Chapter 6

Internal Controls and Cash

This chapter focuses on the current assets of cash and receivables. Internal control over cash involves processes and procedures that include the use of a petty cash fund and the preparation of a bank reconciliation.

Chapter 6 Learning Objectives

- LO1 – Define internal control and explain how it is applied to cash.

- LO2 – Explain and journalize petty cash transactions.

- LO3 – Explain the purpose of and prepare a bank reconciliation, and record related adjustments.

Concept Self-Check

Use the following as a self-check while working through Chapter 6.

- What constitutes a good system of control over cash?

- What is a petty cash system and how is it used to control cash?

- How is petty cash reported on the balance sheet?

- How does the preparation of a bank reconciliation facilitate control over cash?

- What are the steps in preparing a bank reconciliation?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

6.1 Internal Control

LO1 – Define internal control and explain how it is applied to cash.

Assets are the lifeblood of a company. As such, they must be protected. This duty falls to managers of a company. The policies and procedures implemented by management to protect assets are collectively referred to as internal controls. An effective internal control program not only protects assets, but also aids in accurate recordkeeping, produces financial statement information in a timely manner, ensures compliance with laws and regulations, and promotes efficient operations. Effective internal control procedures ensure that adequate records are maintained, transactions are authorized, duties among employees are divided between recordkeeping functions and control of assets, and employees’ work is checked by others. The use of electronic recordkeeping systems does not decrease the need for good internal controls.

The effectiveness of internal controls is limited by human error and fraud. Human error can occur because of negligence or mistakes. Fraud is the intentional decision to circumvent internal control systems for personal gain. Sometimes, employees cooperate in order to avoid internal controls. This collusion is often difficult to detect, but fortunately, it is not a common occurrence when adequate controls are in place.

Internal controls take many forms. Some are broadly based, like mandatory employee drug testing, video surveillance, and scrutiny of company email systems. Others are specific to a particular type of asset or process. For instance, internal controls need to be applied to a company’s accounting system to ensure that transactions are processed efficiently and correctly to produce reliable records in a timely manner. Procedures should be documented to promote good recordkeeping, and employees need to be trained in the application of internal control procedures.

Financial statements prepared according to generally accepted accounting principles are useful not only to external users in evaluating the financial performance and financial position of the company, but also for internal decision making. There are various internal control mechanisms that aid in the production of timely and useful financial information. For instance, using a chart of accounts is necessary to ensure transactions are recorded in the appropriate account. As an example, expenses are classified and recorded in applicable expense accounts, then summarized and evaluated against those of a prior year.

The design of accounting records and documents is another important means to provide financial information. Financial data is entered and summarized in records and transmitted by documents. A good system of internal control requires that these records and documents be prepared at the time a transaction takes place or as soon as possible afterward, since they become less credible and the possibility of error increases with the passage of time. The documents should also be consecutively pre-numbered, to indicate whether there may be missing documents.

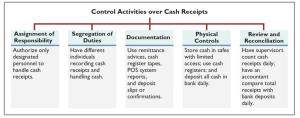

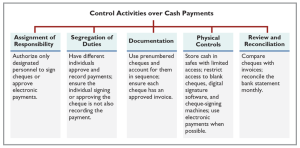

Internal control also promotes the protection of assets. Cash is particularly vulnerable to misuse. A good system of internal control for cash should provide adequate procedures for protecting cash receipts and cash payments (commonly referred to as cash disbursements). Procedures to achieve control over cash vary from company to company and depend upon such variables as company size, number of employees, and cash sources. However, effective cash control generally requires the following:

- Separation of duties: People responsible for handling cash should not be responsible for maintaining cash records. By separating the custodial and record-keeping duties, theft of cash is less likely.

- Same-day deposits: All cash receipts should be deposited daily in the company’s bank account. This prevents theft and personal use of the money before deposit.

- Payments made using non-cash means: Cheques or electronic funds transfer (EFT) provide a separate external record to verify cash disbursements. For example, many businesses pay their employees using electronic funds transfer because it is more secure and efficient than using cash or even cheques.

Two forms of internal control over cash will be discussed in this chapter: the use of a petty cash account and the preparation of bank reconciliations.

Learning Activity 6.1 – Internal Control

This Learning Activity gives you an opportunity to practice applying the requirements for effective cash control.

Instructions: Read each statement below and identify the correct requirement for effective cash control.

6.2 Petty Cash

LO2 – Explain and journalize petty cash transactions.

The payment of small amounts by cheque may be inconvenient and costly. For example, using cash to pay for postage on an incoming package might be less than the total processing cost of a cheque. A small amount of cash kept on hand to pay for small, infrequent expenses is referred to as a petty cash fund.

Establishing and Reimbursing the Petty Cash Fund

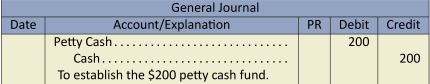

To set up the petty cash fund, a cheque is prepared for the amount of the fund. The custodian of the fund cashes the cheque and places the coins and currency in a locked box. Responsibility for the petty cash fund should be delegated to only one person, who should be held accountable for its contents. Cash payments are made by this petty cash custodian out of the fund as required when supported by receipts. When the amount of cash has been reduced to a pre-determined level, the receipts are compiled and submitted for entry into the accounting system. A cheque is then issued to reimburse the petty cash fund. At any given time, the petty cash amount should consist of cash and supporting receipts, all totalling the petty cash fund amount. To demonstrate the management of a petty cash fund, assume that a $200 cheque is issued for the purpose of establishing a petty cash fund.

The journal entry is:

Petty Cash is a current asset account. When reporting Cash on the financial statements, the balances in Petty Cash and Cash are added together and reported as one amount.

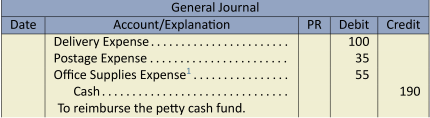

Assume the petty cash custodian has receipts totalling $190 and $10 in coin and currency remaining in the petty cash box. The receipts consist of the following: delivery charges $100, $35 for postage, and office supplies of $55. The petty cash custodian submits the receipts to the accountant who records the following entry and issues a cheque for $190:

The petty cash receipts should be cancelled at the time of reimbursement in order to prevent their reuse for duplicate reimbursements. The petty cash custodian cashes the $190 cheque. The $190 plus the $10 of coin and currency in the locked box immediately prior to reimbursement equals the $200 total required in the petty cash fund.

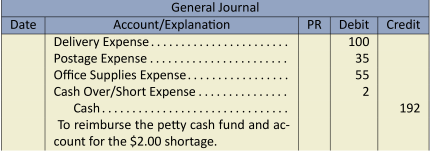

Sometimes, the receipts plus the coin and currency in the petty cash locked box do not equal the required petty cash balance. To demonstrate, assume the same information above except that the coin and currency remaining in the petty cash locked box was $8. This amount plus the receipts for $190 equals $198 and not $200, indicating a shortage in the petty cash box. The entry at the time of reimbursement reflects the shortage and is recorded as:

Notice that the $192 credit to Cash plus the $8 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $200 required total in the petty cash fund.

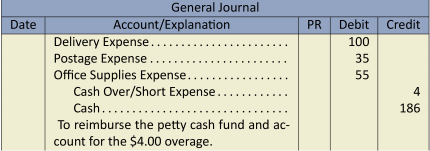

Assume, instead, that the coin and currency in the petty cash locked box was $14. This amount plus the receipts for $190 equals $204 and not $200, indicating an overage in the petty cash box. The entry at the time of reimbursement reflects the overage and is recorded as:

Again, notice that the $186 credit to Cash plus the $14 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $200 required total in the petty cash fund.

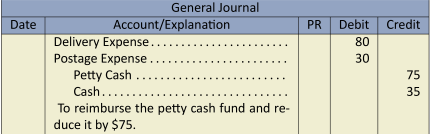

What happens if the petty cash custodian finds that the fund is rarely used? In such a case, the size of the fund should be decreased to reduce the risk of theft. To demonstrate, assume the petty cash custodian has receipts totalling $110 and $90 in coin and currency remaining in the petty cash box. The receipts consist of the following: delivery charges $80 and postage $30. The petty cash custodian submits the receipts to the accountant and requests that the petty cash fund be reduced by $75. The following entry is recorded and a cheque for $35 is issued:

The $35 credit to Cash plus the $90 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $125 new balance in the petty cash fund ($200 original balance less the $75 reduction).

In cases when the size of the petty cash fund is too small, the petty cash custodian could request an increase in the size of the petty cash fund at the time of reimbursement. Care should be taken to ensure that the size of the petty cash fund is not so large as to become a potential theft issue. Additionally, if a petty cash fund is too large, it may be an indicator that transactions that should be paid by cheque are not being processed in accordance with company policy. Remember that the purpose of the petty cash fund is to pay for infrequent expenses; day-to-day items should not go through petty cash.

6.3 Cash Collections and Payments

LO3 – Explain the purpose of and prepare a bank reconciliation, and record related adjustments.

The widespread use of banks facilitates cash transactions between entities and provides a safeguard for the cash assets being exchanged. This involvement of banks as intermediaries between entities has accounting implications. At any point in time, the cash balance in the accounting records of a particular company usually differs from the bank cash balance of that company. The difference is usually because some cash transactions recorded in the accounting records have not yet been recorded by the bank and, conversely, some cash transactions recorded by the bank have not yet been recorded in the company’s accounting records.

The use of a bank reconciliation is one method of internal control over cash. The reconciliation process brings into agreement the company’s accounting records for cash and the bank statement issued by the company’s bank. A bank reconciliation explains the difference between the balances reported by the company and by the bank on a given date.

A bank reconciliation proves the accuracy of both the company’s and the bank’s records, and reveals any errors made by either party. The bank reconciliation is a tool that can help detect attempts at theft and manipulation of records. The preparation of a bank reconciliation is discussed in the following section.

The Bank Reconciliation

The bank reconciliation is a report prepared by a company at a point in time. It identifies discrepancies between the cash balance reported on the bank statement and the cash balance reported in a business’s Cash account in the general ledger, more commonly referred to as the books. These discrepancies are known as reconciling items and are added or subtracted to either the book balance or bank balance of cash. Each of the reconciling items is added or subtracted to the business’s cash balance. The business’s cash balance will change as a result of the reconciling items. The cash balance prior to reconciliation is called the unreconciled cash balance. The balance after adding and subtracting the reconciling items is called the reconciled cash balance. The following is a list of potential reconciling items and their impact on the bank reconciliation.

| Book reconciling items | Bank reconciling items |

| Collection of notes receivable (added) | Outstanding deposits (added) |

| NSF cheques (subtracted) | Outstanding cheques (subtracted) |

| Bank charges (subtracted) | |

| Book errors (added or subtracted, | Bank errors (added or subtracted, |

| depending on the nature of the error) | depending on the nature of the error) |

Book Reconciling Items

The collection of notes receivable may be made by a bank on behalf of the company. These collections are often unknown to the company until they appear as an addition on the bank statement, and so cause the general ledger cash account to be understated. As a result, the collection of a notes receivable is added to the unreconciled book balance of cash on the bank reconciliation.

Cheques returned to the bank because there were not sufficient funds (NSF) to cover them appear on the bank statement as a reduction of cash. The company must then request that the customer pay the amount again. As a result, the general ledger cash account is overstated by the amount of the NSF cheque. NSF cheques must therefore be subtracted from the unreconciled book balance of cash on the bank reconciliation to reconcile cash.

Cheques received by a company and deposited into its bank account may be returned by the customer’s bank for a number of reasons (e.g., the cheque was issued too long ago, known as a stale-dated cheque, an unsigned or illegible cheque, or the cheque shows the wrong account number). Returned cheques cause the general ledger cash account to be overstated. These cheques are therefore subtracted on the bank statement, and must be deducted from the unreconciled book balance of cash on the bank reconciliation.

Bank service charges are deducted from the customer’s bank account. Since the service charges have not yet been recorded by the company, the general ledger cash account is overstated. Therefore, service charges are subtracted from the unreconciled book balance of cash on the bank reconciliation.

A business may incorrectly record journal entries involving cash. For instance, a deposit or cheque may be recorded for the wrong amount in the company records. These errors are often detected when amounts recorded by the company are compared to the bank statement. Depending on the nature of the error, it will be either added to or subtracted from the unreconciled book balance of cash on the bank reconciliation. For example, if the company recorded a cheque as $520 when the correct amount of the cheque was $250, the $270 difference would be added to the unreconciled book balance of cash on the bank reconciliation. Why? Because the cash balance reported on the books is understated by $270 as a result of the error. As another example, if the company recorded a deposit as $520 when the correct amount of the deposit was $250, the $270 difference would be subtracted from the unreconciled book balance of cash on the bank reconciliation. Why? Because the cash balance reported on the books is overstated by $270 as a result of the error. Each error requires careful analysis to determine whether it will be added or subtracted in the unreconciled book balance of cash on the bank reconciliation.

Bank Reconciling Items

Cash receipts are recorded as an increase of cash in the company’s accounting records when they are received. These cash receipts are deposited by the company into its bank. The bank records an increase in cash only when these amounts are actually deposited with the bank. Since not all cash receipts recorded by the company will have been recorded by the bank when the bank statement is prepared, there will be outstanding deposits, also known as deposits in transit. Outstanding deposits cause the bank statement cash balance to be understated. Therefore, outstanding deposits are a reconciling item that must be added to the unreconciled bank balance of cash on the bank reconciliation.

On the date that a cheque is prepared by a company, it is recorded as a reduction of cash in a company’s books. A bank statement will not record a cash reduction until a cheque is presented and accepted for payment (or clears the bank). Cheques that are recorded in the company’s books but are not paid out of its bank account when the bank statement is prepared are referred to as outstanding cheques. Outstanding cheques mean that the bank statement cash balance is overstated. Therefore, outstanding cheques are a reconciling item that must be subtracted from the unreconciled bank balance of cash on the bank reconciliation.

Bank errors sometimes occur and are not revealed until the transactions on the bank statement are compared to the company’s accounting records. When an error is identified, the company notifies the bank to have it corrected. Depending on the nature of the error, it is either added to or subtracted from the unreconciled bank balance of cash on the bank reconciliation. For example, if the bank cleared a cheque as $520 that was correctly written for $250, the $270 difference would be added to the unreconciled bank balance of cash on the bank reconciliation. Why? Because the cash balance reported on the bank statement is understated by $270 as a result of this error. As another example, if the bank recorded a deposit as $520 when the correct amount was actually $250, the $270 difference would be subtracted from the unreconciled bank balance of cash on the bank reconciliation. Why? Because the cash balance reported on the bank statement is overstated by $270 as a result of this specific error. Each error must be carefully analyzed to determine how it will be treated on the bank reconciliation.

Illustrative Problem—Bank Reconciliation

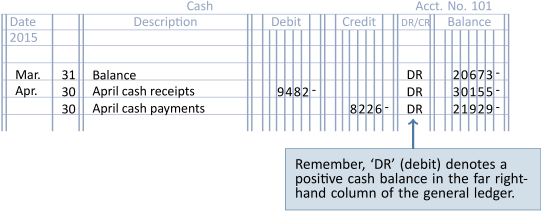

Assume that a bank reconciliation is prepared by Big Dog Carworks Corp. (BDCC) at April 30. At this date, the Cash account in the general ledger shows a balance of $21,929 and includes the cash receipts and payments shown in Figure 6.1:

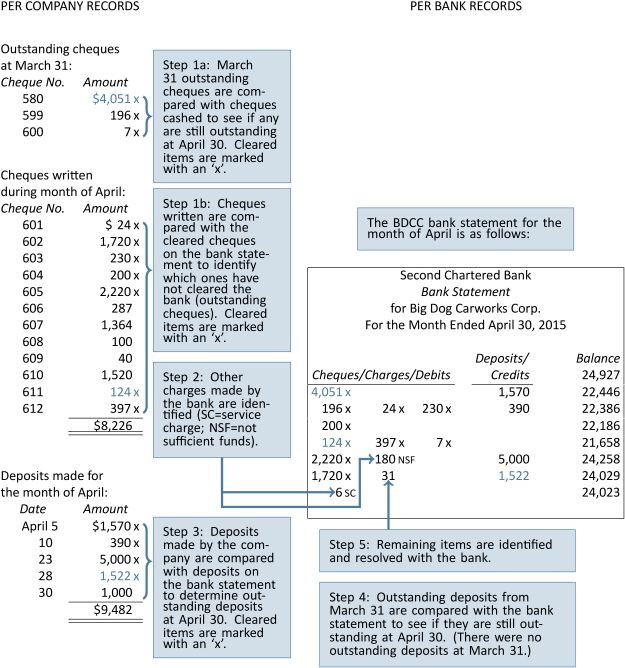

Extracts from BDCC’s accounting records are reproduced with the bank statement for April in Figure 6.2:

For each entry in BDCC’s general ledger Cash account, there should be a matching entry on its bank statement. Items in the general ledger Cash account but not on the bank statement must be reported as a reconciling item on the bank reconciliation. For each entry on the bank statement, there should be a matching entry in BDCC’s general ledger Cash account. Items on the bank statement but not in the general ledger Cash account must be reported as a reconciling item on the bank reconciliation.

There are nine steps to follow in preparing a bank reconciliation for BDCC at April 30, 2015:

Step 1

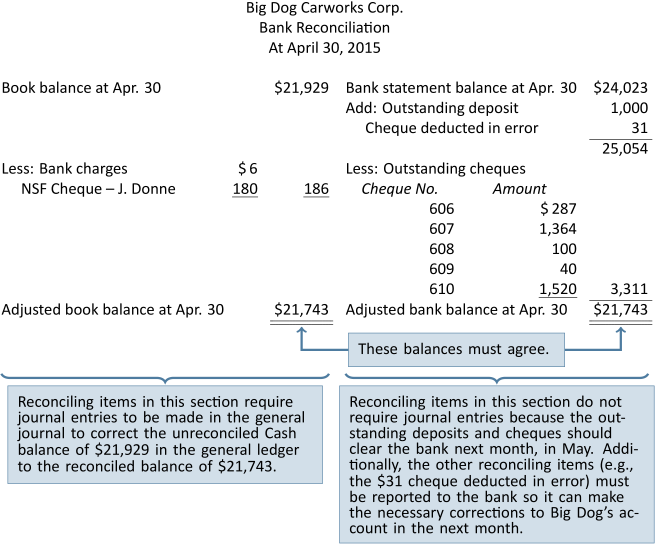

Identify the ending general ledger cash balance ($21,929 from Figure 6.1) and list it on the bank reconciliation as the book balance on April 30 as shown in Figure 6.3. This represents the unreconciled book balance.

Step 2

Identify the ending cash balance on the bank statement ($24,023 from Figure 6.2) and list it on the bank reconciliation as the bank statement balance on April 30 as shown in Figure 6.3. This represents the unreconciled bank balance.

Step 3

Cheques written that have cleared the bank are returned with the bank statement. These cheques are said to be cancelled because, once cleared, the bank marks them to prevent them from being used again. Cancelled cheques are compared to the company’s list of cash payments. Outstanding cheques are identified using two steps:

- Any outstanding cheques listed on the BDCC’s March 31 bank reconciliation are compared to the cheques listed on the April 30 bank statement.For BDCC, all of the March outstanding cheques (nos. 580, 599, and 600) were paid by the bank in April. Therefore, there are no reconciling items to include in the April 30 bank reconciliation. If one of the March outstanding cheques had not been paid by the bank in April, it would be subtracted as an outstanding cheque from the unreconciled bank balance on the bank reconciliation.

- The cash payments listed in BDCC’s accounting records are compared to the cheques on the bank statement. This comparison indicates that the following cheques are outstanding.

Cheque No. Amount 606 $ 287 607 1,364 608 100 609 40 610 1,520 Outstanding cheques must be deducted from the bank statement’s unreconciled ending cash balance of $24,023 as shown in Figure 6.3.

Step 4

Other payments made by the bank are identified on the bank statement and subtracted from the unreconciled book balance on the bank reconciliation.

- An examination of the April bank statement shows that the bank had deducted the NSF cheque of John Donne for $180. This is deducted from the unreconciled book balance on the bank reconciliation as shown in Figure 6.3.

- An examination of the April 30 bank statement shows that the bank had also deducted a service charge of $6 during April. This amount is deducted from the unreconciled book balance on the bank reconciliation as shown in Figure 6.3.

Step 5

Last month’s bank reconciliation is reviewed for outstanding deposits at March 31. There were no outstanding deposits at March 31. If there had been, the amount would have been added to the unreconciled bank balance on the bank reconciliation.

Step 6

The deposits shown on the bank statement are compared with the amounts recorded in the company records. This comparison indicates that the April 30 cash receipt amounting to $1,000 was deposited but it is not included in the bank statement. The outstanding deposit is added to the unreconciled bank balance on the bank reconciliation as shown in Figure 6.3.

Step 7

Any errors in the company’s records or in the bank statement must be identified and reported on the bank reconciliation.

An examination of the April bank statement shows that the bank deducted a cheque issued by another company for $31 from the BDCC bank account in error. Assume that when notified, the bank indicated it would make a correction in May’s bank statement.

The cheque deducted in error must be added to the bank statement balance on the bank reconciliation as shown in Figure 6.3.

Step 8

Total both sides of the bank reconciliation. The result must be that the book balance and the bank statement balance are equal or reconciled. These balances represent the adjusted balance.

The bank reconciliation in Figure 6.3 is the result of completing the preceding eight steps:

Step 9

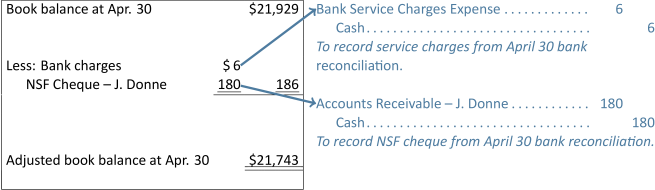

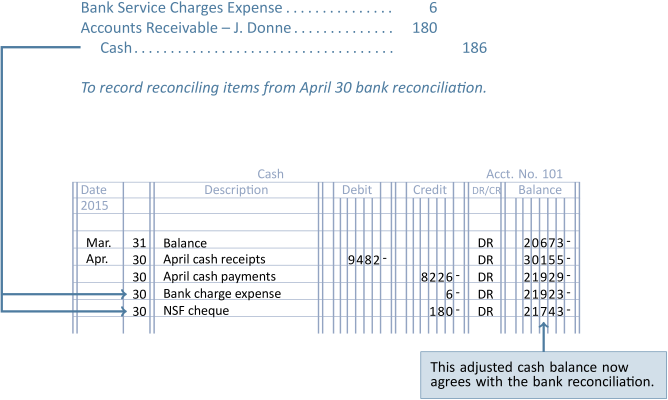

For the adjusted balance calculated in the bank reconciliation to appear in the accounting records, an adjusting entry(s) must be prepared.

The adjusting entry(s) is based on the reconciling item(s) used to calculate the adjusted book balance. The book balance side of BDCC’s April 30 bank reconciliation is copied to the left below to clarify the source of the following April 30 adjustments:

It is common practice to use one compound entry to record the adjustments resulting from a bank reconciliation as shown below for BDCC.

Once the adjustment is posted, the Cash general ledger account is up to date, as illustrated in Figure 6.4:

Note that the balance of $21,743 in the general ledger Cash account is the same as the adjusted book balance of $21,743 on the bank reconciliation. Big Dog does not make any adjusting entries for the reconciling items on the bank side of the bank reconciliation since these will eventually clear the bank and appear on a later bank statement. Bank errors will be corrected by the bank.

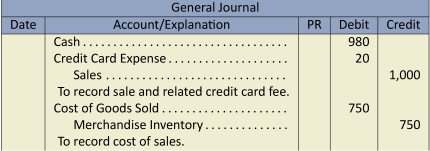

Debit and Credit Card Transactions

Debit and credit cards are commonly accepted by companies when customers make purchases. Because the cash is efficiently and safely transferred directly into a company’s bank account by the debit or credit card company, such transactions enhance internal control over cash. However, the seller is typically charged a fee for accepting debit and credit cards. For example, assume BDCC makes a $1,000 sale to a customer who uses a credit card that charges BDCC a fee of 2%; the cost of the sale is $750. BDCC would record:

The credit card fee is calculated as the ![]() . This means that BDCC collects net cash proceeds of $980 (

. This means that BDCC collects net cash proceeds of $980 (![]() ). The use of debit cards also involves fees and these would be journalized in the same manner.

). The use of debit cards also involves fees and these would be journalized in the same manner.

Summary of Chapter 6 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 6. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Define internal control and explain how it is applied to cash.

The purpose of internal controls is to safeguard the assets of a business. Since cash is a particularly vulnerable asset, policies and procedures specific to cash need to be implemented, such as the use of cheques and electronic funds transfer for payments, daily cash deposits into a financial institution, and the preparation of bank reconciliations.

LO2 – Explain and journalize petty cash transactions.

A petty cash fund is used to pay small, irregular amounts for which issuing a cheque would be inefficient. A petty cash custodian administers the fund by obtaining a cheque from the cash payments clerk. The cheque is cashed and the coin and currency placed in a locked box. The petty cash custodian collects receipts and reimburses individuals for the related amounts. When the petty cash fund is replenished, the receipts are compiled and submitted for entry in the accounting records so that a replacement cheque can be issued and cashed.

LO3 – Explain the purpose of and prepare a bank reconciliation, and record related adjustments.

A bank reconciliation is a form of internal control that reconciles the bank statement balance to the general ledger cash account, also known as the book balance. Reconciling items that affect the bank statement balance are outstanding deposits, outstanding cheques, and bank errors. Reconciling items that affect the book balance are collections made by the bank on behalf of the company, NSF cheques, bank service charges, and errors. Once the book and bank statement balances are reconciled, an adjusting entry is prepared based on the reconciling items affecting the book balance.

Review Questions

After reading through Chapter 6, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

- What is internal control?

- How does the preparation of a bank reconciliation strengthen the internal control of cash?

- What are some reconciling items that appear in a bank reconciliation?

- What are the steps in preparing a bank reconciliation?

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

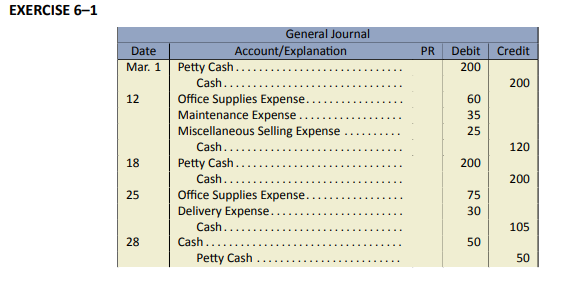

The following transactions were made by Landers Corp. in March 2017.

| Mar. 1 | Established a petty cash fund of $200 | |

| 12 | Reimbursed the fund for the following: | |

|

Postage |

$10 | |

|

Office supplies |

50 | |

|

Maintenance |

35 | |

|

Meals (selling expenses) |

25 | |

| $120 | ||

| 18 | Increased the fund by an additional $200 | |

| 25 | Reimbursed the fund for the following: | |

|

Office supplies |

$75 | |

|

Delivery charges |

30 | |

| $105 | ||

| 28 | Reduced the amount of the fund to $350. | |

Prepare journal entries to record the petty cash transactions.

Click Here to View Solution

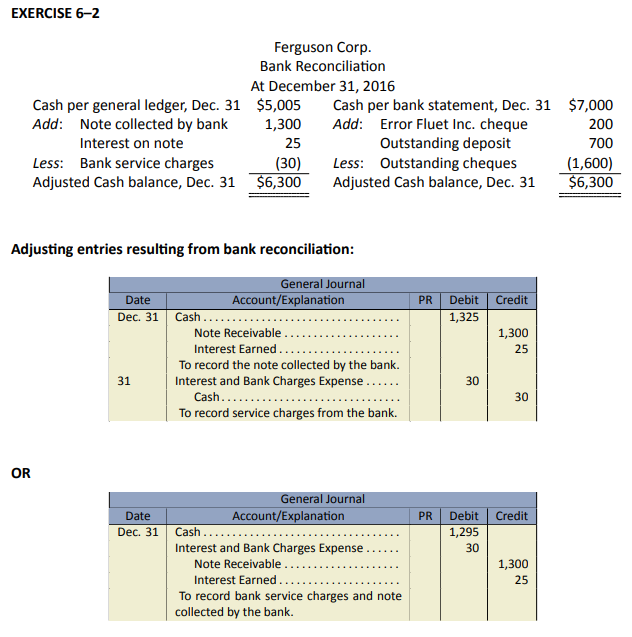

The following information pertains to Ferguson Corp. at December 31, 2016, its year-end:

| Cash per company records | $5,005 | ||

| Cash per bank statement | 7,000 | ||

| Bank service charges not yet recorded in company records | 30 | ||

| Note collected by bank not yet recorded in company records: | |||

|

Amount of note receivable |

$1,300 | ||

|

Amount of interest |

25 | 1,325 | |

| Fluet inc. cheque deducted in error by bank | 200 | ||

| December cheques not yet paid by bank in December: | |||

|

#631 |

$354 | ||

|

#642 |

746 | ||

|

#660 |

200 | ||

|

#661 |

300 | 1,600 | |

| December deposit recorded by the bank January 3, 2017 | 700 | ||

Prepare a bank reconciliation and all necessary adjusting entries at December 31, 2016.

Click Here to View Solution

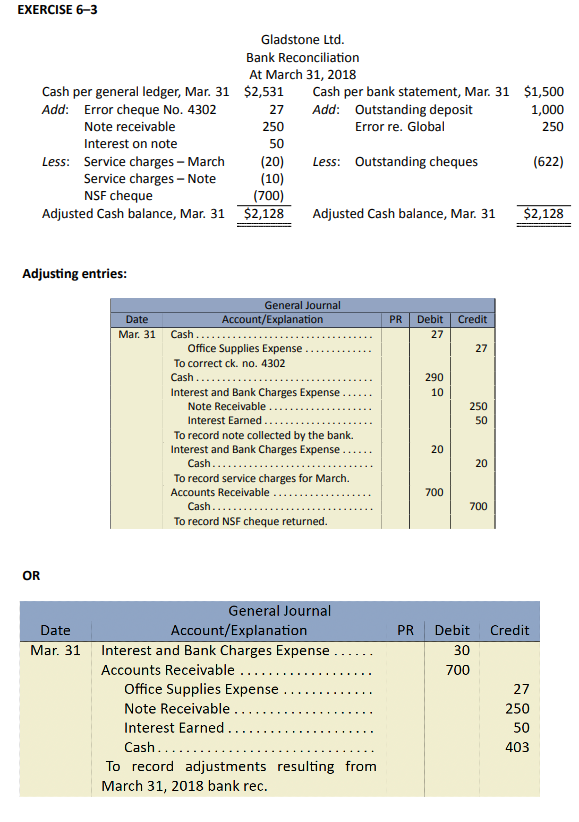

The Cash general ledger account balance of Gladstone Ltd. was $2,531 at March 31, 2018. On this same date, the bank statement had a balance of $1,500. The following discrepancies were noted:

- A deposit of $1,000 made on March 30, 2018 was not yet recorded by the bank on the March statement.

- A customer’s cheque amounting to $700 and deposited on March 15 was returned NSF with the bank statement.

- Cheque #4302 for office supplies expense, correctly made out for $125 and cleared the bank for this amount, was recorded in the company records incorrectly as $152.

- $20 for March service charges were recorded on the bank statement but not in the company records.

- A cancelled cheque for $250 belonging to Global Corp. but charged by the bank to Gladstone Ltd. was included with the cancelled cheques returned by the bank.

- There were $622 of outstanding cheques at March 31.

- The bank collected a net amount of $290: $250 regarding a note receivable, interest revenue of $50, and a $10 service charge that also is not included in the company records.

Click Here to View Solution

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 6. It is recommended that students review any relevant sections that they struggled with in answering these problems.

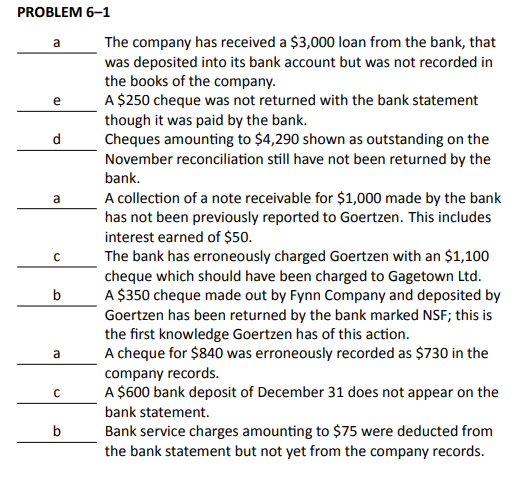

The reconciliation of the cash balance per bank statement with the balance in the Cash account in the general ledger usually results in one of five types of adjustments. These are

- Additions to the reported general ledger cash balance.

- Deductions from the reported general ledger cash balance.

- Additions to the reported cash balance per the bank statement.

- Deductions from the reported cash balance per the bank statement.

- Information that has no effect on the current reconciliation.

Using the above letters a to e from the list, indicate the appropriate adjustment for each of the following items that apply to Goertzen Ltd. for December, 2019:

| 1. The company has received a $3,000 loan from the bank that was deposited | |

| into its bank account but was not recorded in the company records. | |

| 2. A $250 cheque was not returned with the bank statement though it was | |

| paid by the bank. | |

| 3. Cheques amounting to $4,290 shown as outstanding on the November | |

| reconciliation still have not been returned by the bank. | |

| 4. A collection of a note receivable for $1,000 made by the bank has not been | |

| previously reported to Goertzen. This includes interest earned of $50. | |

| 5. The bank has erroneously charged Goertzen with a $1,100 cheque, which | |

| should have been charged to Gagetown Ltd. | |

| 6. A $350 cheque made out by Fynn Company and deposited by Goertzen has | |

| been returned by the bank marked NSF; this is the first knowledge | |

| Goertzen has of this action. | |

| 7. An $840 cheque from customer Abe Dobbs was incorrectly recorded as | |

| $730 in the company records. | |

| 8. A $600 bank deposit of December 31 does not appear on the bank | |

| statement. | |

| 9. Bank service charges amounting to $75 were deducted from the bank | |

| statement but not yet from the company records. |

Click Here to View Solution

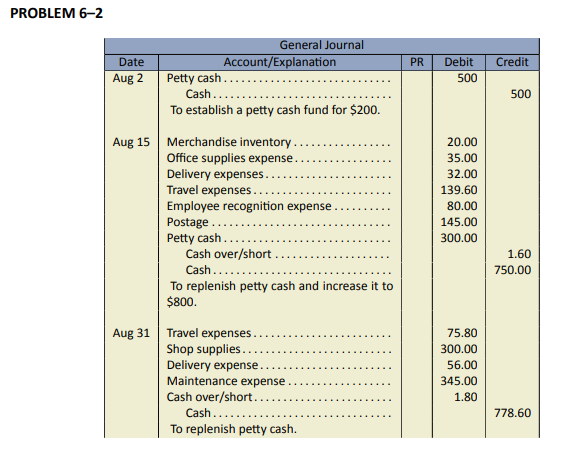

As of August 1, 2017, Bolchuk Buildings Ltd. decided that establishing a petty cash fund would be more efficient way to handle small day-to-day reimbursements. Below is a list of transactions during August:

| August 2 | Prepared and cashed a $500 cheque to establish the petty cash fund for the first time. |

| 3 | Purchased some office supplies for $35.00 for immediate use. |

| 4 | Paid $20.00 for delivery charges for some merchandise inventory purchased from a supplier, fob shipping point. |

| 6 | Reimbursed an employee $139.60 for travel expenses to attend an out of town meeting. |

| 8 | Paid a delivery charge of $32.00 regarding a sale to a customer. |

| 10 | Purchased a birthday cake for all the employees having a birthday in August as part of their employee recognition program. Cost was $80.00. |

| 14 | Paid $145.00 for postage to cover postage needs for the next 6 months. |

| 15 | Checked the petty cash and realized that it needed to be replenished so a cheque was issued to replenish the fund and increase it to $800.00. Petty cash currency was counted and totalled $50.00. |

| 17 | Reimbursed an employee $75.80 for company-related travel expenses. |

| 20 | Purchased shop supplies for $300.00 to replenish shop inventory. |

| 24 | Paid $56.00 to a courier company to deliver documents to a customer. |

| 28 | Paid $345.00 to repair a broken window. |

| 31 | Cheque issued to replenish petty cash. Petty cash was counted and totalled $20.00. |

Prepare journal entries with dates as needed to record the items above.

Click Here to View Solution

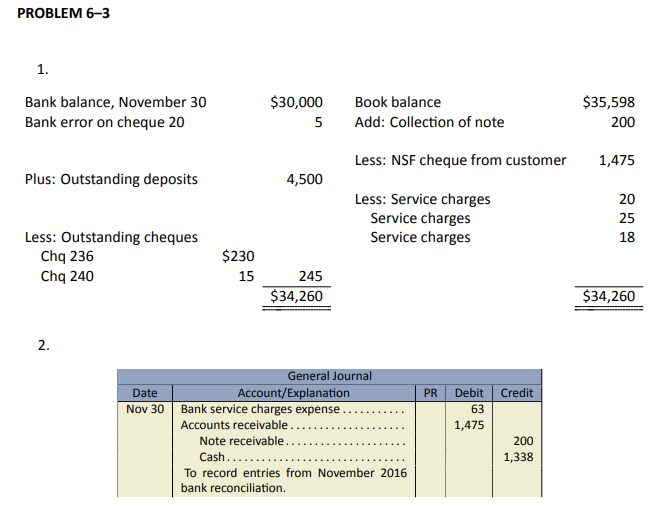

It was time for Trevrini Co. to complete its bank reconciliation for November 30, 2017. Below is information that may relate to the task:

- The cash balance as at November 30, 2017 was a debit balance of $35,598. The ending balance shown on the bank statement was $30,000.

- Cheques that were outstanding at November 30 were:

Chq 236 $230 Chq 240 15 - It was noted that Cheque 230 was recorded as $50 in the accounting records but was posted by the bank as $55 in error.

- The bank statement showed a deposit of $180 for a $200 non-interest bearing note that the bank had collected on behalf of the company, net of the $20 bank service charge for collection of the note. This was not yet recorded in the company’s books.

- The bank statement showed a deduction of $1,500 for a cheque from a customer for payment on account returned NSF. Included in this charge was a $25 NSF charge.

- The bank statement also showed a deduction of bank service charge fees of $18.

- A deposit recorded by the company for $4,500 did not yet appear in the bank statement.

- Prepare a bank reconciliation for the company as at November 30, 2017.

- Prepare any necessary journal entries as a result of the bank reconciliation.

Click Here to View Solution