Chapter 10

Shareholder’s Equity

Corporations sometimes finance a large portion of their operations by issuing equity in the form of shares. This chapter discusses in detail the nature of the corporate form of organization, the different types of shares used to obtain funds for business activities, and how these transactions are recorded. It also expands on the concept of dividends.

Chapter 10 Learning Objectives

- LO1 – Identify and explain characteristics of the corporate form of organization and classes of shares.

- LO2 – Record and disclose preferred and common share transactions including share splits.

- LO3 – Record and disclose cash dividends.

- LO4 – Record and disclose share dividends.

- LO5 – Calculate and explain the book value per share ratio.

Concept Self-Check

Use the following as a self-check while working through Chapter 10.

- What are the characteristics of a corporation?

- What types of shares can a corporation issue to investors?

- What are the rights of common shareholders in a corporation?

- How are the rights of common shareholders different from those of preferred shareholders?

- How are share transactions recorded?

- When both preferred and common shares are issued by a corporation, how is this disclosed in the equity section of the balance sheet?

- What is meant by authorized shares?

- How do issued shares differ from outstanding shares?

- What is a share split?

- How does a share split affect equity?

- How are cash dividends recorded?

- What is a share dividend and how is it recorded?

- How does a share dividend affect equity?

- What is book value and how is it calculated?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

10.1 The Corporate Structure

LO1 – Identify and explain characteristics of the corporate form of organization and classes of shares.

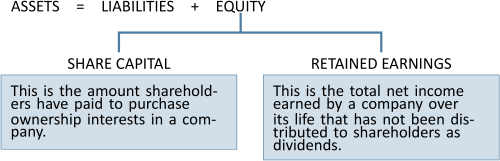

The accounting equation expresses the relationship between assets owned by a corporation and the claims against those assets by creditors and shareholders. Accounting for equity in a corporation requires a distinction between the two main sources of shareholders’ equity: share capital and retained earnings. Their relationship to the accounting equation is shown in Figure 10.1:

Corporate Characteristics

A unique characteristic of corporations is that they are legally separate from their owners, who are called shareholders. Each unit of ownership of a corporation is called a share. If a corporation issues 1,000 shares and you own 100 of them, you own 10% of the company. Corporations can be privately-held shares or publicly-held shares. A privately-held corporation’s shares are not issued for sale to the general public. A publicly-held corporation offers its shares for sale to the general public, sometimes on a stock market like the Toronto Stock Exchange or the New York Stock Exchange.

A corporation has some of the same rights and obligations as individuals. For instance, it pays income taxes on its earnings, can enter into legal contracts, can own property, and can sue and be sued. A corporation also has distinctive features. It is separately regulated by law, has an indefinite life, its owners have limited liability, and it can usually acquire capital more easily than an individual. These features are discussed below.

- Creation by law

A corporation is formed under legislation enacted by a country or a political jurisdiction within it. For instance, in Canada a corporation can be formed under either federal or provincial laws. Although details may vary among jurisdictions, a legal document variously described as articles of incorporation, a memorandum of association, or letters patent is submitted for consideration to the appropriate government by prospective shareholders. The document lists the classes or types of shares that will be issued as well as the total number of shares of each class that can be issued, known as the authorized number of shares.

When approved, the government issues a certificate of incorporation. Investors then purchase shares from the corporation. They meet and elect a board of directors. The board formulates corporation policy and broadly directs the affairs of the corporation. This includes the appointment of a person in charge of day-to-day operations, often called a president, chief executive officer, or similar title. This person in turn has authority over the employees of the corporation.

A shareholder or group of shareholders who control more than 50% of the voting shares of a corporation are able to elect the board of directors and thus direct the affairs of the company. In a large public corporation with many shareholders, minority shareholders with similar ideas about how the company should be run sometimes delegate their votes to one person who will vote on their behalf by signing a proxy statement. This increases their relative voting power, as many other shareholders may not participate in shareholders’ meetings.

Shareholders usually meet annually to vote for a board of directors — either to re-elect the current directors or to vote in new directors. The board meets regularly, perhaps monthly or quarterly, to review the operations of the corporation and to set policies for future operations. The board may decide to distribute some assets of the corporation as a dividend to shareholders. It may also decide that some percentage of the assets of the corporation legally available for dividends should be made unavailable; in this case, a restriction is created. Accounting for such restrictions is discussed later in this chapter.

Wherever it is incorporated, a company is generally subject to the following regulations:

- It must provide timely financial information to investors.

- It must file required reports with the government.

- It cannot distribute profits arbitrarily but must treat all shares of the same class alike.

- It is subject to special taxes and fees.

Despite these requirements, a corporation’s advantages usually outweigh its disadvantages when compared to other forms of business such as a proprietorship or partnership. These features of a corporation are described further below. Proprietorships and partnerships are discussed in more detail in Chapter 13.

- Indefinite life

A corporation has an existence separate from that of its owners. Individual shareholders may die, but the corporate entity continues. The life of a corporation comes to an end only when it is dissolved, becomes bankrupt, or has its charter revoked for failing to follow laws and regulations.

- Limited liability

The corporation’s owners are liable only for the amount that they have invested in the corporation. If the corporation fails, its assets are used to pay creditors. If insufficient assets exist to pay all debts, there is no further liability on the part of shareholders. This situation is in direct contrast to a proprietorship or a partnership. In these forms of organization, creditors have full recourse to the personal assets of the proprietorship or partners if the business is unable to fulfill its financial obligations. For the protection of creditors, the limited liability of a corporation must be disclosed in its name. The words “Limited,” “Incorporated,” or “Corporation” (or the abbreviations Ltd., Inc., or Corp.) are often used as the last word of the name of a company to indicate this corporate form.

- Ease of acquiring capital

Issuing shares allows many individuals to participate in the financing of a corporation. Both small and large investors are able to participate because of the relatively small cost of a share, and the ease with which ownership can be transferred — shares are simply purchased or sold. Large amounts of capital can be raised by a corporation because the risks and rewards of ownership can be spread among many investors.

A corporation only receives money when shares are first issued. Once a share is issued, it can be bought and sold a number of times by various investors. These subsequent transactions between investors do not affect the corporation’s balance sheet.

Income Taxes on Earnings

Because corporations are considered separate legal entities, they pay income taxes on their earnings. To encourage risk-taking and entrepreneurial activity, certain types of corporations may be taxed at rates that are lower than other corporations and individual shareholders’ income tax rates. This can encourage research and development activity or small-company start-ups, for instance.

Classes of Shares

There are many types of shares, with differences related to voting rights, dividend rights, liquidation rights, and other preferential features. The rights of each shareholder depend on the class or type of shares held.

Every corporation issues common shares. The rights and privileges usually attached to common shares are outlined below.

- The right to participate in the management of the corporation by voting at shareholders’ meetings (this participation includes voting to elect a board of directors; each share normally corresponds to one vote).

- The right to receive dividends when they are declared by the corporation’s board of directors.

- The right to receive assets upon liquidation of the corporation.

- The right to appoint auditors through the board of directors.

For other classes of shares, some or all of these rights are usually restricted. The articles of incorporation may also grant the shareholders the pre-emptive right to maintain their proportionate interests in the corporation if additional shares are issued.

If the company is successful, common shareholders may receive dividend payments. As well, the value of common shares may increase. Common shareholders can submit a proposal to raise any matter at an annual meeting and have this proposal circulated to other shareholders at the corporation’s expense. If the corporation intends to make fundamental changes in its business, these shareholders can often require the corporation to buy their shares at their fair value. In addition, shareholders can apply to the courts for an appropriate remedy if they believe their interests have been unfairly disregarded by the corporation.

Some corporations issue different classes of shares in order to appeal to as large a group of investors as possible. This permits different risks to be assumed by different classes of shareholders in the same company. For instance, a corporation may issue common shares but divide these into different classes like class A and class B common shares. When dividends are declared, they might only be paid to holders of class A shares.

Preferred shares is a class of share where the shareholders are entitled to receive dividends before common shareholders. These shares usually do not have voting privileges. Preferred shareholders typically assume less risk than common shareholders. In return, they receive only a limited amount of dividends. Issuing preferred shares allows a corporation to raise additional capital without requiring existing shareholders to give up control. Preferred shares are listed before common shares in the equity section of the balance sheet. Other characteristics of preferred shares and dividend payments are discussed later in this chapter.

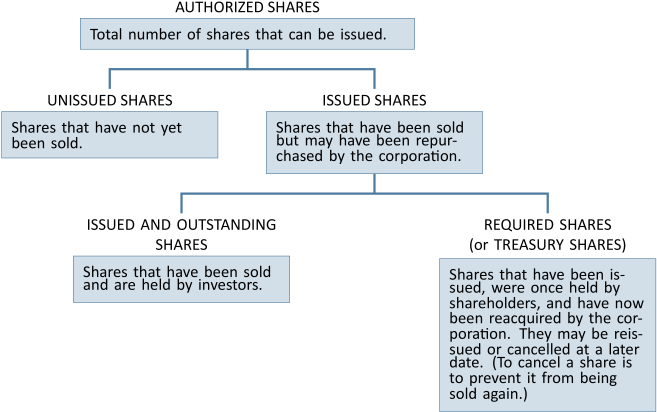

The shares of a corporation can have a different status at different points in time. They can be unissued or issued, issued and outstanding, or issued and reacquired by the corporation (called treasury shares). The meaning of these terms is summarized in Figure 10.2:

The Debt Versus Equity Financing Decision

Many factors influence management in its choice between the issue of debt and the issue of share capital. One of the most important considerations is the potential effect of each of these financing methods on the present shareholders.

Consider the example of Old World Corporation, which has 100,000 common shares outstanding, is a growth company, and is profitable. Assume Old World requires $30 million in cash to finance a new plant. Management is currently reviewing three financing options:

- Issue 12% debt, due in three years

- Issue 300,000 preferred shares at $100 each (dividend $8 per share annually)

- Issue an additional 200,000 common shares at $150 each.

Management estimates that the new plant should result in income before interest and tax of $6 million. Management has prepared the following analysis to compare and evaluate each financing option.

| Plan 1: | Plan 2: | Plan 3: | ||||||

| Issue | Issue | |||||||

| Preferred | Common | |||||||

| Issue Debt | Shares | Shares | ||||||

| Income before interest and income taxes | $ | 6,000,000 | $ | 6,000,000 | $ | 6,000,000 | ||

|

Less: Interest expense ($30M x 12%) |

(3,600,000) | -0- | -0- | |||||

| Income before taxes | $ | 2,400,000 | $ | 6,000,000 | $ | 6,000,000 | ||

|

Less: Income taxes assumed to be 50% |

(1,200,000) | (3,000,000) | (3,000,000) | |||||

| Net income | 1,200,000 | 3,000,000 | 3,000,000 | |||||

|

Less: Preferred dividends (300,000 x $8 per share) |

-0- | (2,400,000) | -0- | |||||

| Net income available to common shareholders | $ | 1,200,000 | $ | 600,000 | $ | 3,000,000 | ||

| Number of common shares outstanding | 100,000 | 100,000 | 300,000 | |||||

| Earnings per common share1 | $ | 12 | $ | 6 | $ | 10 | ||

Plan 1, the issue of debt, has several advantages for existing common shareholders.

- Advantage 1: Earnings per share

If the additional long-term financing were acquired through the issue of debt, the corporate earnings per share (EPS) on each common share would be $12. This EPS is greater than the EPS earned through financing with either preferred shares or additional common shares. On this basis alone, the issue of debt is more financially attractive to existing common shareholders.

- Advantage 2: Control of the corporation

Creditors have no vote in the affairs of the corporation. If additional common shares were issued, there might be a loss of corporate control by existing shareholders because ownership would be distributed over a larger number of shareholders, or concentrated in the hands of one or a few new owners. In the Old World case, issuing common shares would increase the number threefold from 100,000 to 300,000 shares.

- Advantage 3: Income taxes expense

Interest expense paid on debt is deductible from income for income tax purposes. Dividend payments are distributions of retained earnings, which is after-tax income. Thus, dividends are not deductible again for tax purposes. With a 50% income tax rate, the after-tax interest expense to the corporation is only 6% (12% x 50%), with the other 6% being used to offset income tax that would be otherwise due. However, for preferred shares 8% ($8/$100) of the money raised will be paid to the new shareholders as preferred dividends in the first year.

Debt Financing Disadvantages

There are also some disadvantages in long-term financing with debt that must be carefully reviewed by management and the board of directors. The most serious disadvantage is the possibility that the corporation might earn less than $6 million before interest expense and income taxes. The interest expense is a fixed amount. It must be paid to creditors at specified times, unlike dividends.

Another disadvantage is the fact that debt must be repaid at maturity, whether or not the corporation is financially able to do so. Shares do not have to be repaid.

Learning Activity 10.1 – The Corporate Structure

This Learning Activity gives you an opportunity to self-assess how well you understand corporate structures.

Instructions: Read each statement and drag the correct term that it is describing.

10.2 Recording Share Transactions

LO2 – Record and disclose preferred and common share transactions including share splits.

Shares have a stated (or nominal) value—the amount for which they are issued. Alternatively, but rarely, shares will have a par-value which is the amount stated in the corporate charter below which shares cannot be sold upon initial offering. For consistency, we will assume all shares have a stated value.

To demonstrate the issuance and financial statement presentation of shares, assume that New World Corporation is authorized to issue share capital consisting of an unlimited number of voting common shares and 100,000 non-voting preferred shares.

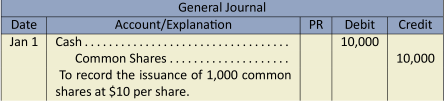

Transaction 1: On January 1, 2015, New World sells 1,000 common shares to its first shareholders for $10 per share, or $10,000 cash. New World records the following entry:

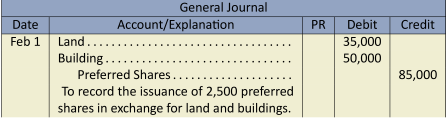

Transaction 2: On February 1, 2015, 2,500 preferred shares are issued to the owner of land and buildings that have a fair value of $35,000 and $50,000, respectively. The journal entry to record this transaction is:

Usually, one or more individuals decide to form a corporation and before the corporation is created, may then use their own funds to pay for legal and government fees, travel and promotional costs, and so on. When the corporation is legally formed, it is not unusual for the corporation to issue shares to these organizers for these amounts. These expenditures are referred to as organization costs (start-up costs) and are expensed.

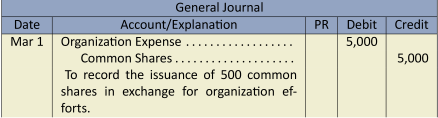

Transaction 3: On March 1, 2015, 500 common shares are issued to the organizers of New World to pay for their services, valued at $5,000. The journal entry to record this transaction is:

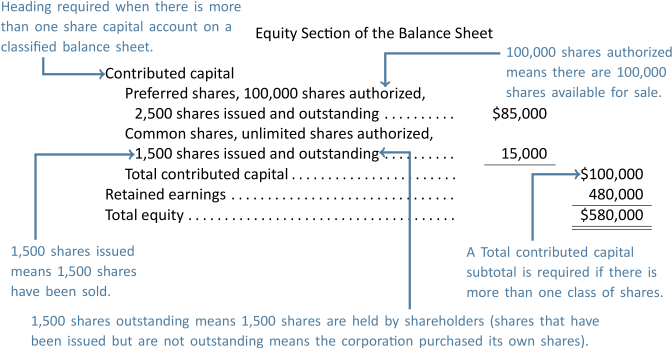

Assuming no further share transactions and a retained earnings balance of $480,000, the equity section of the New World Corporation balance sheet would show the following at December 31, 2015:

Transaction 4: Corporate legislation permits a company to reacquire some of its shares, provided that the purchase does not cause insolvency. A company can repurchase and then cancel the repurchased shares. When repurchased shares are cancelled, they are no longer issued and no longer outstanding. A company can also repurchase shares and then hold them in treasury. Treasury shares are issued but not outstanding. A company can use treasury shares for purposes such as giving to employees as an incentive or bonus.

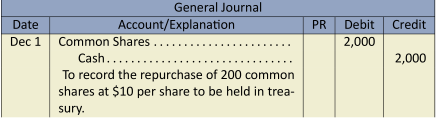

Assume that New World Corporation decides to repurchase 200 common shares on December 1, 2016 and hold them in treasury. Assume that the price of each share is the average issue price of the outstanding common shares, or $10. The journal entry to record the repurchase is:

Assuming no further transactions, the equity section of the New World Corporation balance sheet would show the following at December 31, 2016:

| Equity Section of the Balance Sheet | |||

| Contributed capital | |||

|

Preferred shares, 100,000 shares authorized, |

|||

|

2,500 shares issued and outstanding |

$85,000 | ||

|

Common shares, unlimited shares authorized, |

|||

|

1,500 shares issued; 1,300 shares outstanding |

13,000 | ||

|

Total contributed capital |

$98,000 | ||

| Retained earnings | 480,000 | ||

| Total equity | $578,000 | ||

Notice that the repurchase of shares caused a decrease in both the paid-in capital for the common shares ($2,000 decrease) and in the number of shares outstanding decreased (decreased by 200 shares). If the 200 shares had been cancelled, both the number of shares issued and outstanding would have decreased by 200 shares.

Transaction 5: Shares Retirement

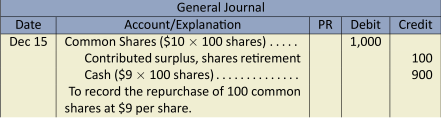

If New World Corporation decides to repurchase and cancel 100 common shares on December 15, 2016. Assume that the purchase price is $9, which is less than the average issue price of $10 per share. The entry would be:

The contributed surplus account is reported in the equity section of the balance sheet, below the share capital accounts. The share capital accounts and the contributed capital account are then subtotalled and reported as total contributed capital of $99,100 as shown below:

| Equity Section of the Balance Sheet | |||

| Contributed capital | |||

|

Preferred shares, 100,000 shares authorized, |

|||

|

2,500 shares issued and outstanding |

$85,000 | ||

|

Common shares, unlimited shares authorized, |

|||

|

1,400 shares issued and outstanding |

14,000 | ||

|

Contributed surplus |

100 | ||

|

Total contributed capital |

$99,100 | ||

| Retained earnings | 480,000 | ||

| Total equity | $579,100 | ||

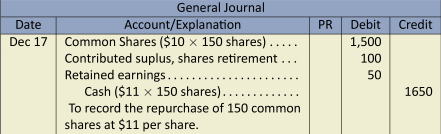

If New World Corporation also repurchases and cancels another 150 common shares on December 17, 2016, at a price of $11, this is more than the average issue price of $10 per share, and the entry would be:

The excess of the purchase price of $11 over the average shares issue price of $10 totals $150 for 150 shares. This would be debited to retained earnings. However, in this case, New World already has contributed surplus of $100 from the December 15 shares cancellation, so this amount must be reversed first. The remainder, or $50, is debited to retained earnings.

Share Splits

A corporation may find its shares are selling at a high price on a stock exchange, perhaps putting them beyond the reach of many investors. To increase the marketability of a corporation’s shares, management may opt for a share split. A share split increases the number of shares issued and outstanding, and lowers the cost of each new share. The originally-issued shares are exchanged for a larger number of new shares.

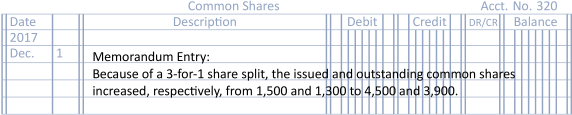

Assume that on December 1, 2017 New World Corporation declares a 3-for-1 common share split. This results in three new common shares replacing each currently-issued and outstanding common share. The number of issued and outstanding shares has now been tripled. The market price of each share will decrease to about one-third of its former market price. Since there is no change in the dollar amount of common shares, no debit-credit entry is required to record the share split. Instead, a memorandum entry would be recorded in the general ledger indicating the new number of shares issued and outstanding, as follows:

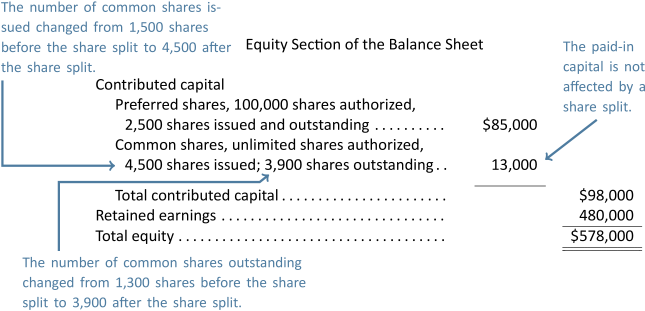

The dollar amount shown on the balance sheet and statement of changes in equity will not change. The only change is an increase in the number of issued and outstanding common shares. After the share split, the equity section of the New World Corporation would appear as follows:

Learning Activity 10.2 – Recording Share Transactions

This Learning Activity gives you an opportunity to better understand how share transactions are recorded.

Instructions: Read the information provided and use it to select the correct answer.

10.3 Cash Dividends

LO3 – Record and disclose cash dividends.

Both creditors and shareholders are interested in the amount of assets that can be distributed as dividends. Dividends The paid-in share capital is not available for distribution as dividends. This helps protect creditors by preventing shareholders from withdrawing assets as dividends to the point where remaining assets become insufficient to pay creditors. For example, assume total assets are $40,000; total liabilities $39,000; and total equity $1,000, consisting of $900 in common shares and $100 of retained earnings. The maximum dividends that could be declared in this situation is $100, the balance in retained earnings.

Dividend Policy

Sometimes the board of directors may choose not to declare any dividends. There may be financial conditions in the corporation that make the payment impractical.

- Consideration 1: There may not be adequate cash

Corporations regularly reinvest their earnings in assets in order to make more profits. In this way, growth occurs and reliance on creditor financing can be minimized. As a result, there may not be enough cash on hand to declare and pay a cash dividend. The assets of the corporation may be tied up in property, plant, and equipment, for instance.

- Consideration 2: A policy of the corporation may preclude dividend payments

Some corporations pay no dividends. Instead, they reinvest their earnings in the business. Shareholders generally benefit through increased earnings, reflected in increased market price for the corporation’s shares. A stated policy to this effect can apprise investors. This type of dividend policy is often found in growth-oriented corporations.

- Consideration 3: No legal requirement that dividends have to be paid

The board of directors may decide that no dividends should be paid. Legally, there is no requirement to do so. If shareholders are dissatisfied, they can elect a new board of directors or sell their shares.

- Consideration 4: Dividends may be issued in shares of the corporation rather than in cash

Share dividends may be issued to conserve cash or to increase the number of shares to be traded on the stock market. Shares dividends are discussed in Section 10.4.

Dividend Declaration

Dividends can be paid only if they have been officially declared by the board of directors. The board must pass a formal resolution authorizing the dividend payment. Notices of the dividend are then published. Once a dividend declaration has been made public, the dividend becomes a liability and must be paid. An example of a dividend notice is shown in Figure 10.3.

New World Corporation

Dividend Notice

On May 25, 2016 the board of directors of New World Corporation declared a dividend of $0.50 per share on common shares outstanding (3,900). The dividend will be paid on June 26, 2016 to shareholders of record on June 7, 2016.

By order of the board

[signed]

Lee Smith

Secretary

May 25, 2016

There are three dates associated with a dividend. Usually dividends are declared on one date, the date of declaration (May 25, 2016 in this case); they are payable to shareholders on a second date, the date of record (June 7, 2016); and the dividend is paid on a third date, the date of payment (June 26, 2016).

Date of Declaration

The dividend declaration provides an official notice of the dividend. It specifies the amount of the dividend as well as which shareholders will receive the dividend. The liability for the dividend is recorded in the books of the corporation at its declaration date.

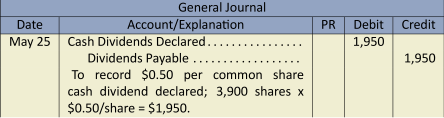

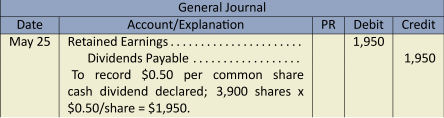

The following entry would be made in the general ledger of New World Corporation on May 25, 2016, the date of declaration:

OR

If, as shown in the second entry above, retained earnings is debited instead of cash dividends declared, a closing entry is not required for dividends during the closing process.

Date of Record

Shareholders who own shares on the date of record will receive the dividend even if they have sold the shares before the dividend is actually paid. No journal entry is made in the accounting records for the date of record.

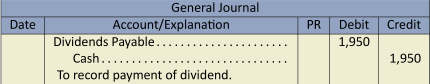

Date of Payment

The dividend is paid on this date and recorded as:

Preferred Shareholder Dividends

Preferred shares are offered to attract investors who have lower tolerance for risk than do common shareholders. Preferred shareholders are content with a smaller but more predictable share of a corporation’s profits. For instance, preferred shareholders are entitled to dividends before any dividends are distributed to common shareholders. Also, most preferred shares specifically state what amount of dividends their holders can expect each year. For example, owners of $8 preferred shares would be paid $8 per share held each year. These dividends are often paid even if the corporation experiences a net loss in a particular year.

Preferred shares may also have other dividend preferences, depending on what rights have been attached to preferred shares at the date of incorporation. One such preference is the accumulation of undeclared dividends from one year to the next — referred to as cumulative dividends. Discussion of other preferences is beyond the scope of this introductory textbook. Cumulative dividends are discussed in the next section.

Cumulative Dividend Preferences

Cumulative preferred shares require that any unpaid dividends accumulate from one year to the next and are payable from future earnings when a dividend is eventually declared by a corporation. These accumulated dividends must be paid before any dividends are paid on common shares. The unpaid dividends are called dividends in arrears. Dividends in arrears are not recorded as a liability on the balance sheet of the company until they have been declared by the board of directors. However, disclosure of dividends in arrears must be made in a note to the financial statements.

If a preferred share is non-cumulative, a dividend not declared by the board of directors in any one year is never paid to shareholders.

Learning Activity 10.3 – Cash Dividends

This Learning Activity gives you an opportunity to apply your understanding of cash dividends

Instructions: Read through the information provided and use it to select the best answer.

10.4 Share Dividends

LO4 – Record and disclose share dividends.

A share dividend is a dividend given to shareholders in the form of shares rather than cash. In this way, the declaring corporation is able to retain cash in the business and reduce the need to finance its activities through borrowing. Like a cash dividend, a share dividend reduces retained earnings. However, a share dividend does not cause assets to change. Instead, it simply transfers an amount from retained earnings to contributed capital. Total assets, total liabilities, and total equity remain unchanged when there is a share dividend. Like a cash dividend, there are three dates regarding a share dividend: date of declaration, date of record, and date of distribution. Notice that there is no ‘date of payment’ as there was for a cash dividend. This is because there is no cash payment involved for a share dividend. Instead, shares are distributed, or given, to the shareholders.

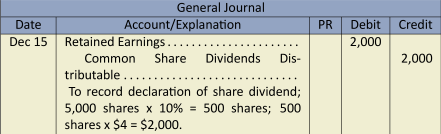

Accounting for Share Dividends

To demonstrate a share dividend, assume that the Sherbrooke Corporation declares a 10% share dividend to common shareholders. The share dividend is declared on December 15, 2015 payable to shareholders of record on December 20, 2015. The share dividend is distributed on January 10, 2016. At the time of the dividend declaration, the shares were trading on the stock exchange at $4 per share and the equity of the corporation consisted of the following:

| Common shares; 20,000 shares authorized; | ||

|

5,000 shares issued and outstanding |

$25,000 | |

| Retained earnings | 100,000 | |

| Total equity | $125,000 |

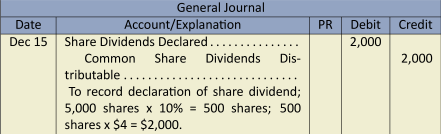

The 10% share dividend equals 500 shares (calculated as 5,000 outstanding shares x 10% share dividend). The market price on the date of declaration is used to record a share dividend. On the declaration date, the journal entry to record the share dividend is:

OR

If, as shown in the second entry above, retained earnings is debited instead of share dividends, a closing entry is not required for dividends during the closing process. Common Share Dividends Distributable is an equity account, specifically, a share capital account.

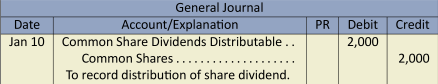

On the share dividend distribution date, the following entry is recorded:

The effect of these entries is to transfer $2,000 from retained earnings to share capital. No assets are paid by the corporation when the additional shares are issued as a share dividend, and therefore the total equity remains unchanged.

Is There Any Change in the Investor’s Percentage of Corporate Ownership Because of a Share Dividend?

Since a share dividend is issued to all shareholders of a particular class, as a result of a share dividend, each shareholder has a larger number of shares. However, ownership percentage of the company remains the same for each shareholder, as illustrated below, for the four shareholders of Sherbrooke Corporation.

Each shareholder has received a 10% share dividend but their ownership percentage of the company remains constant. Since total equity does not change when there is a share dividend, the proportion owned by each shareholder does not change.

| Corporate ownership | ||||||

| Before share dividend | After share dividend | |||||

| Shareholder | Shares | Percent | Shares | Percent | ||

| 1 | 1,000 | 20% | 1,100 | 20% | ||

| 2 | 500 | 10% | 550 | 10% | ||

| 3 | 2,000 | 40% | 2,200 | 40% | ||

| 4 | 1,500 | 30% | 1,650 | 30% | ||

| 5,000 | 100% | 5,500 | 100% | |||

10.5 Book Value

LO5 – Calculate and explain the book value per share ratio.

The book value of a share is the amount of net assets represented by one share. When referring to common shares, book value represents the amount of net assets not claimed by creditors and preferred shareholders. When referring to preferred shares, book value represents the amount that preferred shareholders would receive if the corporation were liquidated:

![]()

![]()

Calculation of the Book Value of Shares

The calculation of the book value of preferred and common shares can be illustrated by using the following data:

| Equity Section of the Balance Sheet | |||

| Contributed capital | |||

|

Preferred shares; 5,000 shares authorized; |

|||

|

1,000 shares issued and outstanding |

$10,000 | ||

|

Common shares; 200,000 shares authorized; |

|||

|

60,000 shares issued and outstanding |

20,000 | ||

|

Total contributed capital |

$30,000 | ||

| Retained earnings | 105,000 | ||

| Total equity | $135,000 | ||

Book value is calculated as:

| Preferred shares | Common shares | |||

| Dividends in arrears | $ 5,000 | Total equity | $135,000 | |

| Plus: Paid-in capital | 10,000 | Less: Preferred claims | 15,000 | |

|

Balance |

$15,000 |

Balance |

$120,000 | |

| Shares outstanding | 1,000 | Shares outstanding | 60,000 | |

| Book value per share | $15 | Book value per share | $2 | |

Comparison of book value with market value provides insight into investors’ evaluations of the corporation. For instance, if the book value of one common share of Corporation A is $20 and its common shares are traded on a public stock exchange for $40 per share (market value), it is said to be trading for “two times book value.” If Corporation B is trading for three times book value, investors are indicating that the future profit prospects for corporation B are higher than those for Corporation A. They are willing to pay proportionately more for shares of Corporation B than Corporation A, relative to the underlying book values.

Some shares regularly sell for less than their book value on various stock exchanges. This does not necessarily mean they are a bargain investment. The market price of a share is related to such factors as general economic outlook and perceived potential of the company to generate earnings.

10.6 Appendix A: Reporting for Multiple Classes of Shares

Multiple classes of shares are to be separately reported in the financial statements. For example, in Section 10.5 the equity portion of the balance sheet has separated the preferred shares and common shares. This provides important information about the composition of the company’s share capital for its shareholders and creditors. Recall that preferred shares are entitled to receive dividends before common shareholders.

Another statement affected by multiple classes of shares is the statement of changes in equity, where multiple classes of shares are to be separately reported, as shown below using some sample data:

| Sample Company Ltd. | ||||||||||||

| Statement of Changes in Equity | ||||||||||||

| For the year ended December 31, 2017 | ||||||||||||

| Preferred | Common | Retained | Total | |||||||||

| Shares | Shares | Earnings | Equity | |||||||||

| Jan 1, 2017, opening balance | $ | 5,000 | $ | 15,000 | $ | 80,000 | $ | 100,000 | ||||

| Additional shares issued | 5,000 | 5,000 | 10,000 | |||||||||

| Dividends declared | (12,000) | (12,000) | ||||||||||

| Net income | 20,000 | 20,000 | ||||||||||

| Dec 31, 2017, closing balance | $ | 10,000 | $ | 20,000 | $ | 88,000 | $ | 118,000 | ||||

Summary of Chapter 10 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 10. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Identify and explain characteristics of the corporate form of organization and classes of shares.

A corporation is a legal entity that is separate from its owners, known as shareholders. The board of directors is responsible for corporate policy and broad direction of the corporation, including hiring the person in charge of day-to-day operations. A corporation has an indefinite life, its shareholders have limited liability, it can acquire capital more easily than a sole proprietorship or partnership, and it pays income taxes on its earnings since it is a separate legal entity. A corporation can issue common and preferred shares. Common shares have voting rights while preferred shares do not. Preferred shares are listed before common shares in the equity section of the balance sheet. Preferred shareholders are entitled to receive dividends before common shareholders. Authorized shares are the total number of shares that can be issued or sold. Shares that have been issued can be repurchased by the corporation and either held in treasury for subsequent sale/distribution or cancelled. Outstanding shares are those that have been issued and are held by shareholders. Shares repurchased by a corporation are not outstanding shares.

LO2 – Record and disclose preferred and common share transactions including share splits.

Common and preferred shares can be issued for cash or other assets. Organization costs are expensed when incurred and organizers sometimes accept shares in lieu of cash for their work in organizing the corporation. When more than one type of share has been issued, the equity section of the balance sheet must be classified by including a Contributed Capital section. When a corporations shares are selling at a high price, a share split may be declared to increase the marketability of the shares. There is no journal entry for a share split. Instead, a memorandum entry is entered into the records detailing the split. A share split increases the number of shares but does not change any of the dollar amounts on the financial statements.

LO3 – Record and disclose cash dividends.

Cash dividends are a distribution of earnings to the shareholders and are declared by the board of directors. On the declaration date, cash dividends declared (or retained earnings) is debited and dividends payable is credited. On the date of record, no journal entry is recorded. Shareholders who hold shares on the date of record are eligible to receive the declared dividend. On the date of payment, dividends payable is debited and cash is credited. Preferred shares may have a feature known as cumulative or non-cumulative. Cumulative preferred shares accumulate undeclared dividends from one year to the next. These unpaid dividends are called dividends in arrears. When dividends are subsequently declared, dividends in arrears must be paid before anything is paid to the other shareholders. Non-cumulative preferred shares do not accumulate undeclared dividends.

LO4 – Record and disclose share dividends.

Share dividends distribute additional shares to shareholders and are declared by the board of directors. On the declaration date, share dividends declared (or retained earnings) is debited and common share dividends distributable, a share capital account, is credited. When the share dividend is distributed to shareholders, the Common Share Dividends Distributable account is debited and common shares is credited. Share dividends cause an increase in the number of shares issued and outstanding but do not affect account balances. Share dividends simply transfer an amount from retained earnings to share capital within the equity section of the balance sheet.

LO5 – Calculate and explain the book value per share ratio.

The book value of a share is the amount of net assets represented by one share. Book value per common share is the amount of net assets not claimed by creditors and preferred shareholders. Preferred book value per share is the net assets that preferred shareholders would receive if the corporation were liquidated.

Discussion Questions

After reading through Chapter 10, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

- What are some advantages of the corporate form of organization?

- What is meant by limited liability of a corporation?

- What rights are attached to common shares? Where are these rights indicated?

- What is a board of directors and whom does it represent? Are the directors involved in the daily management of the entity?

- Describe:

- two main classes of shares that can be issued by a corporation; and

- the different terms relating to the status of a corporation’s shares.

- In what ways can shares be “preferred”? In which ways are they similar to common shares? Different from common shares?

- Why do corporations sometimes opt for a share split?

- Identify the major components of the equity section of a balance sheet. Why are these components distinguished?

- How can retained earnings be said to be reinvested in a corporation?

- What are the main issues a board of directors considers when making a dividend declaration decision?

- Even if a corporation is making a substantial net income each year, why might the board of directors decide to not pay any cash dividends?

- Distinguish among the date of dividend declaration, the date of record, and the date of payment.

- What is the difference in accounting between cash dividends and share dividends?

- Explain the different dividend preferences that may be attached to preferred shares. Why would preferred shares have these preferences over common shares? Does it mean that purchasing preferred shares is better than purchasing common shares?

- What are dividends in arrears? Are they a liability of the corporation?

- How does a share dividend differ from a share split?

- Does a share dividend change an investor’s percentage of corporate ownership? Explain, using an example.

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

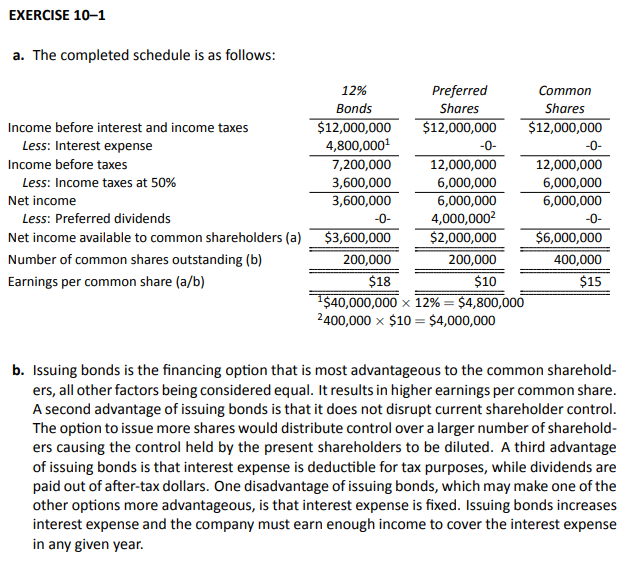

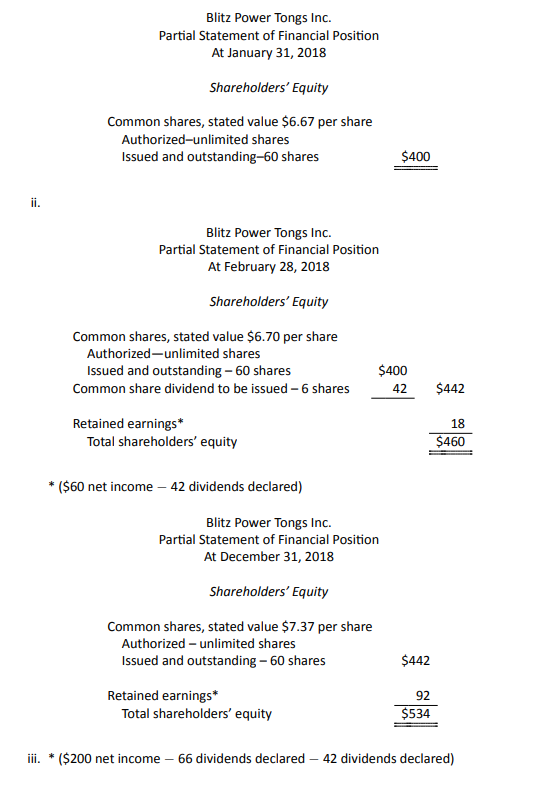

Bagan Corporation, a profitable growth company with 200,000 shares of common shares outstanding, is in need of $40 million in new funds to finance a required expansion. Management has three options:

- Sell $40 million of 12% bonds at face value.

- Sell preferred shares: 400,000, $10 shares at $100 per share.

- Sell an additional 200,000 common shares at $200 per share.

Operating income (before interest and income taxes) upon completion of the expansion is expected to average $12 million per year; assume an income tax rate of 50 per cent.

- Complete the schedule below.

12% Preferred Common Bonds Shares Shares Income before interest and income taxes Less: Interest expense

Income before taxes Less: Income taxes at 50%

Net income Less: Preferred dividends

Net income available to common shareholders Number of common shares outstanding Earnings per common share - Which financing option is most advantageous to the common shareholders? Why?

Click Here to View Solution

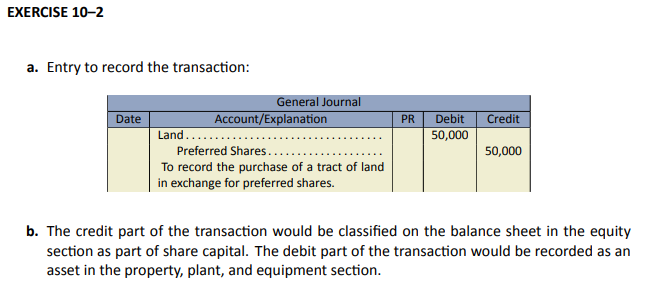

A tract of land valued at $50,000 has been given to a corporation in exchange for 1,000 preferred shares.

- Prepare the journal entry to record the transaction.

- Where would the transaction be classified in the balance sheet?

Click Here to View Solution

The equity section of Gannon Oilfield Corporation’s balance sheet at December 31, 2019 is shown below.

| Preferred Shares | |

|

Authorized – 100 shares |

|

|

Issued and Outstanding – 64 Shares |

$3,456 |

| Common Shares | |

|

Authorized – 2,000 Shares |

|

|

Issued and Outstanding – 800 Shares |

1680 |

| Retained Earnings | 600 |

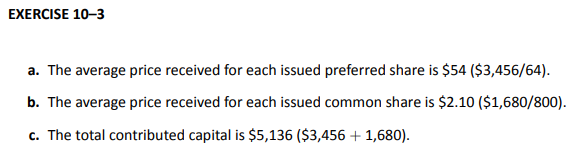

- What is the average price received for each issued preferred share?

- What is the average price received for each issued common share?

- What is the total contributed capital of the company?

Click Here to View Solution

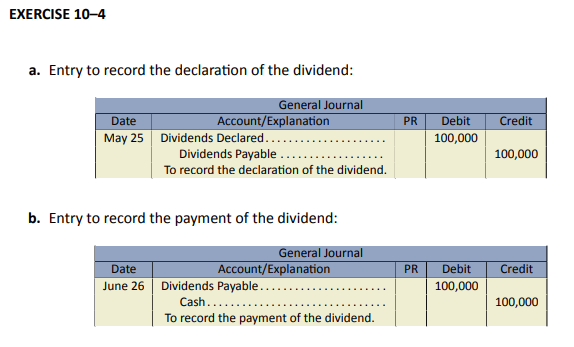

Strada Controls Inc. has 100,000 common shares outstanding on January 1, 2019. On May 25, 2019, the board of directors declared a semi-annual cash dividend of $1 per share. The dividend will be paid on June 26, 2019 to shareholders of record on June 7, 2019.

Prepare journal entries for

- The declaration of the dividend.

- The payment of the dividend.

Click Here to View Solution

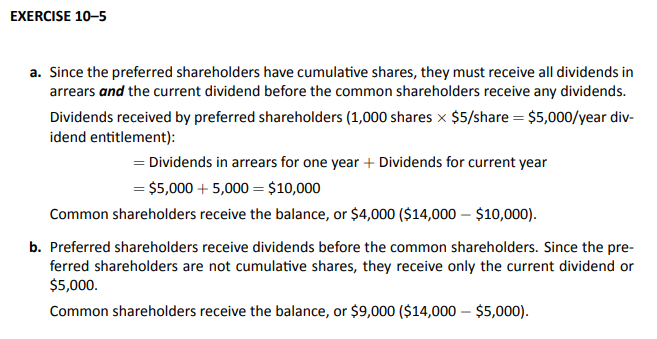

Landers Flynn Inc. has 1,000, $5 cumulative preferred shares outstanding. Dividends were not paid last year. The corporation also has 5,000 common shares outstanding. Landers Flynn declared a $14,000 cash dividend to be paid in the current year.

- Calculate the dividends received by the preferred and common shareholders

- If the preferred shares were non-cumulative, how would your answers to part (a) above change?

Click Here to View Solution

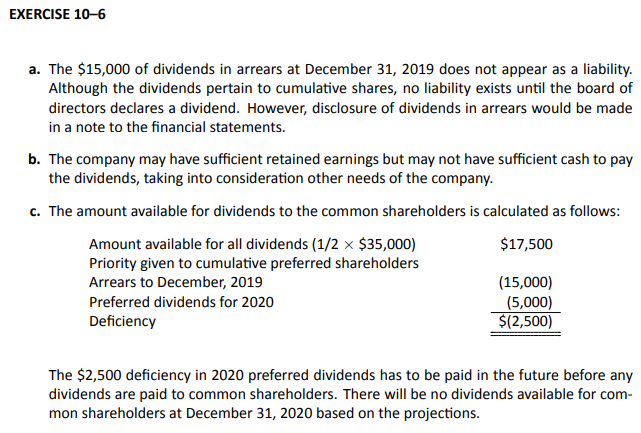

The following note appeared on the balance sheet of Sabre Rigging Limited:

As of December 31, 2019, dividends on the 1,000 issued and outstanding shares of cumulative preferred shares were in arrears for three years at the rate of $5 per share per year or $15,000 in total.

- Does the $15,000 of dividends in arrears appear as a liability on the December 31, 2019 balance sheet? Explain your answer.

- Why might the dividends be in arrears?

- The comptroller of Sabre Rigging projects net income for the 2020 fiscal year of $35,000. When the company last paid dividends, the directors allocated 50 per cent of current year’s net income for dividends. If dividends on preferred shares are declared at the end of 2020 and the established policy of 50 per cent is continued, how much will be available for dividends to the common shareholders if the profit projection is realized?

Click Here to View Solution

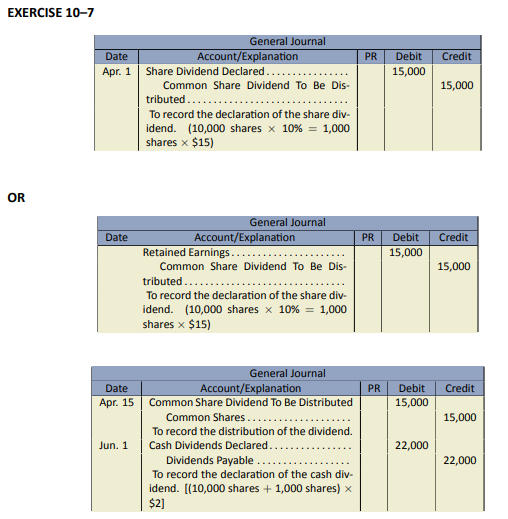

The December 31, 2018 balance sheet for Arrow Streaming Corporation shows that as of that date it issued a total of 10,000 common shares for $140,000. On April 1, 2019 Arrow Streaming declared a 10 per cent share dividend, payable on April 15 to shareholders of record on April 10. The market value of Arrow’s shares on April 1 was $15. On June 1, the company declared a $2 cash dividend per share to common shareholders of record on June 10, and paid the dividend on June 30. Assume the year end of the corporation is December 31.

Prepare journal entries for the above transactions, including closing entries.

Click Here to View Solution

The equity section of Pembina Valley Manufacturing Limited’s balance sheet at December 31, 2019 is shown below.

| Share Capital | |

|

Preferred Shares, Cumulative |

|

|

Authorized – 500 shares |

|

|

Issued and Outstanding – 300 Shares |

$300 |

|

Common Shares |

|

|

Authorized – 100 Shares |

|

|

Issued and Outstanding – 20 Shares |

500 |

|

Total Contributed Capital |

800 |

| Retained Earnings | 192 |

|

Total Equity |

$992 |

Note: There were $30 of dividends in arrears on the preferred shares at December 31, 2019.

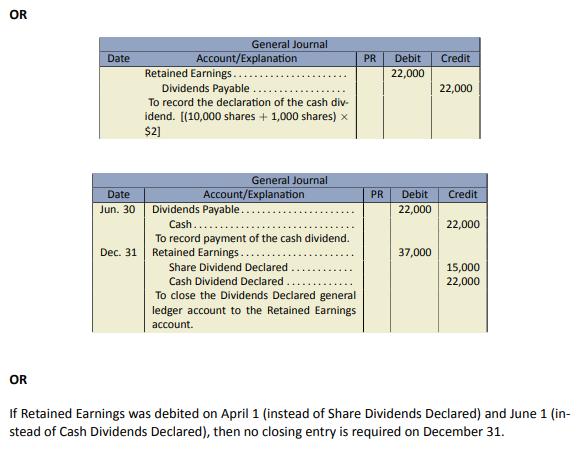

- Calculate the December 31, 2019 book value per share of

- the preferred shares; and

- the common shares.

- Assume that the common shares were split 2 for 1 on January 2, 2020 and that there was no change in any other account at that time. Calculate the new book value of common shares immediately following the share split.

Click Here to View Solution

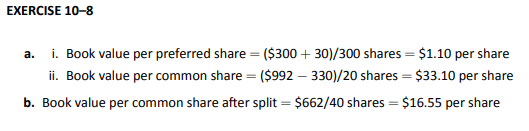

Essential Financial Service Corp. was incorporated on January 1, 2018 to prepare business plans for small enterprises seeking bank financing.

Prepare journal entries to record the following transactions on January 2, 2018:

- Received an incorporation charter authorizing the issuance of an unlimited number of no par-value common shares and 10,000, 4% preferred shares.

- Issued in exchange for incorporation costs incurred by shareholders 10,000 common shares at $1.

- Issued for cash 1,000 preferred shares at $3 each.

Click Here to View Solution

The shareholders’ equity section of Lakeview Homes Corporation’s statement of financial position at December 31, 2018 is reproduced below:

| Shareholders’ Equity | |||

| Common shares | |||

|

Authorized unlimited shares, issued 5,000 shares |

$ | 20,000 | |

| Retained earnings | 100,000 | ||

| Total shareholders’ equity | $ | 120,000 | |

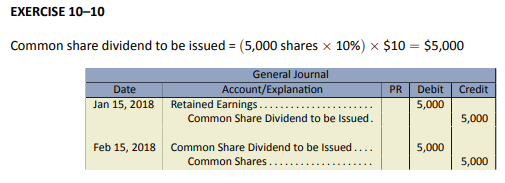

On January 15, 2018, Lakeview Homes declared a 10 per cent share dividend to holders of common shares. At this date, the common shares of the corporation were trading on the stock exchange at $10 each. The share dividend was issued February 15, 2018.

Prepare the journal entries to record the share dividend.

Click Here to View Solution

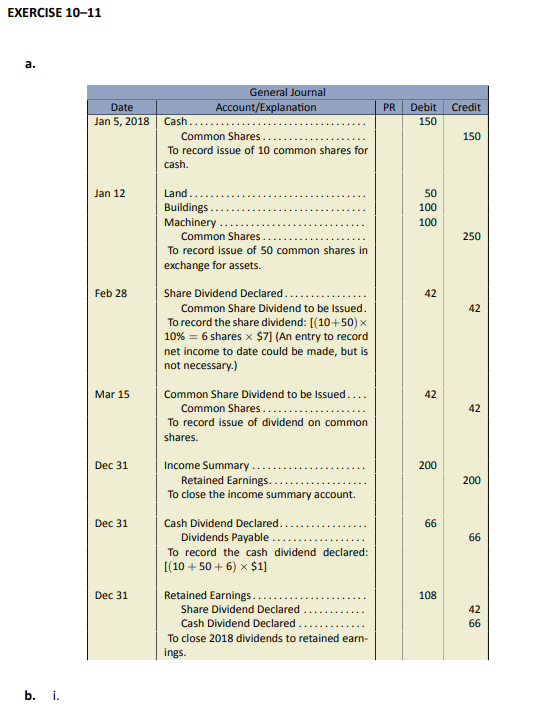

Blitz Power Tongs Inc. received a charter that authorized it to issue an unlimited number of common shares. The following transactions were completed during 2018:

| Jan 5 | Issued 10 common shares for a total of $150 cash. |

| Jan 12 | Exchanged 50 shares of common shares for assets listed at their fair values: machinery – $100; building – $100; land – $50. |

| Feb 28 | Declared a 10% share dividend. Market value is $7 per share. Net income to date is $60. |

| Mar 15 | Issued the share dividend. |

| Dec 31 | Closed the 2018 net income of $200 from the Income Summary account in the general ledger to the Retained Earnings account. |

| Dec 31 | Declared a $1 per share cash dividend. |

- Prepare journal entries for the 2018 transactions, including closing entries.

- Prepare the shareholders’ equity section of the statement of financial position at:

- January 31, 2018

- February 28, 2018

- December 31, 2018

Click Here to View Solution

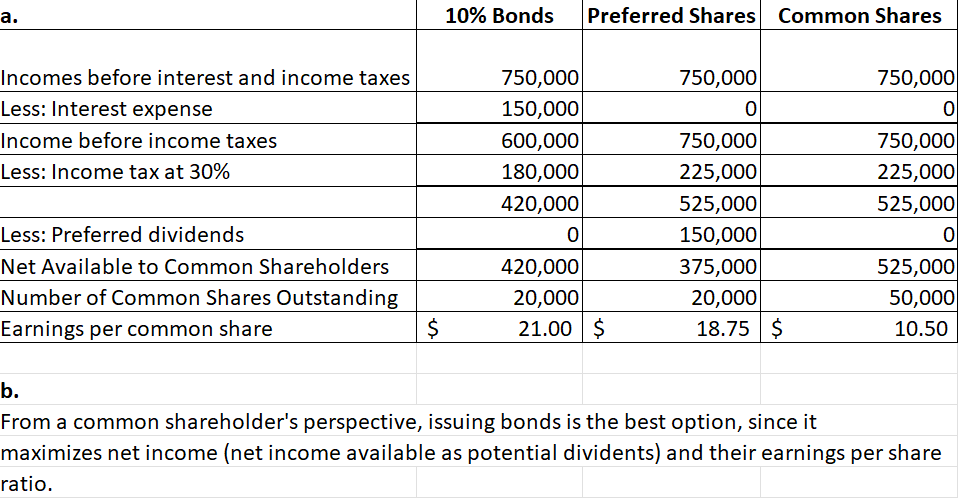

The board of directors of Oolong Ltd. is planning to expand its manufacturing facilities. To raise the $1.5 million capital needed, the following financing methods are being considered:

- Sell $1.5 million of 10% bonds at face value.

- Sell $10 preferred shares: 15,000 shares at $100 a share (no other preferred shares are outstanding).

- Sell another 30,000 shares of common shares at $50 a share (currently 20,000 common shares are outstanding).

Income before interest and income taxes is expected to average $750,000 per year following the expansion; the income tax rate is 30%.

- Calculate the earnings per common share for each alternative.

- Which financing method will the shareholders most likely prefer and why?

Click Here to View Solution

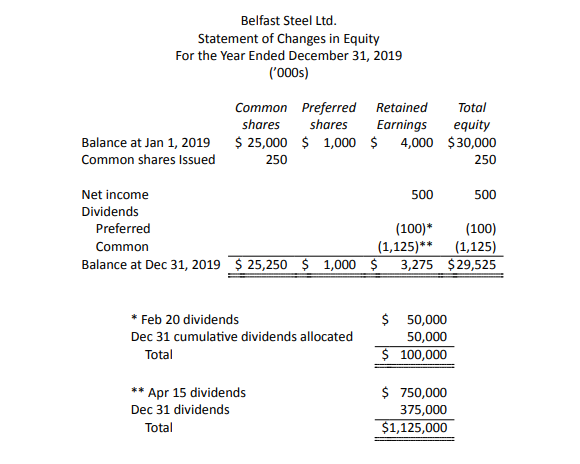

At December 31, 2018, the shareholders’ equity section of the statement of financial position for Belfast Steel Ltd. totalled $30,000,000. Following are the balances of various general ledger accounts at that date.

| Preferred shares, $1.00, cumulative | Issued 100,000 shares | $ | 1,000,000 |

| Common shares | Issued 1,250,000 shares | 25,000,000 | |

| Retained earnings | 4,000,000 |

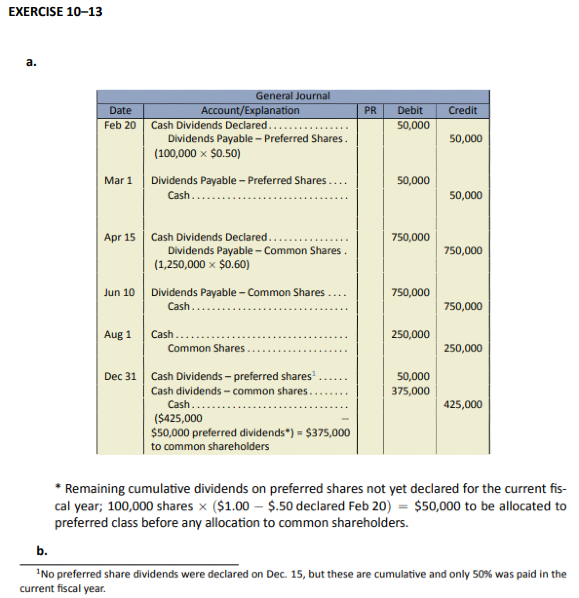

The following transactions occurred during 2019:

| Feb 20 | A cash dividend of $0.50 per preferred share was declared, payable Mar 1 to shareholders of record on Feb 25. |

| Mar 1 | Payment of previously declared dividend on preferred shares was made. |

| Apr 15 | A cash dividend on common shares of $0.60 per share was declared, payable Jun 10 to shareholders of record on May 1. |

| Jun 10 | Payment of the previously-declared dividend on common shares was made. |

| Aug 1 | 10,000 common shares were issued for $250,000 cash. |

| Dec 31 | A cash dividend totalling $425,000 was declared and paid. |

- Prepare journal entries for the 2019 transactions. Separate the dividends for preferred and common shares into the two classes of shares.

- Prepare the statement of changes in equity for the year ended December 31, 2019 assuming net income for the year amounted to $500,000.

Click Here to View Solution

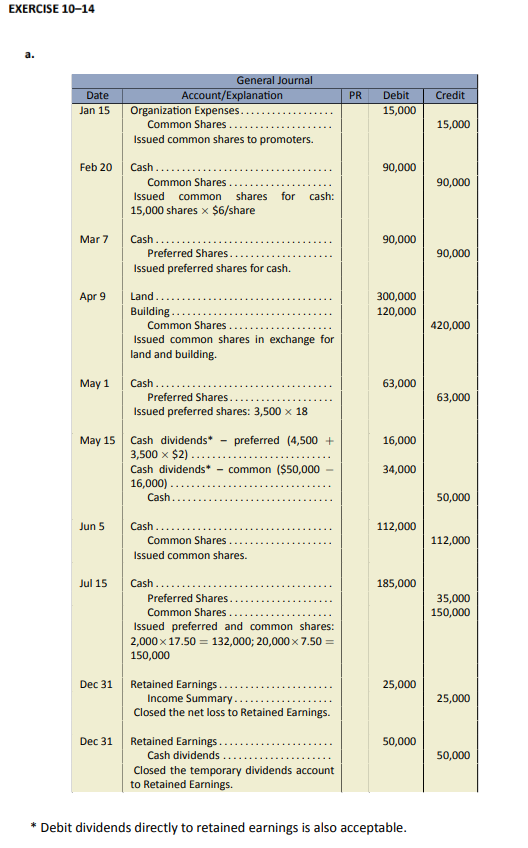

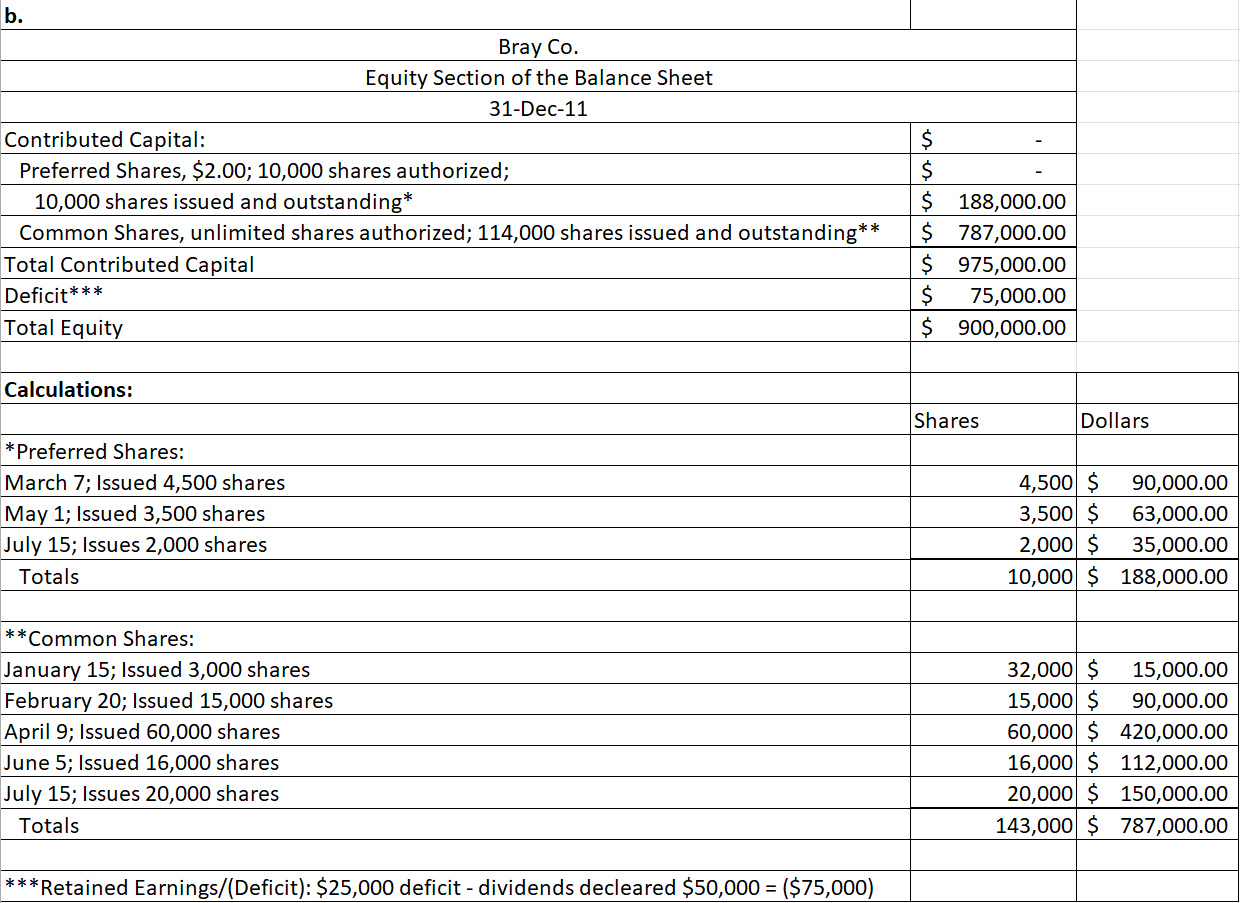

Bray Co. was authorized to issue 10,000 $2.00 preferred shares and unlimited common shares. December 31 is Bray’s year-end. During 2016, its first year of operations, the following selected transactions occurred:

- January 15: Issued 32,000 common shares to the corporation’s organizers in exchange for services to get the company operational. Their efforts are estimated to be worth $15,000.

- February 20: 15,000 common shares were issued for cash of $6 per share.

- March 7: 4,500 preferred shares were issued for cash totalling $90,000.

- April 9: 60,000 common shares were issued in exchange for land and building with appraised values of $300,000 and $120,000 respectively.

- May 1: 3,500 of the preferred shares were issued for a cash price of $18.00 per share.

- May 15: Declared and paid dividends to the shareholders of record May 18. Total cash paid dividends was $50,000.

- June 5: 16,000 of the common shares were issued for a cash total of $112,000.

- July 15: 2,000 preferred shares and 20,000 common shares were issued for a cash price of $17.50 and $7.50 respectively.

- December 31: The company closed all its temporary accounts. The Income Summary account showed a debit balance of $25,000.

- Prepare journal entries for each of the items above during Bray’s first year of operations.

- Prepare the equity section of the balance sheet in good form with all disclosures and subtotals, for the year ended December 31, 2019.

Click Here to View Solution

The partial balance sheet for the Carman Corp. reported the following components of equity on December 31, 2016:

| Carman Corp. | |||

| Equity Section of the Balance Sheet | |||

| December 31, 2016 | |||

| Contributed capital: | |||

| Preferred shares, $1.50 cumulative, 20,000 shares authorized; | |||

|

10,000 shares issued and outstanding |

$ | 150,000 | |

| Common shares, unlimited shares authorized; | |||

|

25,000 shares issued and outstanding. |

250,000 | ||

| Total contributed capital | $ | 400,000 | |

| Retained earnings | 250,000 | ||

| Total equity | $ | 650,000 | |

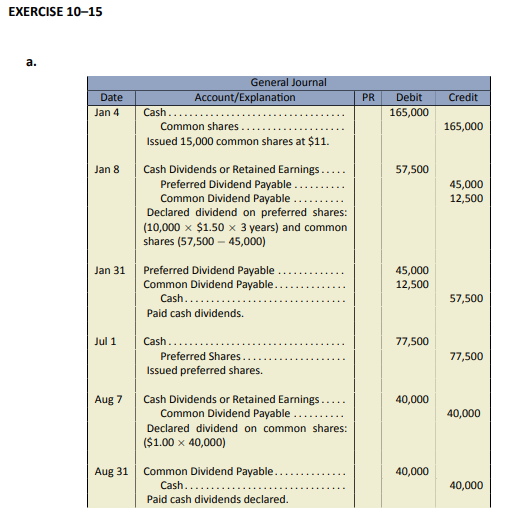

In 2017, Carman Corp. had the following transactions affecting the various equity accounts:

| Jan 4 | Sold 15,000 common shares at $11 per share. |

| Jan 8 | The directors declared a total cash dividend of $57,500 payable on Jan. 31 to the Jan. 21 shareholders of record. Dividends had not been declared for 2015 and 2016. All of the preferred shares had been issued during 2015. |

| Jan 31 | Paid the dividends declared on January 8. |

| July 1 | Sold preferred shares for a total of $77,500. The average issue price was $15.50 per share. |

| Aug 7 | The directors declared a $1.00 dividend per common share cash dividend payable on Aug. 31 to the Aug. 20 shareholders of record. |

| Aug 31 | Paid the dividends declared on Aug 7. |

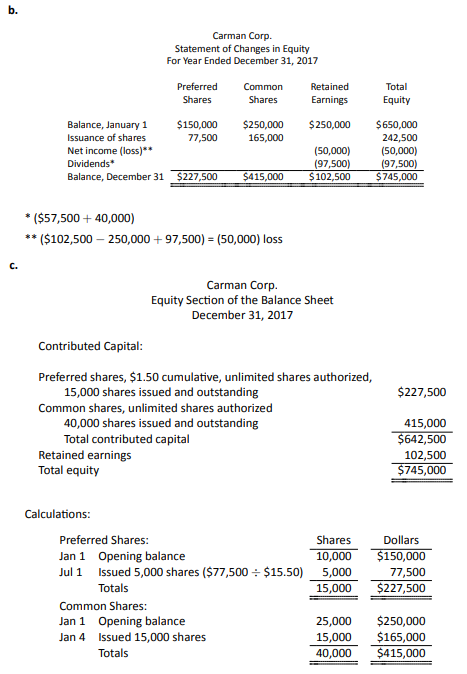

- Prepare journal entries to record the transactions for 2017.

- Prepare a statement of changes in equity for the year ended December 31, 2017. For purposes of preparing this statement, assume that the retained earnings balance at December 31, 2017 was $102,500.

- Prepare the equity section of the company’s balance sheet as at December 31, 2017 in good form with all required disclosures and subtotals.

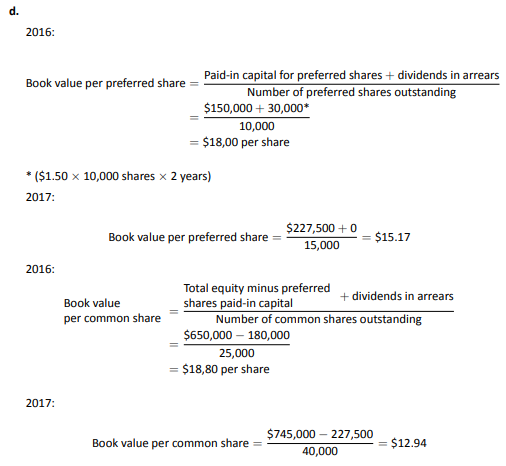

- Calculate the book value per preferred share and per common share as at December 31, 2016 and December 31, 2017. Round final answer to nearest two decimal places.

Click Here to View Solution

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 10. It is recommended that students review any relevant sections that they struggled with in answering these problems.

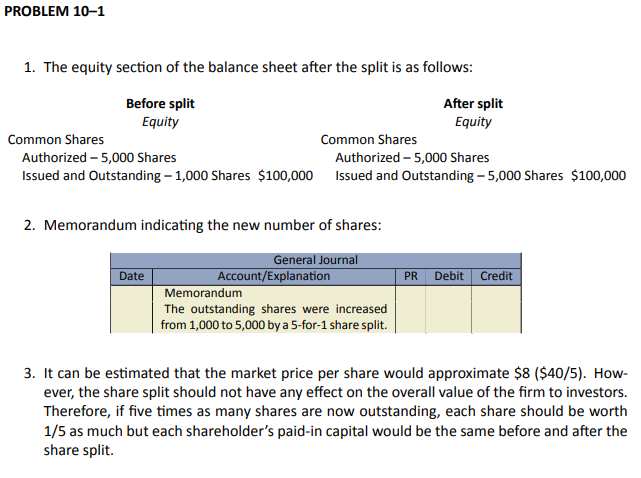

Following is the equity section of Critter Contracting Inc. shown before and after the board of directors authorized a 5 for 1 share split on April 15, 2019.

| Before split | After split | ||

| Equity | Equity | ||

| Common Shares | Common Shares | ||

|

Authorized – 5,000 Shares |

Authorized – ? Shares |

||

|

Issued and Outstanding |

Issued and Outstanding |

||

|

– 1,000 Shares |

$100,000 |

– ? Shares |

$

? |

- Complete the equity section of the balance sheet after the split.

- Record a memorandum indicating the new number of shares.

- If the market value per share was $40 before the split, what would be the market value after the split? Why?

Click Here to View Solution

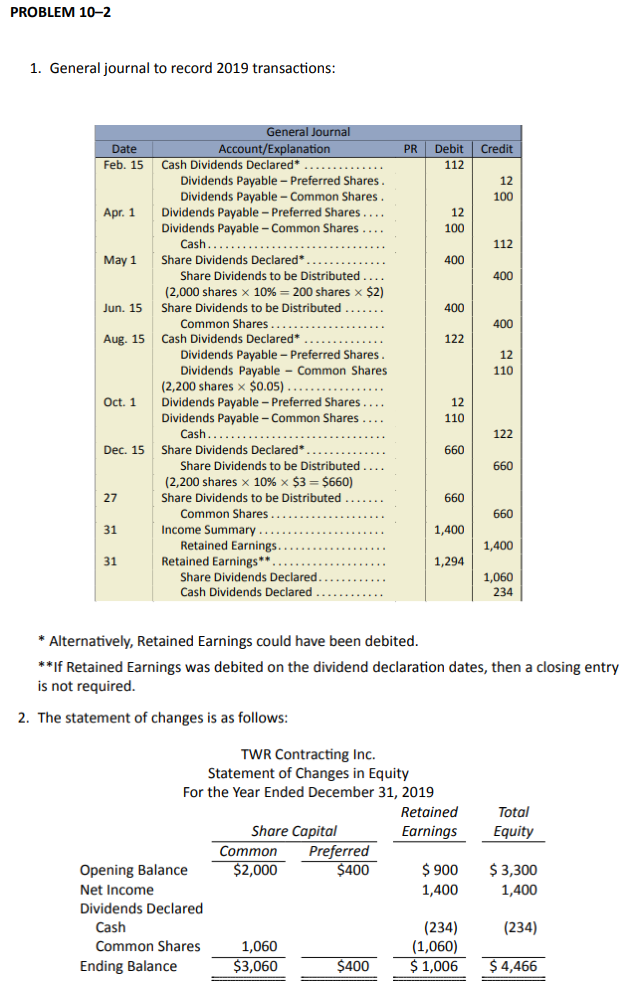

The equity section of TWR Contracting Inc.’s December 31, 2018 balance sheet showed the following:

| Equity | |

| Share Capital | |

|

Preferred Shares, $0.60, Cumulative, |

|

|

Issued and Outstanding – 40 Shares |

$

400 |

|

Common Shares, |

|

|

Issued and Outstanding – 2,000 Shares |

2,000 |

|

Total Contributed Capital |

2,400 |

| Retained Earnings | 900 |

|

Total Equity |

$3,300 |

The following transactions occurred during 2019:

| Feb. 15 | Declared the regular $0.30 per share semi-annual dividend on its |

| preferred shares and a $0.05 per share dividend on the common shares to | |

| holders of record March 5, payable April 1. | |

| Apr. 1 | Paid the dividends declared on February 15. |

| May 1 | Declared a 10 per cent share dividend to common shareholders of record |

| May 15 to be issued June 15, 2016. The market value of the common | |

| shares at May 1 was $2 per share. | |

| June 15 | Distributed the dividends declared on May 1. |

| Aug. 15 | Declared the regular semi-annual dividend on preferred shares and a |

| dividend of $0.05 on the common shares to holders of record August 31, | |

| payable October 1. | |

| Oct. 1 | Paid the dividends declared on August 15. |

| Dec. 15 | Declared a 10 per cent share dividend to common shareholders of record |

| December 20 to be issued on December 27, 2019. The market value of the | |

| common shares at December 15 was $3 per share. | |

| Dec. 27 | Distributed the dividends declared on December 15. |

| Dec. 31 | Net income for the year ended December 31, 2019 was $1,400. |

- Prepare journal entries to record the 2019 transactions, including closing entries for the December 31 year end date. Show calculations. Descriptive narrative is not needed.

- Prepare the statement of changes in equity for the year ended December 31, 2019.

Click Here to View Solution

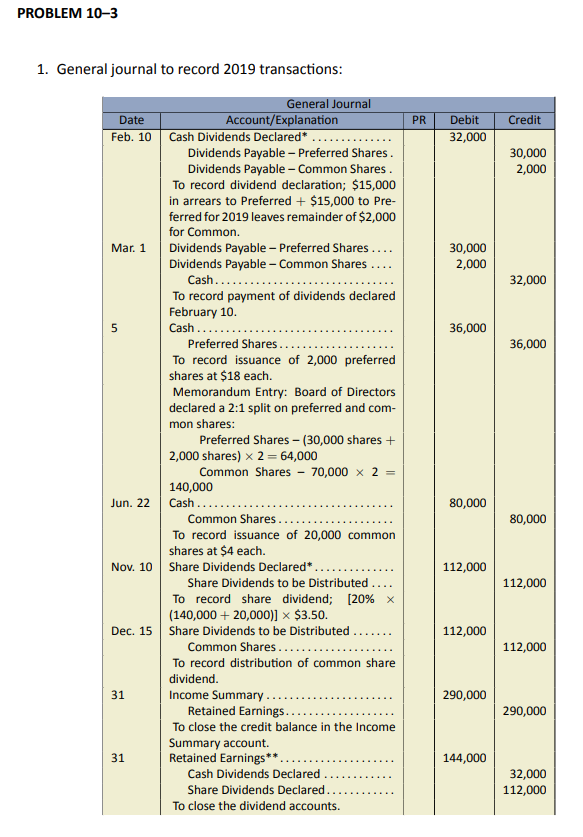

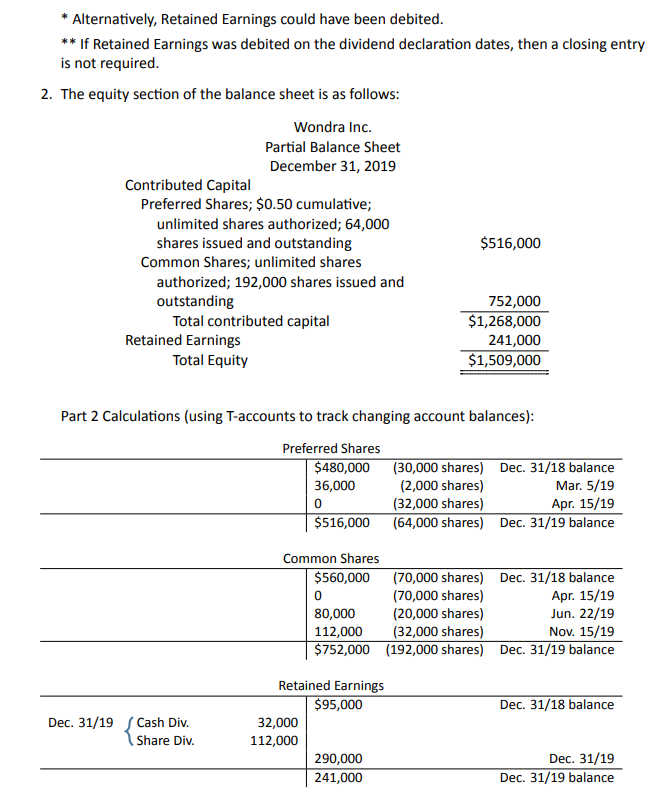

The equity section of Wondra Inc.’s December 31, 2018 balance sheet showed the following:

| Contributed Capital | |

|

Preferred Shares; $0.50 cumulative; |

|

|

unlimited shares authorized; 30,000 |

|

|

shares issued and outstanding |

$

480,000 |

|

Common Shares; unlimited shares |

|

|

authorized; 70,000 shares issued and |

|

|

outstanding |

560,000 |

|

Total contributed capital |

$1,040,000 |

| Retained Earnings | 95,000 |

|

Total Equity |

$1,135,000 |

At December 31, 2018 there were $15,000 of dividends in arrears.

The following transactions occurred during 2019:

| Feb. 10 | Declared a total dividend of $32,000 to shareholders of record on |

| February 15, payable March 1. | |

| Mar. 1 | Paid dividends declared February 10. |

| 5 | Issued for cash 2,000 preferred shares at $18 each. |

| Apr. 15 | The Board of Directors declared a 2:1 split on the preferred and common |

| shares. | |

| Jun. 22 | Issued for cash 20,000 common shares at $4.00 per share. |

| Nov. 10 | Declared a 20% share dividend to common shareholders of record on |

| Nov. 14, distributable Dec. 15. The market price of the shares on Nov. 10 | |

| was $3.50. | |

| Dec. 15 | Distributed share dividend declared on November 10. |

| Dec. 31 | Closed the Income Summary account which had a credit balance of |

| $290,000. | |

| 31 | Closed the dividend accounts. |

- Journalize the 2019 transactions.

- Prepare the equity section of the December 31, 2019 balance sheet.

Click Here to View Solution

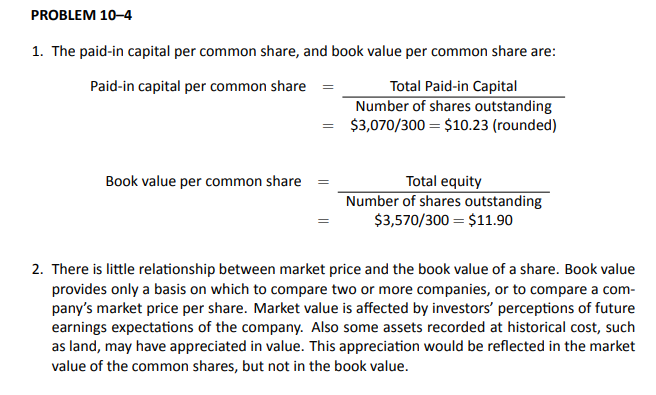

The following is the equity section of the balance sheet of Tridon Construction Limited at December 31, 2019.

| Equity | |

| Share Capital | |

|

Common Shares |

|

|

Authorized – 500 shares |

|

|

Issued and Outstanding – 300 Shares |

$3,070 |

| Retained Earnings | 500 |

|

Total Equity |

$3,570 |

- What is the paid-in capital per common share? …the book value per common share? Round calculations to two decimal places.

- On December 31, the Tridon Construction common shares traded at $24. Why is the market value different from the book value of commons shares?

The amount of net income earned in a year can be divided by the number of common shares outstanding to establish how much return has been earned for each outstanding share. EPS is calculated as:

EPS is quoted in financial markets and is disclosed on the income statement of publicly-traded companies.

Click Here to View Solution