Chapter 3

Adjusting Accounts for Financial Statements

Chapters 1 and 2 described the recording and reporting of economic transactions in detail. However, the account balances used to prepare the financial statements in these previous chapters did not necessarily reflect correct amounts. Chapter 3 introduces the concept of adjusting entries and how these satisfy the matching principle, ensuring revenues and expenses are reported in the correct accounting period. The preparation of an adjusted trial balance is discussed, as well as its use in completing financial statements.

Chapter 3 Learning Objectives

- LO1 – Explain how the timeliness, matching, and recognition of generally-accepted accounting principles (GAAP) require the recording of adjusting entries.

- LO2 – Explain the use of and prepare the adjusting entries required for prepaid expenses, depreciation, unearned revenues, accrued revenues, and accrued expenses.

- LO3 – Prepare an adjusted trial balance and explain its use.

Concept Self-Check

Use the following as a self-check while working through Chapter 3.

- What is the GAAP principle of timeliness?

- What is the GAAP principle of matching?

- What is the GAAP principle of revenue recognition?

- What are adjusting entries and when are they journalized?

- What are the five types of adjustments?

- Why is an adjusted trial balance prepared?

- How is the unadjusted trial balance different from the adjusted trial balance?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

3.1 The Operating Cycle

LO1 – Explain how the timeliness, matching, and recognition of generally-accepted accounting principles (GAAP) require the recording of adjusting entries.

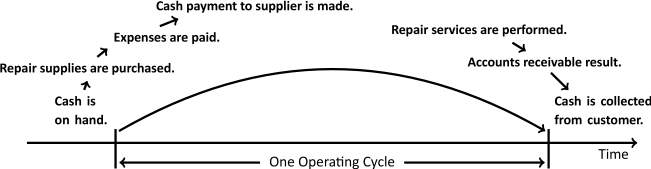

Financial transactions occur continuously during an accounting period as part of a sequence of operating activities. For Big Dog Carworks Corp., this sequence of operating activities takes the following form:

- Operations begin with some cash on hand.

- Cash is used to purchase supplies and to pay expenses.

- Revenue is earned as repair services are completed for customers.

- Cash is collected from customers.

This cash-to-cash sequence of transactions is commonly referred to as an operating cycle and is illustrated in Figure 3.1:

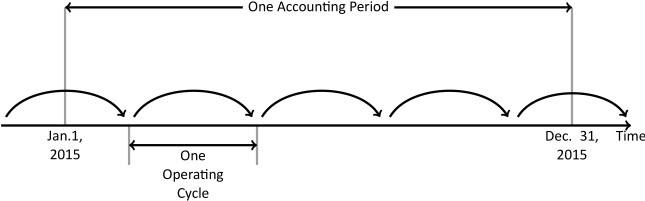

Depending on the type of business, an operating cycle can vary in duration from short, such as one week (e.g., a grocery store) to much longer, such as one year (e.g., a car dealership). Therefore, an annual accounting period could involve multiple operating cycles as shown in Figure 3.2:

Notice that not all of the operating cycles in Figure 3.2 are completed within the accounting period. Since financial statements are prepared at specific time intervals to meet the GAAP requirement of timeliness, it is necessary to consider how to record and report transactions related to the accounting period’s incomplete operating cycles. Two GAAP requirements — recognition and matching — provide guidance in this area, and are the topic of the next sections.

Recognition Principle in More Detail

GAAP provide guidance about when an economic activity should be recognized in financial statements. An economic activity is recognized when it meets two criteria:

- it is probable that any future economic benefit associated with the item will flow to the business; and

- it has a value that can be measured with reliability.

Revenue Recognition Illustrated

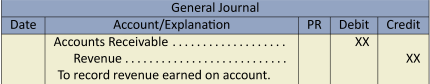

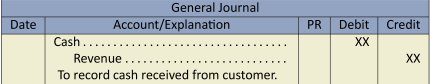

Revenue recognition is the process of recording revenue in the accounting period in which it was earned; this is not necessarily when cash is received. Most corporations assume that revenue has been earned at an objectively-determined point in the accounting cycle. For instance, it is often convenient to recognize revenue at the point when a sales invoice has been sent to a customer and the related goods have been received or services performed. This point can occur before receipt of cash from a customer, creating an asset called Accounts Receivable and resulting in the following entry:

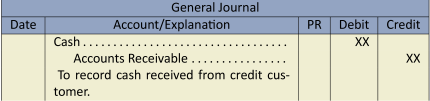

When cash payment is later received, the asset Accounts Receivable is exchanged for the asset Cash and the following entry is made:

Revenue is recognized in the first entry (the credit to revenue), prior to the receipt of cash. The second entry has no effect on revenue.

When cash is received at the same time that revenue is recognized, the following entry is made:

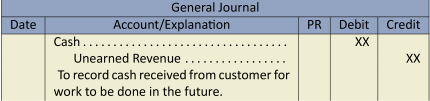

When a cash deposit or advance payment is obtained before revenue is earned, a liability called Unearned Revenue is recorded as follows:

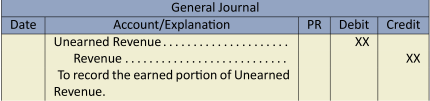

Revenue is not recognized until the services have been performed. At that time, the following entry is made:

The preceding entry reduces the unearned revenue account by the amount of revenue earned.

The matching of revenue to a particular time period, regardless of when cash is received, is an example of accrual accounting. Accrual accounting is the process of recognizing revenues when earned and expenses when incurred regardless of when cash is exchanged; it forms the basis of GAAP. Recognition of expenses is discussed in the next section.

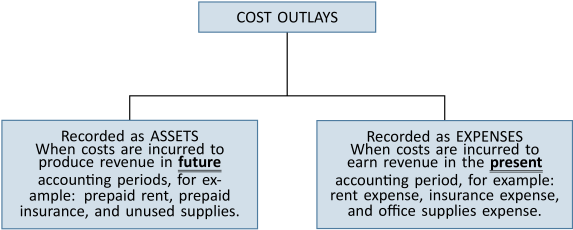

Expense Recognition Illustrated

In a business, costs are incurred continuously. To review, a cost is recorded as an asset if it will be incurred in producing revenue in future accounting periods. A cost is recorded as an expense if it will be used or consumed during the current period to earn revenue. This distinction between types of cost outlays is illustrated in Figure 3.3:

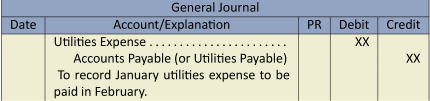

In the previous section regarding revenue recognition, journal entries illustrated three scenarios where revenue was recognized before, at the same time as, and after cash was received. Similarly, expenses can be incurred before, at the same time as, or after cash is paid out. An example of when expenses are incurred before cash is paid occurs when the utilities expense for January is not paid until February. In this case, an account payable is created in January as follows:

The utilities expense is reported in the January income statement.

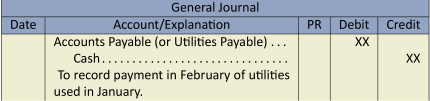

When the January utilities are paid in February, the following is recorded:

The preceding entry has no effect on expenses reported on the February income statement.

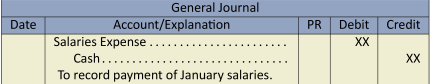

Expenses can also be recorded at the same time that cash is paid. For example, if salaries for January are paid on January 31, the entry on January 31 is:

As a result of this entry, salaries expense is reported on the January income statement when cash is paid.

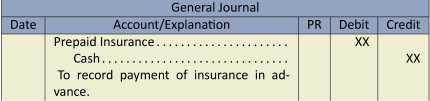

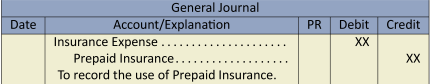

Finally, a cash payment can be made before the expense is incurred, such as insurance paid in advance. A prepayment of insurance creates an asset Prepaid Insurance and is recorded as:

As the prepaid insurance is used, it is appropriate to report an expense on the income statement by recording the following entry:

The preceding examples illustrate how to match expenses to the appropriate accounting period. The matching principle requires that expenses be reported in the same period as the revenues they helped generate. That is, expenses are reported on the income statement: a) when related revenue is recognized, or b) during the appropriate time period, regardless of when cash is paid.

To ensure the recognition and matching of revenues and expenses to the correct accounting period, account balances must be reviewed and adjusted prior to the preparation of financial statements. This is the topic of the next section.

3.2 Adjusting Entries

LO2 – Explain the use of and prepare the adjusting entries required for prepaid expenses, depreciation, unearned revenues, accrued revenues, and accrued expenses.

At the end of an accounting period, before financial statements can be prepared, the accounts must be reviewed for potential adjustments. This review is done by using the unadjusted trial balance. The unadjusted trial balance is a trial balance where the accounts have not yet been adjusted. The trial balance of Big Dog Carworks Corp. at January 31 was prepared in Chapter 2 and appears in Figure 3.4 below. It is an unadjusted trial balance because the accounts have not yet been updated for adjustments. We will use this trial balance to illustrate how adjustments are identified and recorded.

| Big Dog Carworks Corp. | ||||

| Unadjusted Trial Balance | ||||

| At January 31, 2015 | ||||

| Acct. | Account | Debit | Credit | |

| 101 | Cash | $3,700 | ||

| 110 | Accounts receivable | 2,000 | ||

| 161 | Prepaid insurance | 2,400 | ||

| 183 | Equipment | 3,000 | ||

| 184 | Truck | 8,000 | ||

| 201 | Bank loan | $6,000 | ||

| 210 | Accounts payable | 700 | ||

| 247 | Unearned revenue | 400 | ||

| 320 | Share capital | 10,000 | ||

| 330 | Dividends | 200 | ||

| 450 | Repair revenue | 10,000 | ||

| 654 | Rent expense | 1,600 | ||

| 656 | Salaries expense | 3,500 | ||

| 668 | Supplies expense | 2,000 | ||

| 670 | Truck operation expense | 700 | ||

| $27,100 | $27,100 | |||

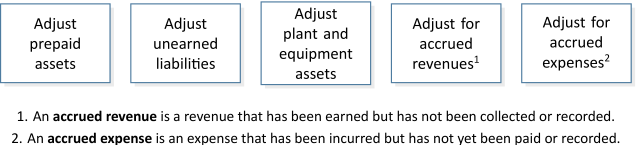

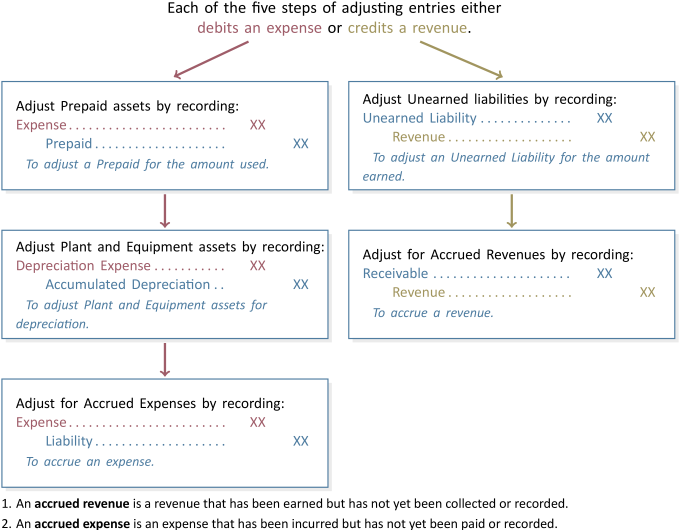

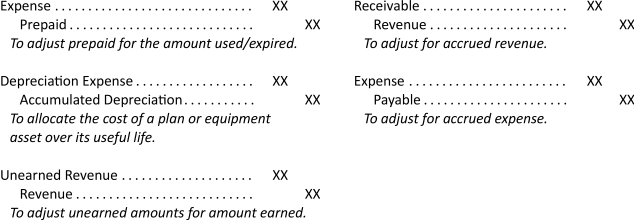

Adjustments are recorded with adjusting entries. The purpose of adjusting entries is to ensure both the balance sheet and the income statement faithfully represent the account balances for the accounting period. Adjusting entries help satisfy the matching principle. There are five types of adjusting entries as shown in Figure 3.5, each of which will be discussed in the following sections:

Adjusting Prepaid Asset Accounts

An asset or liability account requiring adjustment at the end of an accounting period is referred to as a mixed account because it includes both a balance sheet portion and an income statement portion. The income statement portion must be removed from the account by an adjusting entry.

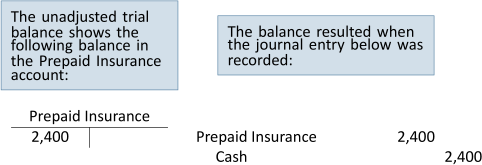

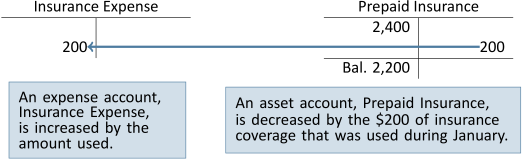

Refer to Figure 3.4 which shows an unadjusted balance in prepaid insurance of $2,400. Recall from Chapter 2 that Big Dog paid for a 12-month insurance policy that went into effect on January 1 (transaction 5):

At January 31, one month or $200 of the policy has expired (been used up) calculated as $2,400/12 months = $200.

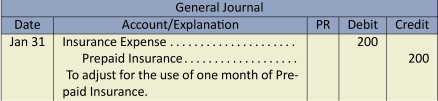

The adjusting entry on January 31 to transfer $200 out of prepaid insurance and into insurance expense is:

As shown below, the balance remaining in the Prepaid Insurance account is $2,200 after the adjusting entry is posted. The $2,200 balance represents the unexpired asset that will benefit future periods, namely, the 11 months from February to December, 2015. The $200 transferred out of prepaid insurance is posted as a debit to the Insurance Expense account to show how much insurance has been used during January:

If the adjustment was not recorded, assets on the balance sheet would be overstated by $200 and expenses would be understated by the same amount on the income statement.

Adjusting Unearned Liability Accounts

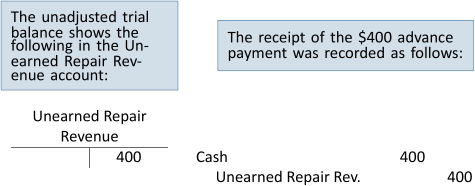

On January 15, Big Dog received a $400 cash payment in advance of services being performed:

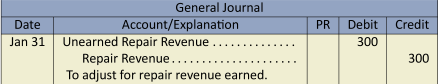

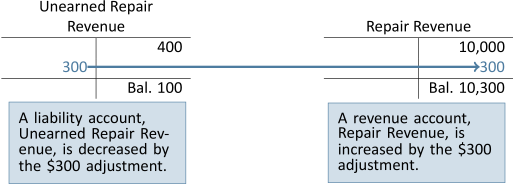

This advance payment was originally recorded as unearned, since the cash was received before repair services were performed. At January 31, $300 of the $400 unearned amount has been earned. Therefore, $300 must be transferred from unearned repair revenue into repair revenue. The adjusting entry at January 31 is:

After posting the adjustment, the $100 remaining balance in unearned repair revenue ($400 – $300) represents the amount at the end of January that will be earned in the future:

If the adjustment was not recorded, unearned repair revenue would be overstated (too high) by $300 causing liabilities on the balance sheet to be overstated. Additionally, revenue would be understated (too low) by $300 on the income statement if the adjustment was not recorded.

Adjusting Plant and Equipment Accounts

Plant and equipment assets, also known as long-lived assets, are expected to help generate revenues over the current and future accounting periods because they are used to produce goods, supply services, or used for administrative purposes. The truck and equipment purchased by Big Dog Carworks Corp. in January are examples of plant and equipment assets that provide economic benefits for more than one accounting period. Because plant and equipment assets are useful for more than one accounting period, their cost must be spread over the time they are used. This is done to satisfy the matching principle. For example, the $100,000 cost of a machine expected to be used over five years is not expensed entirely in the year of purchase because this would cause expenses to be overstated in Year 1 and understated in Years 2, 3, 4, and 5. Therefore, the $100,000 cost must be spread over the asset’s five-year life.

The process of allocating the cost of a plant and equipment asset over the period of time it is expected to be used is called depreciation. The amount of depreciation is calculated using the actual cost and an estimate of the asset’s useful life and residual value. The useful life of a plant and equipment asset is an estimate of how long it will actually be used by the business regardless of how long the asset is expected to last. For example, a car might have a manufacturer’s suggested life of 10 years but a business may have a policy of keeping cars for only 2 years. The useful life for depreciation purposes would therefore be 2 years and not 10 years. The residual value is an estimate of what the plant and equipment asset will be sold for when it is no longer used by a business. Residual value can be zero. There are different formulas for calculating depreciation. We will use the straight-line method of depreciation:

The cost less estimated residual value is the total depreciable cost of the asset. The straight-line method allocates the depreciable cost equally over the asset’s estimated useful life. When recording depreciation expense, our initial instinct is to debit depreciation expense and credit the Plant and Equipment asset account in the same way prepaids were adjusted with a debit to an expense and a credit to the Prepaid asset account. However, crediting the Plant and Equipment asset account is incorrect. Instead, a contra account called accumulated depreciation must be credited. A contra account is an account that is related to another account and typically has an opposite normal balance that is subtracted from the balance of its related account on the financial statements. Accumulated depreciation records the amount of the asset’s cost that has been expensed since it was put into use. Accumulated depreciation has a normal credit balance that is subtracted from a Plant and Equipment asset account on the balance sheet.

Initially, the concept of crediting Accumulated Depreciation may be confusing because of how we learned to adjust prepaids (debit an expense and credit the prepaid). Remember that prepaids actually get used up and disappear over time. The Plant and Equipment asset account is not credited because, unlike a prepaid, a truck or building does not get used up and disappear. The goal in recording depreciation is to match the cost of the asset to the revenues it helped generate. For example, a $50,000 truck that is expected to be used by a business for 4 years will have its cost spread over 4 years. After 4 years, the asset will likely be sold (journal entries related to the sale of plant and equipment assets are discussed in Chapter 8).

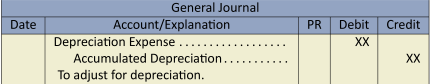

The adjusting journal entry to record depreciation is:

Subtracting the accumulated depreciation account balance from the Plant and Equipment asset account balance equals the carrying amount or net book value of the plant and equipment asset that is reported on the balance sheet.

Let’s work through two examples to demonstrate depreciation adjustments. Big Dog Carworks Corp.’s January 31, 2015 unadjusted trial balance showed the following two plant and equipment assets:

| Big Dog Carworks Corp. | ||||

| Unadjusted Trial Balance | ||||

| At January 31, 2015 | ||||

| Acct. | Account | Debit | Credit | |

| 183 | Equipment | 3,000 | ||

| 184 | Truck | 8,000 | ||

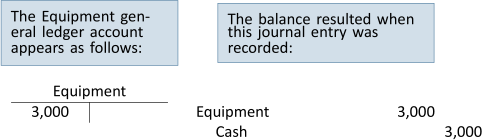

The equipment was purchased for $3,000:

The equipment was recorded as a plant and equipment asset because it has an estimated useful life greater than 1 year. Assume its actual useful life is 10 years (120 months) and the equipment is estimated to be worth $0 at the end of its useful life (residual value of $0):

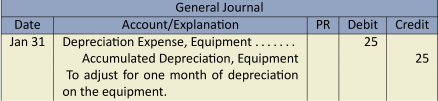

Note that depreciation is always rounded to the nearest whole dollar. This is because depreciation is based on estimates — an estimated residual value and an estimated useful life; it is not exact. The following adjusting journal entry is made on January 31:

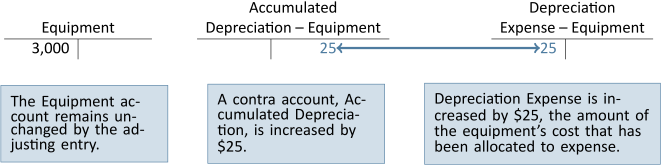

When the adjusting entry is posted, the accounts appear as follows:

For financial statement reporting, the asset and contra asset accounts are combined. The net book value of the equipment on the balance sheet is shown as $2,975 ($3,000 – $25).

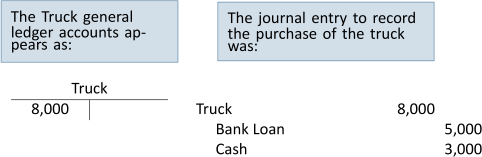

BDCC also shows a truck for $8,000 on the January 31, 2015 unadjusted trial balance:

Assume the truck has an estimated useful life of 80 months and a zero estimated residual value. At January 31, one month of the truck cost has expired since it was put into operation in January. Using the straight-line method, depreciation is calculated as:

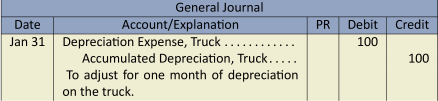

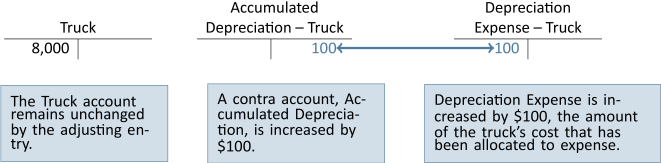

The adjusting entry recorded on January 31 is:

When the adjusting entry is posted, the accounts appear as follows:

For financial statement reporting, the asset and contra asset accounts are combined. The net book value of the truck on the balance sheet is shown as $7,900 ($8,000 – $100).

If depreciation adjustments are not recorded, assets on the balance sheet would be overstated. Additionally, expenses would be understated on the income statement causing net income to be overstated. If net income is overstated, retained earnings on the balance sheet would also be overstated.

It is important to note that land is a long-lived asset. However, it is not depreciated because it does not get used up over time. Therefore, land is often referred to as a non-depreciable asset.

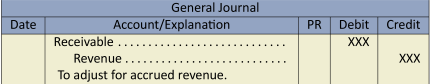

Adjusting for Accrued Revenues

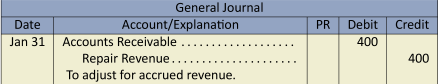

Accrued revenues are revenues that have been earned but not yet collected or recorded. For example, a bank has numerous notes receivable. Interest is earned on the notes receivable as time passes. At the end of an accounting period, there would be notes receivable where the interest has been earned but not collected or recorded. The adjusting entry for accrued revenues is:

For Big Dog Carworks Corp., assume that on January 31, $400 of repair work was completed for a client but it had not yet been collected or recorded. BDCC must record the following adjusting entry:

If the adjustment was not recorded, assets on the balance sheet would be understated by $400 and revenues would be understated by the same amount on the income statement.

Adjusting for Accrued Expenses

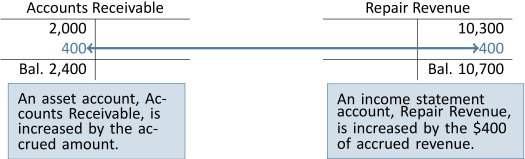

Accrued expenses are expenses that have been incurred but not yet paid or recorded. For example, a utility bill received at the end of the accounting period is likely not payable for 2–3 weeks. Utilities for the period have been used but have not yet been paid or recorded. The adjusting entry for accrued expenses is:

Accruing Interest Expense

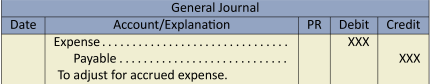

For Big Dog Carworks Corp., the January 31, 2015 unadjusted trial balance shows a $6,000 bank loan balance. Assume it is a 4%, 60-day bank loan1. It was dated January 3 which means that on January 31, 28 days of interest have accrued (January 31 less January 3 = 28 days) as shown in Figure 3.6:

The formula for calculating interest when the term is expressed in days is:

The interest expense accrued at January 31 is calculated as:

Interest is normally expressed as an annual rate. Therefore, the 28 days must be divided by the 365 days in a year. Normally all interest calculations in this textbook are rounded to two decimal places. However, for simplicity of demonstrations in this chapter, we will round to the nearest whole dollar.

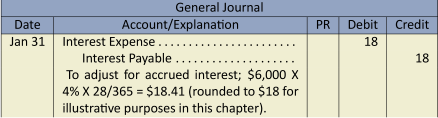

BDCC’s adjusting entry on January 31 is:

This adjusting entry enables BDCC to include the interest expense on the January income statement even though the payment has not yet been made. The entry creates a payable that will be reported as a liability on the balance sheet at January 31.

When the adjusting entry is posted, the accounts appear as:

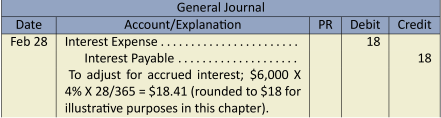

On February 28, interest will again be accrued and recorded as:

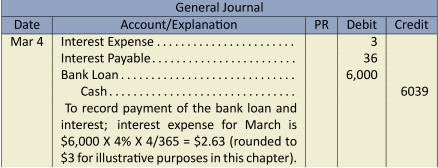

On March 4 when the bank loan matures, Big Dog will pay the interest and principal and record the following entry:

The $36 debit to interest payable will cause the Interest Payable account to go to zero since the liability no longer exists once the cash is paid. Notice that the total interest expense recorded on the bank loan was ![]() expensed in January, $18 expensed in February, and $3 expensed in March. The interest expense was matched to the life of the bank loan.

expensed in January, $18 expensed in February, and $3 expensed in March. The interest expense was matched to the life of the bank loan.

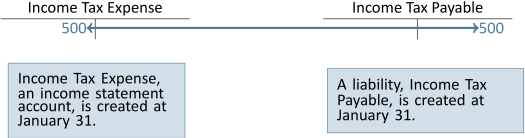

Accruing Income Tax Expense

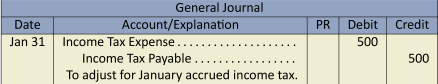

Another adjustment that is required for Big Dog Carworks Corp. involves the recording of corporate income taxes. In most jurisdictions, a corporation is taxed as an entity separate from its shareholders. For simplicity, assume BDCC’s income tax due for January 2015 is $500. The adjusting entry is at January 31:

When the adjusting entry is posted, the accounts appear as follows:

The above adjusting entry enables the company to match the income tax expense accrued in January to the income earned during the same month.

The five types of adjustments discussed in the previous paragraphs are summarized in Figure 3.7:

Learning Activity 3.1 – Adjusting Entries

This Learning Activity gives you an opportunity to practice identifying how to journal different types of amounts

Instructions: Read the transaction and identify whether the amount is to be debited or credited under Assets, Liabilities, or both.

3.3 The Adjusted Trial Balance

LO3 – Prepare an adjusted trial balance and explain its use.

In the last section, adjusting entries were recorded and posted. As a result, some account balances reported on the January 31, 2015 unadjusted trial balance in Figure 2 have changed. Recall that an unadjusted trial balance reports account balances before adjusting entries have been recorded and posted. An adjusted trial balance reports account balances after adjusting entries have been recorded and posted. Figure 3.8 shows the adjusted trial balance for BDCC at January 31, 2015.

In Chapters 1 and 2, the preparation of financial statements was demonstrated using BDCC’s unadjusted trial balance. We now know that an adjusted trial balance must be used to prepare financial statements.

| Big Dog Carworks Corp. | |||

| Adjusted Trial Balance | |||

| At January 31, 2015 | |||

| Account Balance | |||

| Account | Debit | Credit | |

| Cash | $3,700 | ||

| Accounts receivable | 2,400 | ||

| Prepaid insurance | 2,200 | ||

| Equipment | 3,000 | ||

| Accumulated depreciation – equipment | $ 25 | ||

| Truck | 8,000 | ||

| Accumulated depreciation – truck | 100 | ||

| Bank loan | 6,000 | ||

| Accounts payable | 700 | ||

| Interest payable | 18 | ||

| Unearned repair revenue | 100 | ||

| Income tax payable | 500 | ||

| Share capital | 10,000 | ||

| Dividends | 200 | ||

| Repair revenue | 10,700 | ||

| Depreciation expense – equipment | 25 | ||

| Depreciation expense – truck | 100 | ||

| Rent expense | 1,600 | ||

| Insurance expense | 200 | ||

| Interest expense | 18 | ||

| Salaries expense | 3,500 | ||

| Supplies expense | 2,000 | ||

| Truck operation expense | 700 | ||

| Income tax expense | 500 | ||

|

Total debits and credits |

$28,143 | $28,143 | |

Summary of Chapter 3 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 3. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

LO1 – Explain how the timeliness, matching, and recognition GAAP require the recording of adjusting entries.

Financial statements must be prepared in a timely manner, at minimum, once per fiscal year. For statements to reflect activities accurately, revenues and expenses must be recognized and reported in the appropriate accounting period. In order to achieve this type of matching, adjusting entries need to be prepared.

LO2 – Explain the use of and prepare the adjusting entries required for prepaid expenses, depreciation, unearned revenues, accrued revenues, and accrued expenses.

Adjusting entries are prepared at the end of an accounting period. They allocate revenues and expenses to the appropriate accounting period regardless of when cash was received/paid. The five types of adjustments are:

LO3 – Prepare an adjusted trial balance and explain its use.

The adjusted trial balance is prepared using the account balances in the general ledger after adjusting entries have been posted. Debits must equal credits. The adjusted trial balance is used to prepare the financial statements.

Exercises

The questions below have been included to provide you with the opportunity to practice what you have learned. These questions are supplemental – they are not a requirement for the course. If you are struggling with any of the questions, however, it is strongly recommended that you go back and review the content or connect with the instructor for additional support.

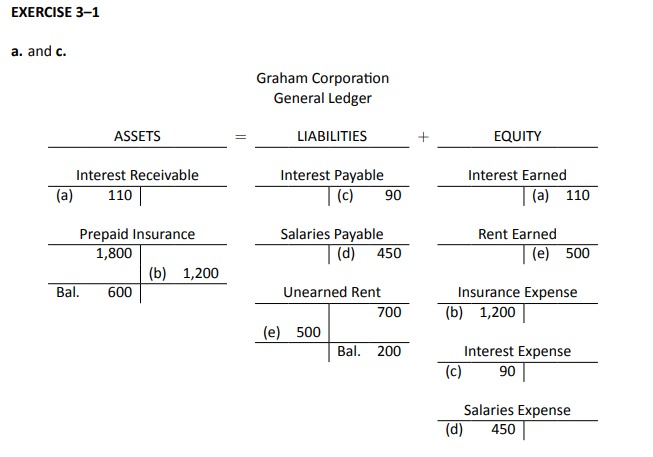

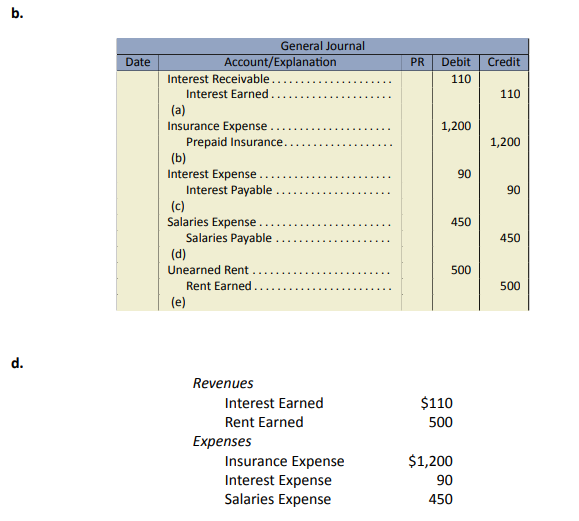

The following are account balances of Graham Corporation:

| Account Title | Amount in | Balance | |

| Unadjusted | after | ||

| Trial Balance | Adjustment | ||

| Interest Receivable | $

-0- |

$110 | |

| Prepaid Insurance | 1,800 | 600 | |

| Interest Payable | -0- | 90 | |

| Salaries Payable | -0- | 450 | |

| Unearned Rent | 700 | 200 |

- Enter the unadjusted balance for each account in the following T-accounts: Interest Receivable, Prepaid Insurance, Interest Payable, Salaries Payable, Unearned Rent, Interest Earned, Rent Earned, Insurance Expense, Interest Expense, and Salaries Expense.

- Reconstruct the adjusting entry that must have been recorded for each account.

- Post these adjusting entries and agree ending balances in each T-account to the adjusted balances above.

- List revenue and expense amounts for the period.

Click Here to View Solution

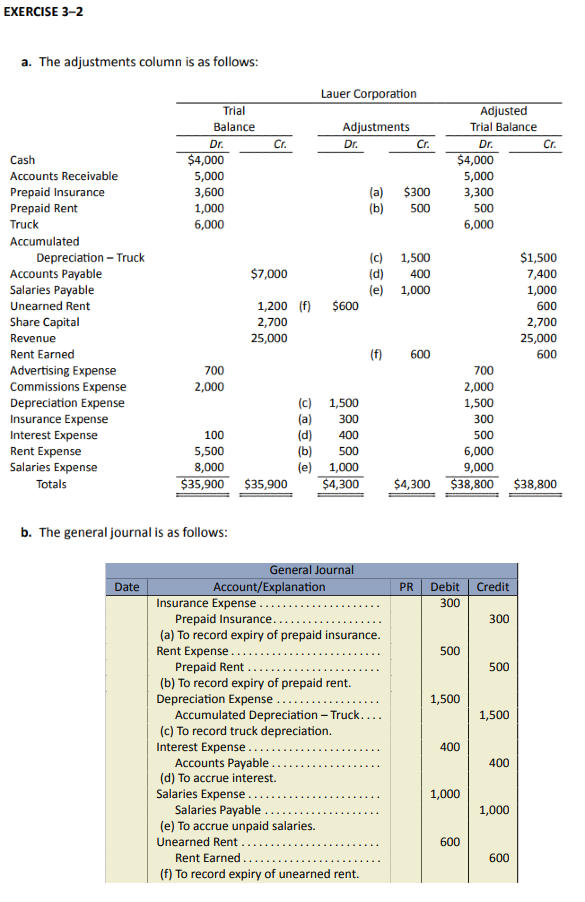

The trial balance of Lauer Corporation at December 31, 2015 follows, before and after the posting of adjusting entries.

| Trial Balance | Adjustments | Adjusted | |||||||||

| Trial Balance | |||||||||||

| Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | ||||||

| Cash | $4,000 | $4,000 | |||||||||

| Accounts Receivable | 5,000 | 5,000 | |||||||||

| Prepaid Insurance | 3,600 | 3,300 | |||||||||

| Prepaid Rent | 1,000 | 500 | |||||||||

| Truck | 6,000 | 6,000 | |||||||||

| Accumulated Depreciation | $

-0- |

$1,500 | |||||||||

| Accounts Payable | 7,000 | 7,400 | |||||||||

| Salaries Payable | 1,000 | ||||||||||

| Unearned Rent | 1,200 | 600 | |||||||||

| Share Capital | 2,700 | 2,700 | |||||||||

| Revenue | 25,000 | 25,000 | |||||||||

| Rent Earned | 600 | ||||||||||

| Advertising Expense | 700 | 700 | |||||||||

| Commissions Expense | 2,000 | 2,000 | |||||||||

| Depreciation Expense | 1,500 | ||||||||||

| Insurance Expense | 300 | ||||||||||

| Interest Expense | 100 | 500 | |||||||||

| Rent Expense | 5,500 | 6,000 | |||||||||

| Salaries Expense | 8,000 | 9,000 | |||||||||

|

Totals |

$35,900 | $35,900 | $38,800 | $38,800 | |||||||

- Indicate in the “Adjustments” column the debit or credit difference between the unadjusted trial balance and the adjusted trial balance.

- Prepare in general journal format the adjusting entries that have been recorded. Include descriptions.

Click Here to View Solution

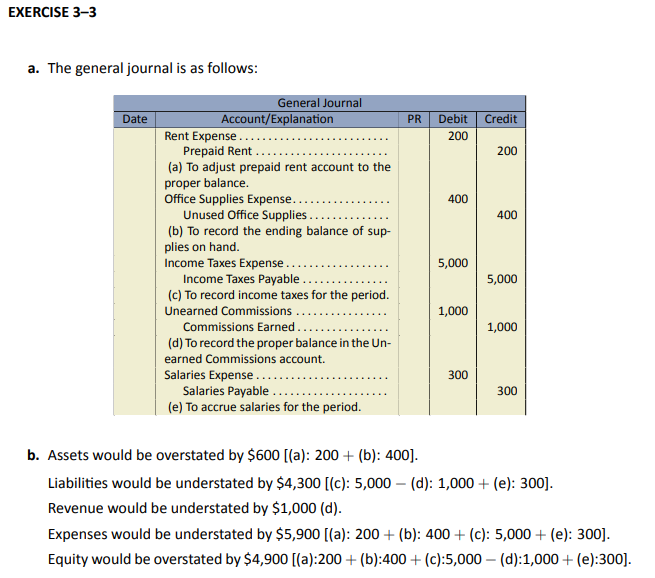

The following data are taken from an unadjusted trial balance at December 31, 2015:

| Prepaid Rent | $

600 |

| Office Supplies | 700 |

| Income Taxes Payable | -0- |

| Unearned Commissions | 1,500 |

| Salaries Expense | 5,000 |

Additional Information:

- The prepaid rent consisted of a payment for three months’ rent at $200 per month for December 2015, January 2016, and February 2016.

- Office supplies on hand at December 31, 2015 amounted to $300.

- The estimated income taxes for 2015 are $5,000.

- All but $500 in the Unearned Commissions account has been earned in 2015.

- Salaries for the last three days of December amounting to $300 have not yet been recorded.

- Prepare all necessary adjusting entries in general journal format.

- Calculate the cumulative financial impact on assets, liabilities, equity, revenue and expense if these adjusting entries are not made.

Click Here to View Solution

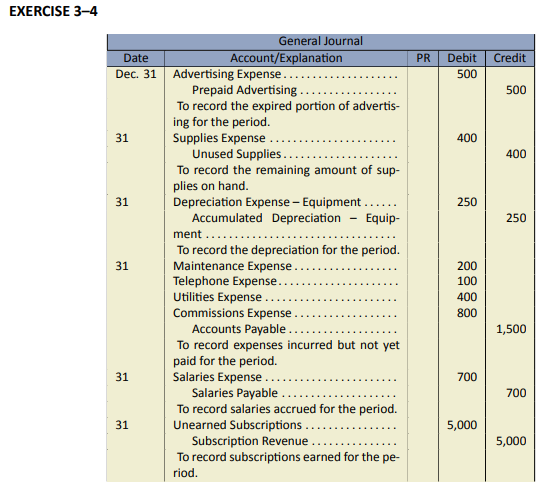

The following are general ledger accounts extracted from the records of Bernard Inc. at December 31, 2015, its year-end (‘Bal’ = unadjusted balance):

| Prepaid Advertising | Accounts Payable | Share Capital | |||||||||||

| Bal. | 1,000 | 500 | Bal. | 15,000 | Bal. | 8,000 | |||||||

| 200 | |||||||||||||

| 100 | Subscription Revenue | ||||||||||||

| Unused Supplies | 400 | 5,000 | |||||||||||

| Bal. | 750 | 400 | 800 | ||||||||||

| Advertising Expense | |||||||||||||

| Salaries Payable | 500 | ||||||||||||

| Equipment | 700 | ||||||||||||

| Bal. | 21,750 | ||||||||||||

| Unearned Subscriptions | Commissions Expense | ||||||||||||

| Acc. Dep’n – Equipment | 5,000 | Bal. | 10,000 | 800 | |||||||||

| Bal. | 1,500 | ||||||||||||

| 250 | Dep’n Expense – Equipment | ||||||||||||

| 250 | |||||||||||||

| Maintenance Expense | |||||||||||||

| 200 | |||||||||||||

| Salaries Expense | |||||||||||||

| Bal. | 9,500 | ||||||||||||

| 700 | |||||||||||||

| Supplies Expense | |||||||||||||

| Bal. | 2,500 | ||||||||||||

| 400 | |||||||||||||

| Telephone Expense | |||||||||||||

| 100 | |||||||||||||

| Utilities Expense | |||||||||||||

| 400 | |||||||||||||

Prepare in general journal format the adjusting entries that were posted. Include plausible descriptions/narratives for each adjustment.

Click Here to View Solution

The following unadjusted accounts are extracted from the general ledger of A Corp. at December 31, 2015:

| Truck | Depreciation Expense – Truck | Acc. Dep’n – Truck | |||||||||||

| 10,000 | 1,300 | 1,300 | |||||||||||

Additional Information: The truck was purchased January 1, 2015. It has an estimated useful life of 4 years.

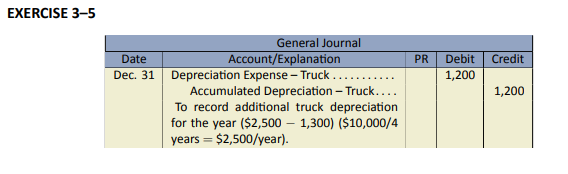

Prepare the needed adjusting entry at December 31, 2015.

Click Here to View Solution

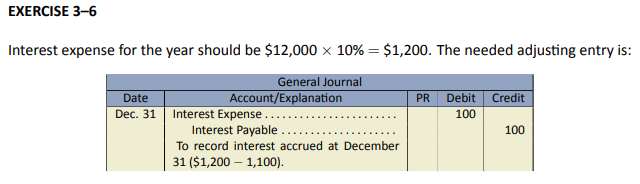

The following unadjusted accounts are taken from the records of B Corp. at December 31, 2015:

| Bank Loan | Interest Expense | Interest Payable | |||||||||||

| 12,000 | 1,100 | 100 | |||||||||||

Additional Information: The bank loan was received on January 1, 2015. It bears interest at 10 per cent.

Prepare the adjusting entry at December 31, 2015.

Click Here to View Solution

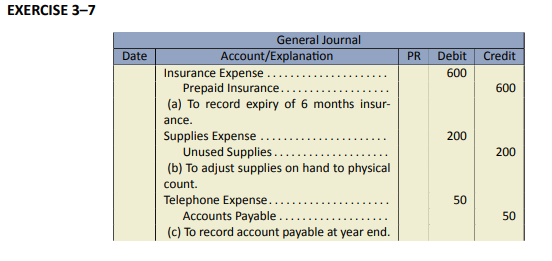

The following general ledger accounts and additional information are taken from the records of Wolfe Corporation at the end of its fiscal year, December 31, 2015.

| Cash | 101 | Unused Supplies | 173 | Advertising Exp. | 610 | ||||||||

| Bal. | 2,700 | Bal. | 700 | Bal. | 200 | ||||||||

| Accounts Receivable | 110 | Share Capital | 320 | Salaries Expense | 656 | ||||||||

| Bal. | 2,000 | Bal. | 3,800 | Bal. | 4,500 | ||||||||

| Prepaid Insurance | 161 | Repair Revenue | 450 | Telephone Expense | 669 | ||||||||

| Bal. | 1,200 | Bal. | 7,750 | Bal. | 250 | ||||||||

Additional Information:

- The prepaid insurance is for a one-year policy, effective July 1, 2015.

- A physical count indicated that $500 of supplies is still on hand.

- A $50 December telephone bill has been received but not yet recorded.

Record all necessary adjusting entries in general journal format.

Click Here to View Solution

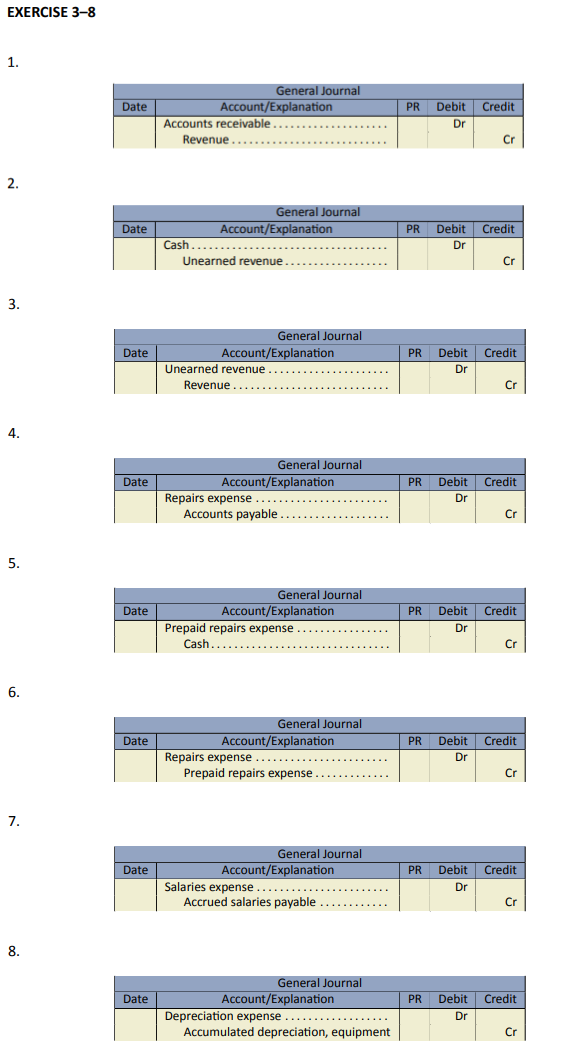

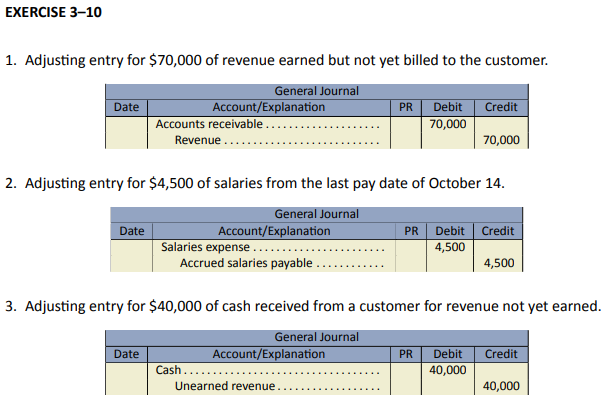

Below are descriptions of various monthly adjusting entries:

- Adjusting entry for revenue earned but not yet billed to the customer.

- Adjusting entry for cash received from a customer for revenue not yet earned.

- Adjusting entry for revenue earned that was originally received as cash in advance in the previous month.

- Adjusting entry for services received from a supplier, but not yet paid.

- Adjusting entry for cash paid to a supplier for repair services not yet received.

- Adjusting entry for repair services received that was originally paid as cash in advance to the supplier in the previous month.

- Adjusting entry for salaries earned by employees, but not yet paid.

- Adjusting entry for annual depreciation expense for equipment.

For each description above, identify the likely journal entry debit and credit account.

Click Here to View Solution

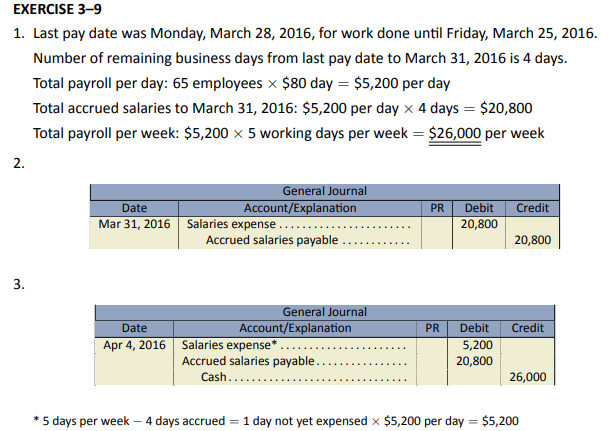

Turner Empire Co. employs 65 employees. The employees are paid every Monday for work done from the previous Monday to the end-of-business on Friday, or a 5-day work week. Each employee earns $80 per day.

- Calculate the total weekly payroll cost and the salary adjustment at March 31, 2016.

- Prepare the adjusting entry at March 31, 2016.

- Prepare the subsequent cash entry on April 4, 2016.

Click Here to View Solution

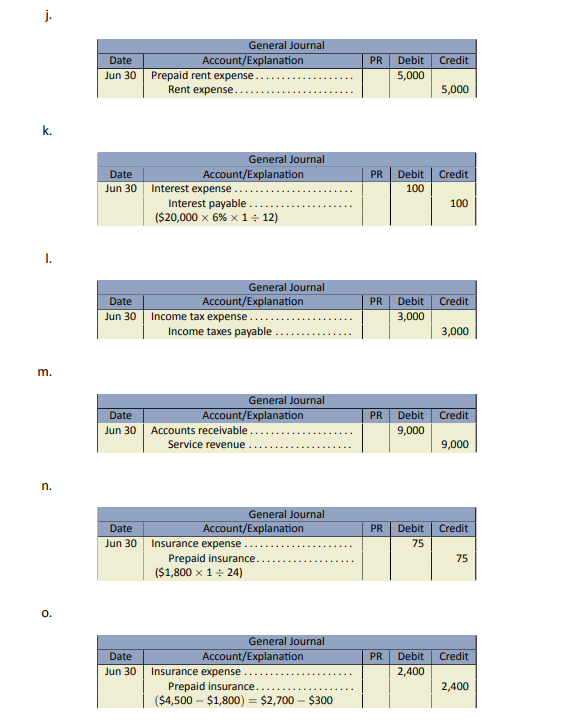

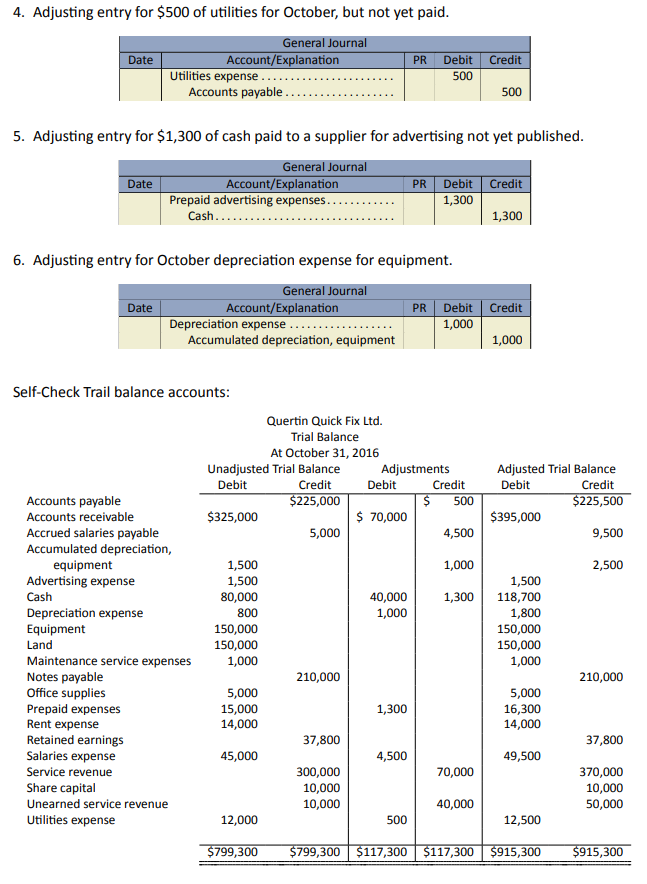

Below is a trial balance for Quertin Quick Fix Ltd. at October 31, 2016 with three sets of debit/credit columns. The first set is before the October month-end adjusting entries, and the third column is after the October month-end adjusting entries.

| Quertin Quick Fix Ltd. | ||||||||||||||

| Trial Balance | ||||||||||||||

| At October 31, 2016 | ||||||||||||||

| Unadjusted Trial Balance | Adjustments | Adjusted Trial Balance | ||||||||||||

| Debit | Credit | Debit | Credit | Debit | Credit | |||||||||

| Accounts payable | $ | 225,000 | $ | 225,500 | ||||||||||

| Accounts receivable | $ | 325,000 | $ | 395,000 | ||||||||||

| Accrued salaries payable | 5,000 | 9,500 | ||||||||||||

| Accumulated depreciation, equipment | 1,500 | 2,500 | ||||||||||||

| Advertising expense | 1,500 | 1,500 | ||||||||||||

| Cash | 80,000 | 118,700 | ||||||||||||

| Depreciation expense | 800 | 1,800 | ||||||||||||

| Equipment | 150,000 | 150,000 | ||||||||||||

| Land | 150,000 | 150,000 | ||||||||||||

| Maintenance service expenses | 1,000 | 1,000 | ||||||||||||

| Notes payable | 210,000 | 210,000 | ||||||||||||

| Office supplies | 5,000 | 5,000 | ||||||||||||

| Prepaid advertising expenses | 15,000 | 16,300 | ||||||||||||

| Rent expense | 14,000 | 14,000 | ||||||||||||

| Retained earnings | 37,800 | 37,800 | ||||||||||||

| Salaries expense | 45,000 | 49,500 | ||||||||||||

| Service revenue | 300,000 | 370,000 | ||||||||||||

| Share capital | 10,000 | 10,000 | ||||||||||||

| Unearned service revenue | 10,000 | 50,000 | ||||||||||||

| Utilities expense | 12,000 | 12,500 | ||||||||||||

| $ | 799,300 | $ | 799,300 | $ | 915,300 | $ | 915,300 | |||||||

Determine the differences for all the account balances and identify the most likely adjusting entries that would have been recorded in October to correspond to these differences.

Click Here to View Solution

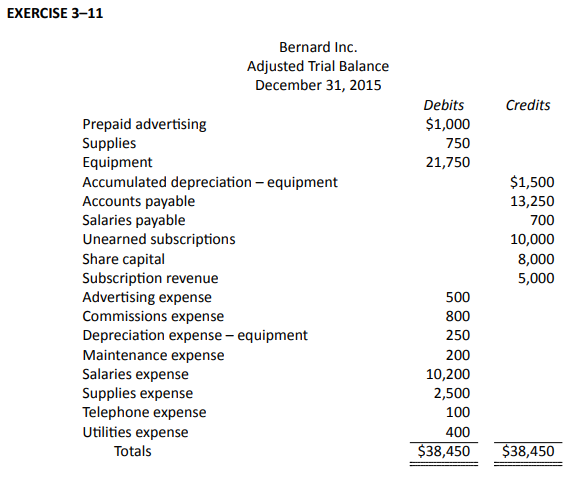

After Bernard Inc. completed its first year of operations on December 31, 2015, the following adjusted account balances appeared in the general ledger.

| Prepaid Advertising | Accounts Payable | Share Capital | |||||||||||

| 1,000 | 13,250 | 8,000 | |||||||||||

| Supplies | Subscription Revenue | ||||||||||||

| 750 | 5,000 | ||||||||||||

| Equipment | Salaries Payable | Advertising Expense | |||||||||||

| 21,750 | 700 | 500 | |||||||||||

| Acc. Dep’n – Equipment | Unearned Subscriptions | Commissions Expense | |||||||||||

| 1,500 | 10,000 | 800 | |||||||||||

| Dep’n Expense – Equipment | |||||||||||||

| 250 | |||||||||||||

| Maintenance Expense | |||||||||||||

| 200 | |||||||||||||

| Salaries Expense | |||||||||||||

| 10,200 | |||||||||||||

| Supplies Expense | |||||||||||||

| 2,500 | |||||||||||||

| Telephone Expense | |||||||||||||

| 100 | |||||||||||||

| Utilities Expense | |||||||||||||

| 400 | |||||||||||||

Prepare an adjusted trial balance at December 31, 2015.

Click Here to View Solution

Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 3. It is recommended that students review any relevant sections that they struggled with in answering these problems.

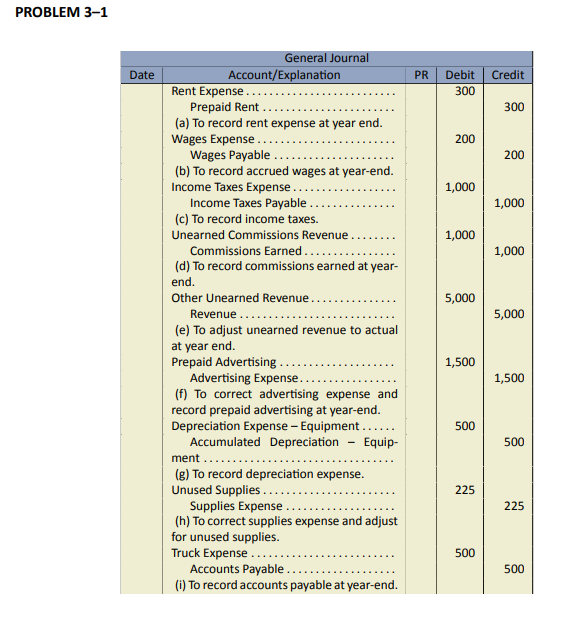

The following unrelated accounts are extracted from the records of Meekins Limited at December 31, its fiscal year-end:

| Balance | ||||

| Unadjusted | Adjusted | |||

| (a) | Prepaid Rent | $

900 |

$

600 |

|

| (b) | Wages Payable | 500 | 700 | |

| (c) | Income Taxes Payable | -0- | 1,000 | |

| (d) | Unearned Commissions Revenue | 4,000 | 3,000 | |

| (e) | Other Unearned Revenue | 25,000 | 20,000 | |

| (f) | Advertising Expense | 5,000 | 3,500 | |

| (g) | Depreciation Expense – Equipment | -0- | 500 | |

| (h) | Supplies Expense | 850 | 625 | |

| (i) | Truck Operation Expense | 4,000 | 4,500 | |

For each of the above unrelated accounts, prepare the most likely adjusting entry including plausible description/narrative.

Click Here to View Solution

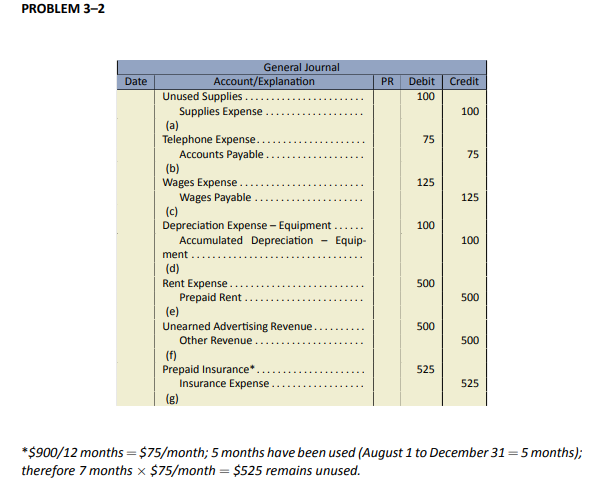

The unadjusted trial balance of Lukas Films Corporation includes the following account balances at December 31, 2015, its fiscal year-end. Assume all accounts have normal debit or credit balances as applicable.

| Prepaid Rent | $

1,500 |

| Unused Supplies | -0- |

| Equipment | 2,400 |

| Unearned Advertising Revenue | 1,000 |

| Insurance Expense | 900 |

| Supplies Expense | 600 |

| Telephone Expense | 825 |

| Wages Expense | 15,000 |

The following information applies at December 31:

- A physical count of supplies indicates that $100 of supplies have not yet been used at December 31.

- A $75 telephone bill for December has been received but not recorded.

- One day of wages amounting to $125 remains unpaid and unrecorded at December 31; the amount will be included with the first Friday payment in January.

- The equipment was purchased December 1; it is expected to last 2 years. No depreciation has yet been recorded.

- The prepaid rent is for three months: December 2015, January 2016, and February 2016.

- Half of the unearned advertising has been earned at December 31.

- The $900 balance in Insurance Expense is for a one-year policy, effective August 1, 2015.

Prepare all necessary adjusting entries at December 31, 2015. Descriptions are not needed.

Click Here to View Solution

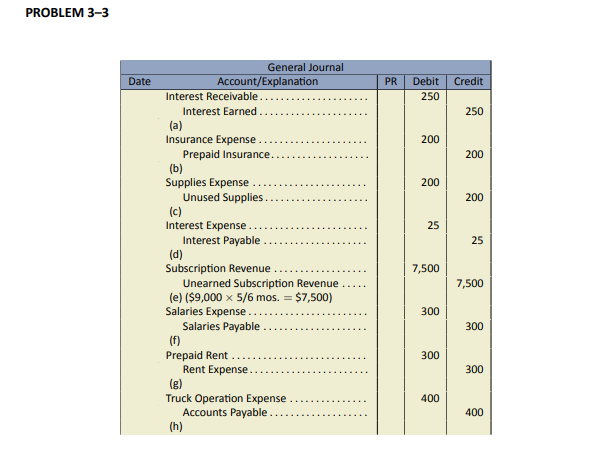

The unadjusted trial balance of Mighty Fine Services Inc. includes the following account balances at December 31, 2015, its fiscal year-end. No adjustments have been recorded. Assume all accounts have normal debit or credit balances.

| Notes Receivable | $10,000 |

| Prepaid Rent | -0- |

| Prepaid Insurance | 600 |

| Unused Supplies | 500 |

| Bank Loan | 5,000 |

| Subscription Revenue | 9,000 |

| Rent Expense | 3,900 |

| Truck Operation Expense | 4,000 |

The following information applies to the fiscal year-end:

- Accrued interest of $250 has not yet been recorded on the Notes Receivable.

- The $600 prepaid insurance is for a one-year policy, effective September 1, 2015.

- A physical count indicates that $300 of supplies is still on hand at December 31.

- Interest on the bank loan is paid on the fifteenth day of each month; the unrecorded interest for the last 15 days of December amounts to $25.

- The Subscription Revenue account consists of one $9,000 cash receipt for a 6-month subscription to the corporation’s Computer Trends report; the subscription period began December 1, 2015.

- Three days of salary amounting to $300 remain unpaid and unrecorded at December 31.

- The rent expense account should reflect 12 months of rent. The monthly rent expense is $300.

- A bill for December truck operation expense has not yet been received; an amount of $400 is owed.

Prepare all necessary adjusting entries at December 31, 2015. Descriptions are not needed.

Click Here to View Solution

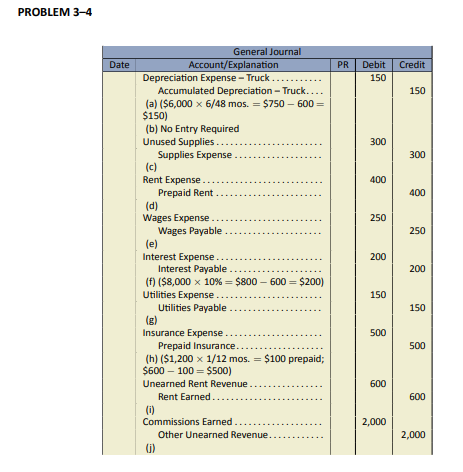

The following accounts are taken from the records of Bill Pitt Corp. at the end of its first 12 months of operations ended December 31, 2015, prior to any adjustments.

In addition to the balances in each set of accounts, additional data are provided for adjustment purposes if applicable. Treat each set of accounts independently of the others.

-

Depreciation Truck Expense – Truck Acc. Dep’n – Truck 6,000 600 600 Additional information: The truck was purchased July 1; it has an estimated useful life of 4 years.

-

Cash Unearned Rent Rent Earned 600 -0- 600 Additional information: A part of the office was sublet during the entire 12 months for $50 per month.

-

Unused Supplies Supplies Expense 1,250 Additional information: A physical inventory indicated $300 of supplies still on hand at December 31.

-

Prepaid Rent Rent Expense 1,200 4,400 Additional information: The monthly rent is $400.

-

Wages Expense Wages Payable 6,000 -0- Additional information: Unrecorded wages at December 31 amount to $250.

-

Bank Loan Interest Expense Interest Payable 8,000 600 100 Additional information: The bank loan bears interest at 10 per cent. The money was borrowed on January 1, 2015.

-

Cash Utilities Expense Utilities Payable 1,000 1,200 200 Additional information: The December bill has not yet been received or any accrual made; the amount owing at December 31 is estimated to be another $150.

-

Cash Prepaid Insurance Insurance Expense 1,200 600 600 Additional information: A $1,200 one-year insurance policy had been purchased effective February 1, 2015; there is no other insurance policy in effect.

-

Unearned Rent Revenue Rent Earned 900 -0- Additional information: The Unearned Rent Revenue balance applies to three months: November 2015, December 2015, and January 2016. $600 of the $900 has been earned as at December 31, 2015.

-

Cash Other Unearned Revenue Commissions Earned 25,200 -0- 25,200 Additional information: $2,000 of the total $25,200 balance in commission revenue has not been earned at December 31, 2015.

Prepare all necessary adjusting entries. Include descriptions/narratives.

Click Here to View Solution

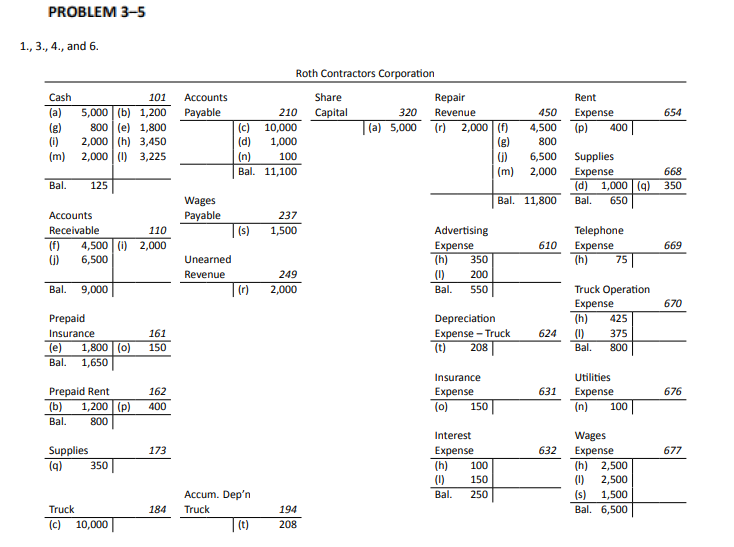

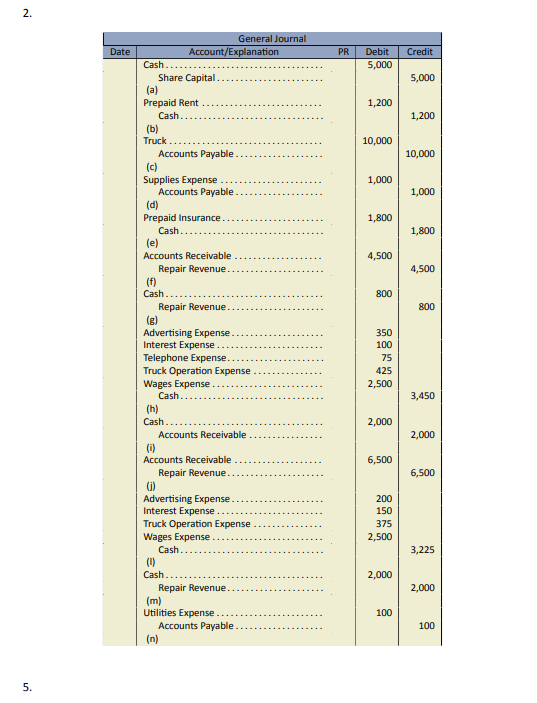

Roth Contractors Corporation was incorporated on December 1, 2015 and had the following transactions during December:

Part A

- Issued share capital for $5,000 cash.

- Paid $1,200 for three months’ rent: December 2015; January and February 2016.

- Purchased a used truck for $10,000 on credit (recorded as an account payable).

- Purchased $1,000 of supplies on credit. These are expected to be used during the month (recorded as expense).

- Paid $1,800 for a one-year truck insurance policy, effective December 1.

- Billed a customer $4,500 for work completed to date.

- Collected $800 for work completed to date.

- Paid the following expenses: advertising, $350; interest, $100; telephone, $75; truck operation, $425; wages, $2,500.

- Collected $2,000 of the amount billed in (f) above.

- Billed customers $6,500 for work completed to date.

- Signed a $9,000 contract for work to be performed in January.

- Paid the following expenses: advertising, $200; interest, $150; truck operation, $375; wages, $2,500.

- Collected a $2,000 advance on work to be done in January (the policy of the corporation is to record such advances as revenue at the time they are received).

- Received a bill for $100 for electricity used during the month (recorded as utilities expense).

- Open general ledger T-accounts for the following: Cash (101), Accounts Receivable (110), Prepaid Insurance (161), Prepaid Rent (162), Truck (184), Accounts Payable (210), Share Capital (320), Repair Revenue (450), Advertising Expense (610), Interest Expense (632), Supplies Expense (668), Telephone Expense (669), Truck Operation Expense (670), Utilities Expense (676), and Wages Expense (677).

- Prepare journal entries to record the December transactions. Descriptions are not needed.

- Post the entries to general ledger T-accounts.

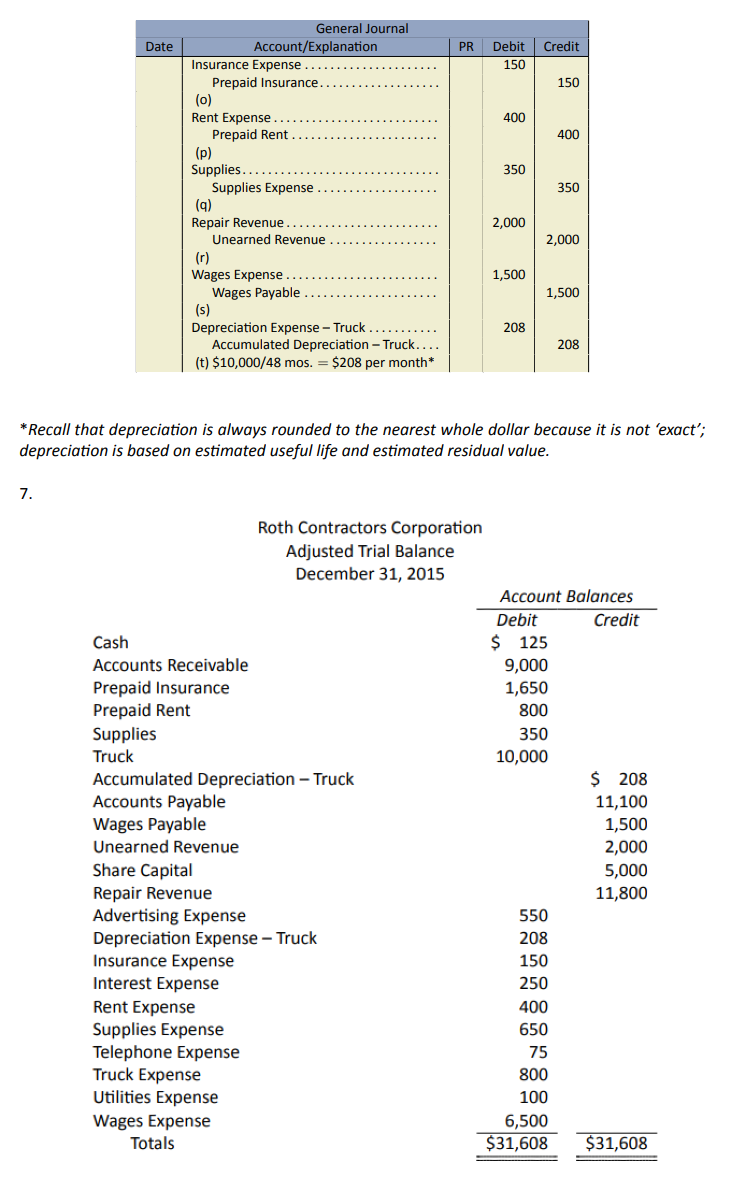

Part B

At December 31, the following information is made available for the preparation of adjusting entries.

- One month of the Prepaid Insurance has expired.

- The December portion of the December 1 rent payment has expired.

- A physical count indicates that $350 of supplies is still on hand.

- The amount collected in transaction (m) is unearned at December 31.

- Three days of wages for December 29, 30, and 31 are unpaid; the unpaid amount of $1,500 will be included in the first Friday wages payment in January.

- The truck has an estimated useful life of 4 years.

- Open additional general ledger T-accounts for the following: Supplies (173), Accumulated Depreciation – Truck (194), Wages Payable (237), Unearned Revenue (249), Depreciation Expense – Truck (624), Insurance Expense (631), and Rent Expense (654).

- Prepare all necessary adjusting entries. Omit descriptions.

- Post the entries to general ledger T-accounts and calculate balances.

- Prepare an adjusted trial balance at December 31, 2015.

Click Here to View Solution

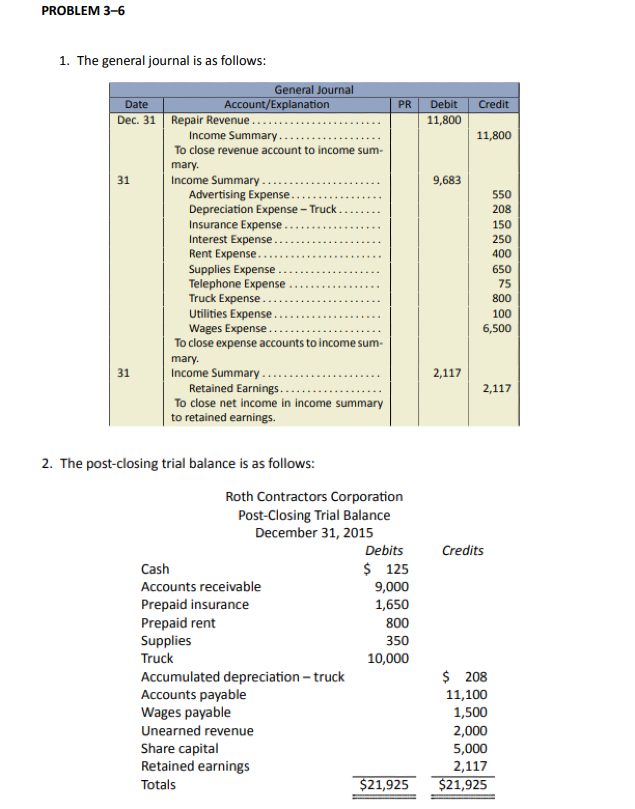

- Using the adjusted trial balance answer from Problem 3–5, journalize the appropriate closing entries (create additional accounts if required).

- Prepare a post-closing trial balance.

Click Here to View Solution

The unadjusted trial balance of Packer Corporation showed the following balances at the end of its first 12-month fiscal year ended August 31, 2015:

| Balance | |||

| Debits | Credits | ||

| Cash | $12,000 | ||

| Accounts Receivable | 3,600 | ||

| Prepaid Insurance | -0- | ||

| Supplies | 2,500 | ||

| Land | 15,000 | ||

| Building | 60,000 | ||

| Furniture | 3,000 | ||

| Equipment | 20,000 | ||

| Accumulated Depreciation – Building | $

-0- |

||

| Accumulated Depreciation – Equipment | -0- | ||

| Accumulated Depreciation – Furniture | -0- | ||

| Accounts Payable | 4,400 | ||

| Salaries Payable | -0- | ||

| Interest Payable | -0- | ||

| Unearned Commissions Revenue | 1,200 | ||

| Unearned Subscriptions Revenue | 800 | ||

| Bank Loan | 47,600 | ||

| Share Capital | 52,100 | ||

| Retained Earnings | -0- | ||

| Income Summary | -0- | ||

| Commissions Earned | 37,900 | ||

| Subscriptions Revenue | 32,700 | ||

| Advertising Expense | 4,300 | ||

| Depreciation Expense – Building | -0- | ||

| Depreciation Expense – Equipment | -0- | ||

| Depreciation Expense – Furniture | -0- | ||

| Insurance Expense | 1,800 | ||

| Interest Expense | 2,365 | ||

| Salaries Expense | 33,475 | ||

| Supplies Expense | 15,800 | ||

| Utilities Expense | 2,860 | ||

|

Totals |

$176,700 | $176,700 | |

At the end of August, the following additional information is available:

- The company’s insurance coverage is provided by a single comprehensive 12-month policy that began on March 1, 2015.

- Supplies on hand total $2,850.

- The building has an estimated useful life of 50 years.

- The furniture has an estimated useful life of ten years.

- The equipment has an estimated useful life of 20 years.

- Interest of $208 on the bank loan for the month of August will be paid on September 1, when the regular $350 payment is made.

- A review of the unadjusted balance in the unearned commissions revenue account indicates the unearned balance should be $450.

- A review of the unadjusted balance in the subscription revenue account reveals that $2,000 has not been earned.

- Salaries that have been earned by employees in August but are not due to be paid to them until the next payday (in September) amount to $325.

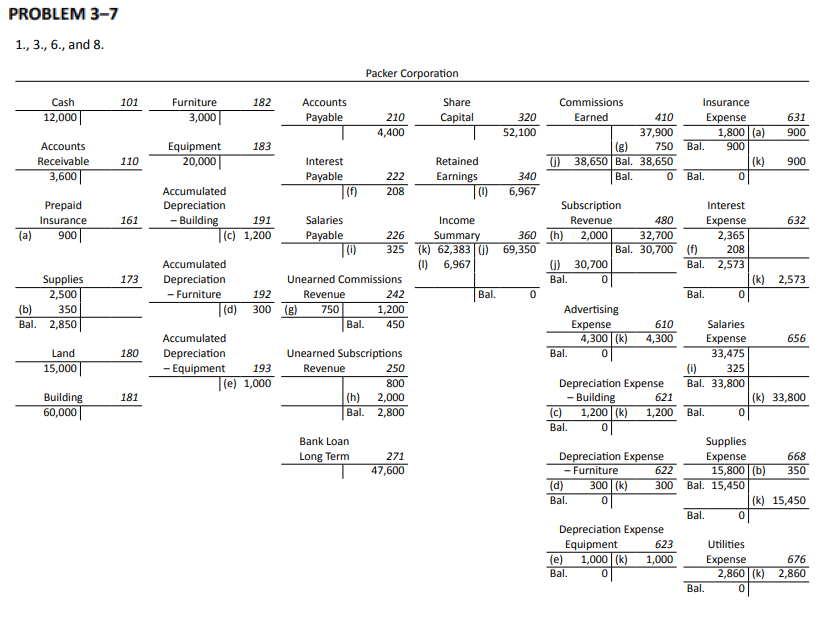

- Set up necessary general ledger T-accounts and record their unadjusted balances. Create and assign account numbers that you deem appropriate.

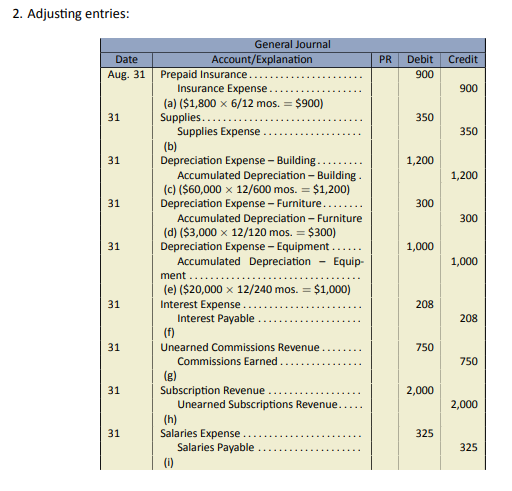

- Prepare the adjusting entries. Descriptions are not needed.

- Post the adjusting entries to the general ledger T-accounts and calculate balances.

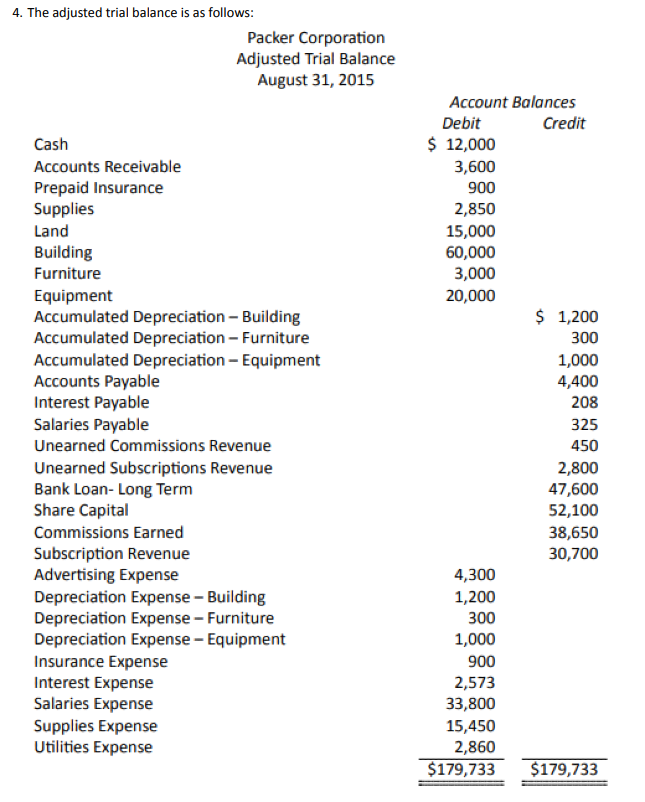

- Prepare an adjusted trial balance at August 31, 2015.

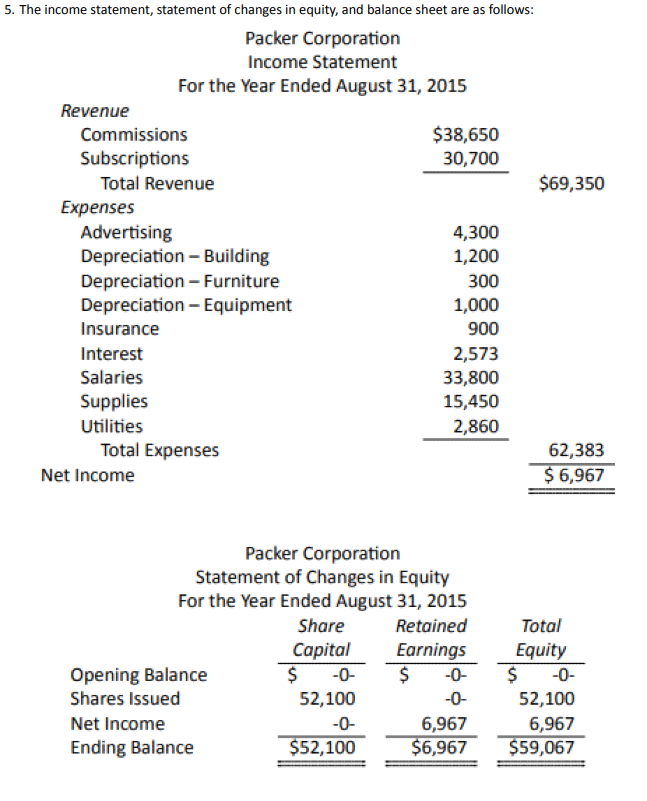

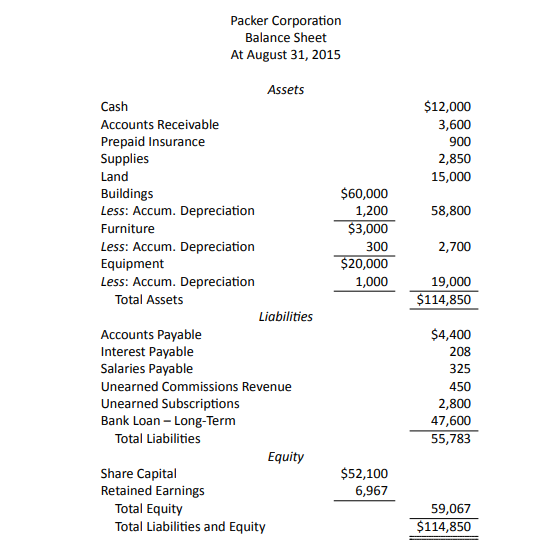

- Prepare an income statement and balance sheet.

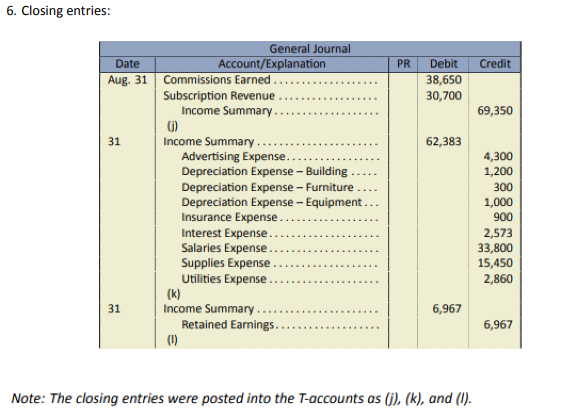

- Prepare and post the closing entries.

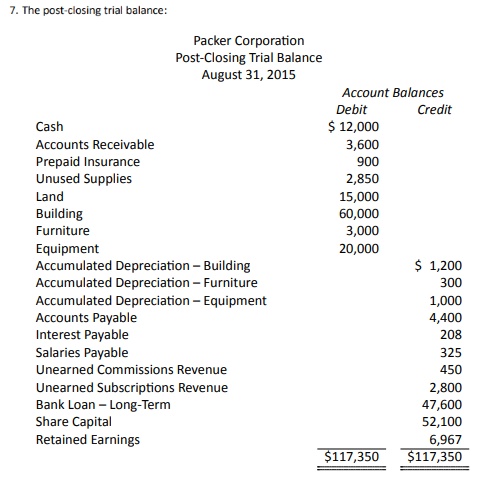

- Prepare a post-closing trial balance.

Click Here to View Solution

Below is an unadjusted trial balance for Smith and Smith Co., at June 30, 2016.

| Smith and Smith Co. | ||||||

| Unadjusted Trial Balance | ||||||

| At June 30, 2016 | ||||||

| Debit | Credit | |||||

| Cash | $ | 50,400 | ||||

| Accounts receivable | 25,000 | |||||

| Shop supplies | 1,500 | |||||

| Prepaid insurance expense | 4,500 | |||||

| Prepaid advertising expense | 2,000 | |||||

| Prepaid rent expense | – | |||||

| Building | 74,000 | |||||

| Accumulated depreciation, building | $ | – | ||||

| Equipment | 10,000 | |||||

| Accumulated depreciation, equipment | 2,000 | |||||

| Accounts payable | 12,000 | |||||

| Accrued salaries payable | 15,500 | |||||

| Interest payable | – | |||||

| Income taxes payable | – | |||||

| Notes payable | 20,000 | |||||

| Unearned service revenue | 30,000 | |||||

| Share capital | 1,000 | |||||

| Retained earnings | 24,900 | |||||

| Service revenue | 125,000 | |||||

| Salaries expense | 22,000 | |||||

| Insurance expense | – | |||||

| Interest expense | – | |||||

| Shop supplies expense | 200 | |||||

| Advertising expense | 2,200 | |||||

| Depreciation expense | 1,400 | |||||

| Maintenance service expense | 5,200 | |||||

| Rent expense | 20,000 | |||||

| Income tax expense | – | |||||

| Utilities expense | 12,000 | |||||

| $ | 230,400 | $ | 230,400 | |||

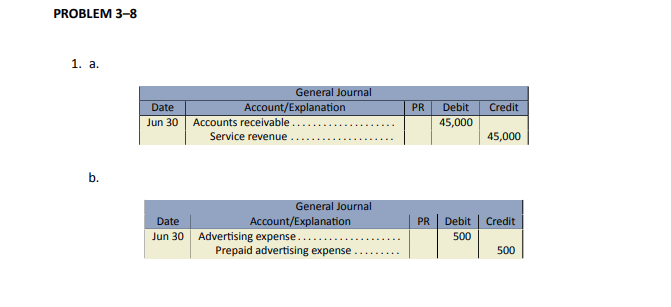

Additional information for June not yet recorded:

- Unbilled and uncollected work to June 30 totals $45,000.

- An analysis of prepaid advertising shows that $500 of the balance was consumed.

- A shop supplies count on June 30 shows that $1,200 are on hand.

- Equipment has an estimated useful life of ten years and an estimated residual value of $500.

- The records show that fifty percent of the work, for a $10,000 fee received in advance from a customer and recorded last month, is now completed.

- Salaries of $5,800 for employees for work done to the end of June has not been paid.

- Utilities invoice for services to June 22 totals $3,500.

- Accrued revenues of $7,800 previously recorded to accounts receivable were collected.

- A building was purchased at the end of May. Its estimated useful life is fifty years and has an estimated residual value of $10,000.

- Rent expense of $5,000 for July has been paid and recorded directly to rent expense.

- Interest for the 6% note payable has not yet been recorded for June.

- Income taxes of $3,000 is owing but not yet paid.

- Unrecorded and uncollected service revenue of $9,000 has been earned.

- A two year, $1,800 insurance policy was purchased on June 1 and recorded to prepaid insurance expense.

- The prior balance in the unadjusted prepaid insurance account (excluding the insurance in item n. above), shows that $300 of that balance is not yet used.

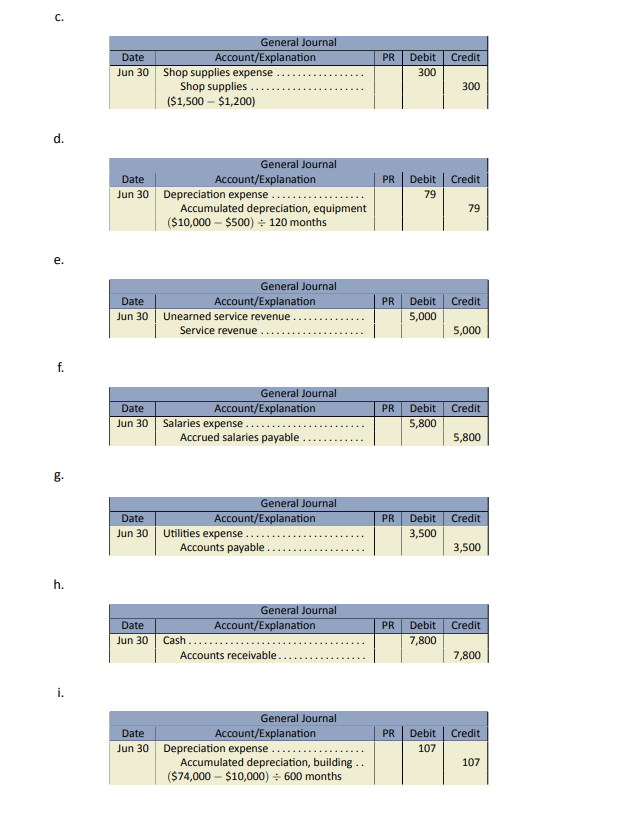

- Prepare the adjusting and correcting entries for June.

- Prepare an adjusted trial balance at June 30, 2016.

Click Here to View Solution