10

INTRODUCTION

Life is full of risks. You can try to avoid them or reduce their likelihood and consequences, but you cannot eliminate them. You can, however, pay someone to share them. That is the idea behind insurance.

There are speculative risks—that is, risks that offer a chance of loss or gain, such as developing a business idea that may or may not sell, or investing in a corporate stock that may or may not provide good returns. Such risks can be avoided simply by not participating. They are almost always uninsurable.

There are pure risks—accidental or unintentional events, such as a car accident or an illness. Pure risks are insurable because their probabilities can be calculated precisely enough for the risk to be quantified, which means it can be priced, bought, and sold.

Risk shifting is the process of selling risk to someone who then assumes the risk and its consequences. Why would someone buy your risk? Because in a large enough market, your risk can be diversified, which minimizes its cost.

Insurance can be purchased for your property and your home, your health, your employment, and your life. In each case, you weigh the cost of the consequence of a risk that may never actually happen against the cost of insuring against it. Deciding what and how to insure is really a process of deciding what the costs of loss would be and how willing you are to pay to get rid of those risks.

First Nations people on reserve can be sued and can sue for personal injury or property damage. Indigenous governments need to protect their assets and their operations from risk. There are a number of Indigenous-owned and -led insurance companies in Canada that provide tailored products and services in order to meet the specific needs of First Nations clients, organizations, and governments. We will also explore some of these companies and the products and services they provide throughout this chapter.

Risk management is the strategic trade-off of the costs of reducing, assuming, and shifting risks. The costs of insurance can also be lowered through risk avoidance or reduction strategies. Risk avoidance is accomplished by completely avoiding the risk through such measures as choosing not to smoke or avoiding an activity that might cause injury. Risk reduction reduces the risk of injury, loss, or illness. For example, installing an alarm system in your home may reduce homeowner’s insurance premiums because that reduces the risk of theft. Of course, installing an alarm system has a cost too. Risk assumption is when one assumes responsibility for a loss or injury instead of pursuing insurance. Risk assumption is often embraced when the potential loss is minimal, risk reduction strategies have been undertaken, insurance is too expensive, and/or when protection is difficult to obtain (Kapoor et al., 2023).

Throughout this chapter, we will explore different types and elements of insurance coverage and how they can help protect what is important to you in your life.

10.1 INSURING YOUR PROPERTY

Learning Objectives

- Describe the purpose of property insurance.

- Identify the causes of property damage.

- Compare the coverage and benefits offered by various homeowner’s insurance plans.

- Analyze the costs of homeowner’s insurance.

- Explain home insurance coverage on-reserve, in Inuit Communities, and across the Métis Homelands.

- Compare the kinds of auto insurance to cover bodily injury and property damage.

- Explain the factors that determine auto insurance costs.

- Analyze the factors used in determining the risks of the driver, the car, and the driving region.

Property insurance is ownership insurance: it ensures that the rights of ownership conferred upon you when you purchased your property will remain intact. Typically, property insurance covers loss of use from either damage or theft; loss of value, or the cost of replacement; and liability for any use of the property that causes damage to others or others’ property. For most people, insurable property risks are covered by insuring two kinds of property: car and home.

Loss of use and value can occur from hazards, which increase the likelihood of loss due to peril, which is the cause of possible loss. Examples of perils are fires, weather disasters, accidents, and the results of deliberate destruction such as vandalism or theft. One can choose named perils coverage, which provides coverage only for loss caused by the perils one chooses. All risks coverage applies to loss from all causes and is usually more expensive than a named perils insurance policy.

When replacement or repair is needed to restore usefulness and value, that cost is the cost of your risk. For example, if your laptop’s hard drive crashes, you not only have the cost of replacing or repairing it, but also the cost of being without your laptop for however long that takes. Insuring your laptop shares that risk (and those costs) with the insurer.

Liability is the risk that your use of your property will injure someone or something else. Ownership implies control of, and therefore responsibility for, property use.

For example, you are liable for your dog’s attack on a pedestrian or for your fallen tree’s damage to a neighbour’s fence. You are also liable for damage a friend causes while driving your car with your permission, and for injury to your invited guests who trip over your lawn ornament, fall off your deck, or leave your party drunk. Legal responsibility can result from:

Legal responsibility can result from:

- negligence, or the failure to take necessary precautions;

- strict liability, or responsibility for intentional or unintentional events (strict liability is when you are liable by default—that is, the onus has shifted from the plaintiff to the defendant. For example, if you have a dangerous thing, like a wild animal, and it escapes, it is presumed to be your fault unless you can demonstrate some intervening cause that was not caused by your negligence); and

- vicarious liability, or responsibility for someone else’s use of your possessions or someone else’s activity for which you are responsible.

Home Insurance Coverage

Homeowner’s insurance insures both the structure and the personal possessions that make the house your home. Tenant’s or renter’s insurance protects your possessions even if you are not the owner of your dwelling. Tenant’s insurance policies will vary depending on the customer. Riders are exemptions included in policies that allow you to adapt your renter’s policy to fit your needs. For example, if you work from home, you might consider an at-home business endorsement rider, which provides additional coverage for certain business-related items such as a computer and other electronic items that can surpass your $2,500 liability limit on business items. This rider could help to double your standard coverage at a low cost.

A deductible—a fixed sum of money—is required before an insurance company will pay a claim. As stated in Kapoor et al., the amount of your deductible often varies between $100 and $1,000, and will be subtracted from your claim. “For example, if you have a $2,000 claim resulting from a fire in your home and your policy stipulates that your deductible is $500, then the insurance company will pay you only $1,500, and you will pay the first $500” (2023, p. 272). Policy premiums are often reduced when one agrees to pay a higher deductible. A policy costs less when you agree to pay a higher deductible because you are essentially sharing more of the risk with the insurance company. Higher deductibles also have other advantages for insurance companies. When people have to pay a higher deductible, they are more careful and, therefore, insurance companies have to process fewer claims (Kapoor et al., 2023).

You may not think you need insurance until you are the homeowner, but even when you don’t need to insure against possible damage or liability for your dwelling, you can still insure your possessions. Even if your furniture came from your aunt’s house or a yard sale, it could cost a lot to replace. Ed and Elizabeth were renting and had chosen to store artwork and a number of heirlooms in the basement of their home rental. Their landlord was negligent and had not cleaned the septic tank in years. The septic tank backed up in the basement of their home rental and most of their artwork and heirlooms were ruined. Luckily, they had tenant’s insurance that covered the replacement cost of most of their items.

If you have especially valuable possessions such as jewelry or fine musical instruments, you may want to insure them separately to get enough coverage for them. Such items are typically referred to as scheduled property and are insured as endorsements added on to a homeowner’s or renter’s policy. Items should be appraised by a certified appraiser to determine their replacement or insured value.

A good precaution is to have an up-to-date inventory of your possessions such as furniture, clothing, electronics, and appliances, along with photographs or video showing these items in your home. Insurance agents recommend taking a video of your belongings and then storing the video somewhere else outside of your home, such as a safe deposit box or someone else’s house. If the house suffered damage, you would then have the inventory to help you document your losses.

A homeowner’s policy covers damage to the structure itself as well as any outbuildings on the property and, in some cases, even the landscaping or infrastructure on the grounds, such as a driveway.

A homeowner’s policy does not cover:

- property of renters, or property kept in an apartment regularly rented;

- business property, even if the business is conducted on the residential premises; and

- most forms of accidental death (e.g., vehicle impact).

According to the Insurance Bureau of Canada, coverage can vary from one insurer to the next. Different policies exist to meet the different needs of insurers. Homeowners insurance covers the personal property (dwelling, contents) and personal liability of you (the policyholder), your spouse or partner, relatives living in your home, and dependents under the age of 21, who are students either living in your home or temporarily living away (IBC, 2024).

If you share your home with a friend or relative, or rent out part of your residence, you must notify your insurance representative.

Home insurance also includes coverage for additional living expenses in the event that you are temporarily unable to live in your home due to an insured loss in certain circumstances.

Homeowners’ policies cover liability for injuries on the property and for injuries that the homeowner may accidentally inflict. You may also want to add an umbrella policy that provides additional personal liability insurance coverage that is either not covered under your homeowner’s insurance or auto insurance or provides additional coverage if a claim is larger than your policy will cover. If you participate in activities where you are assuming responsibilities for others, you may want such extended liability coverage available through your homeowners’ policy (also available separately).

Home Insurance Coverage: The Benefit

Home insurance policies automatically cover your possessions up to a certain percentage of the house’s insured value. You can buy more coverage if you think your possessions are worth more. The benefits are specified as either actual cash value or replacement cost. Actual cash value tries to estimate the actual market value of the item at the time of loss, so it accounts for the original cost less any depreciation that has occurred. Replacement cost is the cost of replacing the item. For most items, the actual cash value is less.

For example, say your policy insures items at actual cash value. You are claiming the loss of a ten-year-old washer and dryer that were ruined when a pipe burst and your basement flooded. Your coverage could mean a benefit of $100 (based on the market price of ten-year-old appliances). However, to replace your appliances with comparable new ones could cost $1,000 or more.

The actual cash value is almost always less than the replacement value, because prices generally rise over time and because items generally depreciate (rather than appreciate) in value. A policy that specifies benefits as replacement costs offers more actual coverage. Guaranteed replacement costs are the full cost of replacing your items, while extended replacement costs are capped at a certain percentage—for example, 125 per cent of actual cash value.

Home Insurance Coverage: The Cost

You buy home insurance by paying a premium to the insurance company. The insurance purchase is arranged through a broker, who may represent more than one insurance company. The broker should be knowledgeable about various policies, coverage, and premiums offered by different insurers.

The amount of the premium is determined by the insurer’s risk—the more risk, the higher the premium. Risk is determined by:

- the insured (the person buying the policy),

- the property insured, and

- the amount of coverage.

To gauge the risk of the insured, the insurer needs information about your personal circumstances and history, the nature of the property, and the amount of coverage desired for protection. This information is summarized in Table 10.1.1.

|

Insured |

Property |

Coverage |

|

|

|

Insurers may offer discounts for enhancements that lower risks, such as alarm systems or upgraded electrical systems. You may also be offered a discount for being a loyal customer, for example, by insuring both your car and home with the same company. Be sure to ask your insurance broker about available discounts for the following:

- Multiple policies (with the same insurer),

- Sprinkler systems,

- Burglar and fire alarms,

- Long-time policyholder,

- Upgrades to plumbing, heating, and electrical systems,

- Age (insurers give discounts to people as young as age forty in some cases), and

- Credit scoring.

Premiums can vary, even for the same levels of coverage for the same items insured. You should compare policies offered by different insurers to shop around for the best premium for the coverage you want.

Home Insurance Coverage: On-Reserve, in Inuit Communities, and across the Métis Homelands

Many First Nations must pay higher premiums on home insurance due to the rural or remote location of their reserves, their limited capacity for risk management planning and building inspections, the higher incident of climate disasters on or near reserves as well as the lack of shared emergency services in rural or remote areas, and older housing and commercial units that don’t meet current building standards and codes (Hilton and Quinless, 2024). Since First Nations reserves are collectively owned, only the band or tribal council can purchase community-level insurance for commercial and band-owned residential properties. Because of the higher premiums on home insurance, many First Nations are faced with unaffordable home insurance premiums. According to the First Nations Finance Authority (FNFA), insurance renewal terms “often arrive only hours before coverage expires, frequently with reduced coverage and higher costs, and without any recourse or options for communities apart from accepting whatever final offer is put in front of them” (FNFA, 2024). Higher premiums are also impacting Inuit communities in the Arctic regions and Métis people in rural and remote communities. According to Hilton and Quinless (2024), supply chain issues, outdated building codes and standards, and capacity challenges have led to higher risk ratings and limited insurance options in the Arctic.

Indigenous insurance brokers are helping create more affordable housing insurance options. AFN Insurance Brokers has been in operation since 1998 as a nationally incorporated insurance brokerage that only serves First Nations across Canada to meet their specific needs. Its First Nations Insurance Program is designed to meet the needs of First Nations Governments and Tribal Councils and its Housing Insurance Program provides affordable housing insurance coverage for Community Housing. The TIPI Insurance Partners and Tipi-IMI Insurance Partners provides Indigenous communities with tailored products and services. Their property coverage insurance typically includes coverage for: commercial buildings, band-owned housing, inventory and contents within covered buildings, and equipment (Tipi Group of Companies, 2024).

The FNFA has partnered with BFL Canada to explore a collective insurance model for FNFA Members and other Indigenous communities. Within this model, First Nations would purchase insurance as a collective group to provide “direct and equitable access to the global insurance market” and “stabilizing insurance coverage and costs” which would support economic growth, community well-being, and enhanced risk management practices and benefits (FNFA, 2024). According to the FNFA and BFL (2022), the study will look at property insurance for community owned assets because “Indigenous community property coverage has been historically challenging to obtain through traditional risk transfer means.” Other types of coverage will be looked at over time.

Insuring Your Car

If you own and drive a car, you must have car insurance. A car accident could affect not only you and your car, but also the health and property of others. An accident often involves a second party, and so legal and financial responsibility must be assigned and covered by both parties.

Conventionally, a victim or plaintiff in an accident is reimbursed by the driver at fault or by his or her insurer. Fault has to be established and the amount of the claim agreed to. In practice, this has often been done only through extensive litigation.

In Canada, the provincial governments of British Columbia, Manitoba, and Saskatchewan offer basic automobile insurance coverage; additional coverage can be purchased from private insurers. In Quebec, the provincial government requires drivers to buy bodily injury coverage from the government insurer and property damage coverage from from a private insurer.. In all other provinces and territories, private insurers provide auto insurance. Public insurance requires just one price for coverage, while private insurance companies’ rates may vary. Manitoba, Ontario, Quebec, and Saskatchewan have adopted variations of no-fault insurance, in which an injured person’s own insurance covers his or her damages and injuries regardless of fault, and a victim’s ability to sue the driver at fault is limited. The person deemed responsible for the accident is responsible for the deductible payment. The goal of no-fault insurance is to lower the incidence of court cases, and thus the cost of legal action against a third party, and to speed up compensation for victims (Kapoor et al., 2023).

Auto Insurance Coverage

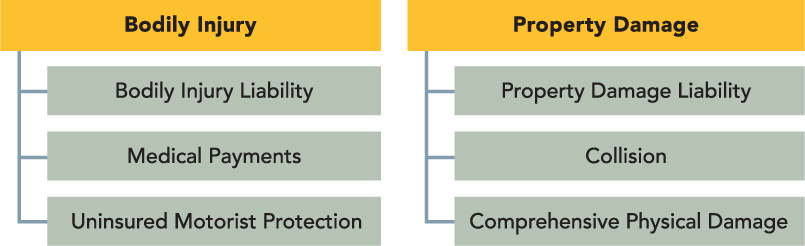

Auto insurance policies cover two types of consequences: bodily injury and property damage. Each cover three types of financial losses. Chart 10.1.1 shows these different kinds of automobile insurance coverage.

Chart 10.1.1 Automobile Insurance Coverage

Bodily injury liability refers to the financial losses of people in the other car that are injured in an accident you cause, including their medical expenses, loss of income, your legal fees, and other expenses associated with the automobile accident. Injuries to people in your car or to yourself are covered by the automobile owner’s policy. If the owner has given permission for someone else to operate his or her vehicle, the automobile owner’s policy will cover any liability claim. Accident Benefits cover the following benefits for people, including yourself, who were injured in your automobile accident: income replacement, medical, rehabilitation, and attendant car expenses, and death and funeral costs (Kapoor et al., 2023).

Uninsured motorist protection covers your injuries if the accident is caused by someone with insufficient insurance or by an unidentified driver.

Property damage liability covers the costs to other people’s property from damage that you cause, while collision covers the costs of damage to your own property. Collision coverage is limited to the market value of the car at the time. To reduce their risk, the lenders financing your car loan will require that you carry adequate collision coverage. Comprehensive physical damage covers your losses from anything other than a collision, such as theft, weather damage, acts of nature, or hitting an animal.

Auto Insurance Costs

As with any insurance, the cost of having an insurer assume risk is related to the cost of that risk. The cost of auto insurance is related to three factors that create risk: the car, the driver, and the driving environment—the region or rating territory.

The model, style, and age of the car determine how costly it may be to repair or replace, and therefore the potential cost of damage or collision. The higher that cost is, the higher the cost of insuring the car. For example, a 2024 luxury car will cost more to insure than a 2005 sedan. Also, different models have different safety features that may lower the potential cost of injury to passengers, and those features may lower the cost of insurance. Different models may come with different security devices or be more or less attractive to thieves, affecting the risk of theft.

The driver is an obvious source of risk as the operator of the car. Insurers use various demographic factors such as age, education level, marital status, gender, and driving habits to determine which kinds of drivers present more risk. Not surprisingly, young drivers (ages sixteen to twenty-four) and elderly drivers (over seventy) are the riskiest. According to data compiled over a ten-year period, provincial police have said that twice as many male drivers, compared to female drivers, aged twenty-five to thirty-four die in auto accidents (Canadian Press, 2015).

Your driving history, and especially your accident claim history, along with your criminal record (or lack thereof) and credit score, can affect your premiums. In some provinces and territories, an accident claim can severely increase your cost of insurance over a number of years. Your driving habits—whether or not you use the car to commute to work, for example—can affect your costs as well. Some insurers offer credits or points that reduce your premium if you have a safe driving record or have passed a driver education course.

Where you live and drive also matters. Insurers use police statistics to determine rates of traffic accidents, auto theft, and vandalism, for example. If you are in an accident-prone area or higher-crime region, you may be able to offset those costs by installing safety and security features in your car.

Premium rates vary, so you should always shop around. You can shop through a broker or directly. Online discount auto insurers have become increasingly popular in recent years. Their rates may be lower, but the same cautions apply as for other high-stakes transactions conducted online.

Also, premiums are not the only cost of auto insurance. You should also consider the insurer’s reliability in addressing a claim. Chances are you rely on your car to get to school, to work, or for your daily errands or recreational activities. Your car is also a substantial investment, and you may still be paying off debt from financing your car. Losing your car to repairs and perhaps being injured yourself is no small inconvenience and can seriously disrupt your life. You want to be working with an insurer who will co-operate in trying to get you and your car back on the road as soon as possible.

Key Takeaways

- Property insurance is to insure the rights of ownership and to protect against its liabilities.

- Property damage can be caused by hazards or by deliberate destruction, such as vandalism or theft.

- Homeowner’s policies insure structures and possessions for actual cash value or replacement cost; an umbrella policy covers personal liability.

- The cost of homeowner’s insurance is determined by the individual taking out the policy, the property insured, and the extent of the coverage and benefits.

- Homeowner’s insurance premiums on-reserve, in Inuit communities, and across Métis homelands is higher for a variety of reasons.

- Auto insurance coverage insures bodily injury through:

• bodily injury liability,

• medical payments coverage, and

• uninsured motorist protection. - Auto insurance coverage insures property damage through:

• property damage liability,

• collision, and

• comprehensive physical damage. - Auto insurance costs are determined by the driver, the car, and the driving region.

- The risk of the driver is determined by demographics, credit history, employment history, and driving record.

- The risk of the car is determined by its cost; safety and security features may lower insurance costs.

- The risk of the driving region is determined by statistical incident histories of accidents or thefts.

Exercises

- In your personal finance journal, record or chart all the insurances you own privately or through a financial institution and/or are entitled to through your employer. In each case, consider the following questions: what is insured, who is the insurer, what is the term, what are the benefits, and what is your premium or deduction? Research online to find the details. Then analyze your insurance in relation to your financial situation. How does each type of insurance shift or reduce your risk or otherwise help protect you and your assets or wealth?

- Conduct and record a complete inventory of all your personal property. State the current market value or replacement cost of each item. Then identify the specific items that would cause you the greatest difficulty and expense if they were lost, damaged, or stolen.

- How would a tenant’s insurance policy help protect your property? What do such policies cover? What factors determine the cost of tenant’s insurance? What is the average cost of tenant’s insurance in Canada?

- How do auto insurance rates in your province or territory—which are based partly on the rates of accidents, injuries, and deaths in your respective province or territory—compare with rates in other provinces?

REFERENCES

Canadian Press. (2015, March 23). OPP data shows twice as many men have died in crashes as women. CBC News. https://www.cbc.ca/news/canada/kitchener-waterloo/opp-data-shows-twice-as-many-men-have-died-in-crashes-as-women-1.3005464.

First Nations Finance Authority. (2024). FNFA/BFL Insurance Feasibility Study. https://www.fnfa.ca/en/projects/fnfa-bfl-insurance/.

First Nations Finance Authority. (2022). FAQ: Exploring an Indigenous Owned Insurance Model. https://www.fnfa.ca/wp-content/uploads/2022/03/02-2022-BFL-FNFA-FAQ.pdf.

Hilton, C. and Quinless, J. (2024). Indigenous Insurance and Risk. https://assets.cmhc-schl.gc.ca/sites/cmhc/professional/housing-markets-data-and-research/housing-research/research-reports/2024/indigenous-insurance-risk-en.pdf.

Kapoor, J., Dlabay, L., Hughes, R., Stevenson, L., and Kerst, E. (2023). Personal Finance (9th ed.). Toronto: McGraw-Hill Ryerson.

Tipi Group of Companies. (2024). Property & Casualty | Insurance Coverages Explained. https://www.tipionline.ca/property-and-casualty.

10.2 INSURING YOUR HEALTH AND INCOME

Learning Objectives

- Discuss how health insurance is important when it comes to financial planning.

- Describe the purposes, coverage, and costs of disability insurance.

- Compare the appropriate uses of term life and whole life insurance.

- Explain the differences among variable, adjustable, and universal whole life policies and the use of riders.

- List the factors that determine the premiums for whole life policies.

As you have learned, assets such as a home or car should be protected from the risk of a loss of value, because assets store wealth, so a loss of value is a loss of wealth.

Your health is also incredibly valuable, and the costs of repairing it in the case of accident or illness are significant enough that it also requires insurance coverage. In addition, however, you may have an accident or illness that leaves you permanently impaired or even dead. In either case, your ability to earn income will be restricted or gone. Thus, your income should be insured, especially if you have dependents who would bear the consequences of losing your income. Disability insurance and life insurance are ways of insuring your income against some limitations.

Health Insurance

In Canada, provincial government health plans cover most basic medical procedures under the Medical Care Act. The following are examples of items either not covered or only partially covered by provincial health insurance plans:

- Semi-private or private hospital rooms

- Prescription drugs

- Eyeglasses

- Dental care

- Private nursing care

- Cosmetic surgery

- Physician testimony in court

Many people insure the above-mentioned items through private medical insurance companies. When travelling internationally, many people will also purchase travel insurance to cover health-care costs that are not fully covered by provincial health-care plans.

Health insurance pays for medical expenses incurred by the insured and reduces the financial burden of risk by “dividing losses among many individuals” (Kapoor et al., 2023, p. 309). Insurance companies establish rates and benefits by determining how many people within a certain population will become ill and how much their illness will cost (Kapoor et al., 2023). Health insurance can reimburse the insured for expenses incurred from illness or injury, or pay the care provider directly.

Group health insurance plans most commonly offer supplemental health insurance coverage and are most often sponsored by the employer, who pays most or part of the cost. Group health insurance plans vary depending on the provider and will likely not cover all of one’s health needs. Therefore, many will supplement their group insurance plans with individual health insurance.

Individual health insurance plans are tailored to an individual’s or family’s specific needs, particularly when group insurance plans do not suffice. Individual health insurance plans do require comparative shopping because coverage and cost can vary greatly from one provider to the next. Some good advice is to “Make sure you have enough insurance, but don’t waste money by over insuring” (Kapoor et al., 2023, pg. 310).

Health Benefits, Services, and Insurance Coverage in Indigenous Communities

The Non-Insured Health Benefits (NIHB) program is a national program that provides eligible First Nations and Inuit people with prescription drugs, over-the-counter medication, medical supplies and equipment, mental health counselling, dental care, vision care, and medical transportation (Indigenous Services Canada, 2024). The NIHB goods and services are not insured by provincial, territorial, or private insurance plans. They are funded by Indigenous Services Canada and administered through the First Nations and Inuit Health Branch (FNIHB) at Health Canada or a First Nations or Inuit community, self-government or health authority to provide some or all NIHB benefits. The First Nations Health Authority of British Columbia, governed by BC First Nations, administers health benefits and services for First Nations people in BC. There are also NIHB Navigators available across the country that provide support and information regarding NIHB-related issues to First Nations governments, organizations, and clients. Through a multi-year joint review of the NIHB program, the Government of Canada and the Assembly of First Nations (AFN) are working together to improve the program for clients. For more information, please see the Government of Canada website on Non-insured health benefits for First Nations and Inuit.

Many First Nations groups view health benefits as an inherent Aboriginal and treaty right in Canada and see the government as responsible for the provision of healthcare because of verbal commitments and written evidence provided through treaty negotiations. Treaty 6 specifically has a medicine chest clause that has been interpreted by many, including judges in several court cases dating back to 1935, that a medicine chest will provide medicines, medical supplies, and drugs, free of charge, to “Treaty Indians” (Craft and Lebihan, 2021, pg. 22). The federal government has viewed the provision of health services under the NIHB program as a humanitarian obligation, not a legal one. Many feel the government’s interpretation of its role and the services it provides does not honour the spirit and intent of the treaties.

Several Indigenous-owned and -led insurance companies across Canada have been established in the last forty years to supplement non-insured health benefits, not replace or duplicate them, and to provide tailored insurance products and services to help meet the needs of First Nations. One such company is the First Nations Insurance Services Limited Partnership (FNISLP) which was established in 1987 by the Kitsaki Management Limited Corporation to address the insurance-related services gaps that existed at that time for First Nations, their institutions, and businesses. Kitsaki Management Limited Corporation is owned by the Lac La Ronge Indian Band and serves more than eleven thousand band members in northern Saskatchewan. FNISLP now provides personal health insurance, disability insurance, life insurance, group insurance and pension plans, pension and insurance plan conversions, and more to Indigenous and non-Indigenous clients (Kitsaki Management, 2024).

Many Nations Financial first began as a non-profit in the late 1990s. Joe Carter, the Director of Education for Onion Lake, saw a need in his community for access to the same type of financial services being provided to non-Indigenous communities. According to Gail Davison, CEO of Many Nations, “[Carter] understood that in order to attract quality teachers that he had to be able to offer benefits comparable to those they would get somewhere else…When he went to the market there were not many companies that were willing to provide those benefits for First Nations. He believed that by coming together collectively they would be large enough that they would get the insurance companies’ attention” (Many Nations Financial, 2018).

The non-profit began to provide financial and group/employee benefit services to First Nations-owned businesses, governments, and organizations. Carter saw the importance of “strength in numbers” so that enhanced buying power would help to provide better quality products to clients; the non-profit grew to represent over 150 communities across Canada (Many Nations Financial, 2018). Many Nations Financial changed its structure and eventually became the first national Indigenous co-operative in Canada to provide services to Indigenous organizations. Indigenous organizations are both the members and owners of Many Nations Financial. The organization tailors its products to meet the needs of First Nations communities. Examples of tailored services, outlined on the Many Nations Financial website, are:

- Extended coverage for dependents without legal guardianship

- Coordination with Non-Insured Health Benefits (NIHB) and First Nations Health Authority (FNHA) on extended health and dental benefits

- Blended rates for families with Status and non-Status family members

- The Many Nations Traditional Wellness Spending Account provides Indigenous organizations with coverage for traditional wellness and healing practices. (Many Nations Finance, 2024)

Disability Insurance

Disability insurance is designed to insure your income should you survive an injury or illness impaired. The definition of “disability” is a variable feature of most policies. Some define it as being unable to pursue your regular work, while others define it more narrowly as being unable to pursue any work. Some plans pay partial benefits if you return to work part-time, and some do not. As always, you should understand the limits of your plan’s coverage.

The costs of disability insurance are determined by the features and/or conditions of the plan, including the following:

- Waiting period

- Amount of benefits

- Duration of benefits

- Cause of disability

- Payments for loss of vision, hearing, speech, or use of limbs

- Inflation-adjusted benefits

- Guaranteed renewal or non-cancelable clause

In general, the more of these features or conditions that apply, the higher your premium.

All plans have a waiting period from the time of disability to the collection of benefits. Most are between 30 and 90 days, but some are as long as 180 days. Generally, the longer the waiting period is, the less the premium.

Plans also vary in the amount and duration of benefits. Benefits are usually offered as a percentage of your current wages or salary. The more the benefits or the longer the insurance pays out, the higher the premium.

In addition, some plans offer benefits in the following cases, all of which carry higher premiums:

- Disability due to accident or illness

- Loss of vision, hearing, speech, or the use of limbs, regardless of disability

- Benefits that automatically increase with the rate of inflation

- Guaranteed renewal, which insures against losing your coverage if your health deteriorates

You may already have some disability insurance through your employer, although in many cases the coverage is minimal. Private medical insurance policies provide coverage for disability. Coverage varies depending on your premium, the company, and the details of your policy. There are provincial and federal programs available to the disabled. Employment insurance is a federal program that provides short-term payments for those who have contributed in the past. Both the Canada and Quebec Pension Plans also include a disability pension for those contributors with a severe or prolonged disability. Please visit the following site for a complete overview of disability benefits. You may also be eligible for workers’ compensation benefits from your province or territory, if the disability is due to an on-the-job accident (Kapoor et al., 2023). Other providers of disability benefits include the following:

- Veterans’ Affairs Canada (if you are a veteran)

- Automobile insurance (if the disability is due to a car accident)

- Labour unions (if you are a member)

- Civil service provisions (if you are a government employee)

You should know the coverage available to you and if you find it’s not adequate, supplement it with private disability insurance.

Life Insurance

Life insurance is a way of insuring that your income will continue after your death. If you have a partner or spouse, children, parents, or siblings who are dependent on your income or care, your death would create new financial burdens for them. To avoid that, you can insure your dependents against your loss, at least financially.

There are many kinds of life insurance policies. Before purchasing one, you should determine what it is you want the insurance to accomplish for your survivors. This could include the following:

- Pay off the mortgage

- Put your kids through university

- Provide income so that your spouse can be home with the kids and not be forced out into the workplace

- Provide alternative care for your elderly parents or dependent siblings

- Cover the costs of your medical expenses and funeral

Your goals for your life insurance will determine how much benefit you need and what kind of policy you need. Weighed against that are its costs—the amount of premium that you pay and how that fits into your current budget. Consider the following scenario.

Omar and Saifina have two children, ages three and five. Saifina works as a credit analyst in a bank. Omar does contract work and helps look after the household and the children and Saifina’s elderly mother, who lives a couple of blocks away. Omar and Saifina help with her grocery shopping, cleaning, laundry, and errands. Omar and Saifina live in a condo they bought, financed with a mortgage. They have established RESPs for each child, and they try to save regularly.

Omar and Saifina need to insure both their lives, because the loss of either would cause the survivors financial hardship. With Saifina’s death, her earnings would be gone, which is how they pay the mortgage and save for their children’s education. Insurance on her life should be enough to pay off the mortgage and fund their children’s university educations, while providing for the family’s living expenses, unless Omar returns to the workforce. With Omar’s death, Saifina would have to hire someone to clean house and care for their children, and also someone to take care of her mother’s house and provide care for her. Insurance on Omar’s life should be enough to maintain everyone’s quality of living.

Term Insurance

Saifina’s income provides for three expenditures: the mortgage, education savings, and living expenses. While living expenses are an ongoing or permanent need, the mortgage payment and the education savings are not: eventually, the mortgage will be paid off and the children educated. To cover permanent needs, Saifina and Omar could consider permanent insurance, also known as whole life, straight life, or cash value insurance. To insure those two temporary goals of paying the mortgage and university tuitions, Saifina and Omar could also consider temporary or term insurance. Term insurance is insurance for a limited time period, usually one, five, ten, or twenty years. After that period, the coverage stops. It is used to cover financial needs for a limited time period—for example, to cover the balance due on a mortgage, or education costs. Premiums are lower for term insurance, because the coverage is limited. The premium is based on the amount of coverage and the length of the time period covered.

A term insurance policy may have a renewability option, so that you can renew the policy at the end of its term, or it may have a conversion option, so that you can convert it to a whole life policy and pay a higher premium. If it is a multi-year level term or straight term, the premium will remain the same over the term of coverage.

Decreasing term insurance pays a decreasing benefit as the term progresses, which may make sense in covering the balance due on a mortgage, which also decreases with payments over time. On the other hand, you could simply buy a one-year term policy with a smaller benefit each year and have more flexibility should you decide to make a change.

A return-of-premium (ROP) term policy will return the premiums you have paid if you outlive the term of the policy. On the other hand, the premiums on such policies are higher, and you may do better by simply buying the regular term policy and saving the difference between the premiums.

Term insurance is a more affordable way to insure against a specific risk for a specific time. It is pure insurance, in that it provides risk shifting for a period of time, but unlike whole life, it does not also provide a way to save or invest.

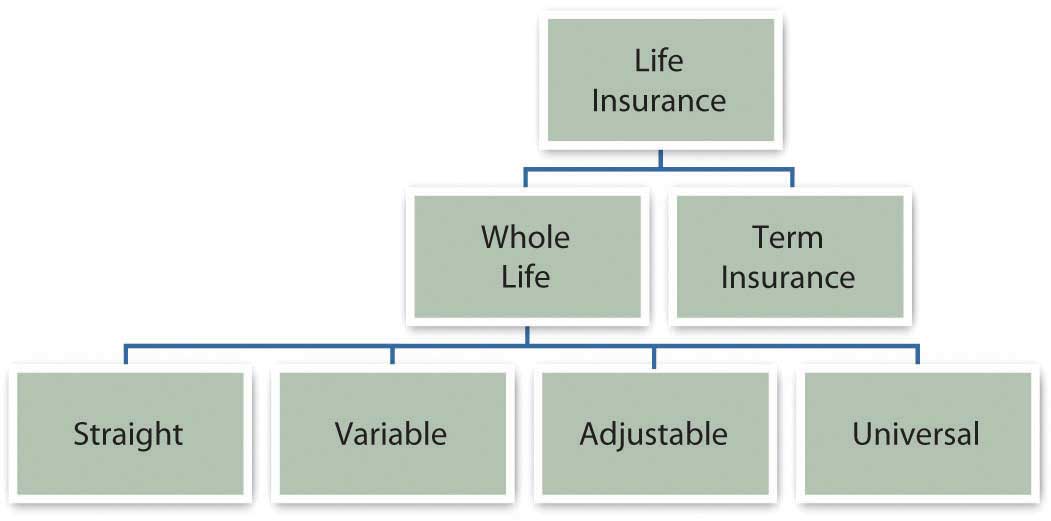

Whole Life Insurance

Whole life insurance is permanent insurance—that is, you pay a specified premium until you die, at which time your specified benefit is paid to your beneficiary. The amount of the premium is determined by the amount of your benefit and your age and life expectancy when the policy is purchased.

Unlike term insurance, where your premiums simply pay for your coverage or risk shifting, a whole life insurance policy has a cash surrender value or cash value that is the value you would receive if you cancelled the policy before you die. You can “cash out” the policy and receive that cash value before you die. In that way, the whole life policy is also an investment vehicle: your premiums are a way of saving and investing, using the insurance company as your investment manager. Whole life premiums are more than term life premiums because you are paying not only to shift risk, but also for investment management.

A variable life insurance policy has a minimum death benefit guaranteed, but the actual death benefit can be higher depending on the investment returns that the policy has earned. In that case, you are shifting some risk, but also assuming some risk of the investment performance.

An adjustable life policy is one where you can adjust the amount of your benefit, and your premium, as your needs change.

A universal life policy offers flexible premiums and benefits. The benefit can be increased or decreased without cancelling the policy and getting a new one (and thus losing the cash value, as in a basic whole life policy). Premiums are added to the policy’s cash value, as are investment returns, while the insurer deducts the cost of insurance (COI) and any other policy fees.

When purchased, universal life policies may be offered with a single premium payment, a fixed (and regular) premium payment until you die, or a flexible premium where you can determine the amount of each premium, so long as the cash value in the account can cover the insurer’s COI. Chart 10.2.1 shows the life insurance options.

Chart 10.2.1 Life Insurance Options

So, is it term or whole life? When you purchase a term life policy, you purchase and pay for the insurance only. When you purchase a whole life policy, you purchase insurance plus investment management. You pay more for that additional service, so its value should be greater than its cost (in additional premiums). Whole life policies take some analysis to assess the real investment returns and fees, and the insurer is valuable to you only if it is a better investment manager than you could have otherwise. There are many choices for investment management. Thus, the additional cost of a whole life policy must be weighed against your choices among investment vehicles. If it’s better than your other choices, then you should buy the whole life. If not, then buy term life and save or invest the difference in the premiums.

Choosing a Policy

All life insurance policies have basic features, which then can be customized with a rider clause that adds specific benefits under specific conditions. The standard features include provisions that protect the insured and beneficiaries in cases of missed premium payments, fraud, or suicide. There are also loan provisions granted, so that you can borrow against the cash value of a whole life policy.

Riders are actually extra insurance that you can purchase to cover less-common circumstances. Commonly offered riders include:

- a waiver of premium payment if the insured becomes completely disabled;

- a double benefit for accidental death;

- guaranteed insurability allowing you to increase your benefit without proof of good health;

- cost of living protection that protects your benefit from inflation; and

- accelerated benefits that allow you to spend your benefit before your death if you need to finance long-term care.

Finally, you need to consider the settlement options offered by the policy: the ways that the benefit is paid out to your beneficiaries. The three common options are:

- as a lump sum, paid out all at once;

- in installments, paid out over a specified period; or

- as interest payments, so that a series of interest payments is made to the beneficiaries until a specified time when the benefit itself is paid out.

You would choose the various options depending on your beneficiaries and their anticipated needs. Understanding these features, riders, and options can help you to identify the appropriate insurance product for your situation. As with any purchase, once you have identified the product, you need to identify the market and the financing.

Many insurers offer many insurance products, usually sold through brokers or agents. Agents are paid on commission, based on the amount of insurance they sell. A captive agent sells the insurance of only one company, while an independent agent sells policies from many insurers. You want a licensed agent that is responsive and will answer questions patiently and professionally. If you die, this may be the person on whom your survivors will have to depend to help them receive their benefits in a troubling time.

You will have to submit an application for a policy and may be required to have a physical exam or release medical records to verify your physical condition. Factors that influence your riskiness are your family medical history, age and weight, and lifestyle choices such as smoking, drinking, and drug use. Your risks will influence the amount of your premiums.

Having analyzed the product and the market, you need to be sure that the premium payments are sustainable for you, that you can add the expense in your operating budget without creating a budget deficit.

Life Insurance as a Financial Planning Decision

Unlike insuring property and health, life insurance can combine two financial planning functions: shifting risk and saving to build wealth. The decision to buy life insurance involves thinking about your choices for both and your opportunity cost in doing so.

Life insurance is about insuring your earnings even after your death. You can create earnings during your lifetime by selling labour or capital. Your death precludes your selling labour or earning income from salary or wages, but if you have assets that can also earn income, they may be able to generate some or even enough income to ensure the continued comfort of your dependents, even without your salary or wages.

In other words, the larger your accumulated asset base, the greater its earnings, and the less dependent you are on your own labour for financial support. In that case, you will need less income protection and less life insurance. Besides life insurance, another way to protect your beneficiaries is to accumulate a large enough asset base with a large enough earning potential.

If you can afford the life insurance premiums, then the money that you will pay in premiums is currently part of your budget surplus and is being saved somehow. If it is currently contributing to your children’s education savings or to your retirement plan, you will have to weigh the value of protecting current income against insuring your children’s education or your future income in retirement. Or that surplus could be used toward generating that larger asset base.

These are tough decisions to weigh because life is risky. If you never have an accident or illness, and simply go through life earning plenty and paying off your mortgage and saving for retirement and educating your children, then are all those insurance premiums just wasted? No. Since your financial strategy includes accumulating assets and earning income to satisfy your needs now or in the future, you need to protect those assets and income, at least by shifting the risk of losing them through a chance accident. At the same time, you must make risk-shifting decisions in the context of your other financial goals and decisions.

Key Takeaways

- Disability insurance insures your income against an accident or illness that leaves your earning ability impaired.

- Disability insurance coverage and costs vary.

- Life insurance is designed to protect dependents against the loss of your income in the event of your death.

- Term insurance provides life insurance coverage for a specified period of time.

- Whole life insurance provides life insurance coverage until the insured’s death.

- Whole life insurance has a cash surrender value and thus can be used as an investment instrument as well as a way of shifting risk.

- Variable, adjustable, and universal life policies offer more flexibility of benefits and premiums.

- Riders provide more specific coverage.

- Premiums are determined by the choice of benefits and riders and the risk of the insured, as assessed by medical history and lifestyle choices.

Exercises

- Find out about workers’ compensation in your province or territory by visiting the website of the Association of Workers’ Compensation Boards of Canada. What does the Association of Workers’ Compensation Boards of Canada do? Find out what programs are available in your province for workers’ compensation covering industrial and workplace accidents. What information does the Canadian Centre for Occupational Health and Safety provide on the prevention of workplace illness and injury?

- Find information about employment insurance at the following websites Employment and Social Development Canada and EI Regular Benefits—Overview to answer the following questions:

• What does it mean to be involuntarily unemployed?

• If you are involuntarily unemployed, does employment insurance replace your wages?

• Are you entitled to employment insurance if you choose to be unemployed temporarily?

• Does it matter what kind of a job you have or how much income you earn?

• Where does the money come from?

• If you have seasonal employment, can you collect unemployment to cover the off-season?

• If you are eligible, how long can you collect unemployment?

• Is the money you receive from unemployment compensation taxable?

REFERENCES

Kapoor, J., Dlabay, L., Hughes, R., Stevenson, L., and Kerst, E. (2023). Personal Finance (9th ed.). Toronto: McGraw-Hill Ryerson.

Kitsaki Management Limited Corporation. (2024). First Nations Insurance Services Limited Partnership. https://kitsaki.com/portfolios/fnis/.

Government of Canada. (2024). About the Non-Insured Health Benefits program. https://www.sac-isc.gc.ca/eng/1576790320164/1576790364553.

Many Nations Financial Services. (2024). A Story of Many Nations. https://manynations.com/news/a-story-of-many-nations.