Chapter 7

Receivables

To match the cost of uncollectible accounts and the related revenue, uncollectible accounts, more commonly referred to as bad debts, must be estimated. Bad debts are accounted for using the allowance approach, applied using either the income statement method or balance sheet method. When uncollectible accounts are specifically identified, they are written off. Write-offs can be subsequently recovered. The journalizing of short-term notes receivable and related interest revenue is also discussed in this chapter.

Chapter 7 Learning Objectives

- LO1 – Explain, calculate, and record estimated uncollectible accounts receivable and subsequent write-offs and recoveries.

- LO2 – Explain and record a short-term notes receivable as well as calculate related interest.

Concept Self-Check

Use the following as a self-check while working through Chapter 7.

- How does use of allowance for doubtful accounts match expenses with revenue?

- How does the income statement method calculate the estimated amount of uncollectible accounts?

- What is an ageing schedule for bad debts, and how is it used in calculating the estimated amount of uncollectible accounts?

- How are credit balances in accounts receivable reported on the financial statements?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

7.1 Accounts Receivable

LO1 – Explain, calculate, and record estimated uncollectible accounts receivable and subsequent write-offs and recoveries.

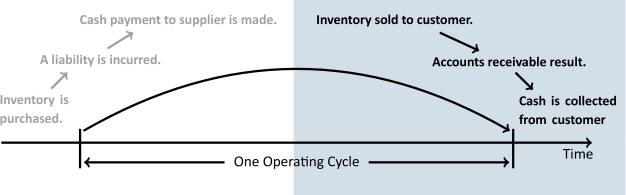

The revenue portion of the operating cycle, as copied in Figure 7.1, begins with a sale on credit and is completed with the collection of cash. Unfortunately, not all receivables are collected. This section discusses issues related to accounts receivable and their collection:

Uncollectible Accounts Receivable

Extending credit to customers results in increased sales and therefore profits. However, there is a risk that some accounts receivable will not be collected. A good internal control system is designed to minimize bad debt losses. One such control is to permit sales on account only to credit-worthy customers; this can be difficult to determine in advance. Companies with credit sales realize that some of these amounts may never be collected. Uncollectible accounts, commonly known as bad debts, are an expense associated with selling on credit.

Bad debt expenses must be matched to the credit sales of the same period. For example, assume BDCC recorded a $1,000 credit sale to XYA Company in April, 2015. Assume further that in 2016 it was determined that the $1,000 receivable from XYA Company would never be collected. The bad debt arising from the credit sale to XYA Company should be matched to the period in which the sale occurred, namely, April, 2015. But how can that be done if it is not known which receivables will become uncollectible? A means of estimating and recording the amount of sales that will not be collected in cash is needed. This is done by establishing a contra current asset account called Allowance for Doubtful Accounts (AFDA) in the general ledger to record estimated uncollectible receivables. This account is a contra account to accounts receivable and is disclosed on the balance sheet as shown below using assumed values.

| Accounts receivable | $25,000 | |||

|

Less: Allowance for doubtful accounts |

1,400 | 23,600 | ||

| OR | ||||

| Accounts receivable (net of $1,400 AFDA) | $ 23,600 |

The Allowance for Doubtful Accounts contra account reduces accounts receivable to the amount that is expected to be collected — in this case, $23,600.

Estimating Uncollectible Accounts Receivable

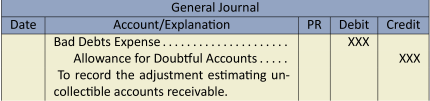

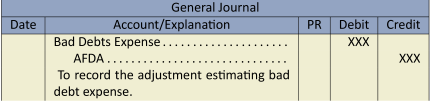

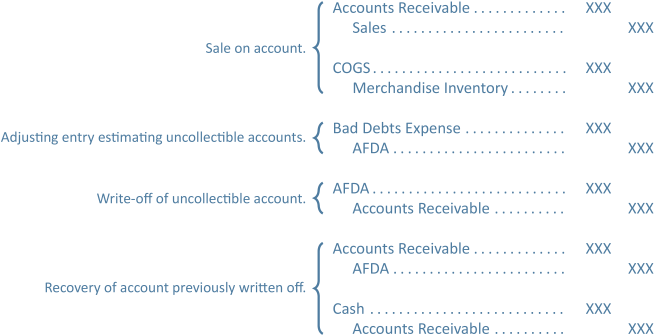

The AFDA account is used to reflect how much of the total Accounts Receivable is estimated to be uncollectible. To record estimated uncollectible accounts, the following adjusting entry is made:

The bad debt expense is shown on the income statement. AFDA appears on the balance sheet and is subtracted from accounts receivable resulting in the estimated net realizable accounts receivable.

Two different methods can be used to estimate uncollectible accounts. One method focuses on estimating Bad Debt Expense on the income statement, while the other focuses on estimating the desired balance in AFDA on the balance sheet.

The Income Statement Method

The objective of the income statement method is to estimate bad debt expense based on credit sales. Bad debt expense is calculated by applying an estimated loss percentage to credit sales for the period. The percentage is typically based on actual losses experienced in prior years. For instance, a company may have the following history of uncollected sales on account:

| Amounts | ||||

| Credit | Not | |||

| Year | Sales | Collected | ||

| 2012 | $150,000 | $1,000 | ||

| 2013 | 200,000 | 1,200 | ||

| 2014 | 250,000 | 800 | ||

| $600,000 | $3,000 |

The average loss over these years is ![]() , or

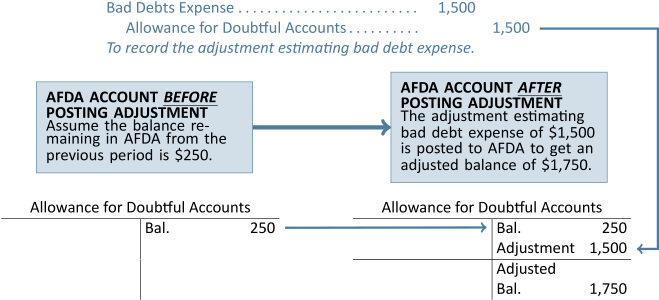

, or ![]() of 1%. If management anticipates that similar losses can be expected in 2015 and credit sales for 2015 amount to $300,000, bad debts expense would be estimated as $1,500 ($300,000 x 0.005). Under the income statement method, the $1,500 represents estimated bad debt expense and is recorded as noted below.

of 1%. If management anticipates that similar losses can be expected in 2015 and credit sales for 2015 amount to $300,000, bad debts expense would be estimated as $1,500 ($300,000 x 0.005). Under the income statement method, the $1,500 represents estimated bad debt expense and is recorded as noted below.

This estimated bad debt expense is calculated without considering any existing balance in the AFDA account:

The Balance Sheet Method

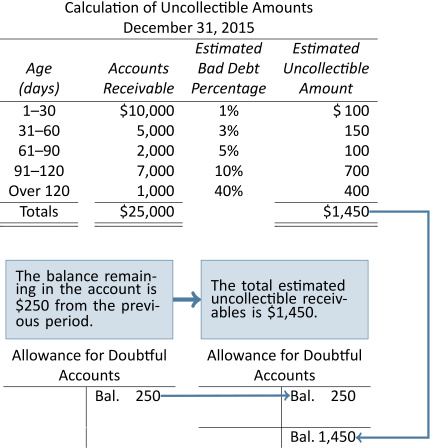

Estimated uncollectible accounts can also be calculated by using the balance sheet method where a process called aging of accounts receivable is used. At the end of the period, the total of estimated uncollectible accounts is calculated by analyzing accounts receivable according to how long each account has been outstanding. An aging analysis approach assumes that the longer a receivable is outstanding, the less chance there is of collecting it. This process is illustrated in the following schedule.

| Aging of Accounts Receivable | ||||||||||||||

| December 31, 2015 | ||||||||||||||

| Number of Days Past Due | ||||||||||||||

| Not Yet | ||||||||||||||

| Customer | Total | Due | 1–30 | 31–60 | 61–90 | 91–120 | Over 120 | |||||||

| Bendix Inc. | $ | 1,000 | $ | 1,000 | ||||||||||

| Devco Marketing Inc. | 6,000 | $ | 1,000 | $ | 3,000 | $ | 2,000 | |||||||

| Horngren Corp | 4,000 | 2,000 | 1,000 | $ | 1,000 | |||||||||

| Perry Co. Ltd. | 5,000 | 3,000 | 1,000 | 1,000 | ||||||||||

| Others | 9,000 | 4,000 | 5,000 | |||||||||||

|

Totals |

$ | 25,000 | $ | 0 | $ | 10,000 | $ | 5,000 | $ | 2,000 | $ | 7,000 | $ | 1,000 |

In this example, accounts receivable total $25,000 at the end of the period. These are classified into six time periods: those receivables that are not yet due; 1–30 days past due; 31–60 days past due; 61–90 days past due; 91–120 days past due; and over 120 days past due.

Based on past experience, assume management estimates a bad debt percentage, or rate of uncollectibility, for each time period as follows:

| Number of Days | Not Yet | |||||||||||

| Outstanding | Due | 1–30 | 31–60 | 61–90 | 91–120 | Over 120 | ||||||

| Rate of | ||||||||||||

| Uncollectibility | 0.5% | 1% | 3% | 5% | 10% | 40% |

The calculation of expected uncollectible accounts receivable at December 31, 2015 would be as follows:

A total of $1,450 of accounts receivable is estimated to be uncollectible at December 31, 2015.

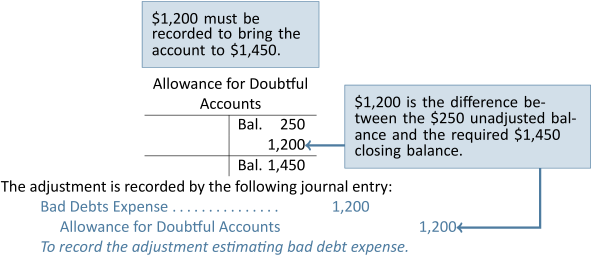

Under the balance sheet method, the estimated bad debt expense consists of the difference between the opening AFDA balance ($250, as in the prior example) and the estimated uncollectible receivables ($1,450) required at year-end:

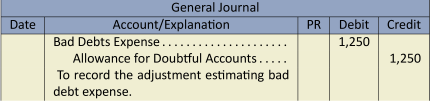

As an alternative to using an aging analysis to estimate uncollectible accounts, a simplified balance sheet method can be used. The simplified balance sheet method calculates the total estimated uncollectible accounts as a percentage of the outstanding accounts receivables balance. For example, assume an unadjusted balance in AFDA of $250 as in the preceding example. Also assume the accounts receivable balance at the end of the period was $25,000 as in the previous illustration. If it was estimated that 6% of these would be uncollectible based on historical data, the adjustment would be:

The total estimated uncollectible accounts was $1,500 ($25,000 ![]() 0.06). Given an unadjusted balance in AFDA of $250, the adjustment to AFDA must be a credit of $1,250 ($1,500 – $250).

0.06). Given an unadjusted balance in AFDA of $250, the adjustment to AFDA must be a credit of $1,250 ($1,500 – $250).

Regardless of whether the income statement method or balance sheet method is used, the amount estimated as an allowance for doubtful accounts seldom agrees with the amounts that actually prove uncollectible. A credit balance remains in the allowance account if fewer bad debts occur during the year than are estimated. There is a debit balance in the allowance account if more bad debts occur during the year than are estimated. By monitoring the balance in the Allowance for Doubtful Accounts general ledger account at each year-end, though, management can determine whether the estimates of uncollectible amounts are accurate. If not, they can adjust these estimates going forward.

Writing Off Accounts Receivable

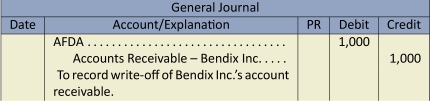

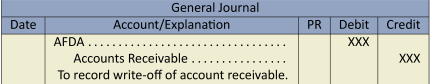

When recording the adjusting entry to estimate uncollectible accounts receivable at the end of the period, it is not known which specific receivables will become uncollectible. When an account is determined to be uncollectible, it must be removed from the accounts receivable account. This process is known as a write-off. To demonstrate the write-off of an account receivable, assume that on January 15, 2016 the $1,000 credit account for customer Bendix Inc. is identified as uncollectible because of the company’s bankruptcy. The receivable is removed by:

The $1,000 write-off reduces both the accounts receivable and AFDA accounts. The write-off does not affect net realizable accounts receivable as demonstrated below.

| Before | After | |||||

| Write-Off | Write-Off | Write-Off | ||||

| Accounts receivable | $25,000 | Cr 1,000 | $24,000 | |||

| Less: Allowance for doubtful accounts | 1,450 | Dr 1,000 | 450 | |||

| Net accounts receivable | $23,550 | $23,550 |

Additionally, a write-off does not affect bad debt expense. This can be a challenge to understand. To help clarify, recall that the adjusting entry to estimate uncollectibles was:

This adjustment was recorded because GAAP requires that the bad debt expense be matched to the period in which the sales occurred even though it is not known which receivables will become uncollectible. Later, when an uncollectible receivable is identified, it is written off as:

Notice that the AFDA entries cancel each other out so that the net effect is a debit to bad debt expense and a credit to accounts receivable. The use of the AFDA contra account allows us to estimate uncollectible accounts in one period and record the write-off of bad receivables as they become known in a later period.

Recovery of a Write-Off

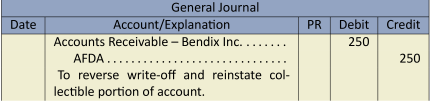

When Bendix Inc. went bankrupt, its debt to Big Dog Carworks Corp. was written off in anticipation that there would be no recovery of the amount owed. Assume that later, an announcement was made that 25% of amounts owed by Bendix would be paid. This new information indicates that BDCC will be able to recover a portion of the receivable previously written off. A recovery requires two journal entries. The first entry reinstates the amount expected to be collected by BDCC—$250

($1,000 ![]() 25%) in this case and is recorded as:

25%) in this case and is recorded as:

This entry reverses the collectible part of the receivable previously written off. The effect of the reversal is shown below.

| Accounts Receivable | Allowance for Doubtful Accounts | |||||||

| Bal. | $25,000 | Bal. | 1,450 | |||||

| Write-off | 1,000 | Write-off | 1,000 | |||||

| Recovery | 250 | Recovery | 250 | |||||

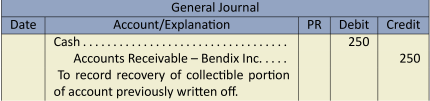

The second entry records the collection of the reinstated amount as:

The various journal entries related to accounts receivable are summarized below:

Learning Activity 7.1 – Accounts Receivable

This Learning Activity gives you an opportunity to assess how well you know the important terms from this section.

Instructions: Match each term to its correct definition.

7.2 Short-Term Notes Receivable

LO2 – Explain and record a short-term notes receivable as well as calculate related interest.

Short-term notes receivable are current assets, since they are due within the greater of 12 months or the business’s operating cycle. A note receivable is a promissory note. A promissory note is a signed document where the debtor, the person who owes the money, promises to pay the creditor the principal and interest on the due date. The principal is the amount owed. The creditor, or payee, is the entity owed the principal and interest. Interest is the fee for using the principal and is calculated as: Principal ![]() Annual Interest Rate

Annual Interest Rate ![]() Time. The time or term of the note is the period from the date of the note to the due date. The due date, also known as the maturity date, is the date on which the principal and interest must be paid. The date of the note is the date the note begins accruing interest.

Time. The time or term of the note is the period from the date of the note to the due date. The due date, also known as the maturity date, is the date on which the principal and interest must be paid. The date of the note is the date the note begins accruing interest.

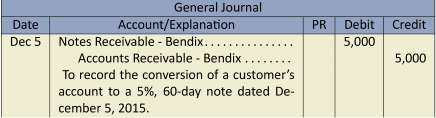

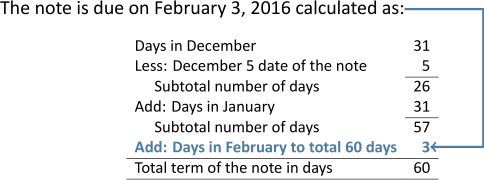

Short-term notes receivable can arise at the time of sale or when a customer’s account receivable becomes overdue. To demonstrate the conversion of a customer’s account to a short-term receivable, assume that BDCC’s customer Bendix Inc. is unable to pay its $5,000 account within the normal 30-day period. The receivable is converted to a 5%, 60-day note dated December 5, 2015 with the following entry:

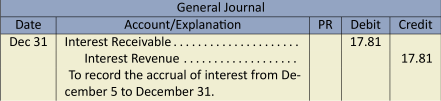

Assuming a December 31, year-end for BDCC, the adjusting entry to accrue interest on December 31 would be:

The interest of $17.81 was calculated as: $5,000 ![]() 5%

5% ![]() 26/3652 = $17.80822 rounded to $17.81. All interest calculations in this textbook are rounded to two decimal places.

26/3652 = $17.80822 rounded to $17.81. All interest calculations in this textbook are rounded to two decimal places.

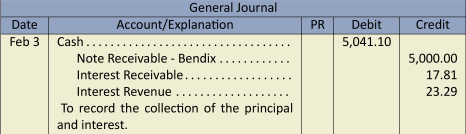

At maturity, February 3, 2016, BDCC collects the note plus interest and records:

The total interest realized on the note was $41.10 ($5,000 ![]() 5%

5% ![]() 60/365 = $41.0959 rounded to $41.10). Part of the $41.10 total interest revenue was realized in 2015 ($17.81) and the rest in 2016 ($41.10 – $17.81 = $23.29). Therefore, care must be taken to correctly allocate the interest between periods. The total cash received by BDCC on February 3 was the sum of the principal and interest: $5,000.00 + $41.10 = $5,041.10.

60/365 = $41.0959 rounded to $41.10). Part of the $41.10 total interest revenue was realized in 2015 ($17.81) and the rest in 2016 ($41.10 – $17.81 = $23.29). Therefore, care must be taken to correctly allocate the interest between periods. The total cash received by BDCC on February 3 was the sum of the principal and interest: $5,000.00 + $41.10 = $5,041.10.

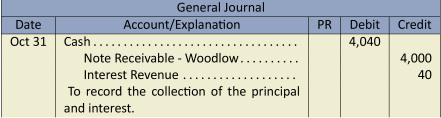

When the term of a note is expressed in months, the calculations are less complex. For example, assume that BDCC sold customer Woodlow a $4,000 service on August 1, 2015. On that date, the customer signed a 4%, 3-month note. The term of the note is based on months and not days therefore the maturity date is October 31, 2015. BDCC would record the collection on October 31 as:

The total interest realized on the note was $40 ($4,000 ![]() 4%

4% ![]() 3/123 = $40.00)

3/123 = $40.00)

Learning Activity 7.2 – Short-Term Notes Receivable

This Learning Activity gives you an opportunity to assess how well you know the important terms from this section.

Instructions: Match each term with its correct definition.

Summary of Chapter 7 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 7. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Explain, calculate, and record estimated uncollectible accounts receivable and subsequent write-offs and recoveries.

Not all accounts receivable are collected, resulting in uncollectible accounts. Because it is not known which receivables will become uncollectible, the allowance approach is used to match the cost of estimated uncollectible accounts to the period in which the related revenue was generated. The adjusting entry to record estimated uncollectibles is a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts (AFDA). The income statement method and the balance sheet method are two ways to estimate and apply the allowance approach. The income statement method calculates bad debt expense based on a percentage of credit sales while the balance sheet method calculates total estimated uncollectible accounts (aka the balance in AFDA) using an aging analysis. When receivables are identified as being uncollectible, they are written off. If write-offs subsequently become collectible, a recovery is recorded using two entries: by reversing the write-off (or the portion that is recoverable) and then journalizing the collection.

LO2 – Explain and record a short-term notes receivable as well as calculate related interest.

A short-term notes receivable is a promissory note that bears an interest rate calculated over the term of the note. Short-term notes receivable are current assets that mature within 12 months from the date of issue or within a business’s operating cycle, whichever is longer. Notes can be issued to a customer at the time of sale, or a note receivable can replace an overdue receivable.

Review Questions

After reading through Chapter 7, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

- How does use of allowance for doubtful accounts match expenses with revenue?

- How does the income statement method calculate the estimated amount of uncollectible accounts?

- What is an ageing schedule for bad debts, and how is it used in calculating the estimated amount of uncollectible accounts?

- How are credit balances in accounts receivable reported on the financial statements?

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

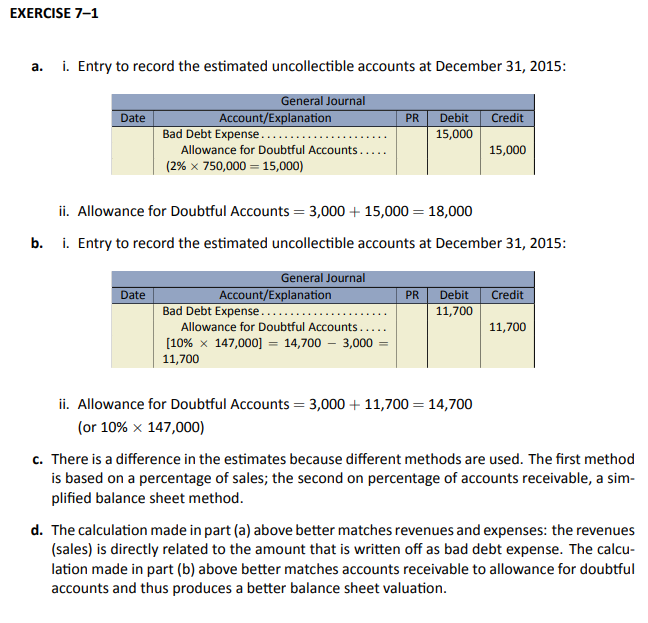

Sather Ltd. had the following unadjusted account balances at December 31, 2015 (assume normal account balances):

| Accounts Receivable | $147,000 |

| Allowance for Doubtful Accounts | 3,000 |

| Sales | 750,000 |

- Assume that Sather Ltd. estimated its uncollectible accounts at December 31, 2015 to be two per cent of sales.

- Prepare the appropriate adjusting entry to record the estimated uncollectible accounts at December 31, 2015.

- Calculate the balance in the Allowance for Doubtful Accounts account after posting the adjusting entry.

- Assume that Sather Ltd. estimated its uncollectible accounts at December 31, 2015 to be ten per cent of the unadjusted balance in accounts receivable.

- Prepare the appropriate adjusting entry to record the estimated uncollectible accounts at December 31, 2015.

- Calculate the balance in the Allowance for Doubtful Accounts account after posting the adjusting entry.

- Why is there a difference in the calculated estimates of doubtful accounts in parts (a) and (b)?

- Which calculation provides better matching: that made in part (a) or in part (b)? Why?

Click Here to View Solution

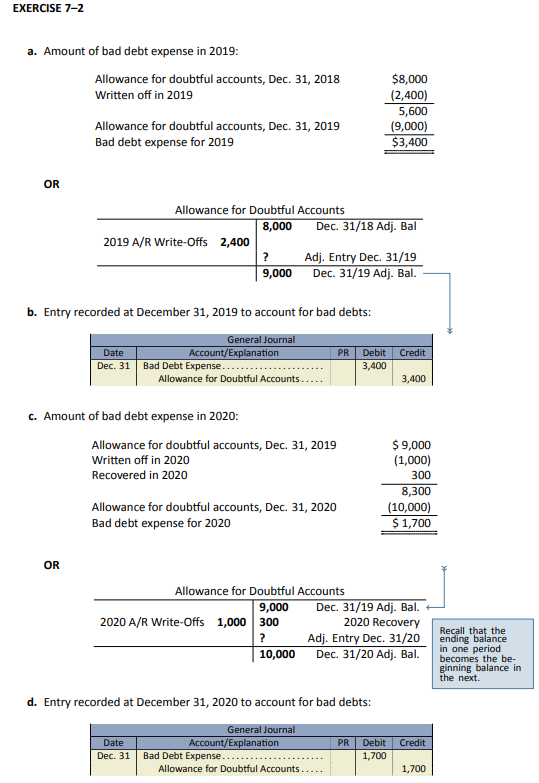

The following information is taken from the records of Salzl Corp. at its December 31 year-end:

| 2019 | 2020 | ||

| Accounts written off | |||

|

During 2019 |

$2,400 | ||

|

During 2020 |

$1,000 | ||

| Recovery of accounts written off | |||

|

Recovered in 2020 |

300 | ||

| Allowance for doubtful accounts | |||

| (adjusted balance) | |||

|

At December 31, 2018 |

8,000 | ||

|

At December 31, 2019 |

9,000 |

Salzl had always estimated its uncollectible accounts at two per cent of sales. However, because of large discrepancies between the estimated and actual amounts, Hilroy decided to estimate its December 31, 2020 uncollectible accounts by preparing an ageing of its accounts receivable. An amount of $10,000 was considered uncollectible at December 31, 2020.

- Calculate the amount of bad debt expense for 2019.

- What adjusting entry was recorded at December 31, 2019 to account for bad debts?

- Calculate the amount of bad debt expense for 2020.

- What adjusting entry was recorded at December 31, 2020 to account for bad debts?

Click Here to View Solution

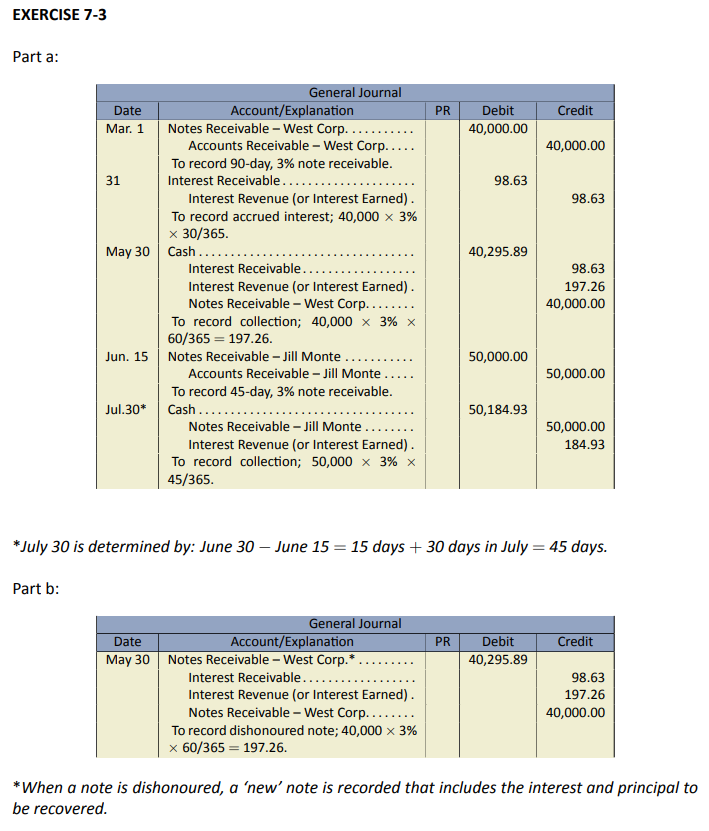

Following are notes receivable transactions of Vilco Inc. whose year-end is March 31:

| Mar. 1 | Accepted a $40,000, 90-day, 3% note receivable dated today in granting a | |

| time extension to West Corp. on its past-due accounts receivable. | ||

| Mar. 31 | Made an adjusting entry to record the accrued interest on West Corp.’s | |

| note receivable. | ||

| May 30 | Received West Corp.’s payment for the principal and interest on the note | |

| receivable dated March 1. | ||

| Jun. 15 | Accepted a $50,000, 45-day, 3% note receivable dated today in granting a | |

| time extension to Jill Monte on her past-due accounts receivable. | ||

| ??? | Received Jill Monte’s payment for the principal and interest on her note | |

| dated June 15. |

- Prepare journal entries to record Vilco Inc.’s transactions (round all calculations to two decimal places).

- Assume instead that on May 30 West Corp. dishonoured (did not pay) its note when presented for payment. How would Vilco Inc. record this transaction on May 30?

Click Here to View Solution

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 7. It is recommended that students review any relevant sections that they struggled with in answering these problems.

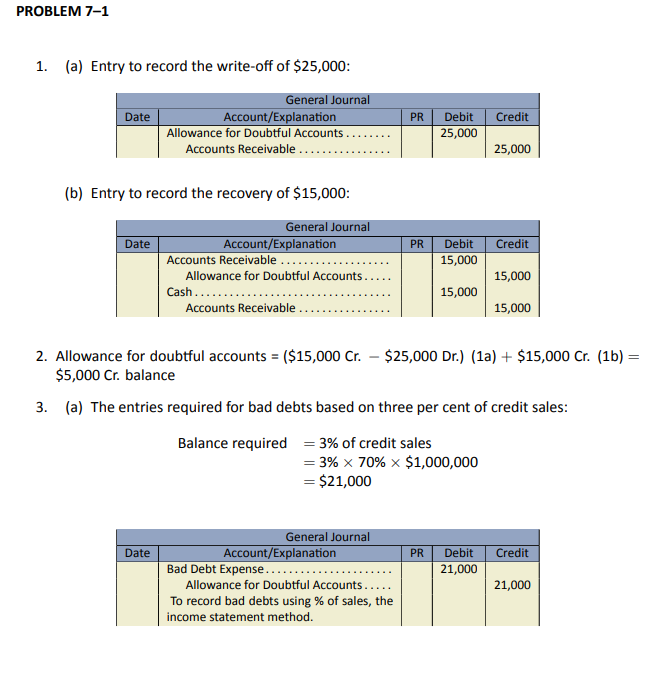

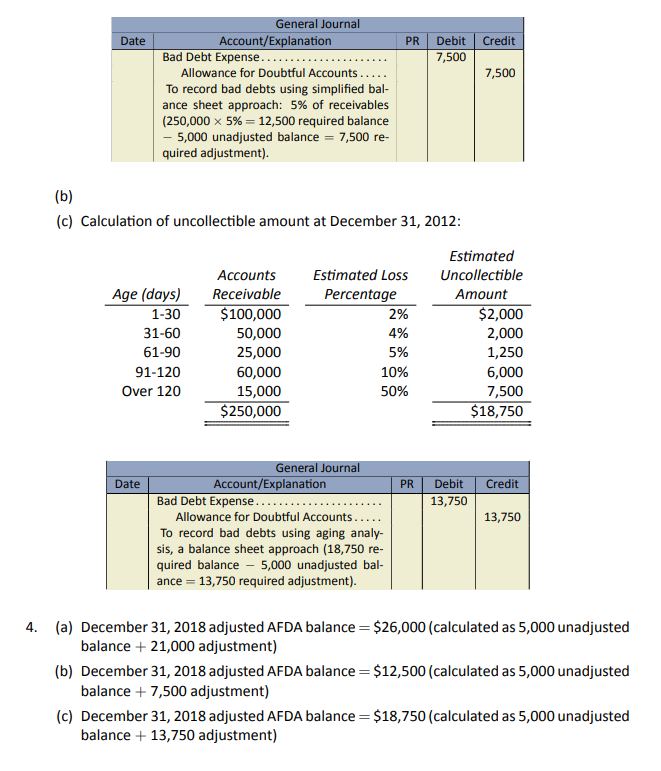

Tarpon Inc. made $1,000,000 in sales during 2018. Thirty per cent of these were cash sales. During 2018, $25,000 of accounts receivable were written off as being uncollectible. In addition, $15,000 of the accounts that were written off in 2017 were unexpectedly collected in 2018. The December 31, 2017 adjusted balance in AFDA was a credit of $15,000. At its December 31, 2018 year-end, Tarpon had the following accounts receivable:

| Accounts | |

| Age (days) | Receivable |

| 1-30 | $100,000 |

| 31-60 | 50,000 |

| 61-90 | 25,000 |

| 91-120 | 60,000 |

| Over 120 | 15,000 |

|

Total |

$250,000 |

- Prepare journal entries to record the following 2018 transactions:

- The write-off of $25,000.

- The recovery of $15,000.

- Calculate the unadjusted balance in AFDA at December 31, 2018.

- Prepare the adjusting entry required at December 31, 2018 for each of the following scenarios:

- Bad debts at December 31, 2018 is based on three per cent of credit sales.

- Estimated uncollectible accounts at December 31, 2018 is estimated at five per cent of accounts receivable.

- Estimated uncollectible accounts at December 31, 2018 is calculated using the following aging analysis:

Estimated Loss Age (days) Percentage 2015-01-30 2% 31-60 4% 61-90 5% 91-120 10% Over 120 50%

- Calculate the December 31, 2018 adjusted balance in AFDA based on the adjustments prepared in 3(a), 3(b), and 3(c) above.

Click Here to View Solution

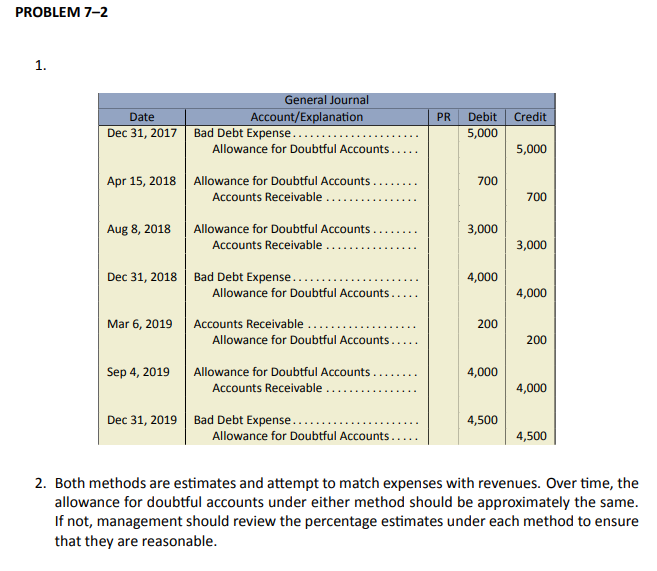

Ripter Co. Ltd. began operations on January 1, 2017. It had the following transactions during 2017, 2018, and 2019.

| Dec 31, 2017 | Estimated uncollectible accounts as $5,000 (calculated as 2% of sales) |

| Apr 15, 2018 | Wrote off the balance of Coulter, $700 |

| Aug 8, 2018 | Wrote off $3,000 of miscellaneous customer accounts as uncollectible |

| Dec 31, 2018 | Estimated uncollectible accounts as $4,000 (1.5% of sales) |

| Mar 6, 2019 | Recovered $200 from Coulter, whose account was written off in 2018; no further recoveries are expected |

| Sep 4, 2019 | Wrote off as uncollectible $4,000 of miscellaneous customer accounts |

| Dec 31, 2019 | Estimated uncollectible accounts as $4,500 (1.5% of sales). |

- Prepare journal entries to record the above transactions.

- Assume that management is considering a switch to the balance sheet method of calculating the allowance for doubtful accounts. Under this method, the allowance at the end of 2019 is estimated to be $2,000. Comment on the discrepancy between the two methods of estimating allowance for doubtful accounts.

Click Here to View Solution

The following balances are taken from the unadjusted trial balance of Cormrand Inc. at its year-end, December 31, 2016:

| Account Balances | ||||

| Debit | Credit | |||

| Accounts Receivable | $100,000 | |||

| Allowance for Doubtful Accounts | 1,800 | |||

| Sales (all on credit) | 750,000 | |||

| Sales Returns and Allowances | $22,000 | |||

The balance of a customer’s account in the amount of $1,000 is over 90 days past due and management has decided to write this account off.

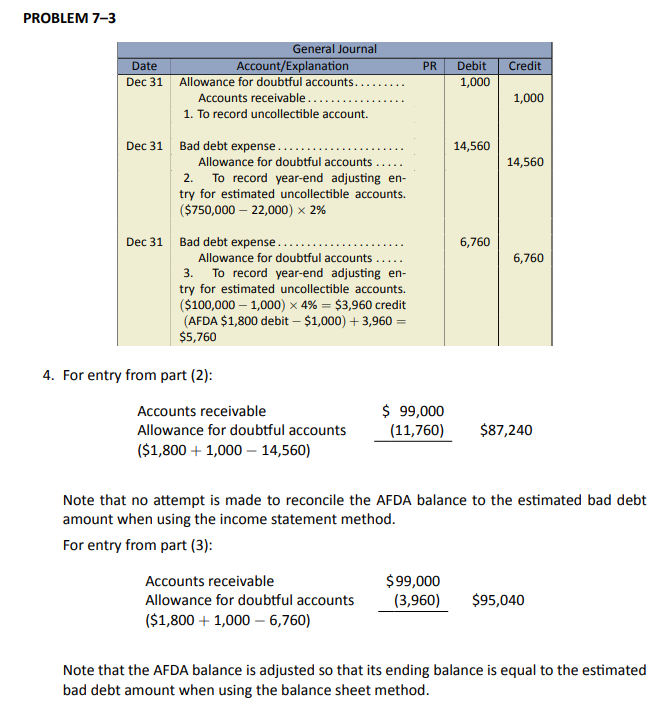

- Record the write-off of the uncollectible account.

- Record the adjusting entry if the bad debts are estimated to be 2% of sales.

- Record the adjusting entry if instead, the bad debts are estimated to be 4% of the adjusted accounts receivable balance as at December 31, 2016.

- Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the December 31, 2011, balance sheet for parts (1) and (2).

Click Here to View Solution

Below are transactions for Regal Co.:

| 2016 | |

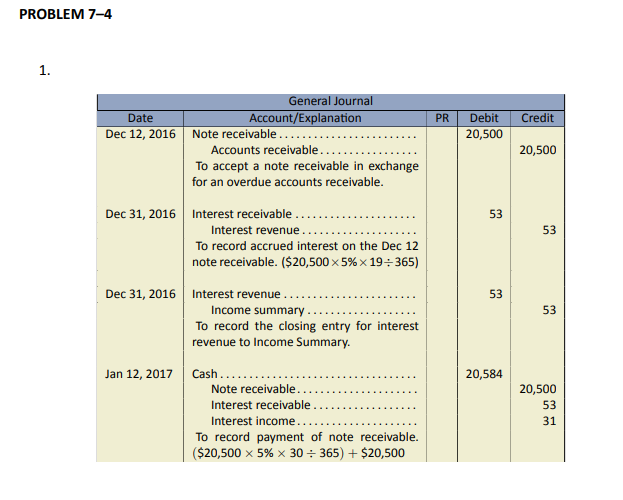

| Dec 12 | Accepted a $20,500, 30-day, 5% note dated this date from a customer in exchange for their past-due accounts receivable amount owing. |

| Dec 31 | Made an adjusting entry to record the accrued interest on the Dec 12 note. |

| Dec 31 | Closed the Interest Revenue account as part of the closing process at year-end. |

| 2017 | |

| Jan 12 | Received payment for the principal and interest on the note dated December 12. |

| Jan 14 | Accepted a $12,000, 6%, 60-day note dated this date for a sale to a customer with a higher credit risk. Cost of goods was $7,500. |

| Jan 31 | Made adjusting entries to record the accrued interest for January, 2017 for all outstanding notes receivable. |

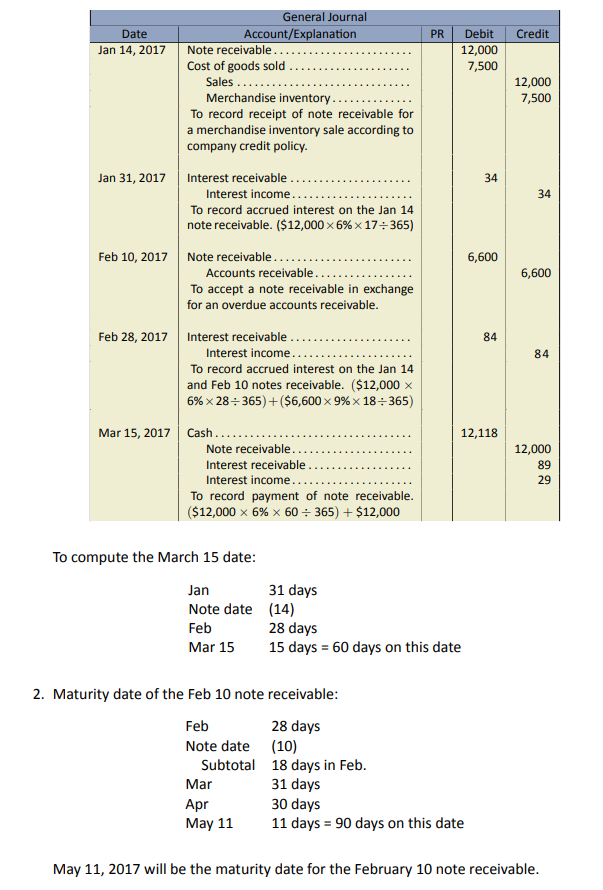

| Feb 10 | Accepted a $6,600, 90-day, 9% note receivable dated this day in exchange for his past-due account. |

| Feb 28 | Made adjusting entries to record the accrued interest for January, 2017 regarding any outstanding notes receivable. |

| ? | Received payment for the principal and interest on the note dated January 14. |

- Prepare the journal entries for the transactions above. Determine the maturity date of the January 14 note required for the journal entry. Round interest amounts to the nearest whole dollar for simplicity.

- Determine the maturity date of the February 10 note.

Click Here to View Solution

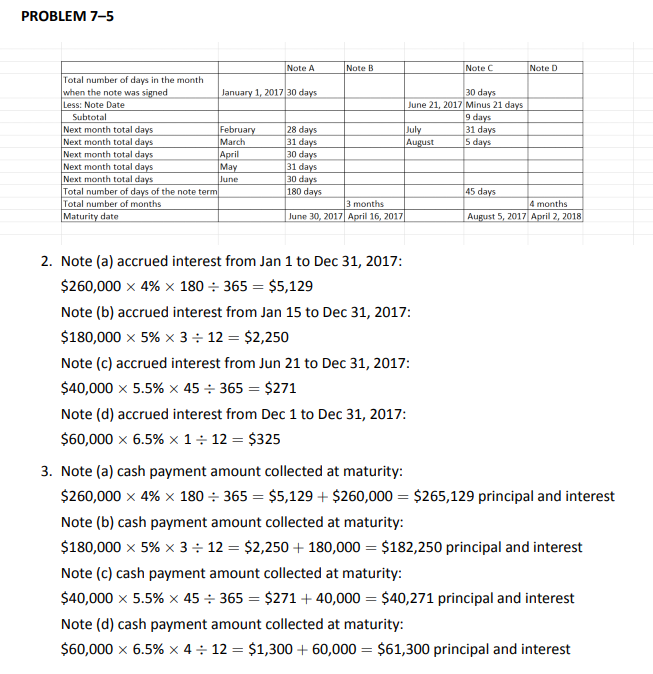

| Note Date | Face Value | Note Term | Interest Rate | Maturity Date | Accrued Interest | |

| Dec 31, 2016 | ||||||

| a) | Jan 1, 2017 | $260,000 | 180 days | 4.0% | ||

| b) | Jan 15, 2017 | 180,000 | 3 months | 5.0% | ||

| c) | Jun 21, 2017 | 40,000 | 45 days | 5.5% | ||

| d) | Dec 1, 2017 | 60,000 | 4 months | 6.5% |

- Determine the maturity date for each note.

- For each note, calculate the total amount of accrued interest from the note date to December 31, 2017 (the company year-end). Round interest to the nearest whole dollar.

- What is the amount that would be collected for each note, assuming that both interest and principal are collected at maturity?

Click Here to View Solution