Chapter 4

Completing the Accounting Cycle and Classifying Accounts

Chapters 1 through 3 discussed and illustrated the steps in the accounting cycle. They also discussed the concepts, assumptions, and procedures that provide a framework for financial accounting as a whole. Chapter 4 expands upon the content and presentation of financial statements. It reinforces what has been learned in previous chapters and introduces the classification or grouping of accounts on the balance sheet. At the end of the accounting period, after financial statements have been prepared, it is necessary to close temporary accounts to retained earnings. This process is introduced in this chapter, as is the preparation of a post-closing trial balance. The accounting cycle, the steps performed each accounting period that result in financial statements, is also reviewed. Chapter 4 expands on notes to the financial statements, the auditor’s report, and the management’s responsibility report which are all integral to meeting disclosure requirements.

Chapter 4 Learning Objectives

- LO1 – Use an adjusted trial balance to prepare financial statements.

- LO2 – Identify and explain the steps in the accounting cycle.

- LO3 – Explain the use of and prepare closing entries and a post-closing trial balance.

- LO4 – Explain the importance of and challenges related to basic financial statement disclosure.

- LO5 – Explain and prepare a classified balance sheet.

- LO6 – Explain the purpose and content of notes to financial statements.

- LO7 – Explain the purpose and content of the auditor’s report.

- LO8 – Explain the purpose and content of the report that describes management’s responsibility for financial statements.

Concept Self-Check

Use the following as a self-check while working through Chapter 4.

- What are the four closing entries and why are they journalized?

- Why is the Dividends account not closed to the income summary?

- When is a post-closing trial balance prepared?

- How is a post-closing trial balance different from an adjusted trial balance?

- What shapes and limits an accountant’s measurement of wealth?

- Are financial statements primarily intended for internal or external users?

- What is a classified balance sheet?

- What are the classifications within a classified balance sheet?

- What are current assets?

- What are non-current assets?

- What are current liabilities?

- What are long-term liabilities?

- What is the current-portion of a long-term liability?

- What is the purpose and content of the notes to the financial statements?

- What is the purpose and content of the auditor’s report?

- What is the purpose and content of the report that describes management’s responsibility for financial statements?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

4.1 Using the Adjusted Trial Balance to Prepare Financial Statements

LO1 – Use an adjusted trial balance to prepare financial statements.

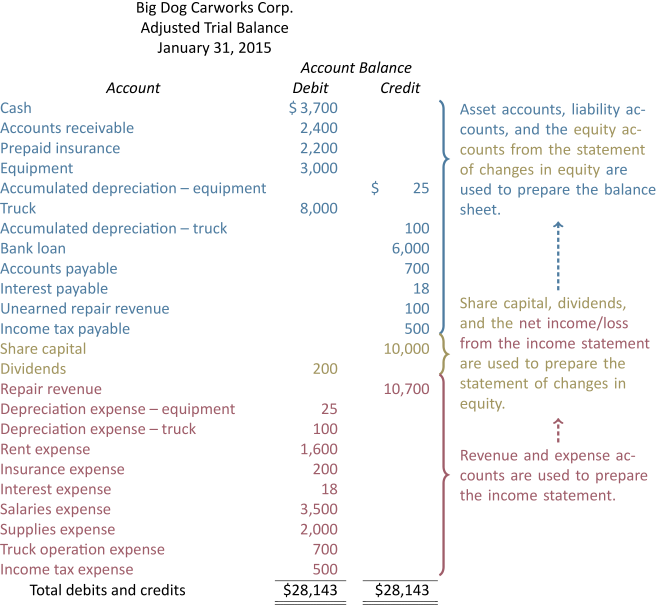

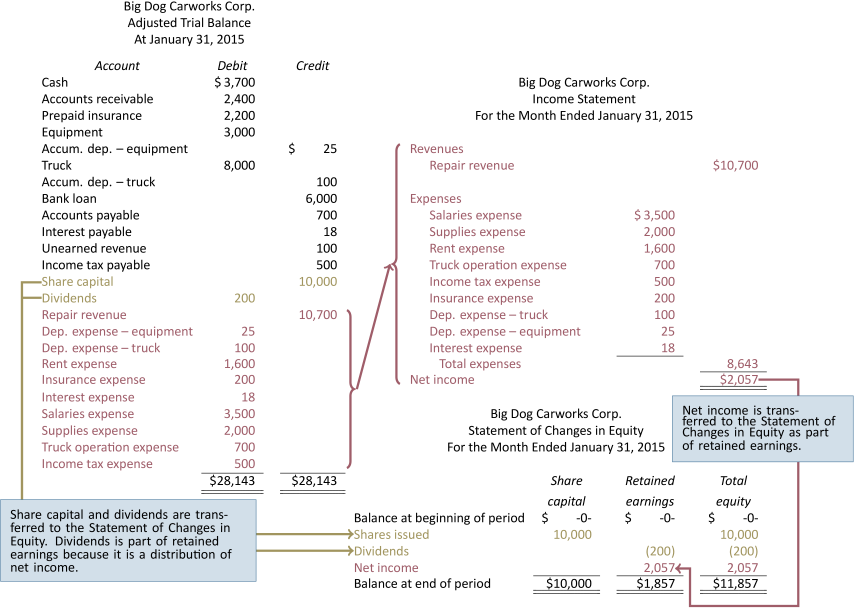

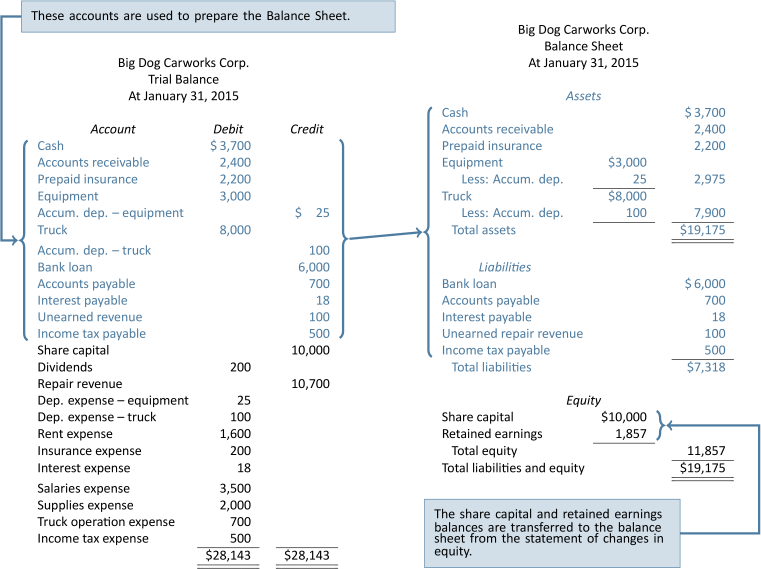

In the last section, we saw that the adjusted trial balance is prepared after journalizing and posting the adjusting entries. This section shows how financial statements are prepared using the adjusted trial balance:

The income statement is prepared first, followed by the statement of changes in equity as shown below:

The balance sheet can be prepared once the statement of changes in equity is complete:

Notice how accumulated depreciation is shown on the balance sheet.

4.2 The Accounting Cycle

LO2 – Identify and explain the steps in the accounting cycle.

The concept of the accounting cycle was introduced in Chapter 2. The accounting cycle consists of the steps followed each accounting period to prepare financial statements. These eight steps are:

Step 1: Transactions are analyzed and recorded in the general journal

Step 2: The journal entries in the general journal are posted to accounts in the general ledger

Step 3: An unadjusted trial balance is prepared to ensure total debits equal total credits

Step 4:The unadjusted account balances are analyzed and adjusting entries are journalized in the general journal and posted to the general ledger

Step 5: An adjusted trial balance is prepared to prove the equality of debits and credits

Step 6:The adjusted trial balance is used to prepare financial statements

Step 7: Closing entries are journalized and posted

Step 8: Prepare a post-closing trial balance

Steps 1 through 6 were introduced in this and the preceding chapters. Steps 7 and 8 are discussed in the next section.

Learning Activity 4.1 – Accounting Cycle

This Learning Activity gives you an opportunity to practice identifying each step of the accounting cycle

Instructions: Fill in each blank space with the correct step of the Accounting Cycle based on the information provided

4.3 The Closing Process

LO3 – Explain the use of and prepare closing entries and a post-closing trial balance.

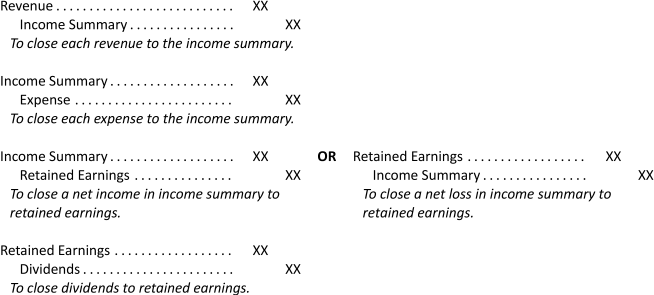

At the end of a fiscal year, after financial statements have been prepared, the revenue, expense, and dividend account balances must be zeroed so that they can begin to accumulate amounts belonging to the new fiscal year. To accomplish this, closing entries are journalized and posted. Closing entries transfer each revenue and expense account balance, as well as any balance in the Dividend account, into retained earnings. Revenues, expenses, and dividends are therefore referred to as temporary accounts because their balances are zeroed at the end of each accounting period. Balance sheet accounts, such as retained earnings, are permanent accounts because they have a continuing balance from one fiscal year to the next. The closing process transfers temporary account balances into a permanent account, namely retained earnings. The four entries in the closing process are detailed below.

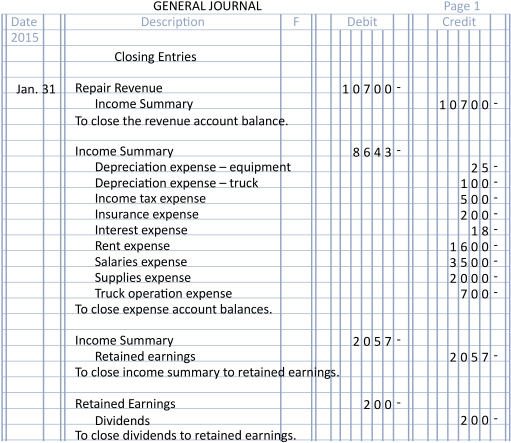

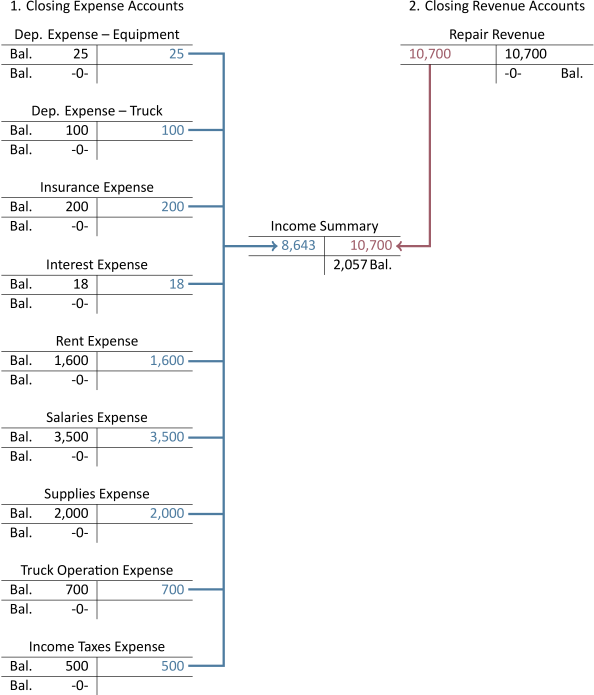

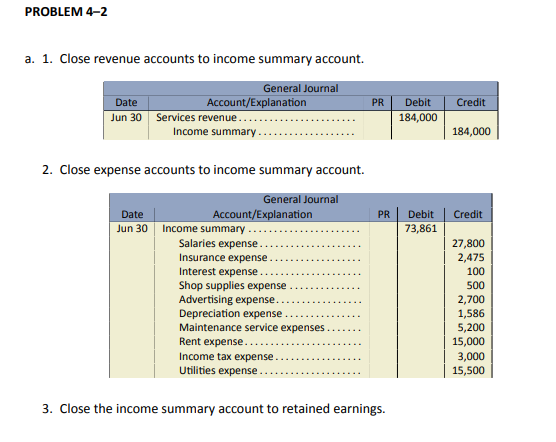

Entry 1: Close the revenue accounts to the income summary account

A single compound closing entry is used to transfer revenue account balances to the income summary account. The income summary is a checkpoint: once all revenue and expense account balances are transferred/closed to the income summary, the balance in the Income Summary account must be equal to the net income/loss reported on the income statement. If not, the revenues and expenses were not closed correctly.

Entry 2: Close the expense accounts to the Income Summary account

The expense accounts are closed in one compound closing journal entry to the Income Summary account. All expense accounts with a debit balance are credited to bring them to zero. Their balances are transferred to the Income Summary account as an offsetting debit.

After entries 1 and 2 above are posted to the Income Summary account, the balance in the income summary must be compared to the net income/loss reported on the income statement. If the income summary balance does not match the net income/loss reported on the income statement, the revenues and/or expenses were not closed correctly.

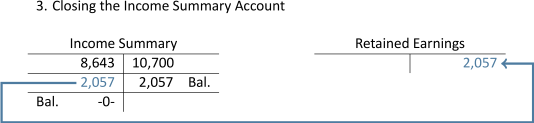

Entry 3: Close the income summary to retained earnings

The Income Summary account is closed to the Retained Earnings account. This procedure transfers the balance in the income summary to retained earnings. Again, the amount closed from the income summary to retained earnings must always equal the net income/loss as reported on the income statement.

Note that the Dividend account is not closed to the Income Summary account because dividends is not an income statement account. The dividend account is closed in Entry 4.

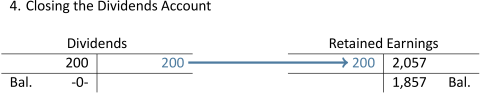

Entry 4: Close dividends to retained earnings

The Dividend account is closed to the Retained Earnings account. This results in transferring the balance in dividends, a temporary account, to retained earnings, a permanent account.

The balance in the Income Summary account is transferred to retained earnings because the net income (or net loss) belongs to the shareholders. The closing entries for Big Dog Carworks Corp. are shown in Figure 4.2:

Posting the Closing Entries to the General Ledger

When entries 1 and 2 are posted to the general ledger, the balances in all revenue and expense accounts are transferred to the Income Summary account. The transfer of these balances is shown in Figure 4.3. Notice that a zero balance results for each revenue and expense account after the closing entries are posted, and there is a $2,057 credit balance in the income summary. The income summary balance agrees to the net income reported on the income statement:

When the income summary is closed to retained earnings in the third closing entry, the $2,057 credit balance in the income summary account is transferred into retained earnings as shown in Figure 4.4. As a result, the income summary is left with a zero balance:

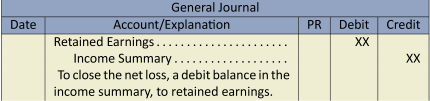

This example demonstrated closing entries when there was a net income. When there is a net loss, the Income Summary account will have a debit balance after revenues and expenses have been closed. To close the Income Summary account when there is a net loss, the following closing entry is required:

Finally, when dividends is closed to retained earnings in the fourth closing entry, the $200 debit balance in the Dividends account is transferred into retained earnings as shown in Figure 4.5. After the closing entry is posted, the Dividends account is left with a zero balance and retained earnings is left with a credit balance of $1,857. Notice that the $1,857 must agree to the retained earnings balance calculated on the statement of changes in equity:

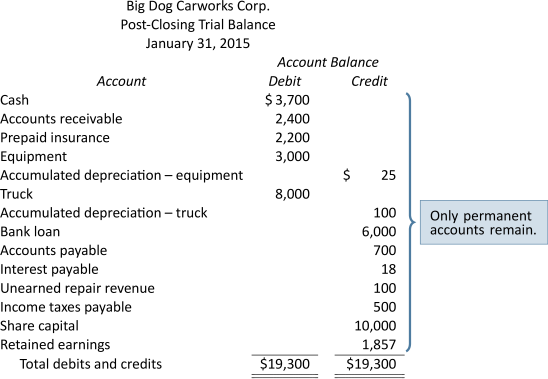

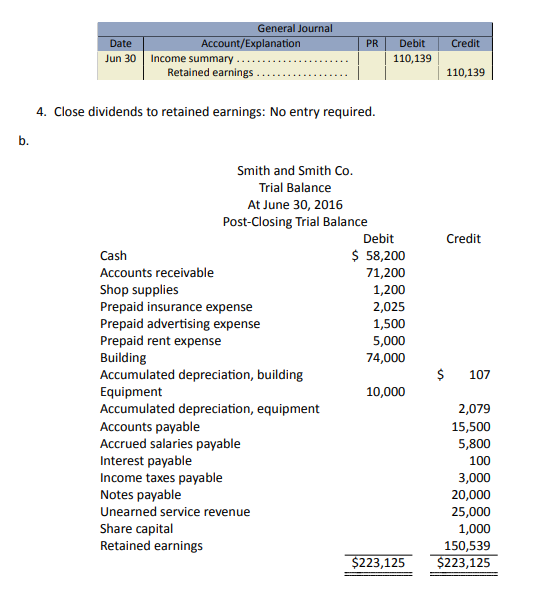

The Post–Closing Trial Balance

A post-closing trial balance is prepared immediately following the posting of closing entries. The purpose is to ensure that the debits and credits in the general ledger are equal and that all temporary accounts have been closed. The post-closing trial balance for Big Dog Carworks Corp. appears below:

Note that only balance sheet accounts, the permanent accounts, have balances and are carried forward to the next accounting year. All temporary accounts begin the new fiscal year with a zero balance, so they can be used to accumulate amounts belonging to the new time period.

Learning Activity 4.2 – Closing Entries and Post-Closing Trial Balance

This Learning Activity gives you an opportunity to help your understanding of closing entries and post-closing trial balances.

Instructions: Select the correct statement(s) as they apply to closing entries and post-closing trial balances.

4.4 Financial Statement Disclosure Decisions

LO4 – Explain the importance of and challenges related to basic financial statement disclosure.

Financial statements communicate information, with a focus on the needs of financial statement users such as a company’s investors and creditors. Accounting information should make it easier for management to allocate resources and for shareholders to evaluate management. A key objective of financial statements is to fairly present the entity’s economic resources, obligations, equity, and financial performance.

Fulfilling these objectives is challenging. Accountants must make a number of subjective decisions about how to apply generally accepted accounting principles. For example, they must decide how to measure wealth and how to apply recognition criteria. They must also make practical cost-benefit decisions about how much information is useful to disclose. Some of these decisions are discussed in the following section.

Making Accounting Measurements

Economists often define wealth as an increase or decrease in the entity’s ability to purchase goods and services. Accountants use a more specific measurement — they consider only increases and decreases resulting from actual transactions. If a transaction has not taken place, they do not record a change in wealth.

The accountant’s measurement of wealth is shaped and limited by the generally accepted accounting principles introduced and discussed in Chapter 1, including cost, the monetary unit, the business entity, timeliness, recognition, and going concern. These principles mean that accountants record transactions in one currency (for example, dollars). They assume the monetary currency retains its purchasing power. Changes in market values of assets are generally not recorded. The entity is expected to continue operating into the foreseeable future.

Economists, on the other hand, do recognize changes in market value. For example, if an entity purchased land for $100,000 that subsequently increased in value to $125,000, economists would recognize a $25,000 increase in wealth. International Financial Reporting Standards generally do not recognize this increase until the entity actually disposes of the asset; accountants would continue to value the land at its $100,000 purchase cost. This practice is based on the application of the cost principle, which is a part of GAAP.

Economic wealth is also affected by changes in the purchasing power of the dollar. For example, if the entity has cash of $50,000 at the beginning of a time period and purchasing power drops by 10% because of inflation, the entity has lost wealth because the $50,000 can purchase only $45,000 of goods and services. Conversely, the entity gains wealth if purchasing power increases by 10%. In this case, the same $50,000 can purchase $55,000 worth of goods and services. However, accountants do not record any changes because the monetary unit principle assumes that the currency unit is a stable measure.

Qualities of Accounting Information

Financial statements are focused primarily on the needs of external users. To provide information to these users, accountants make cost-benefit judgments. They use materiality considerations to decide how particular items of information should be recorded and disclosed. For example, if the costs associated with financial information preparation are too high or if an amount is not sufficiently large or important, a business might implement a materiality policy for various types of asset purchases to guide how such costs are to be recorded. For example, a business might have a materiality policy for the purchase of office equipment whereby anything costing $100 or less is expensed immediately instead of recorded as an asset. In this type of situation, purchases of $100 or less are recorded as an expense instead of an asset to avoid having to record depreciation expense, a cost-benefit consideration that will not impact decisions made by external users of the business’s financial statements.

Accountants must also make decisions based on whether information is useful. Is it comparable to prior periods? Is it verifiable? Is it presented with clarity and conciseness to make it understandable? Readers’ perception of the usefulness of accounting information is determined by how well those who prepare financial statements address these qualitative considerations.

Learning Activity 4.3 – Financial Statement Disclosure Decisions

This Learning Activity gives you an opportunity to check your understanding of statement disclosure decisions.

Instructions: Choose the correct answer for each question.

4.5 Classified Balance Sheet

LO5 – Explain and prepare a classified balance sheet.

The accounting cycle and double-entry accounting have been the focus of the preceding chapters. This chapter focuses on the presentation of financial statements, including how financial information is classified (the way accounts are grouped) and what is disclosed.

A common order for the presentation of financial statements is:

- Income statement

- Statement of changes in equity

- Balance sheet

- Statement of cash flows

- Notes to the financial statements

In addition, the financial statements are often accompanied by an auditor’s report and a statement entitled “Management’s Responsibility for Financial Statements.” Each of these items will be discussed below. Financial statement information must be disclosed for the most recent year with the prior year for comparison.

Because external users of financial statements have no access to the entity’s accounting records, it is important that financial statements be organized in a manner that is easy to understand. Thus, financial data are grouped into useful, similar categories within classified financial statements, as discussed below.

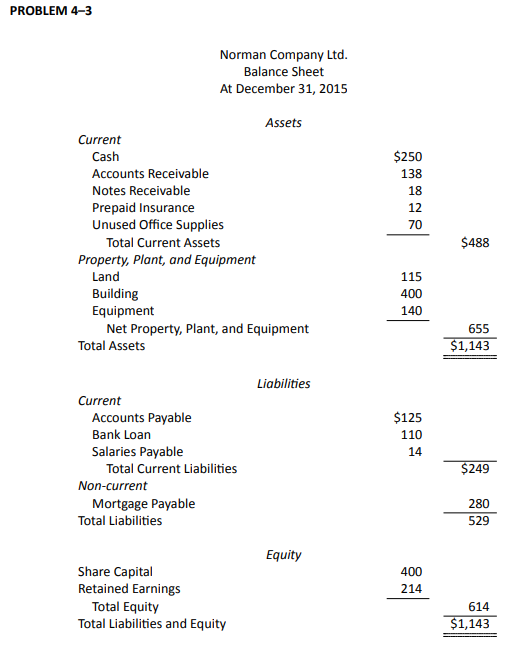

The Classified Balance Sheet

A classified balance sheet organizes the asset and liability accounts into categories. The previous chapters used an unclassified balance sheet which included only three broad account groupings: assets, liabilities, and equity. The classification of asset and liability accounts into meaningful categories is designed to facilitate the analysis of balance sheet information by external users. Assets and liabilities are classified as either current or non-current. Another common term for non-current is long-term. Non-current assets, also referred to as long-term assets, can be classified further into long-term investments; property, plant and equipment; and intangible assets. The asset and liability classifications are summarized below:

| Assets | Liabilities | |

| Non-current or long-term assets: | Non-current or long-term liabilities | |

|

Long-term investments |

||

|

Property, plant and equipment (PPE) |

||

|

Intangible assets |

Current Assets

Current assets are those resources that the entity expects to convert to cash, or to consume during the next year or within the operating cycle of the entity, whichever is longer. Examples of current assets include:

- cash, comprising paper currency and coins, deposits at banks, cheques, and money orders.

- short-term investments, the investment of cash that will not be needed immediately, in short-term, interest-bearing notes that are easily convertible into cash.

- accounts receivable that are due to be collected within one year.

- notes receivable, usually formalized account receivables — written promises to pay specified amounts with interest, and due to be collected within one year.

- merchandise inventory that is expected to be sold within one year.

The current asset category also includes accounts whose future benefits are expected to expire in a short period of time. These are not expected to be converted into cash, and include:

- prepaid expenses that will expire within the next year, usually consisting of advance payments for insurance, rent, and other similar items.

- supplies on hand at the end of an accounting year that will be used during the next year.

On the balance sheet, current assets are normally reported before non-current assets. They are listed by decreasing levels of liquidity — their ability to be converted into cash. Therefore, cash appears first under the current asset heading since it is already liquid.

Non-current Assets

Non-current assets are assets that will be useful for more than one year; they are sometimes referred to as long-lived assets. Non-current assets include property, plant, and equipment (PPE) items used in the operations of the business. Some examples of PPE are: a) land, b) buildings, c) equipment, and d) motor vehicles such as trucks.

Other types of non-current assets include long-term investments and intangible assets. Long-term investments are held for more than one year or the operating cycle and include long-term notes receivable and investments in shares and bonds. Intangible assets are resources that do not have a physical form and whose value comes from the rights held by the owner. They are used over the long term to produce or sell products and services and include copyrights, patents, trademarks, and franchises.

Current Liabilities

Current liabilities are obligations that must be paid within the next 12 months or within the entity’s next operating cycle, whichever is longer. They are shown first in the liabilities section of the balance sheet and listed in order of their due dates, with any bank loans shown first. Examples of current liabilities include:

- bank loans (or notes payable) that are payable on demand or due within the next 12 months

- accounts payable

- accrued liabilities such as interest payable and wages payable

- unearned revenue

- the current portion of long-term liabilities

- income taxes payable.

The current portion of a long-term liability is the principal amount of a long-term liability that is to be paid within the next 12 months. For example, assume a $24,000 note payable issued on January 1, 2015 where principal is repaid at the rate of $1,000 per month over two years. The current portion of this note on the January 31, 2015 balance sheet would be $12,000 (calculated as 12 months X $1,000/month). The remaining principal would be reported on the balance sheet as a long-term liability.

Non-Current or Long-Term Liabilities

Non-current liabilities, also referred to as long-term liabilities, are borrowings that do not require repayment for more than one year, such as the long-term portion of a bank loan or a mortgage. A mortgage is a liability that is secured by real estate.

Equity

The equity section of the classified balance sheet consists of two major accounts: share capital and retained earnings.

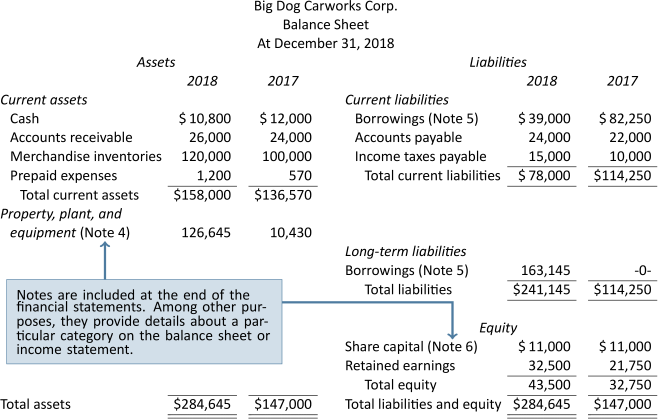

The following illustrates the presentation of Big Dog Carworks Corp.’s classified balance sheet after several years of operation:

The balance sheet can be presented in the account form balance sheet, as shown above where liabilities and equities are presented to the right of the assets. An alternative is the report form balance sheet where liabilities and equity are presented below the assets.

The Classified Income Statement

Recall that the income statement summarizes a company’s revenues less expenses over a period of time. An income statement for BDCC was presented in Chapter 1 as copied below.

| Big Dog Carworks Corp. | ||

| Income Statement | ||

| For the Month Ended January 31, 2015 | ||

| Revenues | ||

|

Repair revenues |

$10,000 | |

| Expenses | ||

|

Rent expense |

$1,600 | |

|

Salaries expense |

3,500 | |

|

Supplies expense |

2,000 | |

|

Fuel expense |

700 | |

|

Total expenses |

7,800 | |

| Net income | $2,200 | |

The format used above was sufficient to disclose relevant financial information for Big Dog’s simple start-up operations. Like the classified balance sheet, an income statement can be classified as well as prepared with comparative information.

Regardless of the type of financial statement, any items that are material must be disclosed separately so users will not otherwise be misled. Materiality is a matter for judgment. Office supplies of $2,000 per month used by BDCC in January 2015 might be a material amount and therefore disclosed as a separate item on the income statement for the month ended January 31, 2015. If annual revenues grew to $1 million, $2,000 per month for supplies might be considered immaterial. These expenditures would then be grouped with other similar items and disclosed as a single amount.

Learning Activity 4.4 – Classified Balance Sheet

This Learning Activity gives you an opportunity to check your understanding of classified balance sheets

Instructions: Choose the correct response for each question.

4.6 Notes to Financial Statements

LO6 – Explain the purpose and content of notes to financial statements.

As an integral part of its financial statements, a company provides notes to the financial statements. In accordance with the disclosure principle, notes to the financial statements provide relevant details that are not included in the body of the financial statements. For instance, details about property, plant, and equipment are shown in Note 4 in the following sample notes to the financial statements. The notes help external users understand and analyze the financial statements.

Although a detailed discussion of disclosures that might be included as part of the notes is beyond the scope of an introductory financial accounting course, a simplified example of note disclosure is shown below for Big Dog Carworks Corp.

Big Dog Carworks Corp.

Notes to the Financial Statements

For the Year Ended December 31, 2018

- Nature of operations

The principal activity of Big Dog Carworks Corp. is the servicing and repair of vehicles. - General information and statement of compliance with IFRS

Big Dog Carworks Corp. is a limited liability company incorporated and domiciled in Canada. Its registered office and principal place of business is 123 Fox Street, Owlseye, Alberta, T1K 0L1, Canada. Big Dog Carworks Corp.’s shares are listed on the Toronto Stock Exchange.The financial statements of Big Dog Carworks Inc. have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued the International Accounting Standards Boards (IASB).The financial statements for the year ended December 31, 2018 were approved and authorised for issue by the board of directors on March 17, 2019. - Summary of accounting policies

The financial statements have been prepared using the significant accounting policies and measurement bases summarized below.- Revenue – Revenue arises from the rendering of service. It is measured by reference to the fair value of consideration received or receivable.

- Operating expenses- Operating expenses are recognized in the income statement upon utilization of the service or at the date of their origin.

- Borrowing costs – Borrowing costs directly attributable to the acquisition, construction, or production of property, plant, and equipment are capitalized during the period of time that is necessary to complete and prepare the asset for its intended use or sale. Other borrowing costs are expensed in the period in which they are incurred and reported as interest expense.

- Property, plant, and equipment – Land held for use in production or administration is stated at cost. Other property, plant, and equipment are initially recognized at acquisition cost plus any costs directly attributable to bringing the assets to the locations and conditions necessary to be employed in operations. They are subsequently measured using the cost model: cost less subsequent depreciation.Depreciation is recognized on a straight-line basis to write down the cost, net of estimated residual value. The following useful lives are applied:

- Buildings: 25 years

- Equipment: 10 years

- Truck: 5 years

Residual value estimates and estimates of useful life are updated at least annually.

- Income taxes – Current income tax liabilities comprise those obligations to fiscal authorities relating to the current or prior reporting periods that are unpaid at the reporting date. Calculation of current taxes is based on tax rates and tax laws that have been enacted or substantively enacted by the end of the reporting period.

- Share capital- Share capital represents the nominal value of shares that have been issued.

- Estimation uncertainty – When preparing the financial statements, management undertakes a number of judgments, estimates, and assumptions about the recognition and measurement of assets, liabilities, income, and expenses. Information about estimates and assumptions that have the most significant effect on recognition and measurement of assets, liabilities, income, and expenses is provided below. Actual results may be substantially different.

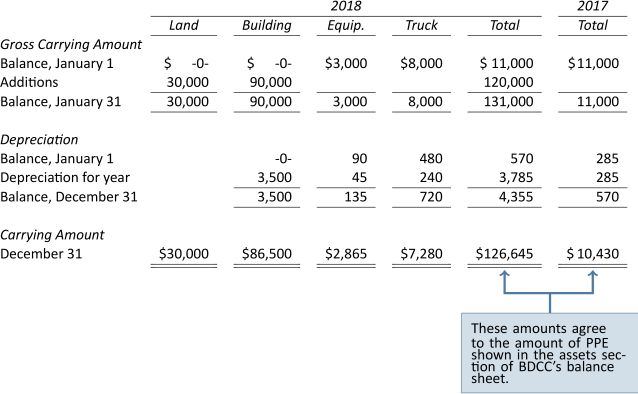

- Property, plant, and equipment – Details of the company’s property, plant, and equipment and their carrying amounts at December 31 are as follows:

- Borrowings – Borrowings include the following financial liabilities measured at cost:

Current Non-Current 2018 2017 2018 2017 Demand bank loan $ 20,000 $ 52,250 $ -0- $ -0- Subordinated shareholder loan 13,762 30,000 -0- -0- Mortgage 5,238 -0- 163,145 -0- Total carrying amount

$39,000 $82,250 $163,145 $ -0- The bank loan is due on demand and bears interest at 6% per year. It is secured by accounts receivable and inventories of the company.

The shareholder loan is due on demand, non-interest bearing, and unsecured.

The mortgage is payable to First Bank of Capitalville. It bears interest at 5% per year and is amortized over 25 years. Monthly payments including interest are $960. It is secured by land and buildings owned by the company. The terms of the mortgage will be re-negotiated in 2021.

- Share capital – The share capital of Big Dog Carworks Corp. consists of fully-paid common shares with a stated value of $1 each. All shares are eligible to receive dividends, have their capital repaid, and represent one vote at the annual shareholders’ meeting. There were no shares issued during 2017 or 2018.

Learning Activity 4.5 – Accounts Classifications

This Learning Activity gives you an opportunity to apply what you have learned about accounts classifications

Instructions: Classify each account from the selection of terms below.

4.7 Auditor’s Report

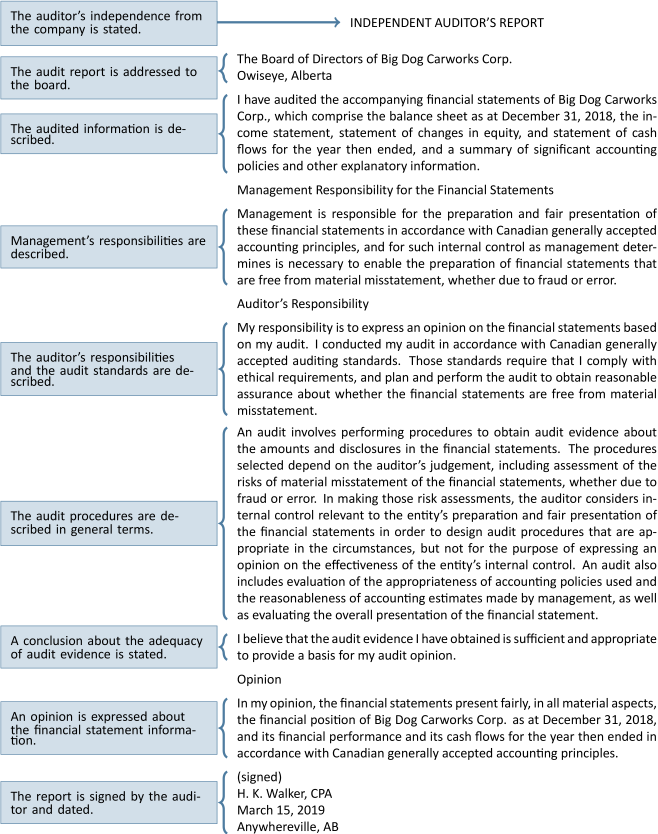

LO7 – Explain the purpose and content of the auditor’s report.

Financial statements are often accompanied by an auditor’s report. An audit is an external examination of a company’s financial statement information and its system of internal controls.

Internal controls are the processes instituted by management of a company to direct, monitor, and measure the accomplishment of its objectives. This includes the prevention and detection of fraud and error. An audit seeks not certainty, but reasonable assurance that the financial statement information is not materially misstated.

The auditor’s report is a structured statement issued by an independent examiner, usually a professional accountant, who is contracted by the company to report the audit’s findings to the company’s board of directors. An audit report provides some assurance to present and potential investors and creditors that the company’s financial statements are trustworthy. Therefore, it is a useful means to reduce the risk of their financial decisions.

An example of an unqualified auditor’s report for BDCC is shown below, along with a brief description of each component. Put in simple terms, an unqualified auditor’s report indicates that the financial statements are truthful and a qualified auditor’s report is one that indicates the financial statements are not or may not be truthful:

Learning Activity 4.6 – Auditor’s Report

This Learning Activity gives you an opportunity to assess how well you understood the information about auditor’s reports.

Instructions: Choose the correct answer from the options provided.

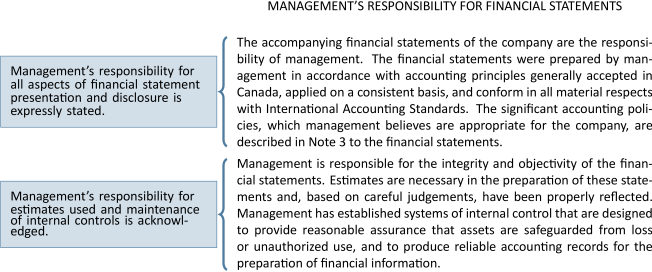

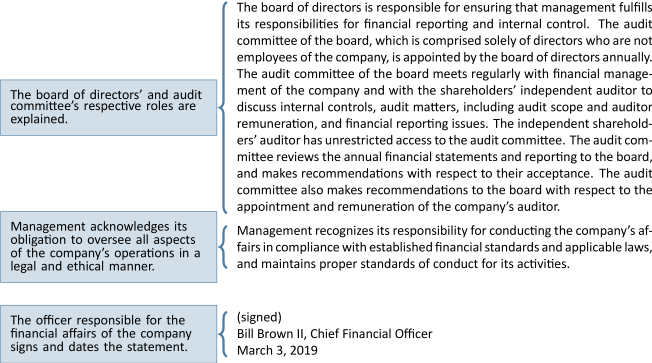

4.8 Management’s Responsibility for Financial Statements

LO8 – Explain the purpose and content of the report that describes management’s responsibility for financial statements.

The final piece of information often included with the annual financial statements is a statement describing management’s responsibility for the accurate preparation and presentation of financial statements. This statement underscores the division of duties involved with the publication of financial statements. Management is responsible for preparing the financial statements, including estimates that underlie the accounting numbers. An example of an estimate is the useful life of long-lived assets in calculating depreciation.

The independent auditor is responsible for examining the financial statement information as prepared by management, including the reasonableness of estimates, and then expressing an opinion on their accuracy. In some cases, the auditor may assist management with aspects of financial statement preparation. For instance, the auditor may provide guidance on how a new accounting standard will affect financial statement presentation or other information disclosure. Ultimately, however, the preparation of financial statements is management’s responsibility.

An example of a statement describing management’s responsibility for the preparation and presentation of annual financial statements is shown below:

Summary of Chapter 4 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 4. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Use an adjusted trial balance to prepare financial statements.

Financial statements are prepared based on adjusted account balances.

LO2 – Identify and explain the steps in the accounting cycle.

The steps in the accounting cycle are followed each accounting period in the recording and reporting of financial transactions. The steps are:

- Transactions are analyzed and recorded in the general journal.

- The journal entries in the general journal are posted to accounts in the general ledger.

- An unadjusted trial balance is prepared to ensure total debits equal total credits.

- The unadjusted account balances are analyzed, and adjusting entries are journalized in the general journal and posted to the general ledger.

- An adjusted trial balance is prepared to prove the equality of debits and credits.

- The adjusted trial balance is used to prepare financial statements.

- Closing entries are journalized and posted.

- Prepare a post-closing trial balance.

LO3 – Explain the use of and prepare closing entries and a post-closing trial balance.

After the financial statements have been prepared, the temporary account balances (revenues, expenses, and dividends) are transferred to retained earnings, a permanent account, via closing entries. The result is that the temporary accounts will have a zero balance and will be ready to accumulate transactions for the next accounting period. The four closing entries are:

The post-closing trial balance is prepared after the closing entries have been posted to the general ledger. The post-closing trial balance will contain only permanent accounts because all the temporary accounts have been closed.

LO4 – Explain the importance of and challenges related to basic financial statement disclosure.

The objective of financial statements is to communicate information to meet the needs of external users. In addition to recording and reporting verifiable financial information, accountants make decisions regarding how to measure transactions. Applying GAAP can present challenges when judgment must be applied as in the case of cost-benefit decisions and materiality.

LO5 – Explain and prepare a classified balance sheet.

A classified balance sheet groups assets and liabilities as follows:

| Assets: | Liabilities: |

| Current assets | Current liabilities |

Non-current assets:

|

Non-current or long-term liabilities |

Current assets are those that are used within one year or one operating cycle, whichever is longer, and include cash, accounts receivables, and supplies. Non-current assets are used beyond one year or one operating cycle. There are three types of non-current assets: property, plant, and equipment (PPE), long-term investments, and intangible assets. Long-term investments include investments in shares and bonds. Intangible assets are rights held by the owner and do not have a physical substance; they include copyrights, patents, franchises, and trademarks. Current liabilities must be paid within one year or one operating cycle, whichever is longer. Long-term liabilities are paid beyond one year or one operating cycle. Income statements are also classified

LO6 – Explain the purpose and content of notes to financial statements.

In accordance with the GAAP principle of full disclosure, relevant details not contained in the body of financial statements are included in the accompanying notes to financial statements. Notes would include a summary of accounting policies, details regarding property, plant, and equipment assets, and specifics about liabilities such as the interest rates and repayment terms.

LO7 – Explain the purpose and content of the auditor’s report.

An audit as it relates to the auditor’s report is an external examination of a company’s financial statement information and its system of internal controls. Internal controls are the processes instituted by management of a company to direct, monitor, and measure the accomplishment of its objectives including the prevention and detection of fraud and error. The auditor’s report provides some assurance that the financial statements are trustworthy. In simple terms, an unqualified auditor’s report indicates that the financial statements are truthful and a qualified auditor’s report is one that indicates the financial statements are not or may not be truthful.

LO8 – Explain the purpose and content of the report that describes management’s responsibility for financial statements.

This report makes a statement describing management’s responsibility for the accurate preparation and presentation of financial statements.

Review Questions

After reading through Chapter 4, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

Refer to the Big Dog Carworks Corp. financial statements for the year ended December 31, 2018 and other information included in this chapter to answer the following questions.

- Identify the economic resources of Big Dog Carworks Corp. in its financial statements.

- What comprise the financial statements of BDCC?

- Why does BDCC prepare financial statements?

- From the balance sheet at December 31, 2018 extract the appropriate amounts to complete the following accounting equation:ASSETS = LIABILITIES + EQUITY

- If ASSETS – LIABILITIES = NET ASSETS, how much is net assets at December 31, 2018? Is net assets synonymous with equity?

- What types of assets are reported by Big Dog Carworks Corp.? What types of liabilities?

- What kind of assumptions is made by Big Dog Carworks Corp. about asset capitalisation? Over what periods of time are assets being amortized?

- What adjustments might management make to the financial information when preparing the annual financial statements? Consider the following categories:

- Current asset accounts.

- Non-current asset accounts.

- Current liability accounts.

- Non-current liability accounts.

Indicate several examples in each category. Use the BDCC balance sheet and notes 3 and 5 for ideas.

- What are the advantages of using a classified balance sheet? Why are current accounts shown before non-current ones on BDCC’s balance sheet?

- How does Big Dog Carworks Corp. make it easier to compare information from one time period to another?

- Who is the auditor of BDCC? What does the auditor’s report tell you about BDCC’s financial statements? Does it raise any concerns?

- What does the auditor’s report indicate about the application of generally accepted accounting principles in BDCC’s financial statements?

- What is BDCC management’s responsibility with respect to the company’s financial statements? Do the financial statements belong to management? the auditor? the board of directors? shareholders?

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

| Debit | Credit | |||||

| Accounts payable | $ | 23,250 | ||||

| Accounts receivable | $ | 106,800 | ||||

| Accrued salaries payable | 8,700 | |||||

| Accumulated depreciation, building | 200 | |||||

| Accumulated depreciation, equipment | 3,200 | |||||

| Advertising expense | 4,050 | |||||

| Building | 111,000 | |||||

| Cash | 87,300 | |||||

| Cash dividends | 5,000 | |||||

| Depreciation expense | 2,380 | |||||

| Equipment | 15,000 | |||||

| Income tax expense | 4,500 | |||||

| Income taxes payable | 4,500 | |||||

| Insurance expense | 3,700 | |||||

| Interest expense | 150 | |||||

| Interest payable | 150 | |||||

| Repair expense | 7,800 | |||||

| Notes payable | 30,000 | |||||

| Office supplies | 1,800 | |||||

| Prepaid insurance expense | 12,790 | |||||

| Rent expense | 22,500 | |||||

| Retained earnings | 65,470 | |||||

| Salaries expense | 41,700 | |||||

| Service revenue | 276,000 | |||||

| Share capital | 1,500 | |||||

| Shop supplies expense | 750 | |||||

| Unearned service revenue | 37,500 | |||||

| Utilities expense | 23,250 | |||||

| $ | 450,470 | $ | 450,470 | |||

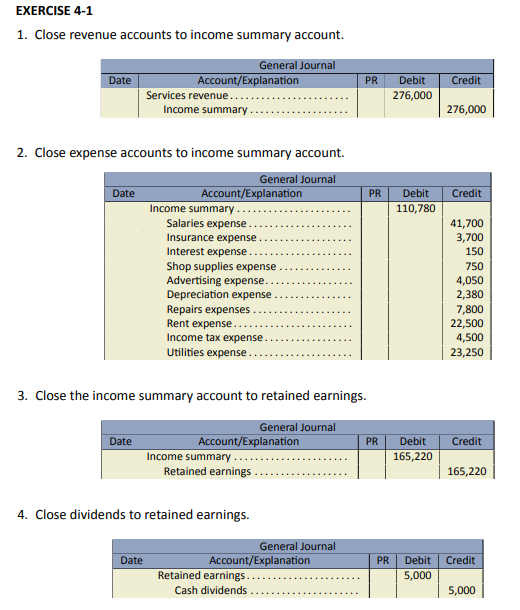

Prepare the closing entries.

Click Here to View Solution

| Accounts Payable | $

4,400 |

| Accounts Receivable | 3,600 |

| Accumulated Depreciation – Machinery | 2,800 |

| Accumulated Depreciation – Warehouse | 8,000 |

| Bank Loan | 47,600 |

| Cash | 12,000 |

| Commissions Earned | 20,000 |

| Depreciation Expense – Machinery | 900 |

| Depreciation Expense – Warehouse | 1,200 |

| Dividends | 14,000 |

| Insurance Expense | 1,800 |

| Interest Expense | 2,365 |

| Interest Payable | 1,200 |

| Land | 15,000 |

| Machinery | 20,000 |

| Retained Earnings | 36,000 |

| Salaries Expense | 33,475 |

| Salaries Payable | 1,970 |

| Share Capital | 52,100 |

| Subscriptions Revenue | 17,630 |

| Supplies | 2,500 |

| Supplies Expense | 15,800 |

| Unearned Fees | 800 |

| Utilities Expense | 2,860 |

| Warehouse | 67,000 |

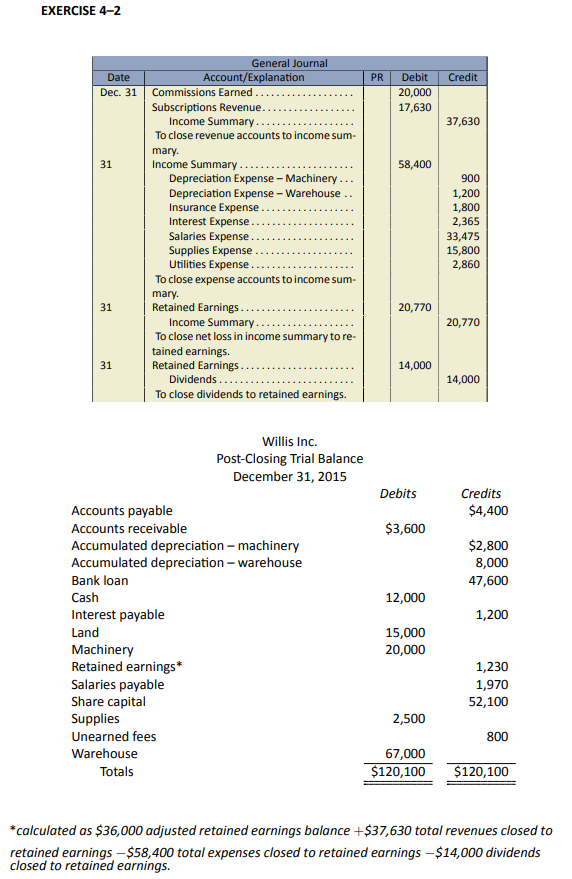

Prepare closing entries and a post-closing trial balance.

Click Here to View Solution

The following accounts and account balances are taken from the records of Joyes Enterprises Ltd. at December 31, 2016, its fiscal year-end.

| Dr. | Cr. | ||

| Accounts Receivable | $8,000 | ||

| Accounts Payable | $7,000 | ||

| Accumulated Depreciation – Buildings | 1,000 | ||

| Accumulated Depreciation – Equipment | 4,000 | ||

| Bank Loan (due 2017) | 5000 | ||

| Buildings | 25,000 | ||

| Cash | 2,000 | ||

| Dividends Declared | 1,000 | ||

| Equipment | 20,000 | ||

| Income Tax Payable | 3,000 | ||

| Land | 5,000 | ||

| Merchandise Inventory | 19,000 | ||

| Mortgage Payable (due 2019) | 5,000 | ||

| Prepaid Insurance | 1,000 | ||

| Share Capital | 48,000 | ||

| Retained Earnings, Jan. 1 2016 | -0- | 2,000 | |

|

Totals |

$81,000 | $75,000 | |

| Net Income | -0- | 6,000 | |

|

Totals |

-0- | -0- |

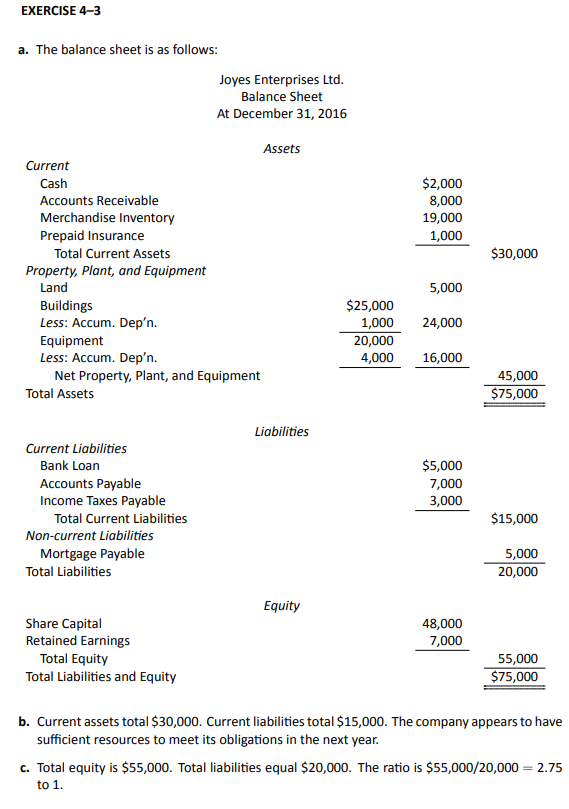

- Using the above information, prepare a classified balance sheet.

- Does Joyes Enterprises Ltd. have sufficient resources to meet its obligations in the upcoming year?

- Calculate the proportion of shareholders’ to creditors’ claims on the assets of Joyes.

Click Here to View Solution

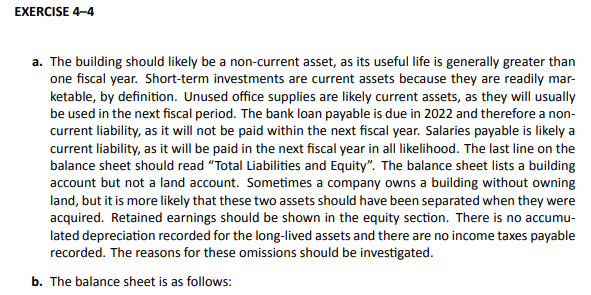

The following balance sheet was prepared for Abbey Limited:

| Abbey Limited | ||||||||

| Balance Sheet | ||||||||

| As at November 30, 2015 | ||||||||

| Assets | Liabilities | |||||||

| Current | Current | |||||||

|

Cash |

$1,000 |

Accounts Payable |

$5,600 | |||||

|

Accounts Receivable |

6,000 |

Notes Payable (due 2016) |

2,000 | |||||

|

Building |

12,000 |

Bank Loan (due 2022) |

1,000 | |||||

|

Merchandise Inventory |

3,000 |

Total Current Liabilities |

$8,600 | |||||

|

Total Current Assets |

$22,000 | |||||||

| Non-current | Non-current | |||||||

|

Short-Term Investments |

3,000 |

Mortgage Payable (due 2023) |

7,000 | |||||

|

Equipment |

1,500 |

Retained Earnings |

1,000 | |||||

|

Unused Office Supplies |

100 |

Salaries Payable |

250 | |||||

|

Truck |

1,350 |

Total Non-current Liabilities |

8,250 | |||||

|

Total Non-current Assets |

5,950 |

Total Liabilities |

16,850 | |||||

| Equity | ||||||||

| Share Capital | 11,100 | |||||||

| Total Assets | $27,950 | Total Liabilities and Assets | $27,950 | |||||

- Identify the errors that exist in the balance sheet of Abbey Limited and why you consider this information incorrect.

- Prepare a corrected, classified balance sheet.

- Based on the balance sheet categories, what additional information should be disclosed in the notes to the financial statements?

Click Here to View Solution

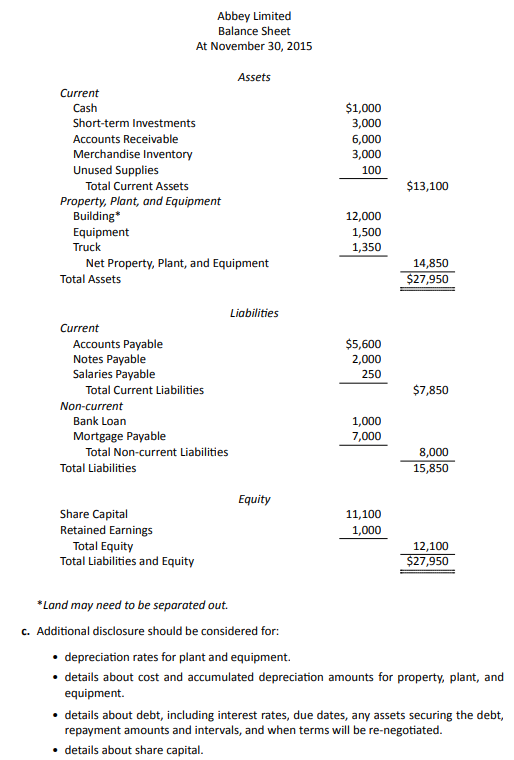

Below are various accounts:

| Land used in the normal course of business operations | Accrued salaries payable | ||

| Notes payable, due in four months | Prepaid advertising | ||

| Truck | Advertising expense | ||

| Land held for investment | Unearned revenue | ||

| Copyright | Service revenue | ||

| Accounts payable | Cash | ||

| Cash dividends | Mortgage payable, due in fifteen years | ||

| Building | Mortgage payable, due in six months | ||

| Furniture | Share capital | ||

| Accounts receivable, from customer sales | Shop supplies | ||

| Franchise | Accumulated depreciation, building | ||

| Utilities expense | Depreciation expense | ||

| Utilities payable | Office supplies |

Classify each account as one of the following:

- current asset

- long-term investment

- property, plant and equipment

- intangible asset

- current liability

- long-term liability

- equity

- not reported on the balance sheet

Click Here to View Solution

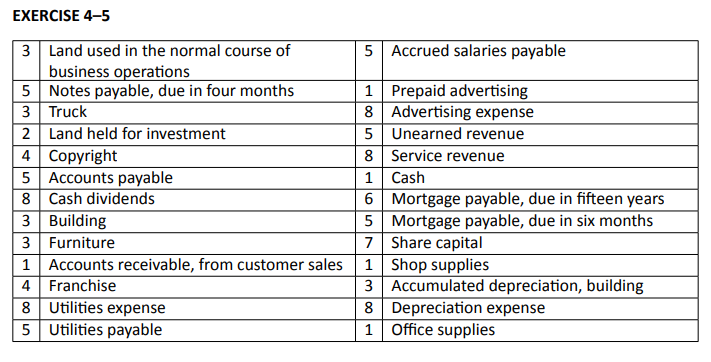

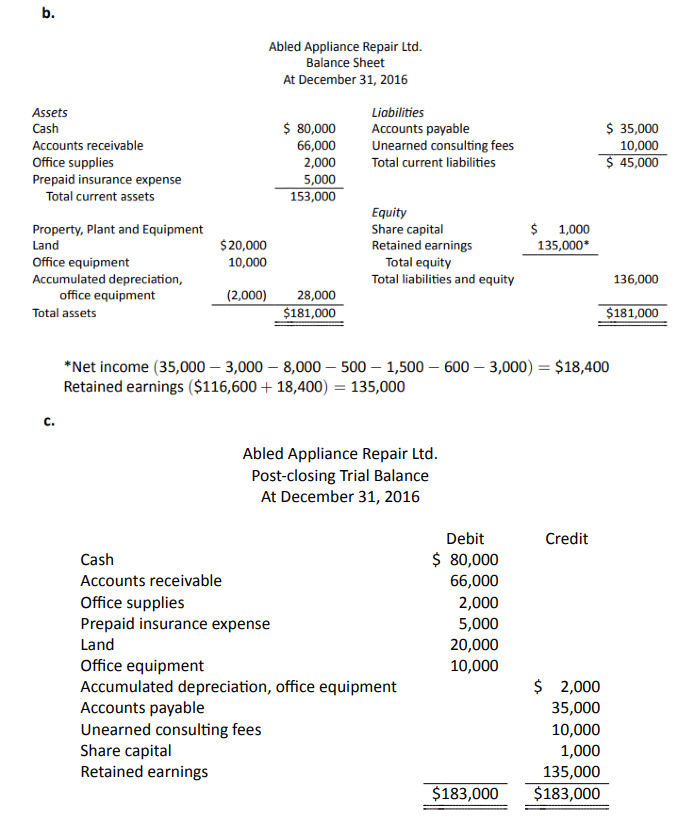

Below are the December 31, 2016, year-end accounts balances for Abled Appliance Repair Ltd. This is the business’s third year of operations.

| Cash | $80,000 | Share capital | $1,000 | |

| Accounts receivable | 66,000 | Retained earnings | 116,600 | |

| Office supplies inventory | 2,000 | Revenue | 35,000 | |

| Prepaid insurance | 5,000 | Rent expense | 3,000 | |

| Land | 20,000 | Salaries expense | 8,000 | |

| Office equipment | 10,000 | Utilities expense | 500 | |

| Accumulated depreciation, office equipment | 2,000 | Travel expense | 1,500 | |

| Accounts payable | 35,000 | Insurance expense | 600 | |

| Unearned consulting fees | 10,000 | Supplies and postage expense | 3,000 |

- Prepare the closing entries.

- Prepare a classified balance sheet.

- Prepare a post-closing trial balance.

Click Here to View Solution

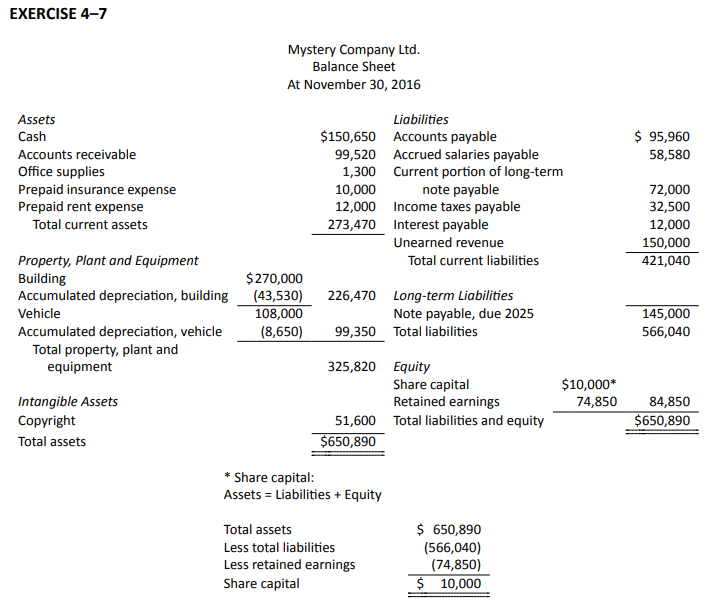

Below is the post-closing trial balance for Mystery Company Ltd. All accounts have normal balances.

| Mystery Company Ltd. | |||

| Trial Balance | |||

| November 30, 2016 | |||

| Accounts payable | $ | 95,960 | |

| Accounts receivable | 99,520 | ||

| Accrued salaries payable | 58,580 | ||

| Accumulated depreciation, building | 43,530 | ||

| Accumulated depreciation, vehicle | 8,650 | ||

| Building | 270,000 | ||

| Cash | 150,650 | ||

| Copyright | 51,600 | ||

| Current portion of long-term debt | 72,000 | ||

| Income taxes payable | 32,500 | ||

| Interest payable | 12,000 | ||

| Notes payable, due 2025 | 145,000 | ||

| Office supplies | 1,300 | ||

| Prepaid insurance expense | 10,000 | ||

| Prepaid rent expense | 12,000 | ||

| Retained earnings | 74,850 | ||

| Share capital | ?? | ||

| Unearned revenue | 150,000 | ||

| Vehicle | 108,000 | ||

Prepare a classified balance sheet.

Click Here to View Solution

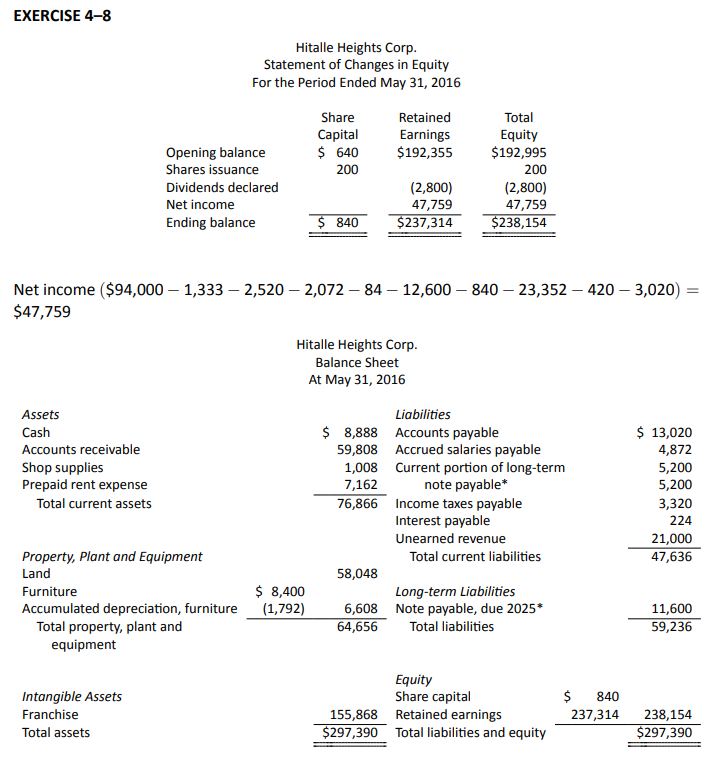

Below is the adjusted trial balance for Hitalle Heights Corp. All accounts have normal balances.

| Hitalle Heights Corp. | |||

| Trial Balance | |||

| May 31, 2016 | |||

| Accounts payable | $ | 13,020 | |

| Accounts receivable | 59,808 | ||

| Accrued salaries and benefits payable | 4,872 | ||

| Accumulated depreciation, furniture | 1,792 | ||

| Cash | 8,888 | ||

| Cash dividends | 2,800 | ||

| Depreciation expense | 1,333 | ||

| Furniture | 8,400 | ||

| Income tax expense | 2,520 | ||

| Income taxes payable | 3,320 | ||

| Insurance expense | 2,072 | ||

| Interest expense | 84 | ||

| Interest payable | 224 | ||

| Land | 58,048 | ||

| Bank loan payable (long-term) | 16,800 | ||

| Shop supplies | 1,008 | ||

| Prepaid insurance expense | 7,162 | ||

| Rent expense | 12,600 | ||

| Travel expense | 840 | ||

| Retained earnings | 192,355 | ||

| Revenue | 94,000 | ||

| Salaries expense | 23,352 | ||

| Share capital | 840 | ||

| Shop supplies expense | 420 | ||

| Franchise | 155,868 | ||

| Unearned revenue | 21,000 | ||

| Utilities expense | 3,020 | ||

Additional information:

The bank loan will be reduced by $5,200 next year.

There were 200 additional shares issued during the year for $200.

Prepare a classified balance sheet and a statement of changes in equity for May 31, 2016.

Click Here to View Solution

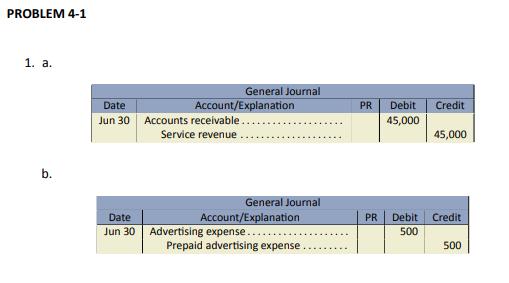

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 4. It is recommended that students review any relevant sections that they struggled with in answering these problems.

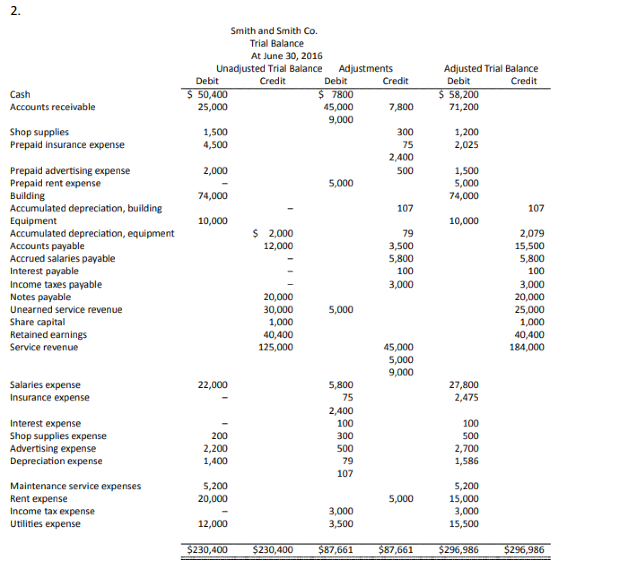

| Smith and Smith Co. | ||||||

| Unadjusted Trial Balance | ||||||

| At June 30, 2016 | ||||||

| Debit | Credit | |||||

| Cash | $ | 50,400 | ||||

| Accounts receivable | 25,000 | |||||

| Shop supplies | 1,500 | |||||

| Prepaid insurance expense | 4,500 | |||||

| Prepaid advertising expense | 2,000 | |||||

| Prepaid rent expense | – | |||||

| Building | 74,000 | |||||

| Accumulated depreciation, building | $ | – | ||||

| Equipment | 10,000 | |||||

| Accumulated depreciation, equipment | 2,000 | |||||

| Accounts payable | 12,000 | |||||

| Accrued salaries payable | – | |||||

| Interest payable | – | |||||

| Income taxes payable | – | |||||

| Notes payable | 20,000 | |||||

| Unearned service revenue | 30,000 | |||||

| Share capital | 1,000 | |||||

| Retained earnings | 40,400 | |||||

| Service revenue | 125,000 | |||||

| Salaries expense | 22,000 | |||||

| Insurance expense | – | |||||

| Interest expense | – | |||||

| Shop supplies expense | 200 | |||||

| Advertising expense | 2,200 | |||||

| Depreciation expense | 1,400 | |||||

| Maintenance service expense | 5,200 | |||||

| Rent expense | 20,000 | |||||

| Income tax expense | – | |||||

| Utilities expense | 12,000 | |||||

| $ | 230,400 | $ | 230,400 | |||

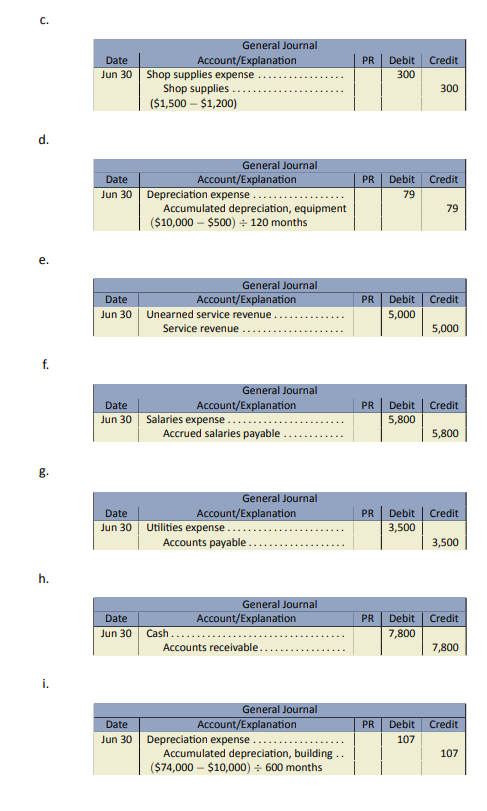

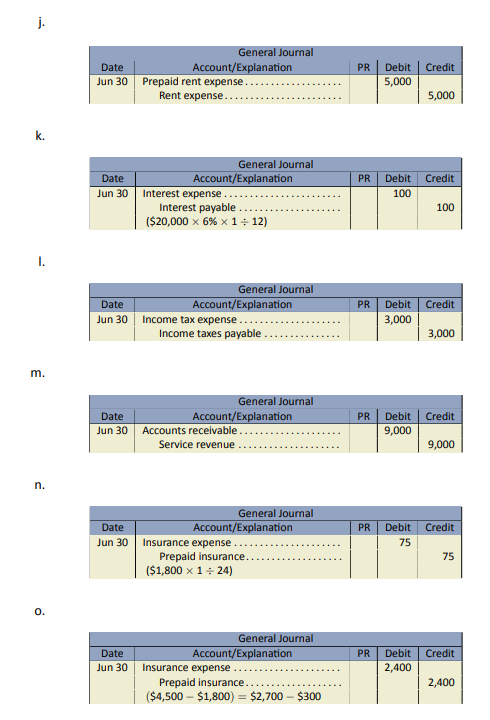

Additional information for June not yet recorded:

- Unbilled and uncollected work to June 30 totals $45,000.

- An analysis of prepaid advertising shows that $500 of the balance was consumed.

- A shop supplies count on June 30 shows that $1,200 are on hand.

- Equipment has an estimated useful life of ten years and an estimated residual value of $500.

- The records show that fifty percent of the work, for a $10,000 fee received in advance from a customer and recorded last month, is now completed.

- Salaries of $5,800 for employees for work done to the end of June has not been paid.

- Utilities invoice for services to June 22 totals $3,500.

- Accrued revenues of $7,800 previously recorded to accounts receivable were collected.

- A building was purchased at the end of May. Its estimated useful life is fifty years and has an estimated residual value of $10,000.

- Rent expense of $5,000 cash for July has been paid and recorded directly to rent expense.

- Interest for the 6% note payable has not yet been recorded for June.

- Income taxes of $3,000 is owing but not yet paid.

- Unrecorded and uncollected service revenue of $9,000 has been earned.

- A two year, $1,800 insurance policy was purchased on June 1 and recorded to prepaid insurance expense.

- The prior balance in the unadjusted prepaid insurance account (excluding the insurance in item n. above), shows that $300 of that balance is not yet used.

- Prepare the adjusting and correcting entries for June.

- Prepare an adjusted trial balance at June 30, 2016.

Click Here to View Solution

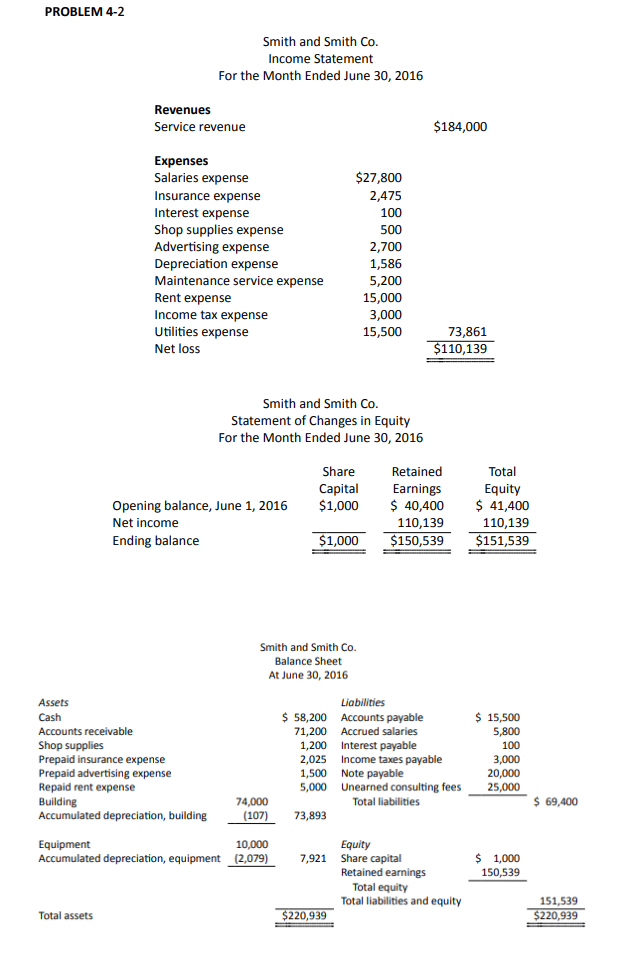

Using the adjusted trial balance in PROBLEM 4–1 above:

Prepare an income statement, statement of changes in equity and a balance sheet as at June 30, 2016. (Hint: For the balance sheet, also include a subtotal for each asset’s book value).

Click Here to View Solution

| Account Title | Balance |

| Accounts Payable | $125 |

| Accounts Receivable | 138 |

| Building | 400 |

| Cash | 250 |

| Share Capital | 400 |

| Equipment | 140 |

| Land | 115 |

| Mortgage Payable (due 2022) | 280 |

| Bank Loan, due within 90 days | 110 |

| Notes Receivable, due within 90 days | 18 |

| Prepaid Insurance | 12 |

| Retained Earnings | 214 |

| Salaries Payable | 14 |

| Unused Office Supplies | 70 |

Prepare a classified balance sheet.

Click Here to View Solution

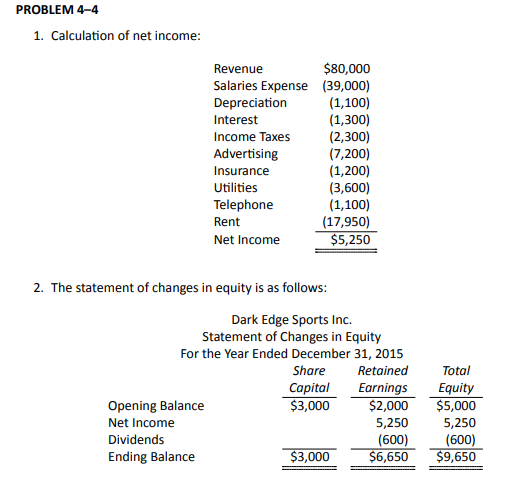

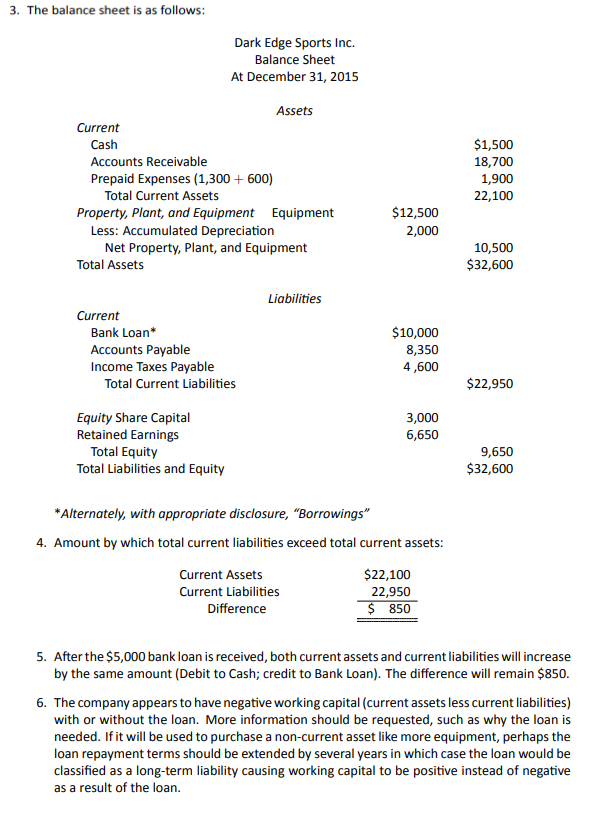

The following adjusted trial balance has been extracted from the records of Dark Edge Sports Inc. at December 31, 2015, its second fiscal year-end.

| Account Balances | |||

| Dr. | Cr. | ||

| Accounts Payable | $8,350 | ||

| Accounts Receivable | $18,700 | ||

| Accumulated Depreciation – Equipment | 2,000 | ||

| Advertising Expense | 7,200 | ||

| Bank Loan, due May 31, 2016 | 10,000 | ||

| Cash | 1,500 | ||

| Depreciation Expense | 1,100 | ||

| Dividends | 600 | ||

| Equipment | 12,500 | ||

| Income Taxes Expense | 2,300 | ||

| Income Taxes Payable | 4,600 | ||

| Insurance Expense | 1,200 | ||

| Interest and Bank Charges Expense | 1,300 | ||

| Prepaid Insurance | 1,300 | ||

| Prepaid Rent | 600 | ||

| Retained Earnings | 2,000 | ||

| Rent Expense | 17,950 | ||

| Revenue | 80,000 | ||

| Salaries Expense | 39,000 | ||

| Share Capital | 3,000 | ||

| Telephone Expense | 1,100 | ||

| Utilities Expense | 3,600 | ||

|

Totals |

$109,950 | $109,950 | |

Note: No shares were issued during 2015.

- Calculate net income for year ended December 31, 2015.

- Prepare a statement of changes in equity for the year ended December 31, 2015.

- Prepare a classified balance sheet at December 31, 2015.

- By what amounts do total current liabilities exceed total current assets at December 31, 2015?

- Assume a $5,000 bank loan is received, payable in six months. Will this improve the negative working capital situation calculated in (4) above? Calculate the effect on your answer to (4) above?

- As the bank manager, what questions might you raise regarding the loan?

Click Here to View Solution

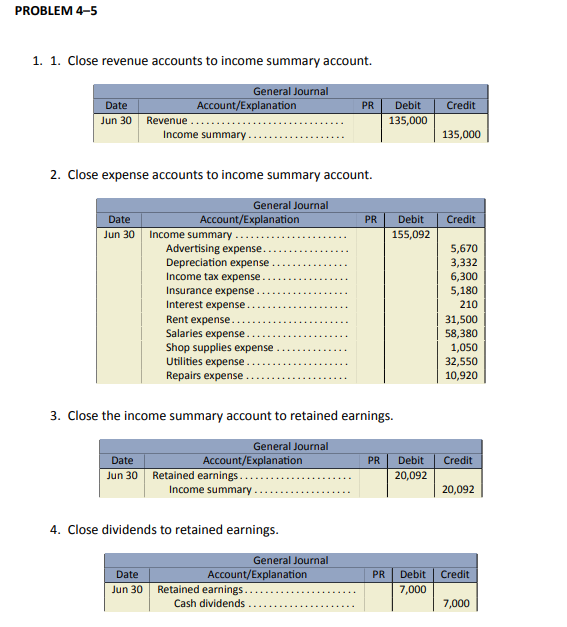

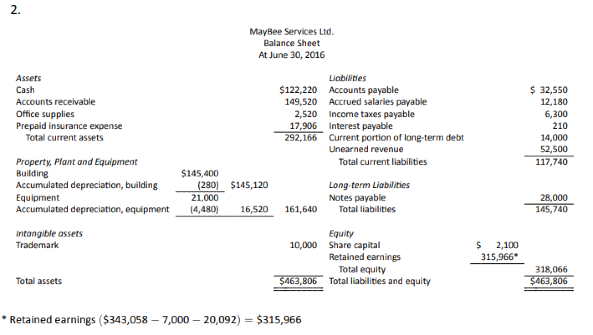

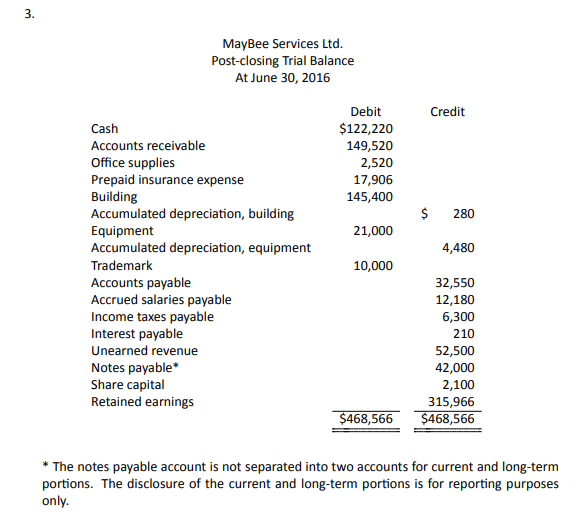

Below is the adjusted trial balance with accounts in alphabetical order for MayBee Services Ltd. All accounts have normal balances.

| MayBee Services Ltd. | |||

| Trial Balance | |||

| At June 30, 2016 | |||

| Accounts payable | $ | 32,550 | |

| Accounts receivable | 149,520 | ||

| Accrued salaries payable | 12,180 | ||

| Accumulated depreciation, building | 280 | ||

| Accumulated depreciation, equipment | 4,480 | ||

| Advertising expense | 5,670 | ||

| Building | 145,400 | ||

| Cash | 122,220 | ||

| Cash dividends | 7,000 | ||

| Depreciation expense | 3,332 | ||

| Equipment | 21,000 | ||

| Income tax expense | 6,300 | ||

| Income taxes payable | 6,300 | ||

| Insurance expense | 5,180 | ||

| Interest expense | 210 | ||

| Interest payable | 210 | ||

| Notes payable, due 2018 | 42,000 | ||

| Office supplies | 2,520 | ||

| Prepaid insurance expense | 17,906 | ||

| Rent expense | 31,500 | ||

| Repairs expense | 10,920 | ||

| Retained earnings | 343,058 | ||

| Revenue | 135,000 | ||

| Salaries expense | 58,380 | ||

| Share capital | 2,100 | ||

| Shop supplies expense | 1,050 | ||

| Trademark | 10,000 | ||

| Unearned revenue | 52,500 | ||

| Utilities expense | 32,550 | ||

Additional Information: For the note payable, its account balance will be reduced by $14,000 as at June 30, 2017.

- Prepare the closing entries.

- Prepare a classified balance sheet.

- Prepare a post-closing trial balance.

Click Here to View Solution

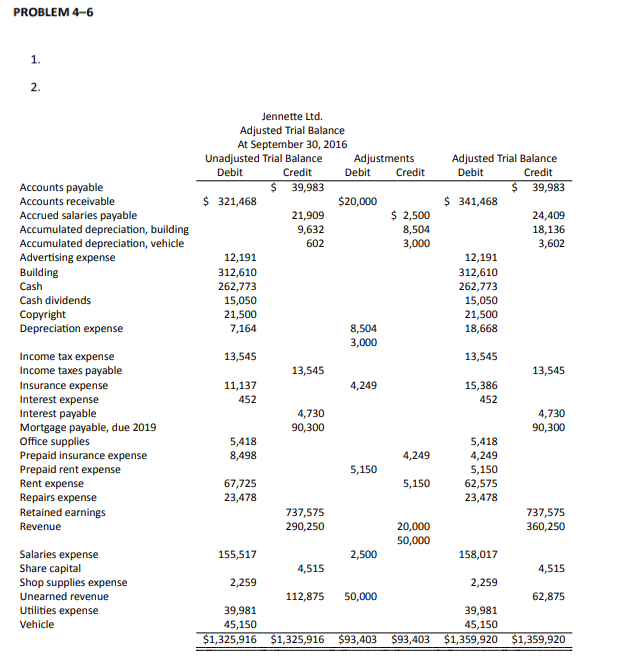

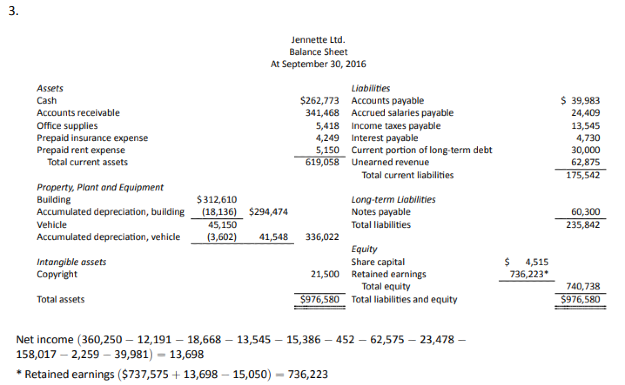

Below is the unadjusted trial balance with accounts in alphabetical order for Jennette Ltd. All accounts have normal balances.

| Jennette Ltd. | |||

| Unadjusted Trial Balance | |||

| At September 30, 2016 | |||

| Accounts payable | $ | 39,983 | |

| Accounts receivable | 321,468 | ||

| Accrued salaries payable | 21,909 | ||

| Accumulated depreciation, building | 9,632 | ||

| Accumulated depreciation, vehicle | 602 | ||

| Advertising expense | 12,191 | ||

| Building | 312,610 | ||

| Cash | 262,773 | ||

| Cash dividends | 15,050 | ||

| Copyright | 21,500 | ||

| Depreciation expense | 7,164 | ||

| Income tax expense | 13,545 | ||

| Income taxes payable | 13,545 | ||

| Insurance expense | 11,137 | ||

| Interest expense | 452 | ||

| Interest payable | 4,730 | ||

| Mortgage payable, due 2019 | 90,300 | ||

| Office supplies | 5,418 | ||

| Prepaid insurance expense | 8,498 | ||

| Rent expense | 67,725 | ||

| Repairs expense | 23,478 | ||

| Retained earnings | 737,575 | ||

| Revenue | 290,250 | ||

| Salaries expense | 155,517 | ||

| Share capital | 4,515 | ||

| Shop supplies expense | 2,259 | ||

| Unearned revenue | 112,875 | ||

| Utilities expense | 39,981 | ||

| Vehicle | 45,150 | ||

Additional information:

Adjustments not yet recorded are:

- Revenue earned but not yet billed is $20,000.

- Depreciation expense for the vehicle is $3,000.

- The building’s estimated residual value is $100,000 and its estimated useful life is 25 years.

- Salaries not yet paid are $2,500.

- Revenue that was paid in cash as an advance of $50,000 is now earned.

- Rent for October 2016 of $5,150 was paid and recorded to rent expense.

- One-half of the prepaid insurance is has now been used.

Mortgage payments for the next fiscal year will total $36,000, which includes interest expense of $6,000.

- Update all the account balances with appropriate adjusting entries based on the six missing adjustments above. (Hint: Use a trial balance format with adjusting entry columns.)

- Prepare an adjusted trial balance.

- Prepare a classified balance sheet.

Click Here to View Solution