest whole dollar.

Click Here to View Solution

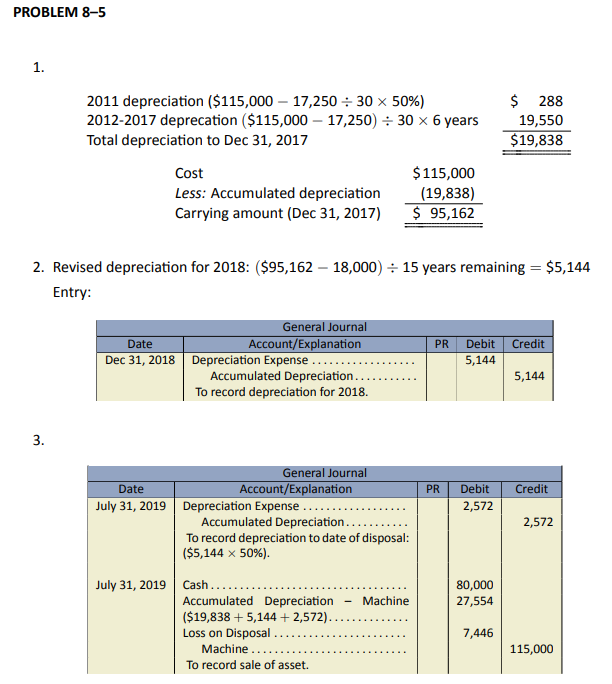

Depreciation has not yet been recorded in 2018. The company uses straight-line method of depreciation and the policy is to depreciate 50% each in the years of acquisition and disposal.

- Calculate the carrying amount of the machine at December 31, 2017.

- Calculate and record the depreciation expense at December 31, 2018.

- Record the journal entries if the machine is sold on July 31, 2019 for $80,000.

Click Here to View Solution

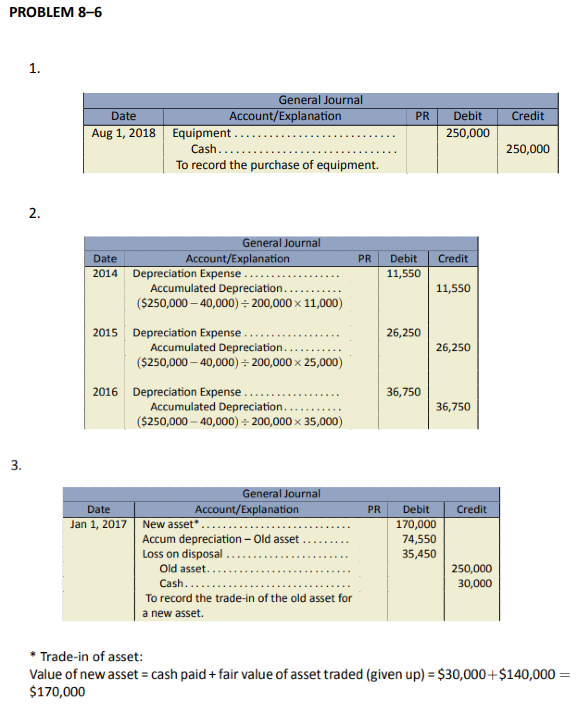

On August 1, 2014 Mayfere Co. commenced business and purchased production equipment for $250,000 cash. The equipment had an estimated useful life of eight years, an estimated total production output of 200,000 units, and a residual value of $40,000. The equipment was depreciated using the units-of-production method. Actual units of output over three years were: 2014: 11,000; 2015: 25,000; and 2016: 35,000.

On January 1, 2017, the company traded in the original equipment for new production equipment. The company paid and additional $30,000 cash for the new equipment. The fair value of the original equipment was $140,000 at the date of the trade.

Prepare journal entries to record the transactions for:

- The equipment purchase

- Depreciation for 2014, 2015 and 2016

- The sale of the equipment

Click Here to View Solution

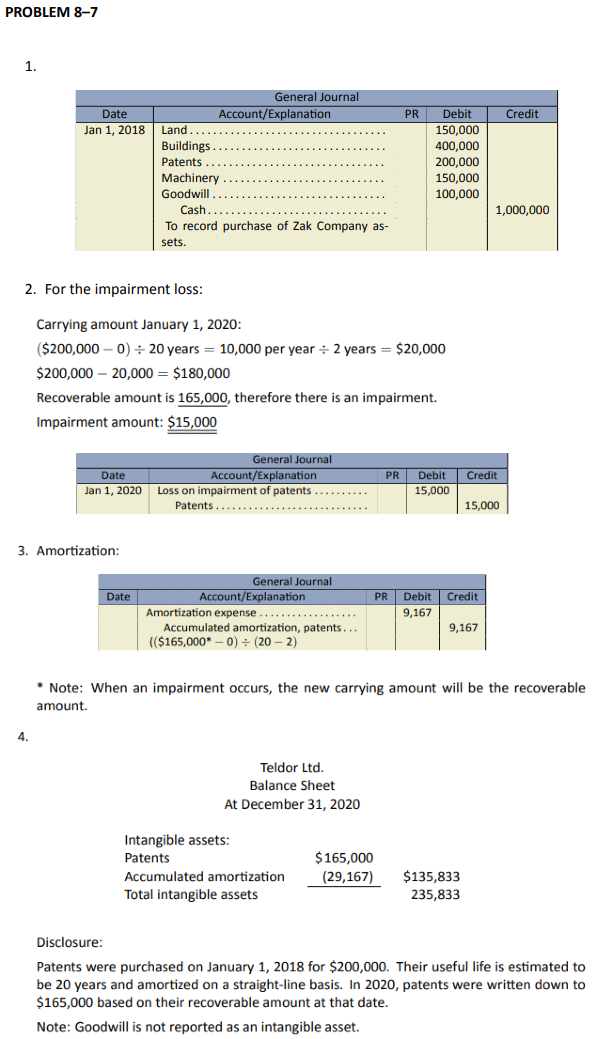

Teldor Ltd. paid $1M cash to purchase the following tangible and intangible assets of Zak Company on January 1, 2018. The fair values of the assets purchased were:

| Land | $150,000 |

| Building | 400,000 |

| Patents | 200,000 |

| Machinery | 150,000 |

The patents have an estimated useful life of twenty years and are amortized on a straight-line basis. They have no residual value. On January 3, 2020, the value of the patents was estimated to be $165,000.

Record the entries for the following transactions for Teldor:

- The $900,000 purchase.

- The decline in value of the patents at January 3, 2020.

- The amortization of the patents at December 31, 2020.

- Prepare a partial balance sheet for the intangible assets section at December 31, 2020 in good form, with proper disclosures.

Click Here to View Solution

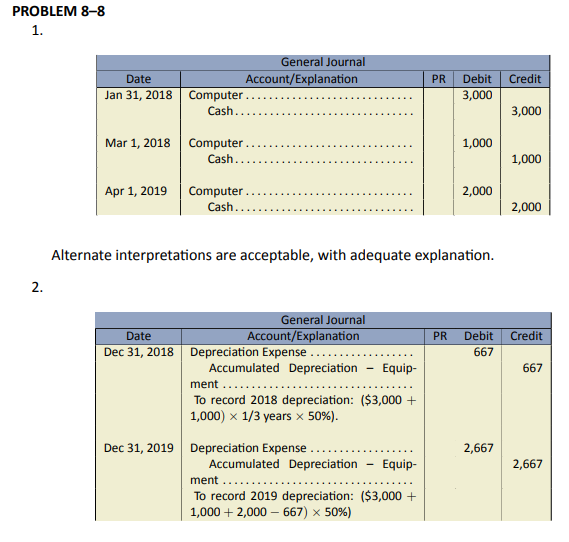

Global Flow Inc. purchased a computer on January 1, 2018 for $3,000 cash. It had an estimated useful life of three years and no residual value. Global Flow made the following changes to the computer:

| Mar 1, 2018 | Added storage capacity at a cost of $1,000. This had no effect on residual value or estimated useful life. |

| Apr 1, 2019 | Added a new processing board for $2,000, which extended the estimated useful life of the computer another three years but did not affect residual value. |

- Prepare a journal entry to record each of the above expenditures. Assume all amounts are material. Descriptions are not necessary.

- Calculate and prepare journal entries to record depreciation expense for 2018 and 2019 using the double-declining balance method. Assume a December 31 fiscal year-end and that the company depreciates 50% each in the acquisition and disposal years.

1. IFRS 2014, IAS 38, para. 98; effective January 1, 2016 but can be applied sooner.

Click Here to View Solution