Chapter 11

Reporting and Analyzing Cash Flows

Details about the amount of cash received and paid out during an accounting period are not shown on the balance sheet, income statement, or statement of changes in equity. This information is disclosed on the statement of cash flows (SCF). This chapter discusses the purpose of the statement of cash flows, the steps in preparing the SCF, as well as how to interpret various sections of the statement of cash flows.

Chapter 11 Learning Objectives

- LO1 – Explain the purpose of the statement of cash flows.

- LO2 – Prepare a statement of cash flows.

- LO3 – Interpret a statement of cash flows.

Concept Self-Check

Use the following as a self-check while working through Chapter 11.

- What is the definition of cash and cash equivalents?

- Why is a statement of cash flows prepared?

- What are the three sections of a statement of cash flows?

- What two methods can be used to prepare the operating activities section of the statement of cash flows?

- Why is depreciation expense an adjustment in the operating activities section of the statement of cash flows?

- Where are dividend payments listed on the statement of cash flows?

- In what section of the statement of cash flows are the cash proceeds resulting from the sale of a non-current asset listed?

- Where on the statement of cash flows is a long-term bank loan payment identified?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

11.1 Financial Statement Reporting

LO1 – Explain the purpose of the statement of cash flows.

Cash flow is an important factor in determining the success or failure of a corporation. It is quite possible for a profitable business to be short of cash. As discussed in Chapter 7, a company can have liquidity issues because of large amounts of cash tied up in inventory and accounts receivable, for instance. Conversely, an unprofitable business might have sufficient cash to pay its bills if it has access to enough financing from loans or by issuing share capital.

We know that the financial activities of a corporation are reported through four financial statements: a balance sheet, an income statement, a statement of changes in equity, and a statement of cash flows (SCF). Statement of cash flowsThis chapter discusses the statement of cash flows in detail.

The SCF identifies the sources (inflows) and uses (outflows) of cash during the accounting period. It explains why the cash balance at the end of the accounting period is different from that at the beginning of the period by describing the enterprise’s financing, investing, and operating activities.

Cash flow information is useful to management when making decisions such as purchasing equipment, plant expansion, retiring long-term debt, or declaring dividends. The SCF is useful to external users when evaluating a corporation’s financial performance.

The SCF, together with the income statement, provides a somewhat limited means of assessing future cash flows because these statements are based on historical, not prospective data. Nevertheless, the ability to generate cash from past operations is often an important indication of whether the enterprise will be able to meet obligations as they become due, pay dividends, pay for recurring operating costs, or survive adverse economic conditions.

For SCF purposes, cash includes cash and cash equivalents — assets that can be quickly converted into a known amount of cash, such as short-term investments that are not subject to significant risk of changes in value. For our purposes, an investment will be considered a cash equivalent when it has a maturity of three months or less from the date of acquisition.

Because of differences in the nature of each entity and industry, management judgment is required to determine what assets constitute cash and cash equivalents for a particular firm. This decision needs to be disclosed on the SCF or in a note to the financial statements as shown in the following example:

Note X

Cash and cash equivalents consist of cash on deposit and short-term investments held for the purposes of meeting cash commitments within three months from the balance sheet date. Cash and cash equivalents consist of the following:

| ($000s) | |||||

| 2019 | 2018 | 2017 | |||

| Cash on Deposit | $20 | $30 | $50 | ||

| Short-term Investments | 36 | 31 | 37 | ||

| $56 | $61 | $87 | |||

For simplicity, examples throughout this chapter involving cash and cash equivalents will include only cash.

Cash flows result from a wide variety of a corporation’s activities as cash is received and disbursed over a period of time. Because the income statement is based on accrual accounting that matches expenses with revenues, net income most often does not reflect cash receipts and disbursements during the time period they were made. As we will see, the statement of cash flows converts accrual net income to a cash basis net income.

11.2 Preparing the Statement of Cash Flows

LO2 – Prepare a statement of cash flows.

The general format for a SCF is shown in Figure 11.1. The SCF details the cash inflows and outflows that caused the beginning of the period cash account balance to change to its end of period balance.

| Name of Company | ||

| Statement of Cash Flows | ||

| For the Period Ended | ||

| Cash flows from operating activities: | ||

|

[Each operating inflow/outflow is listed] |

||

|

Net cash inflow/outflow from operating activities |

$ | XX |

| Cash flows from investing activities: | ||

|

[Each investing inflow/outflow is listed] |

||

|

Net cash inflow/outflow from investing activities |

XX | |

| Cash flows from financing activities: | ||

|

[Each financing inflow/outflow is listed] |

||

|

Net cash inflow/outflow from financing activities |

XX | |

| Net increase/decrease in cash | $ | XX |

| Cash at beginning of period | XX | |

| Cash at end of period | $ | XX |

Notice that the cash flows in Figure 11.1 are separated into three groups: cash flows from operating, investing, and financing activities. Grouping or classifying cash flows is a key component of preparing a SCF.

Classifying Cash Flows—Operating Activities

Cash flow from operating activities represents cash flows generated from the principal activities that produce revenue for a corporation, such as selling products, and the related expenses reported on the income statement. Because of accrual accounting, the net income reported on the income statement includes noncash transactions. For example, revenue earned on account is included in accrual net income but it does not involve cash (debit accounts receivable and credit revenue). Therefore, the operating activities section of the SCF must convert accrual net income to a cash basis net income. There are two generally accepted methods for preparing the operating activities section of the SCF, namely the direct method and the indirect method. Both methods result in the same cash flows from operating activities — it is the way in which the number is calculated that differs. The method used has an impact on only the operating activities section and not on the investing or financing activities sections.

In using the indirect method for preparing the operating activities section, the accrual net income is adjusted for changes in current assets (except cash), current liabilities (except dividends payable), depreciation expense, and gains/losses on the disposition of non-current assets. Figure 11.2 illustrates the effect of these items on the SCF.

| Cash flows from operating activities: | ||

|

Net income/net loss |

$ | XX |

|

Adjustments to reconcile net income/loss to cash provided/used by operating activities: |

||

|

Add: Decreases in current assets (except Cash) |

XX | |

|

Subtract: Increases in current assets (except Cash) |

XX | |

|

Add: Increases in current liabilities (except Dividends payable) |

XX | |

|

Subtract: Decreases in current liabilities (except Dividends payable) |

XX | |

|

Add: Depreciation expense |

XX | |

|

Add: Losses on disposal of non-current assets |

XX | |

|

Subtract: Gains on disposal of non-current assets |

XX | |

|

Net cash inflow/outflow from operating activities |

$ | XX |

Decreases in current assets are added back as an adjustment to net income because, for example, a decrease in accounts receivable indicates that cash was collected from credit customers (debit cash and credit accounts receivable) yet it is not part of accrual net income, so the cash collected must be added. An increase in accounts receivable indicates that sales on account were recorded (debit accounts receivable and credit sales) so it is part of accrual net income. However, since no cash was collected, this must be subtracted from accrual net income to adjust it to a cash basis.

Increases in current liabilities are added back as an adjustment to net income because, for example, an increase in accounts payable indicates that a purchase/expense was made on account (debit expense and credit accounts payable) so it was subtracted in calculating accrual net income. However, since no cash was paid, this must be added back to accrual net income to adjust it to a cash basis. A decrease in accounts payable indicates that a payment was made to a creditor (debit accounts payable and credit cash) yet it is not part of accrual net income so the cash paid must be subtracted.

Depreciation expense is subtracted in calculating accrual net income. However, an analysis of the journal entry shows that no cash was involved (debit depreciation expense and credit accumulated depreciation), so it must be added back to adjust the accrual net income to a cash basis.

A loss on the disposal of a non-current asset is added back as an adjustment to net income because, in analyzing the journal entry when losses occur (e.g., debit cash, debit loss, credit land), the loss represents the difference between the cash proceeds and the book value of the non-current asset. Since a loss is subtracted on the income statement and does not represent a cash outflow, it is added back to adjust the accrual net income to a cash basis. The same logic applies for a gain on the disposal of a non-current asset.

Classifying Cash Flows—Investing Activities

Cash flows from investing activities involve increases and decreases in long-term asset accounts. These include outlays for the acquisition of property, plant, and equipment, as well as proceeds from their disposal. Figure 11.3 illustrates the effect of these items on the SCF.

| Cash flows from investing activities: | ||

|

Cash proceeds from sale of non-current assets |

XX | |

|

Cash paid to purchase non-current assets |

XX | |

|

Net cash inflow/outflow from investing activities |

XX |

Classifying Cash Flows—Financing Activities

Cash flows from financing activities result when the composition of the debt and equity capital structure of the entity changes. This category is generally limited to increases and decreases in long-term liability accounts and share capital accounts such as common and preferred shares. These include cash flows from the issue and repayment of debt, and the issue and repurchase of share capital. Dividend payments are generally considered to be financing activities, since these represent a return to shareholders on the original capital they invested. Figure 11.4 illustrates the effect of these items on the SCF.

| Cash flows from financing activities: | ||

|

Cash proceeds from issuance of shares |

XX | |

|

Cash paid for repurchase of shares |

XX | |

|

Cash proceeds from borrowings |

XX | |

|

Cash repayments of borrowings |

XX | |

|

Cash paid for dividends |

XX | |

|

Net cash inflow/outflow from financing activities |

XX |

Classifying Cash Flows—Noncash Investing and Noncash Financing Activities

There are some transactions that involve the direct exchange of non-current balance sheet items so that cash is not affected. For example, noncash investing and noncash financing activities would include the purchase of a non-current asset by issuing debt or share capital, the declaration and issuance of a share dividend, retirement of debt by issuing shares, or the exchange of noncash assets for other noncash assets. Although noncash investing and noncash financing activities do not appear on the SCF, the full disclosure principle requires that they be disclosed either in a note to the financial statements or in a schedule on the SCF.

Now, let us demonstrate the preparation of a SCF using the balance sheet, income statement, and statement of changes in equity of Example Corporation shown below.

| Example Corporation | |||||

| Balance Sheet | |||||

| At December 31 | |||||

| ($000s) | |||||

| 2016 | 2015 | ||||

| Assets | |||||

| Current assets | |||||

|

Cash |

$ | 27 | $ | 150 | |

|

Accounts receivable |

375 | 450 | |||

|

Merchandise inventory |

900 | 450 | |||

|

Prepaid expenses |

20 | 10 | |||

|

Total current assets |

1,322 | 1,060 | |||

| Property, plant, and equipment | |||||

|

Land |

70 | 70 | |||

|

Buildings |

1,340 | 620 | |||

|

Less: Accumulated depreciation – buildings |

(430) | (280) | |||

|

Machinery |

1,130 | 920 | |||

|

Less: Accumulated depreciation – machinery |

(250) | (240) | |||

|

Total property, plant, and equipment |

1,860 | 1,090 | |||

| Total assets | $ | 3,182 | $ | 2,150 | |

| Liabilities | |||||

| Current liabilities | |||||

|

Accounts payable |

$ | 235 | $ | 145 | |

|

Dividends payable |

25 | 30 | |||

|

Income taxes payable |

40 | 25 | |||

|

Total current liabilities |

300 | 200 | |||

| Long-term loan payable | 1,000 | 500 | |||

| Total liabilities | 1,300 | 700 | |||

| Equity | |||||

| Common shares | 1,210 | 800 | |||

| Retained earnings | 672 | 650 | |||

|

Total equity |

1,882 | 1,450 | |||

| Total liabilities and equity | $ | 3,182 | $ | 2,150 | |

| Example Corporation | |||||

| Income Statement | |||||

| For the Year Ended December 31, 2016 | |||||

| ($000s) | |||||

| Sales | $ | 1,200 | |||

| Cost of goods sold | 674 | ||||

|

Gross profit |

526 | ||||

| Operating expenses | |||||

|

Selling, general, and administration |

$ | 115 | |||

|

Depreciation |

260 | 375 | |||

| Income from operations | 151 | ||||

| Other revenues and expenses | |||||

|

Interest expense |

26 | ||||

|

Loss on disposal of machinery |

10 | 36 | |||

| Income before income taxes | 115 | ||||

|

Income taxes |

35 | ||||

| Net Income | $ | 80 | |||

| Example Corporation | ||||||||

| Statement of Changes in Equity | ||||||||

| For the Year Ended December 31, 2016 | ||||||||

| ($000s) | ||||||||

| Share | Retained | Total | ||||||

| Capital | Earnings | Equity | ||||||

| Opening balance | $ | 800 | $ | 650 | $ | 1,450 | ||

| Common shares issued | 410 | – | 410 | |||||

| Net income | – | 80 | 80 | |||||

| Dividends declared | – | (58) | (58) | |||||

| Ending balance | $ | 1,210 | $ | 672 | $ | 1,882 | ||

The SCF can be prepared from an analysis of transactions recorded in the Cash account. Accountants summarize and classify these cash flows on the SCF for the three major activities noted earlier, namely operating, investing, and financing. To aid our analysis, the following list of additional information from the records of Example Corporation will be used.

Additional Information

- A building was purchased for $720 cash.

- Machinery was purchased for $350 cash.

- Machinery costing $140 with accumulated depreciation of $100 was sold for $30 cash.

- Total depreciation expense of $260 was recorded during the year; $150 on the building and $110 on the machinery.

- Example Corporation received $500 cash from issuing a long-term loan with the bank.

- Shares were issued for $410 cash.

- $58 of dividends were declared during the year.

Analysis of Cash Flows

There are different ways to analyze cash flows and then prepare the SCF; only one of those techniques will be illustrated here using the following steps.

- Set up a cash flow table.

- Calculate the changes in each balance sheet account.

- Calculate and analyze the changes in retained earnings and dividends payable (if there is a Dividends Payable account).

- Calculate and analyze the changes in the noncash current assets and current liabilities (excluding Dividends Payable account).

- Calculate and analyze changes in non-current asset accounts

- Calculate and analyze changes in Long-term Liability and Share Capital accounts.

- Reconcile the analysis.

- Prepare a statement of cash flows.

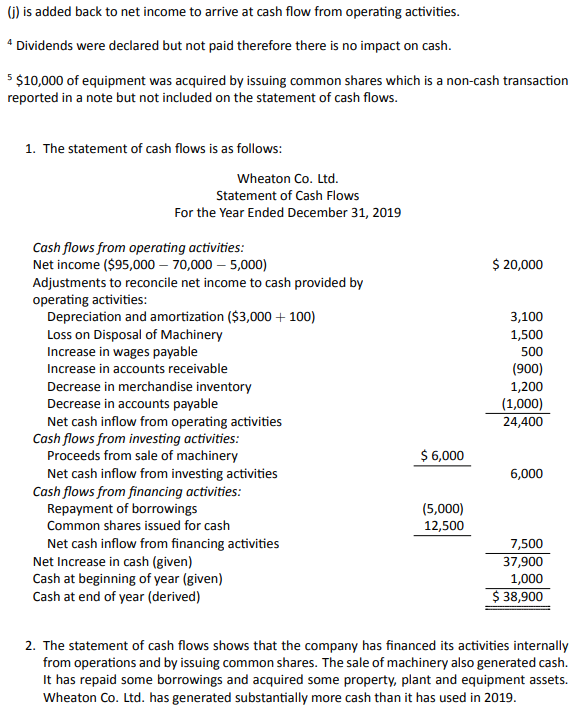

Step 1: Set up a cash flow table

Set up a table as shown below with a row for each account shown on the balance sheet. Enter amounts for each account for 2015 and 2016. Show credit balances in parentheses. Total both columns and ensure they equal zero. The table should appear as follows after this step has been completed:

| Balance | |||

| ($000s) | |||

| Account | 2016 | 2015 | |

| Dr. (Cr.) | Dr. (Cr.) | ||

| Cash | 27 | 150 | |

| Accounts receivable | 375 | 450 | |

| Merchandise inventory | 900 | 450 | |

| Prepaid expenses | 20 | 10 | |

| Land | 70 | 70 | |

| Buildings | 1,340 | 620 | |

| Accum. dep.- buildings | (430) | (280) | |

| Machinery | 1,130 | 920 | |

| Accum. dep.- machinery | (250) | (240) | |

| Accounts payable | (235) | (145) | |

| Dividends payable | (25) | (30) | |

| Income taxes payable | (40) | (25) | |

| Long-term loan payable | (1,000) | (500) | |

| Share capital | (1,210) | (800) | |

| Retained earnings | (672) | (650) | |

| Total | -0- | -0- | |

Step 2: Calculate the change in cash

Add two columns to the cash flow table. Calculate the net debit or net credit change in cash and insert this change in the appropriate column. This step is shown below:

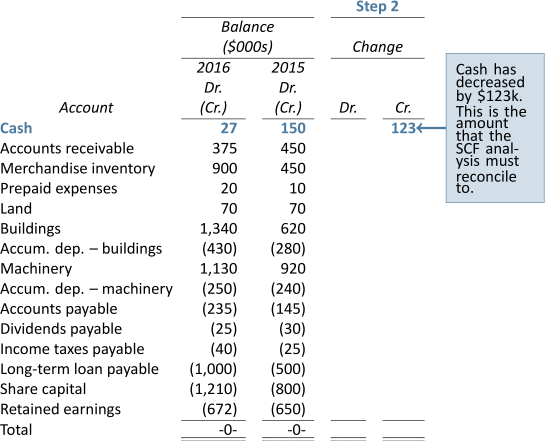

Step 3: Calculate and analyze the changes in retained earnings and dividends payable (if there is a Dividends Payable account)

When we calculate the changes for each of retained earnings and dividends payable, the net difference may not always reflect the causes for change in these accounts. For example, the net difference between the beginning and ending balances in retained earnings is an increase of $22 thousand. However, two things occurred to cause this net change: a net income of $80 thousand (a debit to income summary and a credit to retained earnings) and dividends of $58 thousand that were declared during the year per the additional information (a debit to retained earnings of $58k and a credit to dividends payable of $58k). The net income of $80 thousand is the starting position in the operating activities section of the SCF (see Figure 11.5).

The change in the dividends payable balance was also caused by two transactions — the dividend declaration of $58 thousand (a debit to retained earnings and a credit to dividends payable) and a $63 thousand payment of dividends (a debit to dividends payable and a credit to cash). The $63 thousand cash payment is subtracted in the financing activities section of the SCF (see Figure 11.5). Dividends payable can change because of two transactions, as in this example, or because of one transaction, which could be either a dividend declaration with no payment of cash, or a payment of the dividend payable and no dividend declaration. Step 3 as it applies to Example Corporation is detailed below:

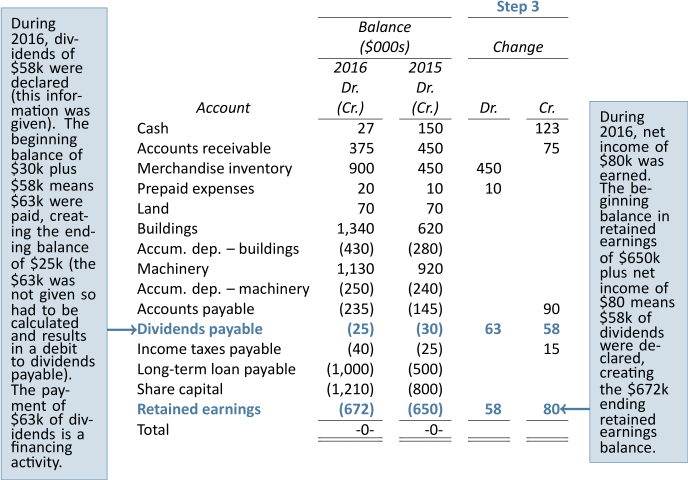

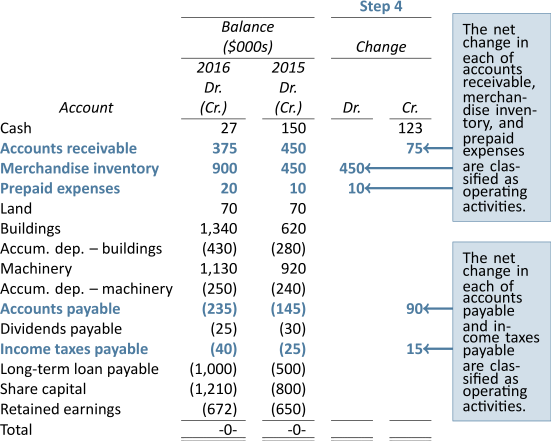

Step 4: Calculate and analyze the changes in the noncash current assets and current liabilities (excluding Dividends Payable account)

Calculate the net debit or net credit changes for each current asset and current liability account on the balance sheet and insert these changes in the appropriate column. Step 4 as it applies to Example Corporation is detailed below. The $75 thousand decrease in accounts receivable is added in the operating activities section of the SCF, the $450 thousand increase in merchandise inventory is subtracted, the $10 thousand increase in prepaid expenses is subtracted, the $90 thousand increase in accounts payable is added, and the $15 thousand increase in income taxes payable is added (see Figure 11.5):

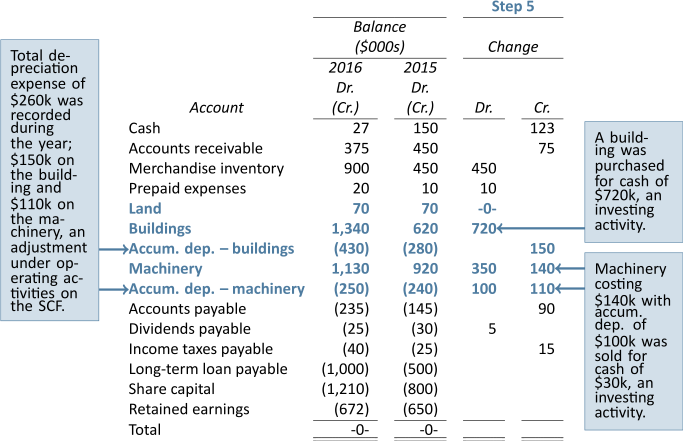

Step 5: Calculate and analyze changes in non-current asset accounts

Changes in non-current assets are classified as investing activities. There was no change in the Land account. We know from the additional information provided that buildings and machinery were purchased and that machinery was sold.

Buildings were purchased for $720 thousand (a debit to buildings and a credit to cash). The cash payment of $720 thousand is shown in the investing activities section (see Figure 11.5).

Accumulated depreciation–buildings is a non-current asset account and it increased by $150 thousand. This change was caused by a debit to depreciation expense and a credit to accumulated depreciation–building. We know from an earlier discussion that depreciation expense is an adjustment in the operating activities section of the SCF therefore the $150 thousand is added in the operating activities section (see Figure 11.5).

Two transactions caused machinery to change. First, the purchase of $350 thousand of machinery (debit machinery and credit cash); the $350 thousand cash payment is shown in the investing activities section (see Figure 11.5). Second, machinery costing $140 thousand with accumulated depreciation of $100 thousand was sold for cash of $30 thousand resulting in a loss of $10 thousand. The cash proceeds of $30 thousand is shown in the investing activities section of the SCF and the $10 thousand loss is added in the operating activities section (see Figure 11.5).

Accumulated depreciation–machinery not only decreased $100 thousand because of the sale of machinery but it increased by $110 thousand because of depreciation (debit depreciation expense and credit accumulated depreciation–machinery). The $110 thousand of depreciation expense is added in the operating activities section of the SCF (see Figure 11.5):

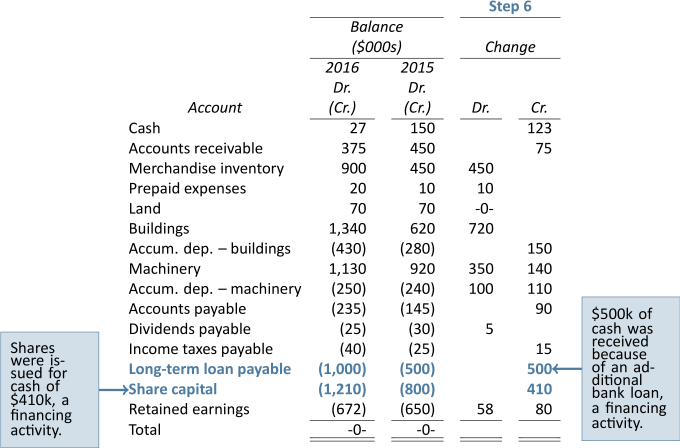

Step 6: Calculate and analyze changes in Long-term Liability and Share Capital accounts

Changes in Long-term Liability and Share Capital accounts result from financing activities. We know from the additional information provided earlier that Example Corporation received cash of $500k from a bank loan (debit cash and credit long-term loan payable) and issued shares for $410k cash (debit cash and credit share capital). The $500 thousand cash proceeds from the bank loan and $410 thousand cash proceeds from the issuance of shares are listed in the financing section of the SCF (see Figure 11.5):

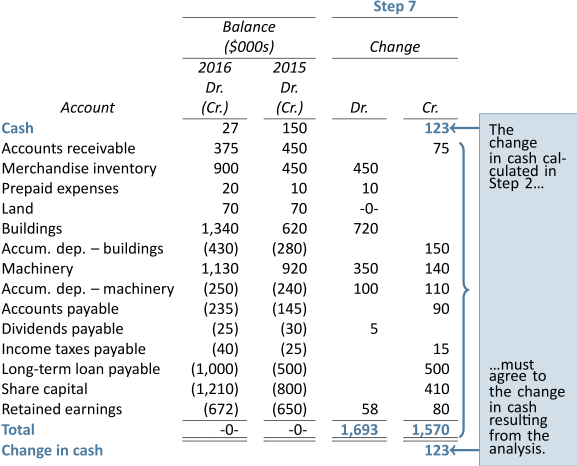

Step 7: Reconcile the analysis

The analysis is now complete. Add the debit and credit changes, excluding the change in cash. The total debits of $1,693 less the total credits of $1,570 equal a difference of $123 which reconciles to the decrease in cash calculated in Step 2:

The information in the completed analysis can be used to prepare the statement of cash flows shown in Figure 11.5.

| Example Corporation | |||||

| Statement of Cash Flows | |||||

| For the Year Ended December 31, 2016 | |||||

| ($000s) | |||||

| Cash flows from operating activities: | |||||

|

Net income |

$ | 80 | |||

|

Adjustments to reconcile net income |

|||||

|

cash provided by operating activities: |

|||||

|

Decrease in accounts receivable |

75 | ||||

|

Increase in merchandise inventory |

(450) | ||||

|

Increase in prepaid expenses |

(10) | ||||

|

Increase in accounts payable |

90 | ||||

|

Increase in income taxes payable |

15 | ||||

|

Depreciation expense |

260 | ||||

|

Loss on disposal of machinery |

10 | ||||

|

Net cash inflow from operating activities |

$ | 70 | |||

| Cash flows from investing activities: | |||||

|

Proceeds from sale of machinery |

30 | ||||

|

Purchase of building |

(720) | ||||

|

Purchase of machinery |

(350) | ||||

|

Net cash outflow from investing activities |

(1,040) | ||||

| Cash flows from financing activities: | |||||

|

Payment of dividends |

(63) | ||||

|

Proceeds from bank loan |

500 | ||||

|

Issuance of shares |

410 | ||||

|

Net cash inflow from financing activities |

847 | ||||

| Net decrease in cash | $ | (123) | |||

| Cash at beginning of year | 150 | ||||

| Cash at end of year | $ | 27 | |||

11.3 Interpreting the Statement of Cash Flows

LO3 – Interpret a statement of cash flows.

Readers of financial statements need to know how cash has been used by the enterprise. The SCF provides external decision makers such as creditors and investors with this information. The statement of cash flows provides information about an enterprise’s financial management policies and practices. It also may aid in predicting future cash flows, which is an important piece of information for investors and creditors.

The quality of earnings as reported on the income statement can also be assessed with the information provided by the SCF. The measurement of net income depends on a number of accruals and allocations that may not provide clear information about the cash-generating power of a company. Users will be more confident in a company with a high correlation between cash provided by operations and net income measured under the accrual basis. Recall, for instance, that although Example Corporation has net income of $80,000 during 2016, its net cash inflow from operations is only $70,000, chiefly due to the large increase in inventory levels. Although net cash flow from operations is still positive, this discrepancy between net income and cash flow from operations may indicate looming cash flow problems, particularly if the trend continues over time.

Example Corporation’s SCF also reveals that significant net additions to plant and equipment assets occurred during the year ($1,070,000), financed in part by cash flow from operating activities but primarily by financing activities. These activities included the assumption of loans and issue of shares that amounted to $847,000, net of dividend payments ($500,000 from issuing a long-term loan plus $410,000 from issuing shares less $63,000 for payment of dividends).

It appears that a significant plant and equipment asset acquisition program may be underway, which may affect future financial performance positively. This expansion has been financed mainly by increases in long-term debt and the issuance of common shares. However, the magnitude of the plant and equipment asset purchases, coupled with the payment of the dividends to shareholders, has more than offset cash inflows from operating and financing activities, resulting in a net overall decrease in cash of $123,000. Though the current cash expenditure on long-term productive assets may be a prudent business decision, it has resulted in (hopefully temporary) adverse effects on overall cash flow.

The SCF is not a substitute for an income statement prepared on the accrual basis. Both statements should be used to evaluate a company’s financial performance. Together, the SCF and income statement provide a better basis for determining the enterprise’s ability to generate funds from operations and thereby meet current obligations when they fall due (liquidity), pay dividends, meet recurring operating costs, survive adverse economic conditions, or expand operations with internally-generated cash.

The SCF highlights the amount of cash available to a corporation, which is important. Excess cash on hand is unproductive. Conversely, inadequate cash decreases liquidity. Cash is the most liquid asset, and its efficient use is one of the most important tasks of management. Cash flow information, interpreted in conjunction with other financial statement analyses, is useful in assessing the effectiveness of the enterprise’s cash management policies.

Readers who wish to evaluate the financial position and results of an enterprise’s operations also require information on cash flows produced by investing and financing activities. The SCF is the only statement that explicitly provides this information. By examining the relationship among the various sources and uses of cash during the year, readers can also focus on the effectiveness of management’s investing and financing decisions and how these may affect future financial performance.

11.4 Appendix A: Putting It All Together: Corporate Financial Statements

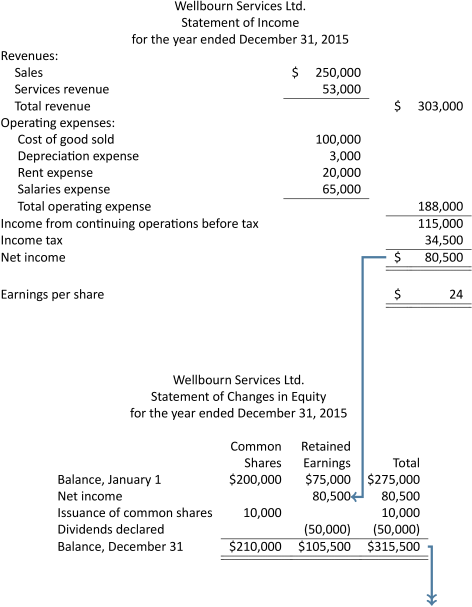

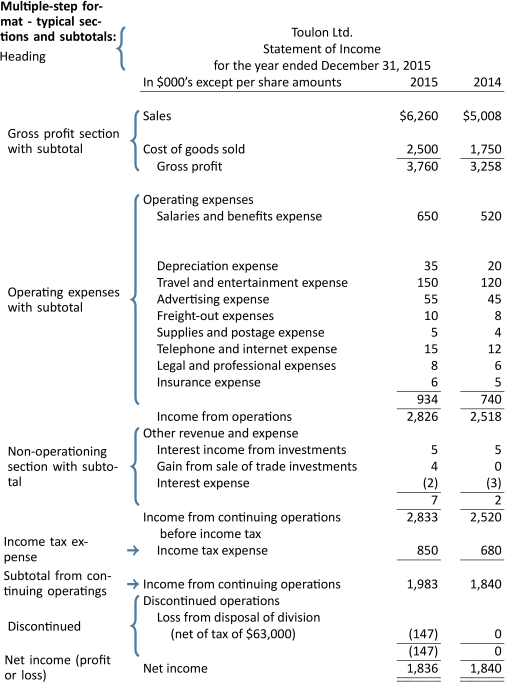

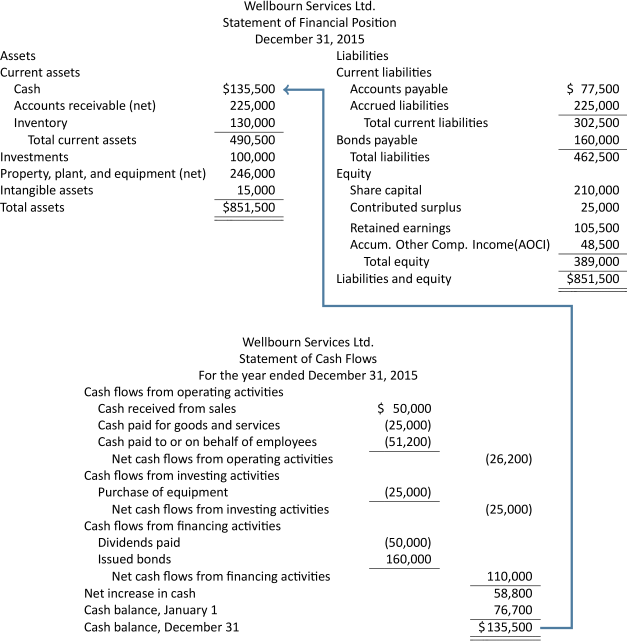

The core financial statements connect to complete an overall picture of the company’s operations and its current financial state. It is important to understand how these reports connect; therefore, a review of some simplified financial statements for Wellbourn Services Ltd. is presented below:

As can be seen from the flow of the numbers above, the net income from the statement of income is closed to retained earnings.

The statement of changes in equity total column flows to the equity section of the balance sheet. Finally, the statement of cash flows (SCF) ending cash balance must be equal to the cash ending balance reported in the balance sheet, which completes the loop of interconnecting accounts and amounts.

Statement of Income with Discontinued Operations

Single-step and Multiple-step Statement of Income

Companies can choose whichever format best suits their reporting needs. Smaller companies tend to use the simpler single-step format, while larger companies tend to use the multiple-step format.

The Wellbourn Services Ltd. statement of income, shown earlier, is an example of a typical single-step income statement. For this type of statement, revenue and expenses are each reported in the two sections for continuing operations. Discontinued operations are separately reported below the continuing operations. The separate disclosure and format for the discontinued operations section is a reporting requirement and is discussed and illustrated below. The single-step format makes the statement simple to complete and keeps sensitive information out of the hands of competitive companies, but provides little in the way of analytical detail.

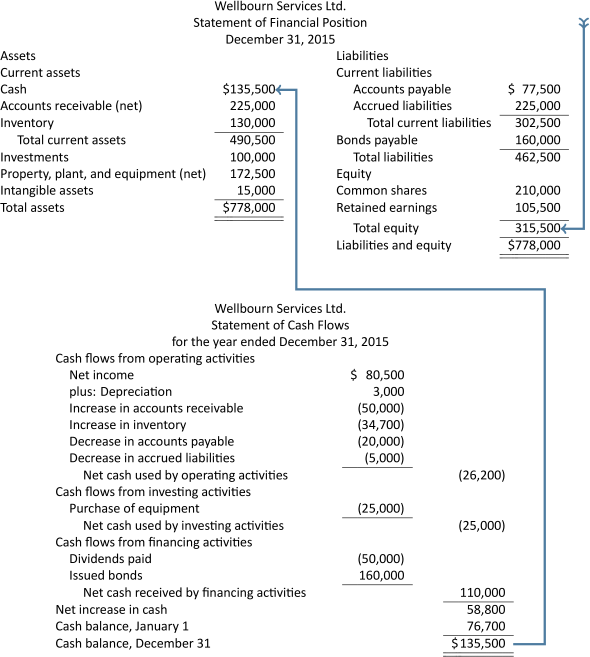

The multiple-step income statement format provides much more detail. Below is an example of a multiple-step statement of income for Toulon Ltd. for the year ended December 31, 2015:

![]()

The multiple-step format with its section subtotals makes performance analysis and ratio calculations such as gross profit margins easier to complete and makes it easier to assess the company’s future earnings potential. The multiple-step format also enables investors and creditors to evaluate company performance results from continuing and ongoing operations having a high predictive value separately, compared to non-operating or unusual items having little predictive value.

Operating Expenses

As discussed in an earlier chapter, expenses from operations can be reported by their nature and, optionally, by function. Expenses by nature relate to the type of expense or the source of expense such as salaries, insurance, advertising, travel and entertainment, supplies expense, depreciation and amortization, and utilities expense, to name a few. The statement for Toulon Ltd. is an example of reporting expenses by nature.

Expenses by function relate to how various expenses are incurred within the various departments and activities of a company such as selling and administrative expenses.

The sum of all the revenues, expenses, gains, and losses to this point represents the income or loss from continuing operations. This is a key component used in performance analysis.

Income Tax Allocations

This is the process of allocating income tax expense to various categories within the statement of income such as income from continuing operations before taxes and discontinued operations. The purpose of these allocations is to make the information within the statements more informative and complete. For example, Toulon’s statement of income for the year ending December 31, 2015, allocates tax at a rate of 30% to the following:

- Income from continuing operations of $850,000 (

)

) - Loss from disposal of discontinued operations of $63,000

Discontinued operations

Sometimes companies will sell or shut down certain business operations because the operating segment is no longer profitable, or they may wish to focus their resources on other business operations. Examples are a major business line or geographical area. If the discontinued operation has not yet been sold, then there must be a formal plan in place to dispose of the component within one year and to report it as a discontinued operation.

The items reported in this section of the statement of income are to be reported net of tax, with the tax amount disclosed.

Earnings per Share

Basic earnings per share represent the amount of income attributable to each outstanding common share, as shown in the calculation below:

The earnings per share amounts are not required for private companies. This is because ownership of privately owned companies is often held by only a few investors, compared to publicly-traded companies where shares are held by many investors.

Basic earnings per share are to be reported on the face of the statement of income as follows:

- Basic EPS from continuing operations

- Basic EPS from discontinued operations, if any

If the outstanding common shares for Toulon was 121,500, the EPS from continuing operations would be $16.32 (![]() ) and $(1.21) from discontinued operations (

) and $(1.21) from discontinued operations (![]() ), as reported in their statement above. There is also a requirement to report diluted EPS but this is beyond the scope of this course.

), as reported in their statement above. There is also a requirement to report diluted EPS but this is beyond the scope of this course.

11.5 Appendix B: Statement of Cash Flows – Direct Method

The Importance of Cash Flow – For Better, For Worse, For Richer, For Poorer…

A business is a lot like a marriage. It takes work to make it succeed. One of the keys to business success is managing and maintaining adequate cash flows. In the field of financial management, there is an old saying that revenue is vanity, profits are sanity, but cash is king. In other words, a firm’s revenues and profits may look spectacular, but this does not guarantee there will be cash in the bank. Without cash, a business cannot pay its bills and it will ultimately not survive.

Let’s take a look at the distinctions between revenue and profits, and cash, using a numeric example for a new business:

| Income Statement | Cash Flows | |||||

| Revenue* | $ | 1,000,000 | Revenue (cash received) | $ | 400,000 | |

| Cost of goods sold** | (500,000) | Cost of goods sold (paid in cash) | (300,000) | |||

| Gross profit | 500,000 | Net cash | 100,000 | |||

| Operating expenses*** | 200,000 | Operating expenses (paid in cash) | 90,000 | |||

| Net income/net profit | $ | 300,000 | Net cash | $ | 10,000 | |

* Sales of $400,000 were paid in cash

** Purchases of $300,000 were paid in cash

*** Operating expenses of $90,000 were cash paid

Revenue is reported in the income statement as $1 million which is a sizeable amount, but only $400,000 was cash paid by customers. (The rest is reported as accounts receivable.) Gross profit is reported in the income statement as $500,000. This is also a respectable number, but only $100,000 translates into a positive cash flow, because only some of the inventory purchases were paid in cash. (The rest of the inventory is reported as accounts payable.) The company must still pay some of its operating expenses, leaving only $10,000 cash in the bank.

When investors and creditors review the income statement, they will see $1 million in revenue with gross profits of one-half million or 50%, and a respectable net income of $300,000 or 30% of revenue. They could conclude that this looks pretty good for the first year of operations and incorrectly assume that the company now has $300,000 available to spend.

However, lurking deeper in the financial statements is the cash position of the company–the amount of cash left over from this operating cycle. Sadly, there is only $10,000 cash in the bank, so the company cannot even pay its remaining accounts payable in the short term. So, how can management keep track of its cash?

The statement of cash flows is the definitive financial statement to bridge the gaps between revenues and profits, and cash. Therefore, it is vital to understand the statement of cash flows.

As cash is generally viewed by many as the most critical asset to success, this appendix will focus on how to correctly prepare and interpret the statement of cash flows using the direct method.

For example, below is the statement of cash flows using the direct method for the year ended December 31, 2015 for Wellbourn Services Ltd. at December 31, 2015:

Note how Wellbourn’s ending cash balance of $135,500, from the statement of cash flows for the year ended December 31, matches the ending cash balance in the balance sheet on that date. This is a critical relationship between these two financial statements. The balance sheet provides information about a company’s resources (assets) at a specific point in time, and whether these resources are financed mainly by debt (current and long-term liabilities) or equity (shareholders’ equity). The statement of cash flows identifies how the company utilized its cash inflows and outflows over the reporting period and, ultimately, ends with its current cash and cash equivalents balance at the balance sheet date. As well, since the statement of cash flows is prepared on a cash basis, it excludes non-cash accruals like depreciation and interest, making the statement of cash flows harder to manipulate than the other financial statements.

Two methods are used to prepare a statement of cash flows, namely the indirect method and the direct method. The indirect method was discussed earlier in this chapter. Both methods organize the reported cash flows into three activities: operating, investing, and financing. The only difference when applying the direct method is in the operating activities section; the investing and financing sections are prepared exactly the same way for both methods.

For the direct method categories are based on the nature of the cash flows. With the indirect method the cash flows are based on the income statement and changes in each current asset and liability account, except cash. Below is a comparison of the two methods:

| Indirect Method | Direct Method | |||||

| Cash flows from operating activities: | Cash flows from operating activities: | |||||

| Net income | $$ | Cash received from sales | $$ | |||

| Adjust for non-cash items: | Cash paid for goods and services | ($$) | ||||

|

Depreciation |

$$ | Cash paid to or on behalf of employees | ($$) | |||

|

Gain on sale of asset |

($$) | Cash received for interest income | $$ | |||

| Increase in accounts receivable | ($$) | Cash paid for interest | ($$) | |||

| Decrease in inventory | $$ | Cash paid for income taxes | ($$) | |||

| Increase in accounts payable | $$ | Cash received for dividends | $$ | |||

| Net cash flows from operating activities | $$ | Net cash flows from operating activities | $$ | |||

The direct method is straightforward due to the grouping of information by nature. This also makes interpretation of the statement easier for stakeholders. However, companies record thousands of transactions every year and many of them do not involve cash. Since the accounting records are kept on an accrual basis, it can be a time-consuming and expensive task to separate and collect the cash-only data required for the direct method categories by nature. Also, reporting on sensitive information, such as cash receipts from customers and cash payments to suppliers, may not be in the best interest of the company in light of competitor companies using the information to their advantage. For these reasons, many companies prefer not to use the direct method, even though IFRS standards prefer its use over the indirect method. Also, the indirect method may be easier to prepare because it collects much of its data directly from the existing income statement and balance sheet. However, it is more difficult to understand because it uses the accounts-based categories as shown above.

11.5.1. Preparing a Statement of Cash Flows: Direct Method

As with the indirect method, preparing a statement of cash flows using the direct method is made much easier if specific steps are followed in sequence. Below is a summary of those steps to complete the operating section of the statement of cash flows using the direct method for Watson Ltd:

| Watson Ltd. | ||||||

| Partial Balance Sheet | ||||||

| As at December 31, 2015 | ||||||

| 2015 | 2014 | |||||

| Current assets | ||||||

| Cash | $ | 307,500 | $ | 250,000 | ||

| Investments – trading | 12,000 | 10,000 | ||||

| Accounts receivable (net) | 249,510 | 165,000 | ||||

| Notes receivable | 18,450 | 22,000 | ||||

| Inventory (LCNRV) | 708,970 | 650,000 | ||||

| Prepaid insurance expenses | 18,450 | 15,000 | ||||

| Total current assets | 1,314,880 | 1,112,000 | ||||

| Current liabilities | ||||||

| Accounts payable | $ | 221,000 | $ | 78,000 | ||

| Accrued interest payable | 24,600 | 33,000 | ||||

| Income taxes payable | 54,120 | 60,000 | ||||

| Unearned revenue | 25,000 | 225,000 | ||||

| Current portion of long-term notes payable | 60,000 | 45,000 | ||||

| Total current liabilities | 384,720 | 441,000 | ||||

| Watson Ltd. | |||

| Income Statement | |||

| For the Year Ended December 31, 2015 | |||

| Sales | $ | 3,500,000 | |

| Cost of goods sold | 2,100,000 | ||

| Gross profit | 1,400,000 | ||

| Operating expenses | |||

| Salaries and benefits expense | 800,000 | ||

| Depreciation expense | 43,000 | ||

| Travel and entertainment expense | 134,000 | ||

| Advertising expense | 35,000 | ||

| Freight-out expense | 50,000 | ||

| Supplies and postage expense | 12,000 | ||

| Telephone and internet expense | 125,000 | ||

| Legal and professional expenses | 48,000 | ||

| Insurance expense | 50,000 | ||

| 1,297,000 | |||

| Income from operations | 103,000 | ||

| Other revenue and expenses | |||

| Dividend income | 3,000 | ||

| Interest income | 2,000 | ||

| Gain from sale of building | 5,000 | ||

| Interest expense | (3,000) | ||

| 7,000 | |||

| Income from continuing operations before income tax | 110,000 | ||

| Income tax expense | 33,000 | ||

| Net income | $ | 77,000 | |

Direct Method Steps:

Step 1: Record headings, categories, and three additional columns into an Operating Activities worksheet as shown below:

| Watson Ltd. | |||

| Operating Activities | |||

| Changes to | Net | ||

| Working Capital | Cash Flow | ||

| Cash flows from operating activities | I/S Accounts | Accounts | In (Out) |

|

Cash received from sales |

|||

|

Cash paid for goods and services |

|||

|

Cash paid to employees |

|||

|

Cash received for interest income |

|||

|

Cash paid for interest |

|||

|

Cash paid for income taxes |

|||

|

Cash received for dividends |

|||

| Net cash flows from operating activities | |||

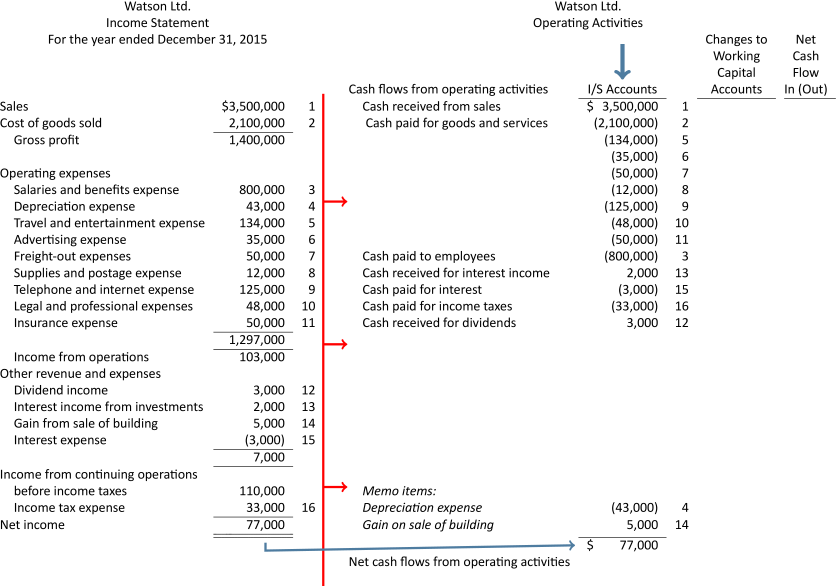

Step 2: Record each income statement amount into the corresponding direct method category of the Operating Activities worksheet shown below (recall that non-cash items such as depreciation and gains or losses are excluded from a statement of cash flows so they are will be recorded as memo items only):

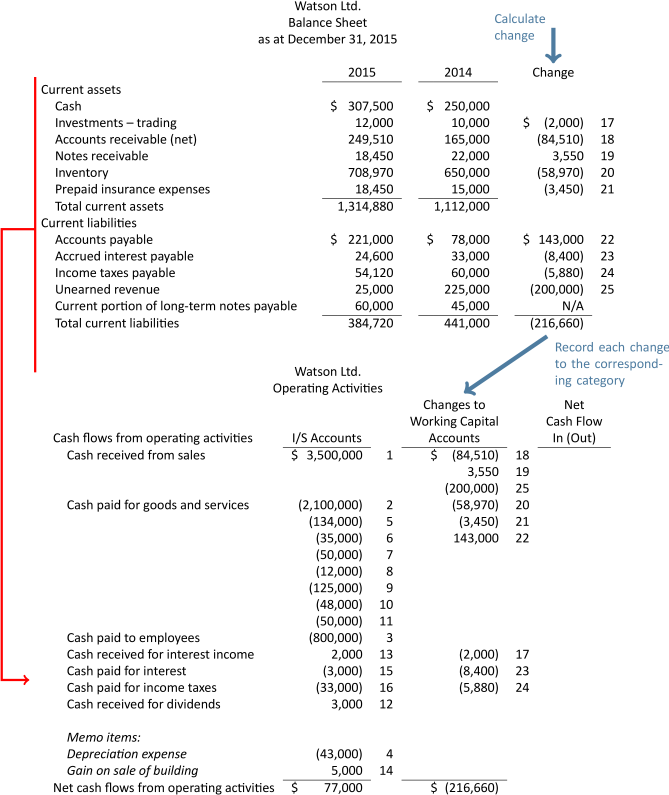

Step 3: Calculate the net change amount for each current asset (except cash), and each current liability from the balance sheet below. Record each change amount in the second column of the Operating Activities worksheet:

Note how items 13 and 17 on the operating activities statement cancel each other out. This is because the interest income was accrued and not actually received in cash. Also note that the current portion of long-term notes was excluded from the operating activities section. Recall from the earlier chapter material on the indirect method that this account is combined with its corresponding long-term note payable account in the financing section of the statement of cash flows.

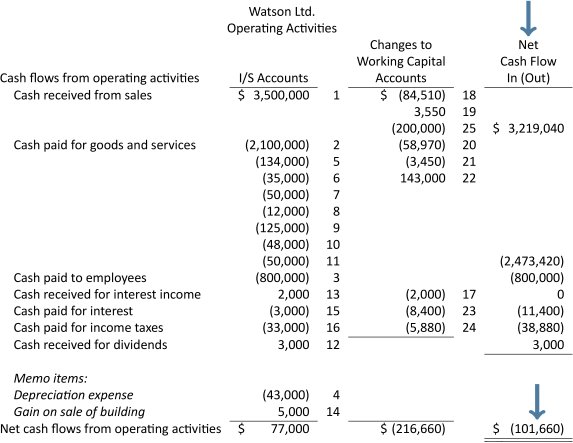

Step 4: Calculate the net cash flow total for each category and the net cashflow total for the operating activities section. Transfer the amounts to the statement of cash flows, operating activities section:

The completed portion of the statement of cash flows, operating section is shown below:

| Watson Ltd. | ||||||

| Statement of Cash Flows – Operating Activities | ||||||

| For the Year Ended December 31, 2015 | ||||||

| Cash flows from operating activities: | ||||||

| Cash received from sales | $ | 3,219,040 | ||||

| Cash paid for goods and services | (2,473,420) | |||||

| Cash paid to or on behalf of employees | (800,000) | |||||

| Cash paid for interest | (11,400) | |||||

| Cash paid for income taxes | (38,880) | |||||

| Cash received for dividends | 3,000 | |||||

| Net cash flows from operating activities | $ | (101,660) | ||||

Summary of Chapter 11 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 11. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Explain the purpose of the statement of cash flows.

The statement of cash flows is one of the four financial statements. It highlights the net increase or decrease in the cash and cash equivalents balance during the accounting period, and details the sources and uses of cash that caused that change.

LO2 – Prepare a statement of cash flows.

The operating activities section of the statement of cash flows can be prepared using the direct or indirect method. This textbook focuses only on the indirect method. The result of both methods is identical; it is only how the calculations are performed that differs. The operating activities section begins with accrual net income and, by adjusting for changes in current assets, current liabilities, adding back depreciation expense, and adding back/subtracting losses/gains on disposal of non-current assets, arrives at net income on a cash basis. The investing activities section analyzes cash inflows and outflows from the sale and purchase of non-current assets. The finance activities section details the cash inflows and outflows resulting from the issue and payment of loans, issue and repurchase of shares, and payment of dividends.

LO3 – Interpret a statement of cash flows.

A statement of cash flows contributes to the decision-making process by explaining the sources and uses of cash. The operating activities section can signal potential areas of concern by focusing on differences between accrual net income and cash basis net income. The investing activities section can highlight if cash is being used to acquire assets for generating revenue, while the financing activities section can identify where the cash to purchase those assets might be coming from. Those who use financial statements can focus on the effectiveness of management’s investing and financing decisions and how these may affect future financial performance.

Discussion Questions

After reading through Chapter 11, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

- Using an example, explain in your own words the function of a statement of cash flows. Why is it prepared? What does it communicate to the reader of financial statements? What is its advantage over a balance sheet? over an income statement?

- Why are financing and investing activities of a corporation important to financial statement readers?

- How does an increase in accounts receivable during the year affect the cash flow from operating activities?

- What effect does the declaration of a cash dividend have on cash flow? the payment of a dividend declared and paid during the current year? the payment of a dividend declared in the preceding year?

- Why may a change in the Short-term investments account not affect the amount of cash provided by operations?

- Why is it possible that cash may have decreased during the year, even though there has been a substantial net income during the same period?

- Describe common transactions affecting balance sheet accounts that use cash. Explain how these items are analysed to identify cash flows that have occurred during the year.

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

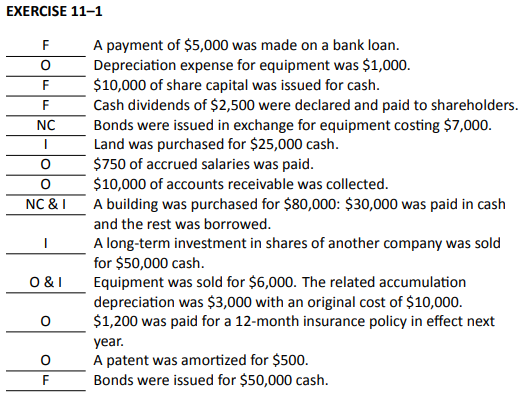

The following transactions were carried out by Crozier Manufacturing Limited.

Indicate into which category each transaction or adjustment is placed in the statement of cash flows: operating (O), financing (F), or investing (I) activities. For non-cash investing/financing activities that are disclosed in a note to the financial statements, indicate (NC).

| A payment of $5,000 was made on a bank loan. | |

| Depreciation expense for equipment was $1,000. | |

| $10,000 of share capital was issued for cash. | |

| Cash dividends of $2,500 were declared and paid to shareholders. | |

| Bonds were issued in exchange for equipment costing $7,000. | |

| Land was purchased for $25,000 cash. | |

| $750 of accrued salaries was paid. | |

| $10,000 of accounts receivable was collected. | |

| A building was purchased for $80,000: $30,000 was paid in cash | |

| and the rest was borrowed. | |

| A long-term investment in shares of another company was sold | |

| for $50,000 cash. | |

| Equipment was sold for $6,000. The related accumulation | |

| depreciation was $3,000 with an original cost of $10,000. | |

| $1,200 was paid for a 12-month insurance policy in effect next | |

| year. | |

| A patent was amortized for $500. | |

| Bonds were issued for $50,000 cash. |

Click Here to View Solution

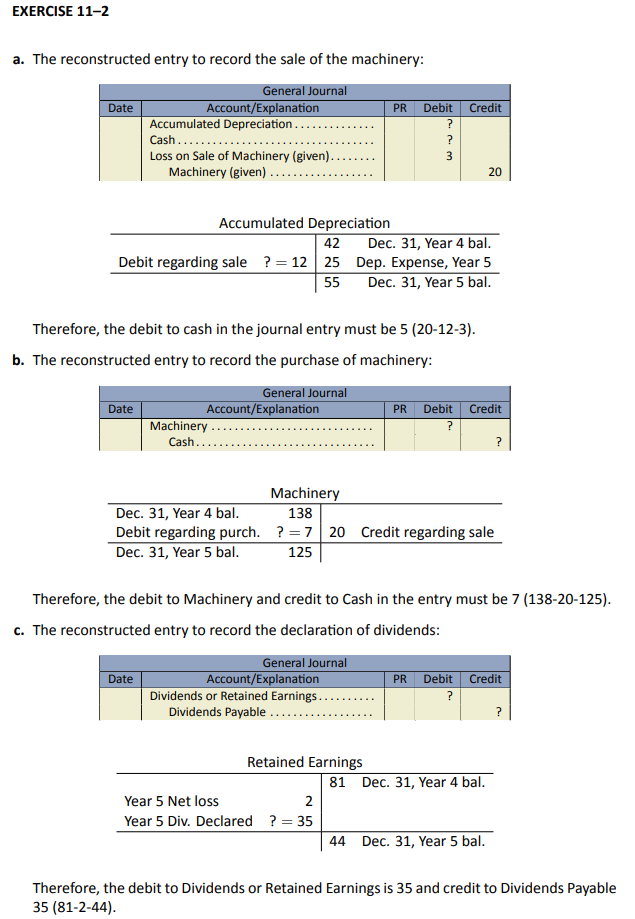

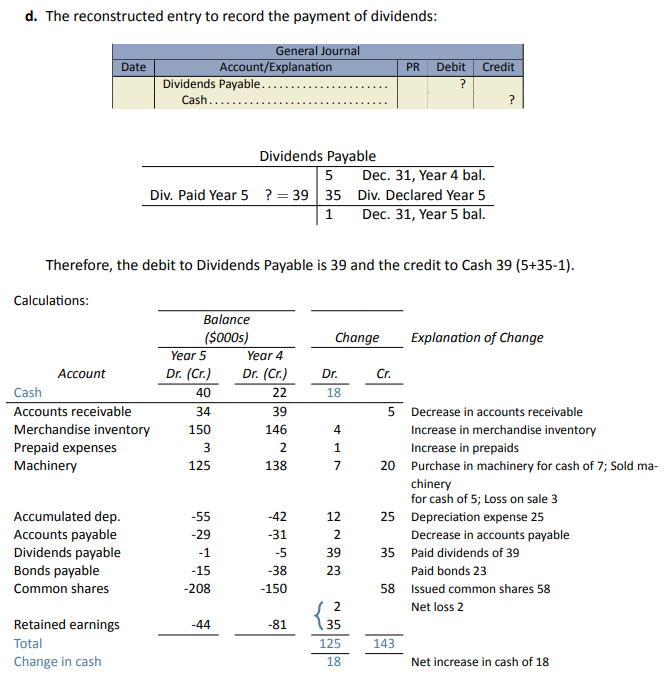

Assume the following selected income statement and balance sheet information for Larriet Inc.:

| Larriet Inc. | ||||||||

| Larriet Inc. | Income Statement | |||||||

| Balance Sheet Information | Year Ended December 31, Year 5 | |||||||

| (000’s) | (000’s) | |||||||

| December 31, | ||||||||

| Year 5 | Year 4 | Sales revenue | $385 | |||||

| Cash | $40 | $22 | Cost of goods sold | $224 | ||||

| Accounts receivable | 34 | 39 | Other operating expenses | 135 | ||||

| Merchandise inventory | 150 | 146 | Depreciation expense | 25 | ||||

| Prepaid expenses | 3 | 2 | Loss on sale of machinery | 3 | (387) | |||

| Machinery | 125 | 138 | Net loss | $2 | ||||

| Accumulated depreciation | 55 | 42 | ||||||

| Accounts payable | 29 | 31 | ||||||

| Dividends payable | 1 | 5 | ||||||

| Bonds payable | 15 | 38 | ||||||

| Common shares | 208 | 150 | ||||||

| Retained earnings | 44 | 81 | ||||||

Additional information:

- Machinery costing $20 thousand was sold for cash.

- Machinery was purchased for cash.

- The change in retained earnings was caused by the net loss and the declaration of dividends.

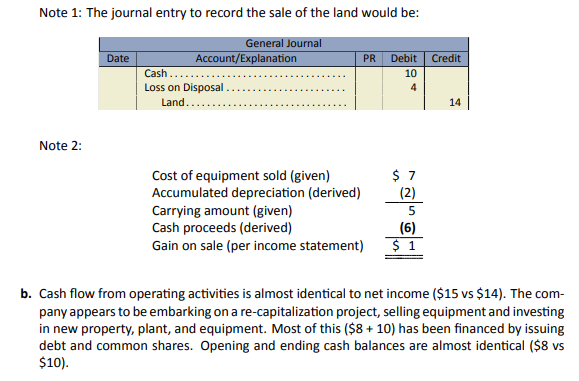

- Reconstruct the journal entry regarding the sale of the machinery.

- Reconstruct the entry regarding the purchase of machinery.

- Reconstruct the entry regarding the declaration of dividends.

- Reconstruct the entry regarding the payment of dividends.

- Prepare the statement of cash flows for the year ended December 31, Year 5.

Click Here to View Solution

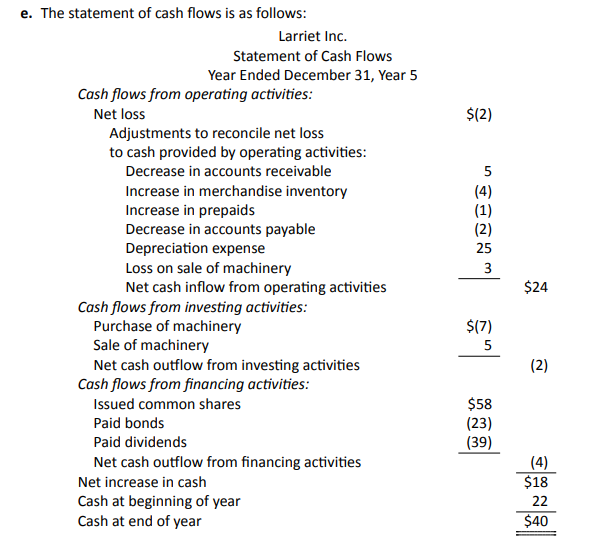

The comparative statement of financial positions of Glacier Corporation showed the following at December 31.

| 2019 | 2018 | |||||

| Debits | ||||||

| Cash | $ | 10 | $ | 8 | ||

| Accounts receivable | 18 | 10 | ||||

| Merchandise inventory | 24 | 20 | ||||

| Land | 10 | 24 | ||||

| Plant and equipment | 94 | 60 | ||||

| $ | 156 | $ | 122 | |||

| Credits | ||||||

| Accumulated depreciation | $ | 14 | $ | 10 | ||

| Accounts payable | 16 | 12 | ||||

| Non-current borrowings | 40 | 32 | ||||

| Common shares | 60 | 50 | ||||

| Retained earnings | 26 | 18 | ||||

| $ | 156 | $ | 122 | |||

The statement of profit and loss for 2019 was as follows:

| Glacier Corporation | ||||||

| Statement of Profit and Loss | ||||||

| For the Year Ended December 31, 2019 | ||||||

| Sales | $ | 300 | ||||

| Cost of sales | 200 | |||||

| Gross profit | 100 | |||||

| Operating expenses | ||||||

|

Rent |

$ | 77 | ||||

|

Depreciation |

6 | 83 | ||||

| Income from operations | 17 | |||||

| Other gains (losses) | ||||||

|

Gain on sale of equipment |

1 | |||||

|

Loss on sale of land |

(4) | (3) | ||||

| Net income | $ 14 | |||||

Additional information:

- Cash dividends paid during the year amounted to $6.

- Land was sold during the year for $10. It was originally purchased for $14.

- Equipment was sold during the year that originally cost $7. Carrying amount was $5.

- Equipment was purchased for $41.

- Prepare a statement of cash flows for the year ended December 31, 2019.

- Comment on the operating, financing, and investing activities of Glacier Corporation for the year ended December 31, 2019.

Click Here to View Solution

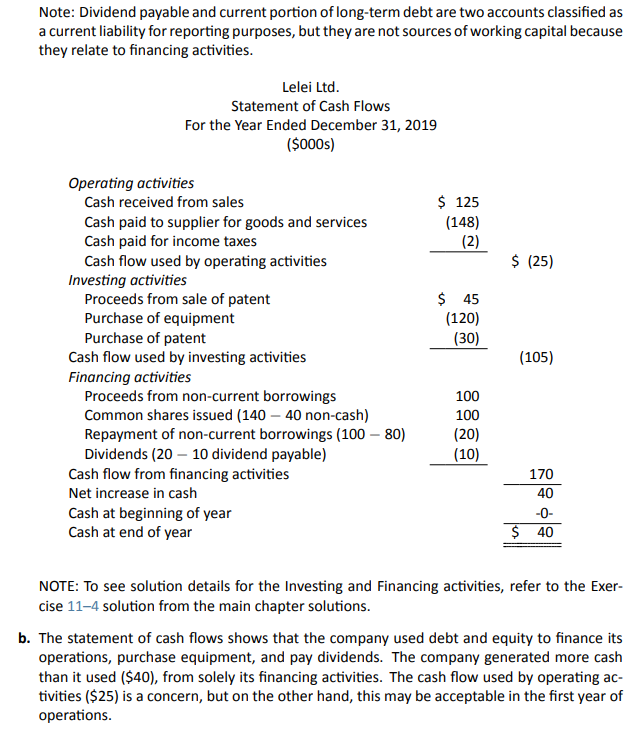

The following trial balance has been prepared from the ledger of Lelie Ltd. at December 31, 2019, following its first year of operations.

| (in $000’s) | ||||||

| Debits | Credits | |||||

| Cash | $ | 40 | ||||

| Accounts receivable | 100 | |||||

| Merchandise inventory | 60 | |||||

| Prepaid rent | 10 | |||||

| Equipment | 160 | |||||

| Accumulated depreciation – equipment | $ | 44 | ||||

| Patent | -0- | |||||

| Accounts payable | 50 | |||||

| Dividends payable | 10 | |||||

| Income taxes payable | 8 | |||||

| Note payable – due 2023 | 80 | |||||

| Common shares | 140 | |||||

| Retained earnings | -0- | |||||

| Cash dividends | 20 | |||||

| Sales | 225 | |||||

| Depreciation | 44 | |||||

| Cost of goods sold | 100 | |||||

| Selling and administrative expenses | 28 | |||||

| Income taxes expense | 10 | |||||

| Gain on sale of land | 15 | |||||

| $ | 572 | $ | 572 | |||

Additional information:

- A patent costing $30,000 was purchased, and then sold during the year for $45,000.

- Lelie assumed $100,000 of long-term debt during the year.

- Some of the principal of the long-term debt was repaid during the year.

- Lelie issued $40,000 of common shares for equipment. Other equipment was purchased for $120,000 cash. No equipment was sold during the year.

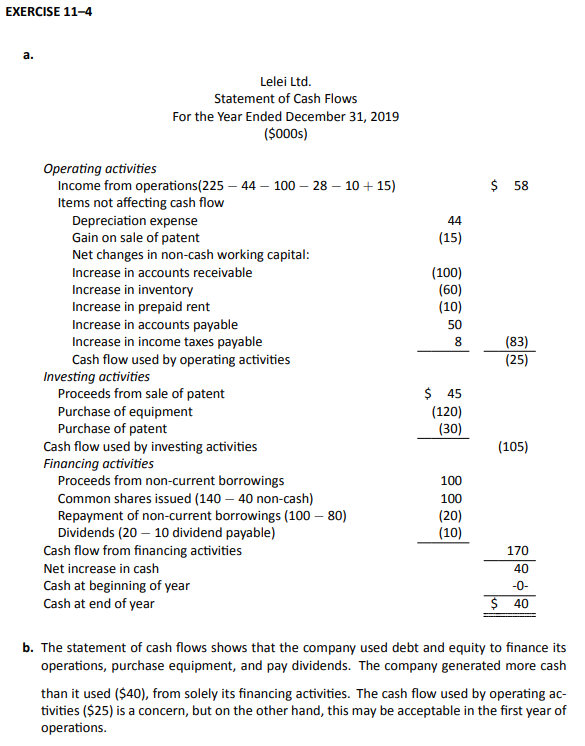

- Prepare a statement of cash flows for the year ended December 31, 2019.

- Explain what the statement of cash flows tells you about Lelei Ltd. at the end of December 31, 2019.

Click Here to View Solution

The accounts balances of ZZ Corp. at December 31 appear below:

| 2019 | 2018 | |||||

| Debits | ||||||

| Cash | $ | 40,000 | $ | 30,000 | ||

| Accounts receivable | 40,000 | 30,000 | ||||

| Merchandise inventory | 122,000 | 126,000 | ||||

| Prepaid expenses | 6,000 | 4,000 | ||||

| Land | 8,000 | 30,000 | ||||

| Buildings | 220,000 | 160,000 | ||||

| Equipment | 123,000 | 80,000 | ||||

| $ | 559,000 | $ | 460,000 | |||

| Credits | ||||||

| Accounts payable | $ | 48,000 | $ | 50,000 | ||

| Accumulated depreciation | 86,000 | 70,000 | ||||

| Note payable, due 2023 | 70,000 | 55,000 | ||||

| Common shares | 300,000 | 250,000 | ||||

| Retained earnings | 55,000 | 35,000 | ||||

| $ | 559,000 | $ | 460,000 | |||

The following additional information is available:

- Net income for the year was $40,000; income taxes expense was $4,000 and depreciation recorded on building and equipment was $27,000.

- Equipment costing $30,000 was purchased; one-half was paid in cash and a 4-year promissory note signed for the balance.

- Equipment costing $50,000 was purchased in exchange for 6,000 common shares.

- Equipment was sold for $15,000 that originally cost $37,000. The gain/loss was reported in net income.

- An addition to the building was built during the year.

- Land costing $22,000 was sold for $26,000 cash during the year. The related gain was reported in the income statement.

- Cash dividends were paid.

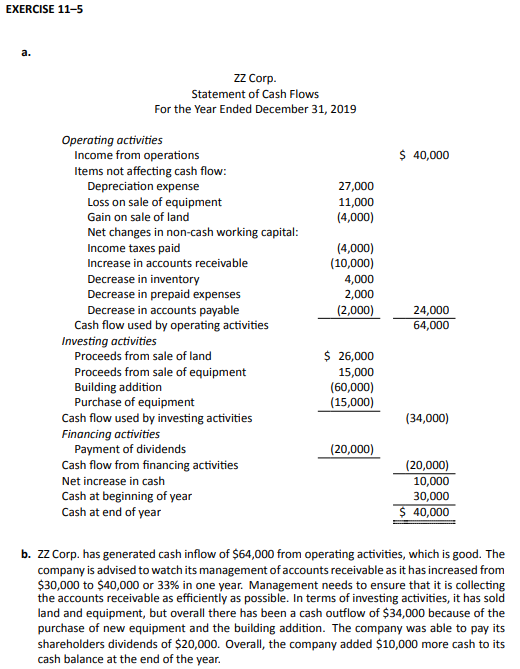

- Prepare a statement of cash flows for the year ended December 31, 2019.

- What observations about ZZ Corp. can be made from this statement?

Click Here to View Solution

Below is a comparative statement of financial position for Egglestone Vibe Inc. as at December 31, 2016:

| Egglestone Vibe Inc. | ||||||

| Statement of Financial Position | ||||||

| December 31 | ||||||

| 2016 | 2015 | |||||

| Assets: | ||||||

| Cash | $ | 166,400 | $ | 146,900 | ||

| Accounts receivable | 113,100 | 76,700 | ||||

| Inventory | 302,900 | 235,300 | ||||

| Land | 84,500 | 133,900 | ||||

| Plant assets | 507,000 | 560,000 | ||||

| Accumulated depreciation – plant assets | (152,100) | (111,800) | ||||

| Goodwill | 161,200 | 224,900 | ||||

|

Total assets |

$ | 1,183,000 | $ | 1,265,900 | ||

| Liabilities and Equity: | ||||||

| Accounts payable | 38,100 | 66,300 | ||||

| Dividend payable | 19,500 | 41,600 | ||||

| Notes payable | 416,000 | 565,500 | ||||

| Common shares | 322,500 | 162,500 | ||||

| Retained earnings | 386,900 | 430,000 | ||||

|

Total liabilities and equity |

$ | 1,183,000 | $ | 1,265,900 | ||

Additional information:

- Net income for the 2016 fiscal year was $24,700. Depreciation expense was $55,900.

- During 2016, land was purchased for cash of $62,400 for expansion purposes. Six months later, another section of land with a carrying value of $111,800 was sold for $150,000 cash.

- On June 15, 2016, notes payable of $160,000 was retired in exchange for the issuance of common shares. On December 31, 2016, notes payable for $10,500 were issued for additional cash flow.

- At year-end, plant assets originally costing $53,000 were sold for $27,300, since they were no longer contributing to profits. At the date of the sale, the accumulated depreciation for the asset sold was $15,600.

- Cash dividends were declared and a portion of those were paid in 2016.

- Goodwill impairment loss was recorded in 2016 to reflect a decrease in the recoverable amount of goodwill. (Hint: Review impairment of long-lived assets in Chapter 8 of the text.)

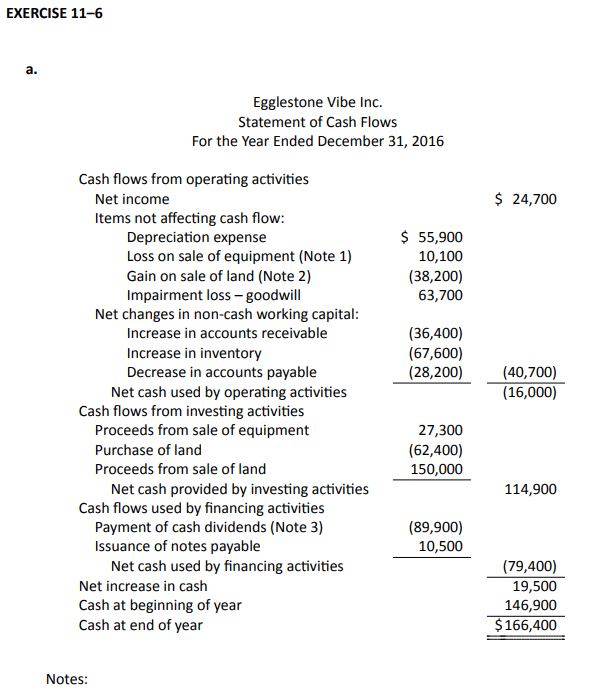

- Prepare a statement of cash flows for the year ended December 31, 2016.

- Analyse and comment on the results reported in the statement.

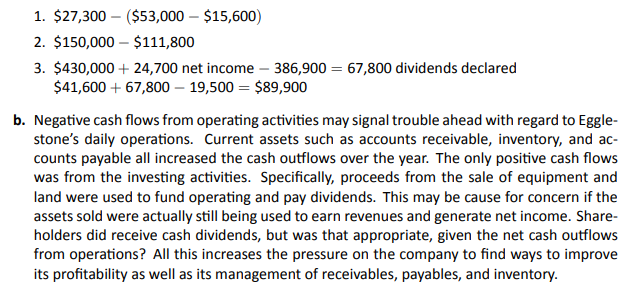

Click Here to View Solution

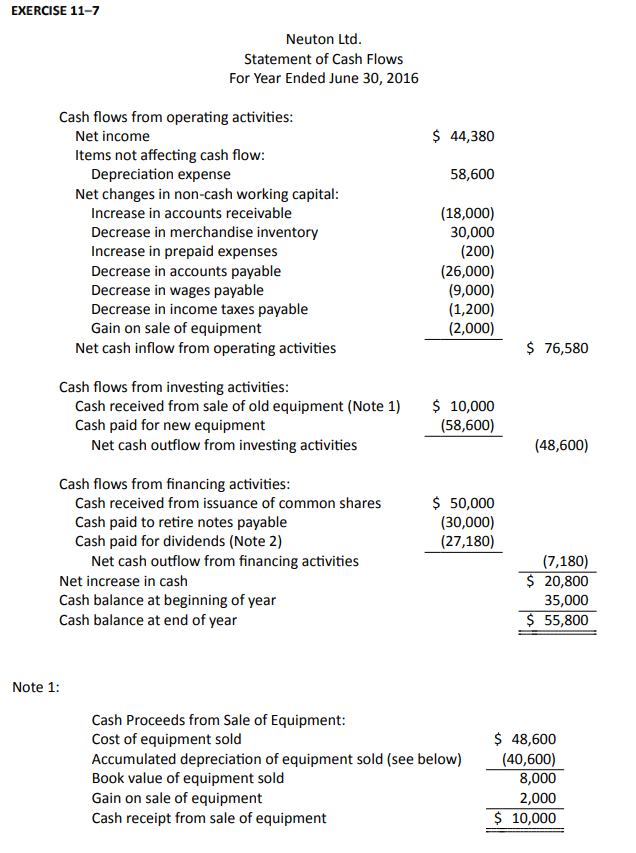

Below is a comparative statement of financial position for Nueton Ltd. as at June 30, 2016:

| Nueton Ltd. | ||||||

| Balance Sheet | ||||||

| June 30 | ||||||

| 2016 | 2015 | |||||

| Cash | $ | 55,800 | $ | 35,000 | ||

| Accounts receivable (net) | 80,000 | 62,000 | ||||

| Inventory | 66,800 | 96,800 | ||||

| Prepaid expenses | 5,400 | 5,200 | ||||

| Equipment | 130,000 | 120,000 | ||||

| Accumulated depreciation | 28,000 | 10,000 | ||||

| Accounts payable | 6,000 | 32,000 | ||||

| Wages payable | 7,000 | 16,000 | ||||

| Income taxes payable | 2,400 | 3,600 | ||||

| Notes payable (long-term) | 40,000 | 70,000 | ||||

| Common shares | 230,000 | 180,000 | ||||

| Retained earnings | 24,600 | 7,400 | ||||

| Nueton Ltd. | |||

| Income Statement | |||

| For Year Ended June 30, 2016 | |||

| Sales | $ | 500,000 | |

| Cost of goods sold | 300,000 | ||

| Gross profit | 200,000 | ||

| Operating expenses: | |||

| Depreciation expense | 58,600 | ||

| Other expenses | 80,000 | ||

| Total operating expenses | 138,600 | ||

| Income from operations | 61,400 | ||

| Gain on sale of equipment | 2,000 | ||

| Income before taxes | 63,400 | ||

| Income taxes | 19,020 | ||

| Net income | $ | 44,380 | |

Additional Information:

- A note is retired at its carrying value.

- New equipment is acquired during 2016 for $58,600.

- The gain on sale of equipment costing $48,600 during 2016 is $2,000.

Use the Neuton Ltd. information given above to prepare a statement of cash flows for the year ended June 30, 2016.

Click Here to View Solution

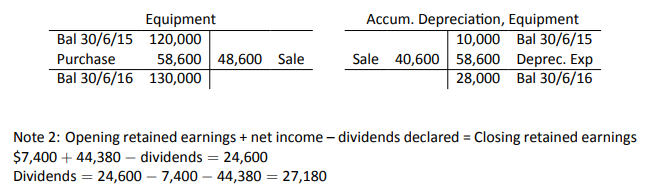

The trial balance for Yucotin Corp. is shown below. All accounts have normal balances.

| Yucotin Corp. | ||||||

| Trial Balance | ||||||

| December 31 | ||||||

| 2016 | 2015 | |||||

| Cash | $ | 248,000 | $ | 268,000 | ||

| Accounts receivable | 62,000 | 54,000 | ||||

| Inventory | 406,000 | 261,000 | ||||

| Equipment | 222,000 | 198,000 | ||||

| Accumulated depreciation, equipment | (104,000) | (68,000) | ||||

| Accounts payable | 46,000 | 64,000 | ||||

| Income taxes payable | 18,000 | 16,000 | ||||

| Common shares | 520,000 | 480,000 | ||||

| Retained earnings | 116,000 | 58,000 | ||||

| Sales | 1,328,000 | 1,200,000 | ||||

| Cost of goods sold | 796,000 | 720,000 | ||||

| Depreciation expense | 36,000 | 30,000 | ||||

| Operating expenses | 334,000 | 330,000 | ||||

| Income taxes expense | 28,000 | 25,000 | ||||

Additional information:

- Equipment is purchased for $24,000 cash.

- 16,000 common shares are issued for cash at $2.50 per share.

- Declared and paid $74,000 of cash dividends during the year.

Prepare a statement of cash flows for 2016.

Click Here to View Solution

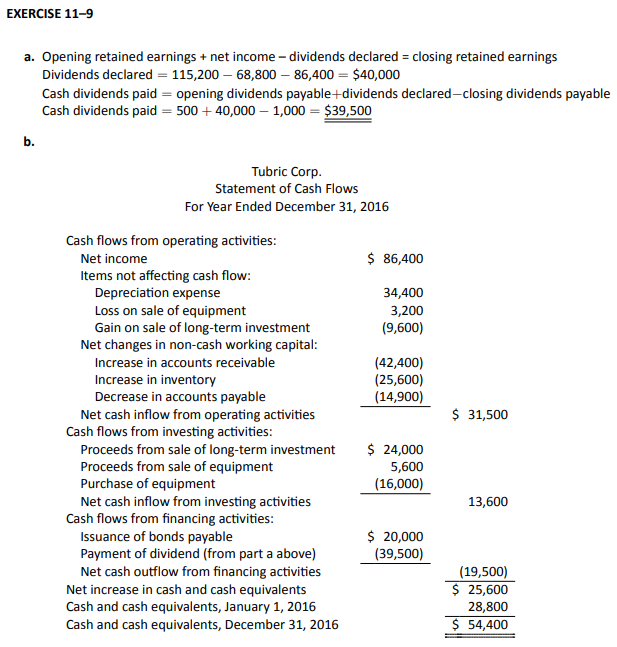

Below is an unclassified balance sheet and income statement for Tubric Corp. for the year ended December 31, 2016:

| Tubric Corp. | ||||||

| Balance Sheet | ||||||

| December 31 | ||||||

| 2016 | 2015 | |||||

| Cash | $ | 40,000 | $ | 20,800 | ||

| Petty cash | 14,400 | 8,000 | ||||

| Accounts receivable | 73,600 | 31,200 | ||||

| Inventory | 95,200 | 69,600 | ||||

| Long-term investment | 0 | 14,400 | ||||

| Land | 64,000 | 64,000 | ||||

| Building and equipment | 370,400 | 380,000 | ||||

| Accumulated depreciation | 98,400 | 80,800 | ||||

|

Total assets |

$ | 559,200 | $ | 507,200 | ||

| Accounts payable | 16,600 | 31,500 | ||||

| Dividends payable | 1,000 | 500 | ||||

| Bonds payable | 20,000 | 0 | ||||

| Preferred shares | 68,000 | 68,000 | ||||

| Common shares | 338,400 | 338,400 | ||||

| Retained earnings | 115,200 | 68,800 | ||||

|

Total liabilities and equity |

$ | 559,200 | $ | 507,200 | ||

| Tubric Corp. | ||||||

| Income Statement | ||||||

| For the year ended December 31, 2016 | ||||||

| Sales | $ | 720,000 | ||||

| Cost of goods sold | 480,000 | |||||

| Gross profit | 240,000 | |||||

| Operating expenses | $ | 110,600 | ||||

| Depreciation expense | 34,400 | |||||

| Loss on sale of equipment | 3,200 | |||||

| Income tax expense | 15,000 | |||||

| Gain on sale of long-term investment | (9,600) | 153,600 | ||||

| Net income | $ | 86,400 | ||||

During 2016, the following transactions occurred:

- Purchased equipment for $16,000 cash.

- Sold the long-term investment on January 2, 2016, for $24,000.

- Sold equipment originally costing $25,600 for $5,600 cash. Equipment had $16,800 of accumulated depreciation at the time of the sale.

- Issued $20,000 of bonds payable at par.

- Calculate the cash paid dividends for 2016.

- Prepare a statement of cash flows for Tubric Corp. for the year ended December 31, 2016.

Click Here to View Solution

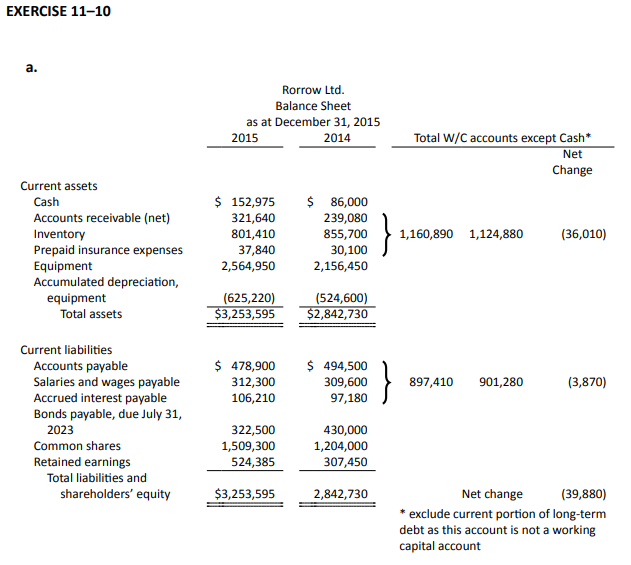

This exercise uses the direct method for creating Statements of Cash Flows as explained in Section 11.5.

Below are the unclassified financial statements for Rorrow Ltd. for the year ended December 31, 2015:

| Rorrow Ltd. | ||||||

| Balance Sheet | ||||||

| As at December 31, 2015 | ||||||

| 2015 | 2014 | |||||

|

Cash |

$ | 152,975 | $ | 86,000 | ||

|

Accounts receivable (net) |

321,640 | 239,080 | ||||

|

Inventory |

801,410 | 855,700 | ||||

|

Prepaid insurance expenses |

37,840 | 30,100 | ||||

|

Equipment |

2,564,950 | 2,156,450 | ||||

|

Accumulated depreciation, equipment |

(625,220) | (524,600) | ||||

|

Total assets |

$ | 3,253,595 | $ | 2,842,730 | ||

|

Accounts payable |

$ | 478,900 | $ | 494,500 | ||

|

Salaries and wages payable |

312,300 | 309,600 | ||||

|

Accrued interest payable |

106,210 | 97,180 | ||||

|

Bonds payable, due July 31, 2023 |

322,500 | 430,000 | ||||

|

Common shares |

1,509,300 | 1,204,000 | ||||

|

Retained earnings |

524,385 | 307,450 | ||||

|

Total liabilities and shareholders’ equity |

$ | 3,253,595 | $ | 2,842,730 | ||

| Rorrow Ltd. | |||

| Income Statement | |||

| For the Year Ended December 31, 2015 | |||

| Sales | $ | 5,258,246 | |

| Expenses | |||

|

Cost of goods sold |

3,150,180 | ||

|

Salaries and benefits expense |

754,186 | ||

|

Depreciation expense |

100,620 | ||

|

Interest expense |

258,129 | ||

|

Insurance expense |

95,976 | ||

|

Income tax expense |

253,098 | ||

| 4,612,189 | |||

| Net income | $ | 646,057 | |

- Complete the direct method worksheet for the operating activities section for the year ended December 31, 2015.

- Prepare the operating activities section for Rorrow Ltd. for the year ended December 31, 2015.

Click Here to View Solution

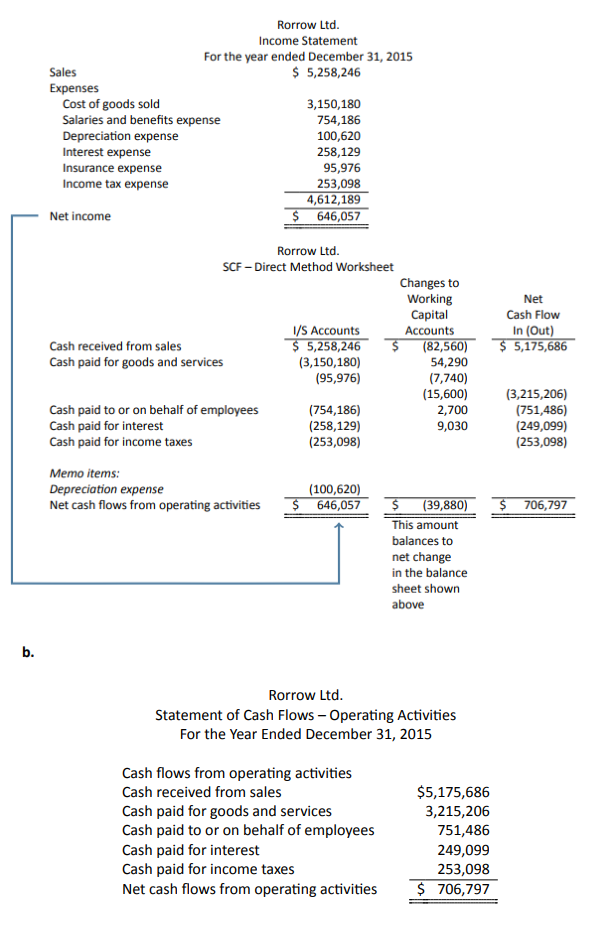

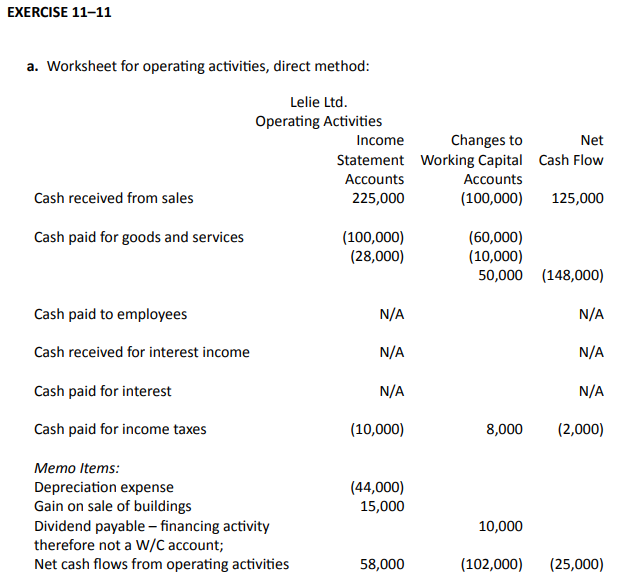

This exercise is similar to Exercise 11–4 except that it uses the direct method for creating Statements of Cash Flows as explained in Section 11.5.

The following trial balance has been prepared from the ledger of Lelie Ltd. at December 31, 2019, following its first year of operations.

| (in $000’s) | ||||||

| Debits | Credits | |||||

| Cash | $ | 40 | ||||

| Accounts receivable | 100 | |||||

| Merchandise inventory | 60 | |||||

| Prepaid rent | 10 | |||||

| Equipment | 160 | |||||

| Accumulated depreciation – equipment | $ | 44 | ||||

| Patent | -0- | |||||

| Accounts payable | 50 | |||||

| Dividends payable | 10 | |||||

| Income taxes payable | 8 | |||||

| Note payable – due 2023 | 80 | |||||

| Common shares | 140 | |||||

| Retained earnings | -0- | |||||

| Cash dividends | 20 | |||||

| Sales | 225 | |||||

| Depreciation | 44 | |||||

| Cost of goods sold | 100 | |||||

| Selling and administrative expenses | 28 | |||||

| Income taxes expense | 10 | |||||

| Gain on sale of land | 15 | |||||

| $ | 572 | $ | 572 | |||

Additional information:

- A patent costing $30,000 was purchased, and then sold during the year for $45,000.

- Lelie assumed $100,000 of long-term debt during the year.

- Some of the principal of the long-term debt was repaid during the year.

- Lelie issued $40,000 of common shares for equipment. Other equipment was purchased for $120,000 cash. No equipment was sold during the year.

- Prepare a statement of cash flows for the year ended December 31, 2019 using the direct method.

- Explain what the statement of cash flows tells you about Lelei Ltd. at the end of December 31, 2019.

Click Here to View Solution

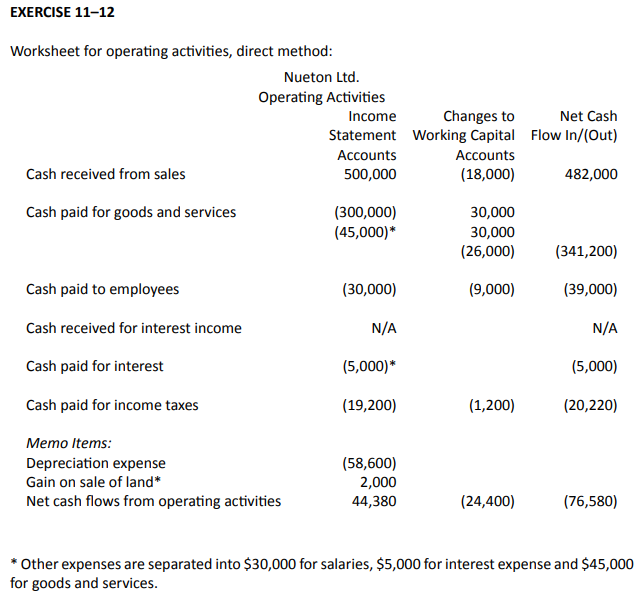

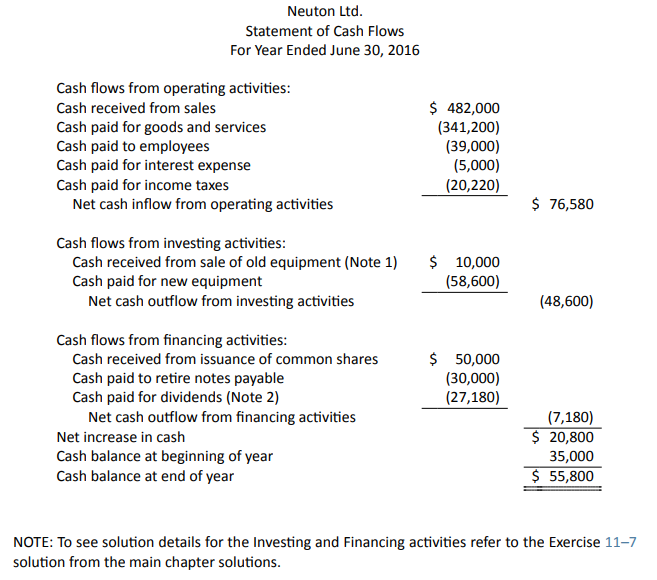

This exercise is similar to Exercise 11–7 except that it uses the direct method for creating Statements of Cash Flows as explained in Section 11.5.

Below is a comparative statement of financial position for Nueton Ltd. as at June 30, 2016:

| Nueton Ltd. | ||||||

| Balance Sheet | ||||||

| June 30 | ||||||

| 2016 | 2015 | |||||

| Cash | $ | 55,800 | $ | 35,000 | ||

| Accounts receivable (net) | 80,000 | 62,000 | ||||

| Inventory | 66,800 | 96,800 | ||||

| Prepaid expenses | 5,400 | 5,200 | ||||

| Equipment | 130,000 | 120,000 | ||||

| Accumulated depreciation | 28,000 | 10,000 | ||||

| Accounts payable | 6,000 | 32,000 | ||||

| Wages payable | 7,000 | 16,000 | ||||

| Income taxes payable | 2,400 | 3,600 | ||||

| Notes payable (long-term) | 40,000 | 70,000 | ||||

| Common shares | 230,000 | 180,000 | ||||

| Retained earnings | 24,600 | 7,400 | ||||

| Nueton Ltd. | |||

| Income Statement | |||

| For Year Ended June 30, 2016 | |||

| Sales | $ | 500,000 | |

| Cost of goods sold | 300,000 | ||

| Gross profit | 200,000 | ||

| Operating expenses: | |||

| Depreciation expense | 58,600 | ||

| Other expenses | 80,000 | ||

| Total operating expenses | 138,600 | ||

| Income from operations | 61,400 | ||

| Gain on sale of equipment | 2,000 | ||

| Income before taxes | 63,400 | ||

| Income taxes | 19,020 | ||

| Net income | $ | 44,380 | |

Additional Information:

- A note is retired at its carrying value.

- New equipment is acquired during 2016 for $58,600.

- The gain on sale of equipment costing $48,600 during 2016 is $2,000.

- Assume that Other expenses includes salaries expense of $30,000, interest expense of $5,000 and the remaining for various purchases of goods and services.

Use the Neuton Ltd. information given above to prepare a statement of cash flows for the year ended June 30, 2016 using the direct method.

Click Here to View Solution

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 11. It is recommended that students review any relevant sections that they struggled with in answering these problems.

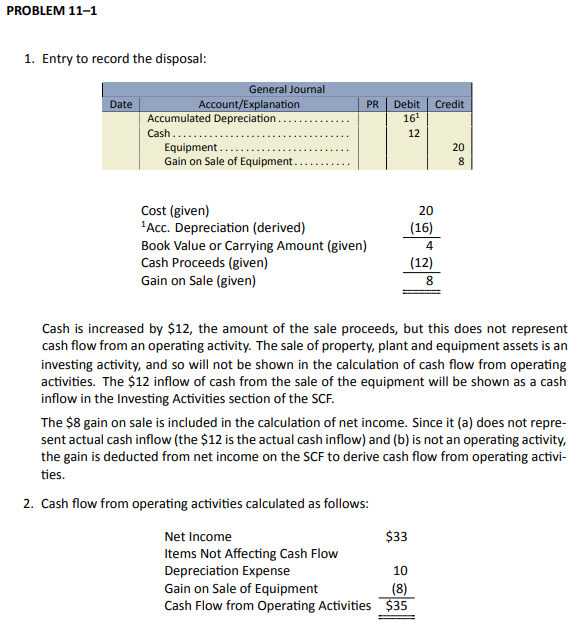

Assume the following income statement information:

| Sales (all cash) | $35 |

| Operating Expenses | |

|

Depreciation |

10 |

| Income before Other Item | 25 |

| Other Item | |

|

Gain on Sale of Equipment |

8 |

| Net Income | $33 |

- Assume the equipment that was sold for a gain of $8 originally cost $20, had a book value of $4 at the date of disposal, and was sold for $12. Prepare the journal entry to record the disposal. What is the cash effect of this entry?

- Calculate cash flow from operating activities.

Click Here to View Solution

Assume the following selected income statement and balance sheet information for the year ended December 31, 2019:

| Sales | $200 |

| Cost of Goods Sold | 120 |

| Gross Profit | 80 |

| Operating Expenses | |

|

Rent |

30 |

| Net Income | $50 |

| 2019 | 2018 | ||

| Dr. (Cr.) | Dr. (Cr.) | ||

| Cash | $100 | $86 | |

| Accounts Receivable | 60 | 40 | |

| Inventory | 36 | 30 | |

| Prepaid Rent | 10 | -0- | |

| Retained Earnings | (206) | (156) |

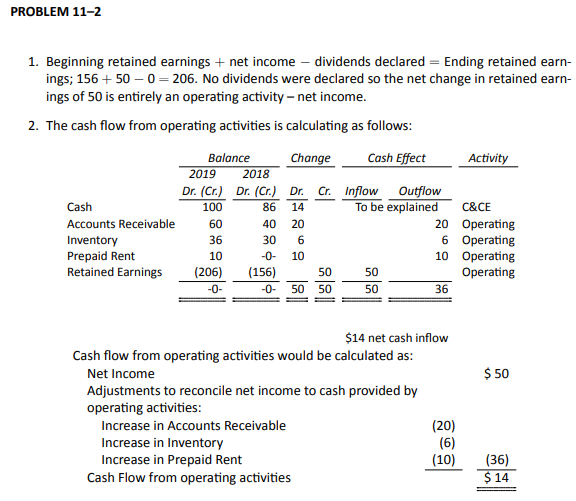

- Reconcile the change in retained earnings from December 31, 2018 to December 31, 2019.

- Calculate cash flow from operating activities.

Click Here to View Solution

PROBLEM 11–3 (LO2)

Assume the following income statement and balance sheet information:

| Revenue | $-0- |

| Depreciation Expense | (100) |

| Net Loss | $(100) |

| 2019 | 2018 | ||

| Dr. (Cr.) | Dr. (Cr.) | ||

| Cash | $350 | $650 | |

| Machinery | 500 | 200 | |

| Accumulated Depreciation – Machinery | (250) | (150) | |

| Retained Earnings | (600) | (700) |

No machinery was disposed during the year. All machinery purchases were paid in cash.

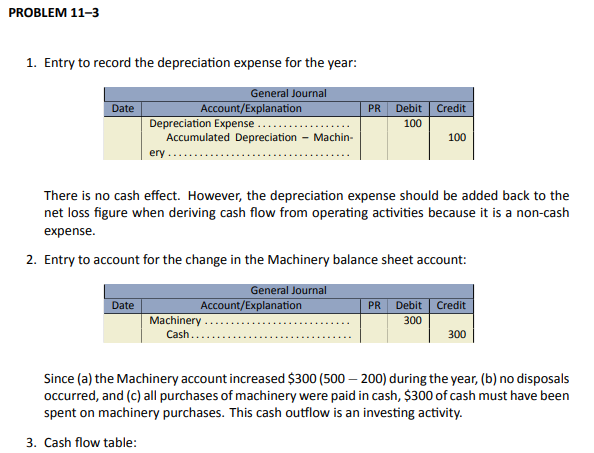

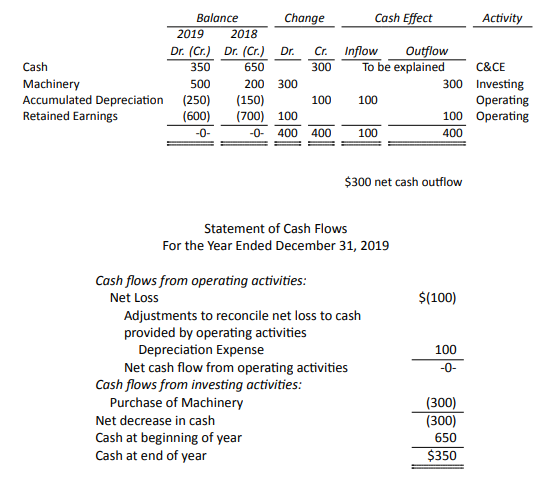

- Prepare a journal entry to record the depreciation expense for the year. Determine the cash effect.

- Prepare a journal entry to account for the change in the Machinery balance sheet account. What is the cash effect of this entry?

- Prepare a statement of cash flows for the year ended December 31, 2019.

Click Here to View Solution

PROBLEM 11–4 (LO2)

Assume the following income statement and balance sheet information:

| Service Revenue (all cash) | $175 |

| Operating Expenses | |

|

Salaries (all cash) |

85 |

| Net Income | $90 |

| 2019 | 2018 | ||

| Dr. (Cr.) | Dr. (Cr.) | ||

| Cash | $1,350 | $1,800 | |

| Borrowings | (800) | (1,300) | |

| Retained Earnings | (550) | (500) |

Other information: All dividends were paid in cash.

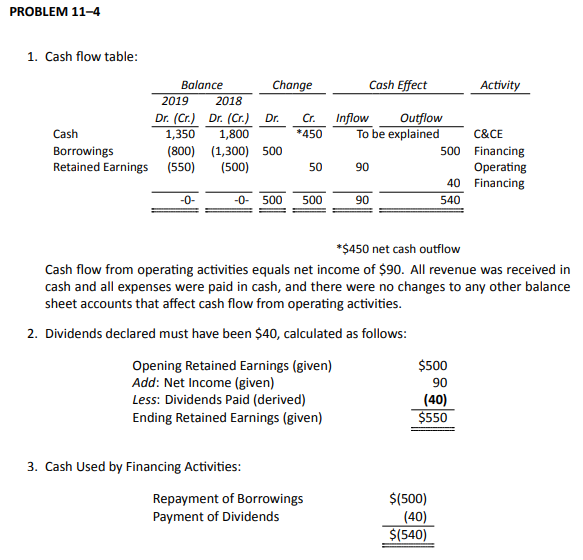

- Calculate cash flow from operating activities.

- Calculate the amount of dividends paid during the year.

- Calculate cash flow used by financing activities.

Click Here to View Solution

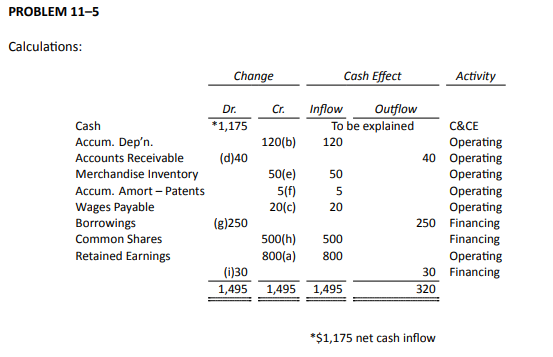

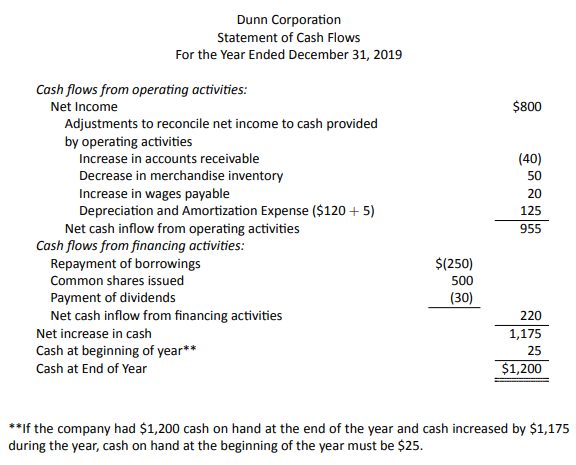

PROBLEM 11–5 (LO2)

The following transactions occurred in the Hubris Corporation during the year ended December 31, 2019.

| (a) | Net income for the year (accrual basis) | $800 |

| (b) | Depreciation expense | 120 |

| (c) | Increase in wages payable | 20 |

| (d) | Increase in accounts receivable | 40 |

| (e) | Decrease in merchandise inventory | 50 |

| (f) | Amortization of patents | 5 |

| (g) | Payment of non-current borrowings | 250 |

| (h) | Issuance of common shares for cash | 500 |

| (i) | Payment of cash dividends | 30 |

Other information: Cash at December 31, 2019 was $1,200.

Prepare a statement of cash flows.

Click Here to View Solution

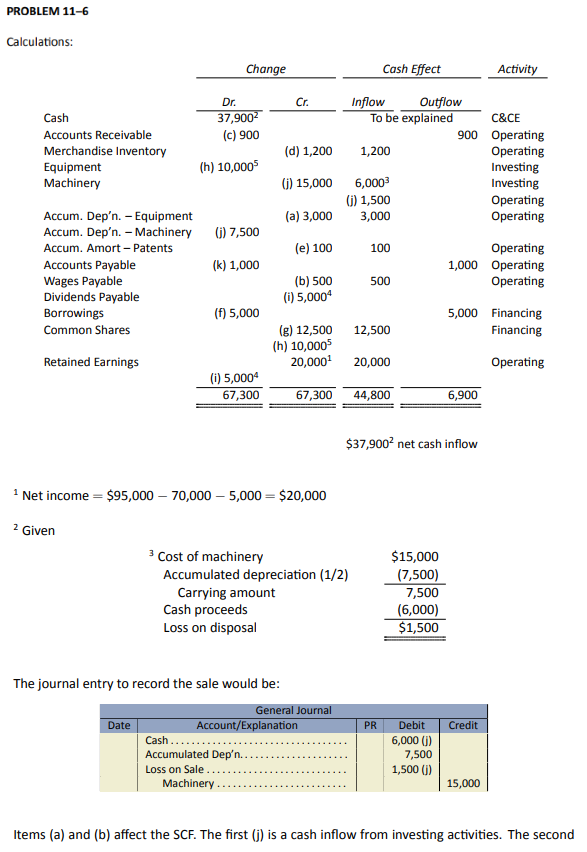

PROBLEM 11–6 (LO2,3)

During the year ended December 31, 2019, the Wheaton Co. Ltd. reported $95,000 of revenues, $70,000 of operating expenses, and $5,000 of income taxes expense. Following is a list of transactions that occurred during the year:

- Depreciation expense, $3,000 (included with operating expenses)

- Increase in wages payable, $500

- Increase in accounts receivable, $900

- Decrease in merchandise inventory, $1,200

- Amortisation of patent, $100

- Non-current borrowings paid in cash, $5,000

- Issuance of common shares for cash, $12,500

- Equipment, cost $10,000, acquired by issuing common shares

- At the end of the fiscal year, a $5,000 cash dividend was declared but not paid.

- Old machinery sold for $6,000 cash; it originally cost $15,000 (one-half depreciated). Loss reported on income statement as ordinary item and included in the $70,000 of operating expenses.

- Decrease in accounts payable, $1,000.

- Cash at January 1, 2019 was $1,000; increase in cash during the year, $37,900

- There was no change in income taxes owing.

- Prepare a statement of cash flows.

- Explain what this statement tells you about Wheaton Co. Ltd.

Click Here to View Solution