2 Chapter 13

Chapter 13: Proprietorships and Partnerships

Chapter 1 introduced the three forms of business organizations — corporations, proprietorships, and partnerships. The corporation has been the focus in Chapters 1 through 12. This chapter will expand on some of the basic accounting concepts as they apply to proprietorships and partnerships.

Chapter 13 Learning Objectives

-

LO1 – Describe the characteristics of a proprietorship, including how its financial statements are different from those of a corporation.

-

LO2 – Describe the characteristics of a partnership including how its financial statements are different from those of a corporation.

Concept Self-Check

Use the following questions as a self-check while working through Chapter 13.

-

What are some of the characteristics of a proprietorship, that are different from those of a corporation?

-

What is the journal entry to record the investment of cash by the owner into a proprietorship?

-

How are the closing entries for a proprietorship different than those recorded for a corporation?

-

Why is there only one equity account on a sole proprietorship’s balance sheet and multiple accounts in the equity section of a corporate balance sheet?

-

What is mutual agency as it relates to a partnership?

-

How is a partnership different than a corporation?

NOTE: The purpose of these questions is to prepare you for the concepts introduced

in the chapter. Your goal should be to answer each of these questions as you read through

the chapter. If, when you complete the chapter, you are unable to answer one or more the

Concept Self-Check questions, go back through the content to find the answer(s). Solutions

are not provided to these questions.

13.1 Proprietorships

LO1 – Describe the characteristics of a proprietorship including, how its financial statements are different from those of a corporation.

As discussed in Chapter 1, a proprietorship is a business owned by one person. It is not a separate legal entity, which means that the business and the owner are considered to be the same entity. As a result, for example, from an income tax perspective, the profits of a proprietorship are taxed as part of the owner’s personal income tax return. Unlimited liability is another characteristic of a proprietorship meaning that if the business could not pay its debts, the owner would be responsible even if the business’s debts were greater than the owner’s personal resources.

Investing in a Proprietorship

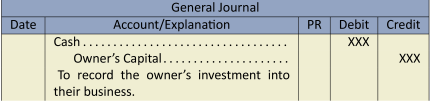

When the owners of a corporation, known as shareholders, invest in the corporation, shares are issued. The shares represent how much of the corporation is owned by each shareholder. In a proprietorship, there is only one owner. When that owner invests in their business, the journal entry is:

Distribution of Income in a Proprietorship — Withdrawals

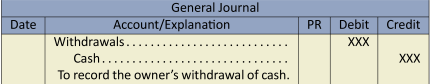

A corporation distributes a portion of income earned to its owners, the shareholders, in the form of dividends. In a proprietorship, the owner distributes a portion of the business’s income to her/himself in the form of withdrawals. Typically, the owner will withdraw cash but they can withdraw other assets as well. The journal entry to record a cash withdrawal is:

Closing Entries for a Proprietorship

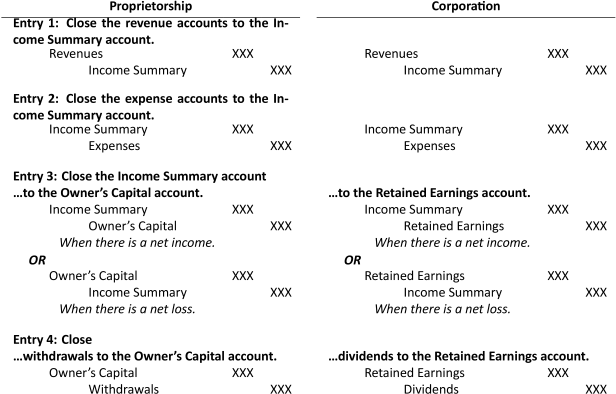

The closing entries for a corporation involved four steps:

Entry 1: Close the revenue accounts to the Income Summary account

This would be identical for a proprietorship.

Entry 2: Close the expense accounts to the Income Summary account

This would also be identical for a proprietorship.

Entry 3: Close the income summary to retained earnings

Instead of closing the balance in the income summary to retained earnings, a proprietorship would close the income summary to the Owner’s Capital account.

Entry 4: Close dividends to retained earnings

The equivalent to dividends for a proprietorship is withdrawals. There is no Retained Earnings account in a proprietorship. A corporation separates investments made by the owners (shareholders) into a Share Capital account while dividends and accumulated net incomes/losses are recorded in retained earnings. In a proprietorship, all owner investments, withdrawals, and net incomes/losses are maintained in the Owner’s Capital account. Therefore, the fourth closing entry for a proprietorship closes withdrawals to this Owner’s Capital account.

Figure 13.1 compares the closing entries for a proprietorship and a corporation.

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Closing Entries.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Closing Entries.

Financial Statements

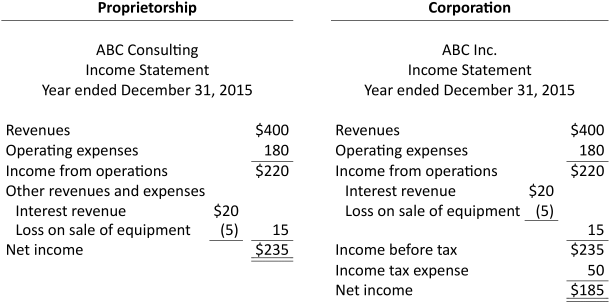

The financial statements for a proprietorship are much the same as for a corporation with some minor differences. As shown in Figure 13.2, the income statements only differ in that the proprietorship does not include income tax expense since its profits are taxed as part of the owner’s personal income tax return.

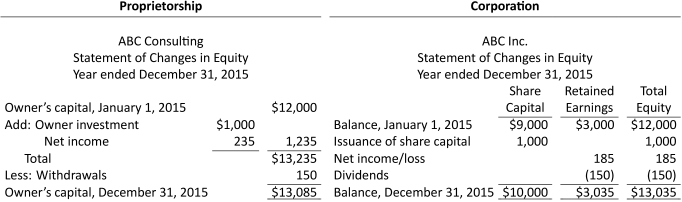

The statement of changes in equity for each of a proprietorship and corporation includes the same elements: beginning equity, additional investments by the owner(s), net income/loss, distribution of income to the owner(s), and the ending balance in equity. However, the statements are structured differently because in a proprietorship, all the equity items are combined in one account, the Owner’s Capital account. In a corporation, equity is divided between share capital and retained earnings. These differences are illustrated in Figure 13.3.

Although both statements are based on identical dollar amounts, notice that the total equity at December 31, 2015 for the proprietorship is $13,085 which is $50 more than the $13,035 shown for the corporation. The $50 difference is the income tax expense deducted on the corporation’s income tax.

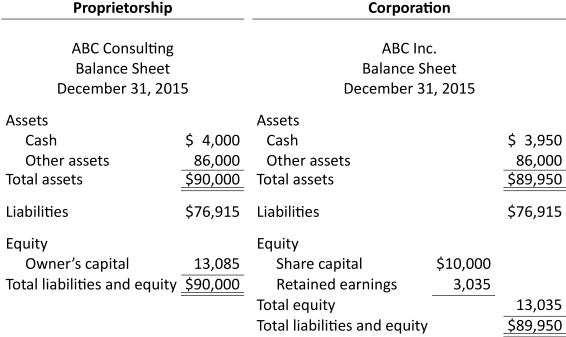

The balance sheet for each of a proprietorship and corporation includes the same elements: assets, liabilities, and equity. However, the equity section of the statement differs because in a proprietorship, all the equity items are combined in one account, the owner’s capital account. In a corporation, equity is divided between share capital and retained earnings. These differences are illustrated in Figure 13.4.

The $50 difference between the proprietorship’s and corporation’s balances in each of cash and total equity is because the corporation paid $50 income tax which the proprietorship is not subject to. The equity sections of the two balance sheets are different only in terms of the types of accounts used.

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Financial Statements.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Financial Statements.

13.2 Partnerships

LO2 – Describe the characteristics of a partnership, including how its financial statements are different from those of a corporation.

As discussed in Chapter 1, a partnership is a business owned by more than one person. Partners should have a partnership contract that details their agreement on things such as each partner’s rights and duties, the sharing of incomes/losses and withdrawals, as well as dispute and termination procedures. A partnership is not a separate legal entity, which means that the business and the partners are considered to be the same entity. As a result, for example, from an income tax perspective, each partner’s share of the profits is taxed as part of that partner’s personal income tax return. Unlimited liability is another characteristic of a partnership, meaning that if the business could not pay its debts, the partners would be responsible even if the business’s debts were greater than their personal resources.

The exception to this would be the formation of a limited liability partnership (LLP) that that is permitted for professionals such as lawyers and accountants. In an LLP, the general partner(s) is/are responsible for the management of the partnership and assume(s) unlimited liability, while the limited partners have limited liability but also limited roles in the partnership as specified in the partnership agreement. Partnerships also have a limited life and are subject to mutual agency. Mutual agency means that a partner can commit the partnership to any contract because each partner is an authorized agent of the partnership. For example, one partner could sign a contract to purchase merchandise that falls within the scope of the business’s operations.

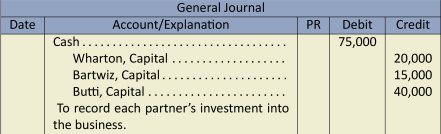

Investing in a Partnership

Recall that when the owners of a corporation, known as shareholders, invest in the corporation, shares are issued. Recall as well that in a proprietorship there is only one owner whose investments into the business are credited to their capital account. A partnership is similar to a proprietorship in that each partner’s investment into the business is credited to an owner’s capital account. The difference is that in a partnership there will be more than one owner’s capital account. For example, assume Doug Wharton, Lisa Bartwiz, and Tahanni Butti started a partnership called WBB Consulting and invested cash of $20,000, $15,000, and $40,000, respectively. The journal entry to record the investment is:

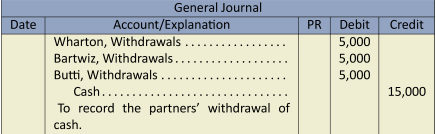

Distribution of Income in a Partnership — Withdrawals

Recall that a corporation distributes a portion of income earned to its owners, the shareholders, in the form of dividends. In a proprietorship and partnership, the owner/partners distribute a portion of the income to themselves in the form of withdrawals. Assume Wharton, Bartwiz, and Butti each withdraw $5,000. The journal entry is:

Closing Entries for a Partnership

The closing entries for a partnership are much the same as those for a proprietorship except that for a partnership there is more than one withdrawals account and more than one capital account. The only complexity with the closing entries for a partnership is with closing the Income Summary account to the capital accounts. The complexity stems from the partnership agreement which details how incomes/losses are to be allocated. Let us review several scenarios.

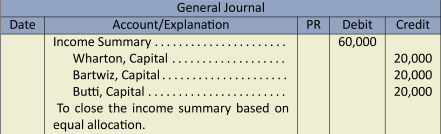

Example 1: Assume WBB Consulting earned $60,000 during the year and the partnership agreement stipulates that incomes/losses are to be allocated equally. The journal entry to close the income summary to the partners’ capital accounts would be:

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income – No Partnership Agreement.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income – No Partnership Agreement.

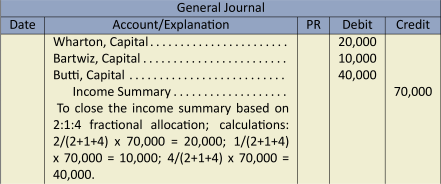

Example 2: Assume WBB Consulting had a net loss of $70,000 during the year and the partnership agreement stipulates that incomes/losses are to be allocated on a fractional basis of 2:1:4, respectively. The journal entry to close the income summary to the partners’ capital accounts would be:

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income/Loss — Fractional Basis.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income/Loss — Fractional Basis.

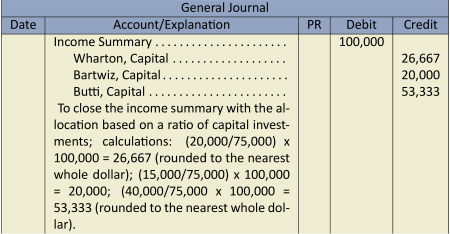

Example 3: Assume WBB Consulting had a net income of $100,000 during the year and the partnership agreement stipulates that incomes/losses are to be allocated on the ratio of capital investments. The journal entry to close the income summary to the partners’ capital accounts would be:

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income — Ratio of Investments.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income — Ratio of Investments.

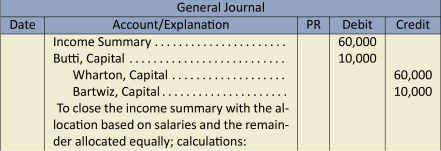

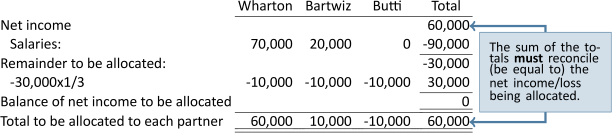

Example 4: Assume WBB Consulting had a net income of $60,000 during the year and the partnership agreement stipulates that incomes/losses are to be allocated based on salaries of $70,000 to Wharton; $20,000 to Bartwiz; zero to Butti; and the remainder equally. The journal entry to close the income summary to the partners’ capital accounts would be:

Notice in Example 4 that Butti is receiving a negative allocation which results in a debit to her Capital account.

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income — Remainder to be Allocated.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income — Remainder to be Allocated.

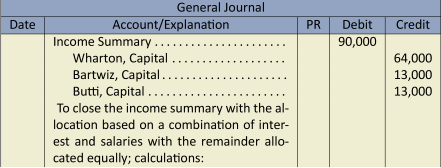

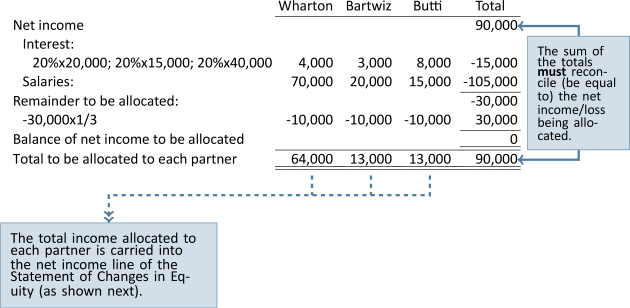

Example 5: Assume WBB Consulting had a net income of $90,000 during the year and the partnership agreement stipulates that incomes/losses are to be allocated based on a combination of: (a) 20% interest of each partner’s beginning-of-year capital balance; (b) salaries of $70,000 to Wharton, $20,000 to Bartwiz, $15,000 to Butti; and (c) the remainder equally. The journal entry to close the income summary to the partners’ capital accounts would be:

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Incomes/Losses — Interest, Salaries, Remainder.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Incomes/Losses — Interest, Salaries, Remainder.

Financial Statements

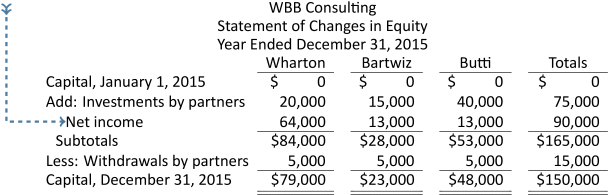

The income statement for a partnership is identical to that for a proprietorship. The statement of changes in equity for a partnership is similar to a proprietorship’s except that there is a Capital account and Withdrawals account for each of the partners.

Assume that on January 1, 2015, the first year of operations for WBB Consulting, the partners, Wharton, Bartwiz, and Butti, invested $20,000, $15,000, and $40,000, respectively. During 2015 they each withdrew $5,000. The statement of changes in equity would appear as illustrated in Figure 13.5 given a net income for the year of $90,000 allocated as shown in Example 5 previously.

![]() An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income — Remainder to be Allocated.

An exploration is available on the Lyryx system. Log into your Lyryx course to run Allocating Income — Remainder to be Allocated.

In the equity section on the balance sheet there will be more than one owner’s capital account as shown in Figure 13.6.

| WBB Consulting | ||||

| Balance Sheet | ||||

| December 31, 2015 | ||||

| Assets | ||||

|

Cash |

$ | 35,000 | ||

|

Other assets |

143,000 | |||

| Total assets | $ | 178,000 | ||

| Liabilities | $ | 28,000 | ||

| Equity | ||||

|

Wharton, capital |

$79,000 | |||

|

Bartwiz, capital |

23,000 | |||

|

Butti, capital |

48,000 | 150,000 | ||

| Total liabilities and equity | $ | 178,000 | ||

Summary of Chapter 13 Learning Objectives

LO1 – Describe the characteristics of a proprietorship, including how its financial statements are different from those of a corporation.

A proprietorship is a business owned by one person. It is not a separate legal entity, which means that the business and the owner are considered to be the same entity. The profits of a proprietorship are taxed as part of the owner’s personal income tax return. Unlimited liability is another characteristic of a proprietorship meaning that if the business could not pay its debts, the owner would be responsible even if the business’s debts were greater than the owner’s personal resources. Owner investments, owner withdrawals, and net incomes/losses are closed to one permanent account: the Owner’s Capital account.

LO2 – Describe the characteristics of a partnership, including how its financial statements are different from those of a corporation.

A partnership is a business owned by more than one person. Partners should have a partnership contract that details their agreement on things such as each partner’s rights and duties, the sharing of incomes/losses and withdrawals, as well as dispute and termination procedures. A partnership is not a separate legal entity, which means that the business and the partners are considered to be the same entity. Each partner’s share of the profits is taxed as part of that partner’s personal income tax return. Unlimited liability is another characteristic of a partnership meaning that if the business could not pay its debts, the partners would be responsible even if the business’s debts were greater than the partners’ personal resources. The exception to this would be the formation of a limited liability partnership (LLP) that is permitted for professionals such as lawyers and accountants. In an LLP, the general partner(s) is/are responsible for the management of the partnership and assume(s) unlimited liability while the limited partners have limited liability but also limited roles in the partnership as specified in the partnership agreement. Partnerships also have a limited life and are subject to mutual agency. Mutual agency means that a partner can commit the partnership to any contract because each partner is an authorized agent of the partnership. The closing entries for a partnership are the same as those for a proprietorship except there is more than one capital account and more than one withdrawals account. The closing of the income summary to each partner’s capital account is based on the allocation details in the partnership agreement.

Discussion Questions

-

Define a partnership and briefly explain five characteristics.

-

What are the advantages and disadvantages of partnerships?

-

How does accounting for a proprietorship, partnership, and corporation differ?

-

How can partnership profits and losses be divided among partners?

-

Why are salary and interest bases used as a means to allocate profits and losses in a partnership?

-

How are partners’ capital balances disclosed in the balance sheet?

Exercises

You are given the following data for the partnership of B. White and C. Green.

| B. White and C. Green Partnership | |||

| Trial Balance | |||

| December 31, 2015 | |||

| Cash | $41,000 | ||

| Accounts Receivable | 68,400 | ||

|

Merchandise Inventory

|

27,000 | ||

| Accounts Payable | $45,800 | ||

| B. White, Capital | 30,000 | ||

| B. White, Withdrawals | 7,000 | ||

| C. Green, Capital | 20,000 | ||

| C. Green, Withdrawals | 5,000 | ||

| Sales | 322,000 | ||

| Cost of Goods Sold | 160,500 | ||

| Rent Expense | 36,000 | ||

| Advertising Expense | 27,200 | ||

| Delivery Expense | 9,600 | ||

| Office Expense | 12,800 | ||

| Utilities Expense | 23,300 | ||

|

Totals |

$417,800 | $417,800 | |

Each partner contributed $10,000 cash during 2015. The partners share profits and losses equally.

Required:

-

Prepare an income statement for the year.

-

Prepare a statement of changes in equity for the year in the following format:

Statement of Changes in Equity For the Year Ended December 31, 2015 White Green Total Opening Balance $ $ $ Add: Investments during 2015 Net Income

$ $ $ Deduct: Withdrawals Ending Balance $ $ $ -

Prepare a balance sheet at December 31, 2015.

-

Prepare closing entries at year end.

Refer to EXERCISE 13–1.

Required: Prepare the equivalent statement of changes in equity at December 31, 2015 assuming that the partnership is instead:

-

A proprietorship owned by B. White called White’s (Combine C. Green balances and transactions with those of B. White.)

-

A corporation named BW and CG Ltd. with 100 common shares issued for $1 per share to each of B. White and C. Green. Assume opening retained earnings equal $29,800 and that 20,000 common shares were issued during 2015 for $20,000. Assume the net income of $52,600 is net of income tax.

Refer to EXERCISE 13–1.

Required: Prepare the journal entry to allocate net income to each of the partners assuming the following unrelated scenarios:

-

Net income is allocated in a fixed ratio of 5:3 (White: Green).

-

Net income is allocated by first paying each partner 10% interest on opening capital balances, then allocating salaries of $30,000 for White and $10,000 for Green, then splitting the remaining unallocated net income in a fixed ratio of 3:2 (White:Green).

Walsh and Abraham began a partnership by investing $320,000 and $400,000, respectively. They agreed to share net incomes/losses by allowing a 10% interest allocation their investments, an annual salary allocation of $75,000 to Walsh and $150,000 to Abraham, and the balance 1:3.

Required: Prepare the journal entry to allocate net income to each of the partners assuming the following unrelated scenarios:

-

Net income for the first year was $210,000.

-

A net loss for the first year was realized in the amount of $95,000.

You are given the following data for the proprietorship of R. Black.

| R. Black Proprietorship | ||||||

| Trial Balance | ||||||

| December 31, 2018 | ||||||

| Debit | Credit | |||||

| Cash | $ | 10,000 | ||||

| Accounts receivable | 20,000 | |||||

| Merchandise inventory | 30,000 | |||||

| Accounts payable | $ | 25,000 | ||||

| R. Black, capital | 5,000 | |||||

| R. Black, withdrawals | 7,000 | |||||

| Sales | 166,000 | |||||

| Cost of goods sold | 100,000 | |||||

| Rent expense | 24,000 | |||||

| Income taxes expense | 5,000 | |||||

|

Totals |

$ | 196,000 | $ | 196,000 | ||

Black contributed $5,000 capital during the year.

Required:

-

Prepare an income statement for the year.

-

Prepare a statement of proprietor’s capital for the year in the following format:

R. Black Proprietorship Statement of Proprietor’s Capital For the Year Ended December 31, 2018 Balance at Jan. 1, 2018 $ Contributions Net income Withdrawals Balance at Dec 31, 2018 $ -

Prepare a balance sheet at December 31, 2018.

-

Prepare closing entries at year-end.

Refer to EXERCISE 13–5. Assume that the proprietorship is instead a corporation named R. Black Ltd., with 1,000 common shares issued on January 1, 2018 for a stated value of $5 per share. Assume there are no opening retained earnings and consider withdrawals to be dividends. Assume income taxes expense applies to corporate earnings.

Required:

-

Prepare an income statement for the year ended December 31, 2018.

-

Prepare a statement of changes in equity.

-

Prepare a balance sheet at December 31, 2018.

-

Prepare closing entries at year-end.

Assume the following information just prior to the admission of new partner I:

| Assets | Liabilities | ||||||||

| Cash | $ | 5,000 | Accounts payable | $ | 8,000 | ||||

| Accounts receivable | 43,000 | ||||||||

| Partners’ Capital | |||||||||

| G, Capital | $ | 30,000 | |||||||

| H, Capital | 10,000 | 40,000 | |||||||

| $ | 48,000 | $ | 48,000 | ||||||

Required: Prepare journal entries to record the following unrelated scenarios:

-

New partner I purchases partners G’s partnership interest for $40,000.

-

New partner I receives a cash bonus of $2,000 and a one-tenth ownership share, allocated equally from the partnership interests of G and H.

-

New partner I contributes land with a fair value of $100,000. Relative ownership interests after this transaction are:

Partner Ownership interest G 20% H 5% I 75% 100%

Assume the following information just prior to the withdrawal of Partner X:

| Assets | Liabilities | ||||||||

| Cash | $ | 20,000 | Accounts payable | $ | 5,000 | ||||

| Inventory | 50,000 | ||||||||

| Partners’ Capital | |||||||||

| X, Capital | $ | 10,000 | |||||||

| Y, Capital | 20,000 | ||||||||

| Z, Capital | 35,000 | 65,000 | |||||||

| $ | 70,000 | $ | 70,000 | ||||||

Required: Prepare journal entries to record the following unrelated scenarios:

-

Partner X sells his interest to new partner T for $25,000.

-

Partner X sells his interest to partner Y for $30,000.

-

Partner X sells his interest and is paid a share of partnership net assets as follows:

Cash $ 5,000 Inventory 5,000 Accounts payable (2,000) $ 8,000 Partner Y receives a 60% share of the partnership interest of X. Partner Z receives 40%.

Smith, Jones, and Black are partners, sharing profits equally. They decide to admit Gray for an equal partnership (25%). The balances of the partners’ capital accounts are:

| Smith, capital | $ | 50,000 | |

| Jones, capital | 40,000 | ||

| Black, capital | 10,000 | ||

| $ | 100,000 |

Required: Prepare journal entries to record admission of Gray, using the bonus method:

-

assuming the bonus is paid to the new partner; Gray invests $5,000 cash;

-

assuming the bonus is paid to existing partners; Gray invests $60,000 cash; the remaining partners benefit equally from the bonus.

Problems

On January 1, 2015, Bog, Cog, and Fog had capital balances of $60,000, $100,000, and $20,000 respectively in their partnership. In 2015 the partnership reported net income of $40,000. None of the partners withdrew any assets in 2013. The partnership agreed to share profits and losses as follows:

-

A monthly salary allowance of $2,000, $2,500, and $4,000 to Bog, Cog and Fog respectively.

-

An annual interest allowance of 10 per cent to each partner based on her capital balance at the beginning of the year.

-

Any remaining balance to be shared in a 5:3:2 ratio (Bog:Cog:Fog).

Required:

-

Prepare a schedule to allocate the 2015 net income to partners.

-

Assume all the income statement accounts for 2015 have been closed to the income summary account. Prepare the entry to record the division of the 2015 net income.