Chapter 2

Analyzing and Recording Transactions

Chapter 2 looks more closely at asset, liability, and equity accounts and how they are affected by double-entry accounting, namely, debits and credits. The transactions introduced in Chapter 1 for Big Dog Carworks Corp. are used to explain debit and credit analysis. The preparation of a trial balance will be introduced. Additionally, this chapter will demonstrate how transactions are recorded in a general journal and posted to a general ledger. Finally, the concept of the accounting cycle is presented.

Chapter 2 Learning Objectives

- LO1 – Describe asset, liability, and equity accounts, identifying the effect of debits and credits on each.

- LO2 – Analyze transactions using double-entry accounting.

- LO3 – Prepare a trial balance and explain its use.

- LO4 – Record transactions in a general journal and post in a general ledger.

- LO5 – Define the accounting cycle.

Concept Self-Check

Use the following as a self-check while working through Chapter 2.

- What is an asset?

- What is a liability?

- What are the different types of equity accounts?

- What is retained earnings?

- How are retained earnings and revenues related?

- Why are T-accounts used in accounting?

- How do debits and credits impact the T-account?

- What is a chart of accounts?

- Are increases in equity recorded as a debit or credit?

- Are decreases in equity recorded as a debit or credit?

- Does issuing shares and revenues cause equity to increase or decrease?

- Are increases in the share capital account recorded as a debit or credit?

- Are increases in revenue accounts recorded as debits or credits?

- Do dividends and expenses cause equity to increase or decrease?

- Are increases in the dividend account recorded as a debit or credit?

- Are increases in expense accounts recorded as debits or credits?

- How is a trial balance useful?

- What is the difference between a general journal and a general ledger?

- Explain the posting process.

- What is the accounting cycle?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

2.1 Accounts

LO1 – Describe asset, liability, and equity accounts, identifying the effect of debits and credits on each.

Chapter 1 reviewed the analysis of financial transactions and the resulting impact on the accounting equation. We now expand that discussion by introducing the way transaction is recorded in an account. An account accumulates detailed information regarding the increases and decreases in a specific asset, liability, or equity item. Accounts are maintained in a ledger also referred to as the books. We now review and expand our understanding of asset, liability, and equity accounts.

Asset Accounts

Recall that assets are resources that have future economic benefits for the business. The primary purpose of assets is that they be used in day-to-day operating activities in order to generate revenue either directly or indirectly. A separate account is established for each asset. Examples of asset accounts are reviewed below.

- Cash has future purchasing power. Coins, currency, cheques, and bank account balances are examples of cash.

- Accounts receivable occur when products or services are sold on account or on credit. When a sale occurs on account or on credit, the customer has not paid cash but promises to pay in the future.

- Notes receivable are a promise to pay an amount on a specific future date plus a predetermined amount of interest.

- Office supplies are supplies to be used in the future. If the supplies are used before the end of the accounting period, they are an expense instead of an asset.

- Merchandise inventory are items to be sold in the future.

- Prepaid insurance represents an amount paid in advance for insurance. The prepaid insurance will be used in the future.

- Prepaid rent represents an amount paid in advance for rent. The prepaid rent will be used in the future.

- Land cost must be in a separate account from any building that might be on the land. Land is used over future periods.

- Buildings indirectly help a business generate revenue over future accounting periods since they provide space for day-to-day operating activities.

Liability Accounts

As explained in Chapter 1, a liability is an obligation to pay for an asset in the future. The primary purpose of liabilities is to finance investing activities that include the purchase of assets like land, buildings, and equipment. Liabilities are also used to finance operating activities involving, for example, accounts payable, unearned revenues, and wages payable. A separate account is created for each liability. Examples of liability accounts are reviewed below.

- Accounts payable are debts owed to creditors for goods purchased or services received as a result of day-to-day operating activities. An example of a service received on credit might be a plumber billing the business for a repair.

- Wages payable are wages owed to employees for work performed.

- Short-term notes payable are a debt owed to a bank or other creditor that is normally paid within one year. Notes payable are different than accounts payable in that notes involve interest.

- Long-term notes payable are a debt owed to a bank or other creditor that is normally paid beyond one year. Like short-term notes, long-term notes involve interest.

- Unearned revenues are payments received in advance of the product or service being provided. In other words, the business owes a customer the product/service.

Equity Accounts

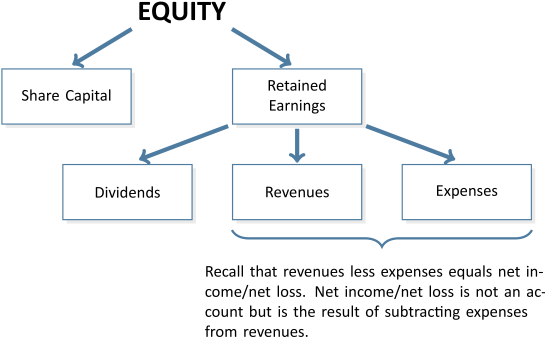

Chapter 1 explained that equity represents the net assets owned by the owners of a business. In a corporation, the owners are called shareholders. Equity is traditionally one of the more challenging concepts to understand in introductory financial accounting. The difficulty stems from there being different types of equity accounts: share capital, retained earnings, dividends, revenues, and expenses. Share capital represents the investments made by owners into the business and causes equity to increase. Retained earnings is the sum of all net incomes earned over the life of the corporation to date, less any dividends distributed to shareholders over the same time period. Therefore, the Retained Earnings account includes revenues, which cause equity to increase, along with expenses and dividends, which cause equity to decrease. Figure 2.1 summarizes equity accounts.

T-accounts

A simplified account, called a T-account, is often used as a teaching/learning tool to show increases and decreases in an account. It is called a T-account because it resembles the letter T. As shown in the T-account below, the left side records debit entries and the right side records credit entries.

| Account Name | |

| Debit | Credit |

| (always on left) | (always on right) |

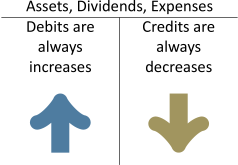

The type of account determines whether an increase or a decrease in a particular transaction is represented by a debit or credit. For financial transactions that affect assets, dividends, and expenses, increases are recorded by debits and decreases by credits. This guideline is shown in the following T-account:

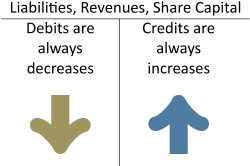

For financial transactions that affect liabilities, share capital, and revenues, increases are recorded by credits and decreases by debits, as follows:

Another way to illustrate the debit and credit rules is based on the accounting equation. Remember that dividends, expenses, revenues, and share capital are equity accounts.

The following summary shows how debits and credits are used to record increases and decreases in various types of accounts:

| ASSETS | LIABILITIES | |

| DIVIDENDS | SHARE CAPITAL | |

| EXPENSES | REVENUE | |

| Increases are DEBITED. | Increases are CREDITED. | |

| Decreases are CREDITED. | Decreases are DEBITED. |

This summary will be used in a later section to illustrate the recording of debits and credits regarding the transactions of Big Dog Carworks Corp. introduced in Module 1.

The account balance is determined by adding and subtracting the increases and decreases in an account. Two assumed examples are presented below.

| Cash | Accounts Payable | |||||||

| 10,000 | 3,000 | 700 | 5,000 | |||||

| 3,000 | 3,000 | |||||||

| 400 | 2,400 | 4,300 | Balance | |||||

| 8,000 | 2,000 | |||||||

| 7,100 | ||||||||

| 200 | ||||||||

| Balance | 3,700 | |||||||

The $3,700 debit balance in the Cash account was calculated by adding all the debits and subtracting the sum of the credits. The $3,700 is recorded on the debit side of the T-account because the debits are greater than the credits. In Accounts Payable, the balance is a $4,300 credit calculated by subtracting the debits from the credits.

Notice that Cash shows a debit balance while Accounts Payable shows a credit balance. The Cash account is an asset so its normal balance is a debit. A normal balance is the side on which increases occur. Accounts Payable is a liability and because liabilities increase with credits, the normal balance in Accounts Payable is a credit as shown in the T-account above.

Chart of Accounts

A business will create a list of accounts called a chart of accounts where each account is assigned both a name and a number. A common practice is to have the accounts arranged in a manner that is compatible with the order of their use in financial statements. For instance, Asset accounts begin with the digit ‘1’, Liability accounts with the digit ‘2’. Each business will have a unique chart of accounts that corresponds to its specific needs. Big Dog Carworks Corp. uses the following numbering system for its accounts:

| 100-199 | Asset accounts |

| 200-299 | Liability accounts |

| 300-399 | Share capital, retained earnings, and dividend accounts |

| 500-599 | Revenue accounts |

| 600-699 | Expense accounts |

Learning Activity 2.1 – Identifying Accounts

This Learning Activity gives you an opportunity to practice identifying accounts.

Instructions: Identify each account as an asset, liability, equity, revenue, or expense – when asked, identify whether the normal balance of each account is a debit or a credit.

2.2 Transaction Analysis Using Accounts

LO2 – Analyze transactions using double-entry accounting.

In Chapter 1, transactions for Big Dog Carworks Corp. were analyzed to determine the change in each item of the accounting equation. In this next section, these same transactions will be used to demonstrate double-entry accounting. Double-entry accounting means each transaction is recorded in at least two accounts where the total debits ALWAYS equal the total credits. As a result of double-entry accounting, the sum of all the debit balance accounts in the ledger must equal the sum of all the credit balance accounts. The rule that debits = credits is rooted in the accounting equation:

| ASSETS | = | LIABILITIES | + | EQUITY3 | |

| Increases are: | Debits | Credits | Credits | ||

| Decreases are: | Credits | Debits | Debits |

Illustrative Problem—Double-Entry Accounting and the Use of Accounts

In this section, the following debit and credit summary will be used to record the transactions of Big Dog Carworks Corp. into T-accounts.

| ASSETS | LIABILITIES | |

| DIVIDENDS | SHARE CAPITAL | |

| EXPENSES | REVENUE | |

| Increases are DEBITED. | Increases are CREDITED. | |

| Decreases are CREDITED. | Decreases are DEBITED. |

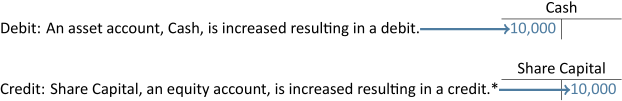

Transaction 1

Jan. 1 – Big Dog Carworks Corp. issued 1,000 shares to Bob Baldwin, a shareholder, for a total of $10,000 cash.

Analysis:

*Note: An alternate analysis would be that the issuance of shares causes equity to increase and increases in equity are always recorded as a credit.

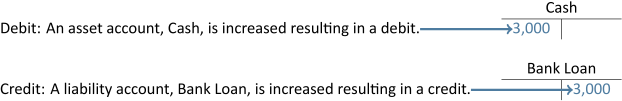

Transaction 2

Jan. 2 – Borrowed $3,000 from the bank.

Analysis:

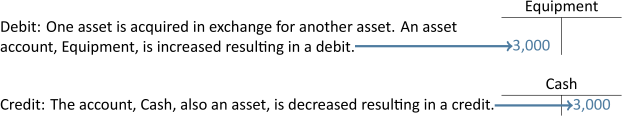

Transaction 3

Jan. 3 – Equipment is purchased for $3,000 cash.

Analysis:

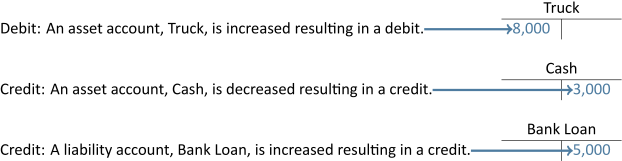

Transaction 4

Jan. 3 – A truck was purchased for $8,000; Big Dog paid $3,000 cash and incurred a $5,000 bank loan for the balance.

Analysis:

Note: Transaction 4 involves one debit and two credits. Notice that the total debit of $8,000 equals the total credits of $8,000 which satisfies the double-entry accounting rule requiring that debits ALWAYS equal credits.

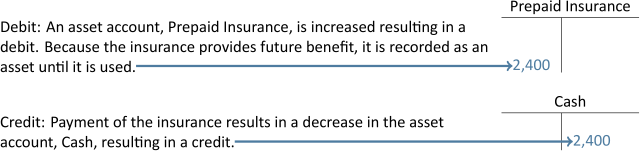

Transaction 5

Jan. 5 – Big Dog Carworks Corp. paid $2,400 cash for a one-year insurance policy, effective January 1.

Analysis:

Transaction 6

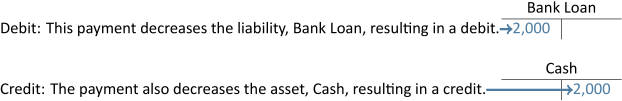

Jan. 10 – The corporation paid $2,000 cash to reduce the bank loan.

Analysis:

Transaction 7

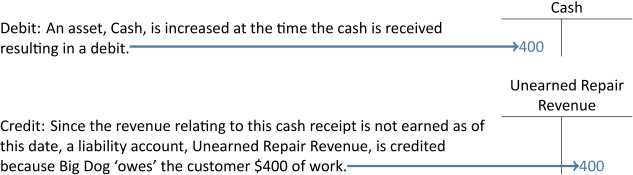

Jan. 15 – The corporation received an advance payment of $400 for repair services to be performed as follows: $300 in February and $100 in March.

Analysis:

Transaction 8

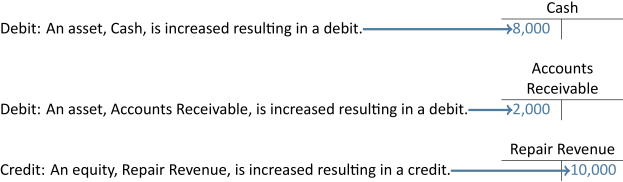

Jan. 31 – A total of $10,000 of automotive repair services is performed for a customer who paid $8,000 cash. The remaining $2,000 will be paid in 30 days.

Analysis:

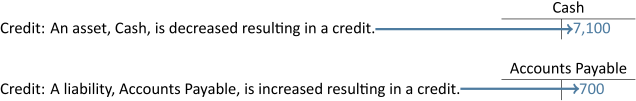

Transaction 9

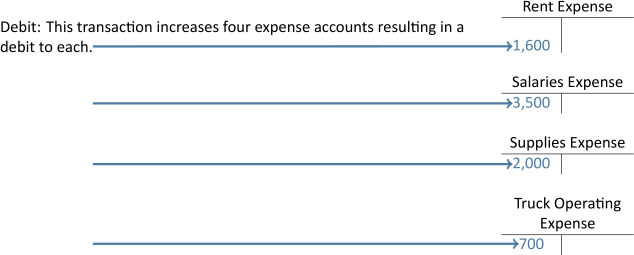

Jan. 31 – Operating expenses of $7,100 were paid in cash: Rent expense, $1,600; salaries expense, $3,500; and supplies expense of $2,000. $700 for truck operating expenses (e.g., oil, gas) were incurred on credit.

Analysis:

Note: Each expense is recorded in an individual account.

Transaction 10

Jan. 31 – Dividends of $200 were paid in cash to the only shareholder, Bob Baldwin.

Analysis:

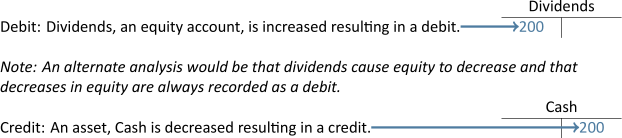

After the January transactions of Big Dog Carworks Corp. have been recorded in the T-accounts, each account is totalled and the difference between the debit balance and the credit balance is calculated, as shown in the following diagram. The numbers in parentheses refer to the transaction numbers used in the preceding section. To prove that the accounting equation is in balance, the account balances for each of assets, liabilities, and equity are added. Notice that total assets of $19,100 equal the sum of total liabilities of $7,100 plus equity of $12,000.

Learning Activity 2.2 – Identifying Accounts: Debit and Credit

This Learning Activity gives you an opportunity to practice identifying accounts.

Instructions: Read the transaction and identify whether the amount is to be debited or credited under Assets, Liabilities, or both.

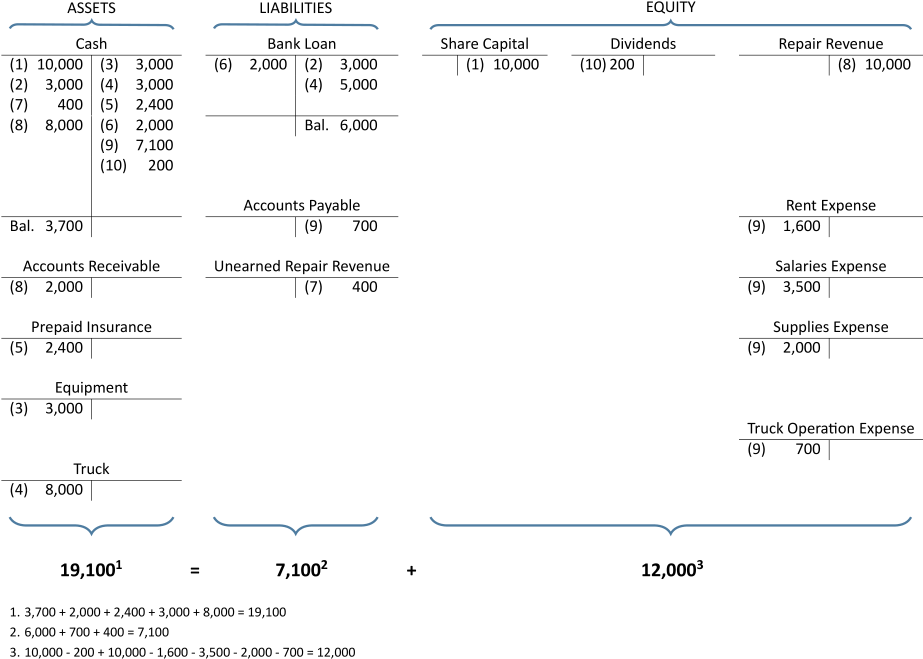

2.3 The Trial Balance

LO3 – Prepare a trial balance and explain its use.

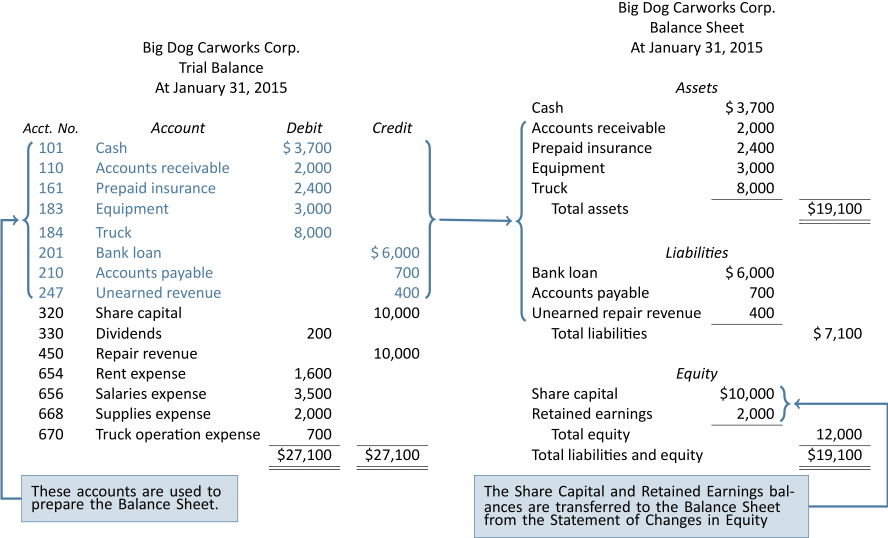

To help prove that the accounting equation is in balance, a trial balance is normally prepared instead of the T-account listing shown in the previous section. A trial balance is an internal document that lists all the account balances at a point in time. The total debits must equal total credits on the trial balance. The form and content of a trial balance is illustrated below, using the account numbers, account names, and account balances of Big Dog Carworks Corp. at January 31, 2015. Assume that the account numbers are those assigned by the business.

| Big Dog Carworks Corp. | ||||

| Trial Balance | ||||

| At January 31, 2015 | ||||

| Acct. No. | Account | Debit | Credit | |

| 101 | Cash | $3,700 | ||

| 110 | Accounts receivable | 2,000 | ||

| 161 | Prepaid insurance | 2,400 | ||

| 183 | Equipment | 3,000 | ||

| 184 | Truck | 8,000 | ||

| 201 | Bank loan | $6,000 | ||

| 210 | Accounts payable | 700 | ||

| 247 | Unearned revenue | 400 | ||

| 320 | Share capital | 10,000 | ||

| 330 | Dividends | 200 | ||

| 450 | Repair revenue | 10,000 | ||

| 654 | Rent expense | 1,600 | ||

| 656 | Salaries expense | 3,500 | ||

| 668 | Supplies expense | 2,000 | ||

| 670 | Truck operation expense | 700 | ||

| $27,100 | $27,100 | |||

Double-entry accounting requires that debits equal credits. The trial balance establishes that this equality exists for Big Dog but it does not ensure that each item has been recorded in the proper account. Neither does the trial balance ensure that all items that should have been entered have been entered. In addition, a transaction may be recorded twice. Any or all of these errors could occur and the trial balance would still balance. Nevertheless, a trial balance provides a useful mathematical check before preparing financial statements.

Preparation of Financial Statements

Financial statements for the one-month period ended January 31, 2015 can now be prepared from the trial balance figures. First, an income statement is prepared.

The asset and liability accounts from the trial balance and the ending balances for share capital and retained earnings on the statement of changes in equity are used to prepare the balance sheet.

NOTE: Pay attention to the links between financial statements.

The income statement is linked to the statement of changes in equity: Revenues and expenses are reported on the income statement to show the details of net income. Because net income causes equity to change, it is then reported on the statement of changes in equity.

The statement of changes in equity is linked to the balance sheet: The statement of changes in equity shows the details of how equity changed during the accounting period. The balances for share capital and retained earnings that appear on the statement of changes in equity are transferred to the equity section of the balance sheet.

The balance sheet SUMMARIZES equity by showing only account balances for share capital and retained earnings. To obtain the details regarding these equity accounts, we must look at the income statement and the statement of changes in equity.

2.4 Using Formal Accounting Records

LO4 – Record transactions in a general journal and post in a general ledger.

The preceding analysis of financial transactions used T-accounts to record debits and credits. T-accounts will continue to be used for illustrative purposes throughout this book. In actual practice, financial transactions are recorded in a general journal.

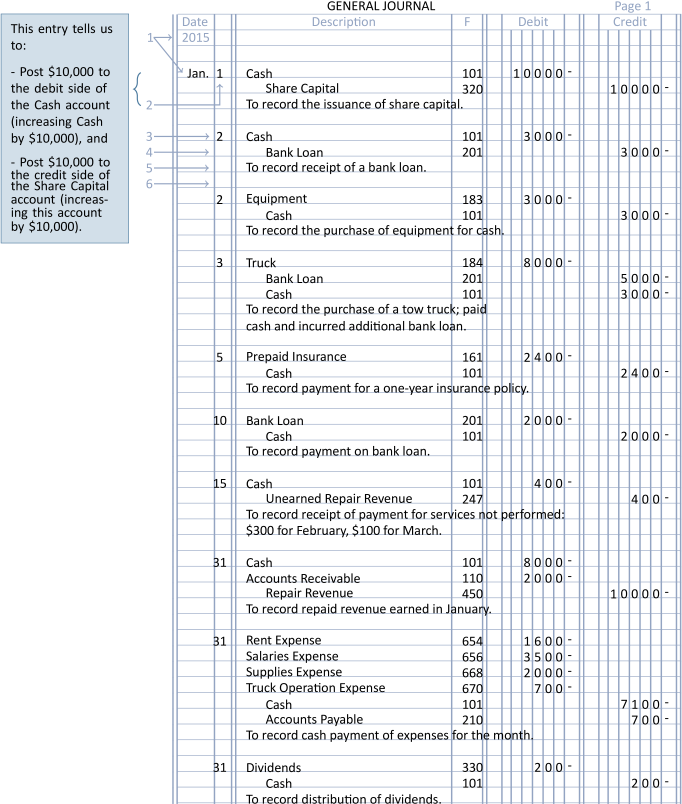

A general journal, or just journal, is a document that is used to chronologically record a business’s debit and credit transactions (see Figure 2.2). It is often referred to as the book of original entry. Journalizing is the process of recording a financial transaction in the journal. The resulting debit and credit entry recorded in the journal is called a journal entry.

A general ledger, or just ledger, is a record that contains all of a business’s accounts. Posting is the process of transferring amounts from the journal to the matching ledger accounts. Because amounts recorded in the journal eventually end up in a ledger account, the ledger is sometimes referred to as a book of final entry.

Recording Transactions in the General Journal

Each transaction is first recorded in the journal. The January transactions of Big Dog Carworks Corp. are recorded in its journal as shown in Figure 2.2. The journalizing procedure follows these steps (refer to Figure 2.2 for corresponding numbers):

- The year is recorded at the top and the month is entered on the first line of page 1. This information is repeated only on each new journal page used to record transactions.

- The date of the first transaction is entered in the second column, on the first line. The day of each transaction is always recorded in this second column.

- The name of the account to be debited is entered in the description column on the first line. By convention, accounts to be debited are usually recorded before accounts to be credited. The column titled ‘F’ (for Folio) indicates the number given to the account in the General Ledger. For example, the account number for Cash is 101. The amount of the debit is recorded in the debit column. A dash is often used by accountants in place of .00.

- The name of the account to be credited is on the second line of the description column and is indented about one centimetre into the column. Accounts to be credited are always indented in this way in the journal. The amount of the credit is recorded in the credit column. Again, a dash may be used in place of .00.

- An explanation of the transaction is entered in the description column on the next line. It is not indented.

- A line is usually skipped after each journal entry to separate individual journal entries and the date of the next entry recorded. It is unnecessary to repeat the month if it is unchanged from that recorded at the top of the page.

Most of Big Dog’s entries have one debit and credit. An entry can also have more than one debit or credit, in which case it is referred to as a compound entry. The entry dated January 3 is an example of a compound entry.

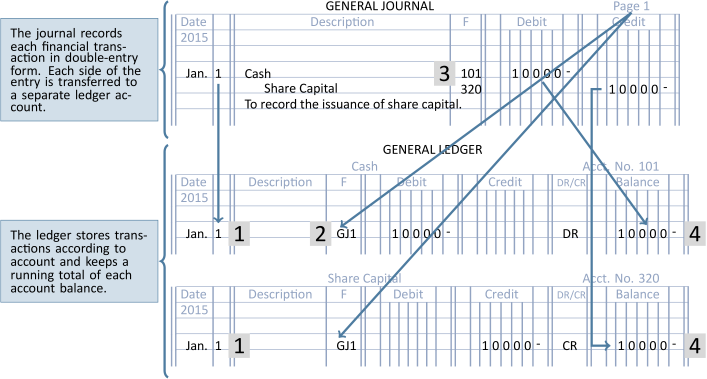

Posting Transactions to the General Ledger

The ledger account is a formal variation of the T-account. The ledger accounts shown in Figure 2.3 are similar to what is used in electronic/digital accounting programs. Ledger accounts are kept in the general ledger. Debits and credits recorded in the journal are posted to appropriate ledger accounts so that the details and balance for each account can be found easily. Figure 2.3 uses the first transaction of Big Dog Carworks Corp. to illustrate how to post amounts and record other information.

- The date and amount are posted to the appropriate ledger account. Here the entry debiting Cash is posted from the journal to the Cash ledger account. The entry crediting Share Capital is then posted from the journal to the Share Capital ledger account.

- The journal page number is recorded in the folio (F) column of each ledger account as a cross reference. In this case, the posting has been made from general journal page 1; the reference is recorded as GJ1.

- The appropriate ledger account number is recorded in the folio (F) column of the journal to indicate the posting has been made to that particular account. Here the entry debiting Cash has been posted to Account No. 101. The entry crediting Share Capital has been posted to Account No. 320.

- After posting the entry, a balance is calculated in the Balance column. A notation is recorded in the column to the left of the Balance column indicating whether the balance is a debit or credit. A brief description can be entered in the Description column but this is generally not necessary since the journal includes a detailed description for each journal entry.

This manual process of recording, posting, summarizing, and preparing financial statements is cumbersome and time-consuming. In virtually all businesses, the use of accounting software automates much of the process. In this and subsequent chapters, either the T-account or the ledger account can be used in working through exercises and problems. Both formats are used to explain and illustrate concepts in subsequent chapters.

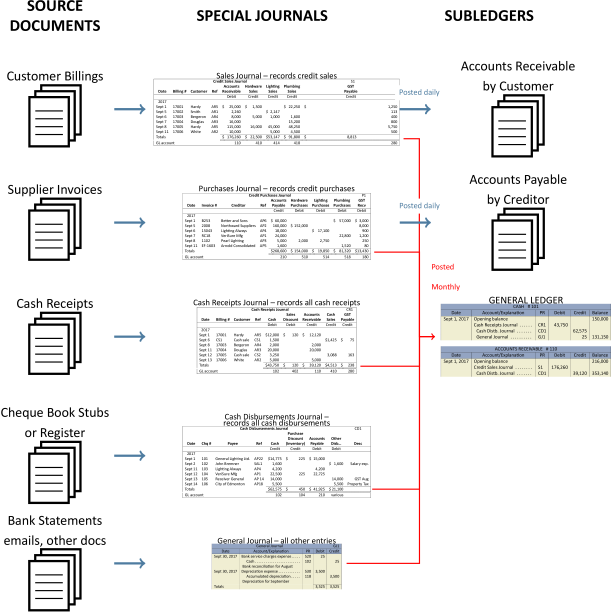

Special Journals and Subledgers

The general journal and the general ledger each act as a single all-purpose document where all the company’s transactions are recorded and posted over the life of the company.

As was shown in Figure 2.2, various transactions are recorded to a general journal chronologically by date as they occurred. When companies engage in certain same-type, high-frequency transactions such as credit purchases and sales on account, special journals are often created in order to separately track information about these types of transactions. Typical special journals that companies often use are a sales journal, cash receipts journal, purchases journal and a cash disbursements journal. There can be others, depending on the business a company is involved in. The general journal continues to be used to record any transactions not posted to any of the special journals, such as:

- correcting entries

- adjusting entries

- closing entries

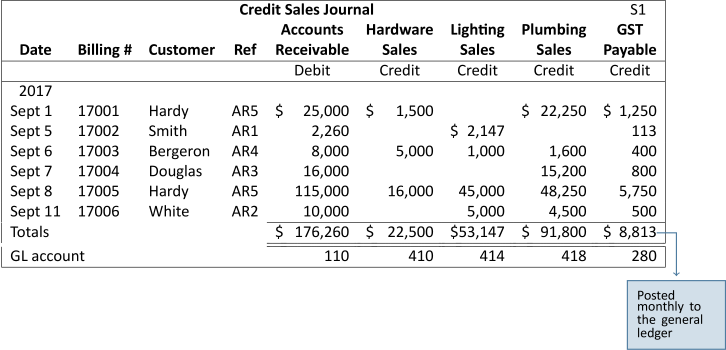

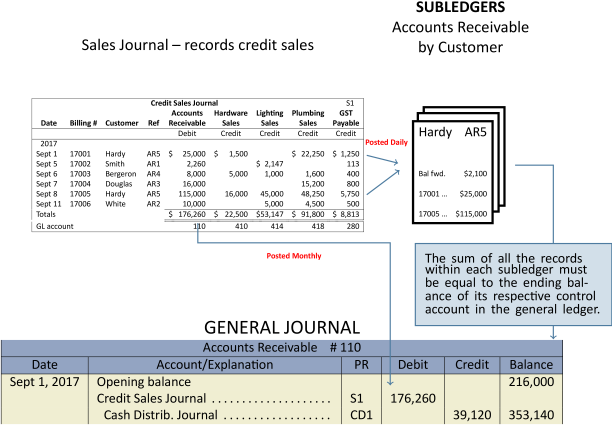

An example of a special journal for credit sales is shown below:

For simplicity, the cost of goods sold is excluded from this sales journal and will be covered in chapter five of this course. The sales journal provides a quick overview of the total credit sales for the month as well as various sub-groupings of credit sales such as by product sold, GST, and customers.

The sales journal can also be expanded to include credit sales returns, and the purchases journal to include purchases returns and allowances for each accounting month. Note that purchase discounts would be recorded in the cash disbursements journal because the discount is usually claimed at the time of the cash payment to the supplier/creditor. This is also the case with sales discounts from customers which would be recorded in the cash receipts journal at the time the cash, net of the sales discount, is received. Any cash sales returns would be recorded in the cash disbursements journal.

Recall from Figure 2.3 that with accounting records that comprise only a general journal and general ledger, each transaction recorded in the general journal was posted to the general ledger. With special journals, such as the sales journal, their monthly totals are posted to the general ledger instead. For larger companies, these journals can be summarized and posted more frequently, such as weekly or daily, if needed.

Below are examples of other typical special journals such as a purchases journal, cash receipts journal, cash disbursements journal and the general journal. Note the different sub-groupings in each one and consider how these would be useful for managing the company’s business.

| Credit Purchases Journal | P1 | ||||||||||||

| Accounts | Hardware | Lighting | Plumbing | GST | |||||||||

| Date | Invoice # | Creditor | Ref | Payable | Purchases | Purchases | Purchases | Recv | |||||

| Credit | Debit | Debit | Debit | Debit | |||||||||

| 2017 | |||||||||||||

| Sept 1 | B253 | Better and Sons | AP6 | $ | 60,000 | $ | 57,000 | $ | 3,000 | ||||

| Sept 5 | 2008 | Northward Suppliers | AP2 | 160,000 | $ | 152,000 | 8,000 | ||||||

| Sept 6 | 15043 | Lighting Always | AP4 | 18,000 | $ | 17,100 | 900 | ||||||

| Sept 7 | RC18 | VeriSure Mfg | AP1 | 24,000 | 22,800 | 1,200 | |||||||

| Sept 8 | 1102 | Pearl Lighting | AP3 | 5,000 | 2,000 | 2,750 | 250 | ||||||

| Sept 11 | EF-1603 | Arnold Consolidated | AP5 | 1,600 | 1,520 | 80 | |||||||

| Totals | $ | 268,600 | $ | 154,000 | $ | 19,850 | $ | 81,320 | $ | 13,430 | |||

| GL account | 210 | 510 | 514 | 518 | 180 | ||||||||

| Cash Receipts Journal | CR1 | ||||||||||||

| Sales | Accounts | Cash | GST | ||||||||||

| Date | Billing # | Customer | Ref | Cash | Discount | Receivable | Sales | Payable | |||||

| Debit | Debit | Credit | Credit | Credit | |||||||||

| 2017 | |||||||||||||

| Sept 1 | 17001 | Hardy | AR5 | $ | 12,000 | $ | 120 | $ | 12,120 | ||||

| Sept 6 | CS1 | Cash sale | CS1 | 1,500 | $ | 1,425 | $ | 75 | |||||

| Sept 8 | 17003 | Bergeron | AR4 | 2,000 | 2,000 | ||||||||

| Sept 11 | 17004 | Douglas | AR3 | 20,000 | 20,000 | ||||||||

| Sept 12 | 17005 | Cash sale | CS2 | 3,250 | 3,088 | 163 | |||||||

| Sept 13 | 17006 | White | AR2 | 5,000 | 5,000 | ||||||||

| Totals | $ | 43,750 | $ | 120 | $ | 39,120 | $ | 4,513 | $ | 238 | |||

| GL account | 102 | 402 | 110 | 410 | 280 | ||||||||

| Cash Disbursements Journal | CD1 | |||||||||||

| Purchase | ||||||||||||

| Discount | Accounts | Other | ||||||||||

| Date | Chq # | Payee | Ref | Cash | (Inventory) | Payable | Disb… | Desc | ||||

| Credit | Credit | Debit | Debit | |||||||||

| 2017 | ||||||||||||

| Sept 1 | 101 | General Lighting Ltd. | AP22 | $ | 14,775 | $ | 225 | $ | 15,000 | |||

| Sept 2 | 102 | John Bremner | SAL1 | 1,600 | $ | 1,600 | Salary exp. | |||||

| Sept 11 | 103 | Lighting Always | AP4 | 4,200 | 4,200 | |||||||

| Sept 12 | 104 | VeriSure Mfg | AP1 | 22,500 | 225 | 22,725 | ||||||

| Sept 13 | 105 | Receiver General | AP 14 | 14,000 | 14,000 | GST Aug | ||||||

| Sept 14 | 106 | City of Edmonton | AP18 | 5,500 | 5,500 | Property Tax | ||||||

| Totals | $ | 62,575 | $ | 450 | $ | 41,925 | $ | 21,100 | ||||

| GL account | 102 | 104 | 210 | various | ||||||||

| General Journal | GJ1 | |||

| Date | Account/Explanation | F | Debit | Credit |

| Sept 30, 2017 |

Bank service charges expense Bank service charges expense

|

520 | 25 | |

|

Cash Cash

|

102 | 25 | ||

| Bank reconciliation for August | ||||

| Sept 30, 2017 |

Depreciation expense Depreciation expense

|

530 | 3,500 | |

|

Accumulated depreciation Accumulated depreciation

|

118 | 3,500 | ||

| Depreciation for September | ||||

| Totals | 3,525 | 3,525 | ||

Each account that exists in the general journal must be represented by a corresponding account in the general ledger. As previously stated, each entry from the general journal is posted directly to the general ledger, if no other special journals or subledgers exist. If there are several hundreds or thousands of accounts receivable transactions for many different customers during a month, this detail cannot be easily summarized in meaningful ways. This may be fine for very small companies, but most companies need certain types of transactions sub-groupings, such as for accounts receivable, accounts payable and inventory. For this reason, subsidiary ledgers or subledgers are used to accomplish this. Subledgers typically include accounts receivable sub-grouped by customer, accounts payable by supplier, and inventory by inventory item. Monthly totals from the special journals continue to be posted to the general ledger, which now acts as a control account to its related subledger. It is critical that the subledgers always balance to their respective general ledger control account, hence the name control account.

Below is an example of how a special journal, such as a sales journal is posted to the subledgers and general ledger:

Note how the general ledger can now be posted using the monthly totals from the sales journal instead of by individual transaction. Each line item within the sales journal is now posted on a daily basis directly to the subledger by customer instead, and balanced to the accounts receivable control balance in the general ledger. The subledger enables the company to quickly determine which customers owe money and details about those amounts.

At one time, recording transactions to the various journals and ledgers was all done manually as illustrated above. Today, accounting software makes this process easy and efficient. Data for each transaction is entered into the various data fields within the software transaction record. Once the transaction entry has been input and saved, the software automatically posts the data to any special journals, subledgers and general ledger. At any time, the accountant can easily obtain summary or detailed reports including a trial balance, accounts receivable by customer, accounts payable by creditor, inventory by inventory item, and so on.

Below is a flowchart that illustrates the flow of the information for a manual system from the source documents to the special journals, the subledgers and to the general ledger. This illustration also helps to give a sense of how the data would flow using accounting software:

2.5 The Accounting Cycle

LO5 – Define the accounting cycle.

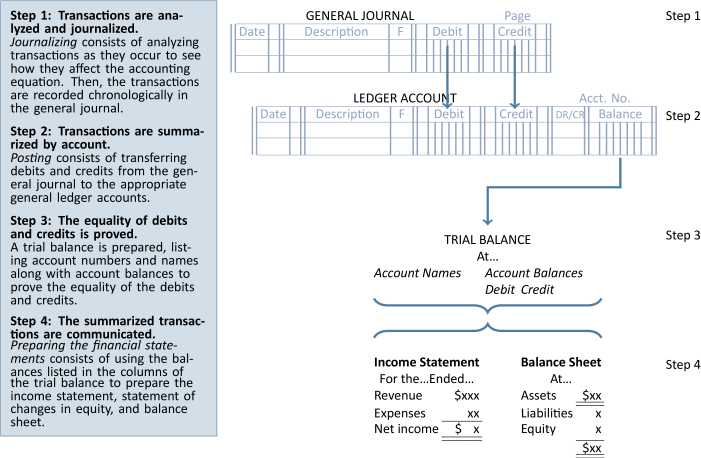

In the preceding sections, the January transactions of Big Dog Carworks Corp. were used to demonstrate the steps performed to convert economic data into financial information. This conversion was carried out in accordance with the basic double-entry accounting model. These steps are summarized in Figure 2.9:

The sequence just described, beginning with the journalising of the transactions and ending with the communication of financial information in financial statements, is commonly referred to as the accounting cycle. There are additional steps involved in the accounting cycle and these will be introduced in Chapter 3.

Summary of Chapter 2 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 2. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Describe asset, liability, and equity accounts, identifying the effect of debits and credits on each.

Assets are resources that have future economic benefits such as cash, receivables, prepaids, and machinery. Increases in assets are recorded as debits and decreases as credits. Liabilities represent an obligation to pay an asset in the future and include payables and unearned revenues. Inrceases in liabilities are recorded as credits and decreases as debits. Equity represents the net assets owned by the owners and includes share capital, dividends, revenues, and expenses. Increases in equity, caused by the issuance of shares and revenues, are recorded as credits, and decreases in equity, caused by dividends and expenses, are recorded as debits. The following summary can be used to show how debits and credits impact the types of accounts.

LO2 – Analyze transactions using double-entry accounting.

Double-entry accounting requires that each transaction be recorded in at least two accounts where the total debits always equal the total credits. The double-entry accounting rule is rooted in the accounting equation: Assets = Liabilities + Equity.

LO3 – Prepare a trial balance and explain its use.

To help prove the accounting equation is in balance, a trial balance is prepared. The trial balance is an internal document that lists all the account balances at a point in time. The total debits must equal total credits on the trial balance. The trial balance is used in the preparation of financial statements.

LO4 – Record transactions in a general journal and post in a general ledger.

The recording of financial transactions was introduced in this chapter using T-accounts, an illustrative tool. A business actually records transactions in a general journal, a document which chronologically lists each debit and credit journal entry. To summarize the debit and credit entries by account, the entries in the general journal are posted (or transferred) to the general ledger. The account balances in the general ledger are used to prepare the trial balance.

LO5 – Define the accounting cycle.

Analyzing transactions, journalizing them in the general journal, posting from the general journal into the general ledger, preparing the trial balance, and generating financial statements are steps followed each accounting period. These steps form the core of the accounting cycle. Additional steps involved in the accounting cycle will be introduced in Chapter 3.

Review Questions

After reading through Chapter 2, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

Use the questions below to self-assess how well you understand the content from Chapter 2:

- Why is the use of a transactions worksheet impractical in actual practice?

- What is an ‘account’? How are debits and credits used to record transactions?

- Some tend to associate “good” and “bad” or “increase” and “decrease” with credits and debits. Is this a valid association? Explain.

- The pattern of recording increases as debits and decreases as credits is common to asset and expense accounts. Provide an example.

- The pattern of recording increases and credits and decreases as debits is common to liabilities, equity, and revenue accounts. Provide an example.

- Summarise the rules for using debits and credits to record assets, expenses, liabilities, equity, and revenues.

- What is a Trial Balance? Why is it prepared?

- How is a Trial Balance used to prepare financial statements?

- A General Journal is often called a book of original entry. Why?

- The positioning of a debit-credit entry in the General Journal is similar in some respects to instructions written in a computer program. Explain, using an example.

- What is a General Ledger? Why is it prepared?

- What is a Chart of Accounts? How are the accounts generally arranged and why?

- List the steps in the accounting cycle.

Practice Exercises

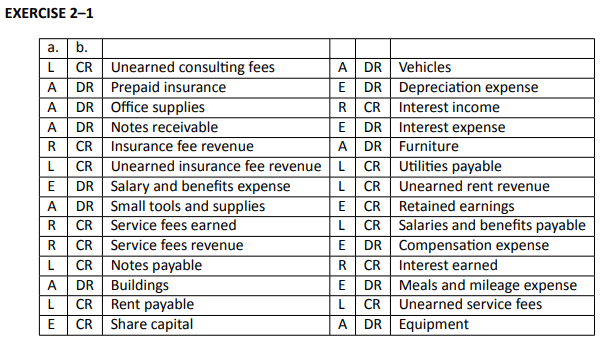

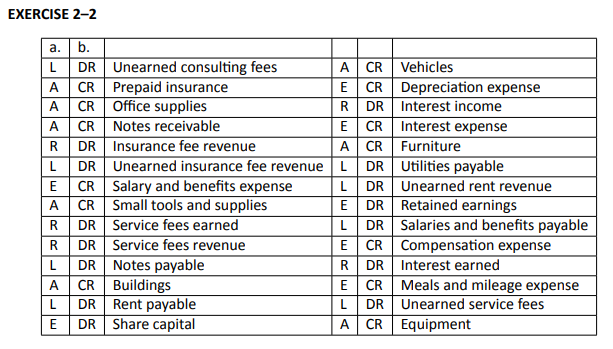

Below is a list of various accounts:

| a. | b. | ||||

| Unearned consulting fees | Vehicles | ||||

| Prepaid insurance | Depreciation expense | ||||

| Office supplies | Interest income | ||||

| Notes receivable | Interest expense | ||||

| Insurance fee revenue | Furniture | ||||

| Unearned insurance fee revenue | Utilities payable | ||||

| Salary and benefits expense | Unearned rent revenue | ||||

| Small tools and supplies | Retained earnings | ||||

| Service fees earned | Salaries and benefits payable | ||||

| Service fees revenue | Compensation expense | ||||

| Notes payable | Interest earned | ||||

| Buildings | Meals and mileage expense | ||||

| Rent payable | Unearned service fees | ||||

| Share capital | Equipment |

- Identify each account as either an asset (A), liability (L), equity (E), revenue (R), or expense (E).

- Identify whether the normal balance of each account is a debit (DR) or credit (CR).

Click Here to View Solution

Using the list from EXERCISE 2–1, identify if a debit or credit is needed to decrease the normal balance of each account.

Click Here to View Solution

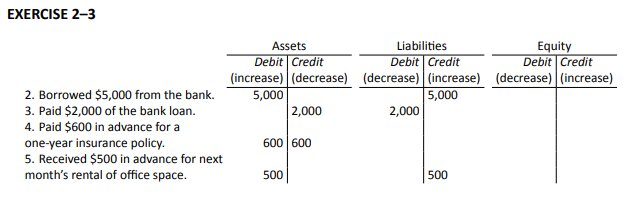

Record the debit and credit for each of the following transactions (transaction 1 is done for you):

| Assets | Liabilities | Equity | ||||||

| Debit | Credit | Debit | Credit | Debit | Credit | |||

| (increase) | (decrease) | (decrease) | (increase) | (decrease) | (increase) | |||

| 1. Purchased a $10,000 truck on credit. | 10,000 | 10,000 | ||||||

| 2. Borrowed $5,000 cash from the bank. | ||||||||

| 3. Paid $2,000 of the bank loan in cash. | ||||||||

| 4. Paid $600 in advance for a one-year | ||||||||

| insurance policy. | ||||||||

| 5. Received $500 in advance from a | ||||||||

| renter for next month’s rental of | ||||||||

| office space. | ||||||||

Click Here to View Solution

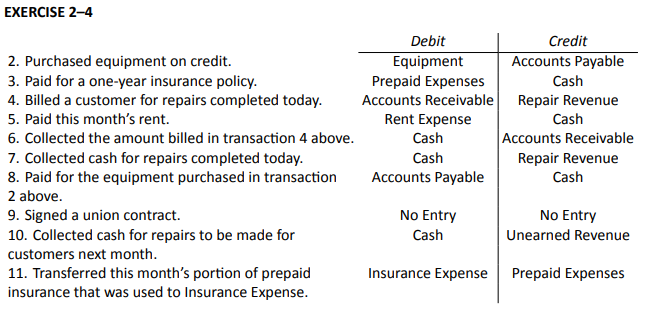

Record the debit and credit in the appropriate account for each of the following transactions (transaction 1 is done for you):

| Debit | Credit | |

| 1. Issued share capital for cash. |

Cash |

Share Capital |

| 2. Purchased equipment on credit. | ||

| 3. Paid for a one-year insurance policy. | ||

| 4. Billed a customer for repairs completed today. | ||

| 5. Paid this month’s rent. | ||

| 6. Collected the amount billed in transaction 4 above. | ||

| 7. Collected cash for repairs completed today. | ||

| 8. Paid for the equipment purchased in transaction 2 above. | ||

| 9. Signed a union contract. | ||

| 10. Collected cash for repairs to be made for customers next month. | ||

| 11. Transferred this month’s portion of prepaid insurance that was | ||

| used to Insurance Expense. |

Click Here to View Solution

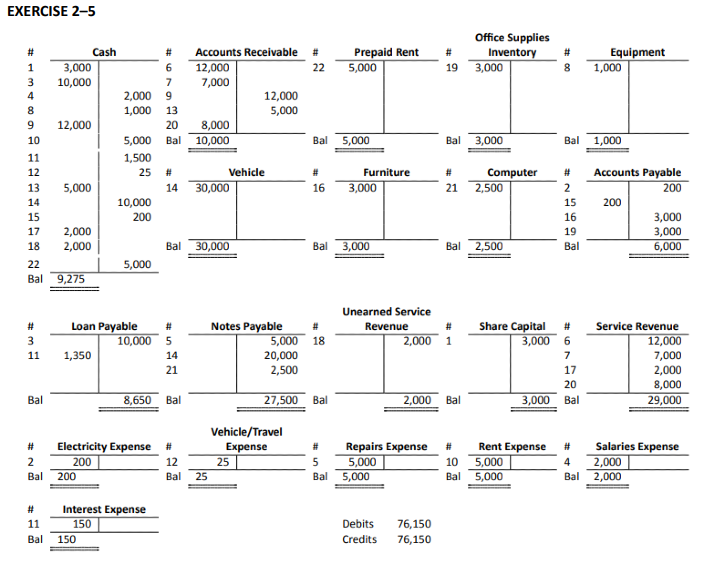

Below are various transactions for the month of August, 2016, for BOLA Co. This is their first month of operations.

- Issued share capital in exchange for $3,000 cash.

- Received an invoice from the utilities company for electricity in the amount of $200.

- Bank approved a loan and deposited $10,000 into the company’s bank account.

- Paid employee salaries in the amount of $2,000.

- Received repair services worth $5,000 from a supplier in exchange for a note due in thirty days.

- Completed service work for a European customer. Invoiced $8,000 EURO (European funds). The Canadian currency equivalent is $12,000 CAD. (hint: Recall the monetary unit principle.)

- Completed $7,000 of service work for a customer on account.

- Purchased $1,000 of equipment, paying cash.

- Received $8,000 EURO ($12,000 CAD) cash for service work done regarding item (6).

- Rent of $5,000 cash was paid for the current month’s rent.

- Made a payment of $1,500 cash as a loan payment regarding item (3). The payment covered $150 for interest expense and the balance of the cash payment was to reduce the loan balance owing.

- Reimbursed $25 in cash to an employee for use of his personal vehicle for company business for a business trip earlier that day.

- Received a cash of $5,000 regarding the service work for item (7).

- Vehicle worth $30,000 purchased in exchange for $10,000 cash and $20,000 note due in six months.

- Paid the full amount of the utilities invoice regarding item (2).

- Purchased $3,000 of furniture on account.

- Completed $2,000 of service work for a customer and collected cash.

- Received a cheque in the amount of $2,000 from a customer for service work to be done in two months.

- Purchased office supplies for $3,000 on account.

- Completed a project for a customer and billed them $8,000 for the service work.

- Purchased a laptop computer for $2,500 in exchange for a note payable.

- September rent of $5,000 was paid two weeks in advance, on August 15.

Create a separate T-account for each asset, liability, equity, revenue and expense account affected by the transactions above. Record the various transactions debits and credits into the applicable T-account (similar to the two T-accounts shown in Section 2.1, under the heading T-accounts, for Cash and Accounts payable). Calculate and record the ending balance for each T-account. (Hint: Include the reference to the transaction number for each item in the T-accounts, to make it easier to review later, if the accounts contain any errors.)

Click Here to View Solution

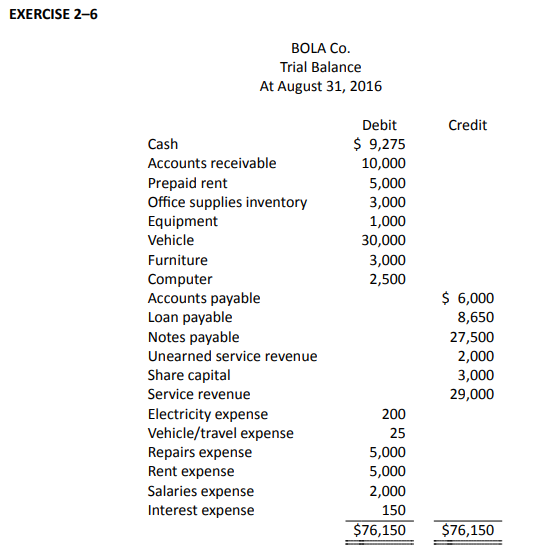

EXERCISE 2–6 (LO3) Preparing a Trial Balance

Using the T-accounts prepared in EXERCISE 2–5, prepare an August 31, 2016, trial balance for the company based on the balances in the T-accounts.

Click Here to View Solution

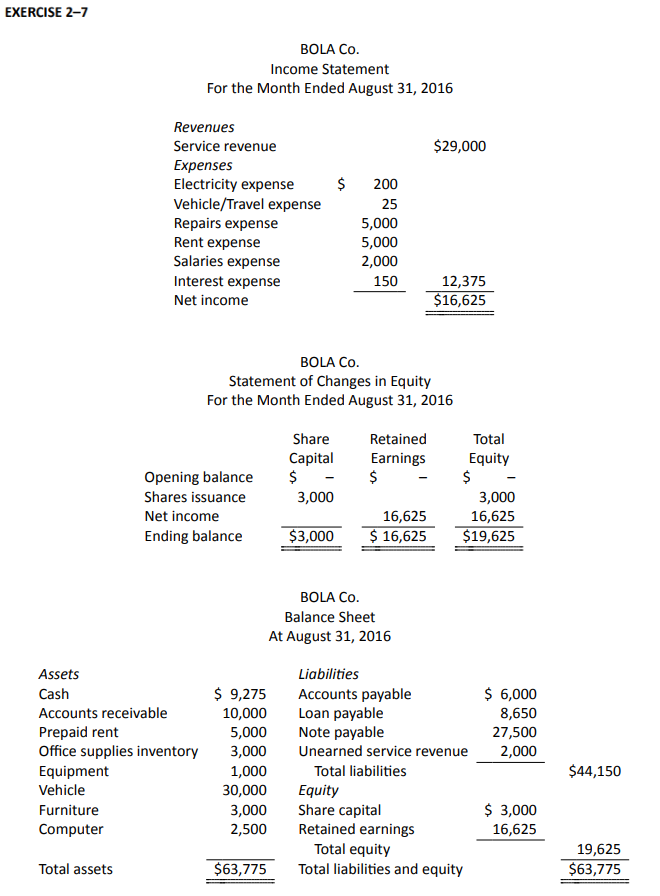

Using the trial balance in EXERCISE 2–6, prepare the August 31, 2016, income statement, statement of changes in equity and the balance sheet for the company based on the balances in the T-accounts.

Click Here to View Solution

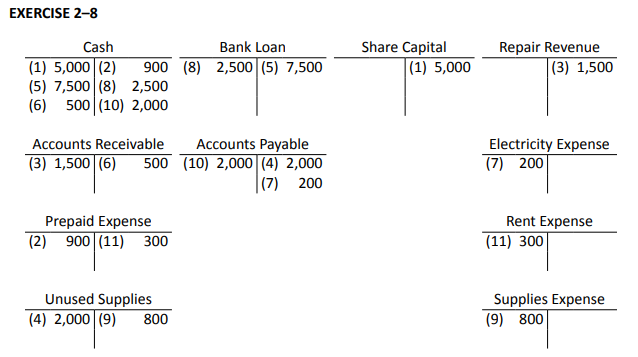

Post the following transactions to the appropriate accounts:

- Issued share capital for $5,000 cash (posted as an example).

- Paid $900 in advance for three months’ rent, $300 for each month.

- Billed $1,500 to customers for repairs completed today.

- Purchased on credit $2,000 of supplies to be used next month.

- Borrowed $7,500 from the bank.

- Collected $500 for the amount billed in transaction (3).

- Received a $200 bill for electricity used to date (the bill will be paid next month).

- Repaid $2,500 of the bank loan.

- Used $800 of the supplies purchased in transaction (4).

- Paid $2,000 for the supplies purchased in transaction (4).

- Recorded the use of one month of the rent paid for in transaction (2).

| Cash | Bank Loan | Share Capital | Repair Revenue | |||||||

| (1)

5,000 |

(1)

5,000 |

|||||||||

| Accounts Receivable | Accounts Payable | Electricity Expense | ||||||||

| Prepaid Expense | Rent Expense | |||||||||

| Unused Supplies | Supplies Expense | |||||||||

Click Here to View Solution

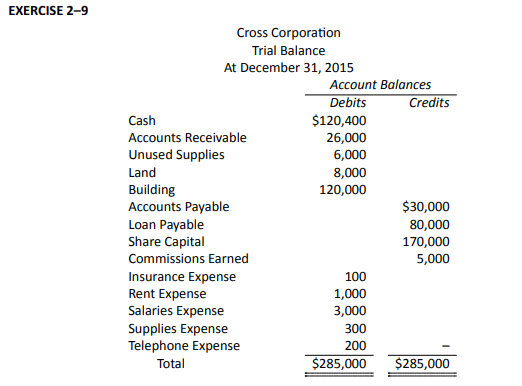

The following Trial Balance was prepared from the books of Cross Corporation at its year-end, December 31, 2015. After the company’s bookkeeper left, the office staff was unable to balance the accounts or place them in their proper order. Individual account balances are correct, but debits may be incorrectly recorded as credits and vice-versa.

| Account Title | Account Balances | ||

| Debits | Credits | ||

| Cash | $120,400 | ||

| Commissions Earned | 5,000 | ||

| Share Capital | $170,000 | ||

| Accounts Payable | 30,000 | ||

| Insurance Expense | 100 | ||

| Land | 8,000 | ||

| Building | 120,000 | ||

| Rent Expense | 1,000 | ||

| Accounts Receivable | 26,000 | ||

| Unused Supplies | 6,000 | ||

| Supplies Expense | 300 | ||

| Loan Payable | 80,000 | ||

| Salaries Expense | 3,000 | ||

| Telephone Expense | 200 | ||

|

Totals |

$161,700 | $408,300 | |

Prepare a corrected Trial Balance showing the accounts in proper order and balances in the correct column. List expenses in alphabetical order. Total the columns and ensure total debits equal total credits.

Click Here to View Solution

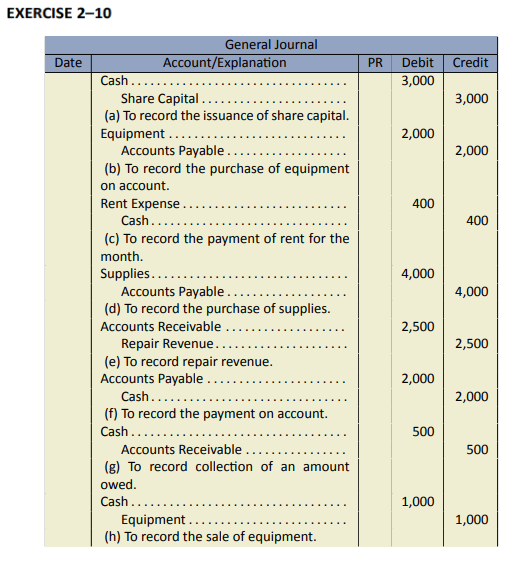

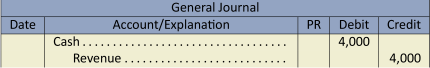

Prepare journal entries for each of the following transactions:

- Issued share capital for $3,000 cash.

- Purchased $2,000 of equipment on credit.

- Paid $400 cash for this month’s rent.

- Purchased on credit $4,000 of supplies to be used next month.

- Billed $2,500 to customers for repairs made to date.

- Paid cash for one-half of the amount owing in transaction (d).

- Collected $500 of the amount billed in transaction (e).

- Sold one-half of the equipment purchased in transaction 2 above for $1,000 in cash.

Click Here to View Solution

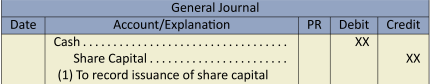

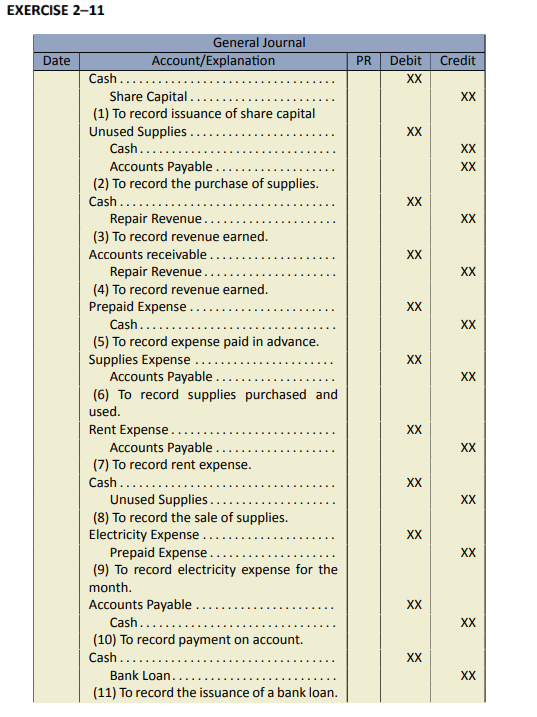

Prepare the journal entries and likely descriptions of the eleven transactions that were posted to the following General Ledger accounts for the month ended January 31, 2015. Do not include amounts. For instance, the first entry would be:

| Cash | Bank Loan | Share Capital | Repair Revenue | |||||||

| 1 | 2 | 11 | 1 | 3 | ||||||

| 3 | 5 | 4 | ||||||||

| 8 | 10 | |||||||||

| 11 | ||||||||||

| Accounts Receivable | Accounts Payable | Electricity Expense | ||||||||

| 4 | 10 | 2 | 9 | |||||||

| 6 | ||||||||||

| 7 | ||||||||||

| Prepaid Expense | Rent Expense | |||||||||

| 5 | 9 | 7 | ||||||||

| Unused Supplies | Supplies Expense | |||||||||

| 2 | 8 | 6 | ||||||||

Click Here to View Solution

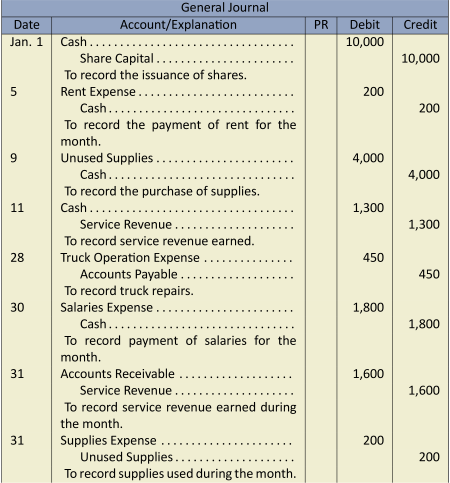

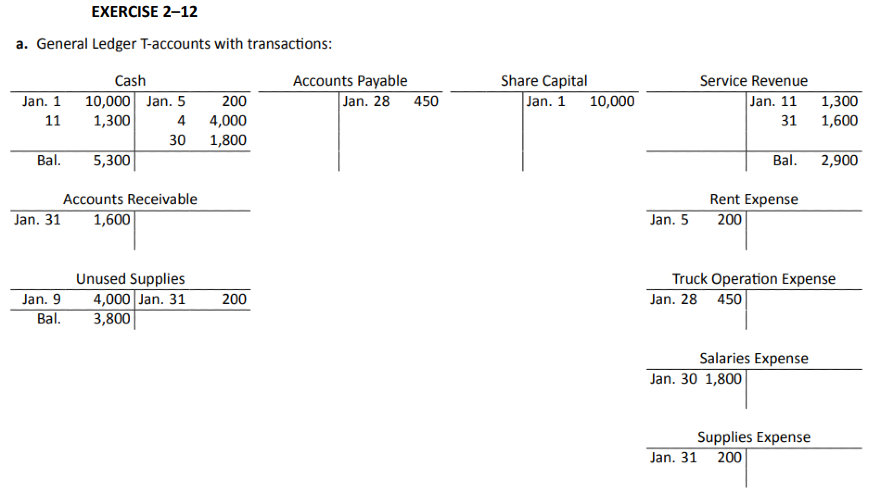

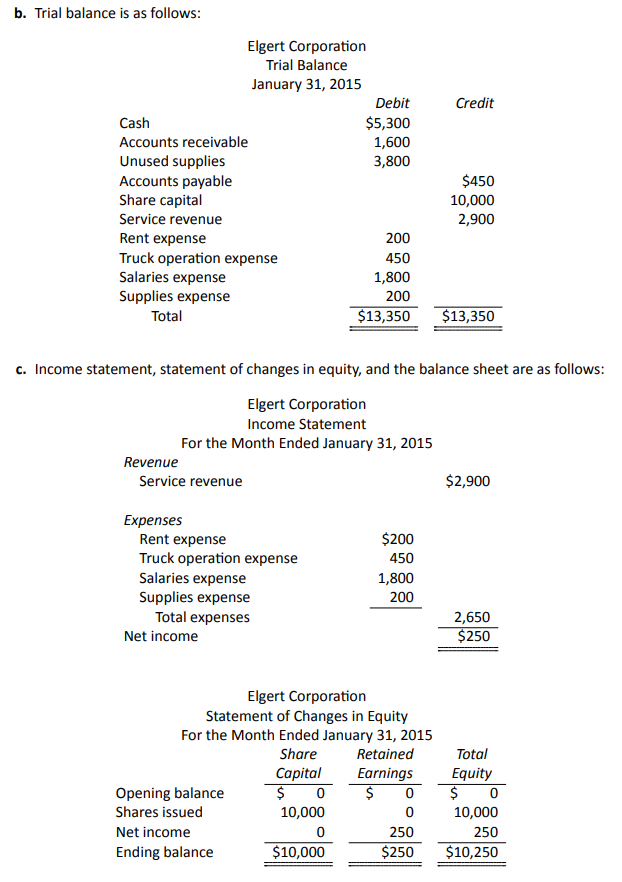

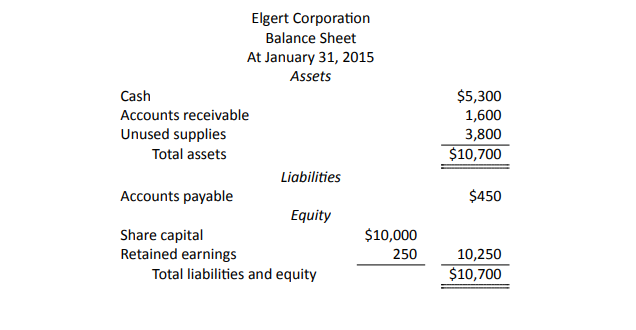

The following journal entries were prepared for Elgert Corporation for its first month of operation, January 2015.

- Prepare necessary General Ledger T-accounts and post the transactions.

- Prepare a Trial Balance at January 31, 2015.

- Prepare an Income Statement and Statement of Changes in Equity for the month ended January 31, 2015 and a Balance Sheet at January 31, 2015.

Click Here to View Solution

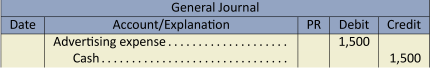

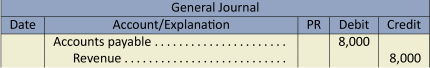

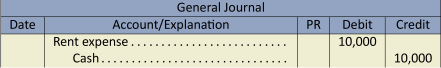

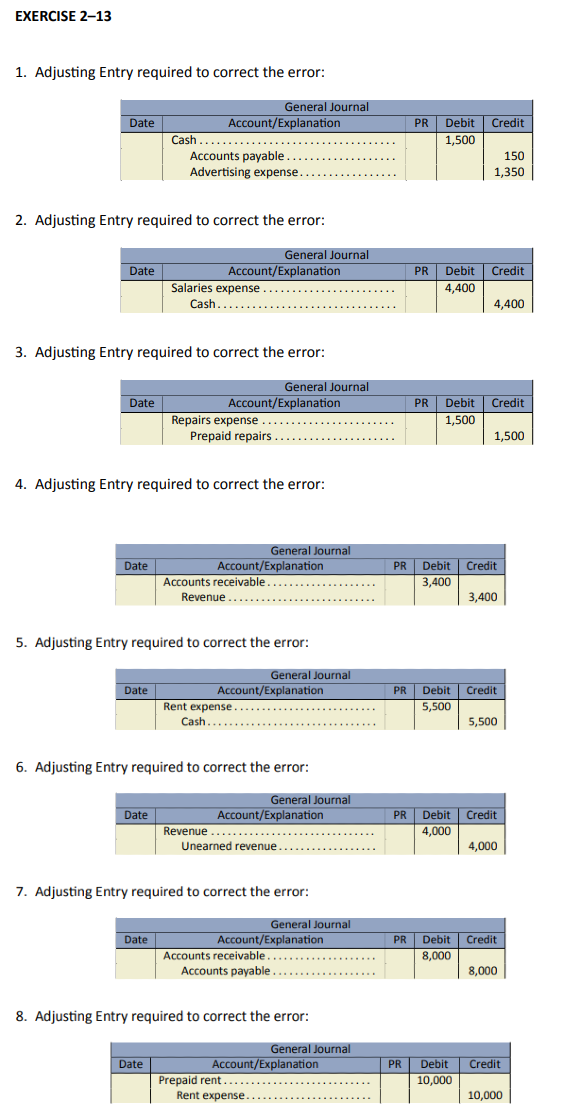

Below are transactions that contain errors in the journal entry.

- Received an invoice from a supplier for advertising in the amount of $150.

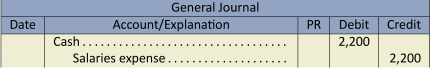

- Paid employee salaries in the amount of $2,200.

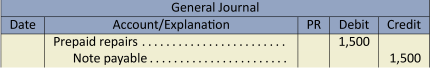

- Received repair services worth $1,500 from a supplier in exchange for a note due in sixty days.

- Completed service work for a British customer. Invoiced $5,000 GBP (British pounds Sterling funds). The Canadian currency equivalent is $8,400 CAD. (Hint: Recall the monetary unit principle.)

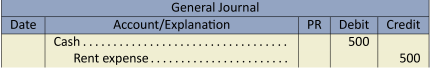

- Rent of $5,000 cash was paid for the current month’s rent.

- Received a cheque in the amount of $4,000 from a customer for service work to be started in three months.

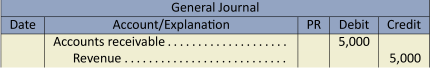

- Completed a project for a customer and billed them $8,000 for the service work.

- Rent of $10,000 for the next six months was paid in advance.

Record the correcting journal entries. (Hint: One method is to reverse the incorrect entry and record the correct entry and a second method is to record the correcting amounts to the applicable accounts only.)

Click Here to View Solution

Practice Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 2. It is recommended that students review any relevant sections that they struggled with in answering these problems.

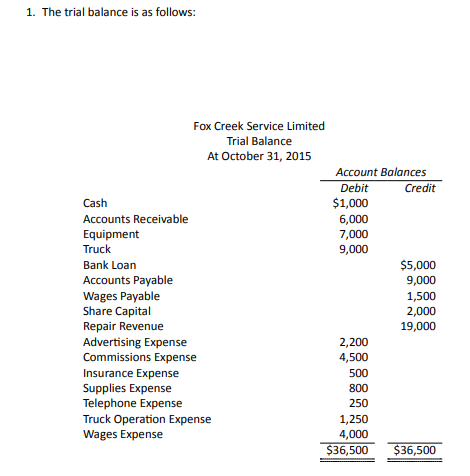

The following account balances are taken from the records of Fox Creek Service Limited at October 31, 2015 after its first year of operation:

| Accounts Payable | $9,000 | Insurance Expense | $

500 |

|

| Accounts Receivable | 6,000 | Repair Revenue | 19,000 | |

| Advertising Expense | 2,200 | Supplies Expense | 800 | |

| Bank Loan | 5,000 | Telephone Expense | 250 | |

| Cash | 1,000 | Truck | 9,000 | |

| Share Capital | 2,000 | Truck Operation | ||

| Commissions Expense | 4,500 |

Expense |

1,250 | |

| Equipment | 7,000 | Wages Expense | 4,000 | |

| Wages Payable | 1,500 |

- Prepare a Trial Balance at October 31, 2015.

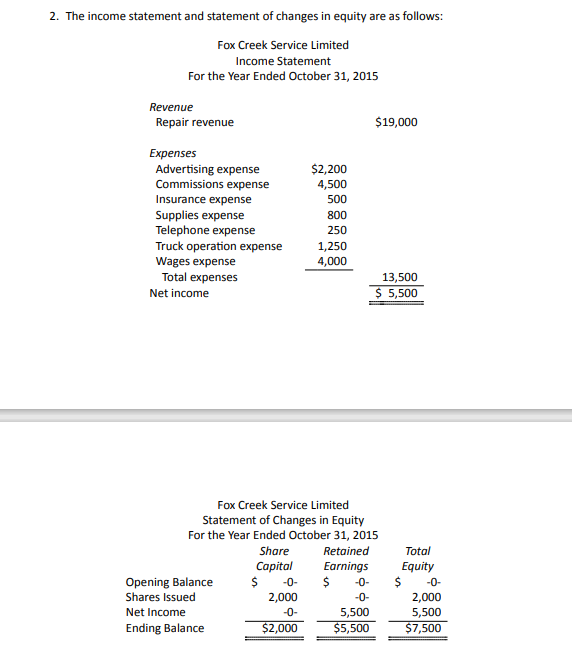

- Prepare an Income Statement and Statement of Changes in Equity for the year ended October 31, 2015.

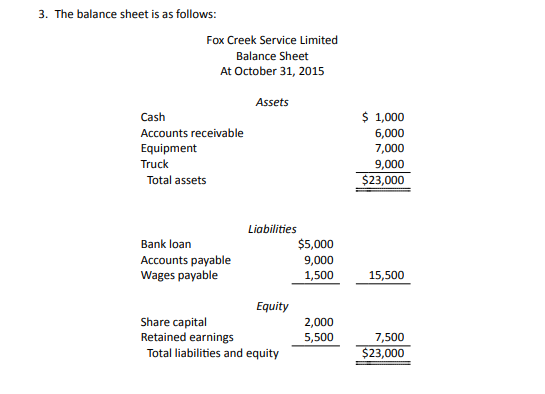

- Prepare a Balance Sheet at October 31, 2015.

Click Here to View Solution

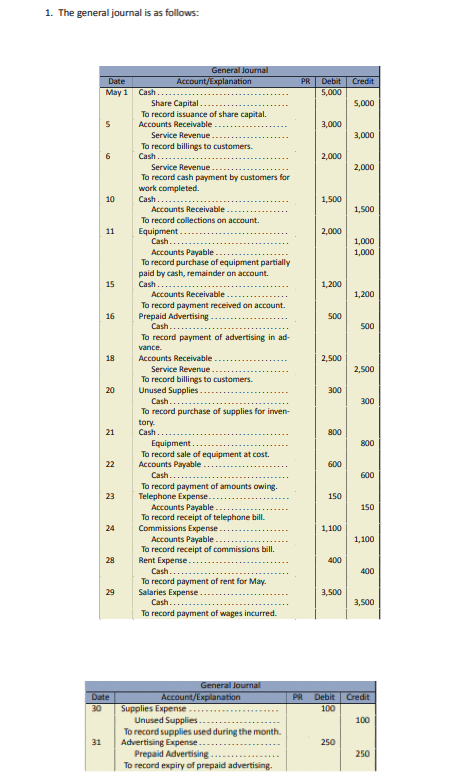

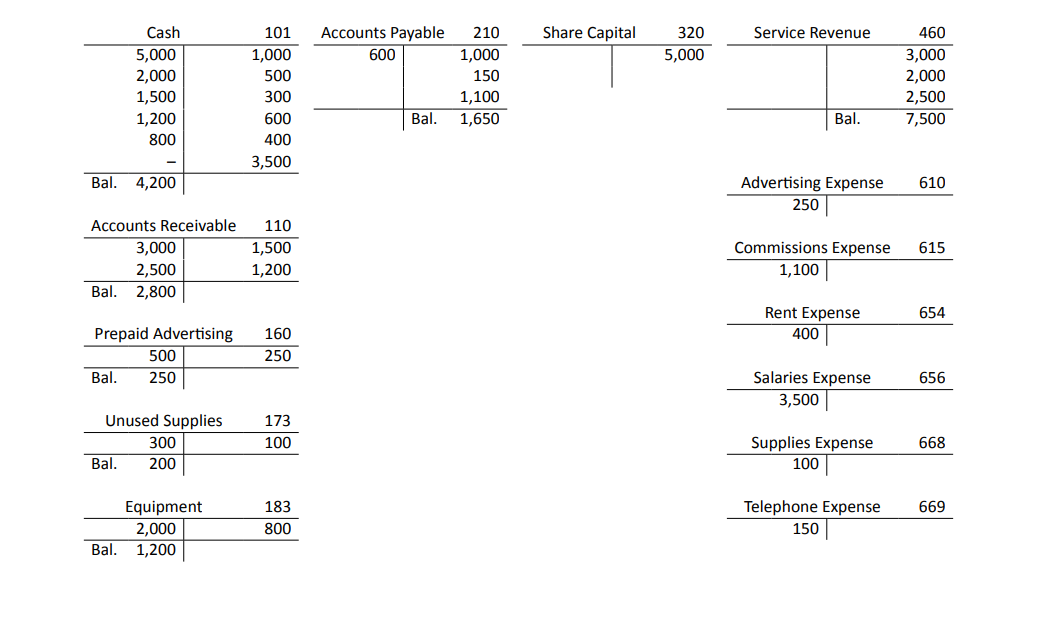

The following ledger accounts were prepared for Davidson Tool Rentals Corporation during the first month of operation ending May 31, 2015. No journal entries were prepared in support of the amounts recorded in the ledger accounts.

| Cash | 101 | Accounts Payable | 210 | Share Capital | 320 | Service Revenue | 470 | |||||||||||

| May 1 | 5,000 | May 11 | 1,000 | May 22 | 600 | May 11 | 1,000 | May 1 | 5,000 | May 5 | 3,000 | |||||||

| 6 | 2,000 | 16 | 500 | 23 | 150 | 6 | 2,000 | |||||||||||

| 10 | 1,500 | 20 | 300 | 24 | 1,100 | 18 | 2,500 | |||||||||||

| 15 | 1,200 | 22 | 600 | |||||||||||||||

| 21 | 800 | 28 | 400 | Advertising Expense | 610 | |||||||||||||

| 29 | 3,500 | May 31 | 250 | |||||||||||||||

| Accounts Receivable | 110 | Commissions Expense | 615 | |||||||||||||||

| May 5 | 3,000 | May 10 | 1,500 | May 24 | 1,100 | |||||||||||||

| 18 | 2,500 | 15 | 1,200 | |||||||||||||||

| Rent Expense | 654 | |||||||||||||||||

| Prepaid Advertising | 160 | May 28 | 400 | |||||||||||||||

| May 16 | 500 | May 31 | 250 | |||||||||||||||

| Salaries Expense | 656 | |||||||||||||||||

| Unused Supplies | 173 | May 29 | 3,500 | |||||||||||||||

| May 20 | 300 | May 30 | 100 | |||||||||||||||

| Supplies Expense | 668 | |||||||||||||||||

| Equipment | 183 | May 30 | 100 | |||||||||||||||

| May 11 | 2,000 | May 21 | 800 | |||||||||||||||

| Telephone Expense | 669 | |||||||||||||||||

| May 23 | 150 | |||||||||||||||||

- Reconstruct the transactions that occurred during the month and prepare journal entries to record these transactions, including appropriate descriptions. Include accounts numbers (Folio) using the Chart of Accounts provided. Calculate the balance in each account.

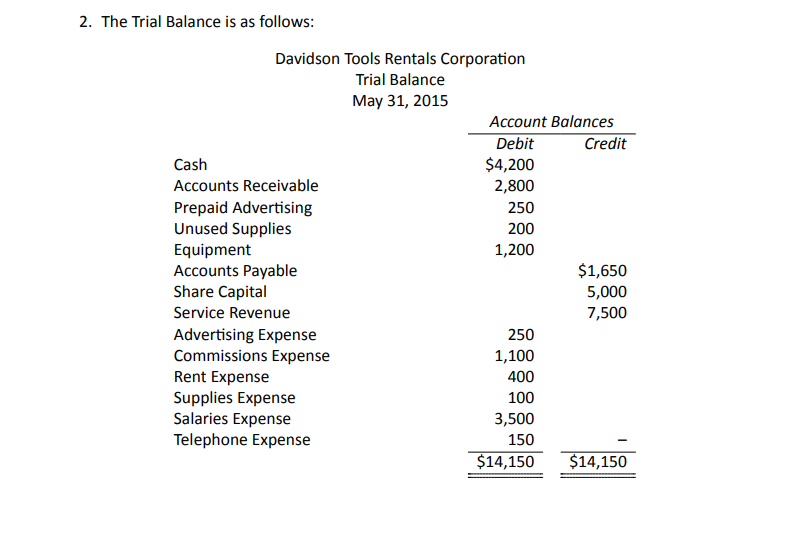

- Total the transactions in each T-account above. Prepare a Trial Balance in proper order (list assets, liabilities, equity, revenue, then expenses) at May 31, 2015.

Click Here to View Solution

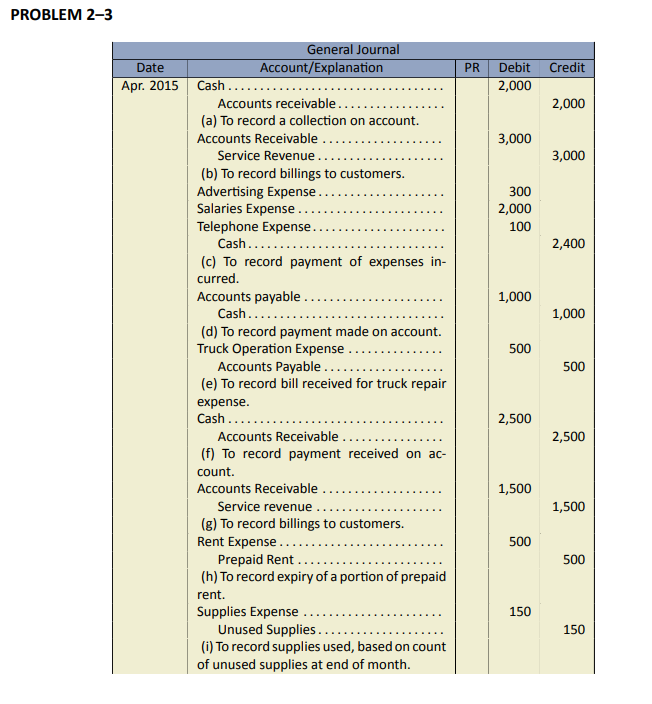

The following balances appeared in the General Ledger of Fenton Table Rentals Corporation at April 1, 2015.

| Cash | $1,400 | Accounts Payable | $2,000 | |

| Accounts Receivable | 3,600 | Share Capital | 4,350 | |

| Prepaid Rent | 1,000 | |||

| Unused Supplies | 350 |

The following transactions occurred during April:

- Collected $2,000 cash owed by a customer.

- Billed $3,000 to customers for tables rented to date.

- Paid the following expenses: advertising, $300; salaries, $2,000; telephone, $100.

- Paid half of the accounts payable owing at April 1.

- Received a $500 bill for April truck repair expenses.

- Collected $2,500 owed by a customer.

- Billed $1,500 to customers for tables rented to date.

- Transferred $500 of prepaid rent to rent expense.

- Counted $200 of supplies on hand at April 30; recorded the amount used as an expense.

Prepare journal entries to record the April transactions.

Click Here to View Solution

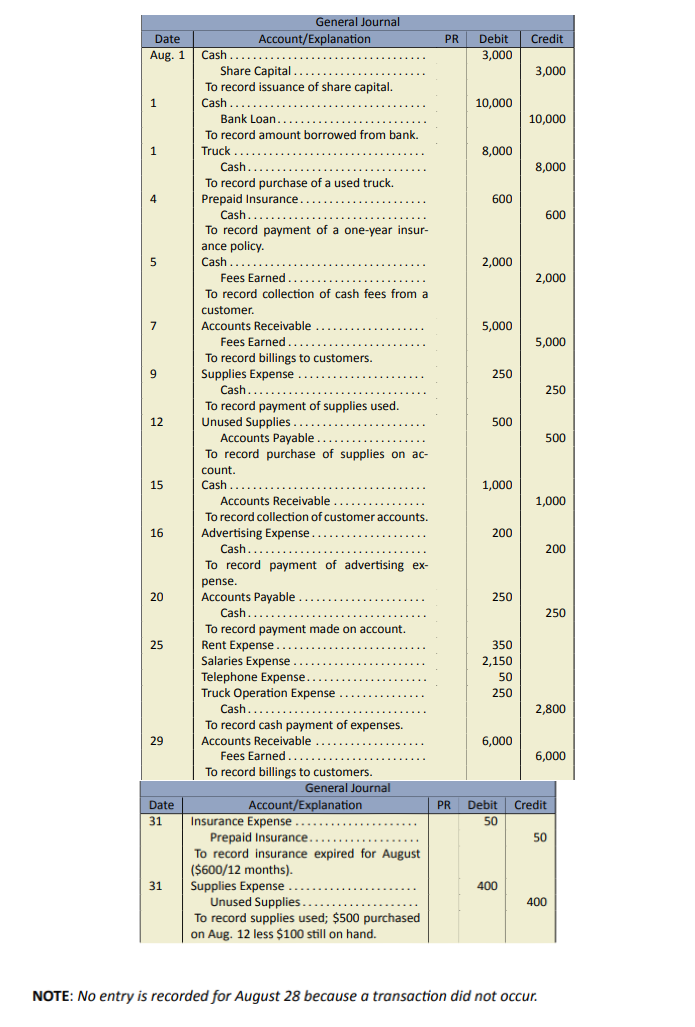

The following transactions occurred in Thorn Accounting Services Inc. during August 2015, its first month of operation.

| Aug. 1 | Issued share capital for $3,000 cash. |

| 1 | Borrowed $10,000 cash from the bank. |

| 1 | Paid $8,000 cash for a used truck. |

| 4 | Paid $600 for a one-year truck insurance policy effective August 1. |

| 5 | Collected $2,000 fees in cash from a client for work performed today |

| (recorded as Fees Earned). | |

| 7 | Billed $5,000 fees to clients for services performed to date (recorded as |

| Fees Earned). | |

| 9 | Paid $250 for supplies used to date. |

| 12 | Purchased $500 of supplies on credit (recorded as Unused Supplies). |

| 15 | Collected $1,000 of the amount billed on August 7. |

| 16 | Paid $200 for advertising in The News during the first two weeks of August. |

| 20 | Paid half of the amount owing for the supplies purchased on August 12. |

| 25 | Paid cash for the following expenses: rent for August, $350; salaries, |

| $2,150; telephone, $50; truck repairs, $250. | |

| 28 | Called clients for payment of the balance owing from August 7. |

| 29 | Billed $6,000 of fees to clients for services performed to date |

| (recorded as Fees Earned). | |

| 31 | Transferred the amount of August’s truck insurance ($50) to |

| Insurance Expense. | |

| 31 | Counted $100 of supplies still on hand (recorded the amount used |

| as Supplies Expense). |

Prepare journal entries to record the August transactions.

Click Here to View Solution

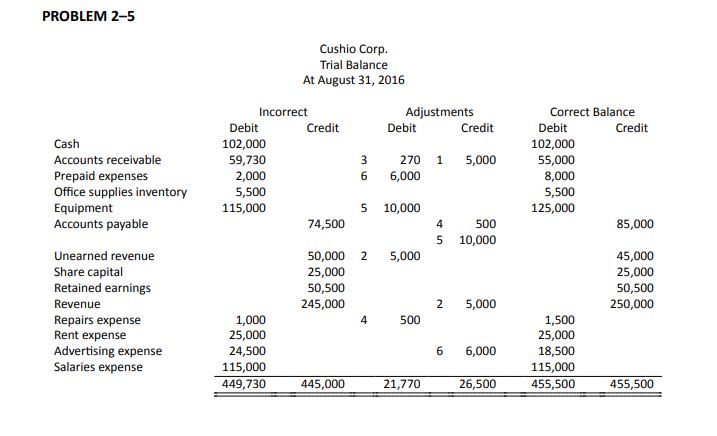

Below is the trial balance for Cushio Corp. which contains a number of errors:

| Cushio Corp. | ||||||

| Trial Balance | ||||||

| At August 31, 2016 | ||||||

| Incorrect | ||||||

| Debit | Credit | |||||

| Cash | $ | 102,000 | ||||

| Accounts receivable | 59,730 | |||||

| Prepaid expenses | 2,000 | |||||

| Office supplies inventory | 5,500 | |||||

| Equipment | 115,000 | |||||

| Accounts payable | $ | 74,500 | ||||

| Unearned revenue | 50,000 | |||||

| Share capital | 25,000 | |||||

| Retained earnings | 50,500 | |||||

| Revenue | 245,000 | |||||

| Repairs expense | 1,000 | |||||

| Rent expense | 25,000 | |||||

| Advertising expense | 24,500 | |||||

| Salaries expense | 115,000 | |||||

| $ | 449,730 | $ | 445,000 | |||

The following errors were discovered:

- Cushio collected $5,000 from a customer and posted a debit to Cash but did not post a credit entry to accounts receivable.

- Cushio completed service work for a customer for $5,000 and debited accounts receivable but credited unearned revenue.

- Cushio received cash of $583 from a customer as payment on account and debited cash for $583, but incorrectly credited accounts receivable for $853.

- Cushio did not post an invoice of $500 received for repairs.

- Cushio purchased equipment for $5,000 on account and posted the transaction as a debit to accounts payable and a credit to equipment.

- Cushio purchased advertising services for cash of $6,000 that will be published in the newspapers over the next six months. This transaction was posted as a debit to advertising expense and a credit to cash for $6,000.

Prepare a corrected trial balance. (Hint: Using T-accounts would be helpful.)

Click Here to View Solution

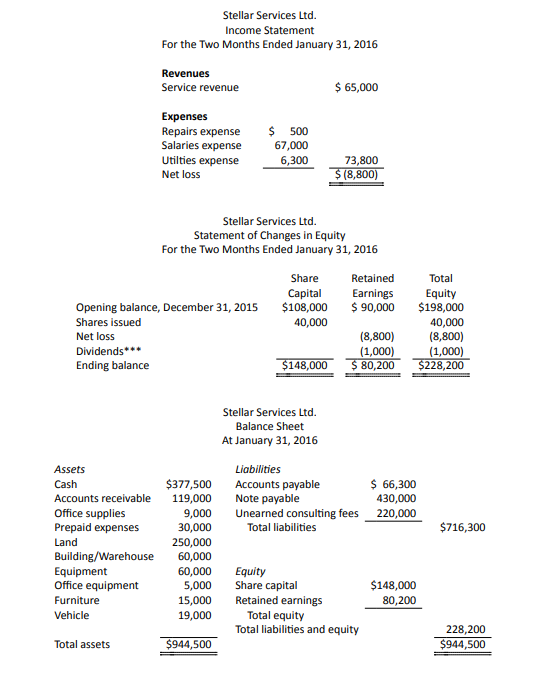

Stellar Services Ltd. is an engineering firm that provides electrical engineering consulting services to various clients. Below are the account balances in its General Ledger as at December 31, 2015 which is its first month of operations. All accounts have normal balances as explained in the text.

| Stellar Services Ltd. | |||

| Trial Balance | |||

| At December 31, 2015 | |||

| Accounts payable | $ | 115,000 | |

| Accounts receivable | 85,000 | ||

| Cash | 150,000 | ||

| Building/warehouse | – | ||

| Equipment | 45,000 | ||

| Furniture | 15,000 | ||

| Land | – | ||

| Notes payable | 20,000 | ||

| Office equipment | – | ||

| Office supplies | 7,000 | ||

| Prepaid expenses | – | ||

| Repairs expense | 500 | ||

| Retained earnings | 90,000 | ||

| Salaries expense | 32,000 | ||

| Service revenue | 25,000 | ||

| Share capital | 108,000 | ||

| Unearned service revenue | – | ||

| Utilities expense | 4,500 | ||

| Vehicle | 19,000 | ||

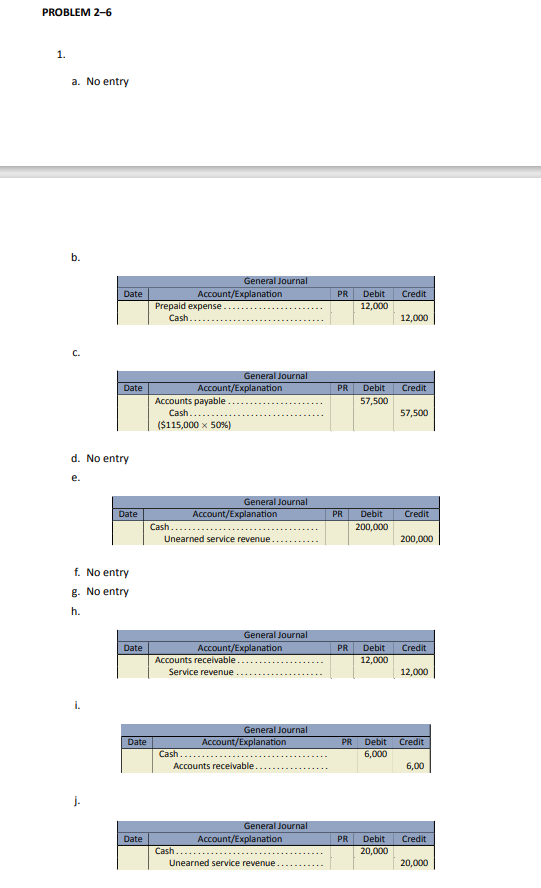

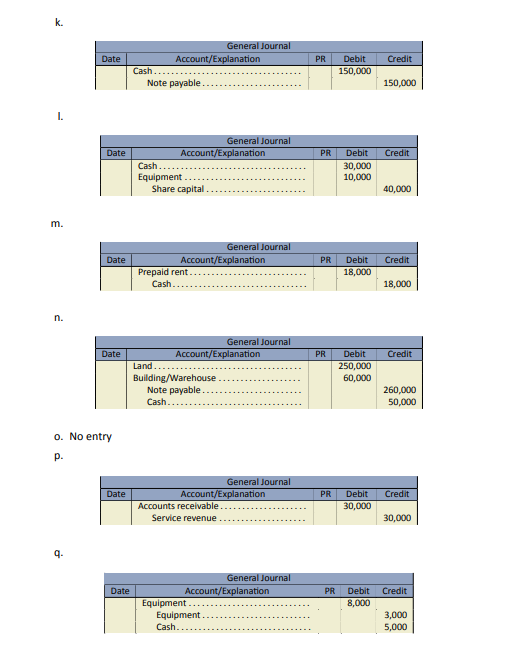

Listed below are activities for Stellar Services Ltd. for the month of January, 2016:

- Stellar ordered $3,500 in new software from a software supplier. It will be paid when it is ready to install in three weeks.

- Paid $12,000 for a two-year insurance policy to begin February 1, 2016.

- Paid one half of the outstanding accounts payable.

- Hired a new employee who will start up February 1, 2016. His salary will be $2,500 every two weeks.

- Received cash of $200,000 from a client for a $1,000,000 consulting contract. Work will commence in April.

- Booked a conference room at a hotel for a presentation to potential customers scheduled for February 15. The $600 rental fee will be paid February 1.

- Met with a client’s lawyer about a fire that destroyed a portion of the client’s building. The client is planning to sue Stellar for $300,000 based on some previous consulting services Stellar provided to the client.

- Completed four electrical inspections today on credit for $3,000 each.

- Collected from two of the credit customers from item 8.

- Received $20,000 from a client in partial payment for services to be provided next year.

- Borrowed $150,000 from their bank by signing a note payable due on August 31, 2017.

- John Stellar invested $30,000 cash and engineering equipment with a fair value of $10,000 in exchange for capital shares.

- Stellar rented some additional office space and paid $18,000 for the next six month’s rent.

- Purchased land and a small warehouse for $50,000 cash and a long-term note payable for the balance. The land was valued at $250,000 and the warehouse at $60,000.

- Signed an agreement with a supplier for equipment rental for a special project to begin on February 23, 2016. A deposit for $300 is to be paid on February 1.

- Completed $30,000 of services for a client which is payable in 30 days.

- Purchased $8,000 of equipment for $5,000 cash and a trade-in of some old equipment that originally was recorded at $3,000.

- Paid $1,000 in cash dividends.

- Refunded the client $2,000 due to a complaint about the consulting services provided in item 16.

- Paid salaries of $35,000.

- Received a bill for water and electricity in the amount of $1,800 for January, which will be paid on February 15.

- Purchased some office equipment for $5,000 and office supplies for $2,000 on account.

- Placed an order with a supplier for $10,000 of drafting supplies to be delivered February 10. This must be paid by February 25.

- Prepare all required journal entries for January.

- Prepare the income statement, the statement of changes in equity and the balance sheet as at January 31, 2016. (Hint: Using T-accounts would be helpful.)

Click Here to View Solution

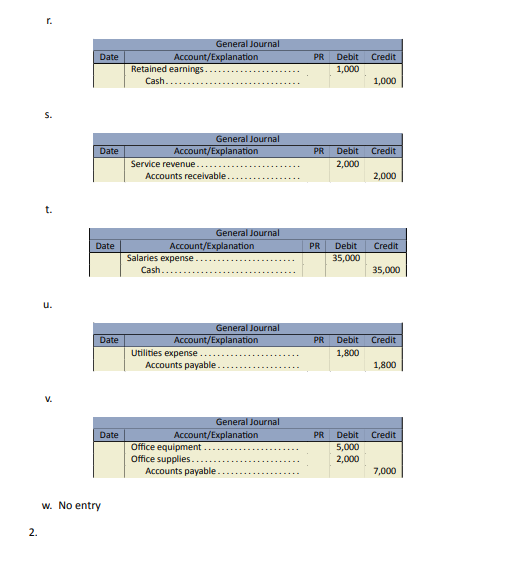

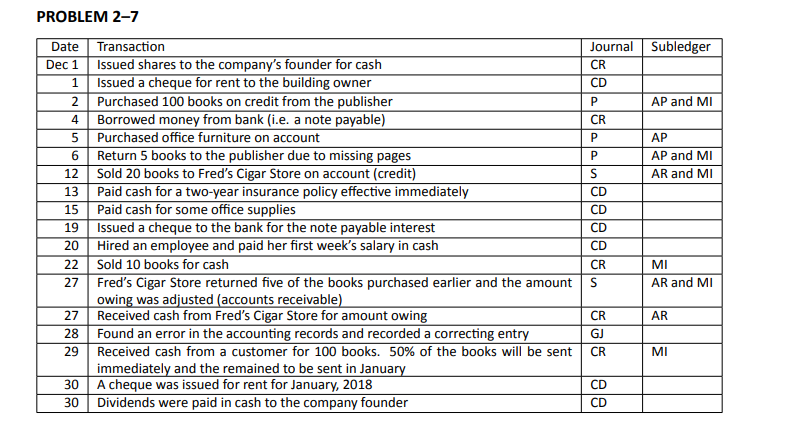

The following are selected transactions from December, 2017 for Readem & Weep Sad Books Co. Ltd., who purchases and sells books for a profit.

Complete the schedule based on the information in Section 2.4, Special Journals and Subledgers from this chapter. If a transaction has no applicable subledger, leave answer blank.

| Journals | |

| Sales | S |

| Purchases | P |

| Cash Receipts | CR |

| Cash Disbursements | CD |

| General Journal | GJ |

| Subledgers | |

| Accounts Receivable | AR |

| Accounts Payable | AP |

| Merchandise Inventory | MI |

| Date | Transaction | Journal | Subledger |

| Dec 1 | Issued shares to the company’s founder for cash | ||

| 1 | Issued a cheque for rent to the building owner | ||

| 2 | Purchased 100 books on credit from the publisher | ||

| 4 | Borrowed money from bank (i.e. a note payable) | ||

| 5 | Purchased office furniture on account | ||

| 6 | Return 5 books to the publisher due to missing pages | ||

| 12 | Sold 20 books to Fred’s Cigar Store on account (credit) | ||

| 13 | Paid cash for a two-year insurance policy effective immediately | ||

| 15 | Paid cash for some office supplies | ||

| 19 | Issued a cheque to the bank for the note payable interest | ||

| 20 | Hired an employee and paid her first week’s salary in cash | ||

| 22 | Sold 10 books for cash | ||

| 27 | Fred’s Cigar Store returned five of the books purchased earlier and the amount owing was adjusted (accounts receivable) | ||

| 27 | Received cash from Fred’s Cigar Store for amount owing | ||

| 28 | Found an error in the accounting records and recorded a correcting entry | ||

| 29 | Received cash from a customer for 100 books. 50% of the books will be sent immediately and the remained to be sent in January | ||

| 30 | A cheque was issued for rent for January, 2018 | ||

| 30 | Dividends were paid in cash to the company founder |

Click Here to View Solution

Listed below are transactions for the first month of operations for Harmand Ltd., a consulting company who provides engineering consulting services and also sells vintage model airplanes (cost of goods sold ignored for simplicity).

| June 1 | Purchased equipment on credit from Bradley & Co., $12,000. |

| 2 | Billed consulting services completed for Cooper Co., Invoice #17001 for $8,000. |

| 3 | Issued cheque #601 to LRS Properties Ltd., for office rent for June, $3,500. |

| 4 | Purchased office supplies from Office Supplies Ltd., cheque #602 for $1,240. |

| 6 | Sold five vintage model airplanes to Mr. F. Scott on account, Invoice #17002 for $2,500 each. |

| 7 | Sold one vintage model airplane as a cash sale, $2,000. |

| 8 | Received cash from Cooper Co., for Invoice #17001 for $7,920. Cooper was entitled to an early payment discount of $80 because they paid their account within 10 days of being billed. |

| 9 | Paid salary for one employee, cheque #603 for $1,400. |

| 10 | Received an invoice from the Daily Gazette for advertising, payable in 30 days; $1,200. |

| 10 | Paid 20% of the June 1 equipment purchase; cheque #604. |

| 11 | Received a cheque for $5,000 from Fort Robbins Bridge Builders Ltd., for consulting work that will begin July 1; |

| 14 | Borrowed $10,000 from the bank as a loan. |

| 18 | Issued a receipt for $5,000 for cash payment from F. Scott as a partial payment of their account. |

| 22 | Issued 500 additional shares to owner and shareholder for $5,000 cash. |

| 23 | Paid utilities bill from last month to HTC Power Corp., cheque #605 for $350. |

| 25 | Billed $35,000 of consulting services rendered to Boyzee Villages Corp. Invoice #17003. |

| 28 | Paid Daily Gazette amount owing early and received a discount of $12, reducing payment to $1,188, cheque #606. |

| 29 | Paid $200 in dividends to Bill Sloan, owner and sole shareholder, cheque #607. |

| 30 | Paid $1,000 to pay the interest owing to date of $30 (interest expense) and reduce the bank loan for the balance, cheque #608. |

| 30 | Paid salary for employee up to date, cheque #609 for $1,600. |

| 30 | Corrected an error in the payment to the bank. Interest expense should be $35 and $965 to reduce the bank loan. |

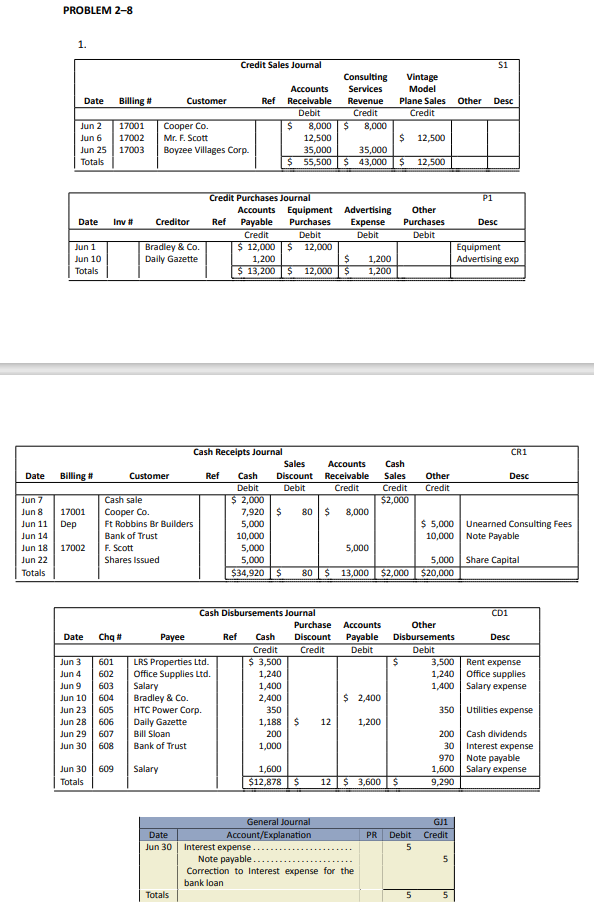

- Prepare a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and general journal as shown below. Record the June transactions into these journals. (Ignore GST and account codes for simplicity.)

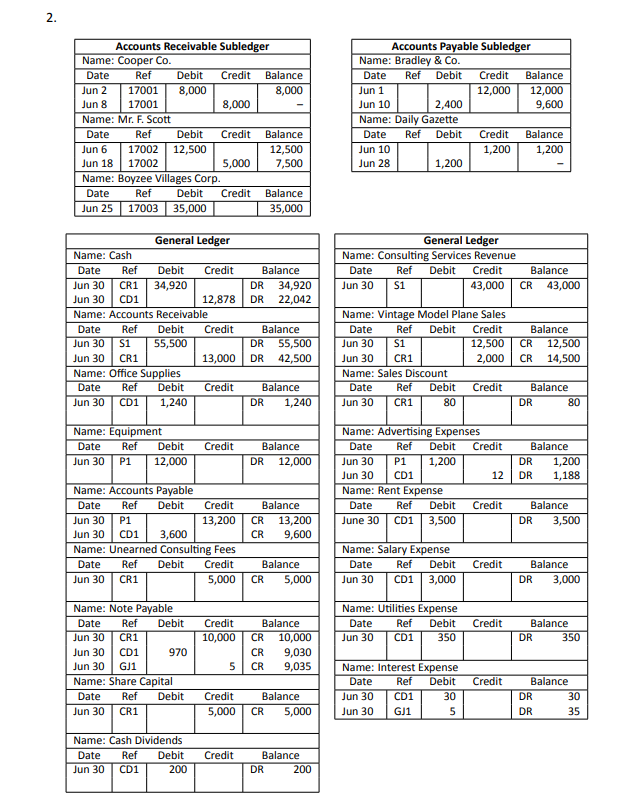

Credit Sales Journal S1 Consulting Vintage Accounts Services Model Date Billing # Customer Ref Receivable Revenue Plane Sales Other Desc Debit Credit Credit Totals Credit Purchases Journal P1 Accounts Equipment Advertising Other Date Invoice # Creditor Ref Payable Purchases Expense Purchases Desc Credit Debit Debit Debit Totals Cash Receipts Journal CR1 Sales Accounts Cash Date Billing # Customer Ref Cash Discount Receivable Sales Other Desc Debit Debit Credit Credit Credit Totals Cash Disbursements Journal CD1 Purchase Accounts Other Date Chq # Payee Ref Cash Discount Payable Disbursements Desc Credit Credit Debit Debit Totals General Journal GJ1 Date Account/Explanation PR Debit Credit Totals - Prepare an accounts receivable subledger, accounts payable subledger, and a general ledger as shown below. Post the journals from part 1 to the subledgers and general ledger as shown in Section 2.4 of this chapter. You will need to create multiple Accounts Receivable and Accounts Payable subledgers, as well as general ledgers.

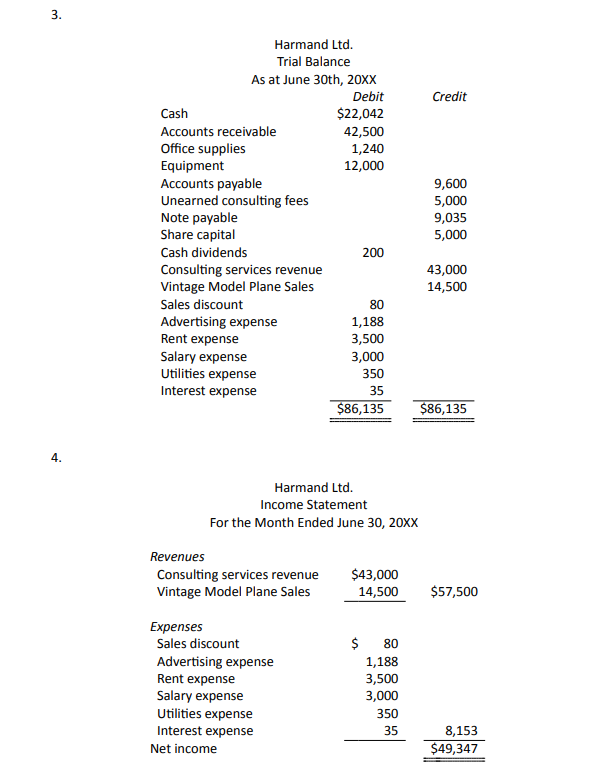

Accounts Receivable Subledger Name: Date Ref Debit Credit Balance Accounts Payable Subledger Name: Date Ref Debit Credit Balance General Ledger Name: Date Ref Debit Credit Balance - Prepare a trial balance from the general ledger accounts. Use the format shown in Section 2.3 of this chapter. Ensure that the trial balance debits equal the credits and that the subledgers balance to their respective accounts receivable and accounts payable control accounts.

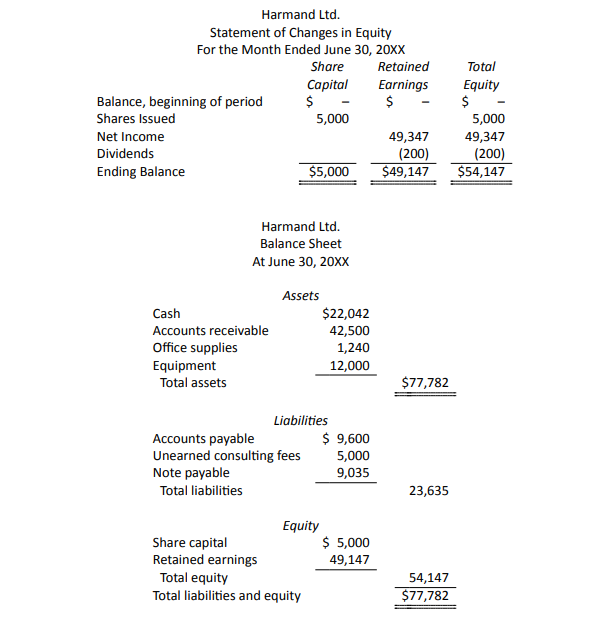

- Prepare an income statement, statement of changes in equity and a balance sheet as at June 30, 20XX. Use the format shown in Section 2.3 of this chapter.

1. Revenues and the issuance of Share Capital are equity accounts. They cause equity to increase so increases in these account types are recorded as credits.

2. Expenses, and Dividends are equity accounts. They cause equity to decrease. Decreases in equity are always recorded as debits so as expenses and dividends are realized, they are debited.

3. The issuance of share capital and revenues cause equity to increase; as indicated above, increases in equity are recorded as credits. Dividends and expenses cause equity to decrease; decreases in equity are recorded as debits.

Click Here to View Solution